The electric option relieves some tensions

Consumption alert

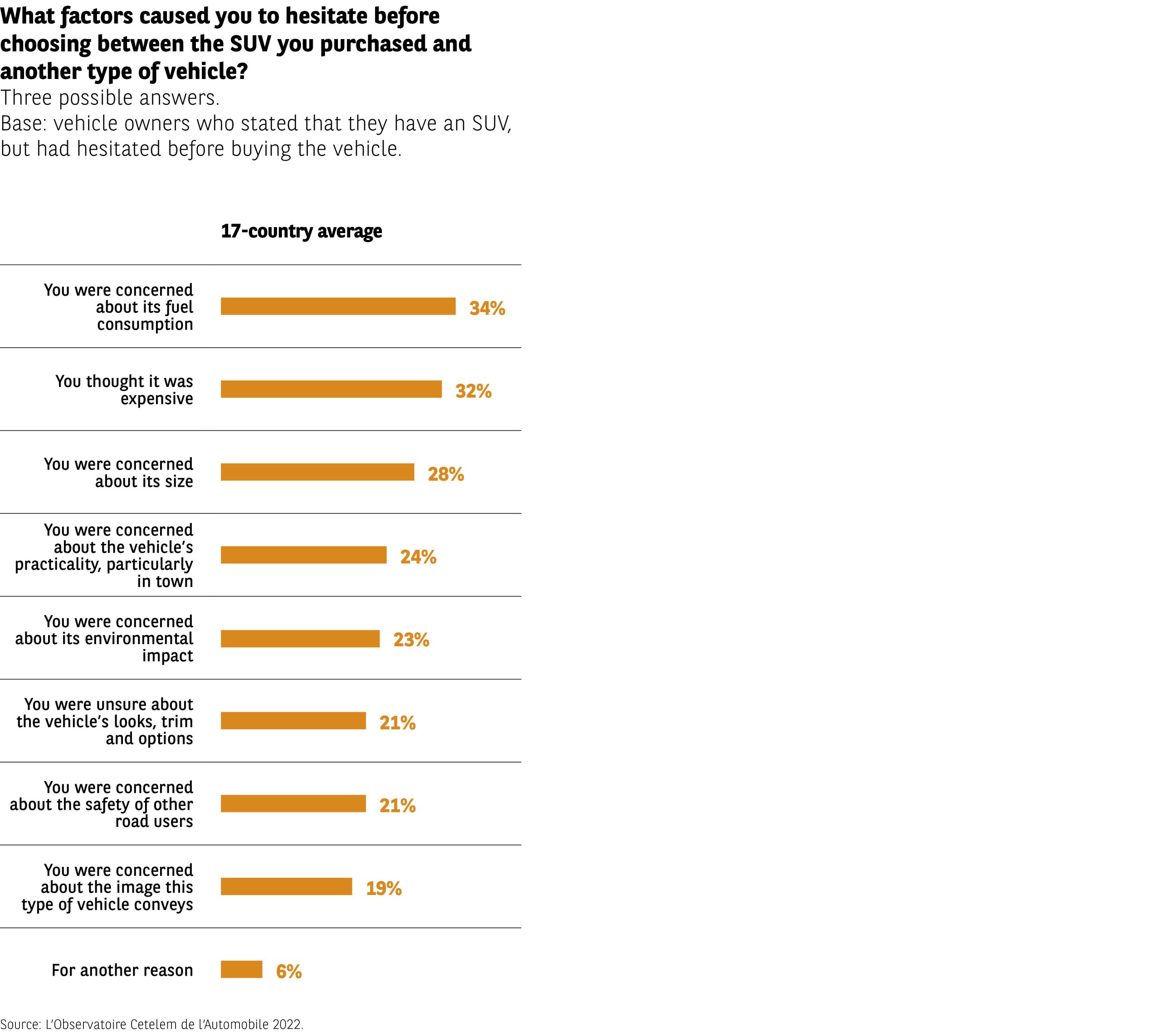

As we have already seen, SUVs are not considered fuel-efficient. However, fuel consumption is a topic of concern even for SUV owners, at a time when petrol and diesel prices are soaring. 34% of owners cite fuel consumption as the main factor that caused them to hesitate before buying an SUV, a sentiment expressed most strongly by the over‑55s (Fig 20).

This is a particularly delicate subject in the emerging countries, but also in Italy and Spain. Respondents in the Netherlands, the United Kingdom, Japan and Norway, where the electric car is king, are less troubled by this issue. However, this concern appears to be grounded primarily in financial, rather than environmental interests. Only 23% of SUV owners were hesitant to buy such a vehicle because of its potential environmental impact.

