Cutting costs, at any cost

Taking personal action

Motorists are taking measures

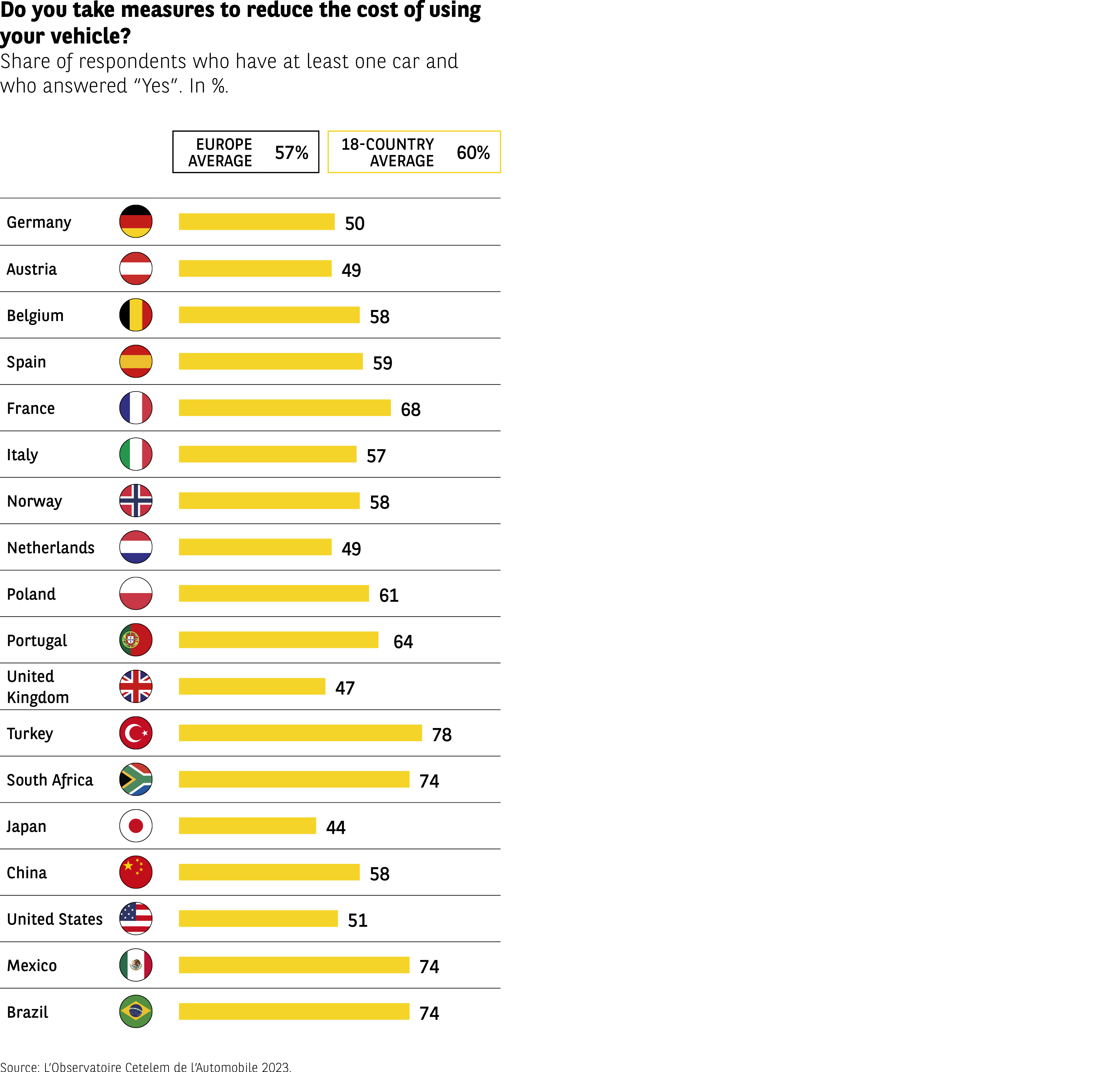

Faced with an economic situation that is looking ever bleaker, motorists are far from complacent. They believe that the cost of running their vehicle is too high. 6 out of 10 are adopting measures to limit these costs (Fig 27). This reaction has been particularly strong in the four countries with the weakest economies, with three-quarters of South Africans, Brazilians and Mexicans taking specific action, and an even higher proportion of Turks.

Of the remaining countries, France is home to the largest majority of individuals who are keen to act (7 out of 10). The central focus placed on fuel prices during the lengthy electoral period that preceded this survey may well have had something to do with this result. In contrast, the Japanese, British, Austrians and Dutch show less gusto.

Fig 27 – Measures implemented to reduce vehicle usage costs

Download this infographic for your presentations The infographic shows the share of respondents owning at least one car and reporting measures to limit their vehicle usage costs.

Two averages are shown:

– European average: 57%

– Average of the 18 countries studied: 60%

Data by country (in %):

Germany: 50%

Austria: 49%

Belgium: 58%

Spain: 59%

France: 68%

Italy: 57%

Norway: 58%

Netherlands: 49%

Poland: 61%

Portugal: 64%

United Kingdom: 47%

Turkey: 78%

South Africa: 74%

Japan: 44%

China: 58%

United States: 51%

Mexico: 74%

Brazil: 74%

The percentages vary significantly from country to country. The highest values are found in Turkey and several non-European countries (74-78%).

The lowest percentages are found in Japan and the United Kingdom (44-47%).

The majority of European countries are around the European average of 57%.

Source: The Cetelem Automotive Observatory 2023.

The infographic shows the share of respondents owning at least one car and reporting measures to limit their vehicle usage costs.

