A stabler mood in Europe and a greater desire to save

A MORE UNCERTAIN OVERALL CONTEXT

If 2018 saw the general mood of Europeans improve significantly, 2019 seems to confirms this dynamic overall. But while Europeans consider their personal circumstances to have further improved, their view on the situation in their country has remained more or less unchanged. However, this stability is only relative and could well be impacted by a slowdown in growth that is just starting to be felt and an increasingly febrile economic, political and social climate.

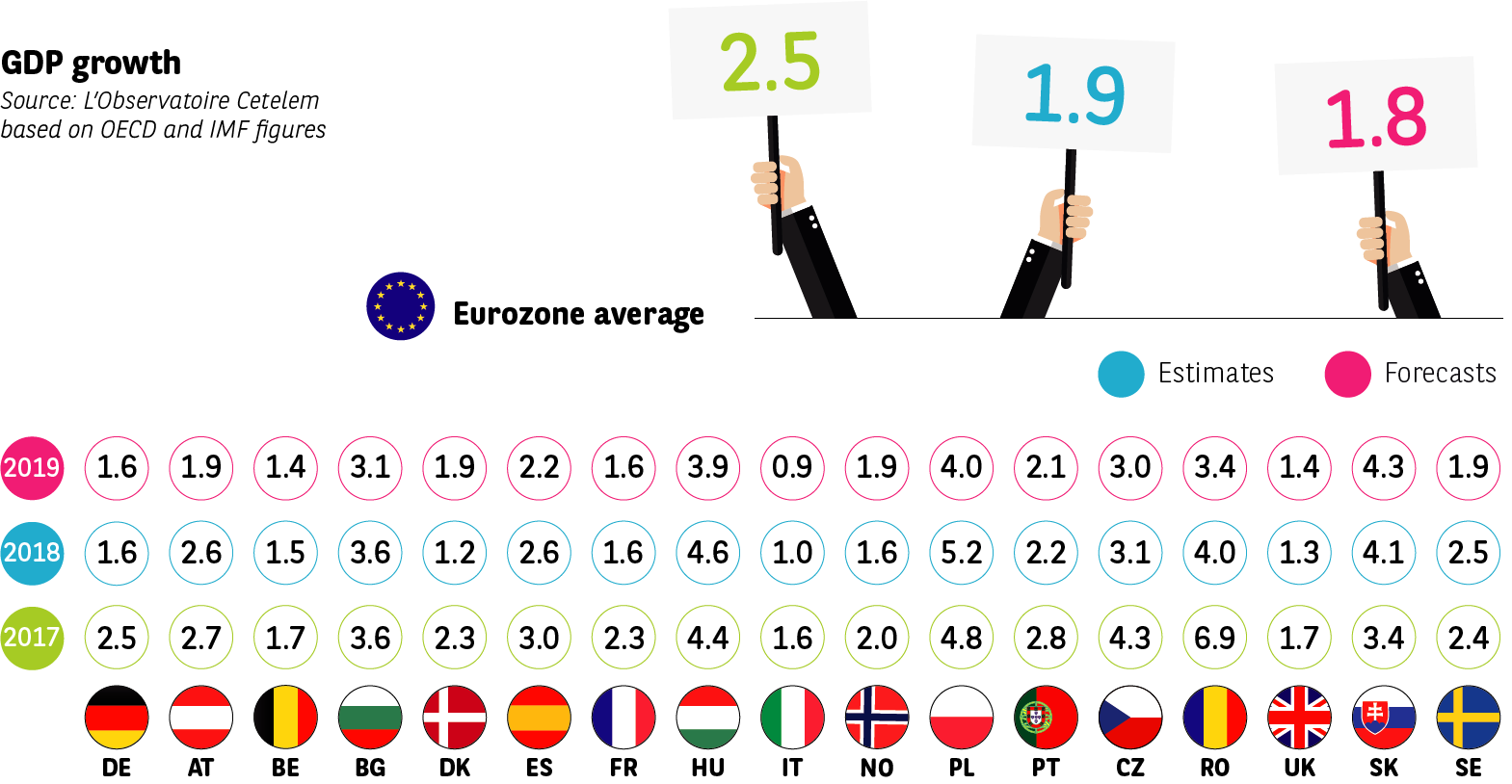

After a strong 2017 in economic terms, the second half of 2018 saw the first signs of a slowdown, which are expected to be confirmed in 2019.

Fragile growth

The majority of forecasters agree that global growth will be more moderate in 2019, at just over 3.5%, compared with 3.7% in 2018 (source: OECD). This figure likely conceals major disparities from one economic region to the next, but it could also be revised downwards depending on shifts in various factors that are hard to predict. In the United States, the effects of vast tax cuts will soon be a distant memory. Growth is also expected to fall in Europe.

Having risen rapidly over the last three years, the price of oil dropped sharply in 2018, putting a dampener on inflation. Despite this positive news for household spending power, the economic climate remains gloomy against a backdrop of uncertainty caused by the trade war declared by the United States on China, and potentially on other countries (hostilities with the European Union could be rekindled).

