A standard bearer for the market

SUVs divide opinion like no other type of vehicle in history. They generate clear and vocal opposition and prompt heated debate. So how can one explain their incredible level of success, one that has made them the passenger vehicle market’s leading segment? This global success has been replicated in all 17 countries covered by this survey and, more broadly, in every nation in which cars are sold. Indeed, SUVs hold great appeal and offer various advantages that draw in an ever increasing number of motorists, but also passengers. Nobody could have predicted the degree of popularity enjoyed by SUVs and their future seems just as bright, especially if we consider the magic dust that electricity is set to sprinkle onto them over the coming years.

Global domination

That is the dream of all manufacturers. To see their product stamp its mark across the world, with breathtaking speed, and exceed any expectations they may have had, however unreasonable. The SUV is one of those dreams and it has come true in a relatively short space of time, establishing itself as the leading segment in the automotive market.

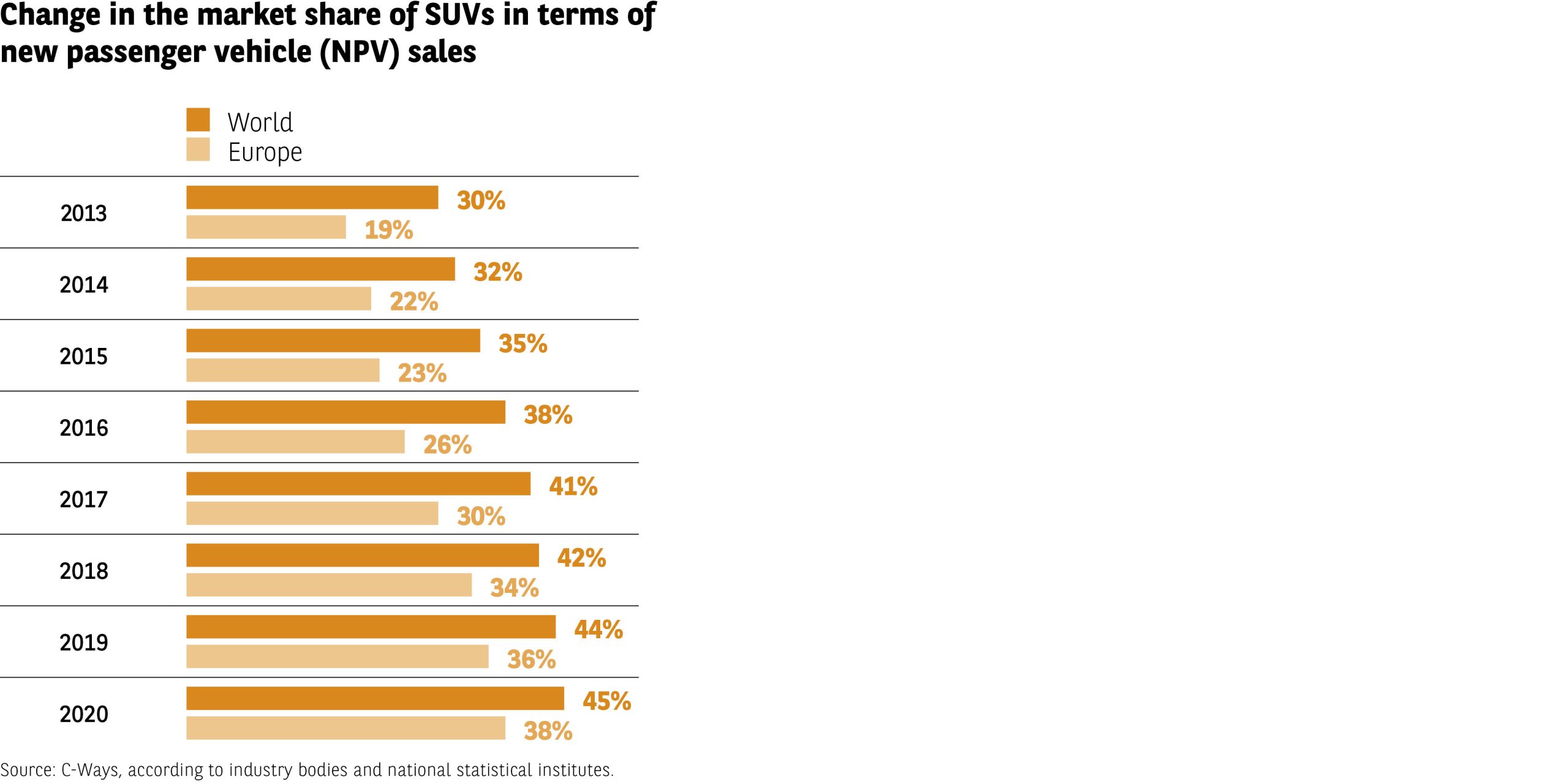

Today, the category accounts for 45% of global sales and 38% of sales in the European Union. In the latter, its market share has increased almost twofold since 2013 (Fig 10).

Worldwide, its growth over the same period has been less blistering, but still stands at an impressive 50%.