Two averages are shown:

– European average: 57%

– Average of the 18 countries studied: 60%

Data by country (in %):

Germany: 50%

Austria: 49%

Belgium: 58%

Spain: 59%

France: 68%

Italy: 57%

Norway: 58%

Netherlands: 49%

Poland: 61%

Portugal: 64%

United Kingdom: 47%

Turkey: 78%

South Africa: 74%

Japan: 44%

China: 58%

United States: 51%

Mexico: 74%

Brazil: 74%

The percentages vary significantly from country to country. The highest values are found in Turkey and several non-European countries (74-78%).

The lowest percentages are found in Japan and the United Kingdom (44-47%).

The majority of European countries are around the European average of 57%.

Source: The Cetelem Automotive Observatory 2023.

An assault on fuel consumption

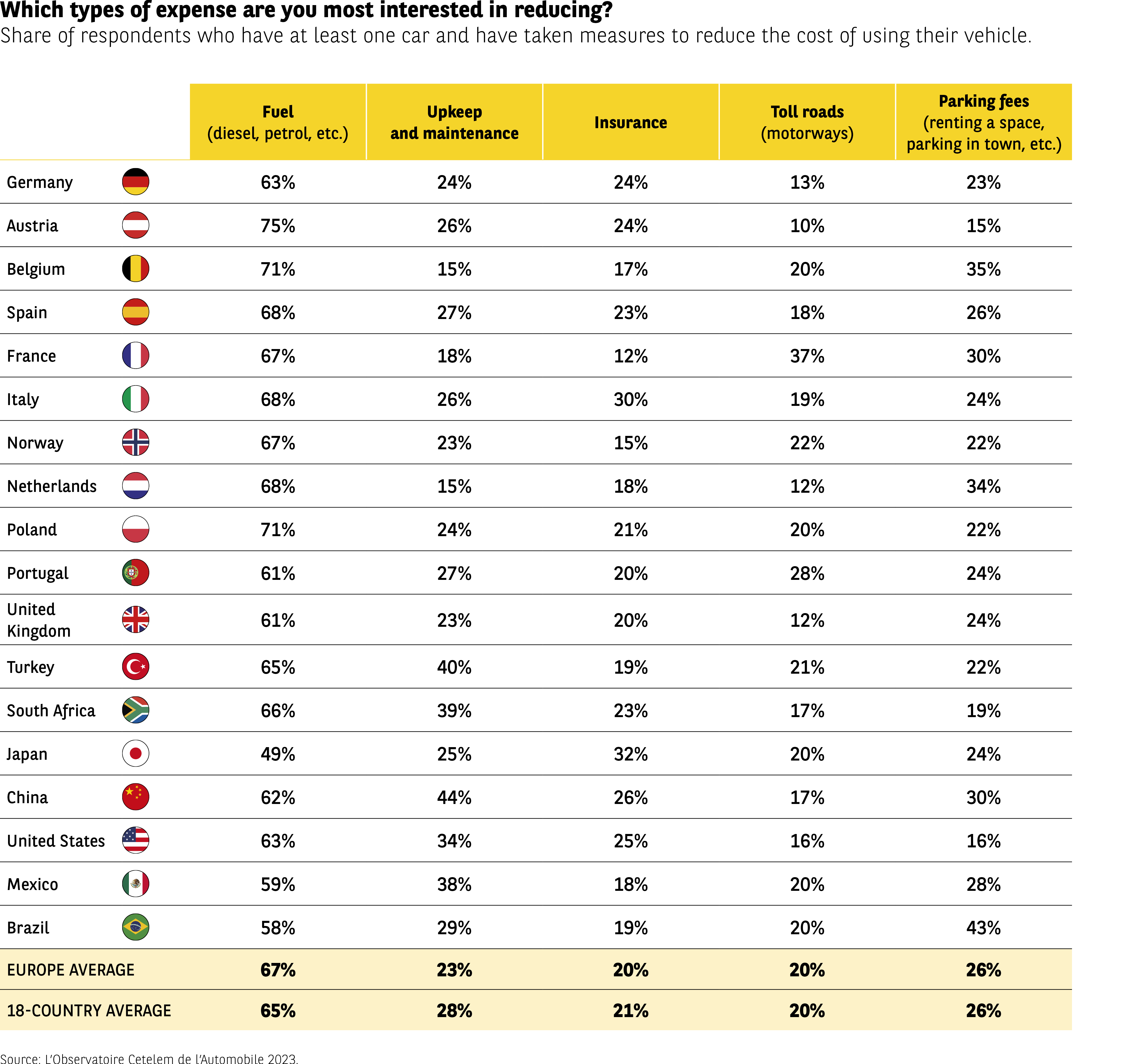

Take measures? Sure, but how? One need not be psychic to guess where people are concentrating their efforts. The answer is obvious from the previous pages. According to 65% of respondents, the main priority is to reduce fuel expenses (Fig 28). The Japanese are the one exception. As we have seen, they do not appear to be suffering unduly from prices at the pump, while in every other country fuel costs have caught people’s attention far more than any other factor. And, for once, Europe is where the desire to limit fuel spending is the most powerful. An analysis of every other cost item reveals local variations. In France, reducing the amount spent on motorway tolls, a French speciality, is the second-highest priority.

In Belgium, Brazil and the Netherlands, spending less on parking comes second. In Italy and Japan, the concern is more with bringing down the cost of insurance.

Fig 28 – Expense categories that drivers aim to reduce

Download this infographic for your presentations A comparative table of five types of automotive expenses that drivers with at least one car are prioritizing to limit.

