Activism tha benefits the community

DOING MORE FOR EVERYONE

When Europeans are asked whether they consider it a priority to improve the circumstances of the population as a whole, they give the idea a score of 5.7 out of 10 (Fig. 30).

No country in the study scores below 5. the Austrians, Germans and French are the least enthusiastic about this prospect (5, 5.2 and 5.2).

At the other end of the scale, the Romanians, Bulgarians, Italians and Spaniards show the most solidarity (6.5, 6.3, 6.2 and 6).

A generational analysis reveals that millennials are more inclined than their elders to prioritize the improvement of the overall situation.

FIG. 30 :

LOCALISM IS VERY MUCH ON THE UP

In terms of actual consumption, people’s concern for the world around them translates into a preference for what is close to them and for what they know.

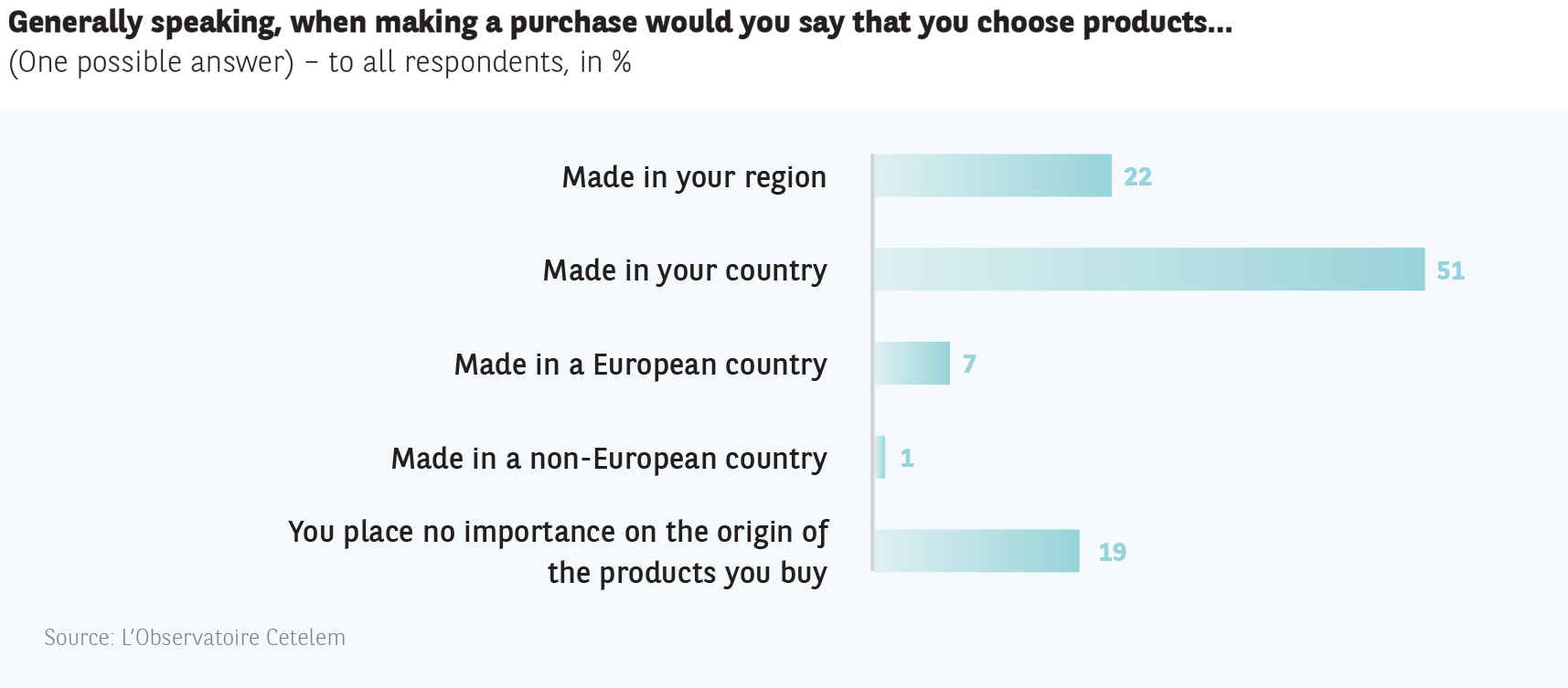

Last year, L’Observatoire Cetelem highlighted a regional and, most of all, a national bias when it comes to the origin of the products purchased. This year’s results clearly confirm this tendency, with an obvious shift towards regionalism (Fig. 31).