Fig 10 – Global and European SUV market evolution

Download this infographic for your presentations the infographic presents the evolution of SUV market share in global and European new passenger car sales from 2013 to 2020.

Two bar series are displayed: global (dark), European (light).

Data by year:

2013: Global 30%, Europe 19%

2014: Global 32%, Europe 22%

2015: Global 35%, Europe 23%

2016: Global 38%, Europe 26%

2017: Global 41%, Europe 30%

2018: Global 42%, Europe 34%

2019: Global 44%, Europe 36%

2020: Global 45%, Europe 38%

Main takeaway: SUV market share increased consistently over the observed period worldwide and in Europe.

Source: C-Ways based on professional federations and national statistical institutes.

the infographic presents the evolution of SUV market share in global and European new passenger car sales from 2013 to 2020.

Two bar series are displayed: global (dark), European (light).

Data by year:

2013: Global 30%, Europe 19%

2014: Global 32%, Europe 22%

2015: Global 35%, Europe 23%

2016: Global 38%, Europe 26%

2017: Global 41%, Europe 30%

2018: Global 42%, Europe 34%

2019: Global 44%, Europe 36%

2020: Global 45%, Europe 38%

Main takeaway: SUV market share increased consistently over the observed period worldwide and in Europe.

Source: C-Ways based on professional federations and national statistical institutes.

