The difficulty of embracing local consumption

THE DECISION TO BUY LOCAL IS A RATIONAL ONE

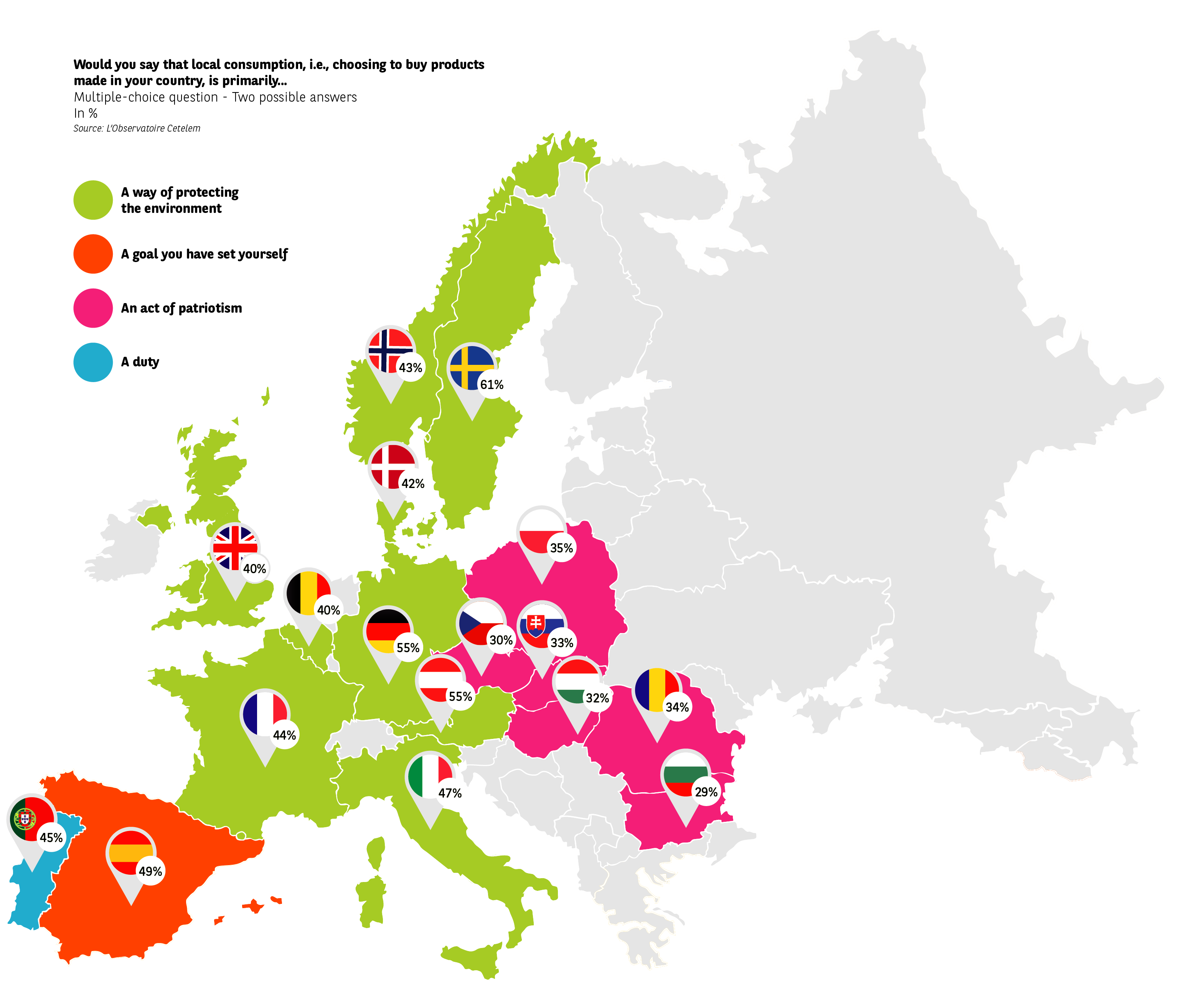

In the eyes of Europeans, local consumption is about values and the positive impact people believe it can have, particularly in socioeconomic terms.