1 in 2 Europeans (+1 point) state that they prefer products made in their country. the rise in the consumption of domestic products is strongest in Austria (+13 points).

All the Eastern European countries have also seen their scores increase significantly. There has been a decline in the desire to “buy domestic” in four countries: Germany, Italy, the UK and Sweden.

This can be explained by a shift towards the purchase of regional products, which increased by 4 points overall (22%). in the four aforementioned countries, the score rose by 6, 5, 5 and 3 points respectively. France, where the likelihood of consuming domestic products was already up 2 points, is doing even better, with a 10-point increase. It now ranks ahead of Austria, where buying local is down 5 points, given the rapid expansion of domestic options.

FIG. 31 :

THERE IS NOW CLEARER DEMAND FOR ENCOURAGING ITS DEVELOPMENT

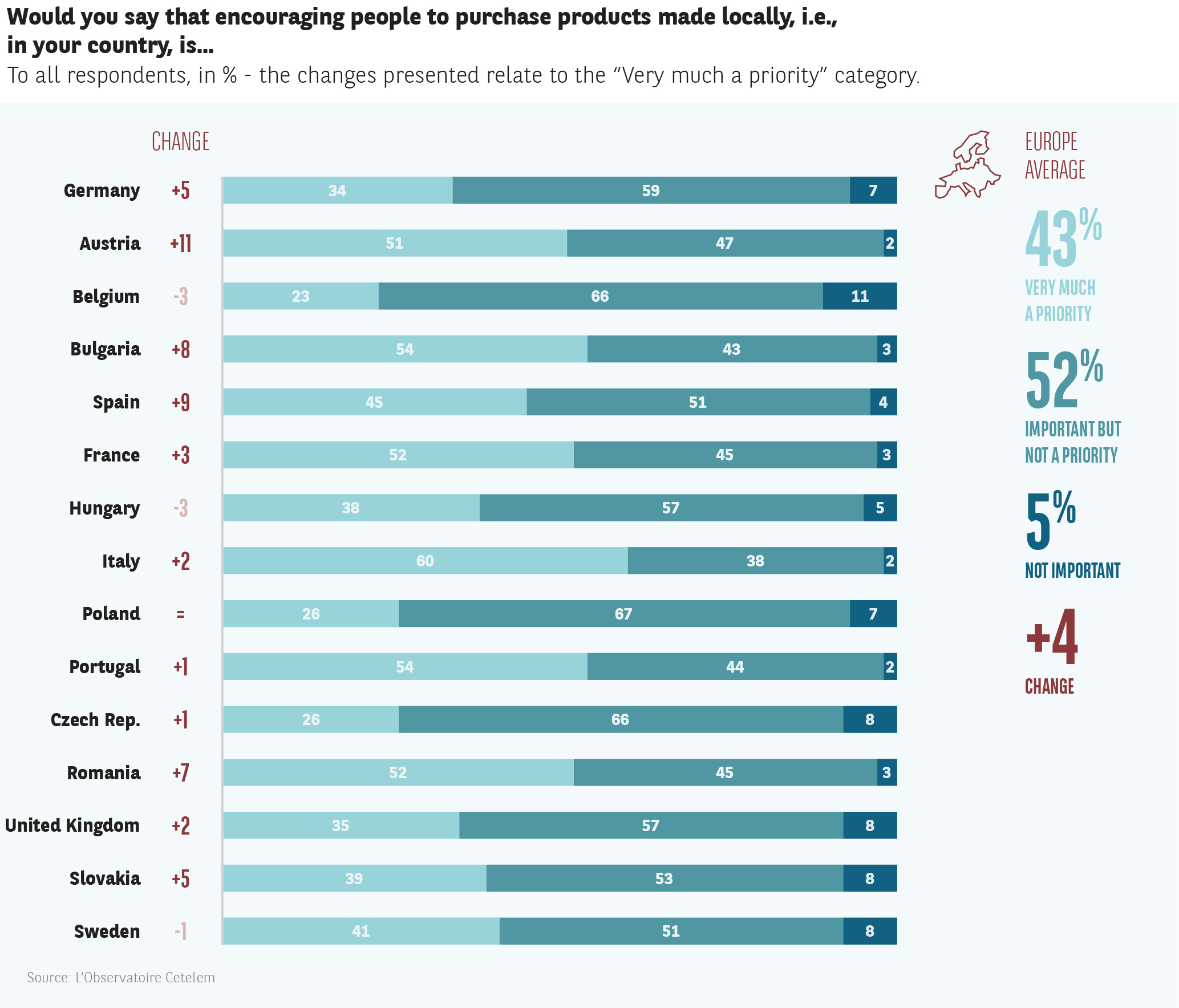

The shift observed in another score since last year demonstrates that localism is taking root in the minds of consumers (Fig. 32). the proportion of Europeans who consider it a priority to encourage its development is up 4 points (43%). There are six countries in which more than 1 in 2 respondents take this point of view.

Austria, Spain and Bulgaria are the most enthusiastic in this regard (+11, +9 and +8).

Only Belgium, Bulgaria and Sweden post lower scores than previously (-3, -3 and -1).

Only 5% of respondents do not consider it necessary, an identical result to last year.

FIG. 32 :

