SPENDING POWER: THE LIGHT AT THE END OF THE TUNNEL

A €550 bonus

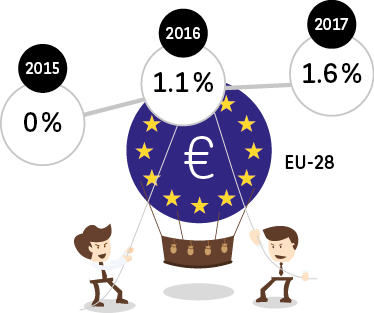

After four years of stagnation at a very low level, and even a contraction in a number of countries, spending power was up once again in 2015, growing by around 4 % overall across the continent (source: Gfk, November 2015). This rise can be explained by rising incomes, virtually zero inflation and the fact that the price of crude oil is at a ten-year low. These three factors combined meant that every European had €550 more in their pocket in 2015, with significant savings made on energy costs in particular. However, this is a trend that remains precarious (Fig. 5).

An improvement that most have not felt.

However, European consumers do not yet appear to be aware of this financial boost. Indeed, just 16 % believe that their spending power has increased over the last 12 months, compared with the 37 % who believe it has fallen. This biased assessment is the result of several years of economic gloom (Fig. 6).

Let’s not forget that the costliest living expenses (rent, service charges and loan repayments) are on the rise in Europe. Thus, while overall spending power is up, the disposable income available to households once their regular direct debits have been made at the start of the month – which equates to their perceived spending power (see BIPE for LSA) – is still under huge strain.

Fig. 5 Inflation forecasts for Europe

Source: European Commission, November 2015.

Fig. 6 Over the last 12 months, would you say that your spending power…

Source: L’Observatoire Cetelem de la Consommation 2016.