Always going beyond expectations

Makes that live up to expectations

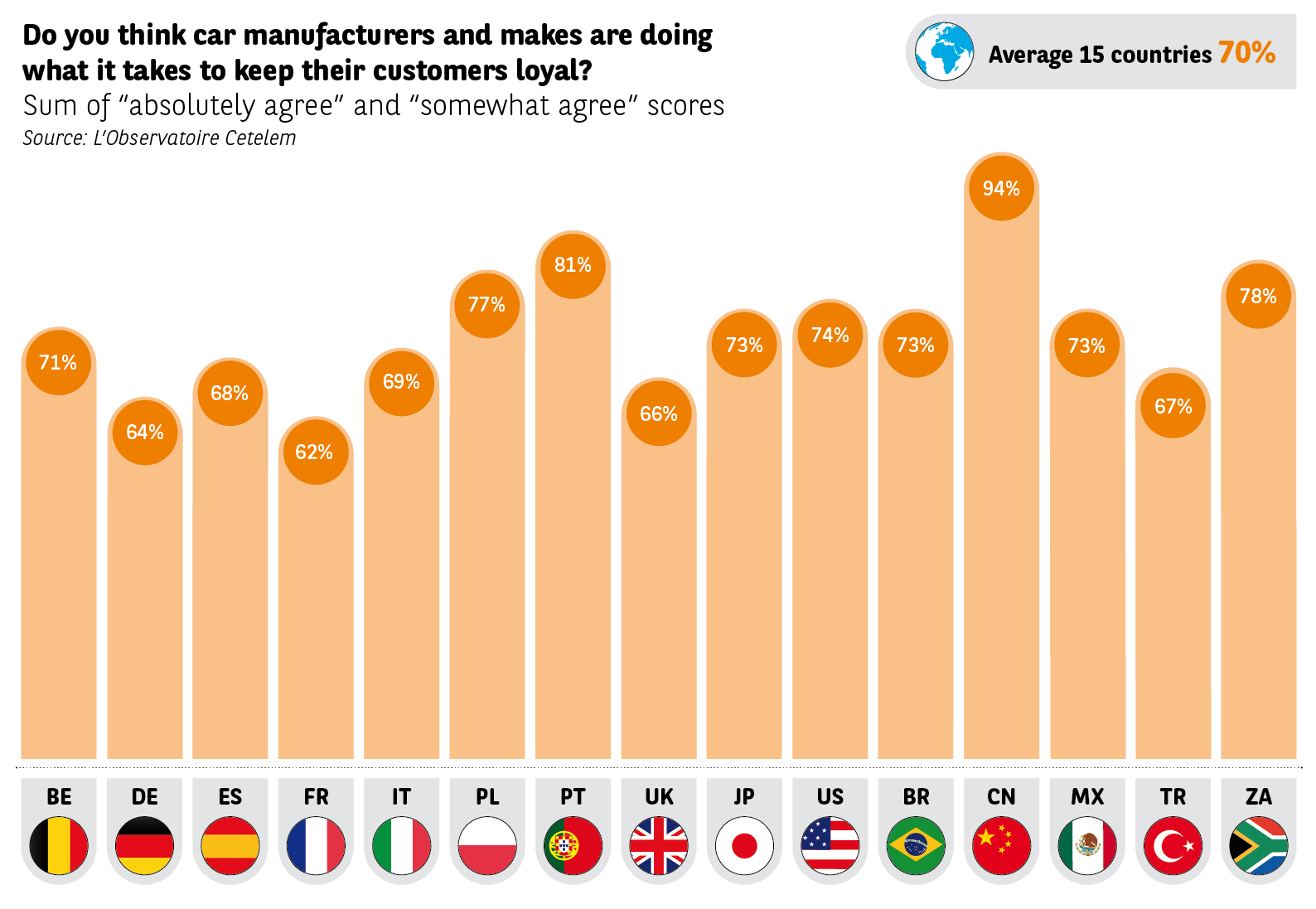

For 70% of people surveyed, the makes are doing what it takes to make them loyal.

This is true even for 60% of French and German consumers, the two populations least convinced by these efforts. However, given the actual loyalty rate, one wonders whether the makes are really doing what it takes. So, should the lack of loyalty observed by the survey and the dealers be blamed on the dealership channels and distributors who intervene at all stages of the car experience (pre-sale info, quotes and sales, after-sales servicing and repair services, etc.)? This traditional role, however, has tended to decrease at both ends of the purchase pipeline.

A changing role

The Google Cars online 2016 survey shows that, on average, buyers now only test drive cars 1.3 times on the dealer’s premises vs. 2.6 times in 2010. Social networks, online videos, and expert forums are increasingly taking over from actual test drives. After the purchase, make dealerships suffer from competition by automotive centres and other fast repair specialists waging a price war to attract customers, whether they supply warranties or not.