Supporting the economy and protecting jobs

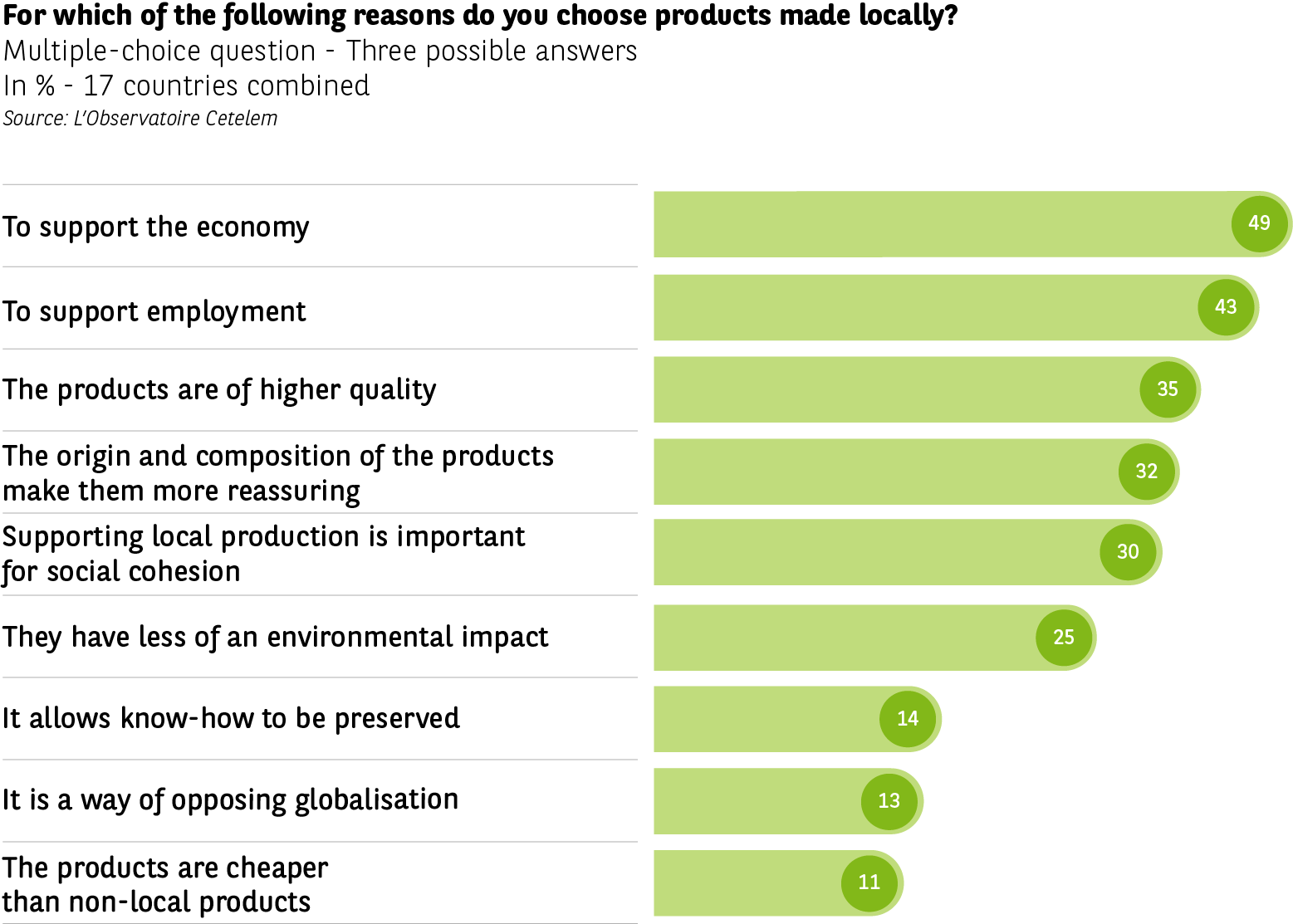

Europeans put forward two main arguments for buying local.

1 in 2 consumers believe that it is a way of bolstering the economy, this being the main reason to choose local products. The Portuguese and Bulgarians are the most likely to adhere to this idea (64% and 60%), while the Danes and Swedes, but also the French, are not quite as vehement.

43% also believe that consuming locally is a good way of protecting jobs. The Portuguese are by far the most engaged in this sense (63%). This opinion is less widely held in Germany and Denmark, where full employment has long been achieved.

An appreciation of quality and the guarantees offered

By fairly general consensus, Europeans also highlight the quality of local products and the assurances they bring (35% and 32%). When it comes to quality, the Bulgarians and Italians are the most mindful (43% and 42%), while the Belgians appear relatively indifferent (22%). As regards the issue of origin, composition and how these factors reassure consumers, the Austrians and Hungarians are the most enthusiastic (40%), with the British less so.

A form of consumption that creates social cohesion

Europeans are also very aware of the social aspects of local consumption. 30% have this in mind when buying this kind of product. The Hungarians are by far the most receptive to this idea (54%), while a relatively small proportion of Austrians and Norwegians share this perspective (20% and 23%).

However, in no way does this result reflect particularly emotional concerns. Europeans are resolutely pragmatic and undeluded. Only a small proportion buy local products to preserve specific know-how (14%). Similarly, few see it as a way of fighting globalisation (13%), as though it is now taken for granted. The French and Norwegians are the most likely to believe that this form of consumption can serve to pass on expertise (21% and 20%), while very few people in Portugal are of this opinion (5%). Meanwhile, the Austrians and Belgians top the list for the number of times they refer to “alter-globalisation” (18%).

The environment loses importance at the moment of purchase

In an ideal world, local consumption would always have an environmental slant, but when it comes to actually making a purchase, this kind of concern loses its appeal. A quarter of Europeans focus on this criterion. There is a clear divide between the maturest countries in this area, such as Sweden and Germany (51% and 35%), and the nations of Eastern Europe, where this awareness is less developed (Bulgaria 6% and Romania 7%).