Political and social tensions

Current economic figures are not alone in generating uncertainty. On the political front, Europe undergoes fresh change as each election goes by. Indeed, recent ballots point to a rise in populism in a number of European countries. In the United Kingdom, Brexit remains the subject of fierce debate and, as 2019 commences, there is still absolutely no certainty regarding its outcome. The European elections in May could simultaneously ramp up this political uncertainty within the European Union and reinforce nationalism in a number of countries. Meanwhile, new social movements have emerged, the prime example being the “yellow vests” in France, further fanning the flames of uncertainty.

IMPROVING PERSONAL CIRCUMSTANCES

The economic, political and social climate, which is taking a turn for the worse overall, influences how Europeans perceive the situation in their country.

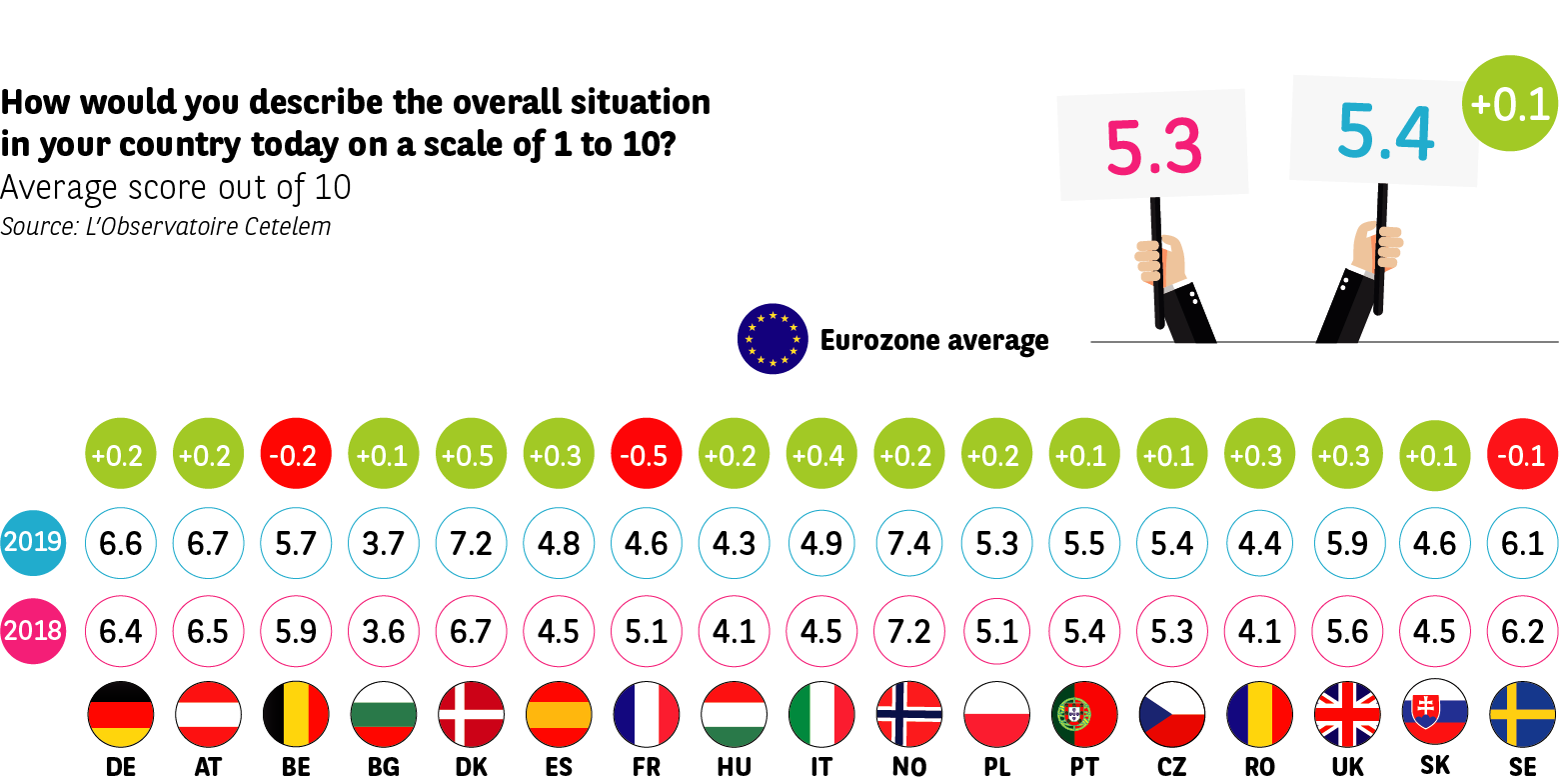

The mood among Europeans has levelled out somewhat

Indeed, the average score is up only very slightly at 5.4 (+0.1 points, compared with +0.3 the previous year). The biggest increases can be seen in Denmark (+0.5 points), where nothing seems to have affected the pervading optimism, and Italy (+0.4), following the elections of spring 2018.

