Car sharing: the advantages remain to be confirmed

EARNING MONEY YES, BUT THAT’S NOT ALL…

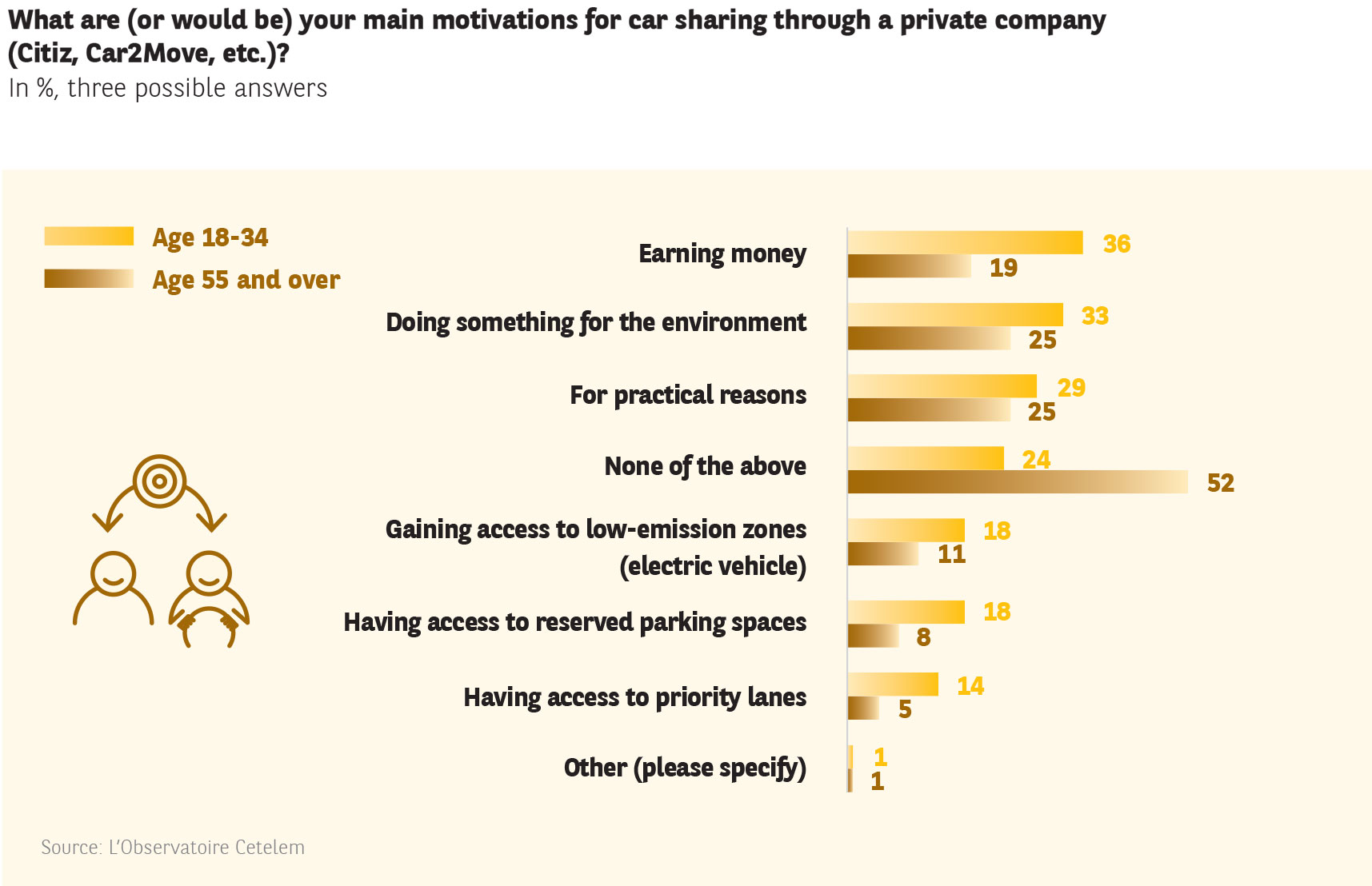

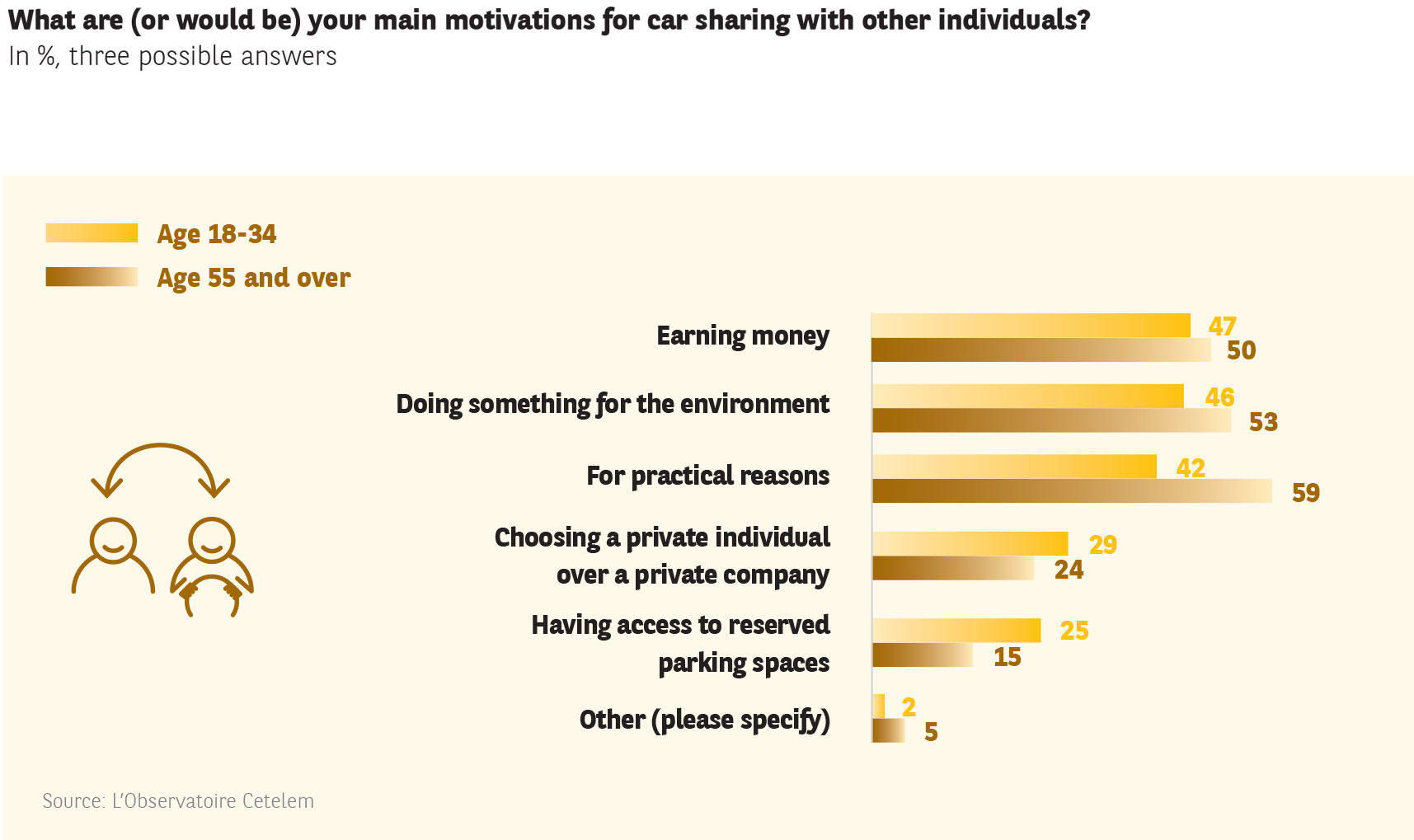

Economic factors are the number one motivation cited for ride sharing. They are also the main reason why people engage in car sharing, on a par with concern for the environment and basic practicality. These three reasons generated almost equal scores, whether it be on the topic of peer-to-peer car sharing (49%, 49% and 46%) or car sharing through a private company (29%, 29% and 28%).

It should be highlighted that financial motivations are more predominant in South Africa, Brazil and Turkey (Fig. 32 and 33).

FIG. 32 et 33 :

MILLENNIALS ARE ALWAYS KEEN TO PROFIT

A generational analysis again reveals clear differences, albeit with a certain degree of nuance. As usual, one could be tempted to say, millennials view car sharing through private companies or with other private individuals as a way of earning money (36% and 47%). They also engage in the practice due to environmental concerns (33% and 46%) and for practical reasons (27% and 42%).

