An unavoidable enterprise for the automotive industry

A choice that is disappearing

All over the world, there are already a large number of low-emission zones with restricted access to petrol and diesel vehicles. Mandatory quotas on EV sales have been in place for a long time in the United States and will be implemented next year in China. If you add CO2 reduction standards, which are becoming increasingly draconian, manufacturers have no choice but to offer EVs.

Changing programmes

With a varying degree of celerity and intensity, and sometimes only to protect brand image, all manufacturers have begun to develop specific programmes. Brands have been created (e.g. Polestar for Volvo, EQ for Mercedes, Sol for Volkswagen in China, etc.), colossal R&D investments have been agreed and new dedicated production capacities have been installed.

Increased range, but it comes at a price

The technical and marketing challenges are as important as the environmental and industrial issues. To win over customers, the EV market needs batteries that can deliver an adequate range and be recharged as quickly as possible. Not only must they be able to provide for 90% of everyday needs, limited to a dozen miles or so, but also for the rare long journeys, which are intimately associated with what motorists expect of a «real» car. However, the problem of electricity storage is as old as electricity itself. Although there are certain avenues of research and technical solutions, the progress will only be worthwhile if it is shared by all. In other words, if the improvements in batteries do not translate into prohibitive and unaffordable costs for the ordinary motorist.

Innovating to make electricity the best solution

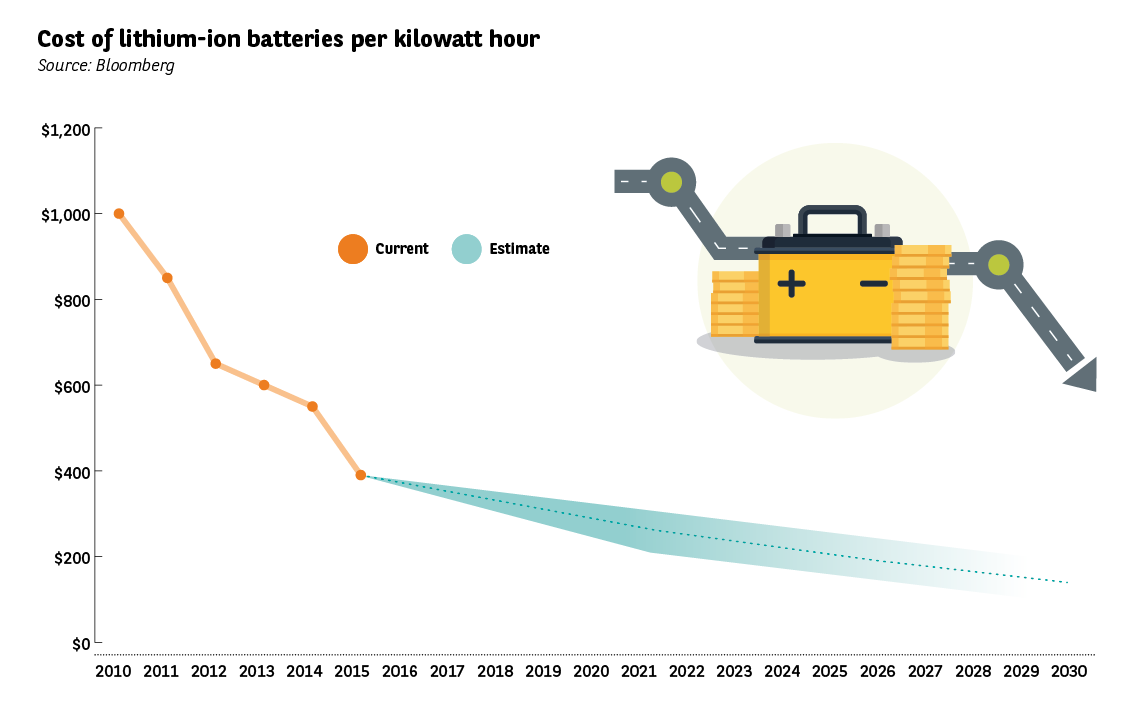

The sector is becoming more organised, research efforts are accelerating, and partnerships are forming between manufacturers and specialists in battery chemistry or recycling. It looks as if the gamble is paying off. Despite the improvements made in terms of range, charging speed, safety and durability, the cost of batteries has been falling for several years now. The scheduled increase in volumes would indicate that there is a good chance prices will drop further.

Better yet, the new so-called solid-state battery technology could revolutionise EVs in the next five years. For a greatly reduced cost, the range would more than double, and the charging time would be limited to just a few minutes. The prospect of an electric car that is more practical and more competitive than any other engine.