This relative loss of momentum is embodied by a group of seven countries whose score is less than 5, although the figure has risen in six of them. It is interesting to note that France has dipped back under the 5/10 mark, posting the greatest year-on-year fall (-0.5 points). This drop can be partially explained by the “yellow vest” movement, which emerged when the survey was being conducted.

A north/east divide

Among the most negative countries, we again find most of the Eastern European nations, with Bulgaria remaining the most pessimistic (3.7 points, i.e., +0.1). Conversely, the Nordic nations continue to display impressive optimism, with Norway leading this group of upbeat countries (7.4 points, i.e., +0.2). Only Sweden allows a little doubt to seep in, it being one of three countries to see its score fall (-0.1 points), the others being France and Belgium. Lastly, the perceptions of the Germans and Austrians seem to be very similar, as we will see with regard to a number of other topics (6.6 and 6.7, respectively, i.e., +0.2 points). As yet, the United Kingdom does not appear to be too worried about the uncertainty surrounding Brexit. It is almost as though the country’s population has become accustomed to this saga of twists and turns (5.9 points).

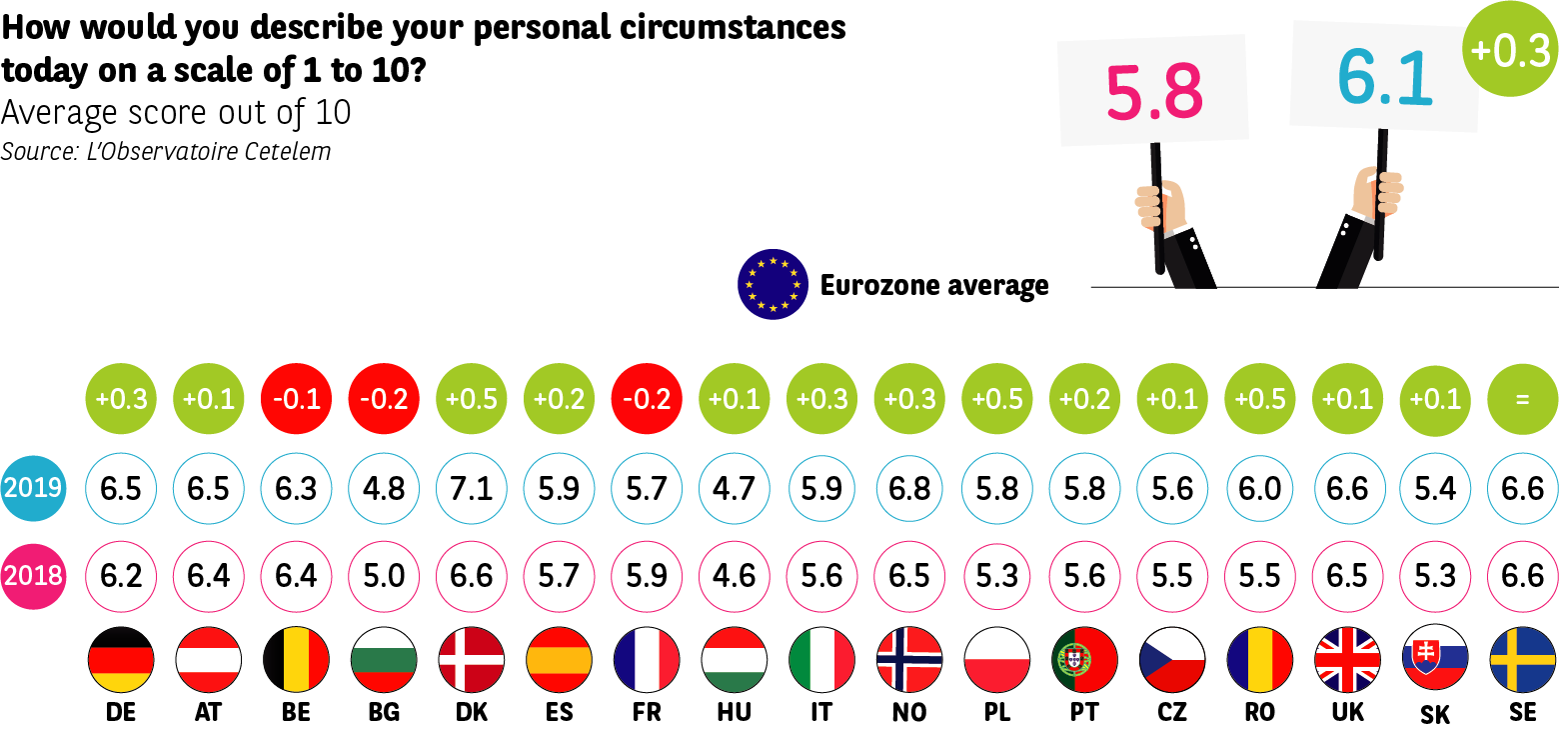

Self-perception is invariably more positive

Each year, it is apparent that Europeans view their personal circumstances more positively than they do those of their country. In 2019, this tradition lives on. In fact, the average score is up 0.3 points to 6.1. Compared with their general perceptions, disparities between the populations of the 17 countries are much less