SENIORS ARE OPEN TO NEW HORIZONS

There is a distinct lack of symmetry in the answers of seniors. Their reasons for car sharing are rooted in environmental and practical concerns, while financial reasons follow in third place. However, seniors are more likely than millennials to want to earn money through peer-to-peer car sharing (50% vs. 47%). This is an atypical result that is worth underlining (Fig. 34 and 35).

FIG. 34 :

FIG. 35 :

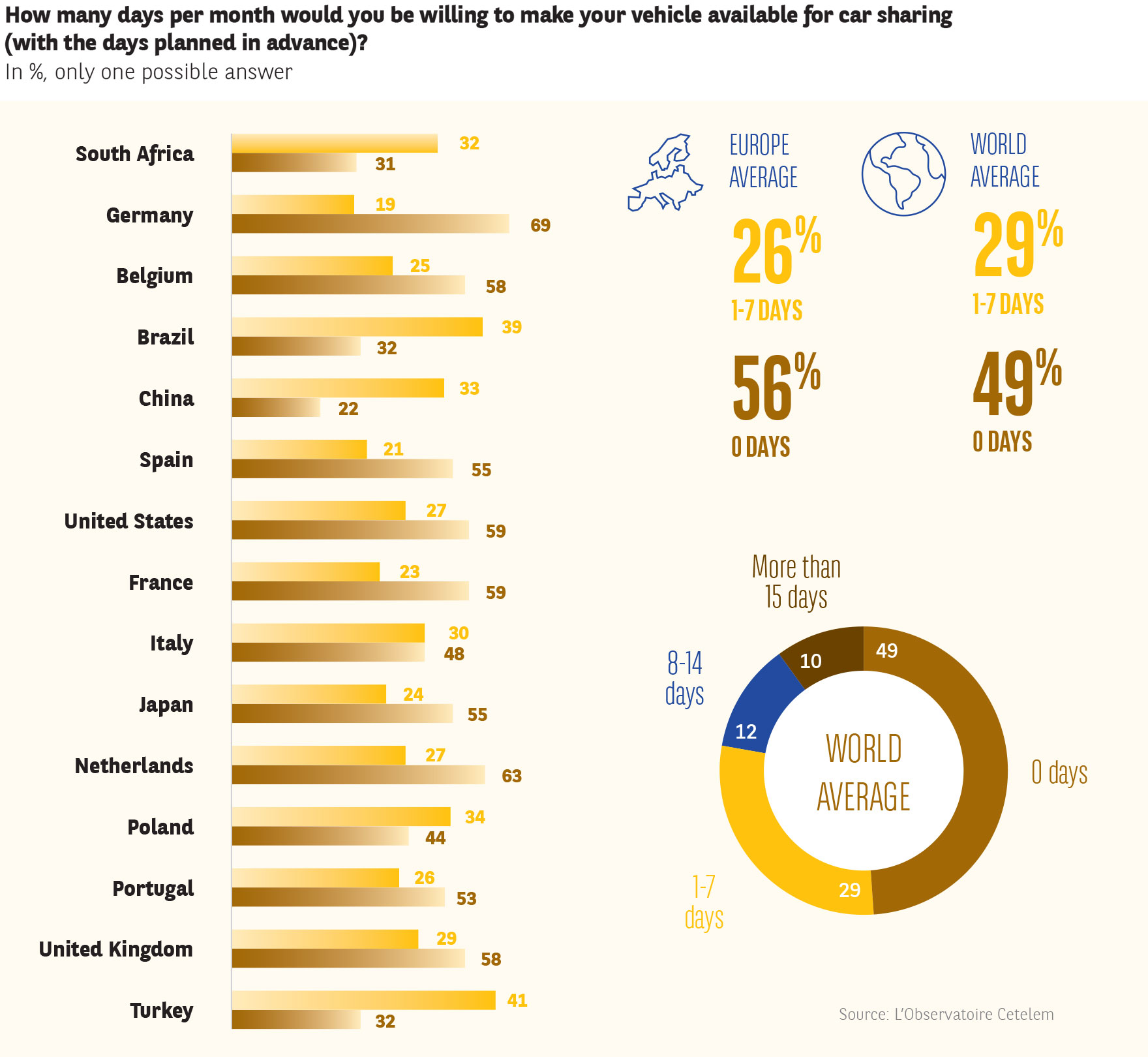

ALLOWING OTHERS TO USE ONE’S CAR:A NORTH-SOUTH DIVIDE

People’s resistance to car sharing remains considerable when it comes to making their own vehicle available to others. A dividing line separates Western economies from emerging countries. 1 in 2 inhabitants of the former (except for Poland and Italy) would not even consider it for one day. On the other hand, only 1 in 3 Turks, South Africans and Brazilians, not to mention only 1 in 5 Chinese, categorically refuse to make their vehicles available for car sharing.

