PREPARED TO HAND OVER THE WHEEL!

Driverless cars no longer seem very far down the road.

When surveyed in summer 2015, motorists were not afraid to show their enthusiasm.

Many are even impatient to step into vehicles that they believe are an imminent reality (Fig. 9). Indeed, once relieved of their role as drivers, car users are well aware that a whole new lifestyle will be offered to them on board these cars. But the battle between traditional manufacturers and new entrants to win the hearts of consumers is sure to be fierce!

Fig. 9 Do you believe that cars capable of driving themselves on certain journeys (fully autonomous vehicles) will become a reality? And would you be interested in using such a car? Select one answer only.

Source: BIPE L’Observatoire Cetelem.

Placing faith in autonomous cars

Driverless cars are a fantasy that is almost as old as the automobile itself. But with every new automated driving technology made available to the general public, reality seems to draw ever closer to fiction and the optimism of consumers regarding the future of these vehicles rises another notch. Indeed, when motorists around the world are questioned, three out of four believe that fully autonomous cars will become a reality (Fig. 9). Individuals from emerging countries are among the most optimistic, with more than 85 % answering positively (China 92 %, Mexico 87 %, Brazil and Turkey 86 %), while the Japanese (63 %), British and Americans (61 %), seem more cautious about the concept’s chances of ever being developed, despite being pioneers in the field. The sluggishness with which legislative frameworks are evolving relative to the technology partly explains the more nuanced opinions expressed in these countries. Witnessing the first tentative outings made by autonomous cars – as well as their teething problems, though rare – may also have been disconcerting for some.

Believing that autonomous vehicles will eventually hit the market is one thing. Considering using one in the future is another! More than half of all motorists are attracted by the prospect and can see themselves using an autonomous vehicle (55 %), with the highest scores again recorded in emerging countries (particularly China: 91 %). The figures reveal that people in these countries will find it easier than others to embrace the car in its most advanced form. In countries where traditional cars are already a well established part of people’s lives, the transition would be slower, because habits and traditions inevitably make change harder to achieve. In Japan, despite fewer people than average believing that autonomous vehicles will become a reality, the attraction is nevertheless strong, with 54 % seeing themselves as potential users (vs. 55 % on average). However, this is not the case for the Americans and British, where it will likely be harder to win over the general public once the technology and legislation have succeeded in making autonomous vehicles a reality.

A reality in the not-so-distant future!

Will cars be driverless by 2025? If consumers are to be believed, yes! 81 % of motorists hope to use a fully autonomous car within the next 10 years, and 52 % can even see it happening in the next five years(Fig. 10)! It could all happen much quicker than Steven Spielberg suggested in his 2002 film Minority Report, in which smart, driverless cars are the norm… in the 2050s.

In Brazil and Mexico, more than a third of motorists would like to be able to hand over the wheel within the next one to two years (35 % and 36 %, respectively, vs. a 15-country average of 20 %) and more than two-thirds within the next five years (67 % and 74 %, respectively, vs. 52 % on average). People in China and Turkey are almost as eager, with 60 % of consumers hoping to step aboard a fully autonomous vehicle by 2020.

Apart from the Spanish and Italians, potential users in countries with mature automotive markets (Europe, United States and Japan) seem more cautious when it comes to predicting when fully autonomous vehicles will become available to the public at large. According to the Germans, the road will be a particularly long one, with 70 % believing that they will not be using these vehicles before 2020, and 36 % before 2025 (vs. a 15-country average of 48 % and 19 %, respectively).

Fig. 10 How long do you believe it could be before you become a user of a fully autonomous car? 15-country average. Select one answer only.

Source: BIPE L’Observatoire Cetelem.

Fig. 11 What are you most likely to do during a journey in a fully autonomous car?

15-country average and countries whose score is higher than the average. Select one or more answers.

Source: BIPE L’Observatoire Cetelem.

Users must invent the lifestyle that goes with autonomous cars

By freeing motorists from their role as drivers, autonomous vehicles encourage their users to enjoy other pursuits (Fig. 11). 48 % of motorists view autonomous cars as entertainment zones, allowing them to read, watch films and surf the web. The Chinese are the keenest to spend the time freed up on these leisure activities (70 %), followed by the Turks (57 %) and the Portuguese (56 %). The results make it easier to comprehend why the so-called GAFA (Google, Apple, Facebook, Amazon) have been so eager to tackle the subject of autonomous cars. Just behind the enjoyment of entertainment comes the desire to speak to the vehicle’s passengers (40 %), followed by rest and relaxation (37 %). 25 % of motorists imagine that they will use this time to work, with the figure reaching almost a third in China, South Africa and Mexico. By gaining autonomy, the car becomes a genuine living space and ceases to be the constraint many people still see it as.

Yet, 28 % of motorists express a degree of caution and admit that they will keep a close eye on the road, just in case… Particularly wary are those in the United States (40 %), Italy (37 %), Poland (35 %), Belgium (34 %) and South Africa (34 %).