Data by country (in % – each row follows the order: Fuel · Maintenance · Insurance · Tolls · Parking):

Germany: 63 · 24 · 24 · 13 · 23

Austria: 75 · 26 · 24 · 10 · 15

Belgium: 71 · 15 · 17 · 20 · 35

Spain: 68 · 27 · 23 · 18 · 26

France: 67 · 18 · 12 · 37 · 30

Italy: 68 · 26 · 30 · 19 · 24

Norway: 67 · 23 · 15 · 22 · 22

Netherlands: 68 · 15 · 18 · 12 · 34

Poland: 71 · 24 · 21 · 20 · 22

Portugal: 61 · 27 · 20 · 28 · 24

United Kingdom: 61 · 23 · 20 · 12 · 24

Turkey: 65 · 40 · 19 · 21 · 22

South Africa: 66 · 39 · 23 · 17 · 19

Japan: 49 · 25 · 32 · 20 · 24

China: 62 · 44 · 26 · 17 · 30

United States: 63 · 34 · 25 · 16 · 16

Mexico: 59 · 38 · 18 · 20 · 28

Brazil: 58 · 29 · 19 · 20 · 43

Two average lines complete the table:

– European average: 67 · 23 · 20 · 20 · 26

– Average of 18 countries: 65 · 28 · 21 · 20 · 26

Fuel is the most frequently targeted expense category in all countries. Priorities then vary: high maintenance in Turkey, South Africa, and China; tolls mainly in France and Portugal; parking particularly high in Belgium and Brazil.

Source: The Cetelem Automotive Observatory 2023.

A comparative table of five types of automotive expenses that drivers with at least one car are prioritizing to limit.

Data by country (in % – each row follows the order: Fuel · Maintenance · Insurance · Tolls · Parking):

Germany: 63 · 24 · 24 · 13 · 23

Austria: 75 · 26 · 24 · 10 · 15

Belgium: 71 · 15 · 17 · 20 · 35

Spain: 68 · 27 · 23 · 18 · 26

France: 67 · 18 · 12 · 37 · 30

Italy: 68 · 26 · 30 · 19 · 24

Norway: 67 · 23 · 15 · 22 · 22

Netherlands: 68 · 15 · 18 · 12 · 34

Poland: 71 · 24 · 21 · 20 · 22

Portugal: 61 · 27 · 20 · 28 · 24

United Kingdom: 61 · 23 · 20 · 12 · 24

Turkey: 65 · 40 · 19 · 21 · 22

South Africa: 66 · 39 · 23 · 17 · 19

Japan: 49 · 25 · 32 · 20 · 24

China: 62 · 44 · 26 · 17 · 30

United States: 63 · 34 · 25 · 16 · 16

Mexico: 59 · 38 · 18 · 20 · 28

Brazil: 58 · 29 · 19 · 20 · 43

Two average lines complete the table:

– European average: 67 · 23 · 20 · 20 · 26

– Average of 18 countries: 65 · 28 · 21 · 20 · 26

Fuel is the most frequently targeted expense category in all countries. Priorities then vary: high maintenance in Turkey, South Africa, and China; tolls mainly in France and Portugal; parking particularly high in Belgium and Brazil.

Source: The Cetelem Automotive Observatory 2023.

