DIGITAL GIANTS INTO CAR MANUFACTURING

By launching their quest to produce autonomous vehicles a decade ago

, digital companies gained a head start on traditional car makers.

They hold a significant lead in terms of technology, first and foremost, with Google Cars having already covered more than a million kilometres in fully autonomous mode and the Californian giant hoping to launch its vehicles on the market by 2020. But they are also ahead when it comes to consumer awareness, because by publicising their work in this field at a very early stage, Google has succeeded in making its mark as the main authority on the topic.

The various players are now in a race to establish a special relationship with consumers, the aim being to understand them better so as to offer them increasingly personalised products and services.

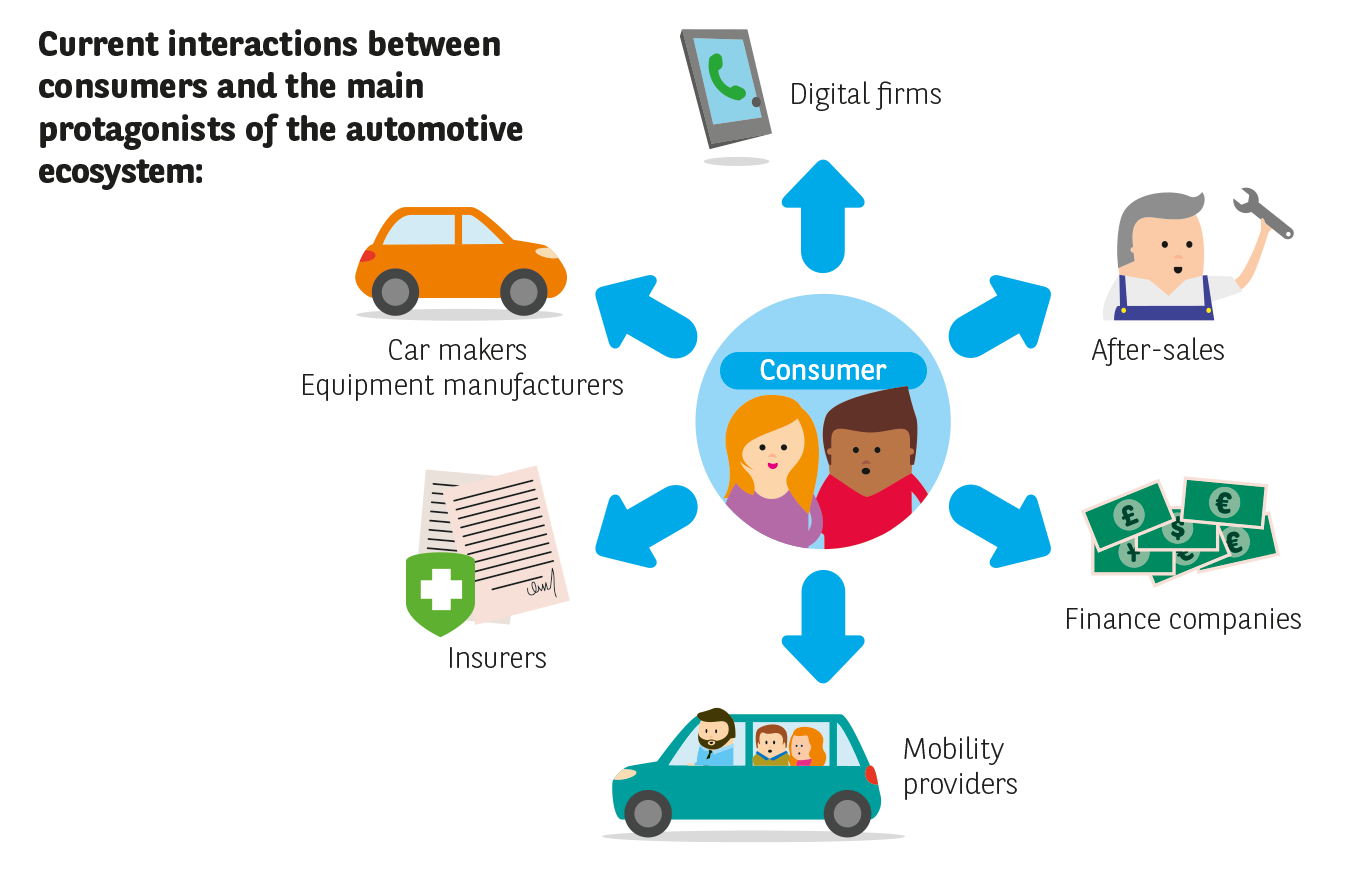

Today, consumers interact directly with the automotive ecosystem’s different components (Fig. 8) throughout their motoring lifetime, from the day they purchase their car, to its maintenance, to the use of hire vehicles. They have also long understood how digital companies can enhance their mobility, with the latter already enjoying a presence in people’s cars via smartphones and navigation equipment. But what will happen tomorrow, when cars become autonomous and hands-on driving is gradually replaced by free time, which individuals will be able to use as they please?

Fig. 8 Current interactions between consumers and the main protagonists of the automotive ecosystem:

Undeniable advantages

Images of the Google Car reveal that a digital firm’s approach to autonomous vehicles is functional, above all. In a world where design, a stylish exterior and passenger comfort are important criteria for motorists, an Apple Car may have a stronger card to play when it comes to seducing buyers.

Google and Apple will be able to rely on their global reputation and extremely well established brand image to enter a sector where such assets have been built up over decades. Despite this advantage, they do not overestimate their ability to compete against the automotive sector’s traditional players on their home ground. Neither will they embark upon the production of sensors or radar systems, even though combining the latter with a mapping system is essential if cars are to determine their position on their road to the nearest centimetre and negotiate the countless obstacles that can appear.

The reality is that they will not need them. Google’s added value lies primarily in the vehicle’s intelligence and the quality of its digital interfaces. Intelligence means the vehicle’s ability to guide itself along a motorway or in a city without external intervention, regardless of the behaviour of nearby vehicles. This will be a highly advanced form of artificial intelligence whose achievement will likely follow many years of fine-tuning. But with more than a million kilometres of autonomous operation already under its belt, the Google Car probably has the most highly trained artificial intelligence of all.