Now, we know that loyalty is twice as high in customers habitually using a make’s own distribution channels for their servicing and repair needs. In the United States, the makes even reward their dealers not only on the basis of sales volumes, but also on their loyalty performance. The aim is to create a true and long lasting relationship of trust.

Responsive professionals

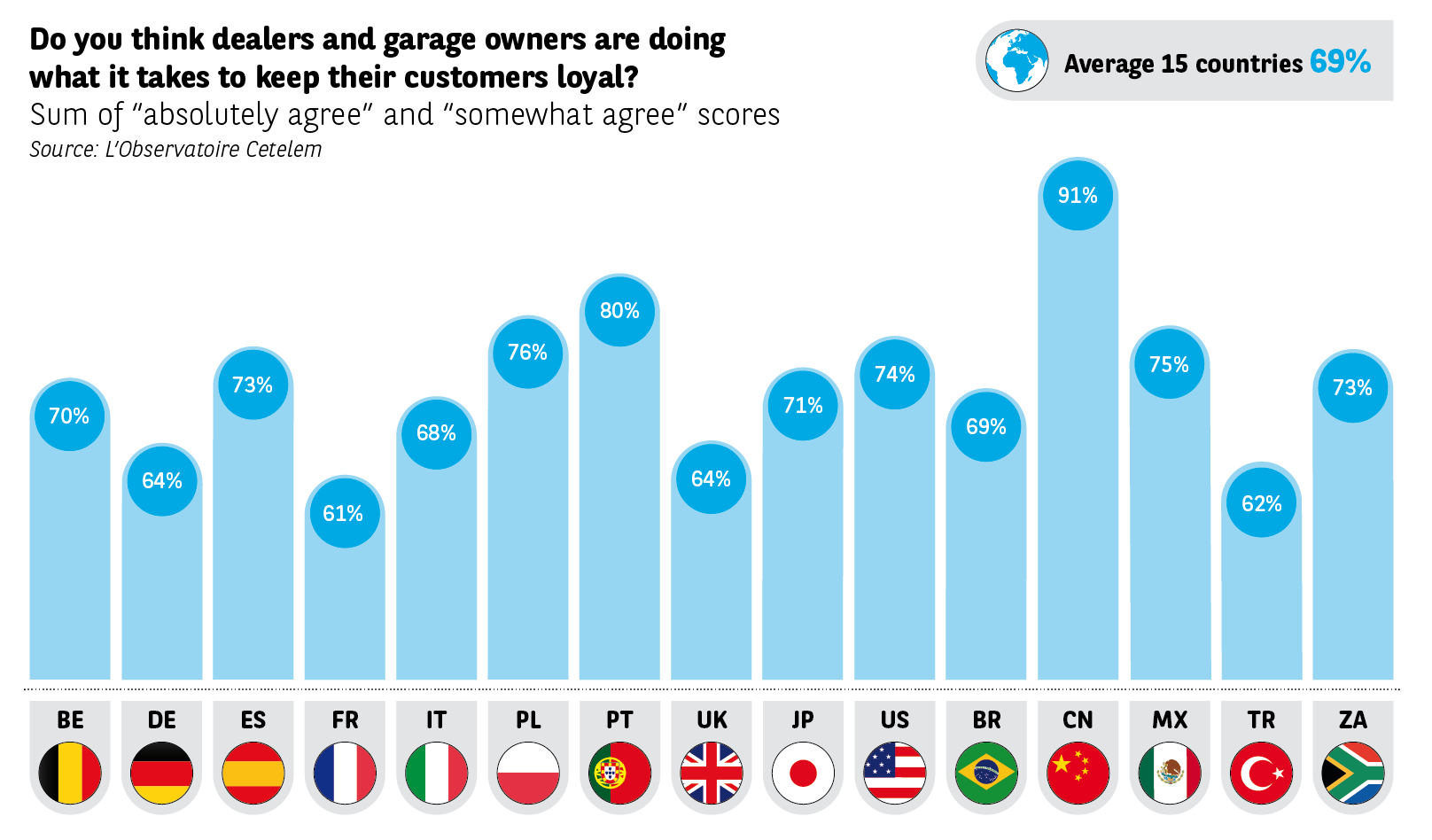

The 2018 survey conducted by L’Observatoire Cetelem de l’Automobile shows that 69% of respondents state that dealers/garage owners are also doing what it takes to secure their loyalty.

They have succeeded in innovating in response to changing commercial practices: new services (short rentals, doorstep delivery, customer clubs with exclusive benefits and services, etc.), brand-new showrooms, experience pathways with virtual reality configurators, etc. The commercial communication style has become more specific with regular, direct follow-up and contacts (calls, mail, and e-mails), especially across the social networks. Online sales websites and platforms run by the dealerships are there to back up the manufacturers’ own versions of them. The business is changing along with society and customer trends. Although these actions are definitely real, they are not an absolute guarantee of seduction. 64% of motorists begin their customer journey without the slightest idea of the make they will eventually buy (Google Cars online 2016 survey).