significant here, with the vast majority of scores being close to the overall average. Only Hungary and Bulgaria post a score of less than 5 (4.7 and 4.8, respectively), highlighting a less confident mood in Eastern Europe. What’s more, Bulgaria is one of three countries, the others being France and Belgium, whose citizens believe that their circumstances worsened in 2018. Conversely, Denmark, Poland and Romania are the countries whose score improved the most (+0.5 points). With 7.1 points, the highest score recorded, Denmark is still the happiest country in the study, as it was in the previous edition of L’Observatoire Cetelem, followed closely by the other Nordic countries (Norway 6.8, Sweden 6.6), but also the United Kingdom (6.6).

VARYING PERCEPTIONS OF SPENDING POWER

One of the main preoccupations that has sparked social movements such as the “yellow vest” phenomenon is the fact that people are finding it increasingly hard to make ends meet. Deep down, they are convinced that their standard of living is falling.

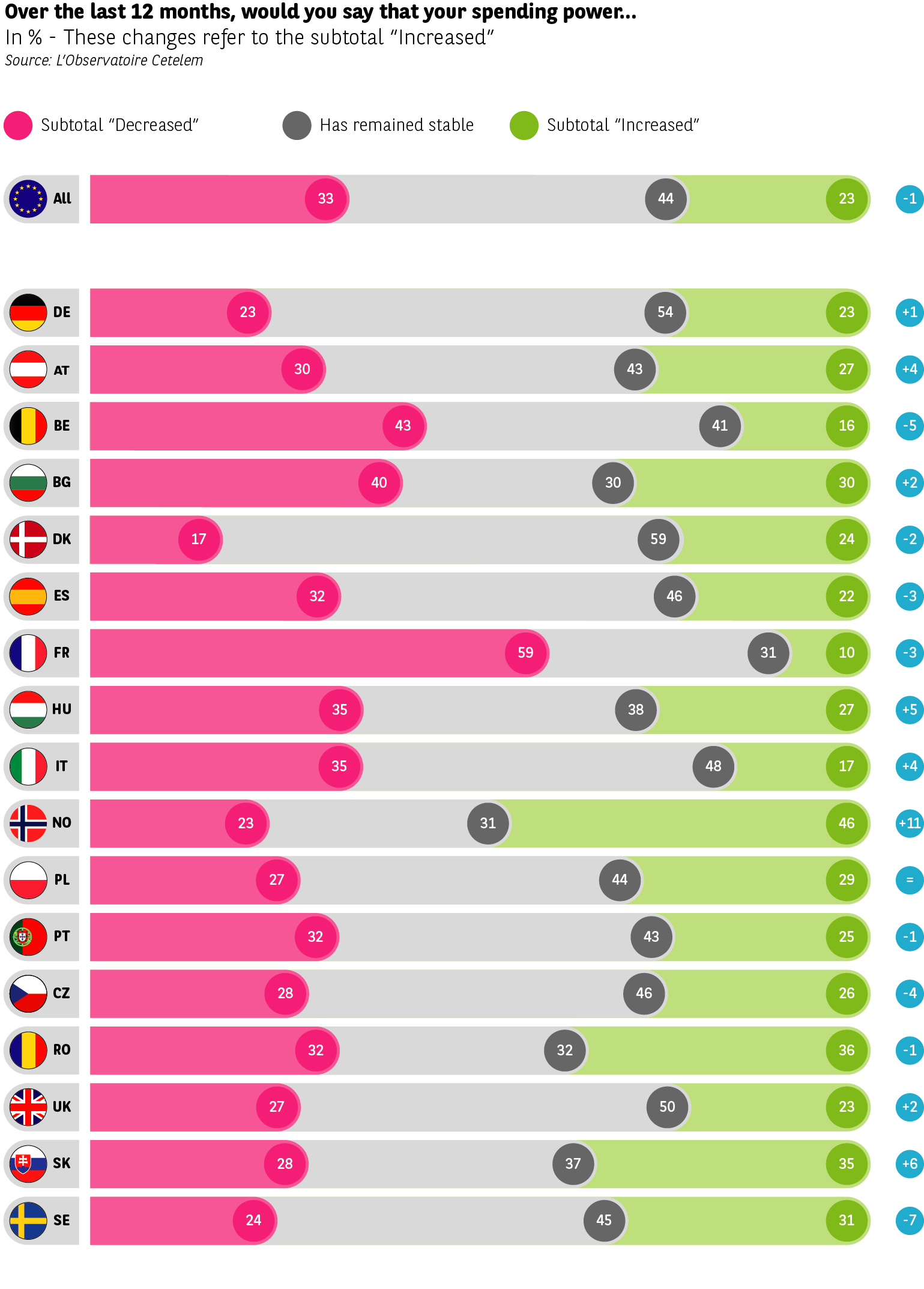

Great worry among the French

The overarching feeling that spending power is falling is contradicted by economic statistics that indicate the opposite. If we take the example of France, overall spending power looks to have risen by 1.4 points in 2018 and could increase further in 2019, according to the forecasts published by the INSEE late last year. But the French consumers surveyed here are, like every year, most likely to consider that their spending power has dropped: 59%, compared with a European average of 33%. In neighbouring Belgium the attitude is similar, with 43% expressing such thoughts.