THE PRICE BARRIER

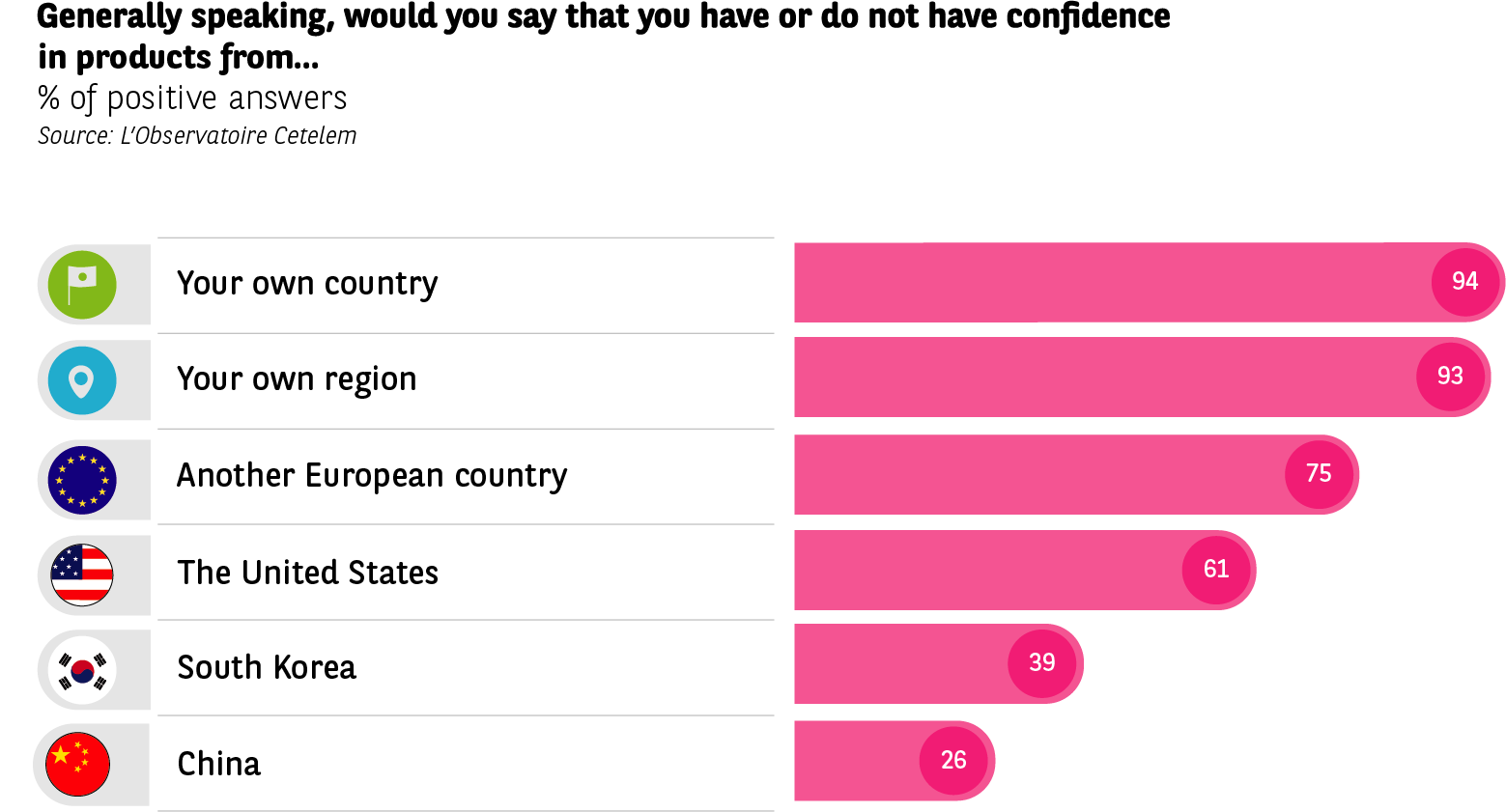

These rational purchasing motivations are also bolstered by greater confidence regarding product origin, with proximity being tantamount to a quality label.

Proximity is a guarantee of quality…

94% of those surveyed think that products manufactured in their home country offer an added guarantee and 93% believe the same is true of regional products. The figure for European-made products is 75%, while for those made in the USA it is 61%. Lagging behind are products manufactured in South Korea and China, in which just 39% and 26% of Europeans have confidence. Whereas those on the Iberian peninsula appear to be great Europhiles (Portugal 91% and Spain 85%), the Romanians, Portuguese and British place their confidence in American products (79%, 74% and 73%). Norway and the United Kingdom are where Asian-made products are the highest rated (South Korea 57% and 45%, China 50% and 45%).

