ESTABLISHING A CONNECTION

With fully autonomous cars still some way down the road, motorists expect a great deal from connected vehicles.

And although consumers are usually fiercely opposed to price rises, they are prepared to accept an increase in the price of vehicles in this particular case. And their judgement is not unfounded: they believe the features offered by connected cars will be of real use to them and justify the extra cost. Far from being just a gadget, connected cars (and eventually autonomous vehicles) will be a genuine growth engine for the automotive sector!

Navigational aids: no longer simply an option

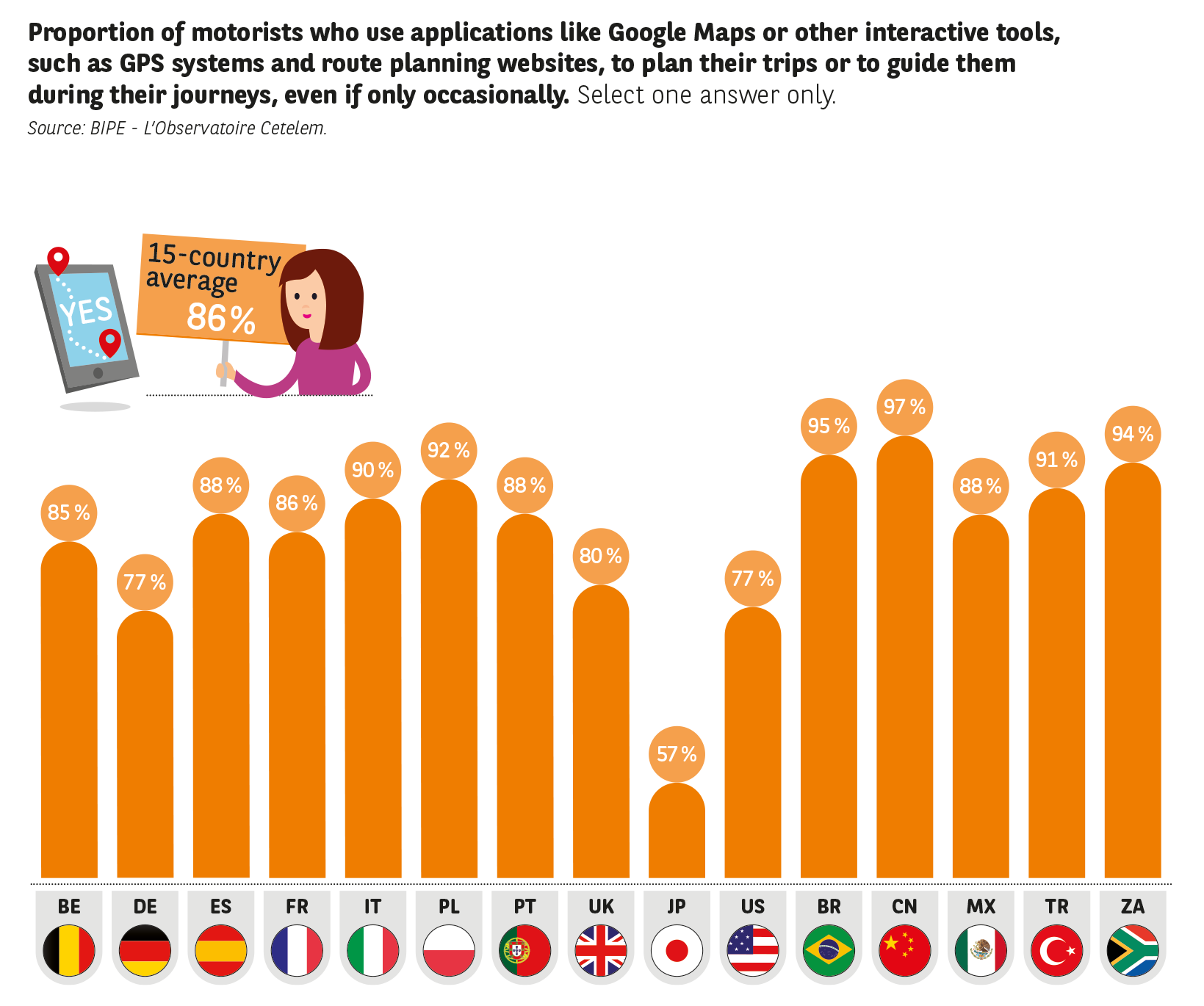

Whether they take the form of a standalone GPS device fitted inside the car, a smartphone app or a route planning website, navigational aids are considered invaluable by the motorists surveyed by L’Observatoire Cetelem: 86 % state that they use them to plan their trips or to guide them during their journeys (Fig. 15).

For consumers in emerging countries, they have even become essential navigation tools: 97 % of Chinese motorists and 95 % of Brazilians declare that they use them.

However, the Japanese seem less fond of these tools, with just 57 % choosing to use them, probably because the accuracy of GPS systems was for a long time less accurate in their country, due to its dense mega-cities and highly irregular terrain.

Fig. 15 Proportion of motorists who use applications like Google Maps or other interactive tools, such as GPS systems and route planning websites, to plan their trips or to guide them during their journeys, even if only occasionally. Select one answer only.

Source: BIPE L’Observatoire Cetelem.

Smartphones: the leading navigational aid

Google Maps, which can be installed free of charge on most smartphones, is one of the world’s most popular mobile applications. Therefore it is no surprise that 69 % of the motorists questioned in the various countries use smartphones for journey preparation or navigation purposes, ahead of standalone GPS devices (40 %) and computers (32 %) (Fig. 16). In the United States, as many as 88 % use their smartphones for navigation.

Although ranked 4th, dashboard-integrated navigation systems still achieve a respectable score: this type of equipment is not yet in widespread use around the world, even if it features in a significant proportion of new cars sold in recent years (40 % in Europe).

Despite being technophiles, the Japanese have adopted smartphones only recently (they long maintained a preference for flip phones) and are the most likely to use dashboard-integrated navigational aids to find their way (36 % vs. 21 % on average in the 15 countries). Meanwhile, the Turks are the most likely to make use of a tablet for these purposes (30 % vs. 19 % on average).