CONSUMING CLOSE TO HOME

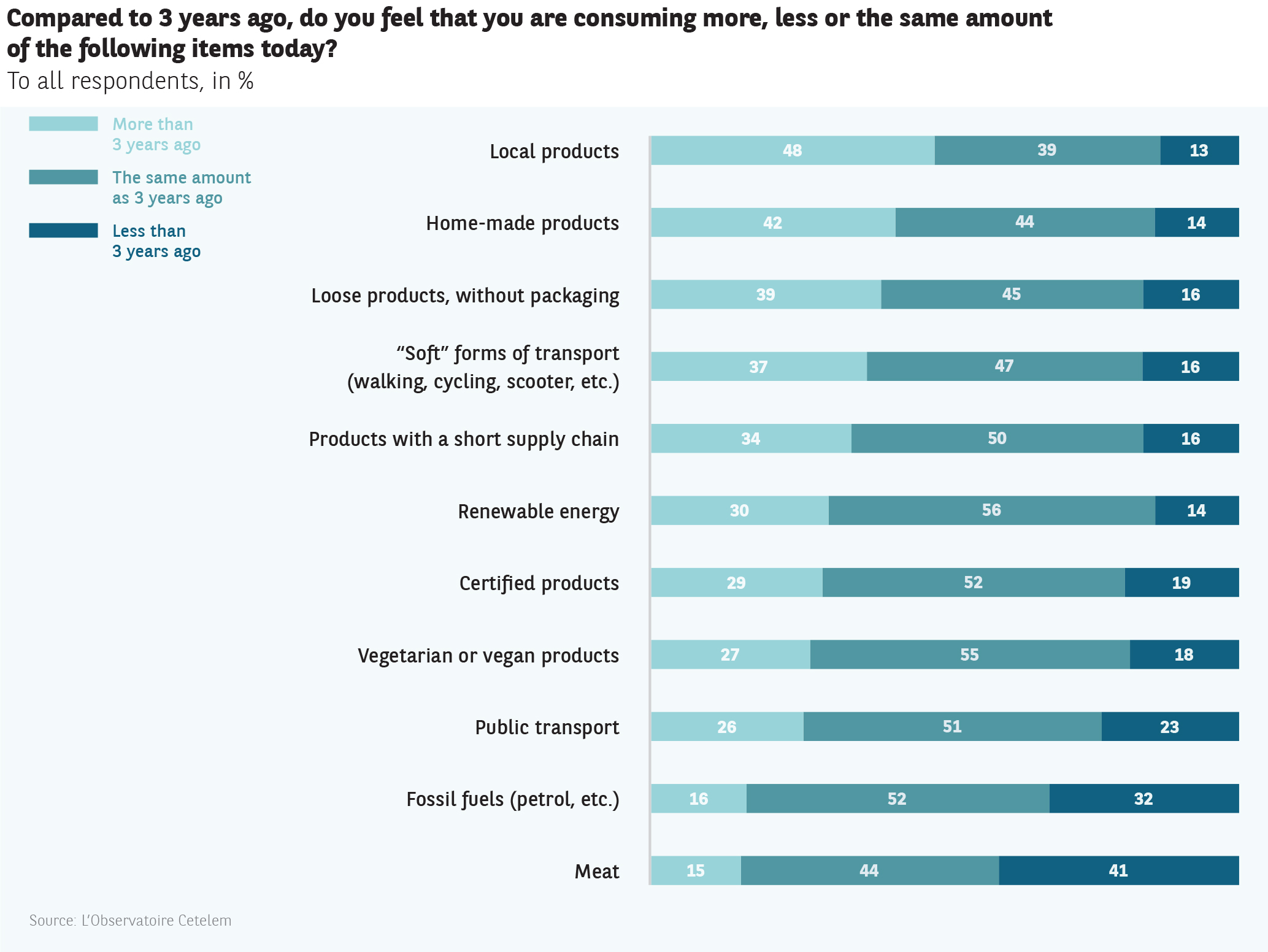

In essence, activist consumers demand of themselves what they want to see encouraged across the board (Fig. 33).

Of all the options available to consumers to demonstrate their preference for responsible and sustainable consumption, purchasing local products comes in first place. 1 in 2 Europeans say they have bought more products of this kind in the last three years. Three countries stand out in this respect: Austria, France and Italy (68%, 61% and 59%), in stark contrast with the United Kingdom (36%) and all the Eastern European countries.

The strong scores obtained by home-made products (42%) and those sold via short distribution channels (34%) also testify to this desire to consume products from closer to home and with a more human touch.

Other results point to a fundamental change in consumer behaviour. the sale of loose goods appears popular (39%). the appeal of soft modes of transport is also confirmed (37%). Meat seems destined to become less and less common on the plates of consumers, with 41% of Europeans cutting down on their meat consumption in the last 3 years.

FIG. 33 :

A trend towards activism

Between 2007 and 2017, the surface area of European agricultural land set aside for organic produce grew 75%.

In France, 17% of people who consume organic products have been doing so for less than a year.

97% are familiar with the AB label and 59% with the European organic logo.

(Sources: Agence Bio, Libération, We Demain)

A trend towards activism

In France, 37% of consumers prefer to buy their products loose, with the under-35s being the most attracted to this type of product. According to a survey by Credoc/Kantar, 47% of French people bought products in this form at least once in 2018. 80% of organic retailers and Carrefour and Franprix stores have areas devoted to them. According to Réseau Vrac, sales of loose products will reach €3 billion in 2022.

A trend towards activism

The meat market is suffering. Since 2002, the consumption of meat products in the European Union has fallen by 17%.

in 2017, Europeans ate an average of 80 kg of meat each year, compared with 95 kg at the beginning of the century.

the Belgians, the undisputed champions when it comes to cutting down on meat consumption, have gone from 100 kg in 2011 to 74 kg today. the Italians have also curbed their carnivorous tendencies by reducing their annual consumption by 8 kg in six years, to just 75 kg.

While the British figure remains within the European average, the results from the French, Germans and Poles are slightly above the mean. Meat consumption is particularly high in two countries: Denmark and Spain, whose inhabitants eat an average of more than 95 kg a year. (Fig. 16).