… but price is the source of debate

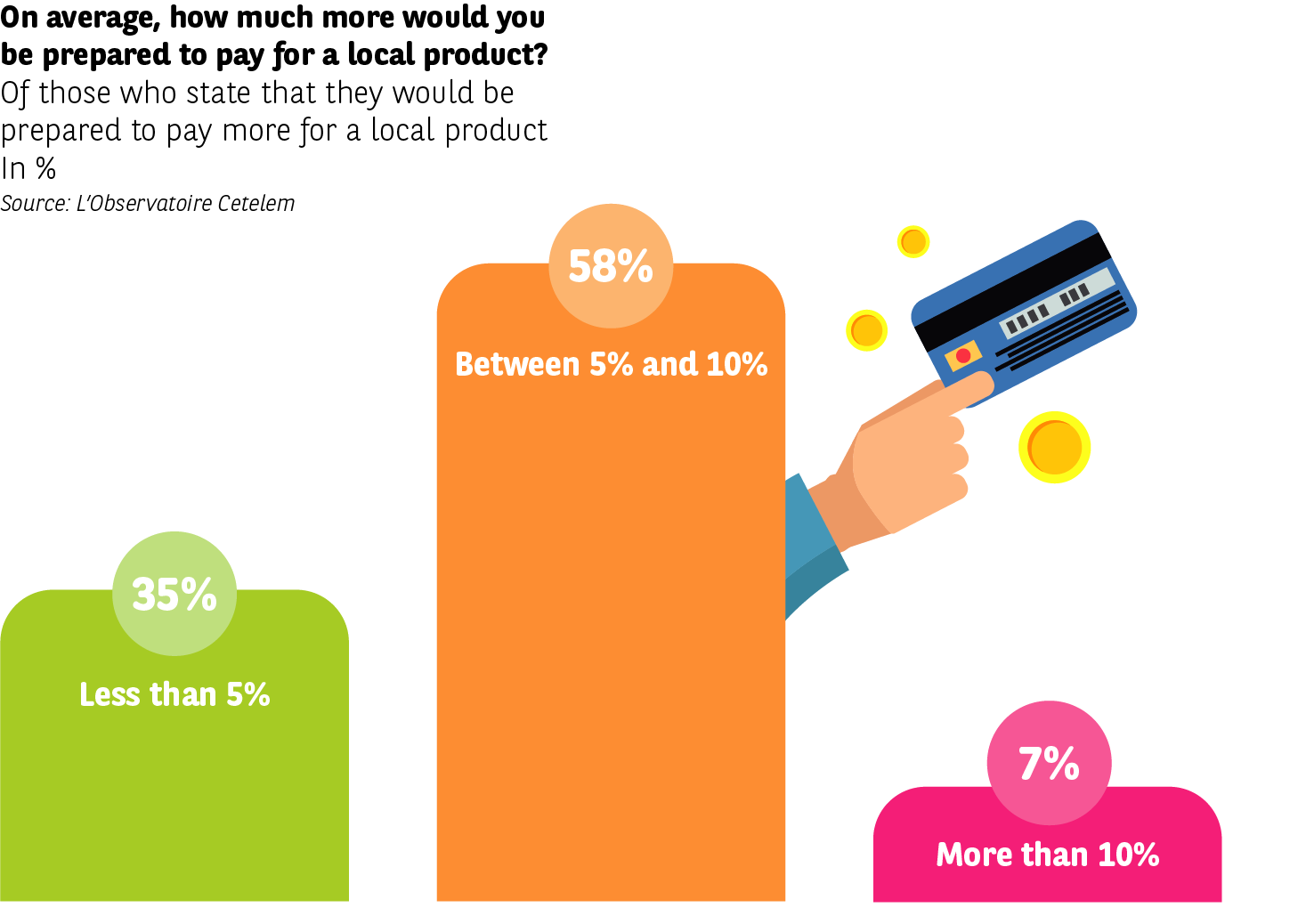

If, as highlighted, local products are overtly associated with quality, when it comes to price the position of Europeans is more complex. 64% believe these products are too expensive. The Swedes, Norwegians and French are most vocal about the cost (78%, 76% and 76%). The Germans, Bulgarians and Romanians are the least categoric (57%, 53% and 53%).

Fortunately for the development of local consumption, however, this is not a deal breaker. 2 out of 3 consumers are prepared to make financial concessions in order to purchase local products. The Italians are the most willing in this respect (75%), followed by the Norwegians, the Slovaks and the Bulgarians. Conversely, more than half the Belgians and Czechs interviewed are not prepared to loosen their purse strings excessively. How much more would Europeans be prepared to pay? 58% state that they would accept a surcharge of between 5% and 10%.

Price and quality: the dynamic duo…

As highlighted by numerous L’Observatoire Cetelem de la Consommation studies, Europeans are pragmatic socioeconomic actors first and foremost.

