PRAGMATIC AND RESPONSIBLE SPENDING

Purchasing in one’s own interests

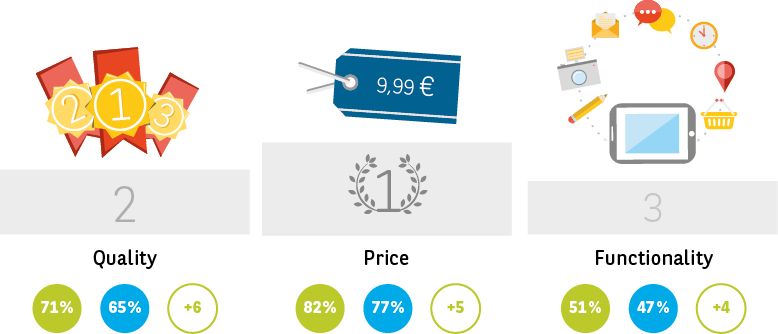

Seniors are pragmatic, first and foremost When buying durable goods, their main purchasing criteria are price (82 %), quality (71 %) and product functionality (51 %). This is a top three that all Europeans share, but seniors place more importance on these factors, on average, than under 50s (Fig. 40).

In those countries where over 60s earn less than the national average (Belgium, Czech Republic, Poland and United Kingdom), price is more often cited as an important purchasing criterion. Elsewhere, it is the emphasis placed on quality and functionality that makes price, or value for money to be specific, a deciding factor.

Fig. 40 When you buy durable goods, what are the five main criteria that govern your choice? Choose a maximum of five answers.

… and in the collective interest

As consumers, seniors appear to be both more pragmatic and more responsible than their juniors. Environmental friendliness

(which the survey equates to awareness of energy use) is among their top-five decision-making criteria. Almost a third take this into account when purchasing durable goods. The gap between seniors and under 50s is such that seniors could be described as the leading proponents of responsible consumer spending. They are also much more mindful than their juniors of the origin of the products they purchase. 13 % consider this to be an important criterion, compared with just 9 % of under 50s.

Responsible spending even seems to be a credo for the Spanish, Portuguese and Hungarians, who are particularly over-represented when it comes to environmental aspects. This is also the case for the French and Italians, who are keen to support their domestic industries. Meanwhile, the British seem less sensitive to these issues.

A more mature relationship with brands

Having had to deal with the economic crisis and the crises of confidence triggered by several recent scandals, consumers in general are becoming more demanding and more careful when choosing a brand. One of the key findings of L’Observatoire Cetelem 2016 is that European seniors place less importance on the brand when choosing a product than the younger generations. 26 % consider it an important purchasing criterion, compared with 30 % of under 50s. While thirty- and forty-somethings seek to highlight their social status through the brands they buy, seniors no longer follow this rationale. Three-quarters of them see the brand as an indicator of a product’s quality. In the eyes of these increasingly shrewd and ever less gullible consumers, the belief in a link between brand and quality subsides with age (74 % of over 60s compared with 81 % of under 35s).

76% of seniors / 80% of non-seniors often view the brand as an indicator of product quality

26% of seniors / 30% of non-seniors consider the brand to be an important purchasing criterion

The brand appears to be more important to male seniors, with 29 % of men considering it important compared with 23 % of women.