Fig. 16 More specifically, what type(s) of device do you generally use to plan your trips or guide you on your journeys? 15-country average, as a % of users. Select one or more answers.

Source: BIPE L’Observatoire Cetelem.

Tools to win the race against time

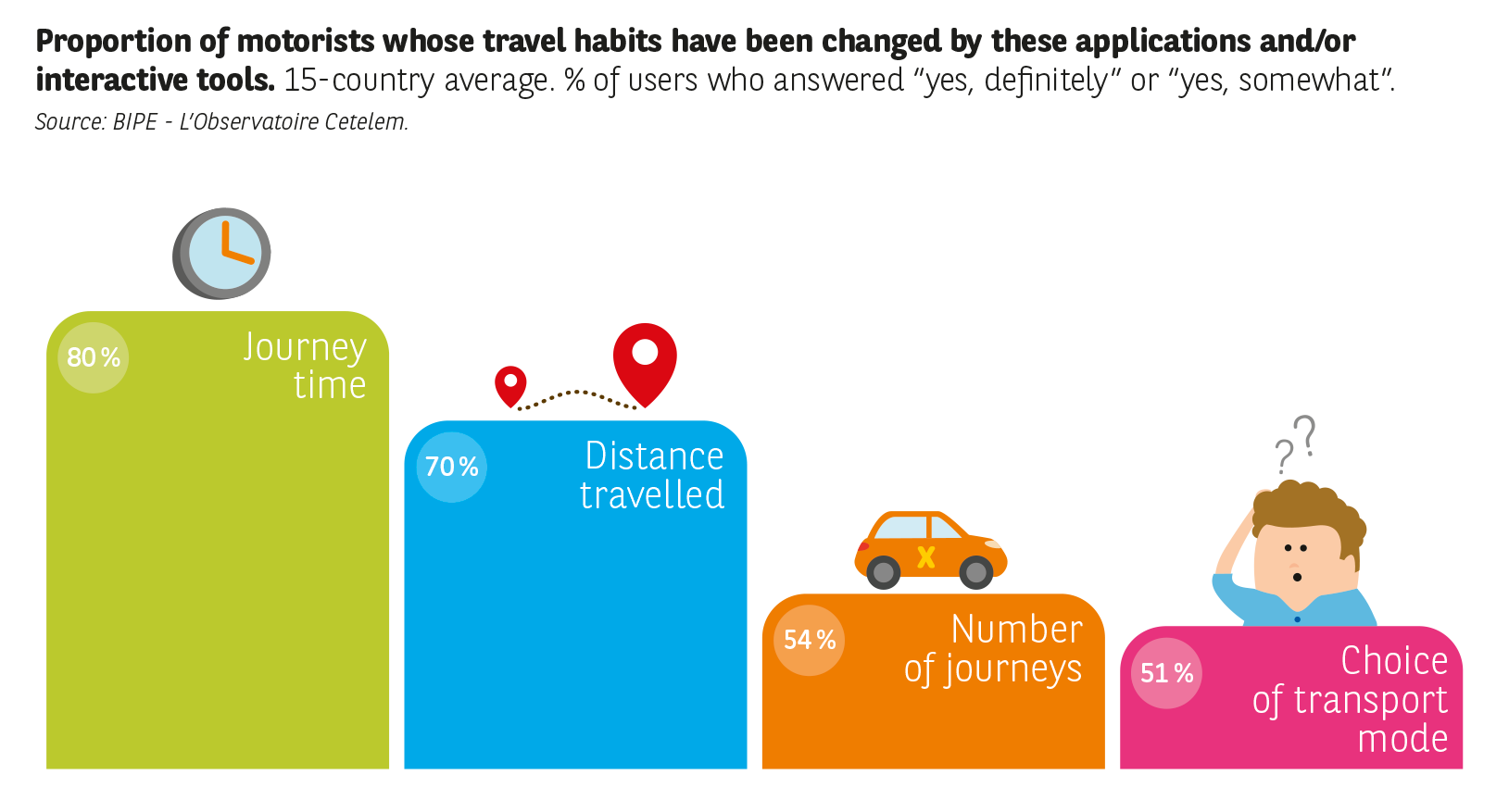

The navigation applications available in vehicles and/or via smartphones and the internet in general, have a significant impact on personal mobility (Fig. 17). Indeed motorists declare that they have altered their habits in terms of journey times (80 %) and the distances travelled (70 %), but also, in a significant proportion of cases, in terms of the number of journeys made (54 %) and the mode of transport chosen (51 %).

In emerging countries, whose major cities suffer from severe congestion, optimising journey times is a constant preoccupation: in the opinion of 95 % of Brazilians and 94 % of Chinese motorists, navigational aids have led to time savings. In Europe, a very high percentage of Poles (88 %) state that these devices have had a positive impact on their journey times. This score is undoubtedly influenced by the fact that many Poles experience extremely heavy traffic on a regular basis (according to TomTom, Warsaw is one of the 10 most congested cities in the world).

Real-time information applications to guide people during their journeys and help them choose forms of transport are numerous in China. They include the service offered by the recently-merged Didi Dache and Kuaidi Dache, which allows users to locate and book a taxi. It is therefore no surprise that 94 % of those surveyed in China declare that these tools sway their decision when choosing a form of transport. In Brazil, 70 % declare that they optimise their decision to choose one form of transport over another using applications, while Rio is the first city in the world to collect data in real time, which is generated both by drivers using the navigation application Waze and pedestrians using the public transport application Moovit. Conversely, in the United States, where cars are by far the dominant form of transport, only 29 % of motorists declare that navigational aids have an influence on their choice of transport mode.

Fig. 17 Proportion of motorists whose travel habits have been changed by these applications and/or interactive tools. 15-country average. % of users who answered “yes, definitely” or “yes, somewhat”.

Source: BIPE L’Observatoire Cetelem.

Fig. 18 In your opinion, connected cars are… 15-country average. % of users who “completely agree” or “somewhat agree”

Source: BIPE L’Observatoire Cetelem.

Connected cars: at what price?