Fig 20 – Reasons for hesitation when buying an SUV

Download this infographic for your presentations the infographic lists the reasons given by SUV owners who hesitated between an SUV and another type of vehicle.

Data:

– Concerns about fuel consumption: 34%

– Perceived high price: 32%

– Concerns about vehicle size: 28%

– Concerns about practicality in urban use: 24%

– Environmental impact: 23%

– Aesthetic or equipment doubts: 21%

– Safety concerns for other road users: 21%

– Concern about the image associated with SUVs: 19%

– Other reasons: 6%

Main takeaway: fuel consumption, cost, and size are the most cited concerns.

Source: L’Observatoire Cetelem de l’Automobile 2022.

the infographic lists the reasons given by SUV owners who hesitated between an SUV and another type of vehicle.

Data:

– Concerns about fuel consumption: 34%

– Perceived high price: 32%

– Concerns about vehicle size: 28%

– Concerns about practicality in urban use: 24%

– Environmental impact: 23%

– Aesthetic or equipment doubts: 21%

– Safety concerns for other road users: 21%

– Concern about the image associated with SUVs: 19%

– Other reasons: 6%

Main takeaway: fuel consumption, cost, and size are the most cited concerns.

Source: L’Observatoire Cetelem de l’Automobile 2022.

The magic of electricity helps the SUV’s cause

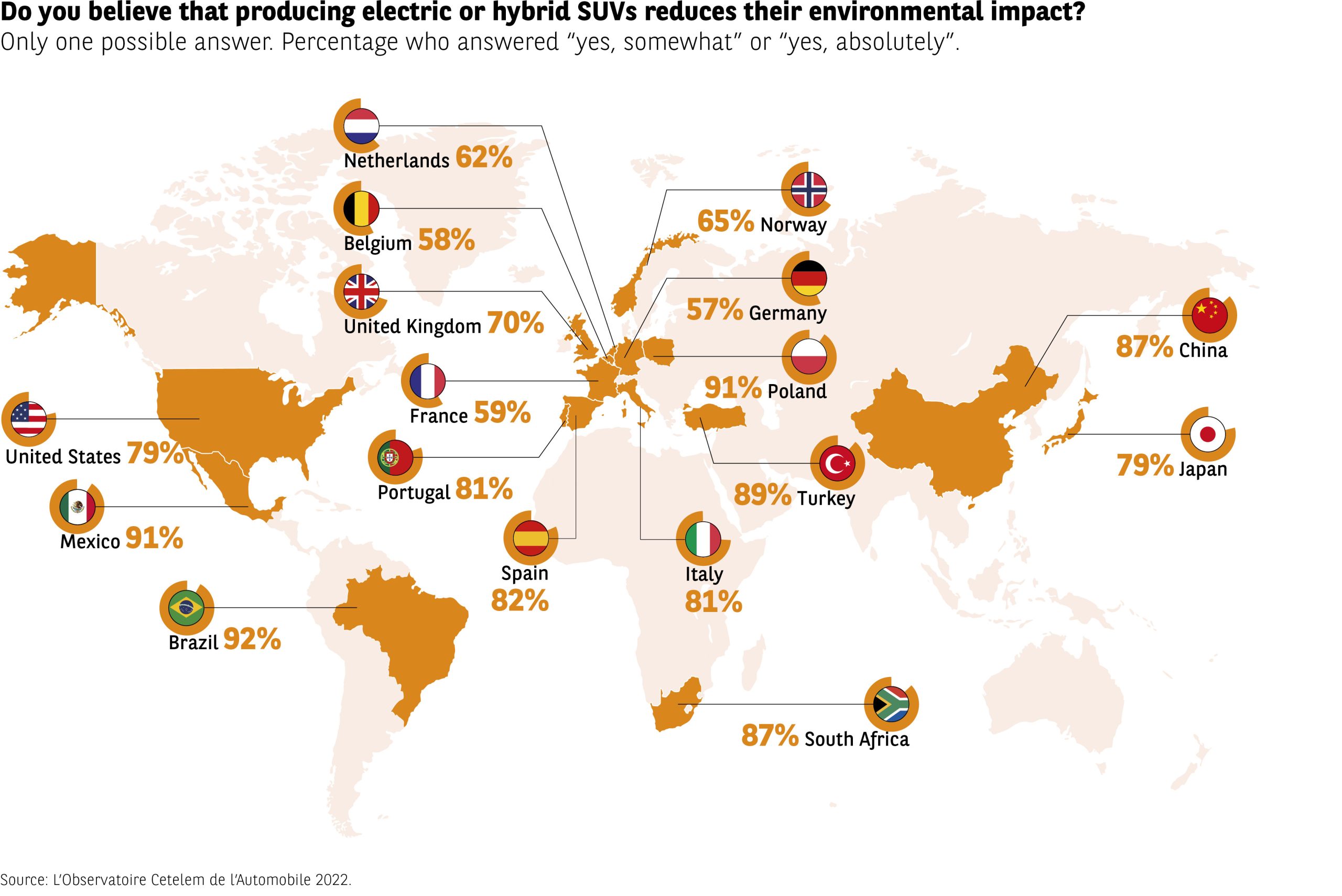

But if there has to be an environmental impact, motorists are clear on how to reduce it. 77% believe that producing electric or hybrid SUVs would help achieve this goal. In the emerging nations, as well as in Poland, this is a solution that prompts even more enthusiasm, with close to 90% voicing this opinion in some countries and an even greater proportion in others. Conversely, the response in countries such as Belgium, France and Germany is a little more ambivalent, with less than 60% favouring this