Greater overall serenity among Europeans

Taken as a whole, the countries of L’Observatoire Cetelem 2019 express more measured views. Close to 1 in 2 people believe that their spending power has remained stable. Half of the countries surveyed deem it to have improved year on year. With an increase of 11 points, Norway posts both the greatest increase and the highest proportion of satisfied respondents, with 46% of Norwegians having seen a rise in their spending power. In this regard, apart from Bulgaria, the countries of Eastern Europe express an opinion comparable to that of the other nations.

A GREATER DESIRE TO SAVE THAN TO SPEND

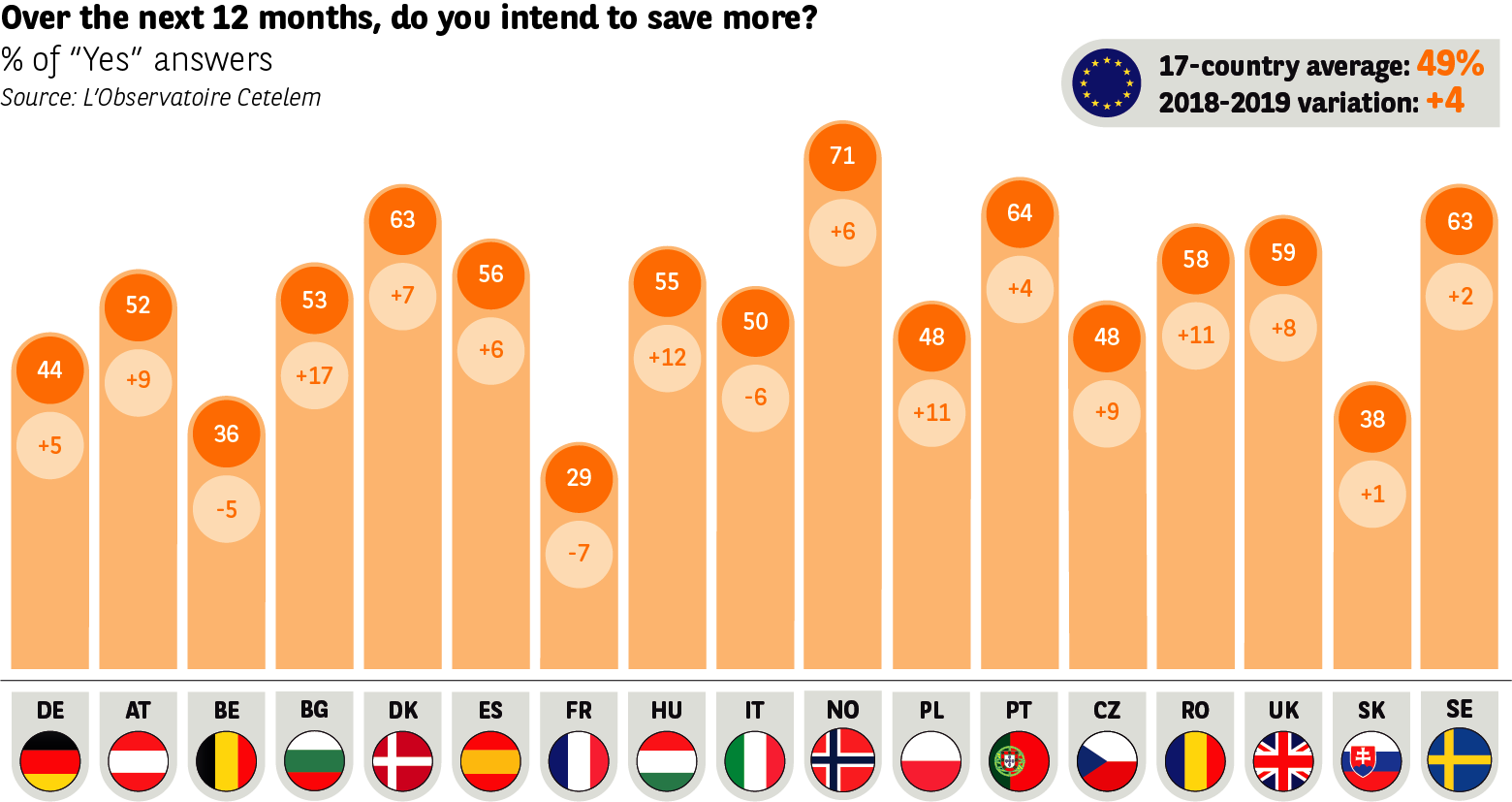

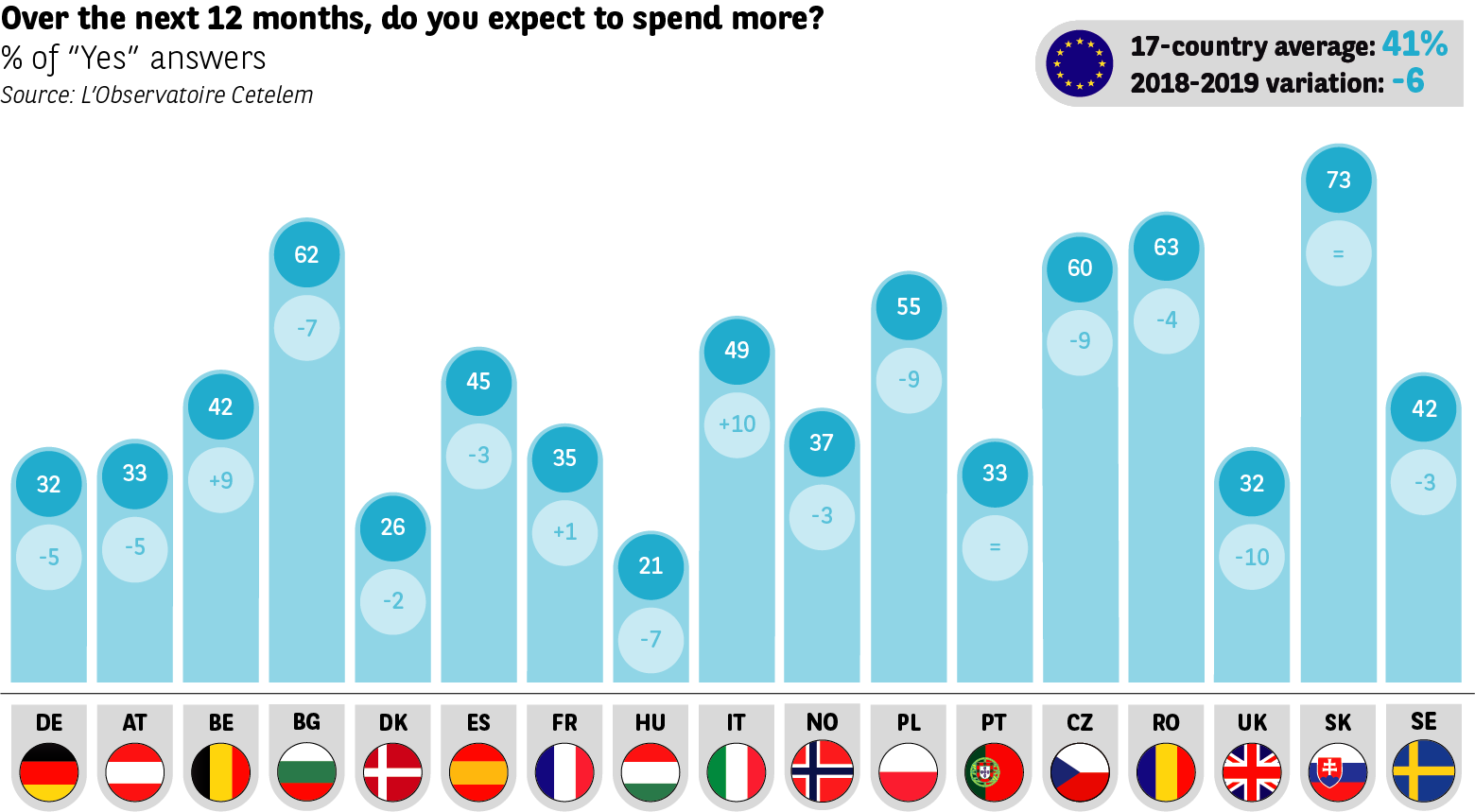

These ambivalent perceptions of spending power translate into greater prudence when it comes to spending intentions and a desire to save more. Indeed, 49% of Europeans plan to grow their nest egg, while just 41% are keen to spend more. But these average figures do not reflect the disparities that exist between the countries.

A general propensity to save more…

Sitting at the top of the ranking of future savers are the Norwegians, the Portuguese, the Swedes and the Danes, all of whom clearly express this intention (71%, 64%, 63% and 63%, respectively). At the opposite end of the scale, the French, Belgians and Slovaks are the three populations most reluctant to put money aside (29%, 36% and 38%,

respectively). It is worth noting that saving intentions have grown significantly in most countries, but particularly in Eastern Europe (+17 points in Bulgaria, +12 points in Hungary and +11 points in Romania and Poland). They have only fallen in France, Italy and Belgium (-7, -6 and -5 points, respectively).

