Observatoire 2025 Habitat: an european study about europeans, how they feel about their home and the energy transition.

In this Harris Interactive study you will first find a picture of housing situation in Europe: what importance do Europeans give to their home? Are they willing to optimize its energy efficiency? Which renovation work are they prioritizing? All these questions will help us understand where europeans stand on this topic. In a second part, we will discover what are the deal breaker for starting these renovation works and what are the main motivation? Finally, you can learn 10 strong levers to take action.

You can either read the full study below, download it or read the press release.

To go further, you can also discover our white paper on solar energy.

Enjoy!

Methodology

The quantitative consumer survey was carried out by Harris Interactive from May 19th to May 28th, 2025, in 8 European countries: Germany, Belgium, Spain, France, Italy, Poland, Portugal, and the United Kingdom.

A total of 12,574 people were interviewed online (CAWI), with participants aged 18 to 75, coming from nationally representative samples in each country. The representativeness of the sample is ensured by the quota method (gender, age, region of residence, and income/social class).

1. Europeans, who are attached to their homes, want to improve its energy efficiency

Housing: A strong attachment at the heart of European’s lives

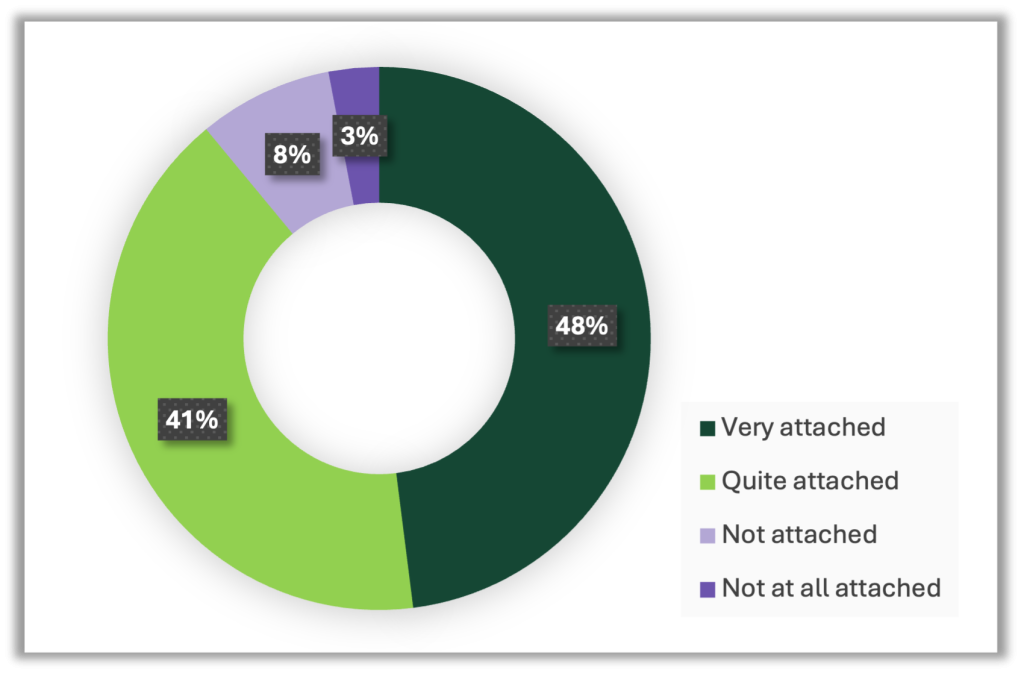

Attachment to housing

89% of Europeans are attached to their housing.

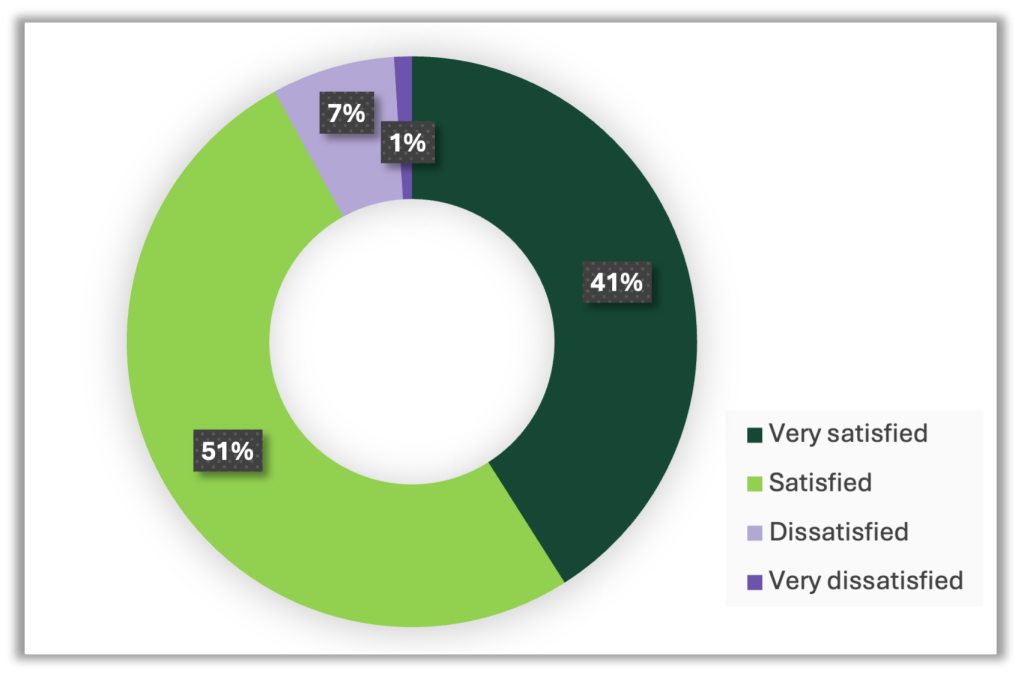

Housing satisfaction

92% are satisfied with their housing.

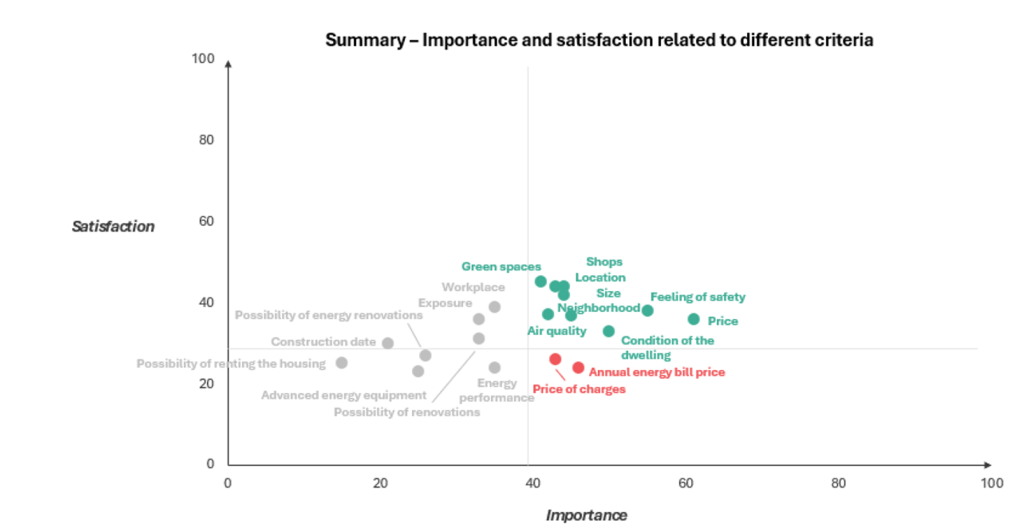

The reasons for this attachment are various: Between satisfaction and importance

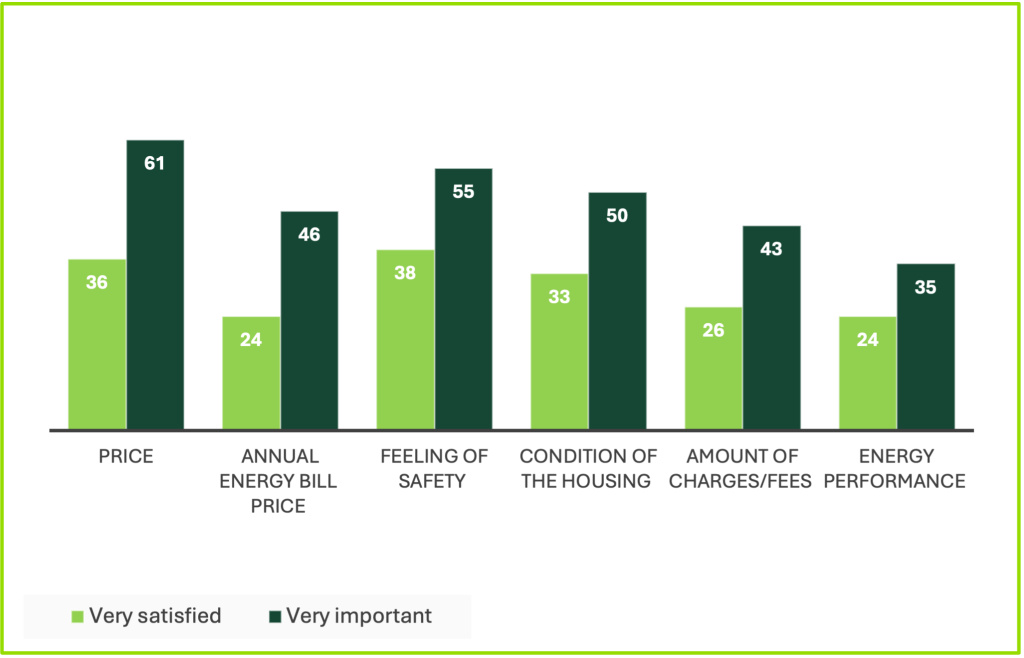

Price, Energy, Security – The blind spots of satisfaction: What still needs improvement