approach (Fig 21). Interestingly, in previous editions of L’Observatoire Cetelem de l’Automobile we had already seen these three countries clustered together when it came to environmental issues. This clustering stems from their maturity regarding this topic and their awareness that environmental impact is not linked purely to energy consumption.

Fig 21 – Perceived environmental benefit of electric SUVs

Download this infographic for your presentations the infographic shows the proportion of respondents who believe producing electric or hybrid SUVs contributes to reducing environmental impact. Percentages include “yes, somewhat” and “yes, definitely.”

A world map displays each country with its flag and the corresponding percentage.

Data:

South Africa: 87%

Germany: 57%

Belgium: 58%

Brazil: 92%

China: 87%

Spain: 82%

United States: 79%

France: 59%

Italy: 81%

Japan: 79%

Mexico: 91%

Norway: 65%

Netherlands: 62%

Poland: 91%

Portugal: 81%

United Kingdom: 70%

Turkey: 89%

Main takeaway: belief in environmental benefits is high across all countries, although with noticeable variation.

Source: L’Observatoire Cetelem de l’Automobile 2022.

the infographic shows the proportion of respondents who believe producing electric or hybrid SUVs contributes to reducing environmental impact. Percentages include “yes, somewhat” and “yes, definitely.”

A world map displays each country with its flag and the corresponding percentage.

Data:

South Africa: 87%

Germany: 57%

Belgium: 58%

Brazil: 92%

China: 87%

Spain: 82%

United States: 79%

France: 59%

Italy: 81%

Japan: 79%

Mexico: 91%

Norway: 65%

Netherlands: 62%

Poland: 91%

Portugal: 81%

United Kingdom: 70%

Turkey: 89%

Main takeaway: belief in environmental benefits is high across all countries, although with noticeable variation.

Source: L’Observatoire Cetelem de l’Automobile 2022.