Connected cars, which are defined as vehicles equipped with integrated tools and connections enabling communication with the outside world, have very positive associations for the majority of the motorists surveyed (Fig. 18).

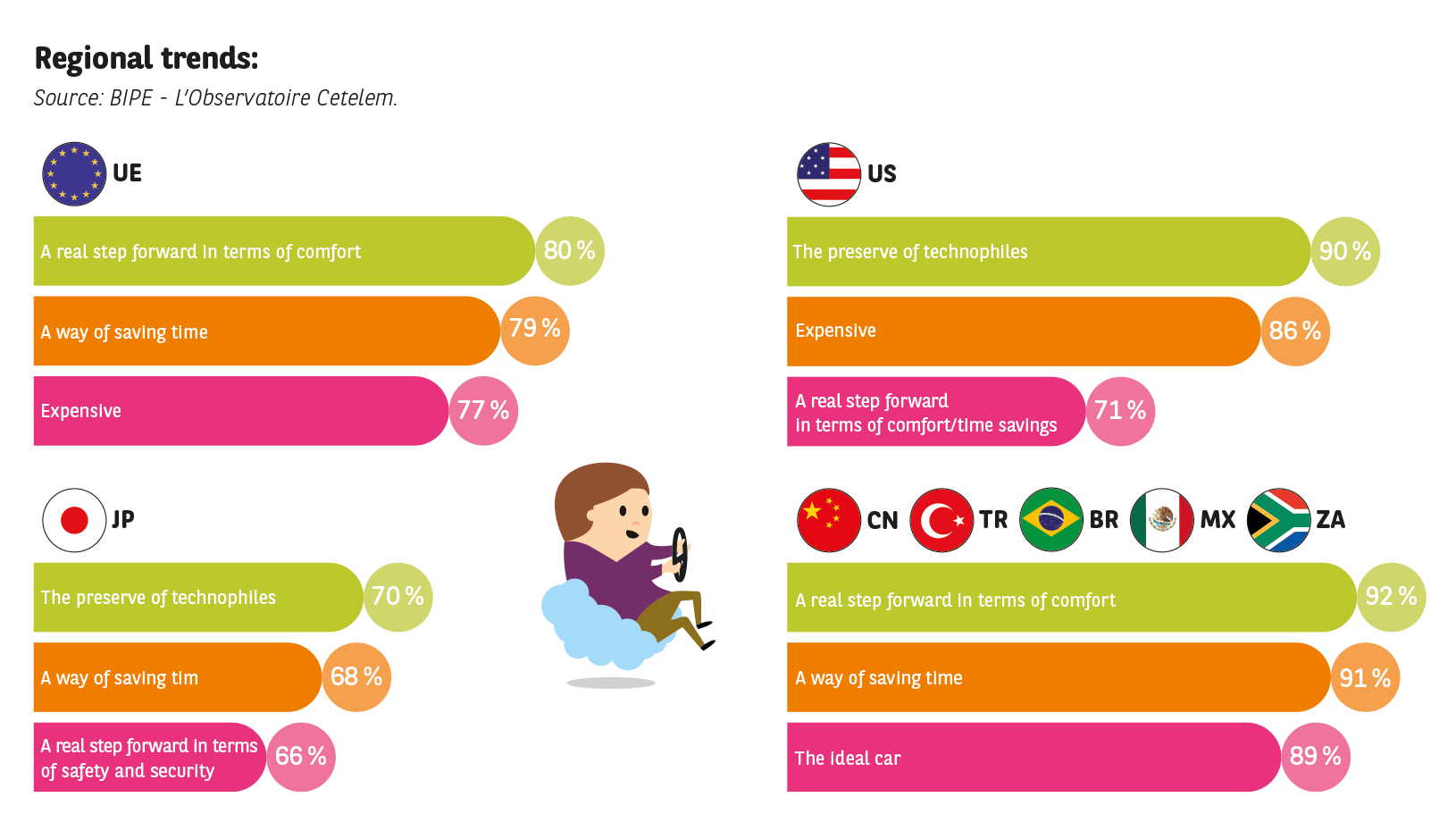

Indeed, they are synonymous with genuine progress in terms of driving comfort for an average of 83 % of those surveyed, with time savings for 81 % and with improved safety for 77 %. But motorists are not so naive as to imagine that these technological advances will not come at a cost: 78 % believe that connected vehicles will inevitability be expensive.

However, certain regional trends appear to be forming (Fig. 19). Motorists in emerging countries, led by the Brazilians (94 %) and Mexicans (93 %), are the most enthusiastic about connected cars, believing that they represent a significant step forward in terms of driving comfort. These drivers also hope to save time, which is a crucial factor in Mexico, Shenzhen and Beijing, the three most congested cities in the world in 2011, according to IBM’s Global Commuter Pain Survey. Lastly, connected cars are even seen as being the “ideal vehicle” by 89 % of motorists.

In Japan, while the overall level of enthusiasm is a little less pronounced than in emerging countries, the top three opinions regarding connected cars are all positive: comfort, time savings and safety are the attributes most commonly highlighted.

The greatest degree of apprehension and reticence with respect to connected cars can be found in the other Western nations surveyed. While Europeans acknowledge the connected car’s benefits in terms of driving comfort and time savings, they are equally aware that this will come at a certain cost. The cost factor is also mentioned by the Americans, 90 % of whom also consider that connected cars are the preserve of technophiles, ironic given that the Google Car is already operating in certain US states (California, Texas). But the figure is nonetheless consistent with those produced by previous questions…

Fig. 19 Regional trends:

Source: BIPE L’Observatoire Cetelem.

While connected cars represent a major step forward in the eyes of most motorists, in some rare cases they also raise fears (Fig. 20): Overall, 37 % admit that connect cars are a source of concern for them, but the figure is 54 % in the United States and 46 % in France. The fear of no longer controlling the vehicle and concern over the way in which the data sent might be used are the two main sources of worry. In the United States, where the most advanced autonomous vehicle trials are taking place and where a few accidents involving these vehicles have occurred, the fear of no longer being in total control of the vehicle is more apparent (33 % vs. 24 % on average). The Germans, on the other hand, seem more apprehensive about the use made of the information communicated by the car and the loss of control over their private data (32 % vs. 22 % on average). The car-loving Italians appear more fearful than most about surrendering the pleasure of driving (17 % vs. 9 % on average).

