Contrasting relationships with brands

AN EXTENSION OF ONE’S PERSONALITY

Examining people’s relationship with cars in terms of image, which is strongly linked to the brands that produce them, reveals generational differences. When it comes to the factors that influence their choice of vehicle, young people focus on style, design and power. This is a generation who like their cars to have character. On the flip side, the brand and especially the country of manufacture are much less important to young people than they are to seniors. Are brands losing their sparkle and their power to influence?

The reality is more complex…

VALUED ADVICE

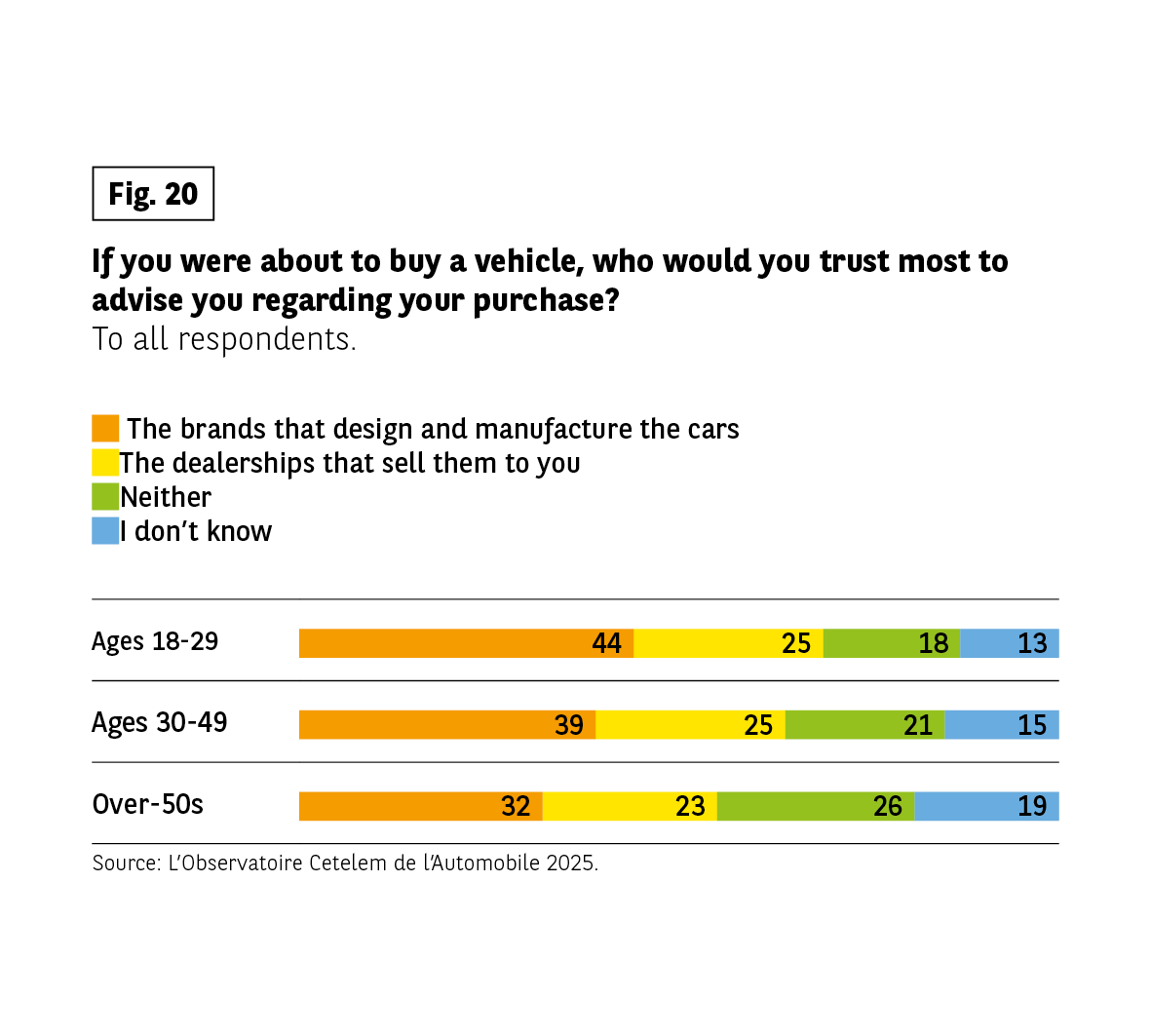

Indeed, when young people are looking to buy a car, they prefer to acquire them from brands, rather than trusting dealerships.

Similarly, after a test drive, the information provided by brands is the most important factor in their decision, with almost 9 out of 10 young people prioritising these criteria. It is interesting to note that the web is not the primary source of information for this generation, as one might have expected (Fig. 20).

ON THE RIGHT TRACK

Far from vilifying brands, young people seem to be fairly satisfied with what they offer. More surprisingly, this is also the case when it comes to environmental matters. Around 1 in 2 young people feel that manufacturers are doing enough to produce eco-friendly vehicles. This result can probably be explained by the ever-growing number of electric vehicles being produced, but also by the effectiveness of marketing that focuses on the virtues carmakers seek to present in this day and age. Note also that in all the countries surveyed, the total number of “yes” answers exceeds the total number of “no” answers.

Fig 20 – Trust in accompanying the purchase of a vehicle

Download this infographic for your presentations The infographic presents the responses to the question: “If you were about to buy a vehicle, who would you trust most to accompany you during the purchase?”, asked to all respondents. Four options are proposed: trust “car manufacturers”, “distributors who sell them”, “neither”, or “don’t know”. The results are compared for three age groups: 18-29 years old, 30-49 years old, and 50 years old and over.

The data indicated are:

18-29 years old: manufacturers 44%, distributors 25%, neither 21%, don’t know 13%

30-49 years old: manufacturers 39%, distributors 25%, neither 21%, don’t know 15%

50 years old and over: manufacturers 32%, distributors 23%, neither 26%, don’t know 19%

The results show that manufacturers are the actors to whom respondents most often grant their trust, with a decreasing trend according to age. Distributors receive comparable levels in the three age groups. The proportion of respondents who do not trust either manufacturers or distributors increases with age.

Source: Cetelem Automobile Observatory 2025

The infographic presents the responses to the question: “If you were about to buy a vehicle, who would you trust most to accompany you during the purchase?”, asked to all respondents. Four options are proposed: trust “car manufacturers”, “distributors who sell them”, “neither”, or “don’t know”. The results are compared for three age groups: 18-29 years old, 30-49 years old, and 50 years old and over.

The data indicated are:

18-29 years old: manufacturers 44%, distributors 25%, neither 21%, don’t know 13%

30-49 years old: manufacturers 39%, distributors 25%, neither 21%, don’t know 15%

50 years old and over: manufacturers 32%, distributors 23%, neither 26%, don’t know 19%

The results show that manufacturers are the actors to whom respondents most often grant their trust, with a decreasing trend according to age. Distributors receive comparable levels in the three age groups. The proportion of respondents who do not trust either manufacturers or distributors increases with age.

Source: Cetelem Automobile Observatory 2025

KEY DATA

- 8 out of 10 young people are attached to their car

- 3 in 10 see it as a source of memories

- 8 out of 10 believe it is essential for the day to day

- 45% look at the price first and foremost before they buy

- 9 out of 10 take notice of the information provided by brands before buying