Electric SUVs – Combustion engine city cars: 1-0

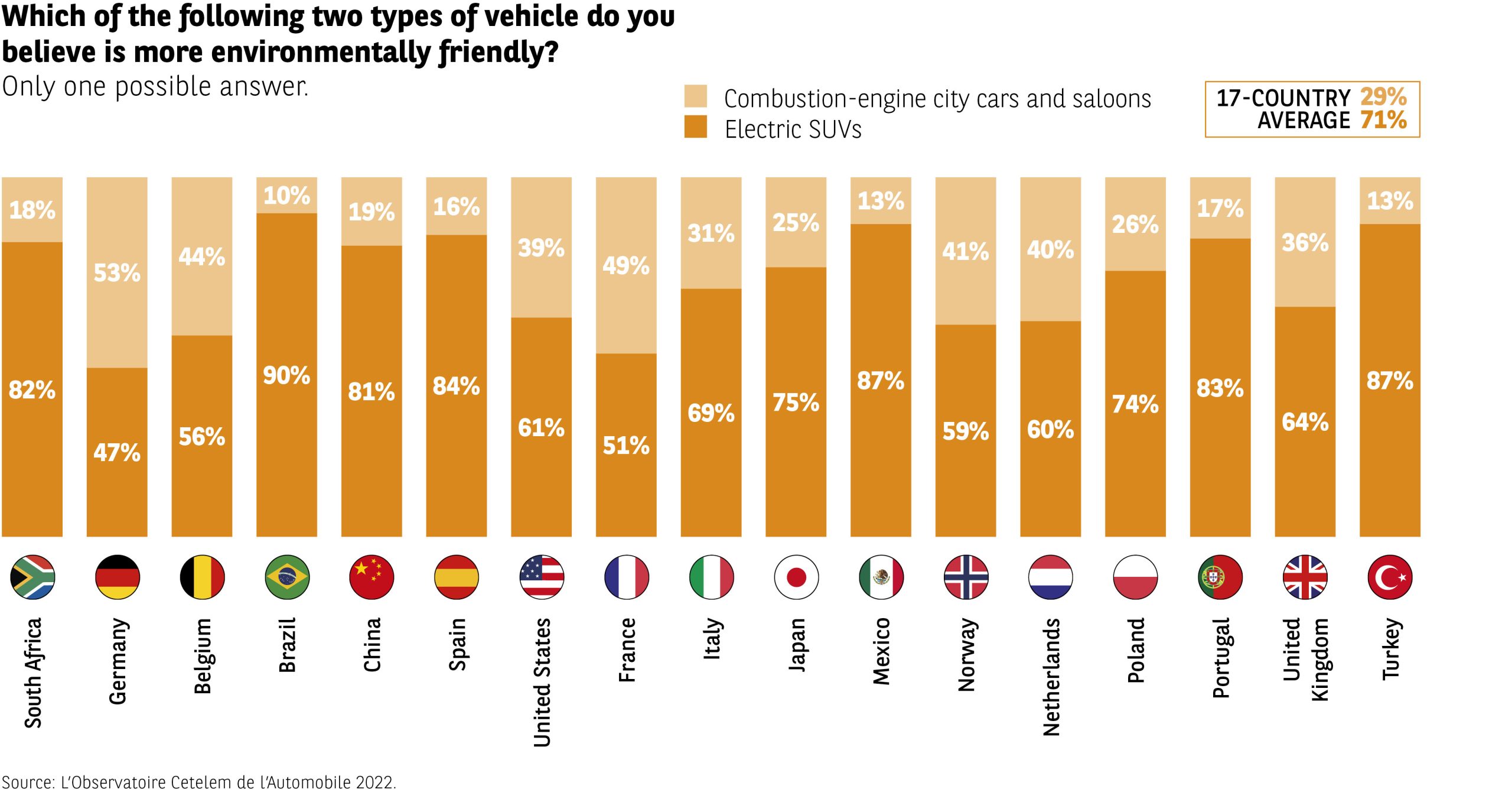

Electrical power again demonstrates its superior environmental credentials when electric SUVs are pitched against combustion engine city cars. This is something of a mismatch, with the former receiving an average of 71% of the vote and the latter 29% (Fig 22). Here, the geographical divide revealed earlier reappears, with respondents in the emerging nations wholeheartedly supporting electric SUVs and the aforementioned trio, along with Norway, remaining more sceptical. Germany is the only country in which combustion engine city cars prevail over electric SUVs, while France is just 1 point away from producing the same result. The Iberian peninsula also stands apart, with Spain and Portugal producing scores similar to those of the emerging nations.

Fig 22 – Environmental perception of vehicle types

Download this infographic for your presentations The infographic presents, across 17 countries, which of two vehicle types is viewed as the most environmentally friendly: “small cars and sedans with combustion engines” or “electric SUVs.”

The averages displayed are 29% for combustion cars and 71% for electric SUVs.

Data by country:

South Africa: 18% combustion, 82% electric SUVs

Germany: 53% / 47%

Belgium: 44% / 56%

Brazil: 10% / 90%

China: 19% / 81%

Spain: 16% / 84%

United States: 39% / 61%

France: 49% / 51%

Italy: 31% / 69%

Japan: 25% / 75%

Mexico: 13% / 87%

Norway: 41% / 59%

Netherlands: 40% / 60%

Poland: 26% / 74%

Portugal: 17% / 83%

United Kingdom: 36% / 64%

Turkey: 13% / 87%

Main takeaway: electric SUVs are considered more environmentally friendly in most countries, with significant variations between regions.

Source: L’Observatoire Cetelem de l’Automobile 2022.

The infographic presents, across 17 countries, which of two vehicle types is viewed as the most environmentally friendly: “small cars and sedans with combustion engines” or “electric SUVs.”

The averages displayed are 29% for combustion cars and 71% for electric SUVs.

Data by country:

South Africa: 18% combustion, 82% electric SUVs

Germany: 53% / 47%

Belgium: 44% / 56%

Brazil: 10% / 90%

China: 19% / 81%

Spain: 16% / 84%

United States: 39% / 61%

France: 49% / 51%

Italy: 31% / 69%

Japan: 25% / 75%

Mexico: 13% / 87%

Norway: 41% / 59%

Netherlands: 40% / 60%

Poland: 26% / 74%

Portugal: 17% / 83%

United Kingdom: 36% / 64%

Turkey: 13% / 87%

Main takeaway: electric SUVs are considered more environmentally friendly in most countries, with significant variations between regions.

