Money: a different meaning for different ages

MONEY AND VALUES: WHEN THE GAP WIDENS

Echoing the reality of the figures, which reveal the differences in income between age groups, more than half of senior citizens believe that the gap between generations has widened over the last 10 years in terms of purchasing power.

It should be noted that this view was shared by all age groups, with French people being the most likely to point to the widening gap. This financial impression comes with a similar realisation that values have not been quite the same over the last decade.

Fig 51 – Perceived evolution of the generational gap

Download this infographic for your presentations This graph compares the perceived evolution of the generational gap compared to ten years ago, expressed as a percentage, by age and two dimensions: purchasing power and values.

This graph compares the perceived evolution of the generational gap compared to ten years ago, expressed as a percentage, by age and two dimensions: purchasing power and values.

CLEAR FINANCIAL SUPPORT FOR YOUNG PEOPLE

Even with less purchasing power, income and assets, seniors still see it as a matter of course to support their children financially.

8 out of 10 consider it important to help their offspring. This is particularly the case in Latin countries, where intentions are close to, or even exceed, 90%. This is in contrast to Germany and Sweden, where this intention is less self-evident. Another illustration of the socio-cultural and even cultural differences between Catholic and Protestant countries? The desire to help one’s children financially does not stop at intentions, but becomes a reality for the vast majority of seniors. 7 out of 10 occasionally reached for their wallet to help with at least one item of expenditure. In this respect, geographical and cultural maps have been completely reshuffled. Alongside the Romanians, Poles and Portuguese, the French and Italians were the most generous. The Germans and the Spaniards formed a pair of more frugal countries.

