An active duo on the front line

To envisage an effective and sustainable rebound in the automotive industry, we still need players capable of activating the levers. This new study by the Cetelem Observatory clearly identifies two of them, manufacturers and public authorities. An inseparable couple, united for the better, motorists hope, and not for the worse. A couple that has serious assets to succeed, assets that are however unevenly supported.

Manufacturers and governments: it’s up to them to act

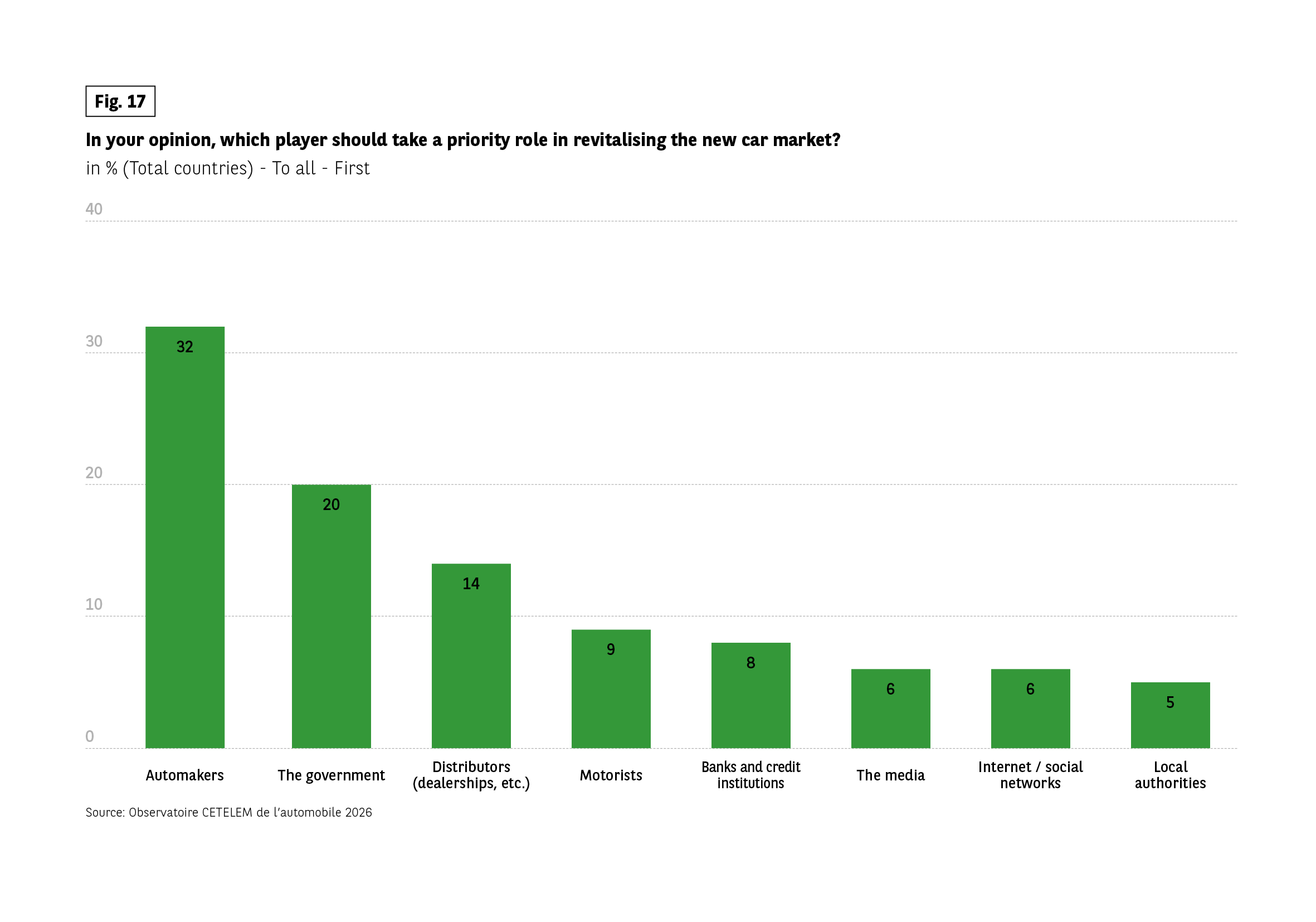

When motorists were asked about the entities that could ensure the recovery of the market, two stood out. In their view, manufacturers and governments have a vital role to play in creating this momentum.

