Consumption has fallen, saving has increased: the economic machine has slowed down

Consumption is constricted

In concrete terms, the pandemic has led to economic activity essentially being put on hold, as a result of the lockdowns and curfews imposed by governments. When many shops are closed or access to them is restricted in terms of time and space, when opportunities to leave one’s home are eliminated or severely constrained, it is not surprising that consumption suffers as a direct consequence. Another factor taken into account by consumers is uncertainty. It is difficult to predict how the pandemic will unfold in the coming months, whether more lockdowns will be announced and whether vaccines will be highly effective in combatting the virus and its many variants. Uncertainty is one of the biggest obstacles to consumption and therefore growth.

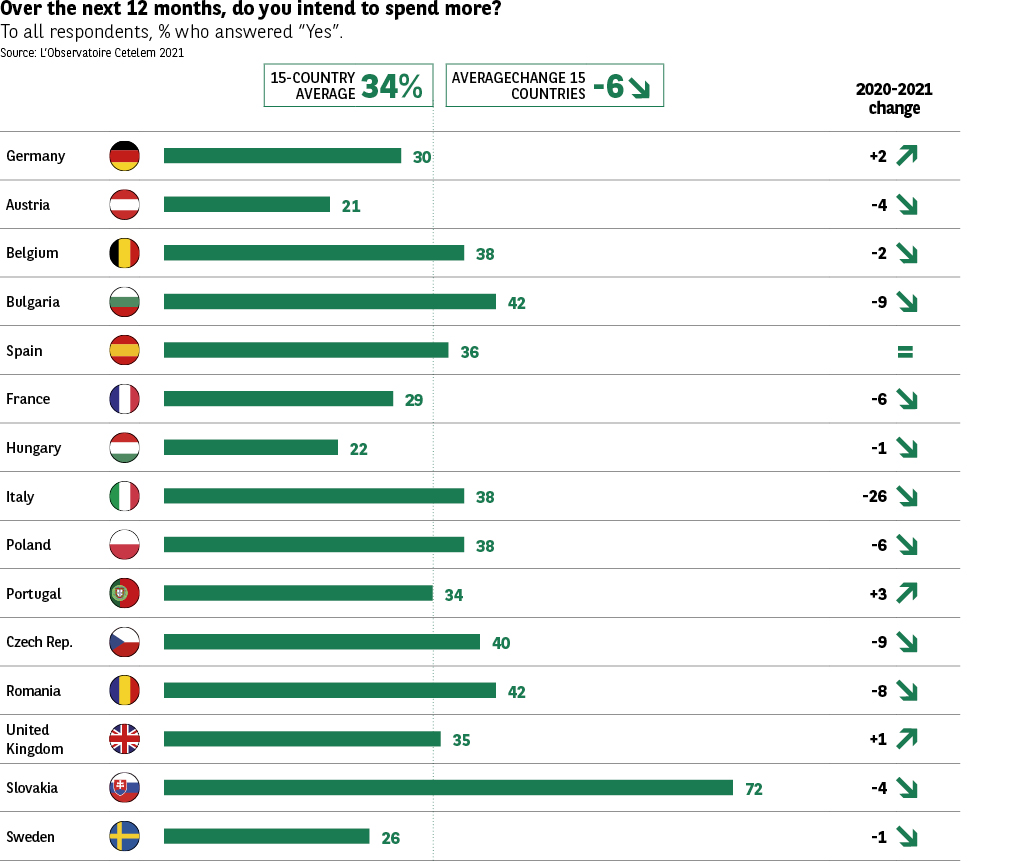

As a consequence, the proportion of Europeans who believe they will increase their spending over the coming months has contracted by 6 pts compared with 2020 (34%) (Fig. 3 Barometer). Despite usually being champions of consumerism, the Italians have stepped back into line with a spectacular drop of 26 pts in their intentions to spend more. The Bulgarians, Czechs and Romanians display similar caution in this regard. Conversely, the Portuguese, Germans and British post slightly higher spending intentions than previously (+3 pts et +2 pts).

The French score is within the European average (-6 pts). It is worth bearing in mind that this survey was conducted when the second wave was in its infancy, which may explain the positive results recorded.