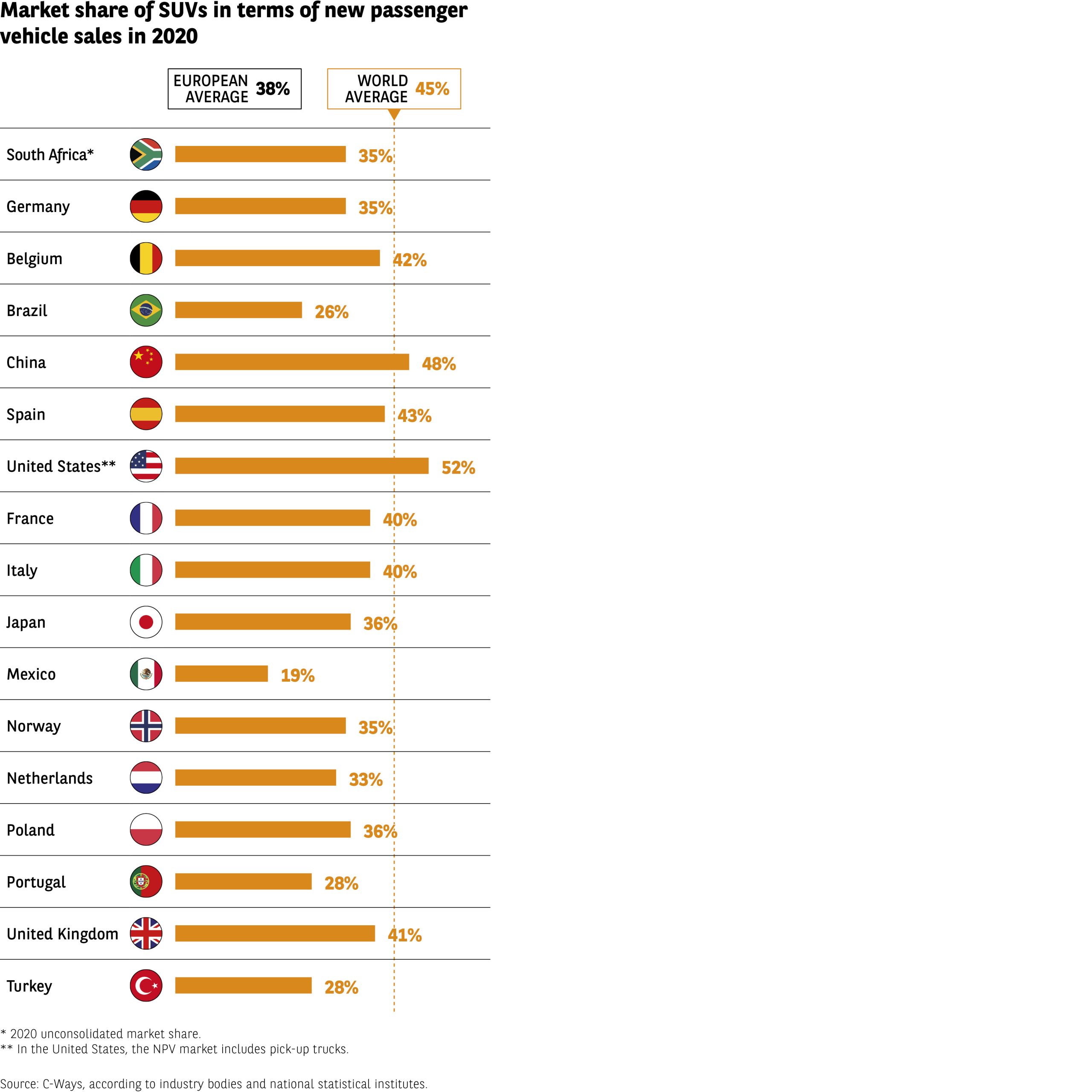

Right at the top of the tree is the USA, a country we tend to associate with big cars and wide open spaces.

SUVs account for just over half of all car sales in the States (52%) and the segment has grown 50% in less than a decade. With SUVs securing a market share of 48%, China is the second ranked country of L’Observatoire Cetelem de l’Automobile 2022. Thus, close to 1 in 2 Chinese motorists now drive this type of vehicle. Portugal, Turkey, Brazil and Mexico sit at the bottom of the ranking (28%, 28%, 26% and 19%). In France, meanwhile, the market share of SUVs is just above the European average, at 40%, a similar figure to most of the other countries surveyed (Fig 11).

Fig 11 – SUV market share by country in 2020

Download this infographic for your presentations the infographic compares the market share of SUVs in new passenger car registrations in 2020.

Two reference points are displayed: Europe average 38%, world average 45%.

Data by country:

South Africa: 35%

Germany: 35%

Belgium: 42%

Brazil: 26%

China: 48%

Spain: 43%

United States: 52%

France: 40%

Italy: 40%

Japan: 36%

Mexico: 19%

Norway: 35%

Netherlands: 33%

Poland: 36%

Portugal: 28%

United Kingdom: 41%

Turkey: 28%

Main takeaway: SUV market share differs widely, with higher values in markets such as the USA and China.

Source: C-Ways based on professional federations and national statistics institutes.

the infographic compares the market share of SUVs in new passenger car registrations in 2020.

Two reference points are displayed: Europe average 38%, world average 45%.

Data by country:

South Africa: 35%

Germany: 35%

Belgium: 42%

Brazil: 26%

China: 48%

Spain: 43%

United States: 52%

France: 40%

Italy: 40%

Japan: 36%

Mexico: 19%

Norway: 35%

Netherlands: 33%

Poland: 36%

Portugal: 28%

United Kingdom: 41%

Turkey: 28%

Main takeaway: SUV market share differs widely, with higher values in markets such as the USA and China.