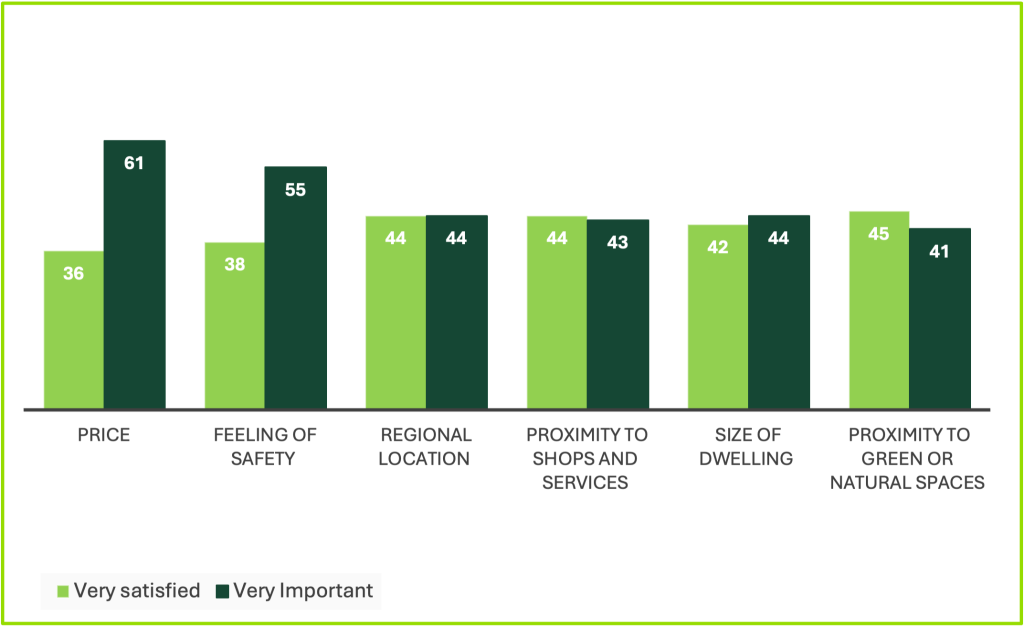

Top 6 criteria – importance & satisfaction

Top 6 gaps – importance & satisfaction

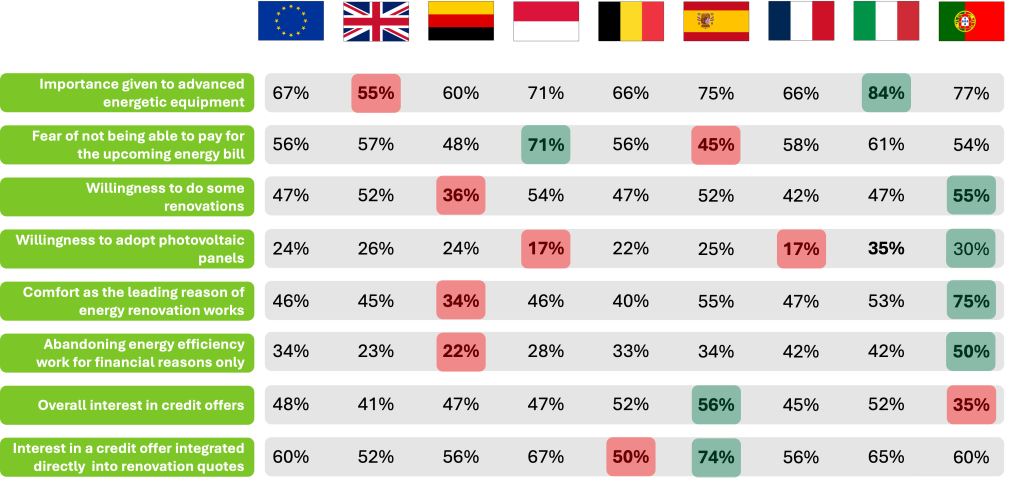

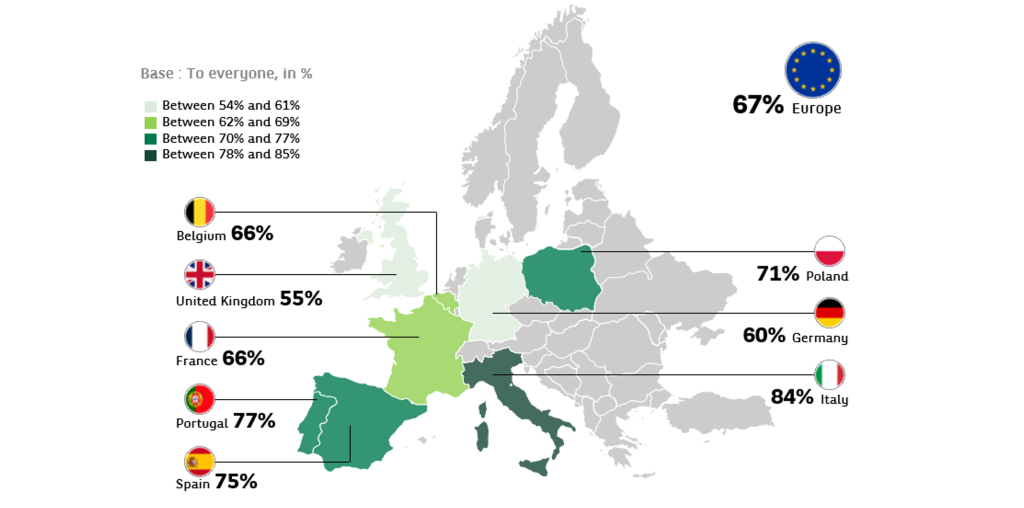

Importance given to advanced energetic equipment, symptomatic of a two-speed Europe

Italy being the country according the most importance to it.

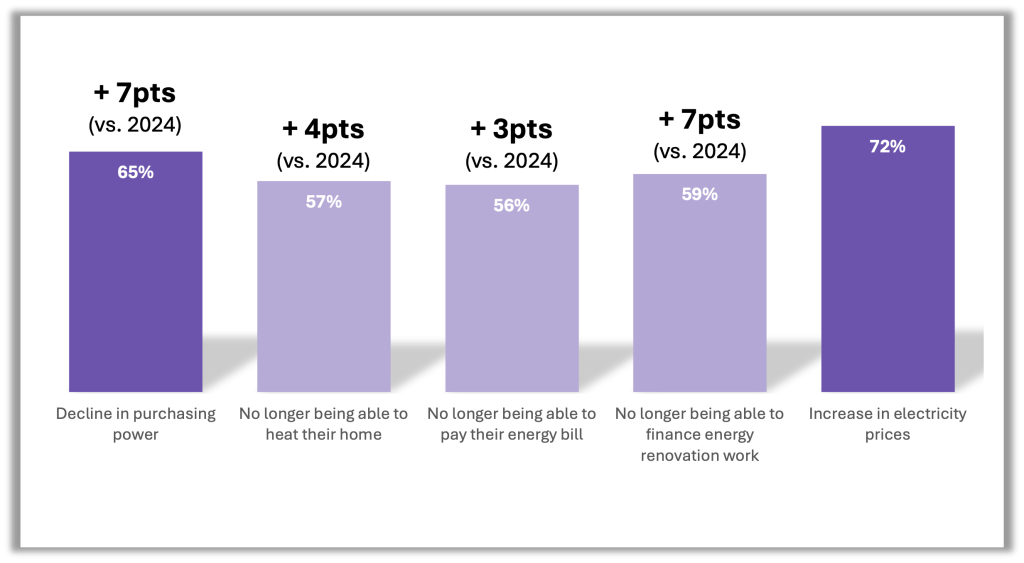

Energy and its financing increasingly undermine households’ future

65% of Europeans fear a decline in purchasing power (vs 58% in 2024).