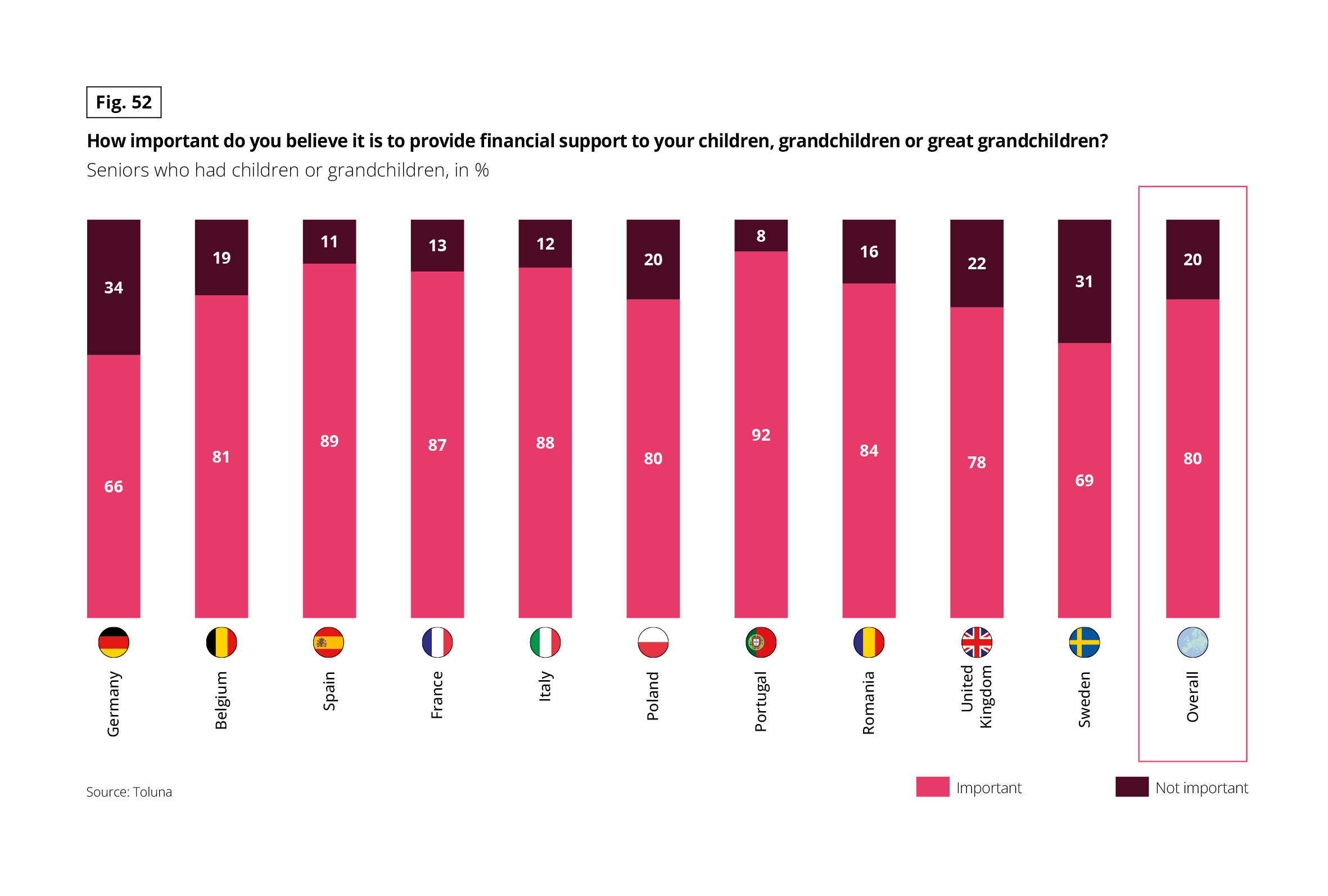

Fig 52 – Importance of financial support for descendants

Download this infographic for your presentations This graph presents the percentage of seniors who consider it important or not to financially support their children, grandchildren, or great-grandchildren.

In all countries, a majority of seniors consider this support important. The highest rates are observed in Portugal with 92%, Spain with 89%, and Italy with 88%. In Germany, 66% consider this support important. In Sweden, 69% consider this support important and 31% not important. For all ten countries, 80% consider this support important and 20% not important.

The stacked bars distinguish between the responses “important” and “not important”.

Source: Toluna.

This graph presents the percentage of seniors who consider it important or not to financially support their children, grandchildren, or great-grandchildren.

In all countries, a majority of seniors consider this support important. The highest rates are observed in Portugal with 92%, Spain with 89%, and Italy with 88%. In Germany, 66% consider this support important. In Sweden, 69% consider this support important and 31% not important. For all ten countries, 80% consider this support important and 20% not important.

The stacked bars distinguish between the responses “important” and “not important”.

Source: Toluna.