Source: C-Ways based on professional federations and national statistics institutes.

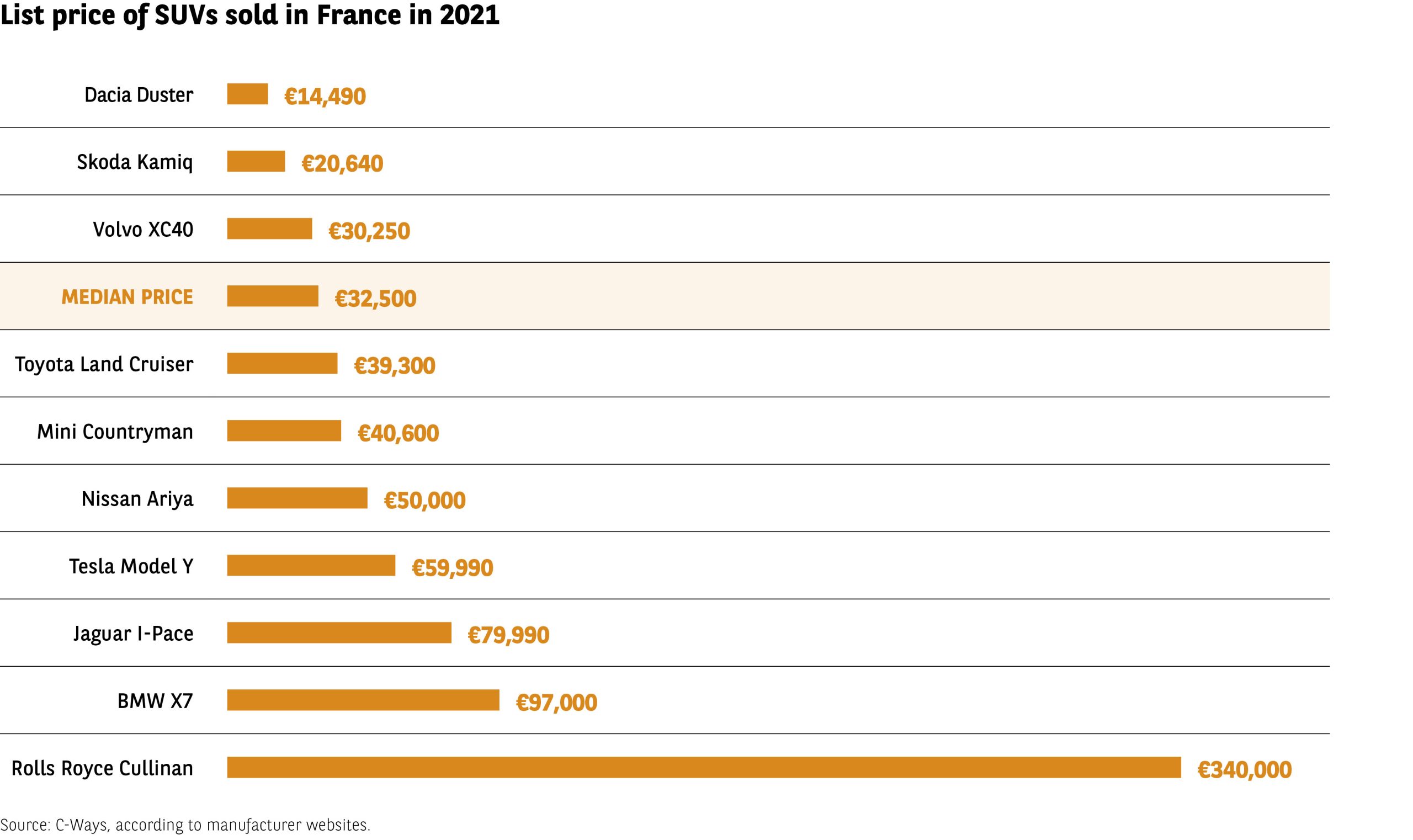

An SUV for every budget

Even without gathering the opinion of motorists on the reasons for this incredible popularity, one explanation is obvious. Over time, SUVs have become available at as wide a range of prices as that of saloon cars. So we now have both budget and luxury SUVs, something that was not necessarily to be expected given the nature of these vehicles.