Growing fears of not being able to pay for future energy bills

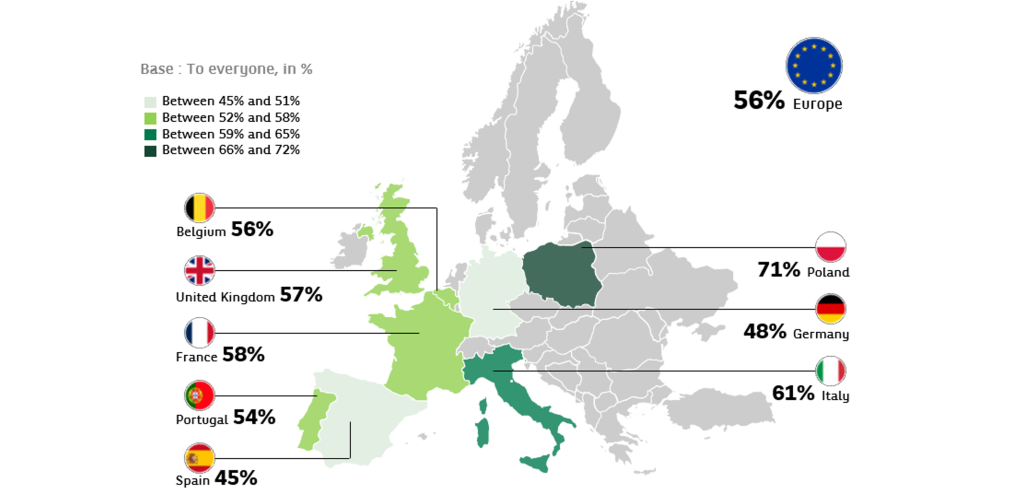

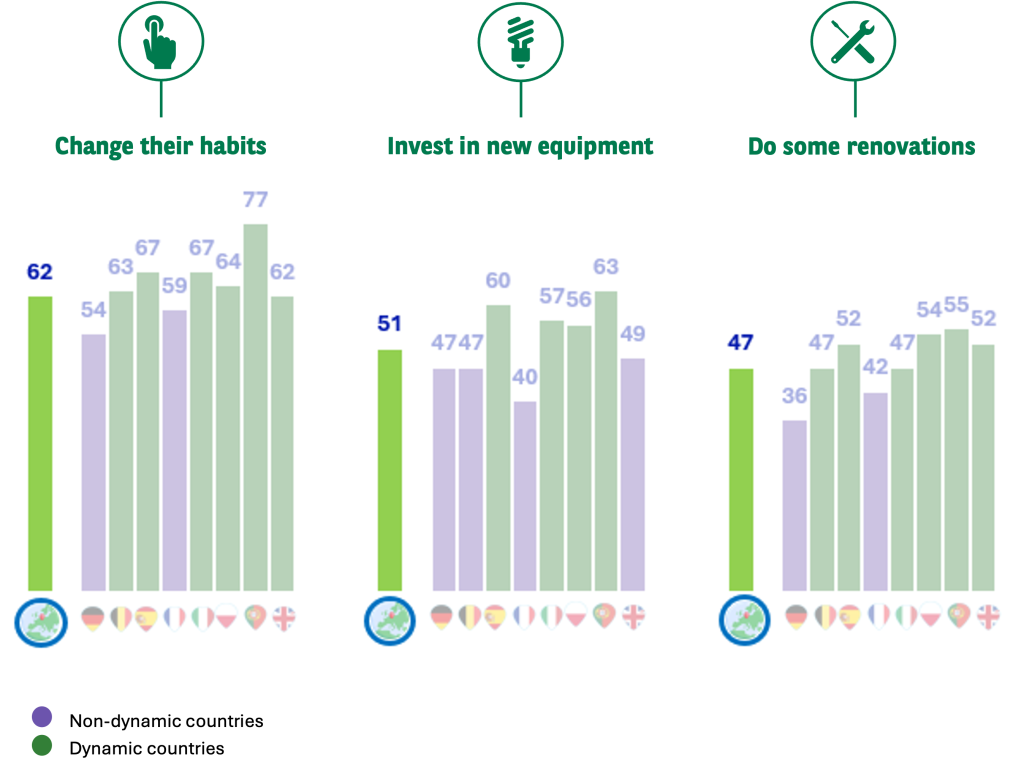

A two-speed European dynamic for investing in the energy transition

62% of Europeans want to change their habits to reduce their energy consumption.

51% of Europeans want to invest in new equipment.

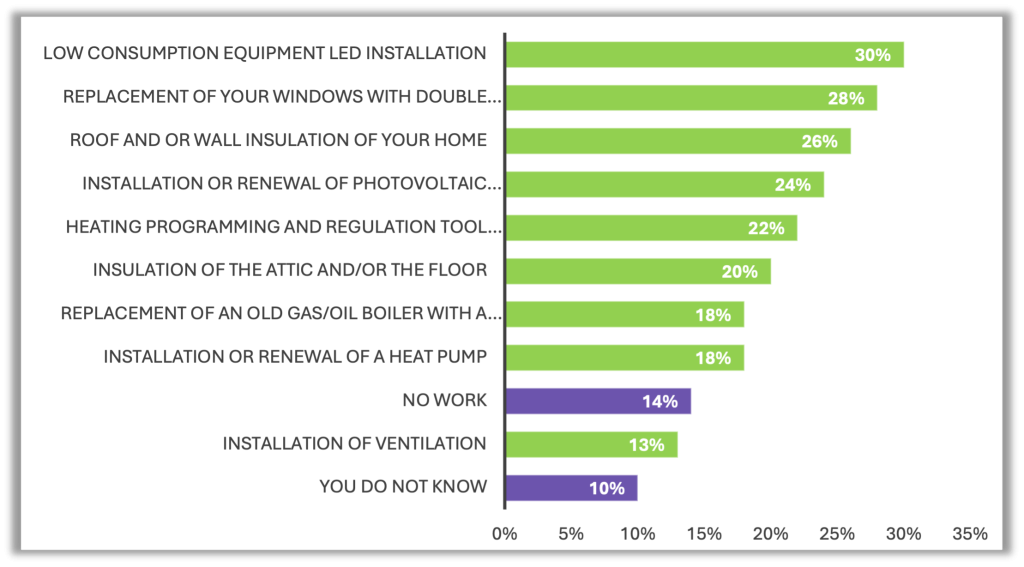

Targeted renovation: Specific projects rather than a full transformation

Main reason for renovating one’s home

In Europe, almost 1 in 3 households see LED equipment (30%) and window replacement (28%) as the top priorities to improve their home’s energy efficiency.

76% of Europeans ideally have in mind at least one project to enhance energy efficiency.

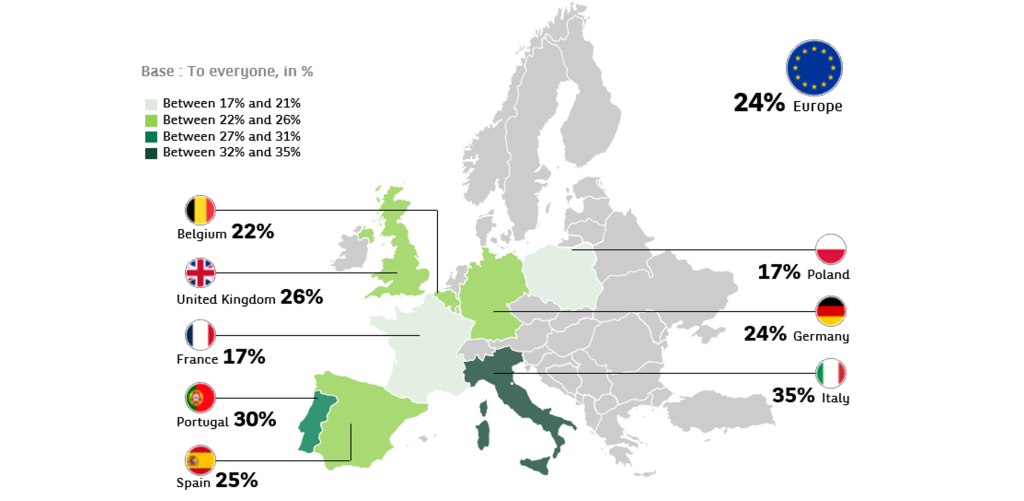

Targeted renovation: A specific willingness to produce energy through solar panels

Economy and Comfort: The concrete drivers of an ecological approach

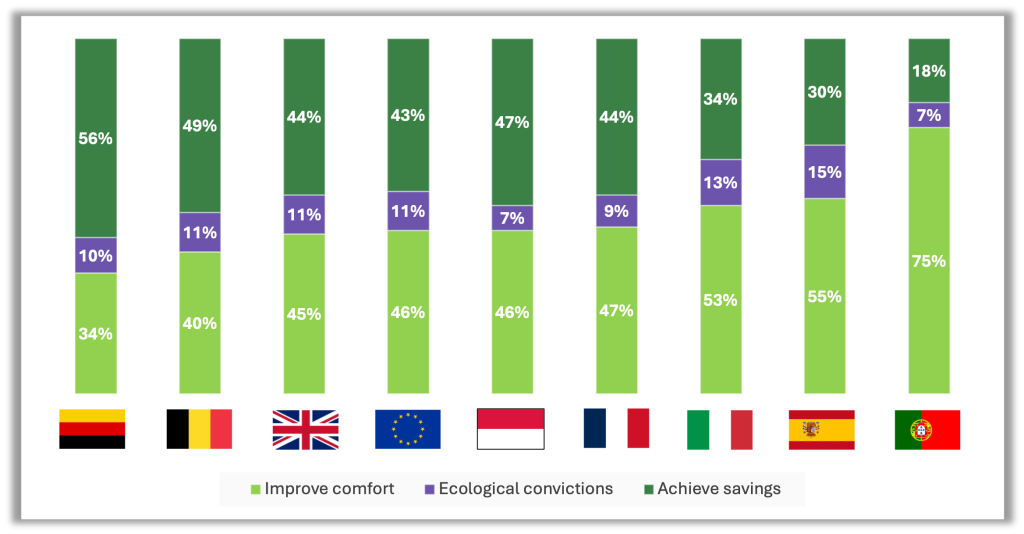

Main reason for renovating one’s home

Ecological awareness of Europeans as a driver of renovation work has significantly declined since last year: – 10 points

46% of Europeans consider comfort as the leading reason to renovate their home.