Source: L’Observatoire Cetelem de l’Automobile 2022.

The response from manufacturers aligns with expectations

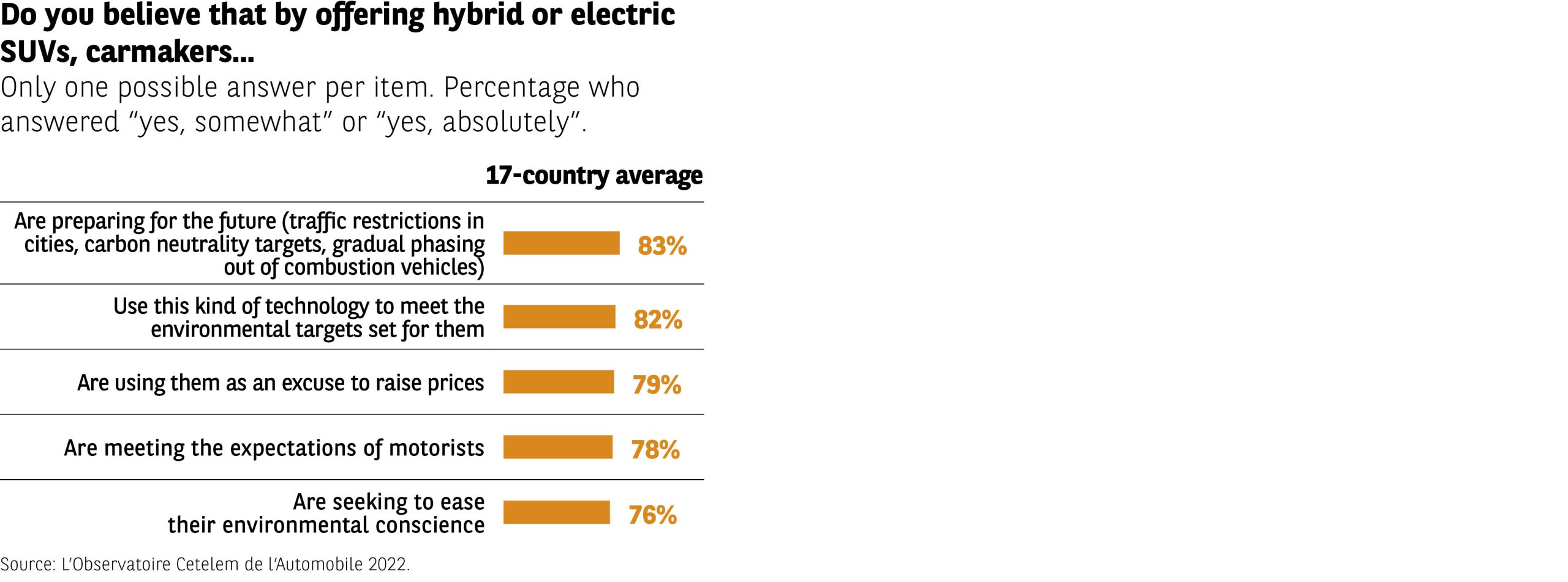

The growing interest expressed by motorists towards electric vehicles also prompts them to hold a rather favourable view of carmakers’ efforts to offer more hybrid or electric cars. According to 83% of those surveyed, this shows that manufacturers are keen to prepare for the future. That means anticipating future traffic restrictions in cities, carbon neutrality targets and the gradual phasing out of combustion vehicles. Once again, with the exception of Spain, Italy and Poland, the Western countries are slightly less likely to be of this belief. An almost identical percentage of motorists (82%) believe that manufacturers are relying on these types of vehicle to meet the increasingly stringent environmental targets set for them (Fig 23). On this topic, the answers of the different countries are more homogeneous than for the previous item.

Fig 23 – Perceived motivations of SUV manufacturers

Download this infographic for your presentations the infographic presents, as a 17-country average, the proportion of respondents who believe manufacturers have different motivations when offering hybrid or electric SUVs. Values include responses “yes, somewhat” and “yes, definitely.”

Data:

– Preparing for the future (urban restrictions, carbon neutrality goals, phase-out of combustion engines): 83%

– Meeting environmental targets set for them: 82%

– Using it to justify higher prices: 79%

– Responding to motorists’ expectations: 78%

Improving their ecological image: 76%

Main takeaway: respondents attribute multiple motivations to manufacturers, combining regulatory, environmental, and commercial considerations.