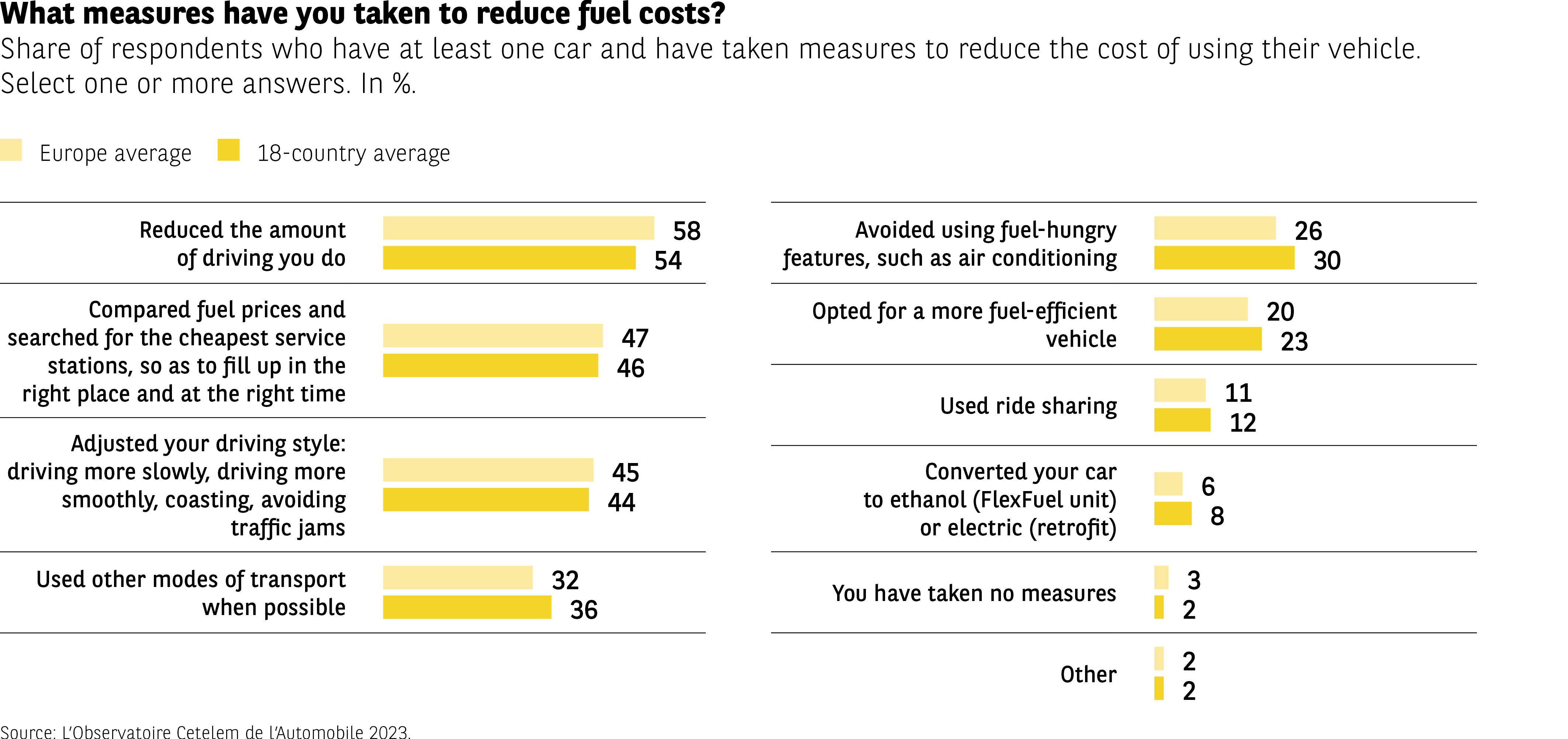

Priority no. 1: drive less to consume less

To lower their fuel bill, motorists are willing to consider several options, the first being the most obvious: driving less. 6 out of 10 people have embraced this measure. The consensus is broadly in favour of this approach, the exceptions being Japan and China, where 1 in 3 and 1 in 5 motorists, respectively, are willing to consider it. Along with the South Africans, the French are the most likely to reduce the mileage they cover (69% and 65% respectively).

So motorists are keen to drive less, but 46% of respondents are also interested in comparing fuel prices and searching for the cheapest service stations.

Paradoxically, this means that they are driving further and therefore burning more fuel to do so. This option is much less appealing to the Turks and South Africans.

An almost identical proportion of motorists (44%) are willing to change their driving style. This means driving more smoothly and more slowly. Norwegians, many of whom use electric vehicles, are not particularly inclined to take their foot off the accelerator or drive less aggressively (24%).

On these three points, the difference between residents of rural and urban areas is significant. 61% of rural inhabitants plan to drive less, compared with 51% of city dwellers. When it comes to searching for cheaper fuel and driving in a way that is more economical, the gap is smaller (4% and 6%, respectively).

Looking at the ranking of measures people are prepared to take, switching to other modes of transport is another fairly popular option (36%), particularly among urban dwellers (39% vs. 27% of country dwellers), but it is clear most of all that certain eco-friendly solutions are of little interest to motorists.

Choosing a more fuel-efficient vehicle appeals to only 1 in 5 people and ridesharing to only 1 in 10. However, the figure for the latter reaches 1 in 5 in Turkey, South Africa and Mexico (Fig 29).

Fig 29 – Measures to reduce fuel costs

Download this infographic for your presentations The infographic presents the actions taken by drivers who own at least one car to reduce fuel costs. Multiple responses are possible.

Comparative data between European average → average of 18 countries (in %):

– Limiting travel: 58% → 54%

– Comparing fuel prices and choosing the cheapest station: 47% → 46%

– Optimizing driving (driving more slowly, smoothly, avoiding traffic jams…): 45% → 44%

– Using alternative transportation: 32% → 36%

– Avoiding the use of expensive equipment (e.g. air conditioning): 26% → 30%

– Prioritizing a fuel-efficient vehicle: 20% → 23%

– Carpooling: 11% → 12%

– Converting your car to ethanol or electric: 6% → 8%

– Not taking any measures: 3% → 2%

– Other: 2% → 2%

The most common measures concern reducing travel, comparing fuel prices, and optimizing driving. More engaging actions (converting vehicles, carpooling) are significantly less frequent.

Source: The Cetelem Automotive Observatory 2023.

The infographic presents the actions taken by drivers who own at least one car to reduce fuel costs. Multiple responses are possible.

Comparative data between European average → average of 18 countries (in %):

– Limiting travel: 58% → 54%

– Comparing fuel prices and choosing the cheapest station: 47% → 46%

– Optimizing driving (driving more slowly, smoothly, avoiding traffic jams…): 45% → 44%

– Using alternative transportation: 32% → 36%

– Avoiding the use of expensive equipment (e.g. air conditioning): 26% → 30%

– Prioritizing a fuel-efficient vehicle: 20% → 23%

– Carpooling: 11% → 12%

– Converting your car to ethanol or electric: 6% → 8%

– Not taking any measures: 3% → 2%

– Other: 2% → 2%

The most common measures concern reducing travel, comparing fuel prices, and optimizing driving. More engaging actions (converting vehicles, carpooling) are significantly less frequent.

Source: The Cetelem Automotive Observatory 2023.