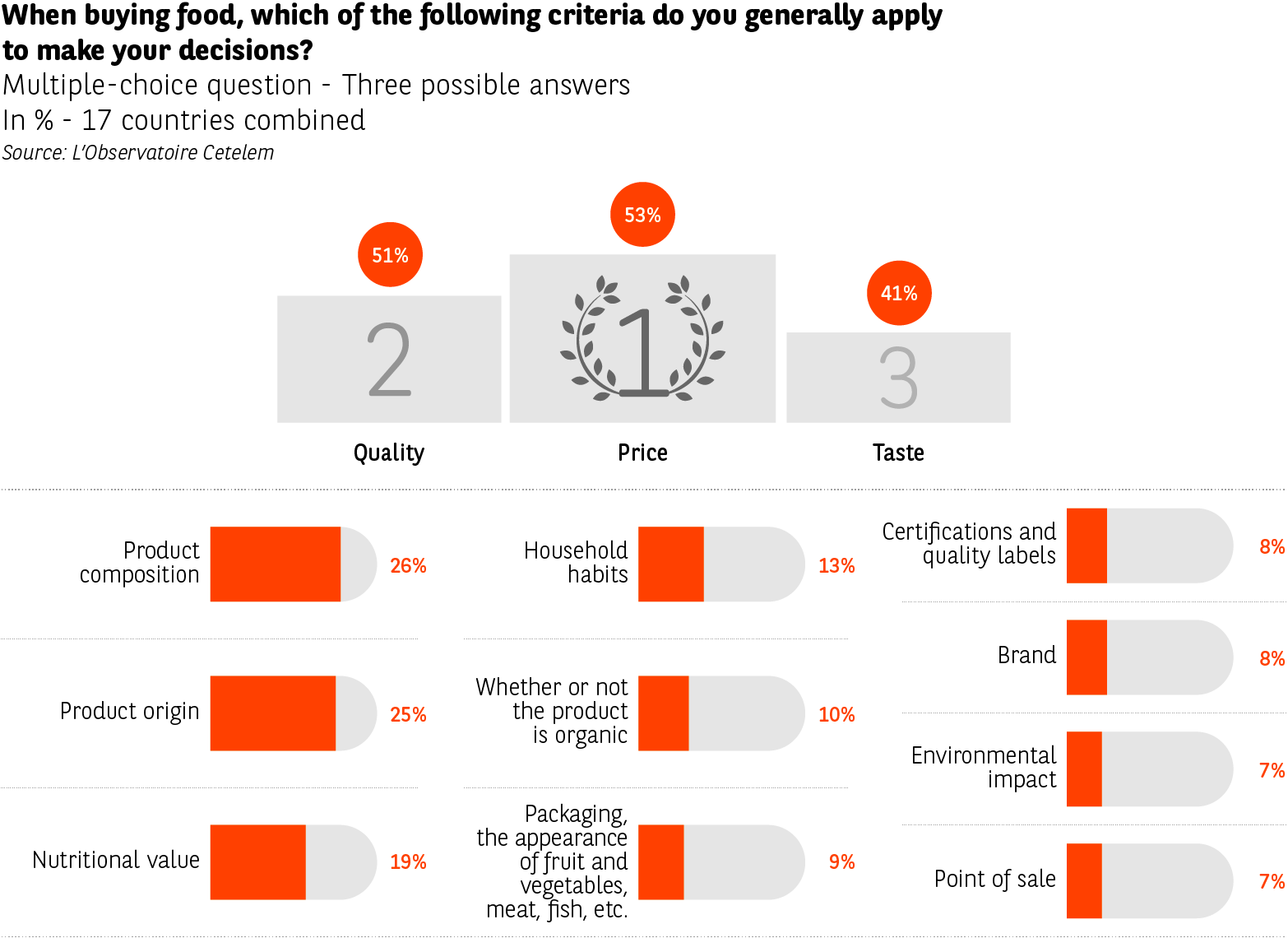

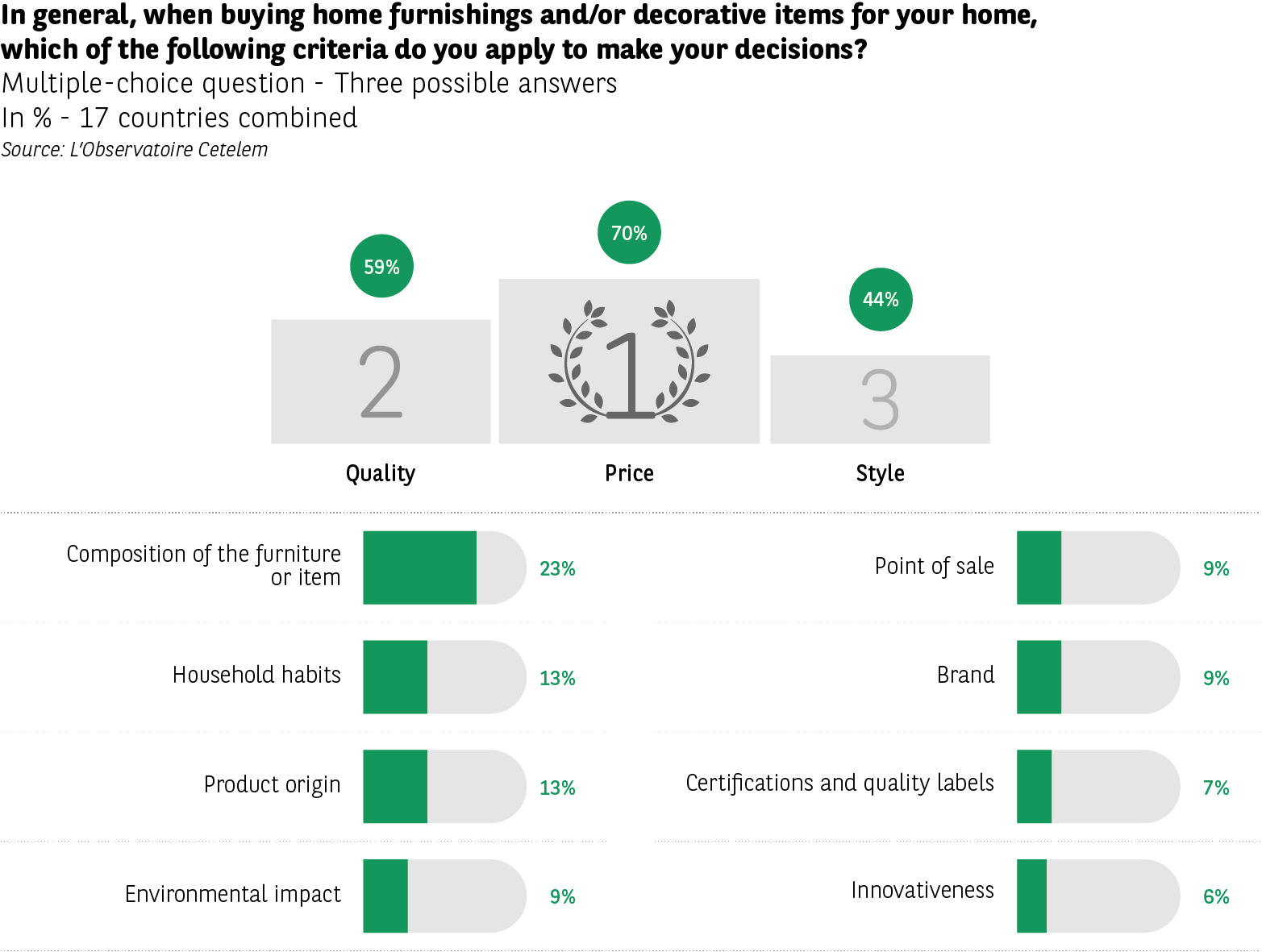

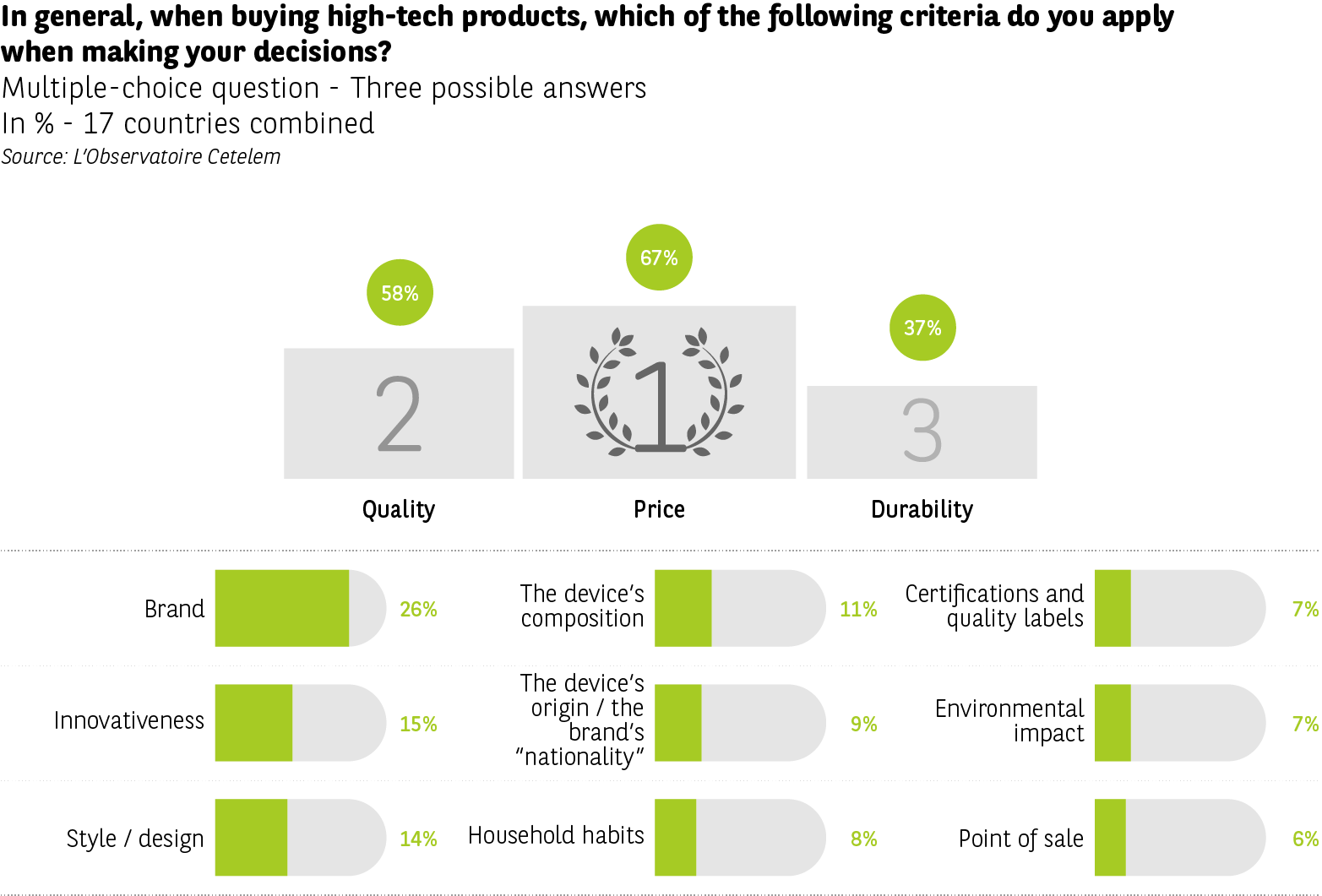

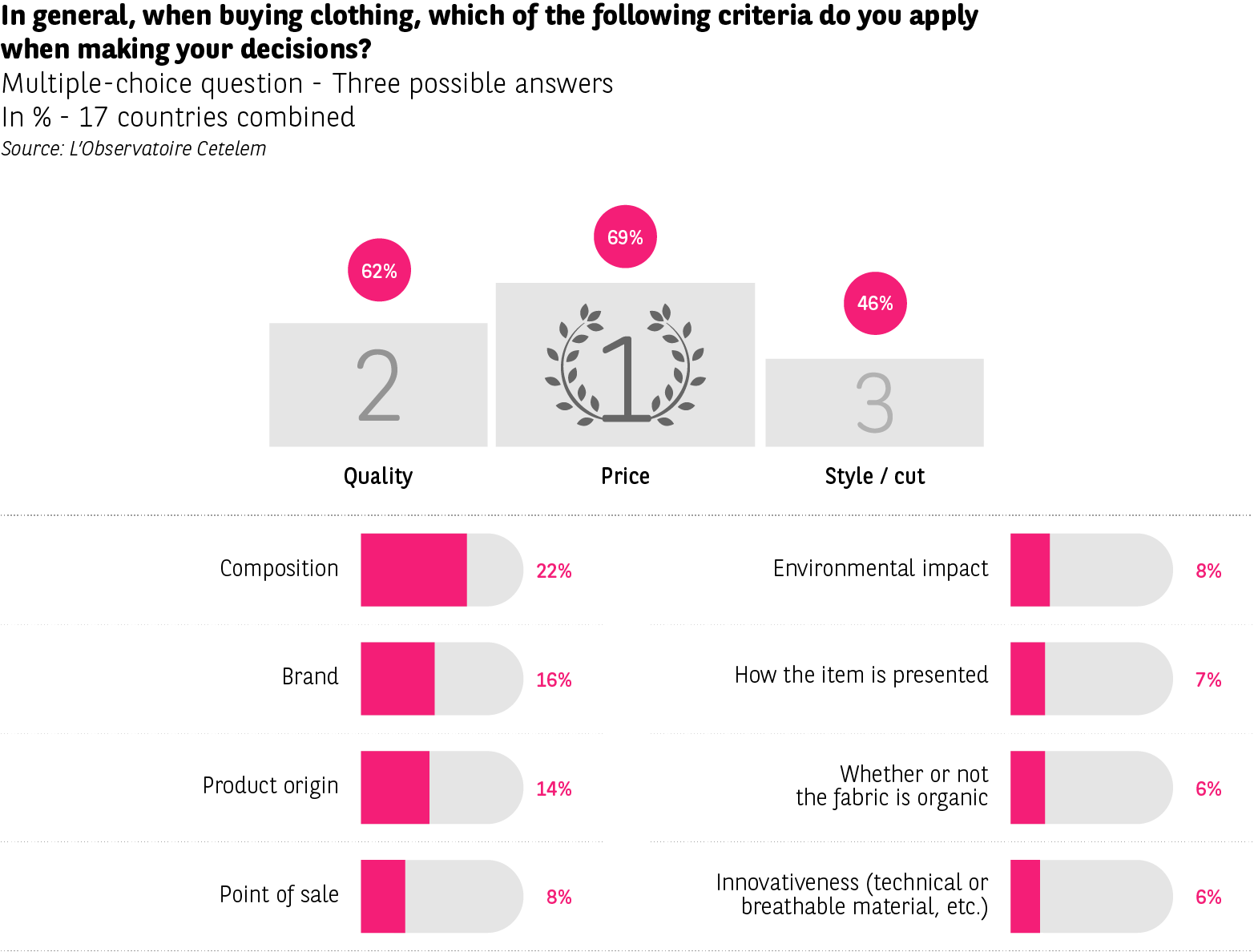

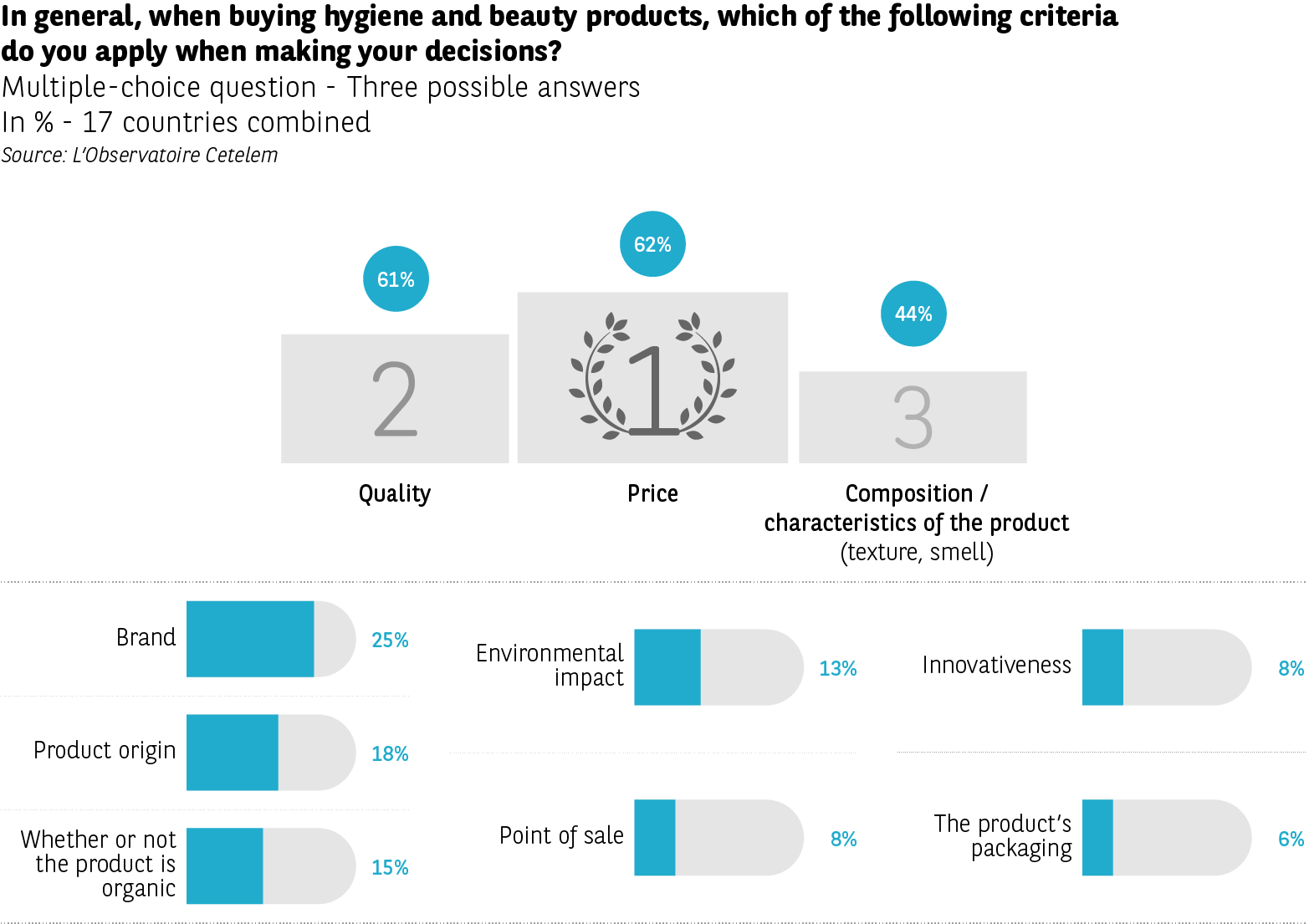

When questioned about their purchasing criteria in five key retail sectors (clothing, tech products, food, home furnishings and hygiene & beauty products), the same two factors top the list, regardless of the type of product: price and quality. Nothing is able to unsettle this order, with these two criteria alone securing an average of more than 50% of the positive answers provided.

… but people’s food choices are not lacking in taste…

When it comes to food, the dominance of price and quality is least clear (53% and 51%), with other criteria having a greater influence on consumer choices (composition 26%, origin 25% and nutritional value 19%). All the countries have price, quality and taste as their top three, except for the Italians, who base