Saving is down, consumption holds up

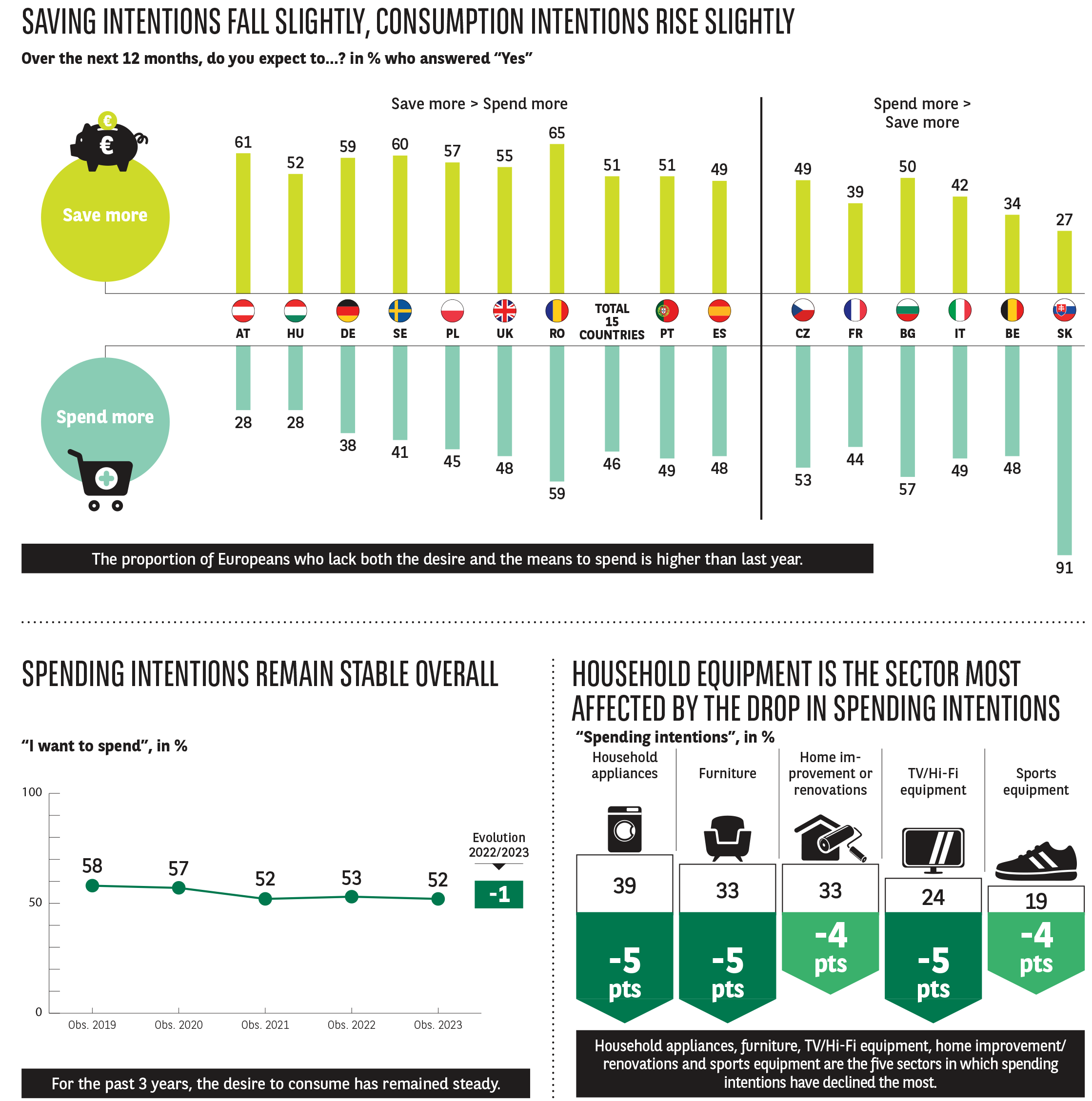

At a time of such uncertainty, with inflation reaching a level not seen for decades and purchasing power declining, one might have expected Europeans to alter their strategy when it comes to saving and spending. But that is not borne out in reality. On average, saving intentions have fallen by 3 points, while spending intentions are heading in the opposite direction, having risen by 5 points.