Fig. 20 What is your main concern regarding connected cars?

Select one answer only.

Source: BIPE L’Observatoire Cetelem.

Their functionalities will soon be outdated

The priorities: safety, security and savings

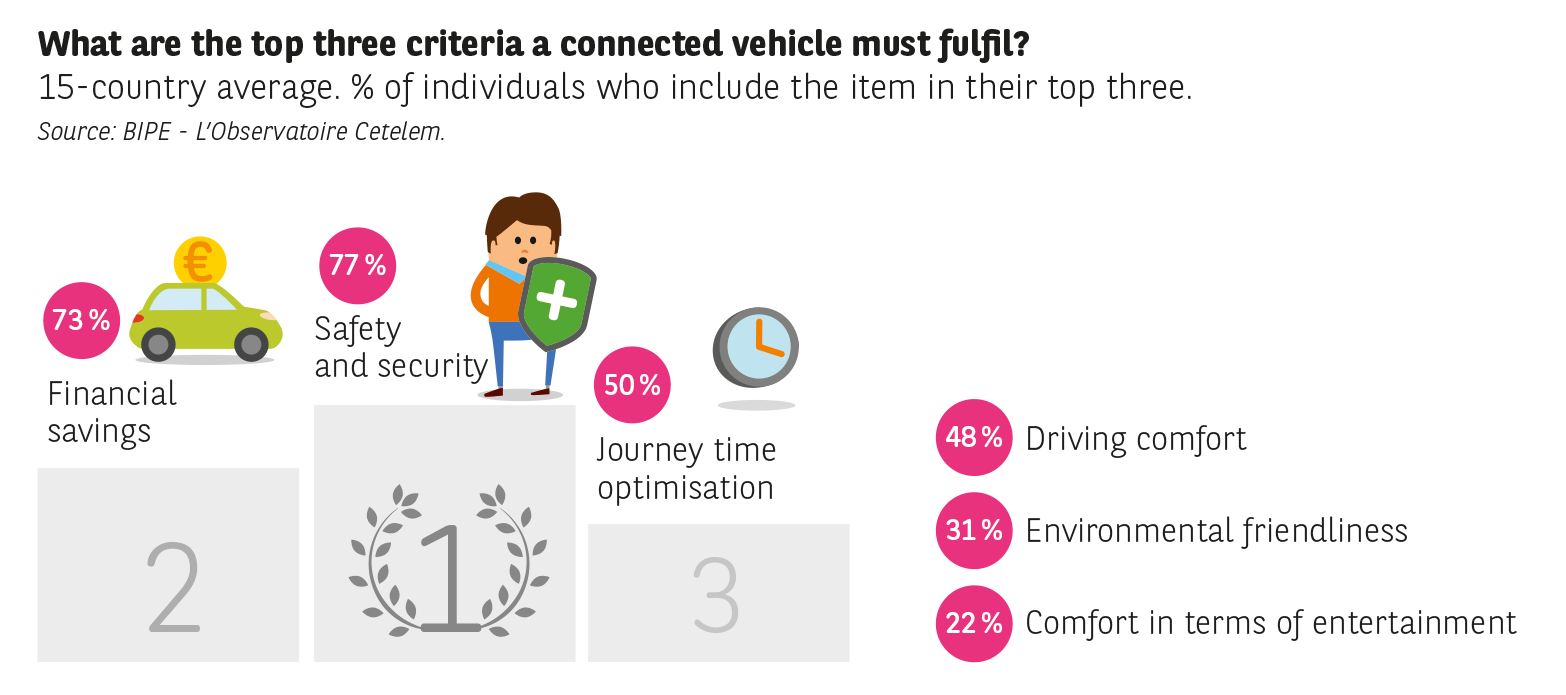

If they are to find an audience, connected vehicles will, first and foremost, need to guarantee the safety of individuals and the security of vehicles (Fig. 21). Achieving financial savings (vehicle usage costs) and optimising journey times are other key expectations, as is the improvement of driving comfort, a notion on which the Japanese and Americans place a great deal of importance.

Numerous systems enabling these criteria to be fulfilled prompt interest among the drivers questioned, irrespective of their price.

The number one feature cited by motorists is a vehicle immobilisation system to combat theft (89 %) (Fig. 22), which helps satisfy their security requirements. Given the amount of car crime in their countries, Mexicans and Brazilians are particularly keen on such services (96 % and 95 %, respectively). In Brazil, this is a particularly crucial issue: according to the São Paulo Transport Union, more than 1,250 vehicles are stolen every day in Brazil, adding up to over 450,000 thefts per year. In an attempt to resolve the problem, in 2013 the Minister of Transport passed legislation that requires all new vehicles to be fitted with stolen vehicle tracking systems by the start of 2016. Systems to detect pedestrians/road obstacles are also among the main requirements of users (86 %), particularly in emerging countries (>90 %), where mortality rates remain high. In Japan, this is actually the feature most frequently cited by motorists (78 %), again as a result of the extremely high population densities of its urban areas. Predictive maintenance systems, whose role it is to alert the driver in the event of a fault or an imminent problem, are also popular among motorists (89 %), particularly in China, Brazil and South Africa (95 %), but also in the United States, where this type of functionality heads the list of features they expect to see in a connected vehicle (85 %). Therefore there is every chance that such a service will become widespread, whether drivers are at the wheel of newer vehicles (5 years in China) or older cars (more than 11 years in the United States and 13 years in Brazil).

Fig. 21 What are the top three criteria a connected vehicle must fulfil?

15-country average. % of individuals who include the item in their top three.

Source: BIPE L’Observatoire Cetelem.