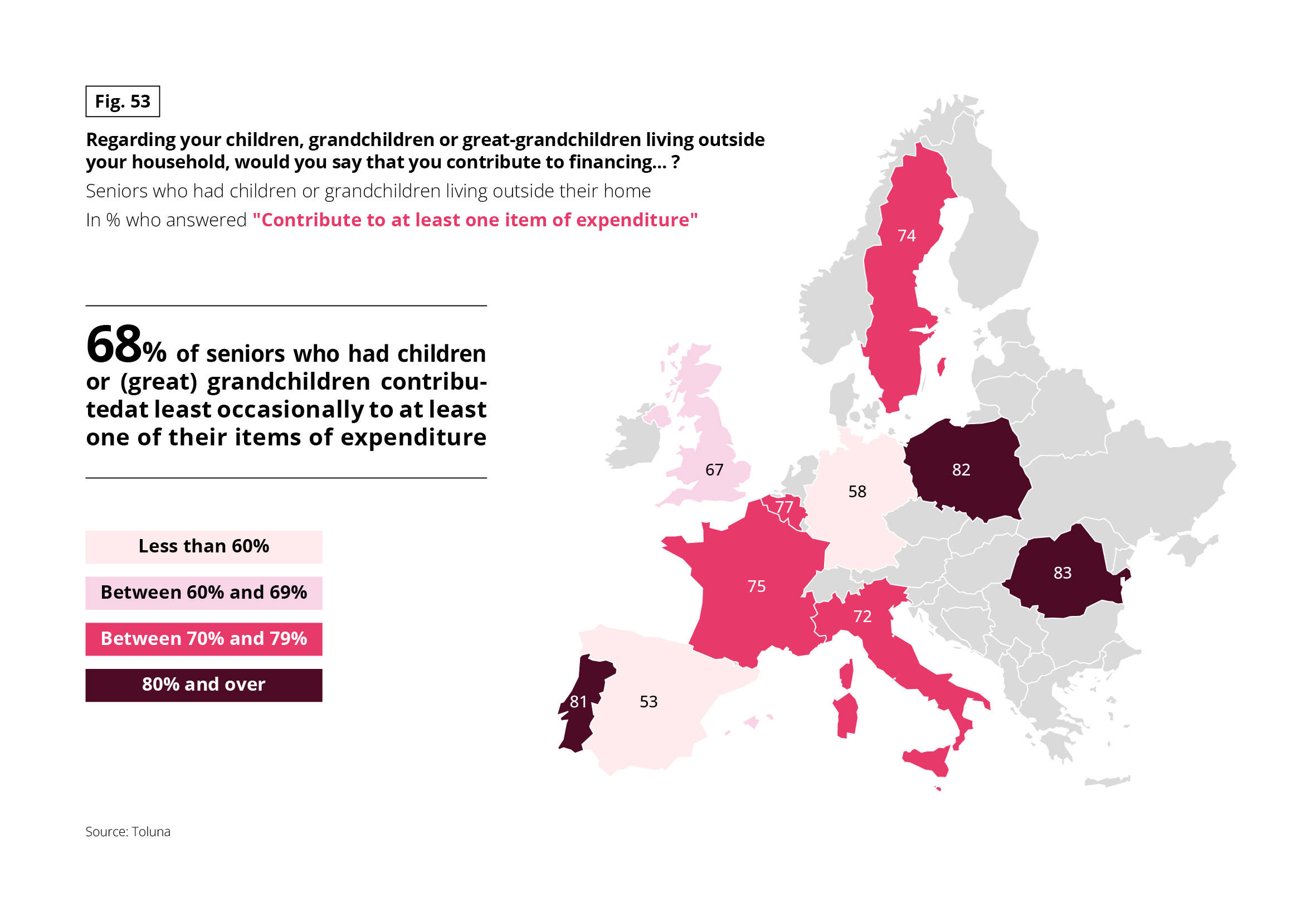

Fig 53 – Financial contribution of seniors to descendants

Download this infographic for your presentations This map presents, by country, the percentage of seniors with children, grandchildren, or great-grandchildren outside their home and declaring participation in at least one expense category.

This map presents, by country, the percentage of seniors with children, grandchildren, or great-grandchildren outside their home and declaring participation in at least one expense category.

HELPING THEIR OWN PARENTS TOO

At the other end of the generational scale, supporting one’s forebears seems just as natural for senior citizens. In 10 years, the share of senior citizens who are inclined in this direction has hardly changed, with 6 out of 10 helping their parents financially. This support is considered very important in France, Italy and Spain, but much less so in Germany and the UK.

Fig 54 – Financial support for aging parents

Download this infographic for your presentations This graph presents, for seniors who still have parents, step-parents, or grandparents, the importance given to financial support, expressed as a percentage.

This graph presents, for seniors who still have parents, step-parents, or grandparents, the importance given to financial support, expressed as a percentage.