Source: L’Observatoire Cetelem de l’Automobile 2022.

the infographic presents, as a 17-country average, the proportion of respondents who believe manufacturers have different motivations when offering hybrid or electric SUVs. Values include responses “yes, somewhat” and “yes, definitely.”

Data:

– Preparing for the future (urban restrictions, carbon neutrality goals, phase-out of combustion engines): 83%

– Meeting environmental targets set for them: 82%

– Using it to justify higher prices: 79%

– Responding to motorists’ expectations: 78%

Improving their ecological image: 76%

Main takeaway: respondents attribute multiple motivations to manufacturers, combining regulatory, environmental, and commercial considerations.

Source: L’Observatoire Cetelem de l’Automobile 2022.

While 78% are also of the opinion that manufacturers are catering for the expectations of motorists, this relatively positive consensus is clouded by two counterpoints. 79% are of the belief that carmakers are using these vehicles as an excuse to raise prices and 76% believe that they are a way of easing their conscience. Here, the traditional geographical dichotomy collapses, giving way to clusters we have not seen before. The Brazilians, the French and the Poles are united in denouncing what they perceive as greed on the part of manufacturers. Meanwhile, the Japanese and Chinese are more charitable in their attitudes. The French, together with the Spanish, Turks, Brazilians, Poles and Japanese, are the most likely to condemn manufacturers for cynically seeking to ease their conscience. The Norwegians, Dutch and Portuguese, on the other hand, are less suspicious in this regard.