Energy transition, a genuine intention, but hindered

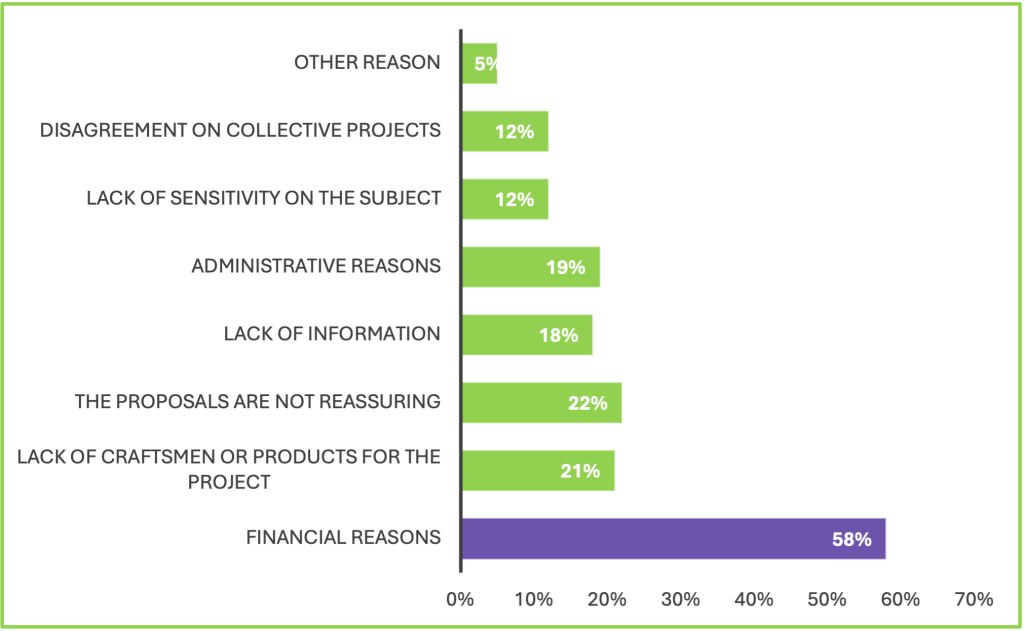

Access to energy renovation: An issue that goes beyond the sole question of cost

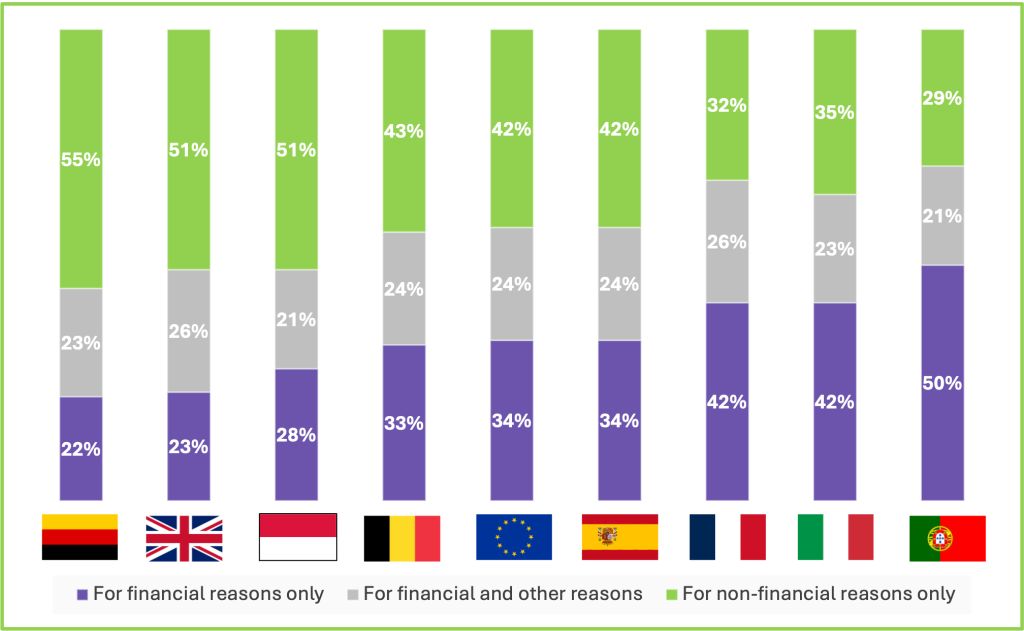

Overall reasons for abandoning energy efficiency work

Detailed reasons for abandoning energy efficiency work

Despite financial reason being an important reason for Europeans, 42% of them are abandoning their renovation project due to non-financial reasons only.

The housing budget: A financial burden for one household out of three

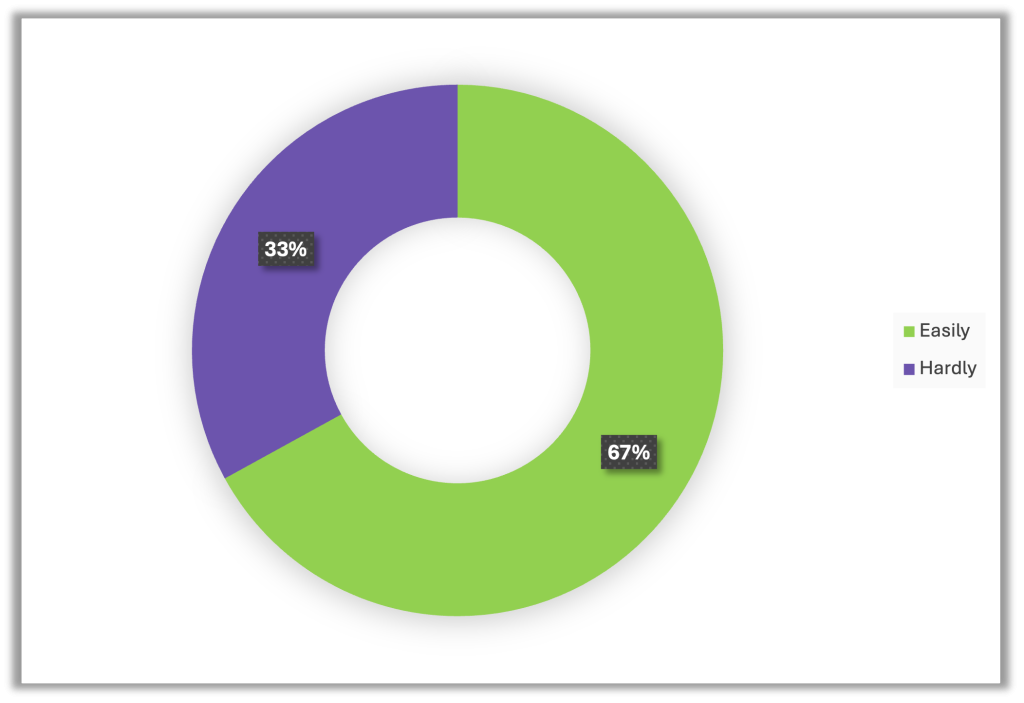

Assessment of their housing budget situation

For 33% of Europeans, the housing budget situation is difficult (vs. 35% in 2024).

Public aid: Decisive but difficult to access

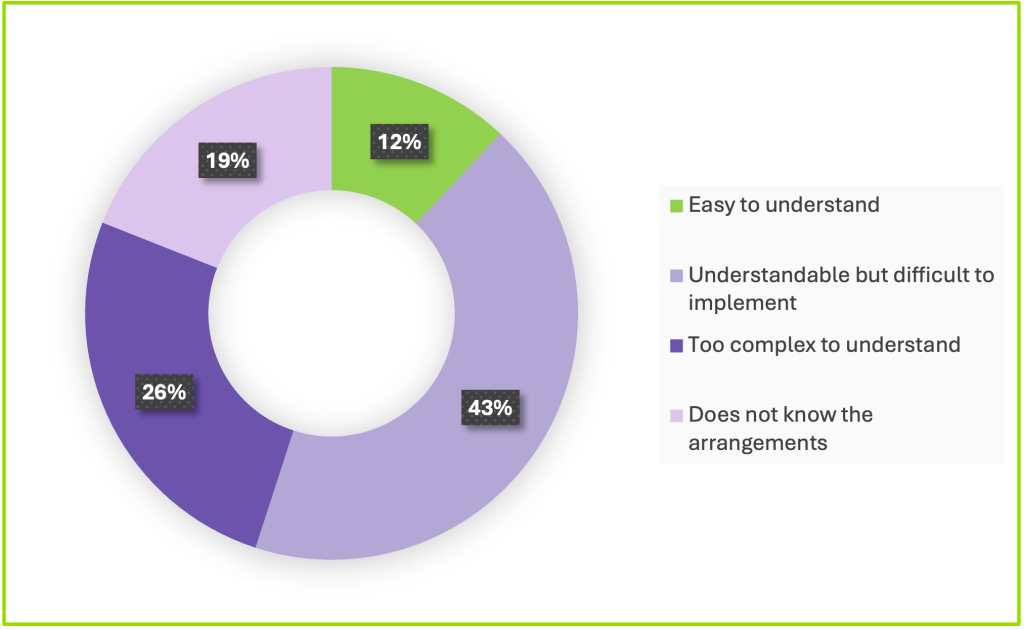

Opinion on public financial aid

43% of Europeans say that public aid is understandable but difficult to implement.

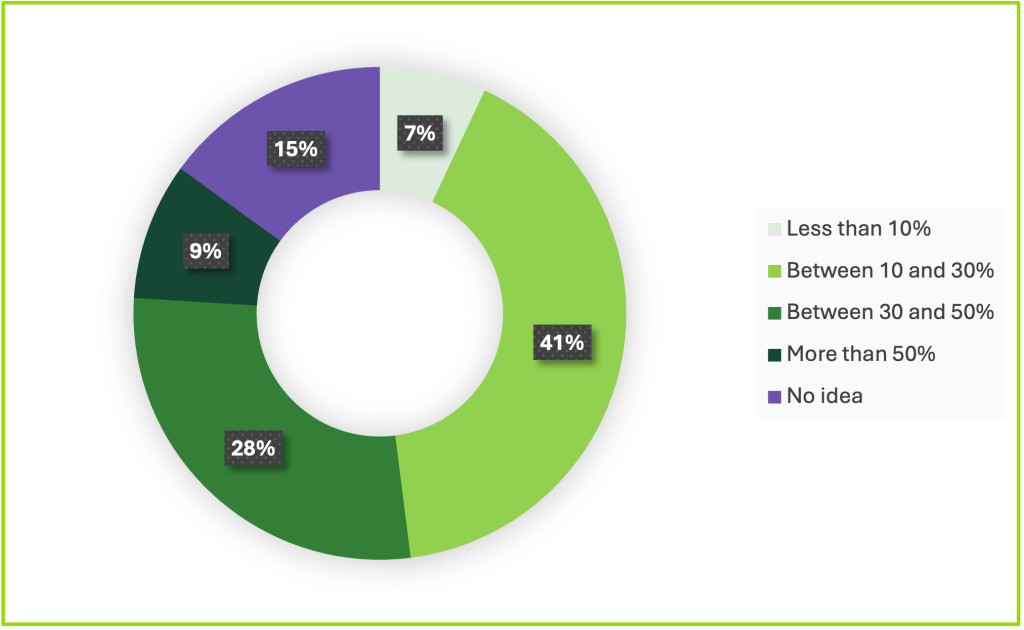

Percentage of expenses covered by public bodies

69% of Europeans say that state or public bodies cover between 10% and 50% of expenses.