Car manufacturers are clearly in the lead, garnering a third of opinions. In all countries except Turkey and China, they are the first choice, with very high scores especially in Japan, but also in Germany, the Netherlands, the United States and the United Kingdom.

Our previously mentioned pair of categories, senior citizens and people living in rural areas, clearly show their preference. In second place in this ranking, governments received an average of 1 vote out of 5. While China and Turkey have made this their first choice, the liberal Anglo-American pair are clearly rejecting the idea.

Note that distributors are clearly in third place: we will cover them in the fourth part of the report, discussing the role they can play as a lever for recovery.

Fig 17 – Priority actors for reviving the new car market

Download this infographic for your presentations The chart shows household final consumption expenditure for personal vehicle use as a percentage of total consumption from 2019 to 2023.

Germany: 6.6% in 2019, 6.0% in 2020, 6.6% in 2021, 7.2% in 2022

Belgium: 7.0%, 6.5%, 6.6%, 6.6%

Spain: 7.2%, 6.3%, 6.9%, 7.3%

United States: 8.1% in 2022, 6.2% in 2023 [previous years not shown]

France: 8.1%, 7.3%, 8.2%, 8.6%

Italy: 7.8%, 6.9%, 7.7%, 8.2%

Netherlands: 6.8%, 6.6%, 7.0%, 7.1%

Poland: 7.5%, 6.9%, 7.1%, 7.5%, 7.2%

Portugal: 7.0%, 6.3%, 6.7%, 6.4%

United Kingdom: 5.6% in 2019 only

Source: Eurostat.

The chart shows household final consumption expenditure for personal vehicle use as a percentage of total consumption from 2019 to 2023.

Germany: 6.6% in 2019, 6.0% in 2020, 6.6% in 2021, 7.2% in 2022

Belgium: 7.0%, 6.5%, 6.6%, 6.6%

Spain: 7.2%, 6.3%, 6.9%, 7.3%

United States: 8.1% in 2022, 6.2% in 2023 [previous years not shown]

France: 8.1%, 7.3%, 8.2%, 8.6%

Italy: 7.8%, 6.9%, 7.7%, 8.2%

Netherlands: 6.8%, 6.6%, 7.0%, 7.1%

Poland: 7.5%, 6.9%, 7.1%, 7.5%, 7.2%

Portugal: 7.0%, 6.3%, 6.7%, 6.4%

United Kingdom: 5.6% in 2019 only

Source: Eurostat.