… rather than spend more

When it comes to spending intentions, four Eastern European countries soar ahead, with Slovakia on top (73%), followed by Romania, Bulgaria and the Czech Republic (63%, 62% and 60%, respectively). The Hungarians and Danes (21% and 26%) are by far the most averse to spending. Overall though, all European countries are tightening their budgets compared with last year, in some cases quite considerably, as in the United Kingdom, the Czech Republic and Poland (-10 points, -9 points and -9 points). And who will be increasing their spending year on year? The Italians and Belgians lead the way here (+10 and +9 points). The measures announced by the Macron government to support spending power were as yet unknown at the time of the survey.

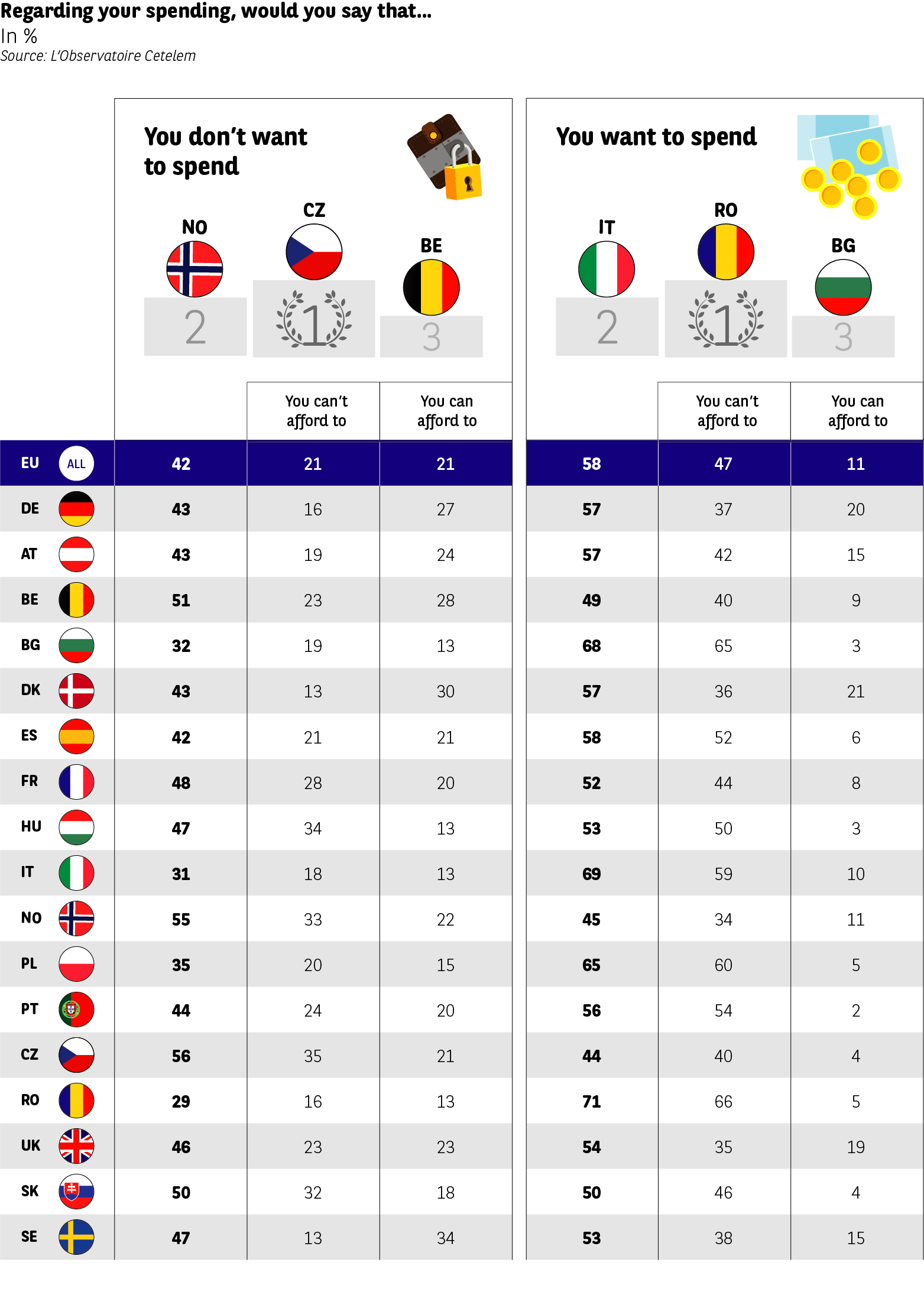

The desire to consume has been stifled

Spending is a nice idea… if you have the funds. Because while 58% of those surveyed declare that they would like to spend, 47% state that they cannot afford to. The figure is up 7 points compared with last year. This consumer frustration is focused primarily on the countries of Eastern Europe, which are again united in their intentions (Romania 66%, Bulgarie 65% and Poland 60%). To this group we can add Italy, whose inhabitants display a degree of enthusiasm for the changes promised, but are still reluctant to believe that their dreams will come true (59%).