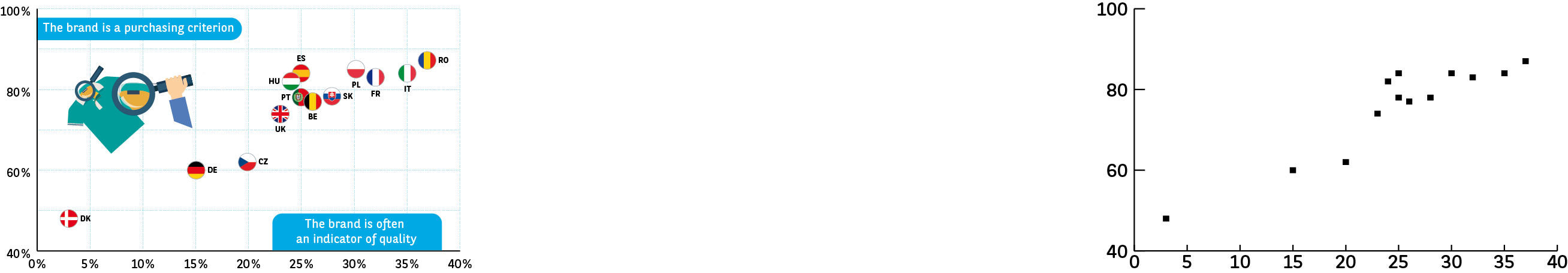

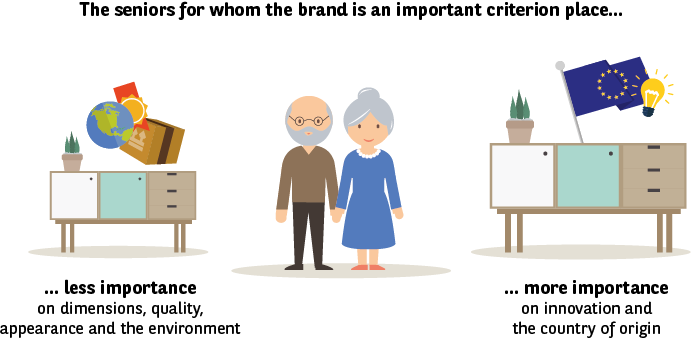

One interesting point to note is that seniors are split into two consumer categories. Those in the first care about the brand and see it as an indicator of quality. Those in the second are more concerned about the environment and about the design and general appearance of the product (Fig. 41).

There are also significant differences from one country to the next (Fig. 42). The French, Italians and Romanians place a greater focus on the brand than the Danes and the Germans, who are also less likely to correlate brand and quality.

Fig. 41 Do you consider the brand to be an important criterion when making a purchase? Do you consider the brand to be an indicator of quality?

Source: L’Observatoire Cetelem de la Consommation 2016.

Fig. 42 When you buy durable goods, what are the main criteria that govern your choice?

Source: L’Observatoire Cetelem de la Consommation 2016.

Seniors are not great lovers of advertising

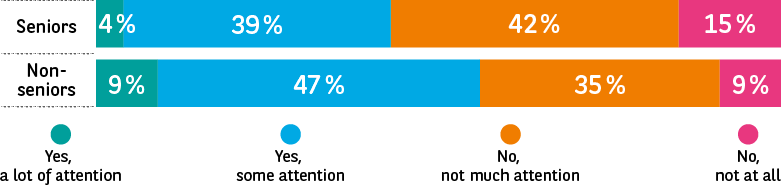

As responsible consumers, seniors tend to keep brands at arm’s length, despite the fact that their purchasing power could lead us to believe the contrary. But what about advertising? Displaying consistency, they state that they are less sensitive to advertising than under 50s (Fig. 43). 43 % take notice of these messages, 13 points less than their juniors. The figure even drops to 32 % among retired seniors!

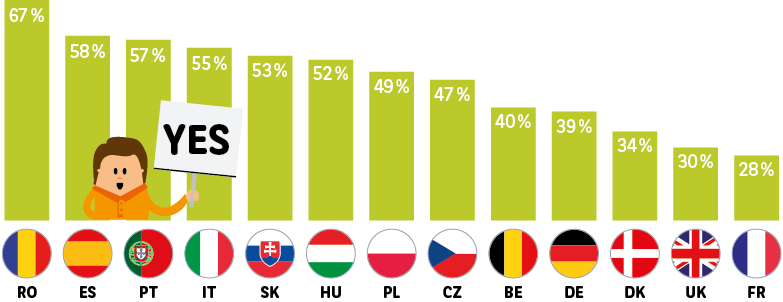

Should this be seen as a blow to the brands targeting them? Advertisers in Southern and Eastern European countries can rest easy. Commercials have a greater effect on their “silver customers” than elsewhere in Europe (Fig. 44). In the North and West (Denmark, Germany, United Kingdom and France), advertising clearly has less of an impact on seniors, despite the fact that they watch the most television (16.5 hours per week compared with 11 hours in other countries).