Identical differences appear regarding the question of average duration. The figure is 7.5 days in China, three times more than in Germany and the Netherlands, the two countries at the bottom of this ranking (Fig. 36).

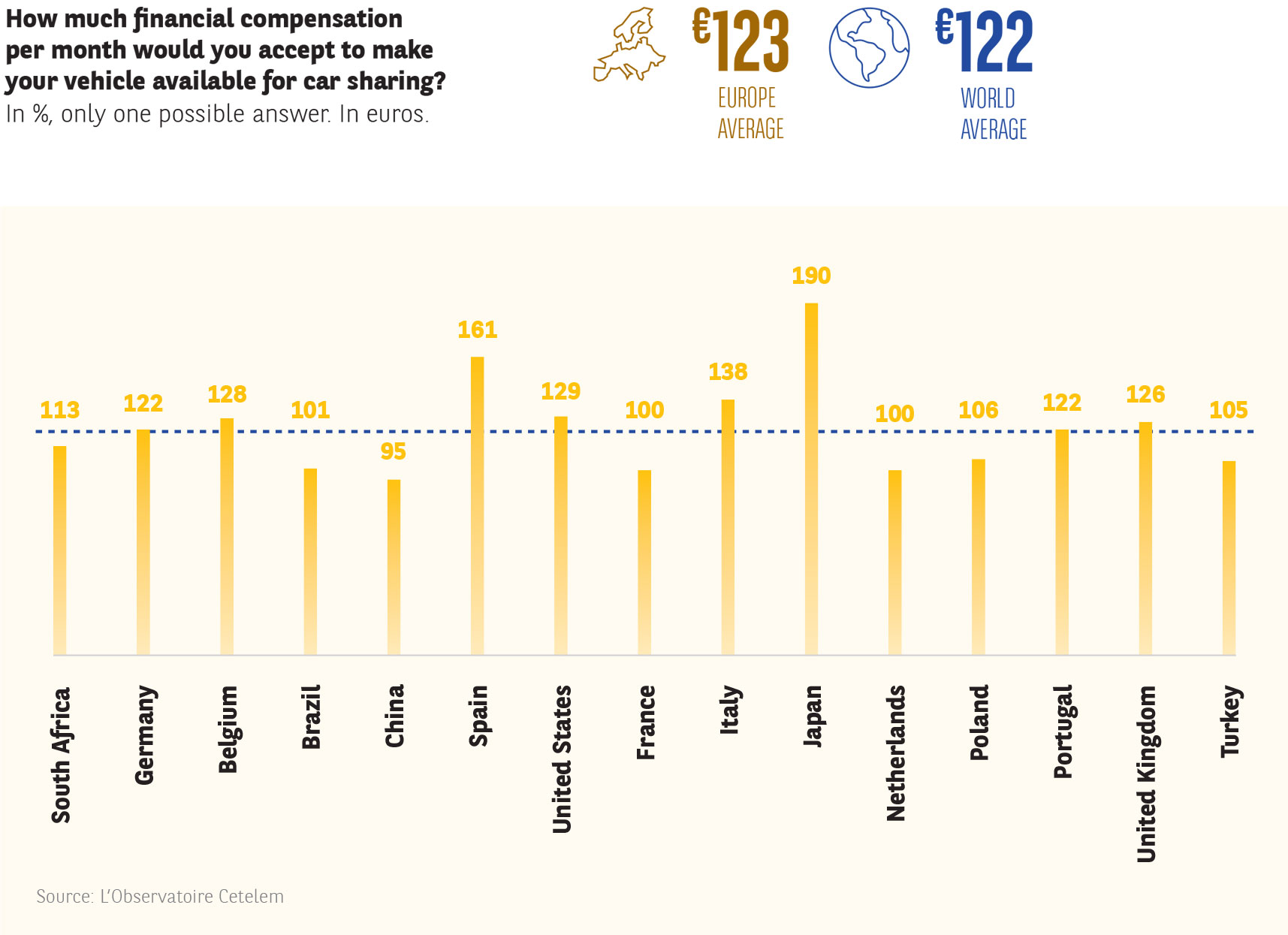

The monthly sum that would prompt motorists to accept car sharing suggests their their opposition is not so clear.