To meet the requirements of consumers, connected cars will also need to include budget optimisation systems to locate the cheapest service stations or garages, for instance, or eco-driving modules that advise drivers on how to reduce their fuel consumption. Consumers in emerging countries place particular importance on these features. Indeed, among the solutions suggested, integrated eco-driving services lie in third place and garner a positive response from 92 % of those questioned in these nations. Although fuel prices are lower in countries that are either emerging or in transition (with the exception of Turkey, where taxes are high), they still represent a significant financial outlay given the income levels in these countries, thus explaining the eagerness of consumers to optimise their vehicle expenses. Conversely, in the United States, where no tax is paid on the price at the pump, eco-driving is not a priority (64 %, 6th place)

Systems geared towards entertainment or facilitating journeys are also popular among motorists, including those offering information on nearby shops (73 %, 7th place) and services allowing them to locate, reserve and pay for a parking space (71 %, 8th place).

Fig. 22 Irrespective of their price, would you say you are interested in the following services/functionalities that a connected car may offer?

Source: BIPE L’Observatoire Cetelem.

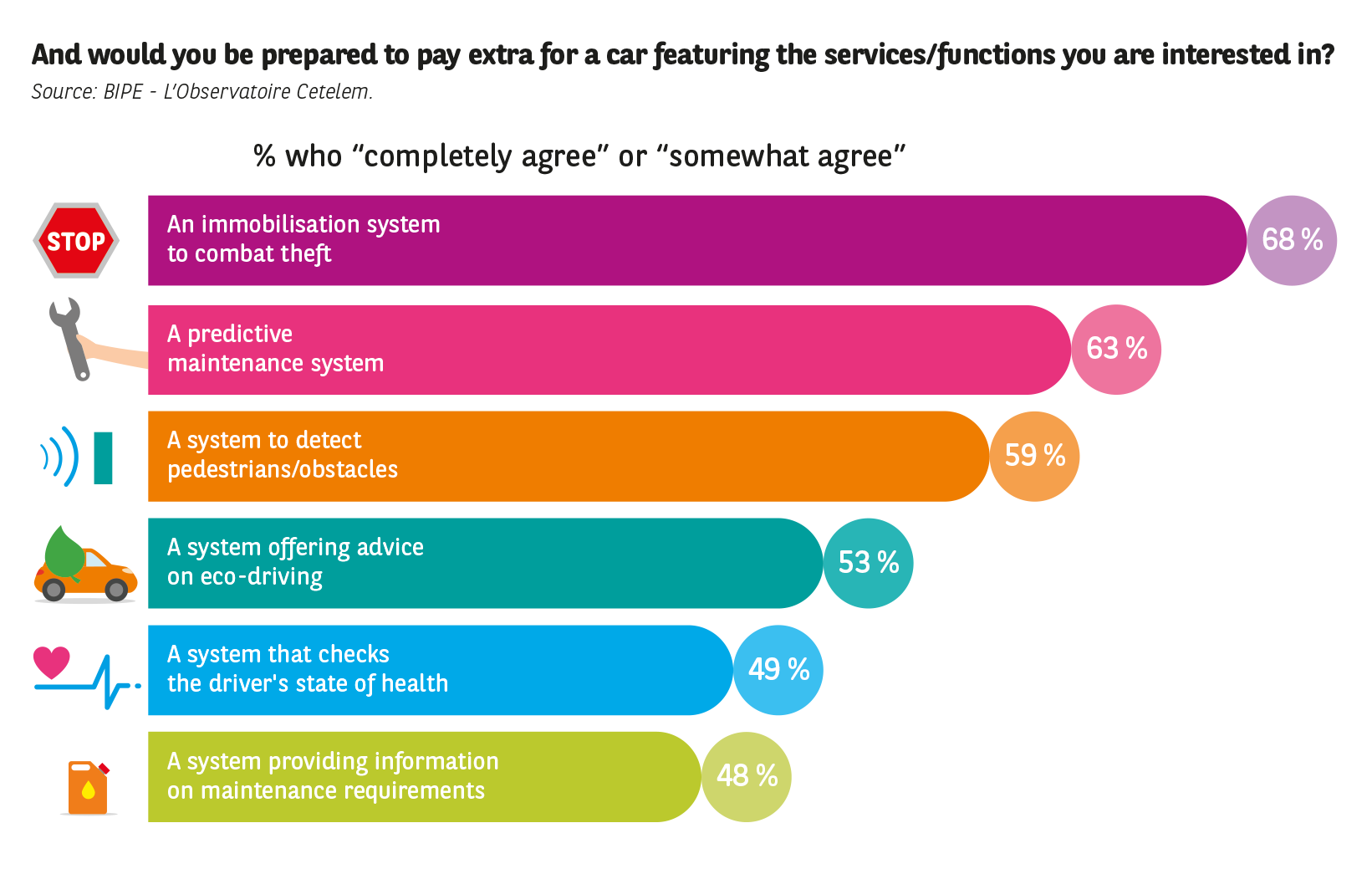

Fig. 23 And would you be prepared to pay extra for a car featuring the services/functions you are interested in?

Source: BIPE L’Observatoire Cetelem.

Investing in safety and cost optimisation: why not?

Highlighting the fact that motorists are preoccupied by safety and budget optimisation, many of those surveyed say they are prepared to pay more for connected features that fulfil these criteria (Fig. 23).

Consumers from emerging countries appear to be the most willing to pay. Including for functions geared towards entertainment: more than half of the motorists questioned in these countries are prepared to invest if it means receiving store location information or being able to use the internet and receive messages, while the figure is less than a third in Western nations.

Although systems that check the driver’s state of health are not among the most popular functionalities in this survey (they receive a favourable response in 70 % of cases on average in the 15 countries, placing them 10th), those interested in these types of feature seem particularly keen on the benefits they bring, as almost half are prepared to invest in them (49 %, 5th place).