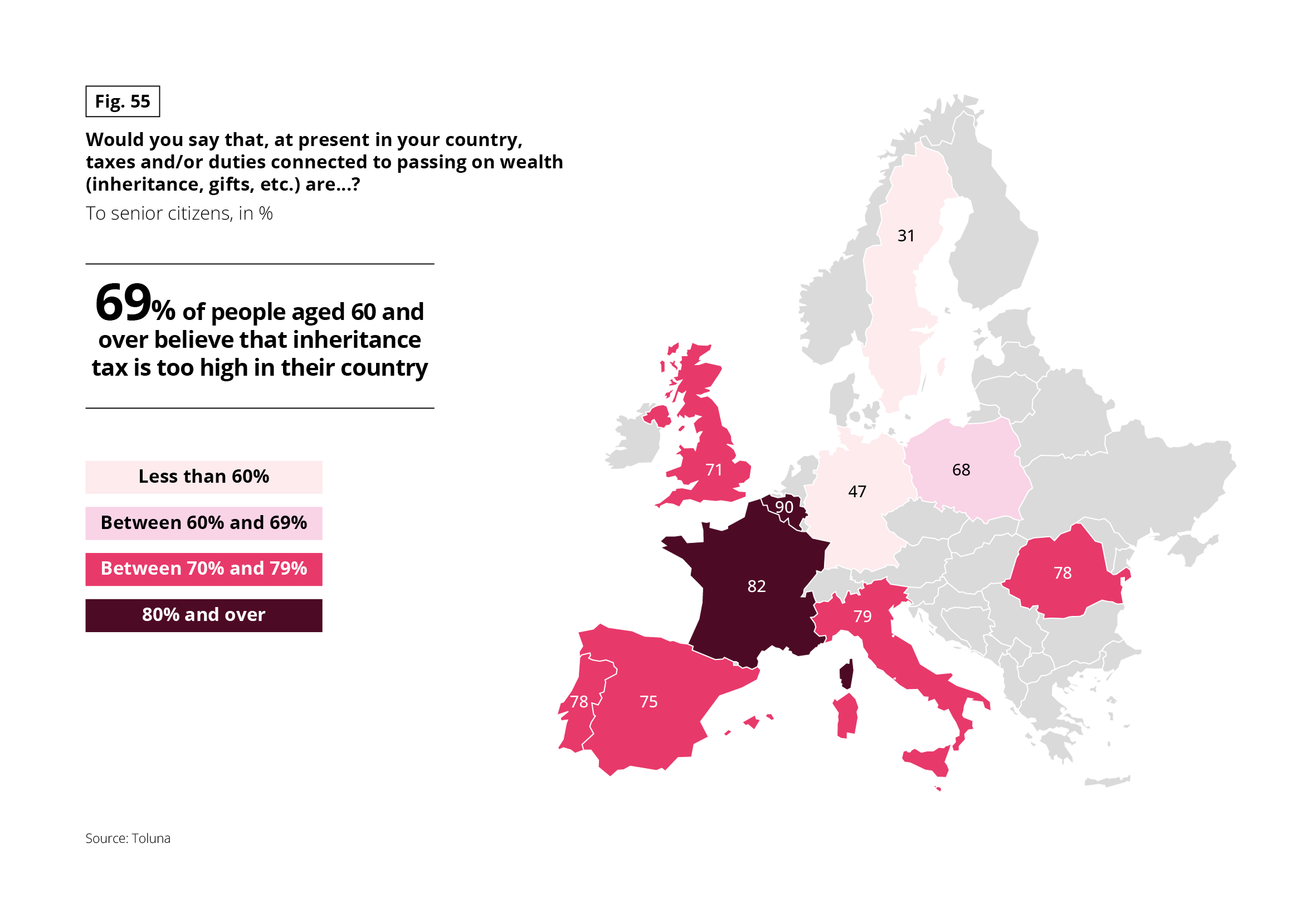

PASSING ON WEALTH IS FINANCIALLY TOO COSTLY

As we have seen, gifts naturally become more frequent with age, as they are another way of giving your children or grandchildren a helping hand. The same goes with inheritances linked to the death of one’s own parents. However, both seem to leave a bitter taste in the mouths of senior citizens. 7 out of 10 said that the taxes levied on inheritance are too high.

As recent history has shown in a number of crises involving increases in state levies, the French assert themselves as anti-tax leaders.As a historic paragon of the social-democratic distribution model, the Swedes (and to a lesser extent the Germans) do not consider inheritance tax to be too high, not out of a heightened sense of Nordic tolerance, but more prosaically because it was abolished in their country in 2005.

Fig 55 – Perception of taxes on transmissions

Download this infographic for your presentations This map shows, by country, the percentage of seniors estimating that taxes and duties related to the transmission of wealth are too high, expressed as a percentage.

This map shows, by country, the percentage of seniors estimating that taxes and duties related to the transmission of wealth are too high, expressed as a percentage.