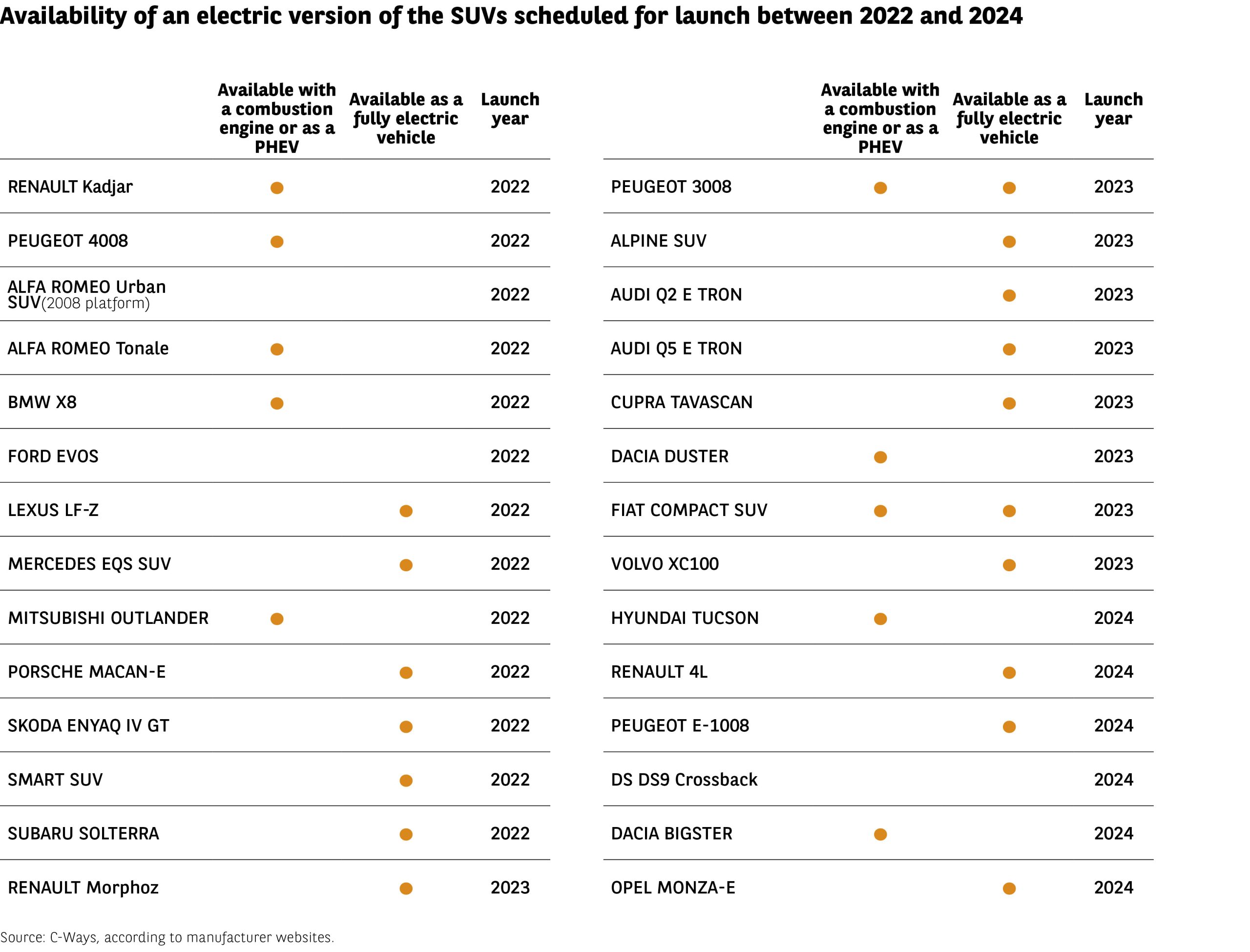

The SUV goes electric

While the automotive market has been enriched by “pure electric players” that have designed and launched their own SUVs, the next three years will see many vehicles of this type from other carmakers receive the fully electric treatment.

Fig 24 – Availability of electric versions of SUVs, 2022–2024

Download this infographic for your presentations the table presents SUV models scheduled for release between 2022 and 2024. For each model, the graphic indicates whether a thermal/PHEV version exists, whether a fully electric version exists, and the planned release year.

Structured data (complete but concise):

2022 models:

Renault Kadjar (thermal/PHEV), Peugeot 4008 (electric), Alfa Romeo Urban SUV (electric), Alfa Romeo Tonale (thermal/PHEV), BMW X8 (electric), Ford Evos (2022), Lexus LF-Z (electric), Mercedes EQS SUV (electric), Mitsubishi Outlander (thermal/PHEV), Porsche Macan-E (electric), Skoda Enyaq IV GT (electric), Smart SUV (2022), Subaru Solterra (electric).

2023 models:

Renault Morphoz (electric), Peugeot 3008 (electric), Alpine SUV (electric), Audi Q2 e-tron (electric), Audi Q5 e-tron (electric), Cupra Tavascan (electric), Dacia Duster (thermal/PHEV), Fiat compact SUV (electric), Volvo XC100 (electric).

2024 models:

Hyundai Tucson (electric), Renault 4L (electric), Peugeot e-1008 (electric), DS9 Crossback (2024), Dacia Bigster (thermal/PHEV), Opel Monza-E (electric).

Main takeaway: most models expected in 2023–2024 include a fully electric version.

Source: C-Ways based on manufacturer data.

the table presents SUV models scheduled for release between 2022 and 2024. For each model, the graphic indicates whether a thermal/PHEV version exists, whether a fully electric version exists, and the planned release year.

Structured data (complete but concise):

2022 models:

Renault Kadjar (thermal/PHEV), Peugeot 4008 (electric), Alfa Romeo Urban SUV (electric), Alfa Romeo Tonale (thermal/PHEV), BMW X8 (electric), Ford Evos (2022), Lexus LF-Z (electric), Mercedes EQS SUV (electric), Mitsubishi Outlander (thermal/PHEV), Porsche Macan-E (electric), Skoda Enyaq IV GT (electric), Smart SUV (2022), Subaru Solterra (electric).

2023 models:

Renault Morphoz (electric), Peugeot 3008 (electric), Alpine SUV (electric), Audi Q2 e-tron (electric), Audi Q5 e-tron (electric), Cupra Tavascan (electric), Dacia Duster (thermal/PHEV), Fiat compact SUV (electric), Volvo XC100 (electric).

2024 models:

Hyundai Tucson (electric), Renault 4L (electric), Peugeot e-1008 (electric), DS9 Crossback (2024), Dacia Bigster (thermal/PHEV), Opel Monza-E (electric).

Main takeaway: most models expected in 2023–2024 include a fully electric version.

Source: C-Ways based on manufacturer data.