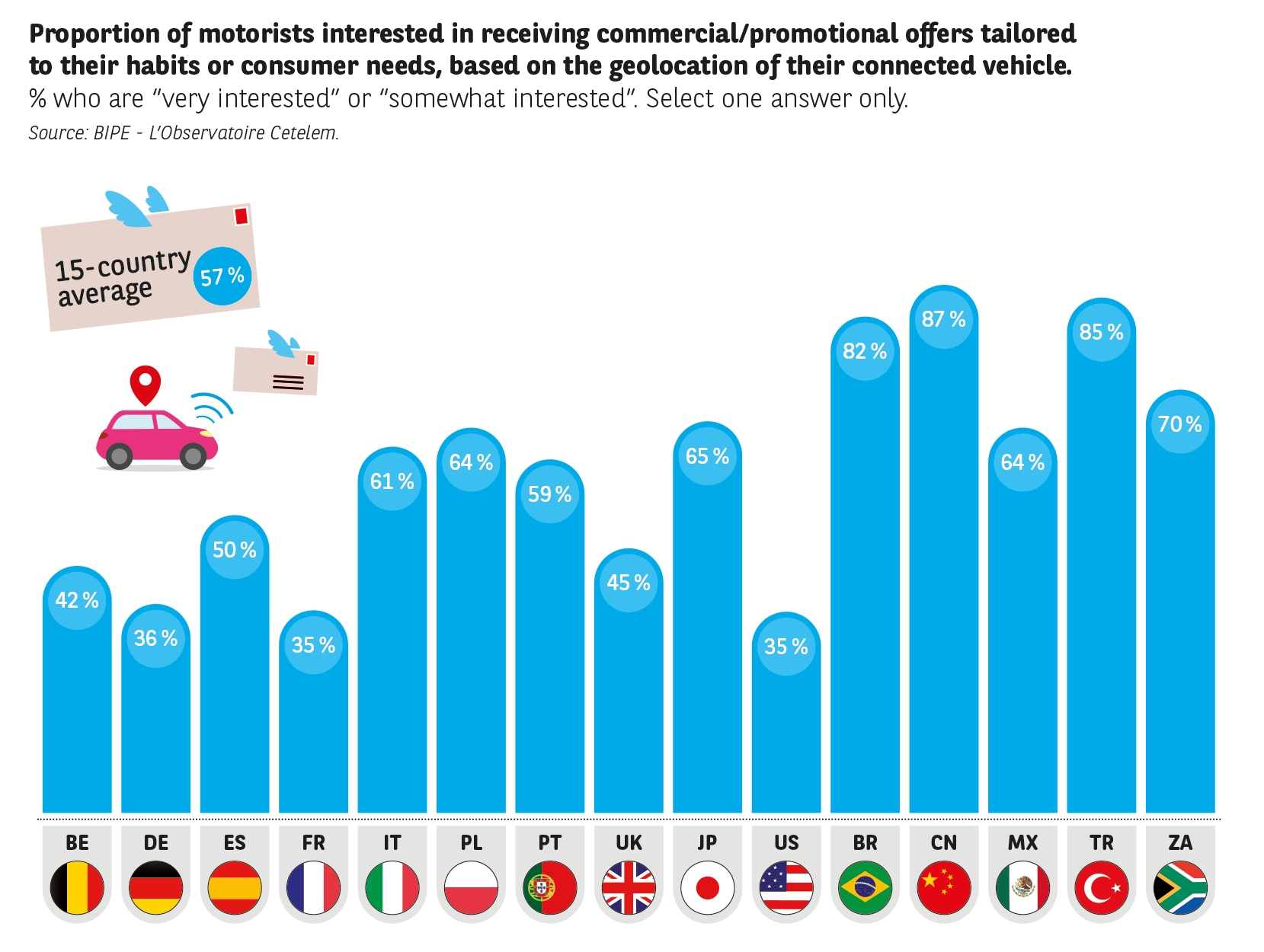

Contextual advertising, consume in moderation

The geolocation of connected cars will allow motorists to receive commercial or promotional offers tailored to their habits or consumer needs. This is a prospect that an average of 57 % of motorists are excited by.

The Chinese, who are extremely fond of coupons and shopping via their smartphones (42 % of web users made a purchase using their mobile in 2014, according to the China Internet Network Information Center, i.e., 13.5 % more than in 2013), are the keenest to receive personalised commercial offers (87 %). The other emerging countries are not found wanting in this area: 85 % of responses on this topic are positive in Turkey, 82 % in Brazil. In Japan (65 %), Poland (64 %) and Italy (61 %), these offers are also viewed favourably. However, the French (35 %), Germans (36 %) and Americans (35 %) seem much more reticent (Fig. 24).