Relatively positive public support for manufacturers

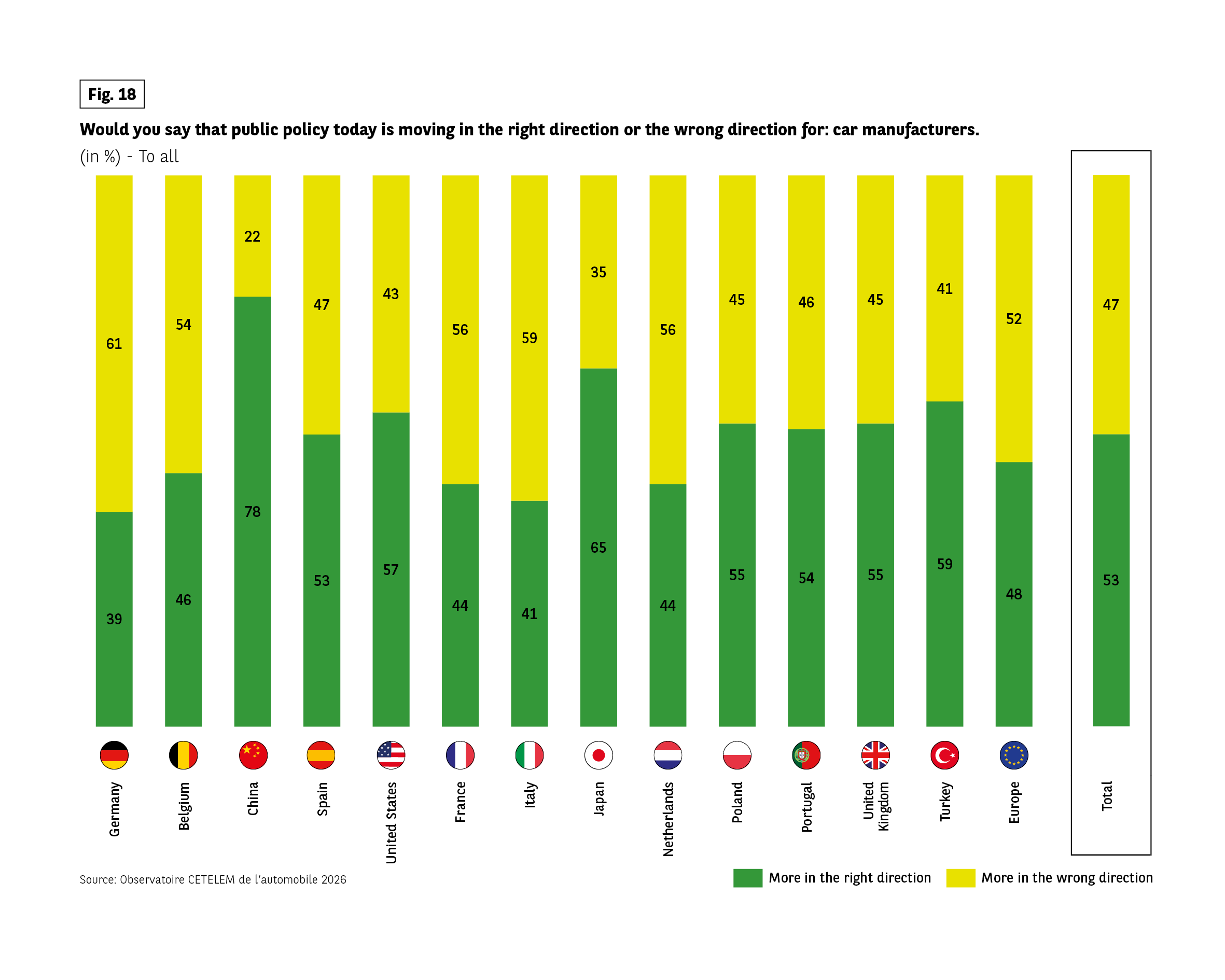

The combination of these two may seem promising, given the support extended to manufacturers through public policy. Slightly more than 1 in 2 people think they are hea- ding in the right direction. However, geographical location is also crucial.

Several European countries with national brands, including Germany, France and Italy, have joined forces to question their relevance. This is in stark contrast to Asian neighbours China and Japan, who have no doubts about their effectiveness.

Fig 18 – Perception of public policy for car manufacturers

Download this infographic for your presentations The stacked bar chart shows the percentage of respondents who believe public policy is moving more in the right direction or more in the wrong direction for car manufacturers.

Germany: 39% right direction, 61% wrong direction

Belgium: 46% right, 54% wrong

China: 78% right, 22% wrong

Spain: 53% right, 47% wrong

United States: 57% right, 43% wrong

France: 44% right, 56% wrong

Italy: 41% right, 59% wrong

Japan: 65% right, 35% wrong

Netherlands: 44% right, 56% wrong

Poland: 55% right, 45% wrong

Portugal: 54% right, 46% wrong

United Kingdom: 55% right, 45% wrong

Turkey: 59% right, 41% wrong

Europe total: 48% right, 52% wrong

Total all countries: 53% right, 47% wrong

Source: Observatoire Cetelem de l’Automobile 2026.

The stacked bar chart shows the percentage of respondents who believe public policy is moving more in the right direction or more in the wrong direction for car manufacturers.

Germany: 39% right direction, 61% wrong direction

Belgium: 46% right, 54% wrong

China: 78% right, 22% wrong

Spain: 53% right, 47% wrong

United States: 57% right, 43% wrong

France: 44% right, 56% wrong

Italy: 41% right, 59% wrong

Japan: 65% right, 35% wrong

Netherlands: 44% right, 56% wrong

Poland: 55% right, 45% wrong

Portugal: 54% right, 46% wrong

United Kingdom: 55% right, 45% wrong

Turkey: 59% right, 41% wrong

Europe total: 48% right, 52% wrong

Total all countries: 53% right, 47% wrong

Source: Observatoire Cetelem de l’Automobile 2026.