New players or established stalwarts?

While the new players, who hail mainly from the digital world, have gained a head start on the connected road in terms of image and communication, traditional manufacturers are by no means in a hopeless position on the wayside of surging progress.

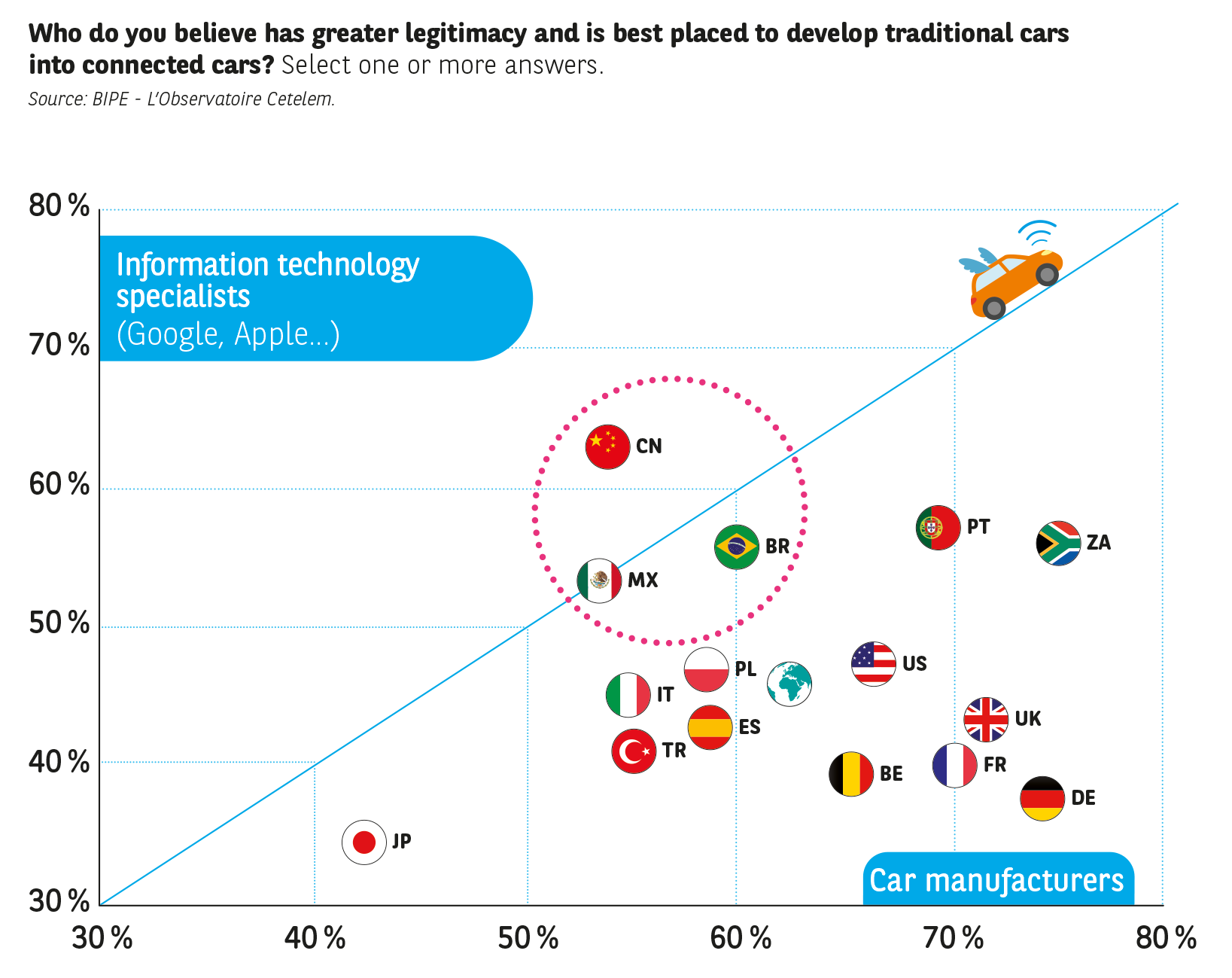

The majority of motorists grant car manufacturers greater legitimacy when it comes to designing and marketing connected cars (Fig. 12), the first step towards autonomous vehicles (62 %). The South Africans (75 %), Germans (74 %), French (70 %), British (71 %) and Portuguese (69 %) appear to be particularly attached to the traditional car makers. The IT specialists remain second choice, with 46 % of motorists placing their trust in them, followed by equipment manufacturers (36 %).

And as the chart highlights (Fig. 13), it should be a very close contest in some countries. This is true in both Brazil and Mexico, where (almost) as many consumers place their trust in the IT giants as in the traditional manufacturers. The Chinese even go as far as expressing greater belief in digital firms (63 %) than in car manufacturers (53 %).

Fig. 12 Who do you believe has greater legitimacy and is best placed to develop traditional cars into connected cars? 15-country average. Select one or more answers.

