GREATER OPTIMISM AMONG (ALMOST) ALL EUROPEANS

A return to growth…

Slowly but surely, Europe is returning to economic growth (Fig. 1).

With growth reaching 1.6 % in the Euro Zone in 2015 (vs. 0.9 % in 2014), Europeans should see a scaling down of austerity policies and a slight increase in their spending power. On the jobs front, the news is just as positive (at last!), suggesting that unemployment could gradually fall in a number of countries.

… and confidence too

European consumers have increased their spending in line with this recovery (+1.8 % in 2015, source: European Commission). A sign of their renewed confidence is the fact that their perception of the overall situation in their country has improved for the third year running, having been in a downward spiral for a number of years since the financial crisis. Bolstered notably by an upturn in the Mediterranean countries, the average score of the countries examined by L’Observatoire Cetelem reached 4.7 this year, not far off the pre-crisis figure (4.8 in 2008).

Germany is the only European country whose score has dropped significantly, by 0.7 points. Although the Germans are still the most optimistic European population when it comes to the overall situation in their country (with a score of 5.7, one point higher than the average), this figure is the worst recorded in six years.

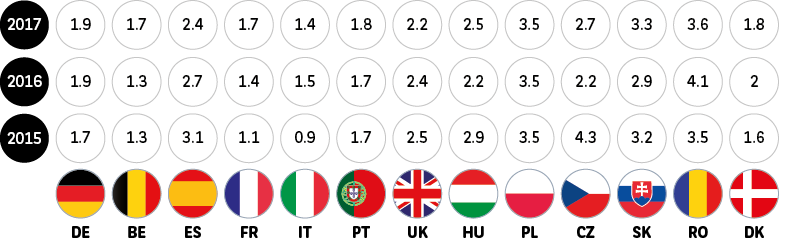

Fig. 1 GDP growth of the countries examined by L’Observatoire Cetelem

Source: European Commission, November 2015 forecasts.

Doubts are creeping into German minds

This is not entirely surprising. Having led Europe out of the economic and political crisis, the German economy stalled in 2015. The cause? The slowdown in foreign demand, notably from China, and the Russian embargo have had a significant effect on exports. Another factor is the scandal that has hit one of the crown jewels of Germany’s automotive industry. While economic growth remains strong in the country, the numerous downward revisions by its national institutes have not gone unnoticed among German consumers.

France regains its senses

Among those countries whose score has improved, Spain and Italy post the greatest increases. Gaining almost a whole point, both countries now boast scores higher than 4/10, a sign of renewed economic hope after a few dark years.

France also contributes to this upward trend by gaining half a point. It is now back on a par with the European average after six years of gloom, during which its score struggled to exceed 4/10. The French now seem less critical of the situation in their country.

Probably hindered by its difficult relationship with the European Union, the United Kingdom has failed to improve its score, but remains in the leading group, just behind Germany and Denmark.

Portugal and Hungary bring up the rear but have posted significant and encouraging improvements. Nonetheless, these are the only two nations of L’Observatoire Cetelem to score lower than 4/10 when it comes to assessing the overall situation in the country.

The end of a multi-tiered Europe?

The 2016 Observatoire Cetelem marks a real shift. Indeed, never in the last six years have the scores given by European consumers been so close. The fall in the German score, the stabilisation of the British and Belgian scores, together with the upsurges in Spain, Italy and France, are evidence of greater homogeneity among Europeans when it comes to assessing the overall situation in their country.

This contrasts immensely with 2014, when L’Observatoire Cetelem was able to clearly identify a three-tier Europe, with the German “locomotive” positioned far ahead of Spain and Italy at the back of the “train”.

Spain and Italy find renewed confidence

Having agreed to make considerable efforts after the crisis, Spanish and Italian households have made the most of a healthier economic climate that has enabled consumer spending to recover. In Spain, the lowering of interest rates has enabled the middle classes to take on debt more cheaply, thus favouring purchases of durable goods. Meanwhile, Italy has finally enjoyed a positive year in terms of job creation – the result of a proactive policy in this area – after a disastrous 2013 and an uninspiring 2014. Spain’s growth was twice as dynamic as Germany’s in 2015 and, little by little, Italy is making up lost ground.

Poland is set to continue posting what are record growth figures for a European country, a trend that other nations of Central and Western Europe are expected to follow. This should help redress the balance between households on the continent.