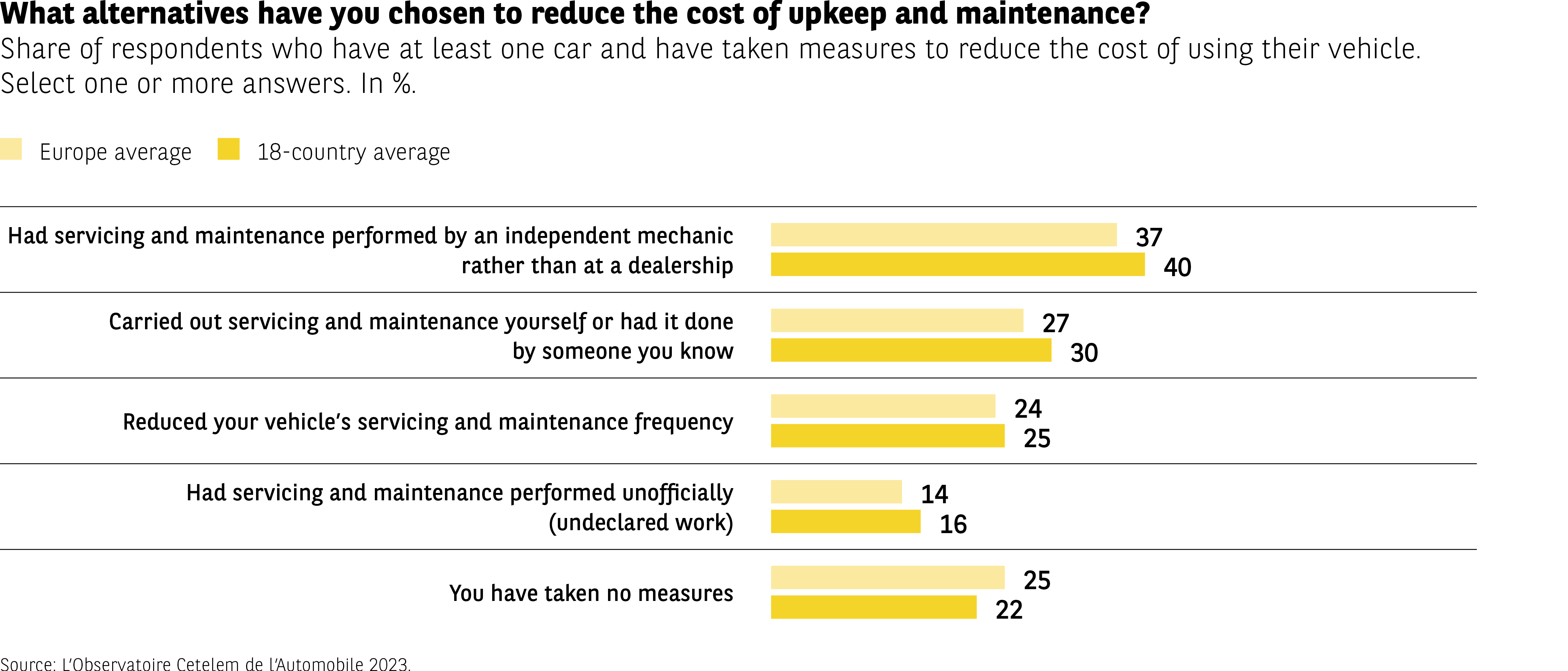

Repairing your own car is always a winner

Focusing on upkeep and maintenance is another possible avenue for cost-cutting motorists (Fig 30). Car dealership networks bear the biggest brunt of this self-sufficient approach. Of those motorists who seek to lower costs, almost 4 in 10 opt to have their vehicle serviced and repaired by independent mechanics.

The two Iberian nations are where dealer networks have the most to worry about. DIY maintenance is also popular, with 3 in 10 motorists stating that they are prepared to get their hands dirty. The highest proportions of home mechanics are to be found in China and the United States. A quarter of those surveyed put their faith in an even more radical solution: reducing the amount of vehicle servicing and maintenance performed. More than 4 out of 10 Turks are tempted by the idea.

Fig 30 – Alternatives to reduce vehicle maintenance costs

Download this infographic for your presentations The infographic presents the alternatives adopted to decrease the cost of automotive maintenance.

Comparative data between European average → average of 18 countries (in %):

– Having maintenance done by independent repairers: 37% → 40%

– Performing maintenance oneself or through a acquaintance: 27% → 30%

– Limiting maintenance and repairs: 24% → 25%

– Using unofficial maintenance (underground work): 14% → 16%

– Not having taken any measures: 25% → 22%

The preferred solutions are using independent repairers and self-maintenance. The use of undeclared work remains minority. A notable proportion indicates not having taken any measures.

Source: The Cetelem Automotive Observatory 2023

The infographic presents the alternatives adopted to decrease the cost of automotive maintenance.

Comparative data between European average → average of 18 countries (in %):

– Having maintenance done by independent repairers: 37% → 40%

– Performing maintenance oneself or through a acquaintance: 27% → 30%

– Limiting maintenance and repairs: 24% → 25%

– Using unofficial maintenance (underground work): 14% → 16%

– Not having taken any measures: 25% → 22%

The preferred solutions are using independent repairers and self-maintenance. The use of undeclared work remains minority. A notable proportion indicates not having taken any measures.