At the top of the list, the Japanese would require a fee twice as high as the Chinese, who can be found at the bottom. The respective living standards of the two countries partly explain this gap (Fig. 37).

FIG. 36 :

FIG. 37 :

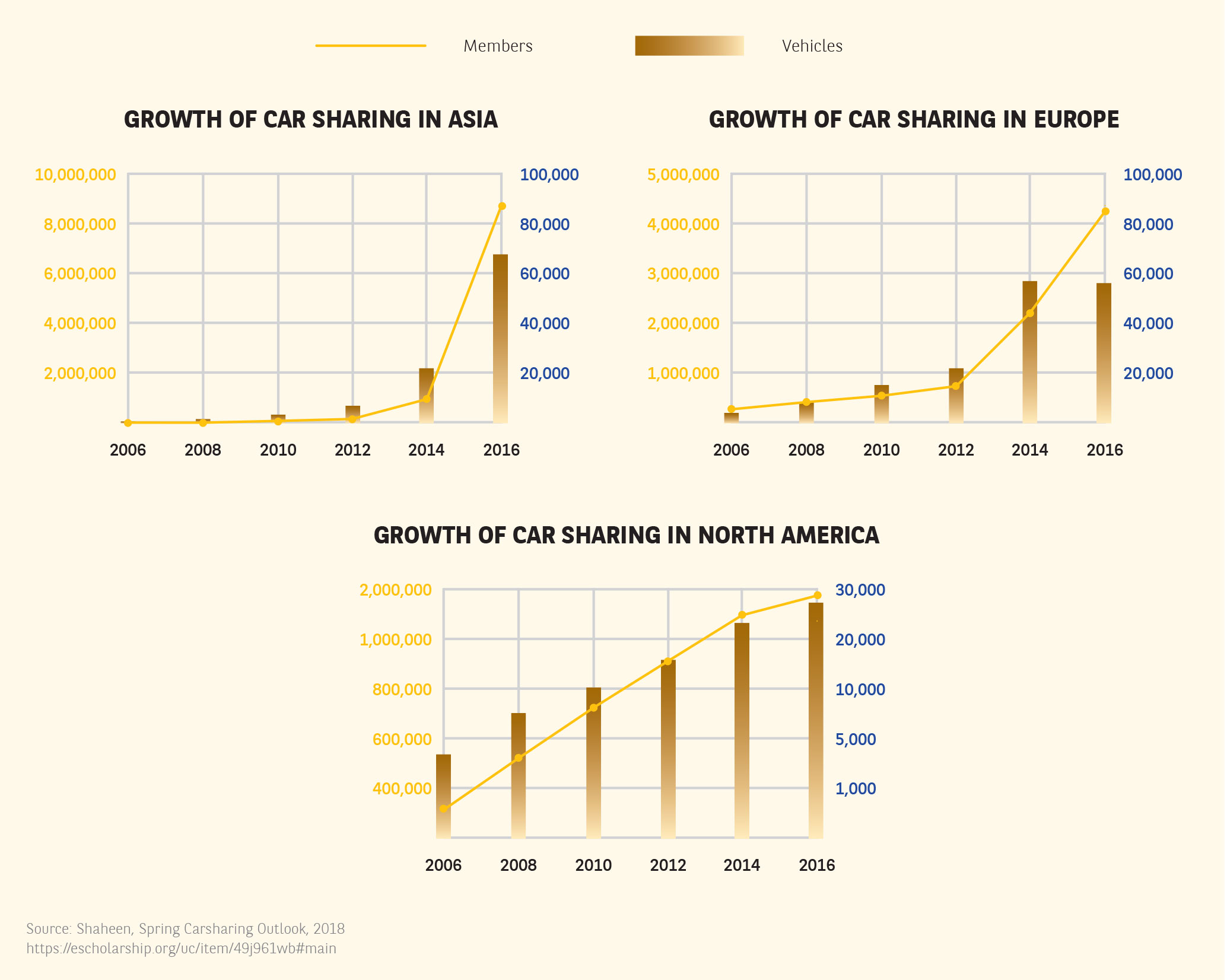

Car sharing: Asia leads the way

When it comes to car sharing, the Asian market clearly leads the way ahead of Europe and the United States, thanks to its continued and sustained development. China’s contribution is obviously significant, with companies growing thanks to government programs and varying levels of support from the authorities.