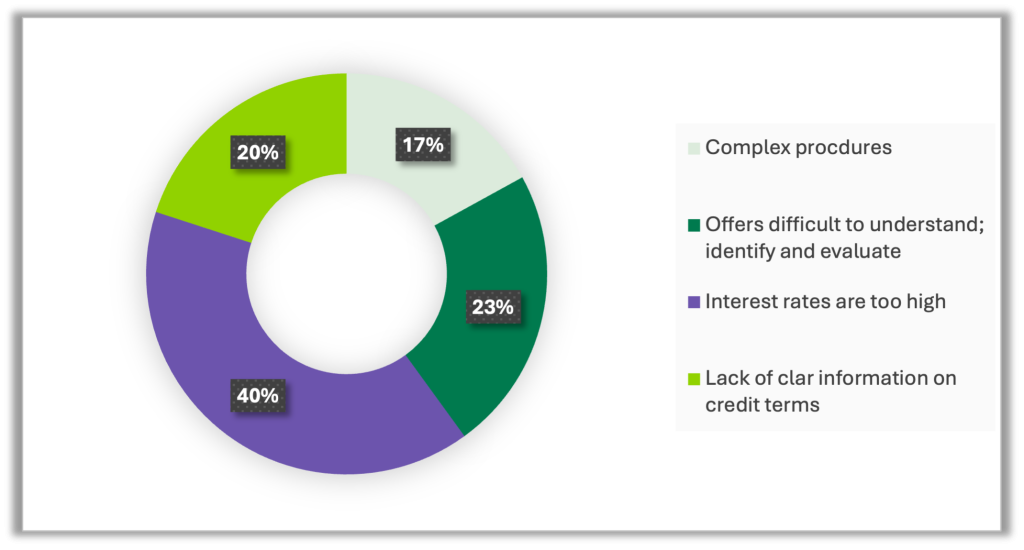

Financing: A complexity to overcome to facilitate action

60% of Europeans have another principal barrier to financing renovation works than interest rates.

23% of Europeans see the difficulty to understand, identify, and evaluate offers as a main barrier to financing renovation works.

Main barriers to financing renovation works

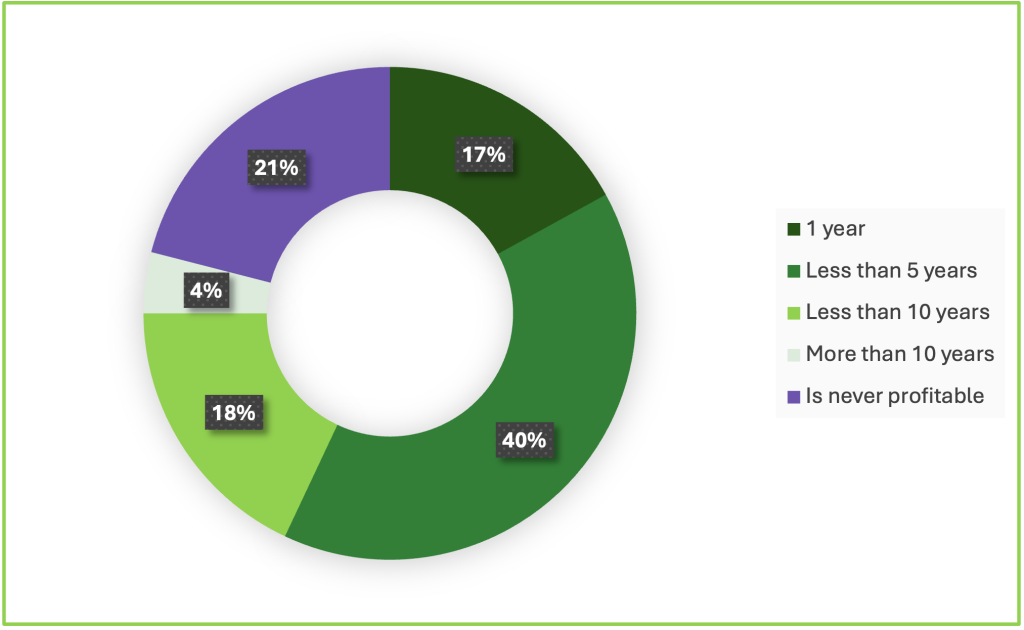

A quick ROI: A condition for commitment, difficult to meet

Perception of the acceptable payback period

57% of Europeans expect profitability within 5 years for their energy renovation.

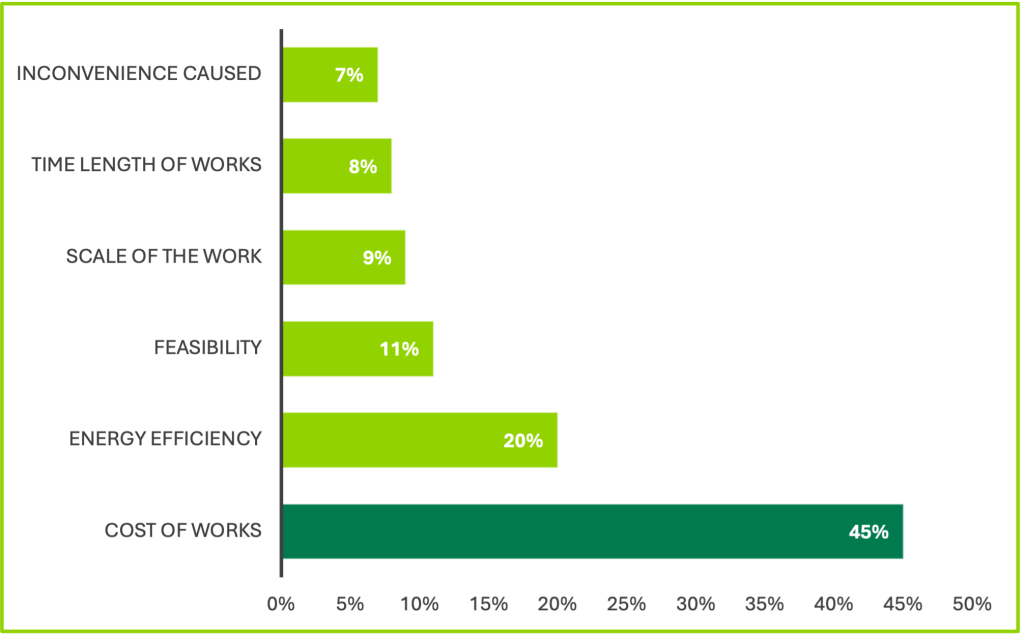

Critères prioritaires dans le choix du type de travaux à réaliser

45% of Europeans think that the cost of works is a priority criterion when deciding on renovation projects.

Energy transition: the 10 drivers for taking action

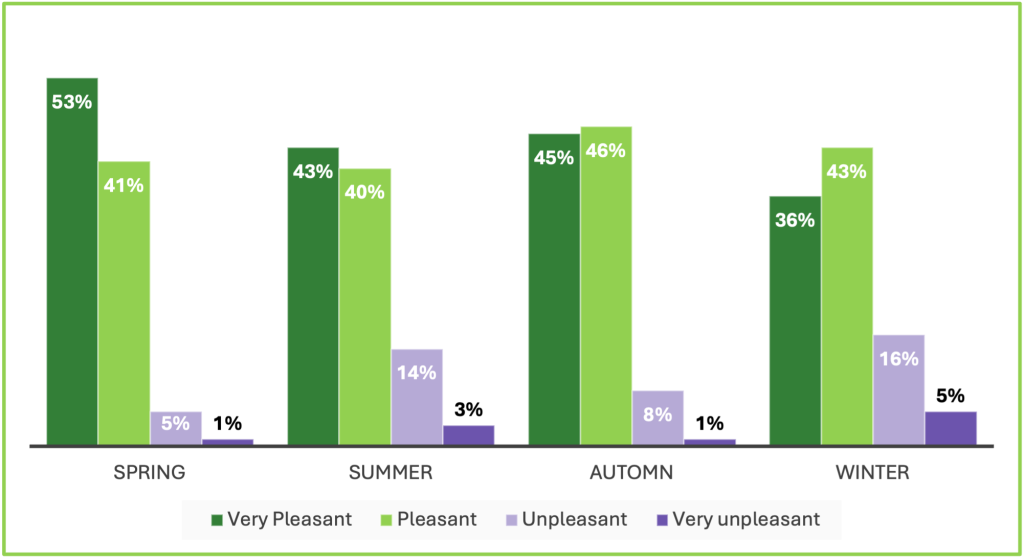

1. Thermal comfort: A sensitive driver amplified by seasonality

Comfort by season

29% of Europeans experience an unpleasant or very unpleasant winter season.

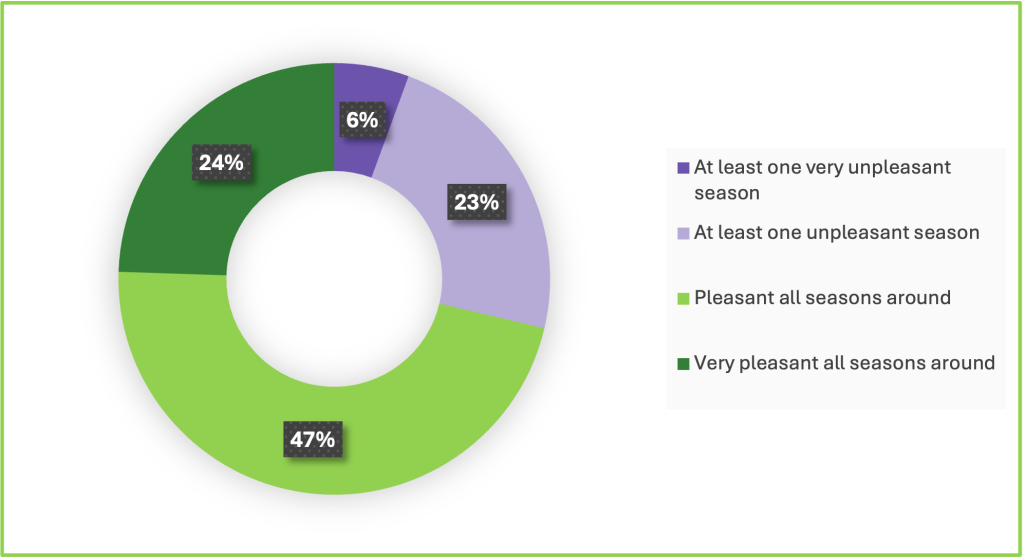

Overall housing comfort throughout seasons

21% of Europeans experience an unpleasant or very unpleasant winter season.