Source: The Cetelem Automotive Observatory 2023

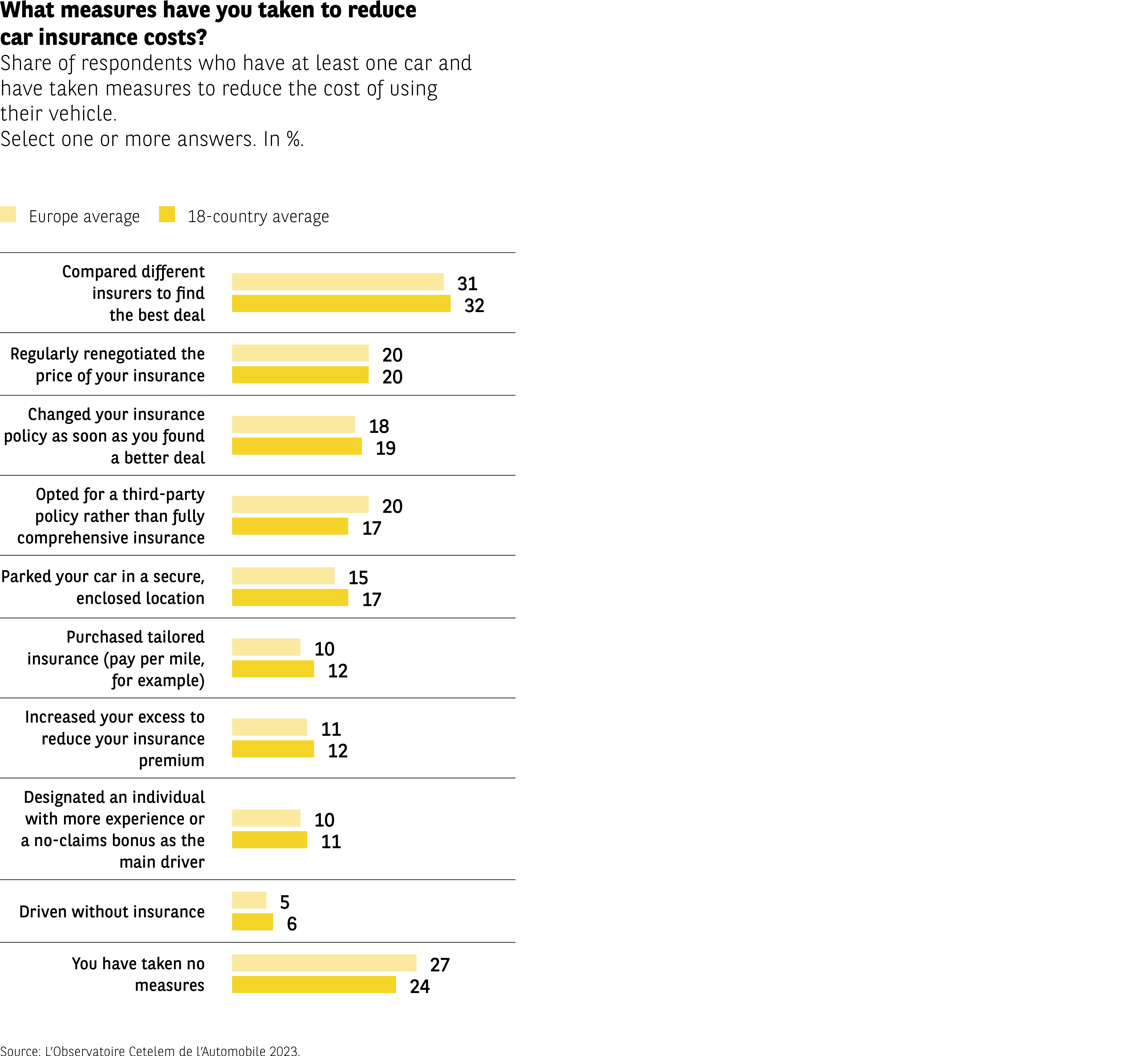

Fewer savings are expected on the insurance side of things

The third stage of the cost reduction rocket, i.e., spending less by making savings on insurance, is a somewhat trickier proposition (Fig 31). It is worth noting first of all that 24% of those who seek to cut costs have taken no steps in this direction, with Europeans being the most reluctant to do so. 6% have even decided to drive uninsured.

The main way of saving money on insurance is to compare deals (32%), something that has been embraced in a very uneven way. Indeed, 47% of drivers in Turkey choose to do so, compared with just 19% in the Netherlands. Purely for financial reasons, 17% have also decided to downgrade their cover by going for a third-party policy.

Another route people go down is to regularly switch insurers (19%), with the Chinese and the British leading the way in this area. Also popular among some motorists is parking their car in a secure location, which is the best way of avoiding accidents (17%). Tailored insurance, including policies linked to the mileage covered, appeals to 12% of respondents.

Fig 31 – Measures to reduce car insurance costs

Download this infographic for your presentations Infographic indicating the measures adopted by drivers to limit the cost of their car insurance.

Comparative data between European average → average of 18 countries (in %):

– Comparing insurance policies: 31% → 32%

– Renegotiating insurance: 20% → 20%

– Changing insurance regularly: 18% → 19%

– Prioritizing third-party insurance: 20% → 17%

– Parking in a secure or closed location: 15% → 17%

– Subscribing to a customized insurance policy (e.g. pay-per-mile): 10% → 12%

– Increasing the deductible: 11% → 12%

– Designating an experienced primary driver: 10% → 11%

– Driving without insurance: 5% → 6%

– Not having taken any measures: 27% → 24%

Comparing insurance policies stands out as the most frequent measure. Around a quarter of respondents do not take any action. Risky practices such as driving without insurance remain marginal.

Source: The Cetelem Automotive Observatory 2023.

Infographic indicating the measures adopted by drivers to limit the cost of their car insurance.

Comparative data between European average → average of 18 countries (in %):

– Comparing insurance policies: 31% → 32%

– Renegotiating insurance: 20% → 20%

– Changing insurance regularly: 18% → 19%

– Prioritizing third-party insurance: 20% → 17%

– Parking in a secure or closed location: 15% → 17%

– Subscribing to a customized insurance policy (e.g. pay-per-mile): 10% → 12%

– Increasing the deductible: 11% → 12%

– Designating an experienced primary driver: 10% → 11%

– Driving without insurance: 5% → 6%

– Not having taken any measures: 27% → 24%

Comparing insurance policies stands out as the most frequent measure. Around a quarter of respondents do not take any action. Risky practices such as driving without insurance remain marginal.

Source: The Cetelem Automotive Observatory 2023.

Action is expected from carmakers and governments

While motorists are doing what they can to lower the cost of using their vehicle, they also expect governments and brands to offer their support on this issue.