their decisions on quality first, origin second and price third when buying food (52%, 42% and 36%). In Germany, Romania and Bulgaria, quality takes precedent over price as the leading criterion.

… while in the other sectors a third criterion comes into play

In the non-food sectors, price and quality again firmly establish themselves ahead of the rest, but a third criterion also stands out. Regarding home furnishings, style is mentioned by 44% of respondents, compared with 70% and 59% in the case of price and quality.

For tech devices, durability is the main challenger (37%, vs. 67% and 58%).

Style and cut take the third step on the podium when it comes to choosing clothes (46% vs. 69% and 62%).

As for beauty products, composition and characteristics are mentioned by 44% of respondents (62% and 61% for price and quality).

LOCAL CONSUMPTION: DOMESTIC AND FOOD FOCUSED ABOVE ALL

Europeans once viewed local products as being regional by definition. They are now expanding their horizons when it comes to actually making a purchase.

At the moment of purchase, domestic products take precedence

One in two respondents favour products made in their home country, but just 18% favour those made in their region.

Origin has no influence on the purchasing behaviour of 1 in 5 Europeans. While the preference for domestic goods is strongest in Italy and Bulgaria (65% and 62%), it is significantly weaker in Belgium and Norway (34% and 36%). Austria, Germany and Spain, which have well defined “regional” structures, are home to the highest number of consumers who favour regionally-made products (33%, 29% and 24%). For the Danes, Bulgarians, Czechs and Slovaks, this criterion is almost a non-issue (4%, 7%, 7% and 8%). The Belgians display the greatest indifference regarding product origin, with 34% stating that they place no importance on this criterion. Could the debate over Belgium’s nationhood be a factor here?