Often thought of as imposing and bulky, SUVs are now available in all sizes and above all, as we have just highlighted, at every price point. While you might pay €14,000 for a Dacia Duster or a Ssangyong Tivoli, a Rolls Royce Cullinan will set you back €340,000, a 25:1 price ratio (Fig 12). However, it should be stated that most models sell for between €30,000 and €40,000. By way of an example, the sales-weighted median price in France is €32,500.

Fig 12 – SUV list prices in France in 2021

Download this infographic for your presentations The infographic lists the catalogue prices of several SUVs sold in France in 2021, ordered from lowest to highest.

Data:

Dacia Duster: €14,490

Skoda Kamiq: €20,640

Volvo XC40: €30,250

Median price: €32,500

Toyota Land Cruiser: €39,300

Mini Countryman: €40,600

Nissan Ariya: €50,000

Tesla Model Y: €59,990

Jaguar I-Pace: €79,990

BMW X7: €97,000

Rolls Royce Cullinan: €340,000

Main takeaway: SUV prices vary widely, with a range exceeding €300,000.

Source: C-Ways based on manufacturers’ data.

The infographic lists the catalogue prices of several SUVs sold in France in 2021, ordered from lowest to highest.

Data:

Dacia Duster: €14,490

Skoda Kamiq: €20,640

Volvo XC40: €30,250

Median price: €32,500

Toyota Land Cruiser: €39,300

Mini Countryman: €40,600

Nissan Ariya: €50,000

Tesla Model Y: €59,990

Jaguar I-Pace: €79,990

BMW X7: €97,000

Rolls Royce Cullinan: €340,000

Main takeaway: SUV prices vary widely, with a range exceeding €300,000.

Source: C-Ways based on manufacturers’ data.

The brands associated with SUVs

The fact that SUVs are available at such a wide range of prices also stems from one of the key factors in their success: almost every carmaker has entered the segment. In the minds of many of those interviewed for this 2022 edition of L’Observatoire Cetelem de l’Automobile, SUVs are still associated with the Jeep brand. Indeed, the company is at the top of the list in 1 in 2 countries.

However, this is not the case in the US, the home of Jeep, where it has been overtaken by Ford. And yet, in terms of global sales, the Jeep Compass is ranked “only” 16th. Another brand that scores highly when it comes to recognition is BMW. With three top spots and eight second-place rankings, the German brand’s three-letter moniker is closely associated with the three letters “SUV”. This is hardly surprising, given that BMW’s range of saloon cars is mirrored in its various X-class SUVs.

Toyota completes the podium of brands that best embody the SUV category, with two first-place and numerous third-place spots. This is a result that defies logic, since the Toyota Rav 4 was the top selling SUV in the world in 2019, with 950,000 vehicles sold (source: IHS) (Fig 13), placing it 4th in the ranking of passenger vehicle sales. Since its launch in 1994, more than 10 million units of the Rav 4 have been sold.

Fig 13 – Global SUV sales in 2020

Download this infographic for your presentations Shows the top three best-selling SUVs worldwide in 2020.

Shows the top three best-selling SUVs worldwide in 2020.