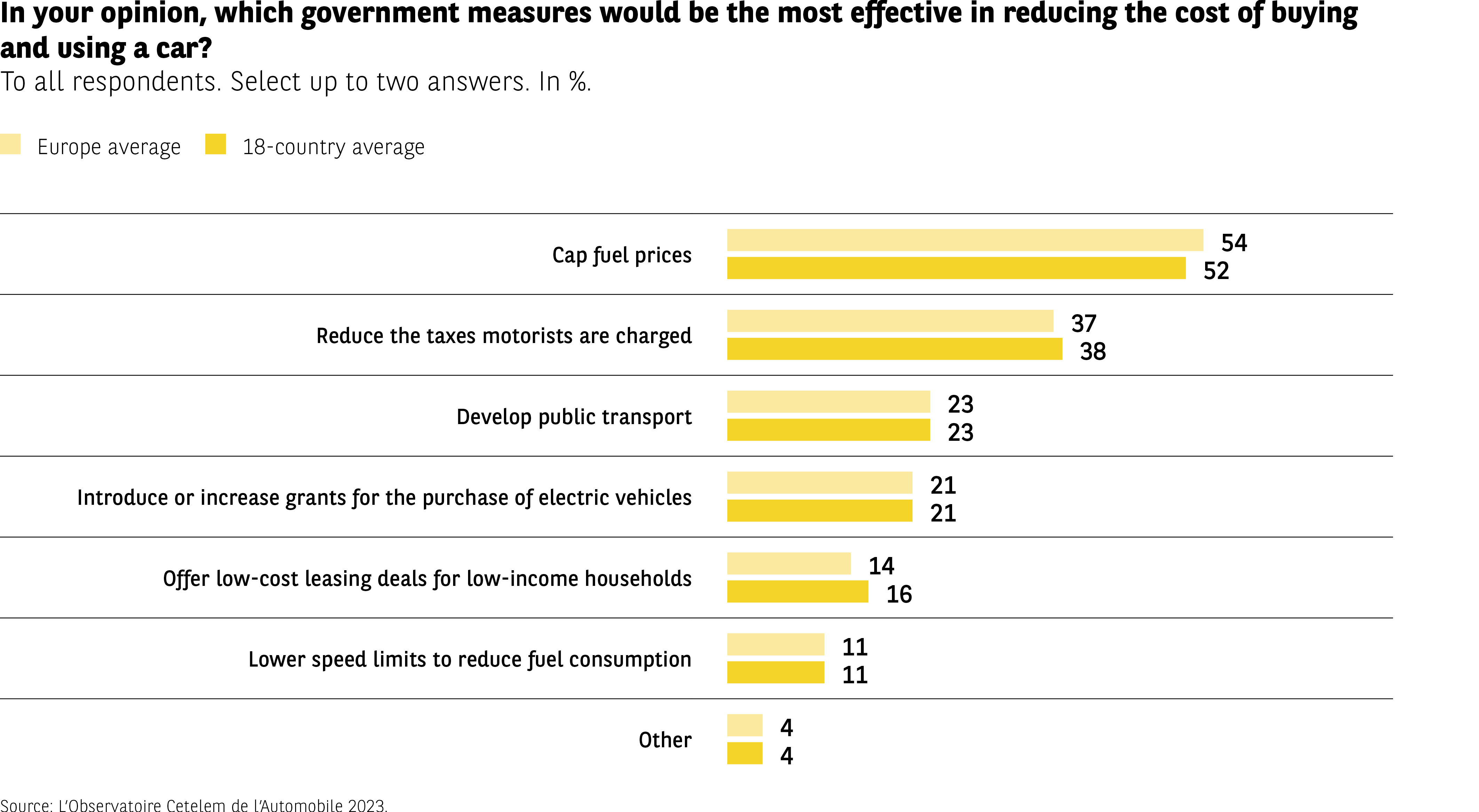

Governments must act

The main type of measure people would like governments to take is financial, with respondents keen first and foremost to see fuel prices capped (Fig 32). 1 in 2 motorists would like to see this happen. Rural dwellers are the most likely to be in favour of such a policy, particularly in France, where 67% are of this view. The Purchasing Power Act passed by the French parliament on 4 August this year includes a measure that grants a discount on the price of fuel, having seemingly taken these demands into account. By contrast, motorists in both China and Japan are less fervent in their desire to see fuel prices limited (36%).

Fig 32 – Expected public measures to reduce vehicle costs

Download this infographic for your presentations Infographic presenting the measures that respondents consider most relevant to limit the cost of purchasing and using a vehicle.

Comparative data between European average → Average of 18 countries :

Limiting fuel costs: 54% → 52%

Reducing taxes on vehicles: 37% → 38%

Developing public transportation: 23% → 23%

Implementing or strengthening incentives for the purchase of electric vehicles: 21% → 21%

Offering affordable car leasing: 14% → 16%

Lowering maximum allowed speeds: 11% → 11%

Other: 4% → 4%

Reducing fuel costs and taxes stands out as a major priority. Measures related to public transportation or electric vehicles achieve similar levels between regions. More structural actions (affordable leasing, lowering speeds) are much less cited.

Source: The Cetelem Automotive Observatory 2023.

Infographic presenting the measures that respondents consider most relevant to limit the cost of purchasing and using a vehicle.

Comparative data between European average → Average of 18 countries :

Limiting fuel costs: 54% → 52%

Reducing taxes on vehicles: 37% → 38%

Developing public transportation: 23% → 23%

Implementing or strengthening incentives for the purchase of electric vehicles: 21% → 21%

Offering affordable car leasing: 14% → 16%

Lowering maximum allowed speeds: 11% → 11%

Other: 4% → 4%

Reducing fuel costs and taxes stands out as a major priority. Measures related to public transportation or electric vehicles achieve similar levels between regions. More structural actions (affordable leasing, lowering speeds) are much less cited.

Source: The Cetelem Automotive Observatory 2023.

Again on the financial front, close to 4 out of 10 motorists would like to see the government lower the various taxes car users are charged. The Poles are the least likely to hold this view, contrary to the Brazilians.

Two other measures achieve almost equal levels of popularity: just over 1 in 5 respondents would like public transport to be developed further and support to be offered to those who purchase electric vehicles. Both solutions are favoured by urban dwellers. When it comes to improving public transport, the opinions of the Chinese and Americans are at odds (36% vs. 15%). As regards support for those who switch to an electric vehicle, Spain and Germany are at opposite ends of the scale (31% and 14%).