Among those who are reluctant to spend, the populations of four countries post figures of 50% or more. Leading this group are the Czechs, 56% of whom intend to keep their purse strings tied. Despite an upbeat economic climate, 55% of Norwegians say they will do the same. Next come the Slovaks and the Belgians (50% and 51%). Once more, identical proportions of Germans and Austrians intend to spend or keep their wallets in their pockets (57% and 43%), while the French are split into two almost equal groups (52% and 48%).

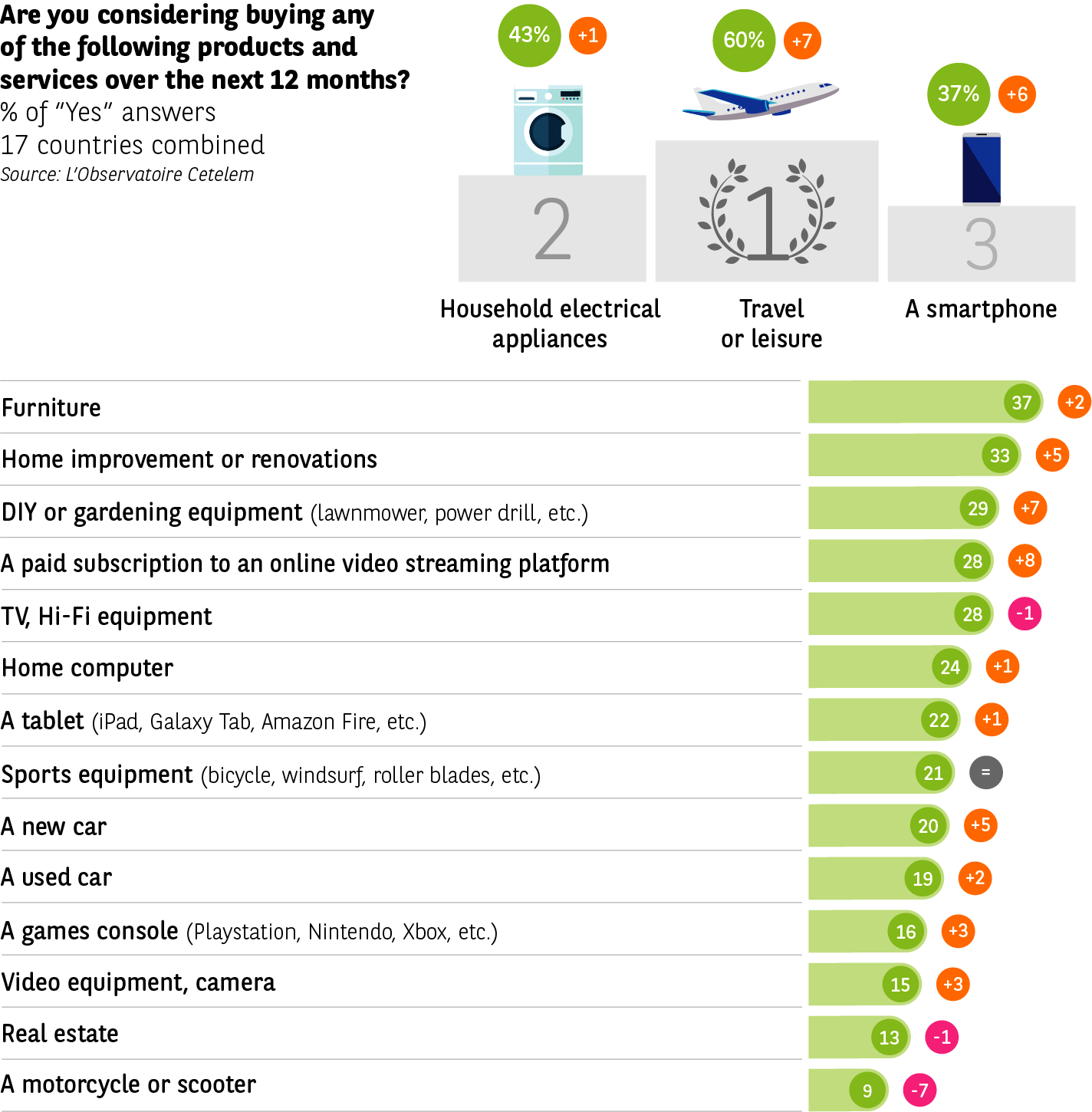

Retail therapy

Breaking down the data, purchasing intentions have increased in almost all retail sectors. Much like in previous years, travel and leisure top the list (60%), with spending intentions rising by 7 points. Household electrical appliances are next (43%), followed by smartphones, which have gained 6 points (37%). Considering this figure in combination with the results for streaming subscriptions (28%, +8 points, the largest rise) and TV equipment (28%, -1 point) highlights the incredible success of globalised cultural products, which are usually broadcast via digital media. Lastly, it should be noted that spending intentions have increased significantly in three other sectors: DIY (+7 points), automotive (+5 points) and home improvement/renovation work (+5 points).