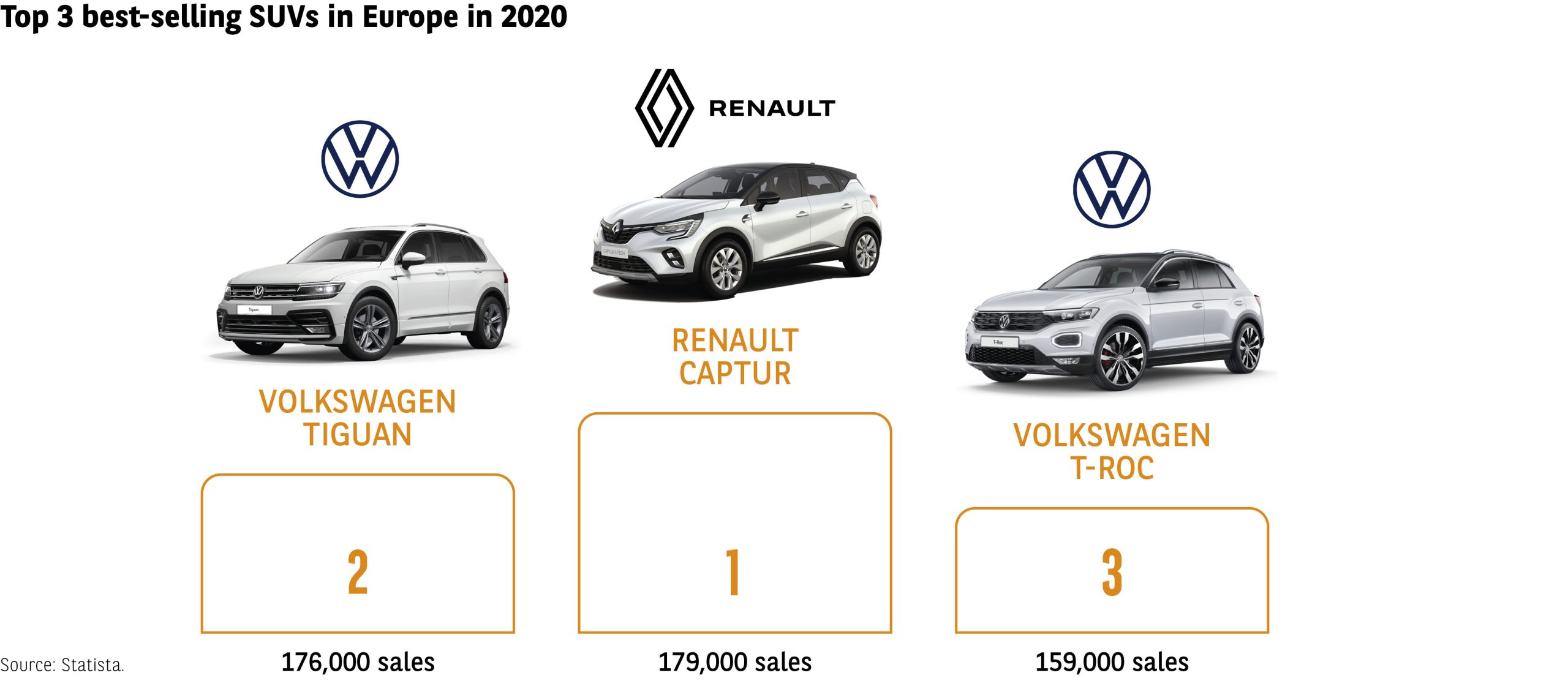

Further down the list, a wide array of brands are associated with the SUV category. This diversity is reflected in the sales figures, with eight different brands occupying the top eight positions. When it comes to annual global sales, Japanese and Korean carmakers lead the way, with only the Volkswagen Tiguan and the Chevrolet Equinox getting a look-in, securing third and eighth place, respectively. Volkswagen also enjoys a strong presence in Europe, with its Tiguan again ranking highly in second place, while its T-Roc comes third in terms of annual sales (Fig 14).

The Renault Captur stands in the way of German domination by securing the top spot, if only narrowly, with 179,000 units sold.

Fig 14 – European SUV sales in 2020

Download this infographic for your presentations The infographic displays the top three SUV models in Europe in 2020, with related sales figures.

Data:

Renault Captur — 179,000 sales

Volkswagen Tiguan — 176,000 sales

Volkswagen T-Roc — 159,000 sales

Main takeaway: the Renault Captur leads, with a narrow margin over the Tiguan.

Source: Statista.

The infographic displays the top three SUV models in Europe in 2020, with related sales figures.

Data:

Renault Captur — 179,000 sales

Volkswagen Tiguan — 176,000 sales

Volkswagen T-Roc — 159,000 sales

Main takeaway: the Renault Captur leads, with a narrow margin over the Tiguan.

Source: Statista.