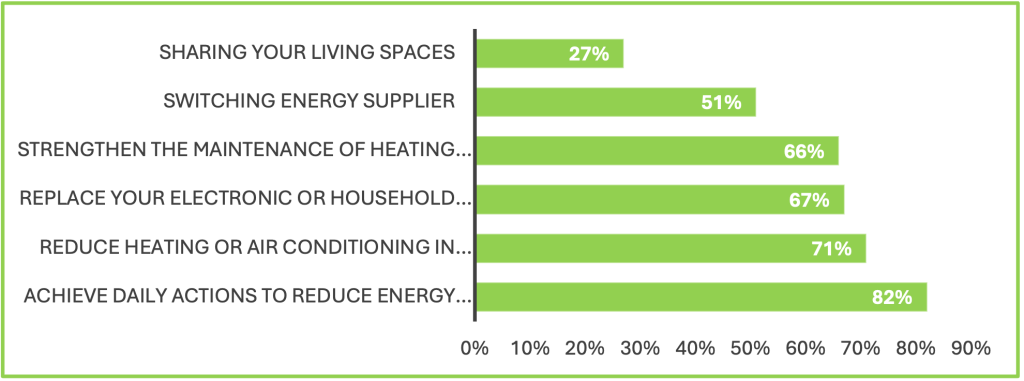

2. Habits: The first step that triggers action

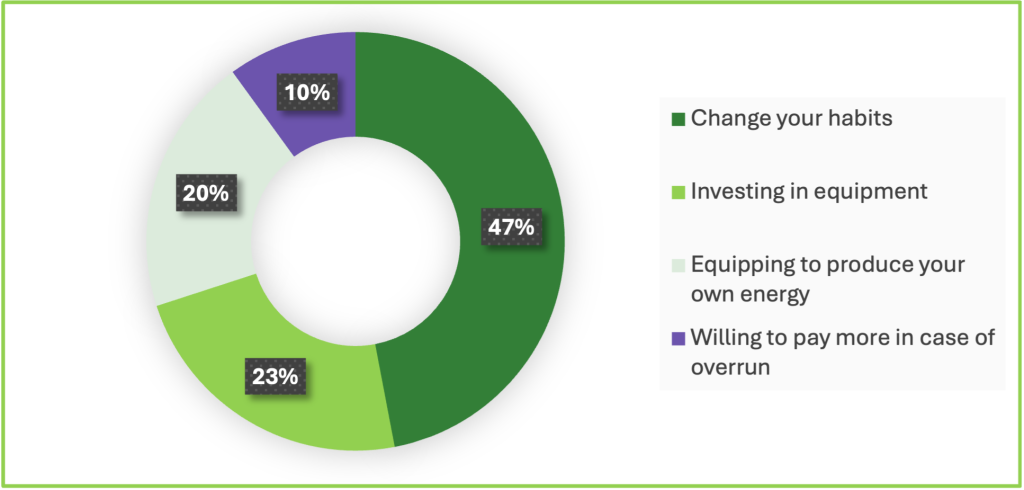

Actions considered to optimize or reduce energy cost in housing

82% of Europeans say that everyday actions are necessary to reduce energy consumption.

Actions taken if the price of electricity doubled by 2030

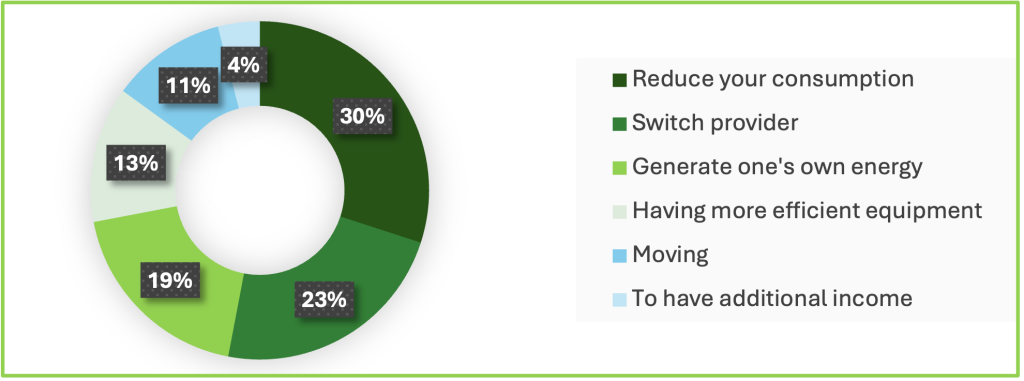

If electricity prices doubled by 2030, 30% of Europeans say they would reduce their consumption.

3. A concrete example: When renovation proves its effectiveness

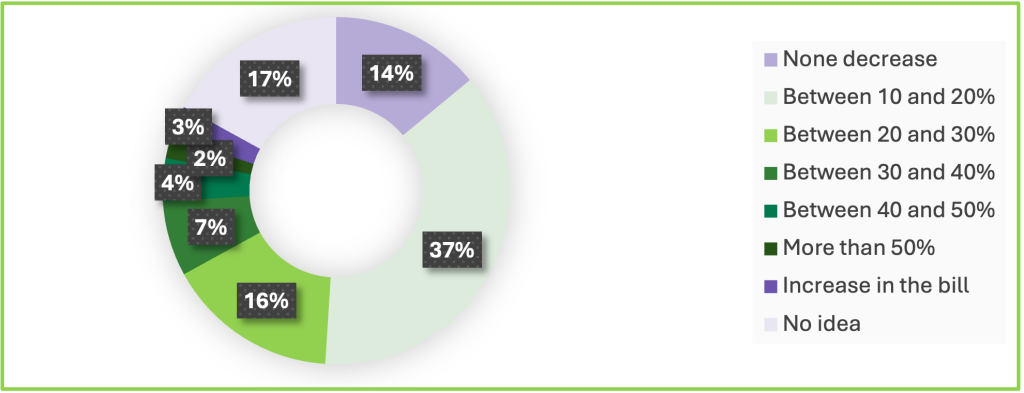

Reported decrease in monthly energy bills after renovation

66% of Europeans have noticed a decrease in their energy bills after renovation works.

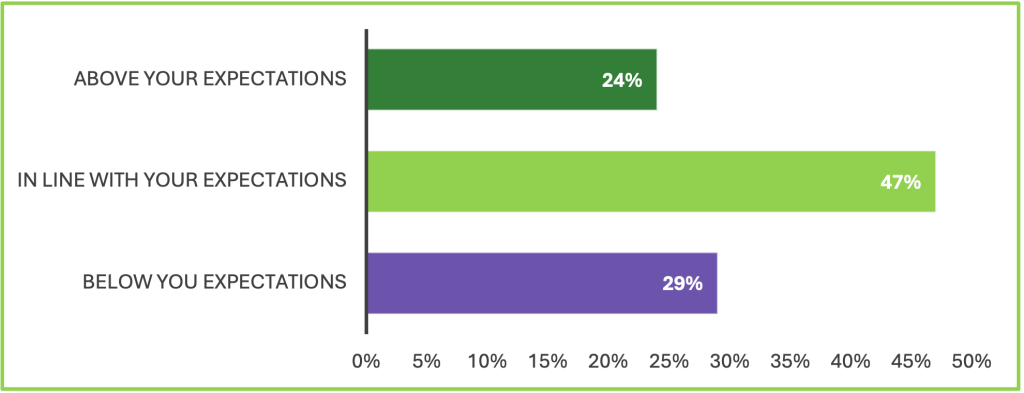

Nature of decrease in energy bills compared to expectations

71% of Europeans found that their energy savings after renovation met or exceeded their expectations.

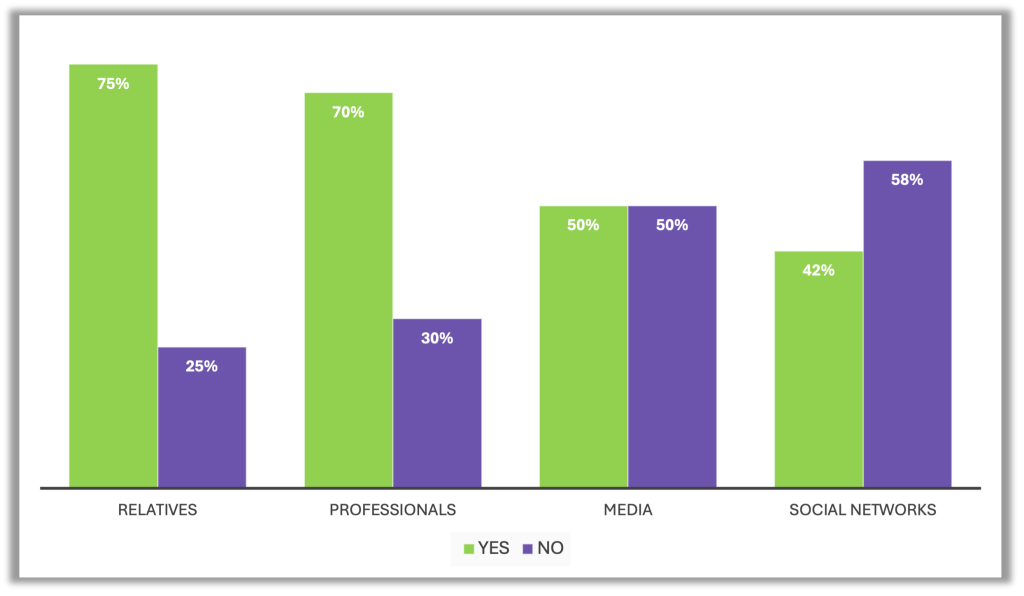

4. The social circle: The decisive role of relatives and professionals

Perception of being influenced by different actors in housing projects

75% of Europeans are influenced by their relatives.