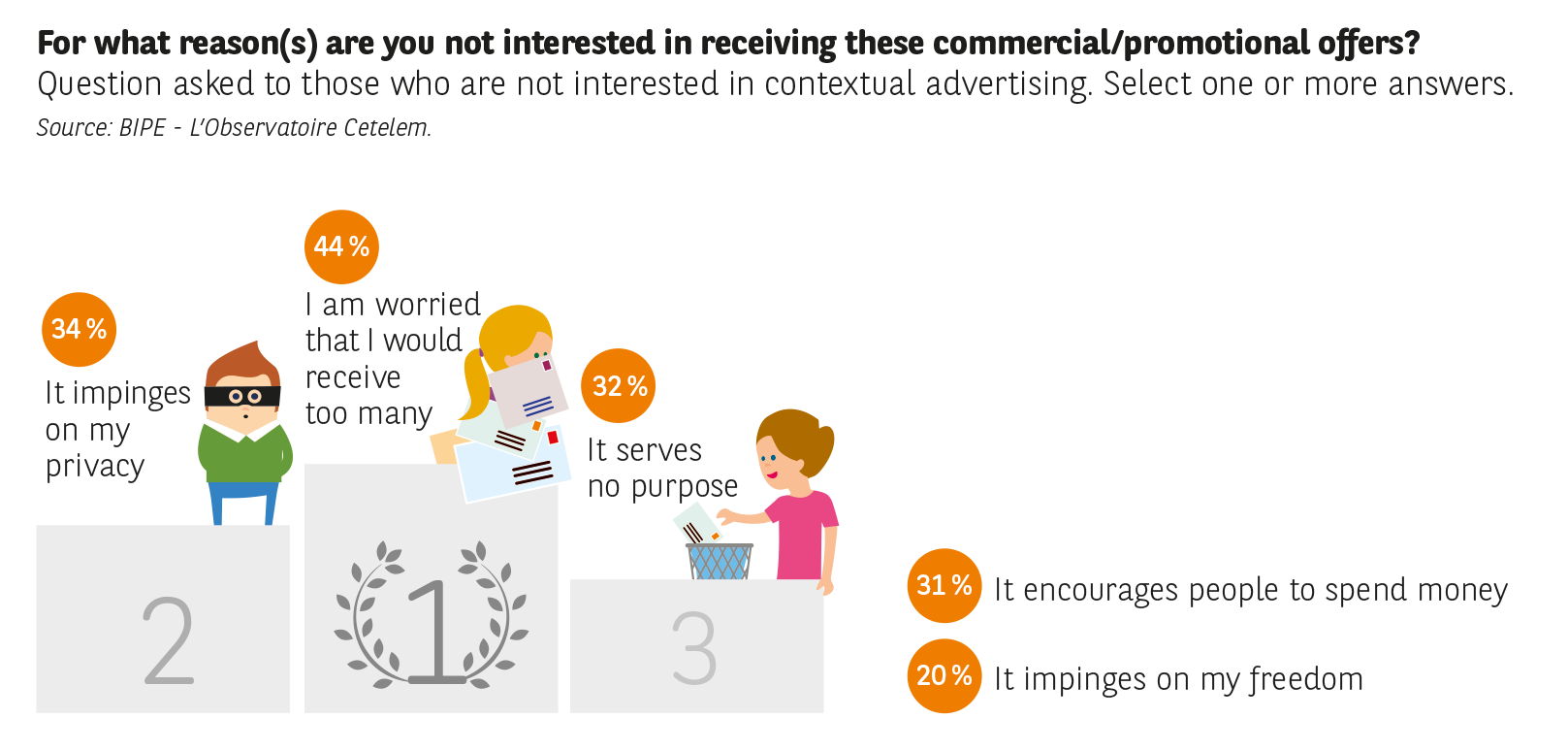

The main fear among the 43 % of motorists who say they are not interested is that cars will be turned into a new advertising medium (Fig. 25). Indeed, motorists are concerned that this personalised advertising would become too invasive (44 %), and 34 % believe that it would impinge on their privacy. The Spanish (37 %) and French (40 %), but also the Mexicans (47 %) and Turks (40 %), go as far as stating that these types of offer primarily encourage spending. This degree of reticence is now prompting EU Member States to revise European regulations, so as to reinforce the control consumers have over their data and its protection.

Fig. 24 Proportion of motorists interested in receiving commercial/promotional offers tailored to their habits or consumer needs, based on the geolocation of their connected vehicle. % who are “very interested” or “somewhat interested”. Select one answer only.

Source: BIPE L’Observatoire Cetelem.

Fig. 25 For what reason(s) are you not interested in receiving these commercial/promotional offers? Question asked to those who are not interested in contextual advertising. Select one or more answers.

Source: BIPE L’Observatoire Cetelem.