But that is not to say that advertising, particularly on TV, does not have a subliminal effect on viewers. The latter is difficult to assess from a simple statement of opinion, as its impact on spending is extremely subtle.

Fig. 43 In general, do you pay attention to brand advertising?

Source: L’Observatoire Cetelem de la Consommation 2016.

Fig. 44 In general, do you pay attention to brand advertising?

Source: L’Observatoire Cetelem de la Consommation 2016.

Passion over reason

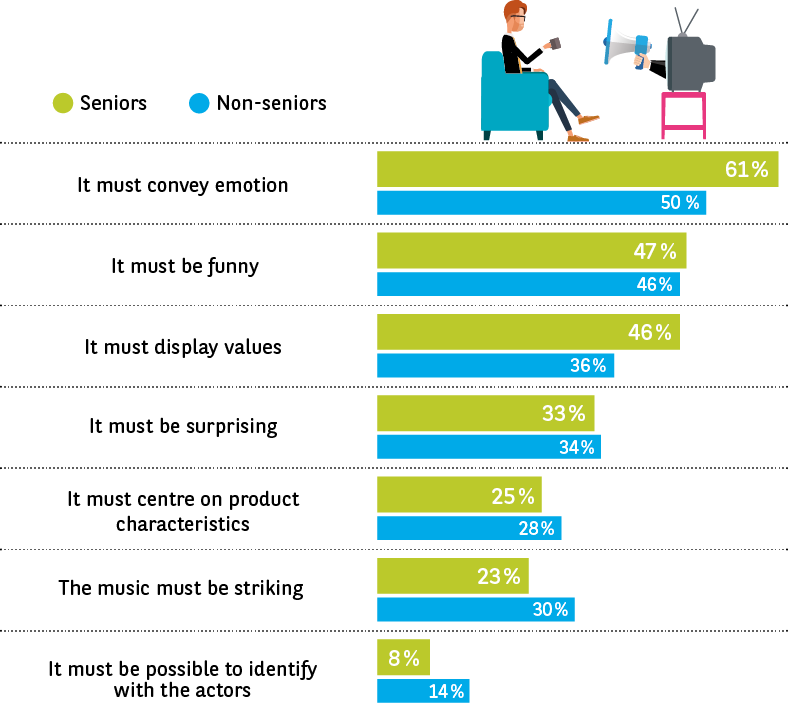

In actual fact, if advertising is to appeal to seniors, it needs to focus on emotions, humour and values (Fig. 45). For seniors, these are the three primary factors (61 %, 47 % and 46 %, respectively). Contradicting the austere image often associated with them, the Germans are the exception to this rule, considering that a funny advertisement is the best way of catching the attention of consumers. Conversely, the Spanish, who are accustomed to humorous advertising, would rather see more functional advertisements, much like the Romanians. However, on the whole, this functional approach seems to bore European seniors. Bear in mind that they are perfectly capable of finding this information themselves via the web or by asking a sales advisor. Only 25 % of them believe it is important for advertising to emphasise a product’s characteristics. In any case, the expectations of seniors when it comes to advertising clearly differ from those of the younger generations. While the former are keen on emotion and values, the latter are also sensitive to the music used and, to a lesser extent, the presence of actors with whom they can identify.

Fig. 45 In your opinion, what are the three main criteria an advertisement must meet in order to be effective? Choose a maximum of three answers.

Source: L’Observatoire Cetelem de la Consommation 2016.