The availability of local products…

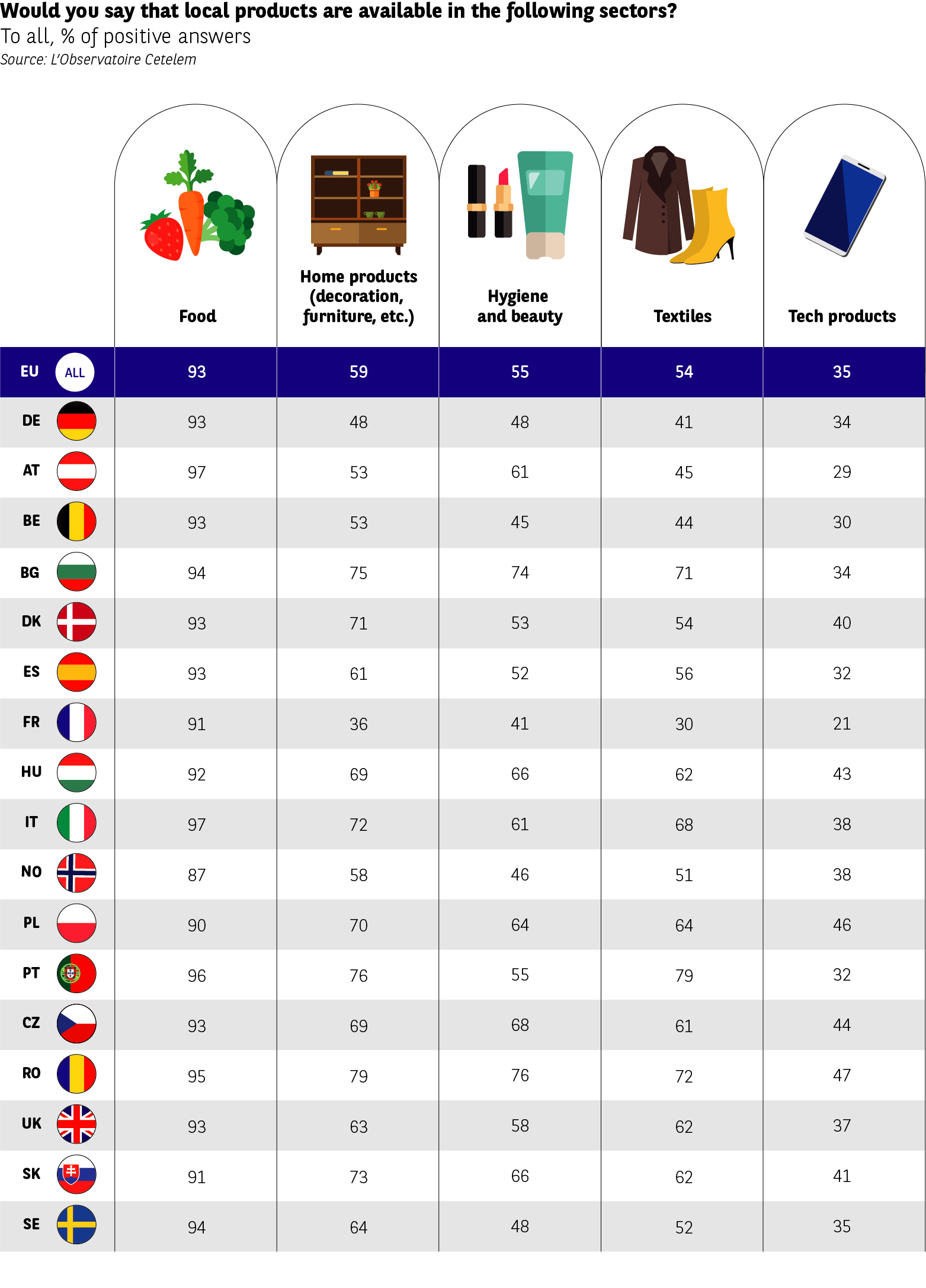

When assessing the availability of local products in the five sectors mentioned above, opinion is again split to varying degrees.

When it comes to food, there is no debate. 93% of Europeans observe the presence of local products, with no significant differences between the countries.

The home products market comes second in terms of the perception that the availability of local products is high. 59% of consumers are of this opinion, but the disparities between the countries are significant here. In nine countries, the result is well above the 50% mark, with Romania leading the way (79%), while Germany and especially France post scores that fall short of this mark (48% and 36%).

While the figures for the hygiene and beauty sector are less contrasted, the same countries take more or less the same stance. The Romanians are the most likely to find local products of this type (76% vs. 55% on average), while the French, despite being leading players in the cosmetics industry, are more reserved on this matter (41%).

As for textiles, the European average stands at 54%, with a wide range of opinions expressed. Whereas the French are again the most sceptical about the presence of local products (just 30%), the Portuguese are at the opposite end of the spectrum (79%). Their country’s textile manufacturing tradition could well have something to do with this result.

Lastly, the tech sector struggles to convince Europeans that it has any kind of local base (35%). There is a general acceptance of Asia’s domination.

However, close to 1 in 2 Romanians believe that local products of this type are available, while only 1 in 5 French respondents come to the same conclusion.

Nonetheless, Europeans highlight certain inadequacies in the overall availability of local products. 71% declare that imported products offer the latter tough competition. The French, Italians and Portuguese express concerns about this competition (81%, 80% and 81%), while it is only a preoccupation for 53% of Britons, who by nature see free trade as more desirable. Consumers also associate local products with a form of exclusivity that hinders their sale via certain distribution networks (55%) or to certain categories of consumer (43 %). The Czechs are the most likely to hold this view (65% and 53%), while the Germans tend to believe the opposite (48% and 29%).

… generates local demand

In terms of purchasing behaviour, the results are similar to those above, with a propensity to favour the same sectors and similar figures within each of the countries.

With positive responses accounting for an average of 87% of the total, “local” food enjoys great popularity. All the countries covered by the study are more or less in agreement, except for Belgium, which is slightly behind the rest with 75%.

With an average of 65%, the hygiene and beauty sector sits in second place in the list. Once again Belgium stands apart, with just 40% of consumers buying local. The Poles, Italians, Romanians and Germans are more inclined to do so.

With scores of 60% and 56%, home furnishings and textiles lie in third and fourth place, respectively, with greater disparities from one country to the next. The Italians and Bulgarians are enthusiastic buyers of local products from both of these sectors, whereas the Belgians, almost predictably, as well as the Austrians, the French and the Norwegians, are somewhat less keen.

The tech sector again comes last, with just 33% of consumers favouring local products from this category. It is preceded by the automotive sector, where a local preference is exercised by 41% of Europeans. This preference is all the greater in countries that are home to major automakers and brands. Thus, Germany and France occupy the top two positions, with 56% and 50%.