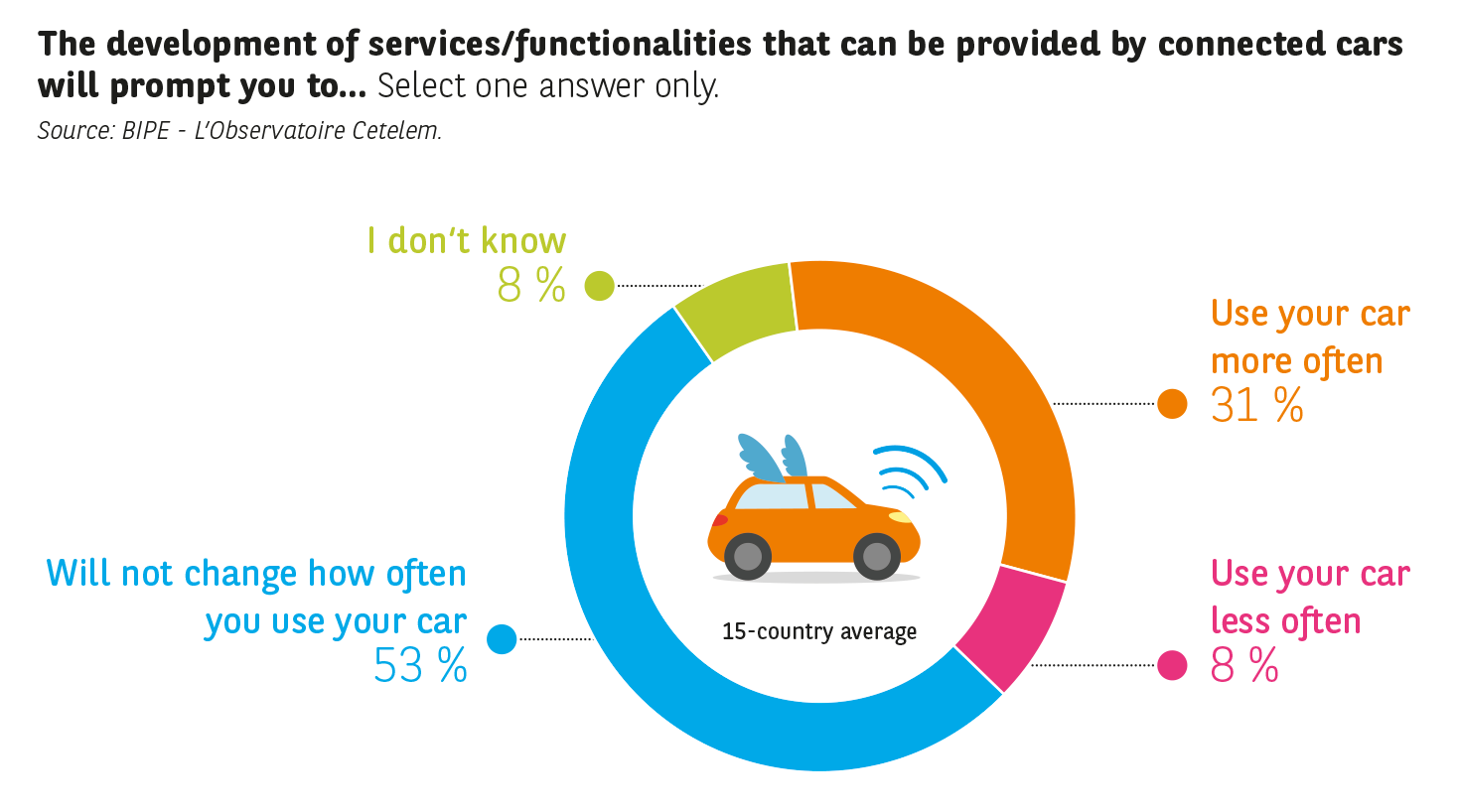

Connected cars, a new way of winning over consumers

While connected vehicles will do nothing to alter the frequency with which 53 % of the motorists questioned use their vehicle, 31 % believe that the benefits of connected features will make them more likely to use their car to travel, while only 8 % will use their car less often (Fig. 26). Only in Belgium do the results swing the other way when it comes to vehicle usage (13 % will use their car less frequently, 10 % more frequently). By improving the driving experience and the time people spend in their car, connected vehicles could offer a new way of winning over consumers.

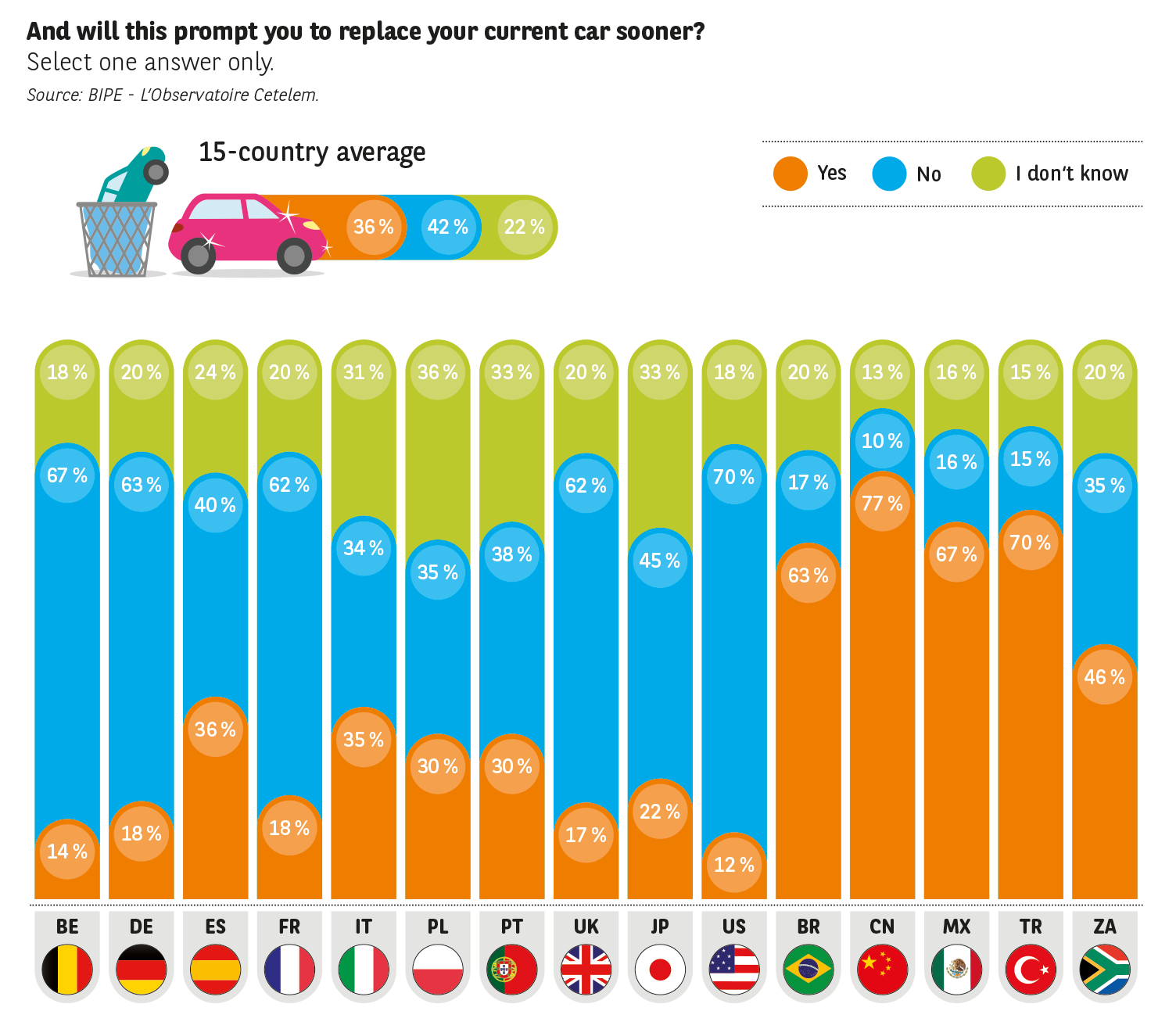

In emerging countries, if the statements of consumers are to be believed, car use, which is already intense in urban areas, could further rise with the widespread deployment of connected cars: more than half of motorists in Brazil, China, Mexico and Turkey say they would use their car more frequently if it was connected. A sizeable proportion of drivers in these emerging countries even state that connected vehicles will prompt them to replace their car sooner (Fig. 27).

To conclude, the launch of the connected vehicle and that of its most advanced version, the autonomous vehicle, could kick-start a renaissance for the product and the automotive sector, such is the enthusiasm shown for them by consumers. Comfort, time savings and safety are just some of the benefits expected and acknowledged by the majority of those surveyed. And they are prepared to pay for these improvements.

By making urban mobility more automotive, the autonomous car can be a genuine growth engine for both vehicle sales and the after-sales market.

Fig. 26 The development of services/functionalities that can be provided by connected cars will prompt you to… Select one answer only.

Source: BIPE L’Observatoire Cetelem.

Fig. 27 And will this prompt you to replace your current car sooner?

Select one answer only.

Source: BIPE L’Observatoire Cetelem.