Source: BIPE L’Observatoire Cetelem.

Fig. 13 Who do you believe has greater legitimacy and is best placed to develop traditional cars into connected cars? Select one or more answers.

Source: BIPE L’Observatoire Cetelem.

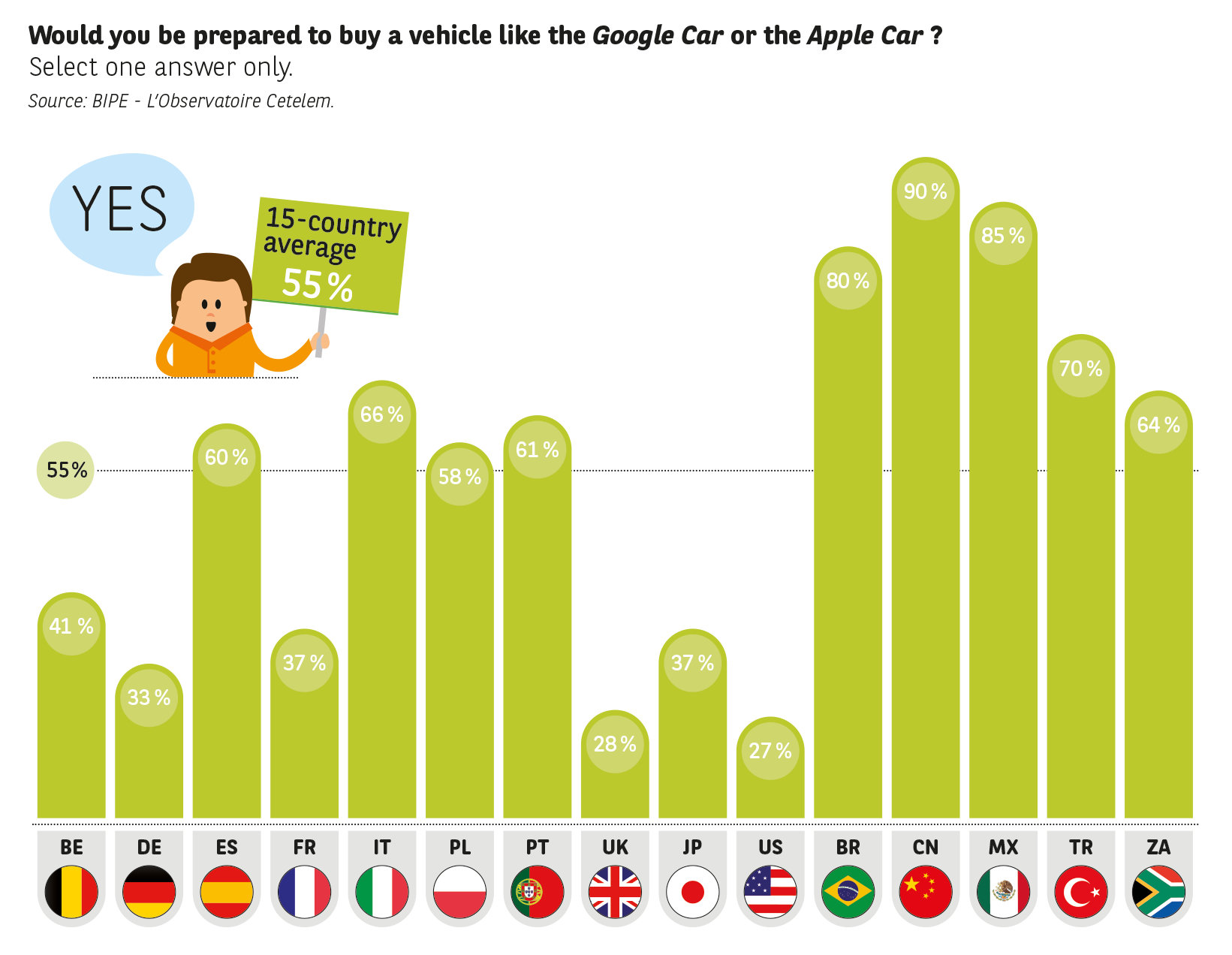

Apple Car or Google Car, more than one in two motorists say yes

This trend is illustrated more tangibly by the significant appeal the purchase of a Google Car or an Apple Car holds for consumers in emerging countries (Fig. 14): Nine out of ten Chinese motorists and eight out of ten Brazilians and Mexicans say they are prepared to use a car designed by either firm.

However, the divide between emerging and developed nations is by no means absolute: in Europe, despite traditional car makers being well established and universally recognised, almost half of all motorists state that they are also keen on the Google Car or its Apple equivalent (48 %). However, they will have a tougher time winning over consumers in Japan (37 %) and the United States (27 %).

Fig. 14 Would you be prepared to buy a vehicle like the Google Car or the Apple Car?

Select one answer only.

Source: BIPE L’Observatoire Cetelem.