Fig. 03 Barometer:

Download this infographic for your presentations

Saving reaches new heights

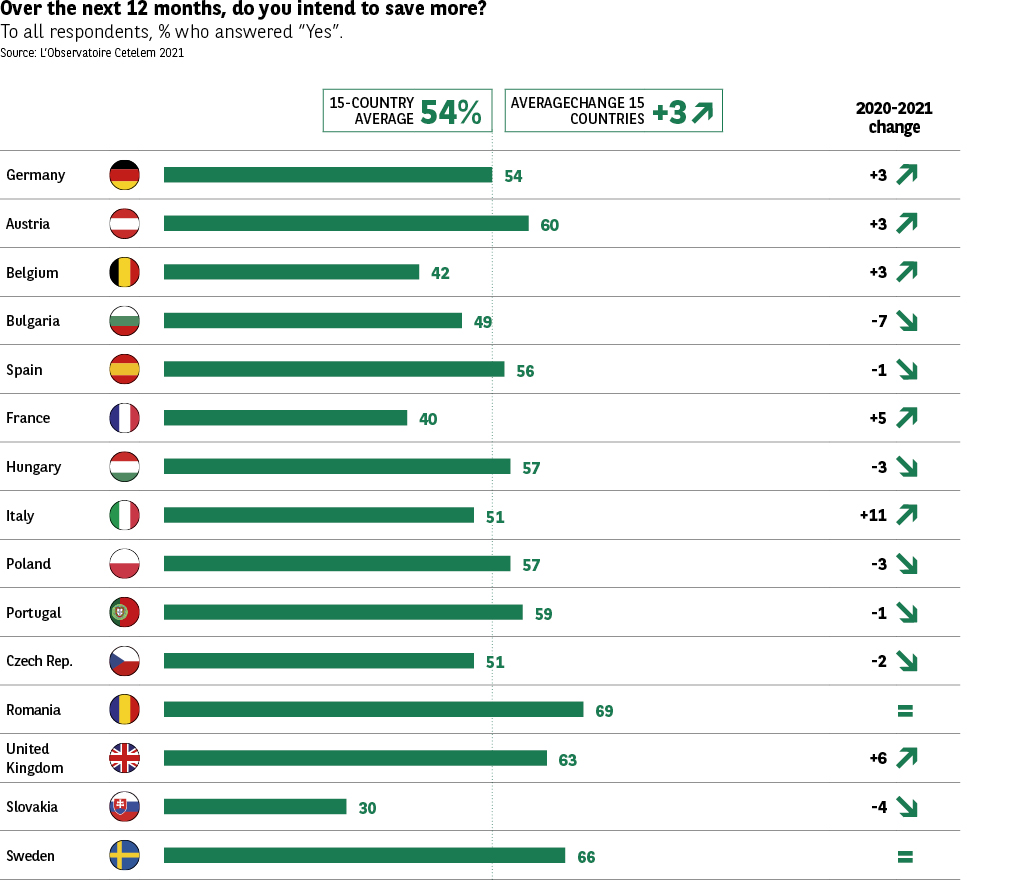

Thanks to a seesaw effect, saving intentions are up (Fig. 4 Barometer). This makes sense if we consider the restrictions placed on consumption in an uncertain public health climate (Fig. 5 Barometer). More than 1 in 2 Europeans declare such an intention (+3 pts). The usually free-spending Italians have turned into keen savers (+11 pts). A group of five countries that includes the United Kingdom, France, Germany, Austria and Belgium are more measured in their pursuit of this cautious strategy. At the other end of the scale, Bulgaria, Slovakia, Hungary and Poland are less intent on building up their savings (with scores that are down compared with 2020).

Fig. 04 Barometer:

Download this infographic for your presentations

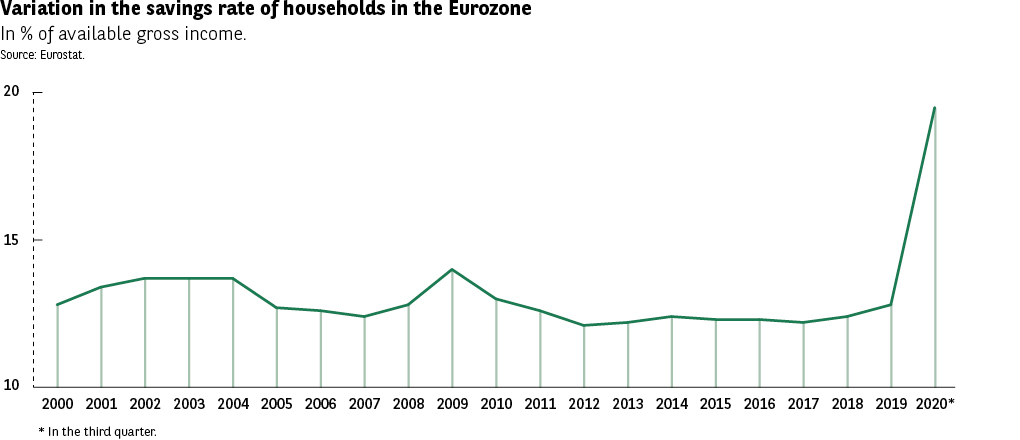

Fig. 05 Barometer:

Download this infographic for your presentations

Looking beyond people’s intentions, savings rates for the 2nd quarter of 2020 clearly confirmed that the pandemic was causing people to put their money away. Most of the countries covered by the Observatoire Cetelem Barometer post spectacular increases in savings rates. These have gone as far as tripling in Spain and Portugal. Scores exceed 25% in France, Belgium and Germany.