70% of Europeans are influenced by professionals.

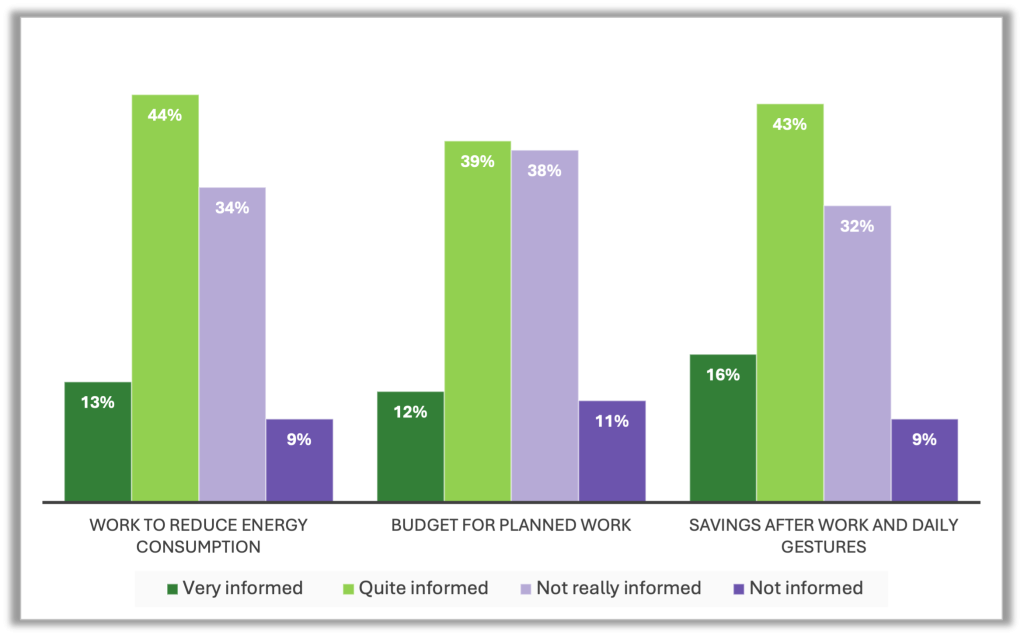

5. Education: Informing and guiding to trigger action

Feeling of being informed

57% of Europeans consider themselves informed or very informed about the work that exist to reduce energy consumption.

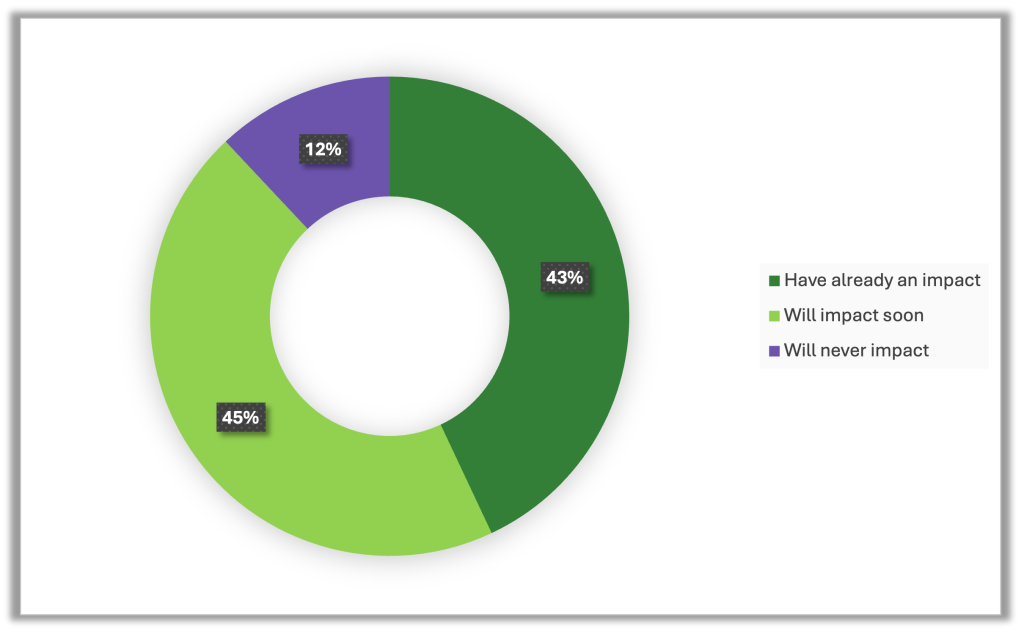

6. Energy commitment: A lever for property value enhancement

Perception of the impact of energy performance on property value

88% of Europeans believe that investing in their home impacts or will impact the value of their property.

43% of Europeans declare that investing in their home already impacts the value of their property.

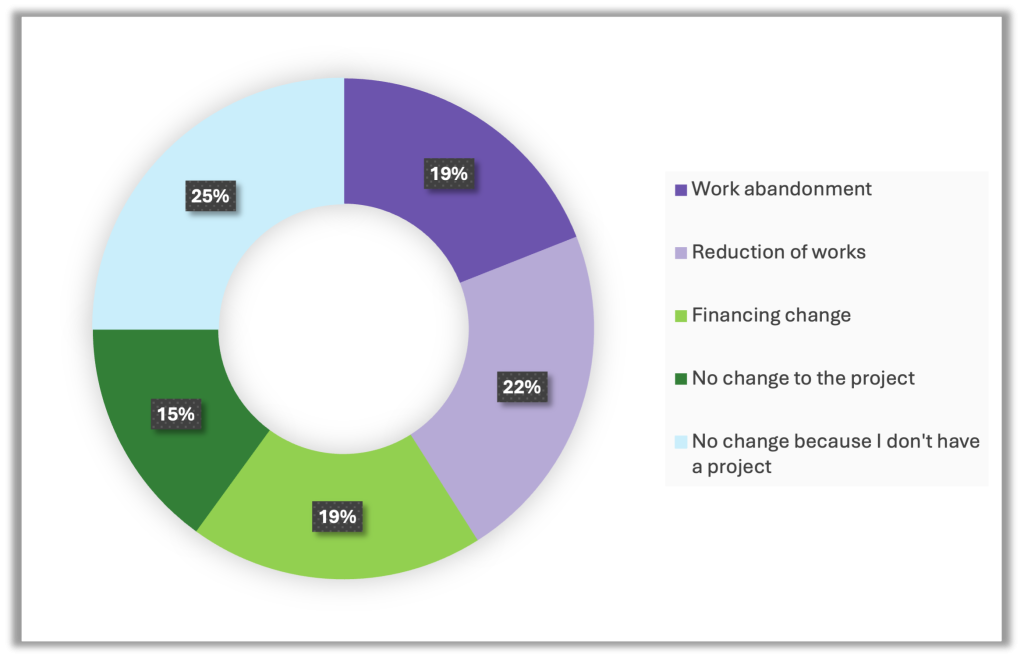

7. Public aid: A trigger for a majority of homeowners

Actions taken by owners in case public aids for insulation and low consumption equipment were removed

41% of Europeans would give up or reduce renovation works for financial reasons.