The new generations of hydrogen fuel cells are often put forward as the future of the electric vehicle. Although the number of models could be counted on one hand and the hydrogen fuel cell distribution network is still in its infancy, this technology offers great promise with a recharging time of 3 to 5 minutes and a range of 700 km.

Unstoppable growth

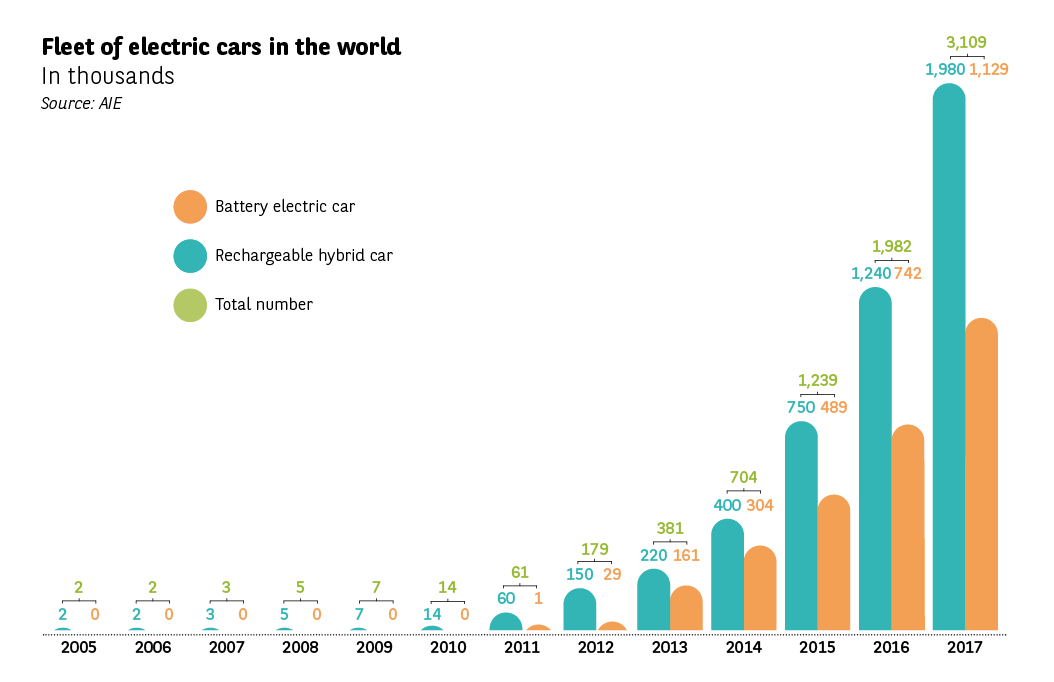

In 2017, EV sales reached 1.2 million units worldwide, i.e. an increase of 60% in 2016.

However, this figure represents only 1.5% of new car sales. These sales are also concentrated in certain geographical areas. 8 countries (China, United States, Japan, Norway, United Kingdom, France, Germany and Sweden) account for 90% of global sales. China dominates the market with 600,000 units, 80% of which are electric vehicles and 20% are plug-in hybrid vehicles.

There is therefore still significant growth potential to recoup the investments made by the manufacturers in developing the EV. Because the manufacturers’ objectives in terms of sales volumes are huge. Although, in the past, the announcements and projects of manufacturers have not always come to fruition, it would appear that the current impetus is irreversible. As we progress from a niche solution to its development for mainstream use, the current and future perception of EVs by motorists and their expectations becomes even more crucial.

Manufacturers’ declared objectives in terms of electric vehicle volumes – 2017

| BMW | 100,000 EV sales in 2017 15 to 25% of BMW group sales by 2025 |

| Chevrolet (GM) | 30,000 annual EV sales by 2017 |

| Chinese manufacturers | 4.52 million annual EV sales by 2020 |

| Daimler | 100,000 annual EV sales by 2020 |

| Ford | 13 new EV models by 2020 |

| Honda | Two-thirds of sales in 2030 will be electric vehicles (including hybrid, plug-in hybrid, electric and «fuel cell» vehicles) |

| Renault–Nissan | 1.5 million electric vehicles sold in 2020 (total sales) |

| Tesla | 500,000 annual EV sales within 2 years 1 million annual EV sales by 2020 |

| Volkswagen | 2 to 3 million annual EV sales by 2025 |

| Volvo | 1 million electric vehicles sold in 2025 (total sales) |