Whether people can afford to or not, there is less of a desire to consume

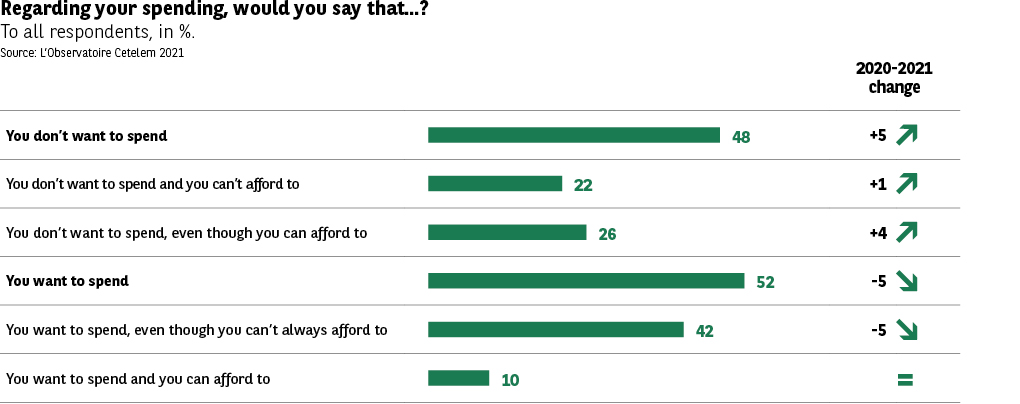

The gloom is such that the urge to spend is gone (Fig. 6 Barometer). Almost 1 in 2 Europeans attest to this. And it doesn’t seem to matter whether or not people can afford to. The proportion of those who believe they can but say they lack the desire to spend has grown by 4 points. It should also be pointed out that seniors have no intention of spending at all.

This desire is most lacking in some of the more “prosperous” economies, but also in the Czech Republic. 62% of Austrians (+15 pts) and 55% of French respondents (+12 pts) have lost their consumerist ardour. Only the Italians are noticeably keener to spend than previously (+3 pts).

Fig. 06 Barometer:

Download this infographic for your presentations

A desire to escape… without leaving the house

The cocooning people engaged in for many months, and to which they may have to return in the near-future, has been a boon for products and services that allow them to escape. Video streaming platforms and games consoles come out on top in terms of purchasing intentions (+5 pts). Most other expenses are experiencing something of a status quo. This looks like another sign that Europeans have adopted a wait-and-see attitude when it comes to spending.

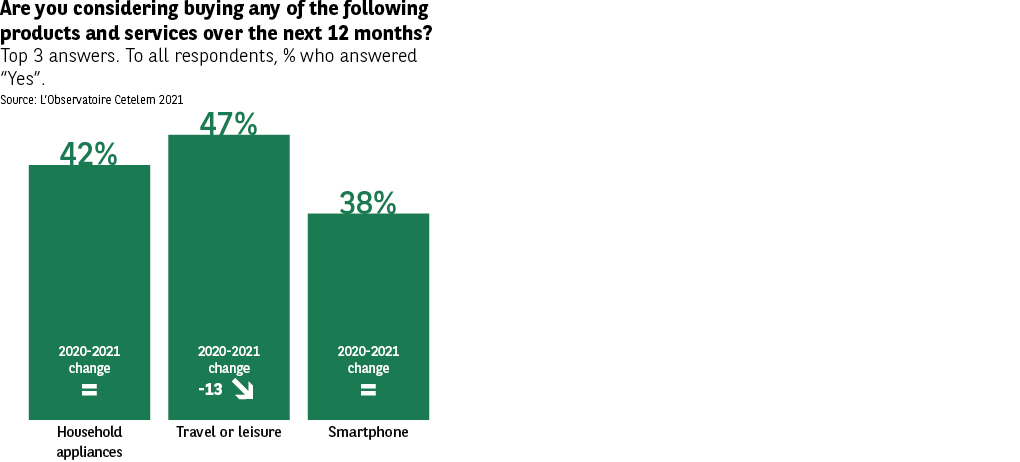

Looking beyond the urge to consume, the health crisis has directly impacted all consumption items. Year after year, travel and leisure top the list of purchasing intentions in the Cetelem Consumption Barometer (Fig. 7 Barometer). And while the item still occupies the number one spot this year, its decline is striking. As if to echo the difficulties faced by airlines, intentions to partake in travel or leisure are down 13 points. In Hungary, Poland and Slovakia, they are even relegated to second place in the ranking. With tourism accounting for more than 10% of their GDP, Portugal, Spain, Italy and Austria could suffer greatly from the economic consequences of these choices.

Fig. 07 Barometer:

Download this infographic for your presentations