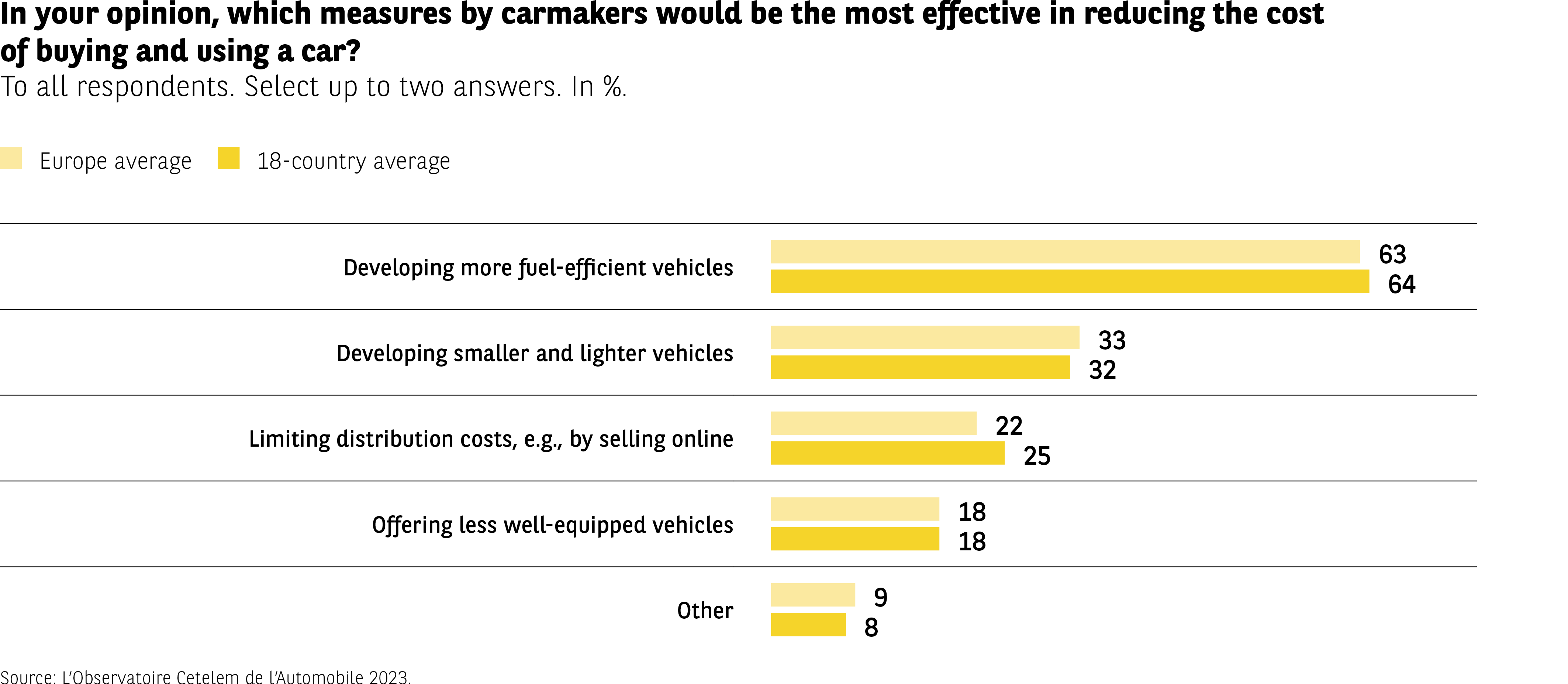

Carmakers need to put their hands to the wheel

If motorists expect a great deal from governments, they also believe that brands should not simply sit back and watch, buoyed by their strong results (more on this later). It is clear that they too will need to place an emphasis on the fuel factor (Fig 33). 64% of those surveyed are of the view that manufacturers should primarily be designing more fuel-efficient vehicles. This is an opinion shared by almost twice as many people as the next item in the list, further evidence of the immense importance that motorists place on this issue. Not surprisingly, the Norwegians and Americans are the least likely to back this kind of measure (56% and 53%). The former is a nation of electric vehicle users, the latter a land of cheap fuel.

Another approach, which aims to reduce fuel consumption via a different route, is to design lighter vehicles (32%). This is an avenue favoured in Germany, which is renowned for its large saloon cars.

Limiting distribution costs and reducing the quantity of equipment fitted to vehicles receives far fewer positive responses, another sign that manufacturers should really be directing their energy towards improving fuel economy, which has a clear day-to-day impact.

Fig 33 – Expected actions from manufacturers to reduce vehicle costs

Download this infographic for your presentations Infographic presenting the actions that consumers expect most from car manufacturers to reduce the cost of using and purchasing a vehicle.

Comparative data between European average → Average of 18 countries (in %):

– Developing fuel-efficient vehicles: 63% → 64%

– Developing smaller and lighter vehicles: 33% → 32%

– Limiting distribution costs (e.g. online sales): 22% → 25%

– Offering less equipped vehicles: 18% → 18%

– Other: 9% → 8%

Energy efficiency is far ahead. The demand for lighter vehicles is notable. Expectations related to distribution or reduction of equipment remain more limited but visible.

Source: The Cetelem Automotive Observatory 2023.

Infographic presenting the actions that consumers expect most from car manufacturers to reduce the cost of using and purchasing a vehicle.

Comparative data between European average → Average of 18 countries (in %):

– Developing fuel-efficient vehicles: 63% → 64%

– Developing smaller and lighter vehicles: 33% → 32%

– Limiting distribution costs (e.g. online sales): 22% → 25%

– Offering less equipped vehicles: 18% → 18%

– Other: 9% → 8%

Energy efficiency is far ahead. The demand for lighter vehicles is notable. Expectations related to distribution or reduction of equipment remain more limited but visible.

Source: The Cetelem Automotive Observatory 2023.

The Essential

- According to 7 out of 10 motorists, buying a car is possible but requires financial sacrifices

- 6 out of 10 people have decided not to travel in the past because of the cost of using their car

- More than 8 out of 10 motorists believe that running costs are increasing

- 3 in 4 motorists could not live without their car

- 7 out of 10 motorists believe their fuel budget is too high

- 1 in 2 people believe car insurance is expensive

- More than 6 out of 10 motorists want carmakers to produce more economical vehicles

- 1 in 2 people want governments to take action on the price of fuel