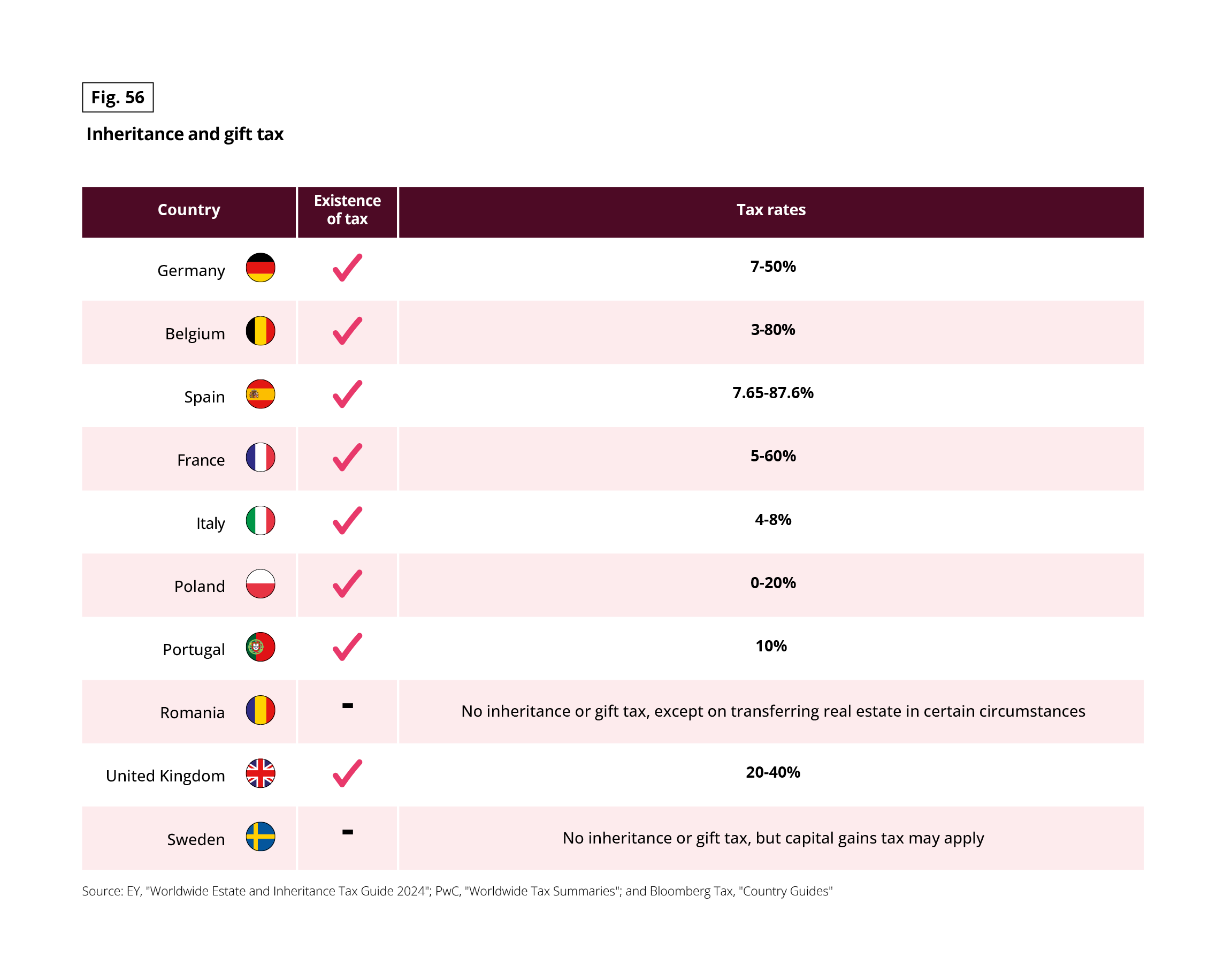

Fig 56 – Taxation of successions and donations in Europe

Download this infographic for your presentations This table compares the existence of an inheritance and gift tax and the applicable tax rates in several European countries.

This table compares the existence of an inheritance and gift tax and the applicable tax rates in several European countries.