The giants are quick to position themselves

The example provided by mobile telephony has shown that the emergence of smartphones caused a rapid shift in consumers’ perception of value and, subsequently, the positioning of firms. Leaving aside the quality of the handsets themselves, consumers became attached to the applications and services offered by smartphones. Phone ergonomics soon became structured around two main operating systems: Apple and Android. Google was able to enter the sector and catch up with Apple’s technology because it had no hesitation in acquiring mobile phone manufacturer Motorola and its precious patents for $12.5 billion in 2011.

Today, backed by its colossal financial clout and its groundbreaking advances in the field of autonomous vehicles, Google could well become the number one in this segment. So would it be fantastical to imagine that the digital giants could acquire car manufacturers? It is fairly unlikely, but the set-up of alliances is a possibility. One route towards the industrial deployment of autonomous vehicles will be traditional car makers.

The car industry responds and accelerates

While Google and Tesla have undeniably gained a head start in the field of autonomous vehicles, many players in the automotive industry are rushing to deploy their own strategies. The most startling evidence is the takeover of Nokia’s proprietary mapping application, Here, by a consortium comprising the cream of Germany’s automotive industry, BMW, Audi and Mercedes-Benz, for a total of almost $2.5 billion dollars. Because mapping provides the spine of autonomous cars, acquiring the firm that supplies 80 % of the world’s integrated satellite navigation systems is a way of restoring the balance of power with the leading mapping firms.

Meanwhile, General Motors, Ford, Toyota and Nissan have started to test their autonomous cars at a unique tailor-made site in Michigan, dubbed Mcity. The objective is two-fold: to catch up with Google, which is thousands of kilometres ahead when it comes to testing on public roads, but primarily to impose common standards for inter-vehicle communication and the interoperability of in-car visual displays with other devices such as smartphones and computers. On this last point, a whole host of firms have joined forces to found the Car Connectivity Consortium, which includes car makers as diverse as Peugeot, China’s BYD, General Motors and Mercedes-Benz, as well as firms from the digital world, including Sony, Samsung and Microsoft.