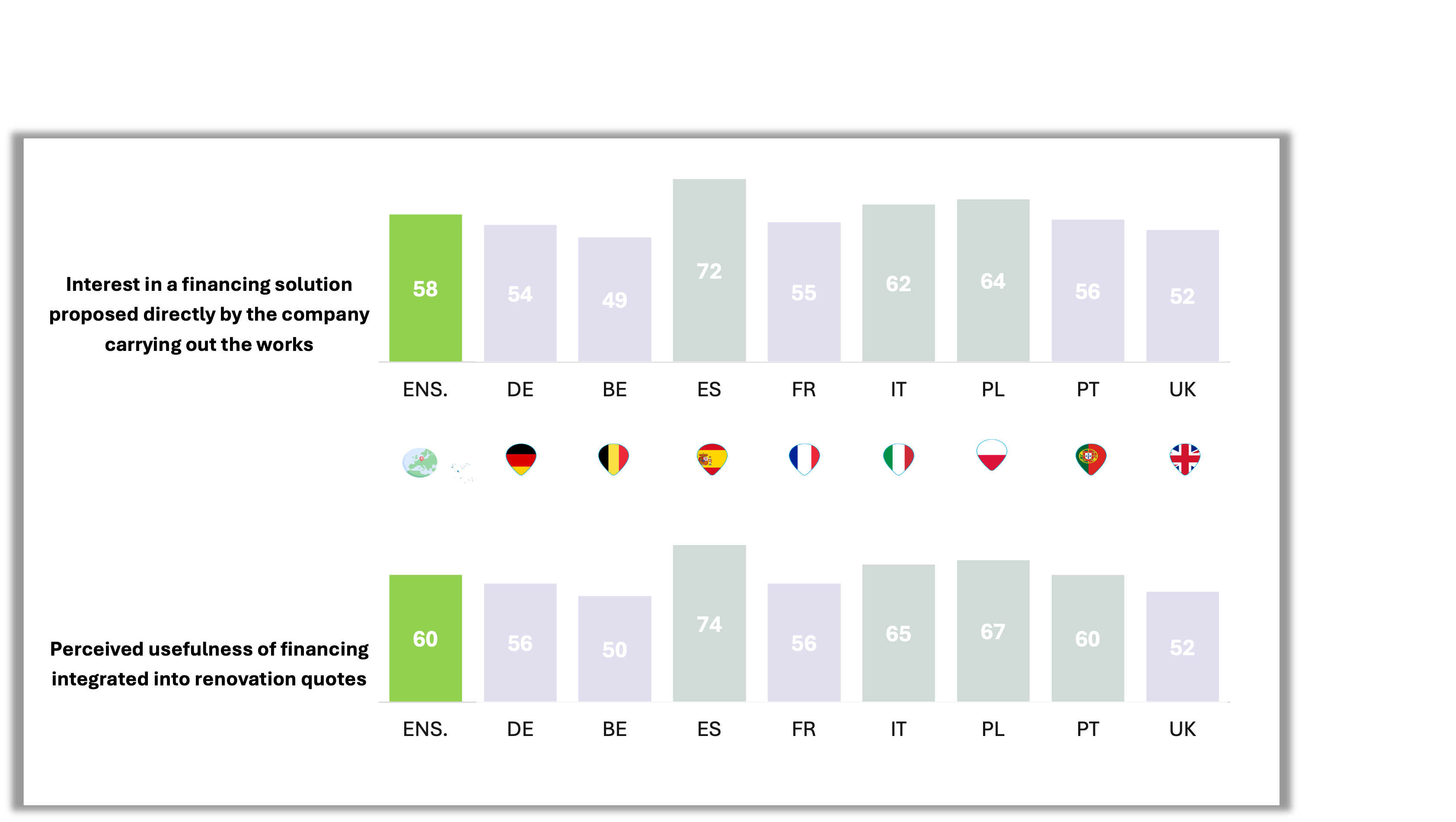

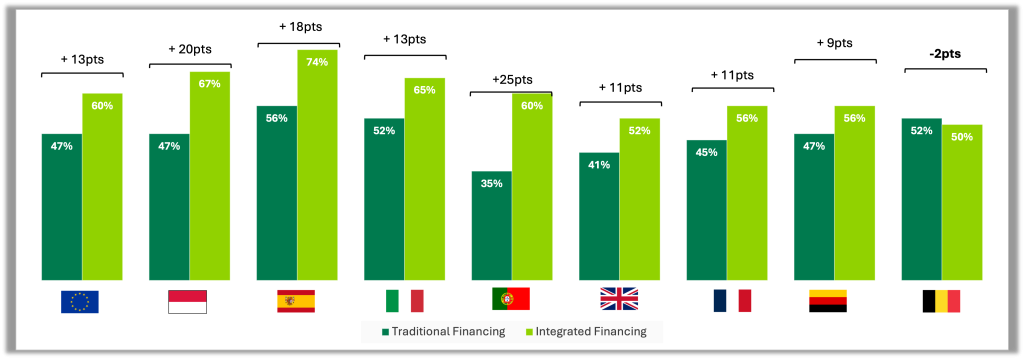

8.A. Integrated financing vs. traditional bank credit

Interest and usefulness of financing associated within renovation offers

58% of Europeans would be interested if the credit offer was proposed directly by the company.

60% of Europeans would find financing integrated directly into renovation quotes useful.

8.B. Attractivity of integrated financing vs. traditional bank credit

Main reason for renovating one’s home

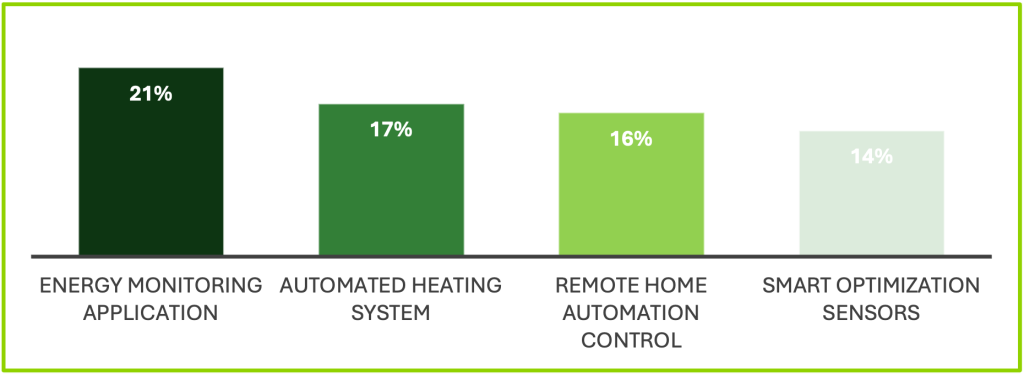

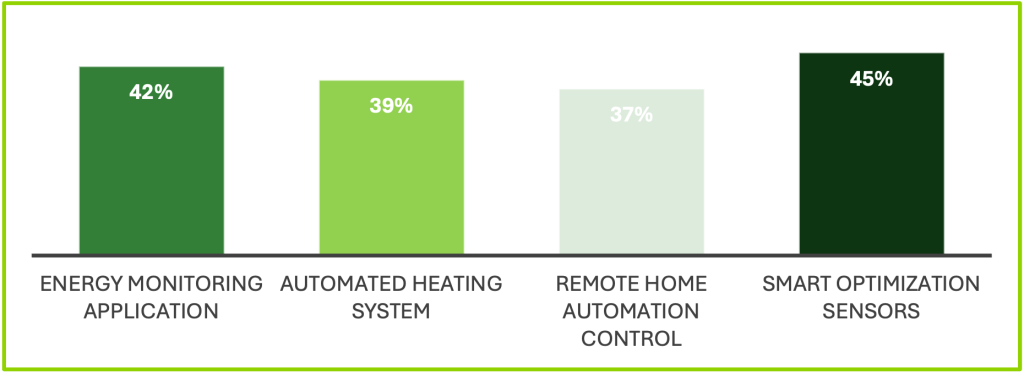

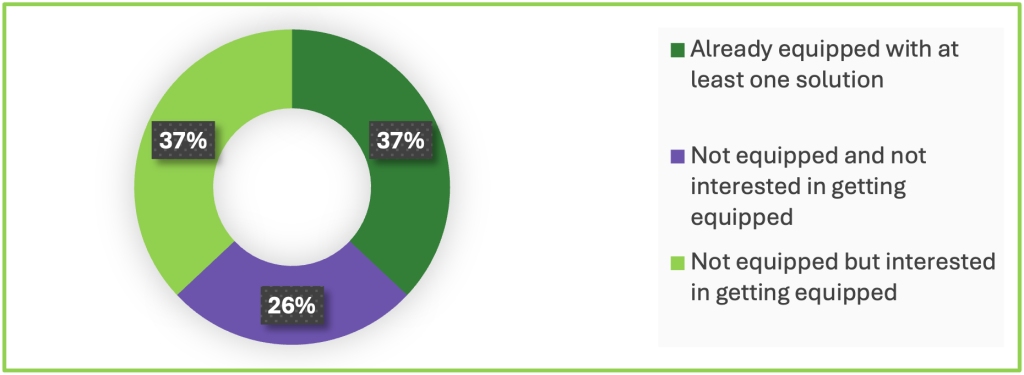

9. Managing consumption: Regaining control of the transition

Current equipment

Planned equipment

Current equipment and interest to get equipped

74% of Europeans are already equipped or are interested in getting equipped.

10. Energy autonomy: From latent dream to possible breakthrough

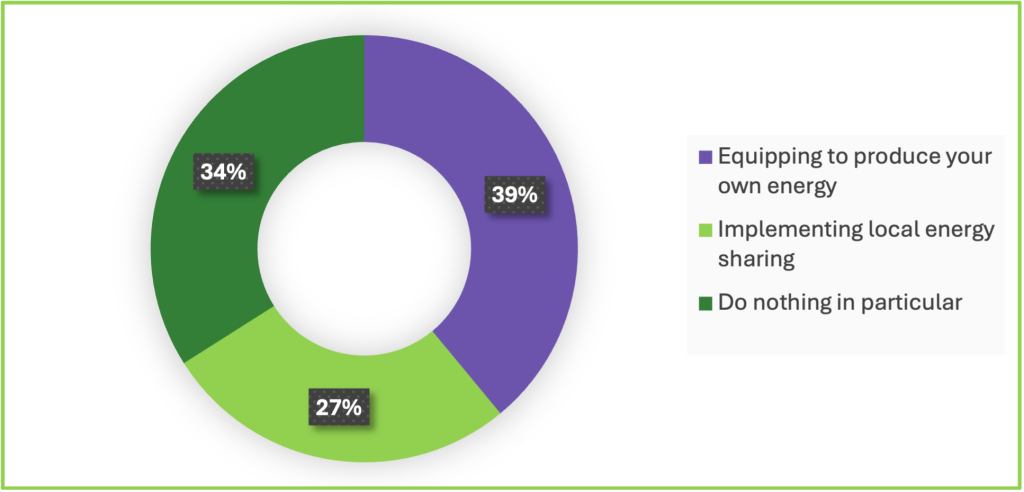

Impact of electricity quotas and tripled prices

Impact of affordable storage and efficient solar panels

35% of Europeans would be ready to produce their own energy if storage became affordable.

Europe’s vision in a nutshell

Housing: A commitment under financial pressure

89% of Europeans maintain a deep attachment to their home, a pillar of their identity and their security.

But 3 vulnerabilities emerge among the housing choice criteria:

1. Cost and value of housing.

2. Housing security.

3. Energy/renovation.

Energy renovation and its ecological dimension are now integrated into European’s lives. If budgetary pressure remains central, comfort becomes a goal in its own right. But expectations remain linked to the question of “how much” and “how” to act concretely.

2 critical obstacles to the energy transition

- Budget: Households favor habit changes over renovation works. -> Europe at 2 speeds: more pronounced difficulty in Poland, Spain, Italy, Portugal vs. Fance, Germany, Belgium, UK.

- Complexity of the process: Lack of clear information, difficulties in finding professionals, financial obstacles, overly complex financing, ROI too long.

10 keys to unlock the energy transition

- Thermal discomfort, a sensitive driver

- Small actions, everyday reflexes

- Tangible results, drivers of commitment

- Relatives and experts, influential actors

- Information, to give meaning

- Property value enhancement, as a booster

- Public aids, often essential but poorly understood

- Good financing, without overcomplicating

- Talking control, for better mastery

- Energy autonomy, still under construction

Comparative analysis: Main indicators