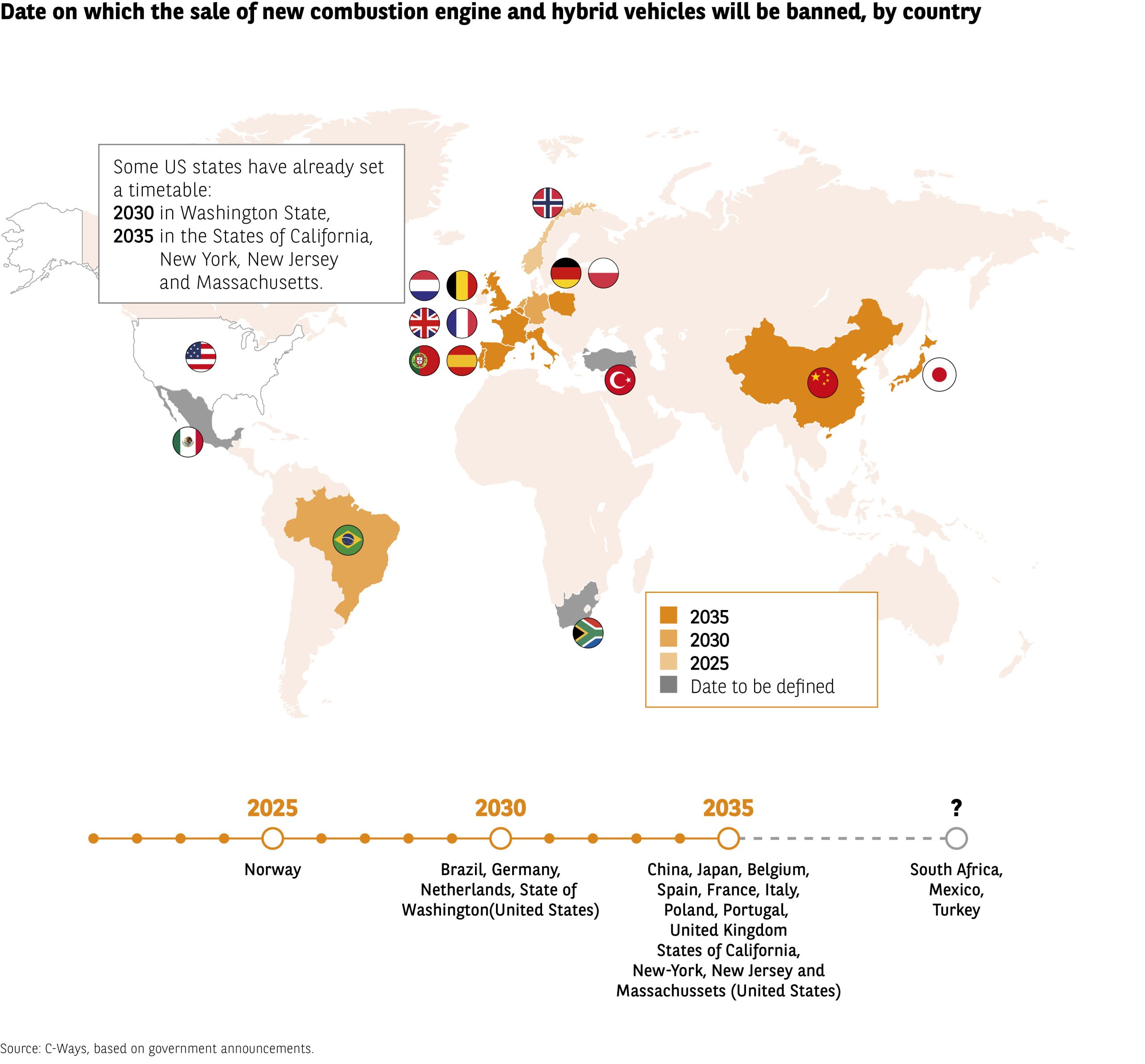

Fig 25 – Planned phase-out dates for combustion vehicle sales

Download this infographic for your presentations the map presents the announced timelines by various countries regarding the end of new combustion or hybrid vehicle sales. Countries are grouped into three deadlines—2025, 2030, and 2035.

Data:

• 2025: Norway

• 2030: Brazil, Germany, Netherlands, Washington State (USA)

• 2035: China, Japan, Belgium, Spain, France, Italy, Poland, Portugal, United Kingdom, California, New York, New Jersey, Massachusetts (USA)

• No defined date: South Africa, Mexico, Turkey

Main takeaway: most highlighted countries plan phase-outs in 2035, while some have not yet announced a target.

Source: C-Ways based on government announcements.

the map presents the announced timelines by various countries regarding the end of new combustion or hybrid vehicle sales. Countries are grouped into three deadlines—2025, 2030, and 2035.

Data:

• 2025: Norway

• 2030: Brazil, Germany, Netherlands, Washington State (USA)

• 2035: China, Japan, Belgium, Spain, France, Italy, Poland, Portugal, United Kingdom, California, New York, New Jersey, Massachusetts (USA)

• No defined date: South Africa, Mexico, Turkey

Main takeaway: most highlighted countries plan phase-outs in 2035, while some have not yet announced a target.

Source: C-Ways based on government announcements.