The desire to save has waned overall

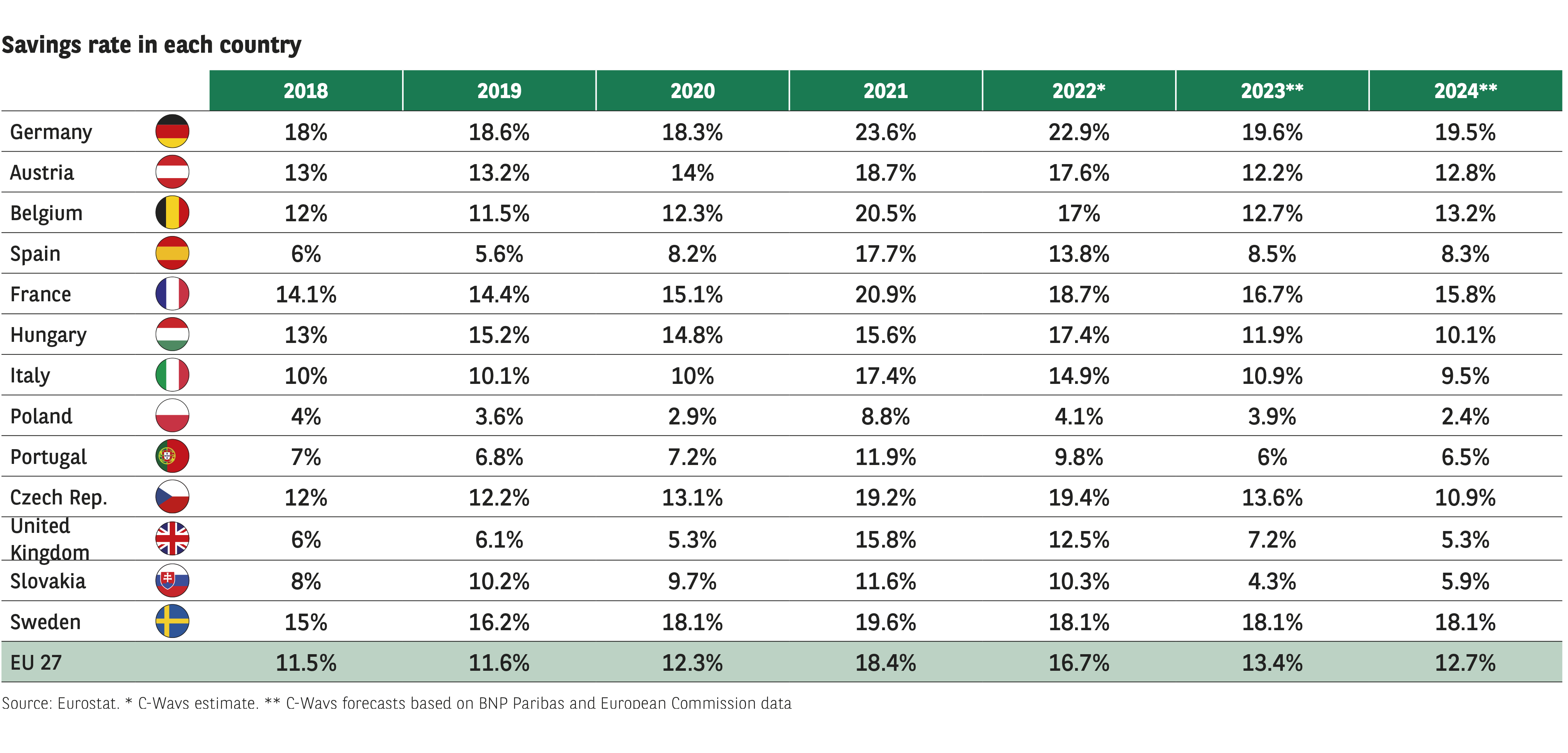

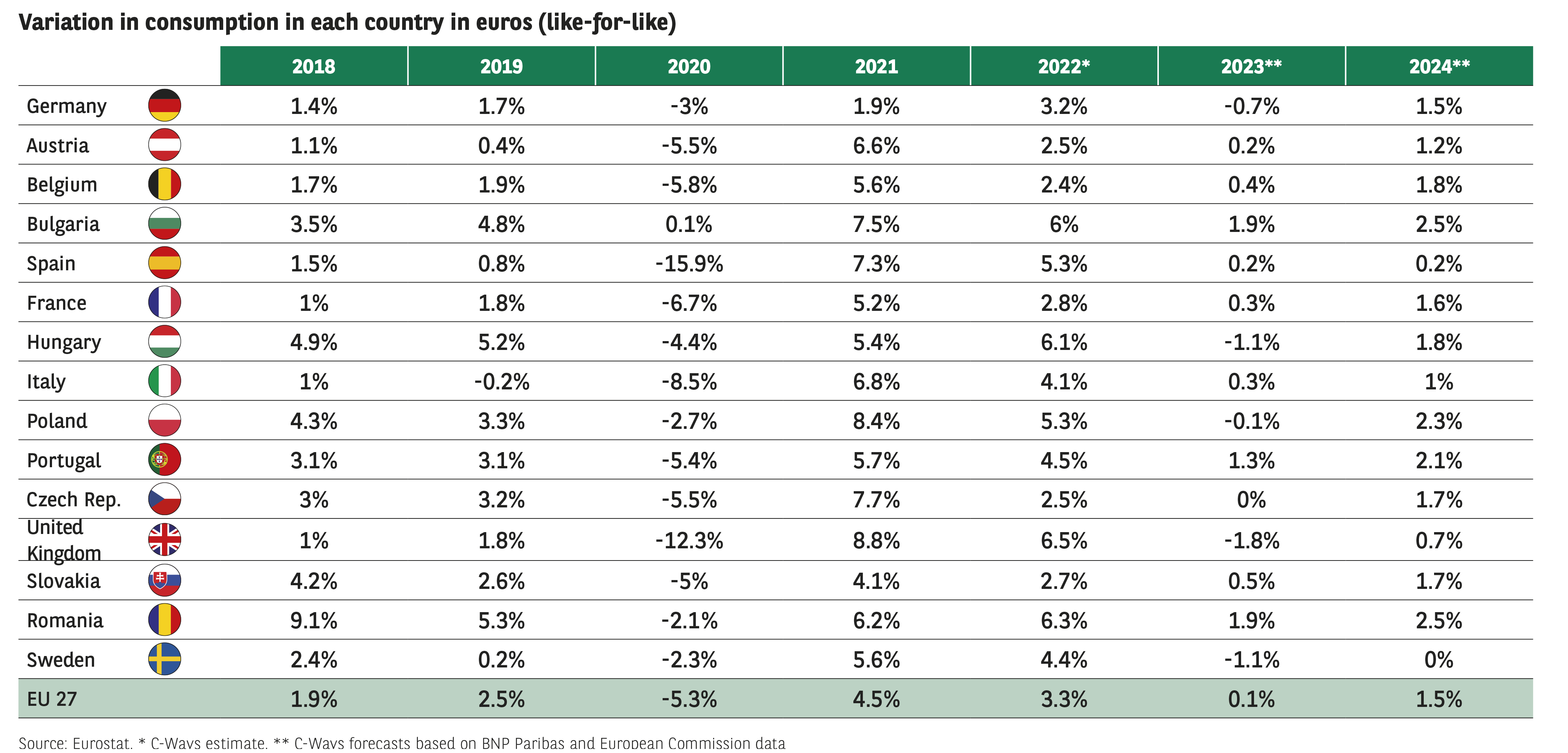

On the topic of savings, it is worth remembering, first of all, that subsequent to the Covid crisis the savings rate increased spectacularly between 2020 and 2021 in every country surveyed, in some cases doubling or even tripling, as was the case in Spain and Poland. These “glass ceilings” are difficult to break through.

The intentions of Europeans only confirm this finding. A willingness to save more can only be observed in 5 countries. At 59% (+7 points), Germany posts a score that it had not attained in the last five years. The country’s dependence on Russian gas, which places Germany at the heart of the Ukrainian conflict, not to mention the almost unthinkable prospect of a recession hitting its economy, probably go some way to explaining this result.

Meanwhile, the desire to save is down in 7 countries, dropping by almost 10 points in Spain, Italy, Sweden and the UK. In these countries, the focus is no longer on creating a larger nest egg, but instead on coping with rapidly increasing food prices, like in Spain, or skyrocketing energy bills, like in the UK. This is another issue on which the Eastern European countries are relatively homogeneous, with saving intentions shifting little, if at all, compared with last year.

An expectation of constrained consumption

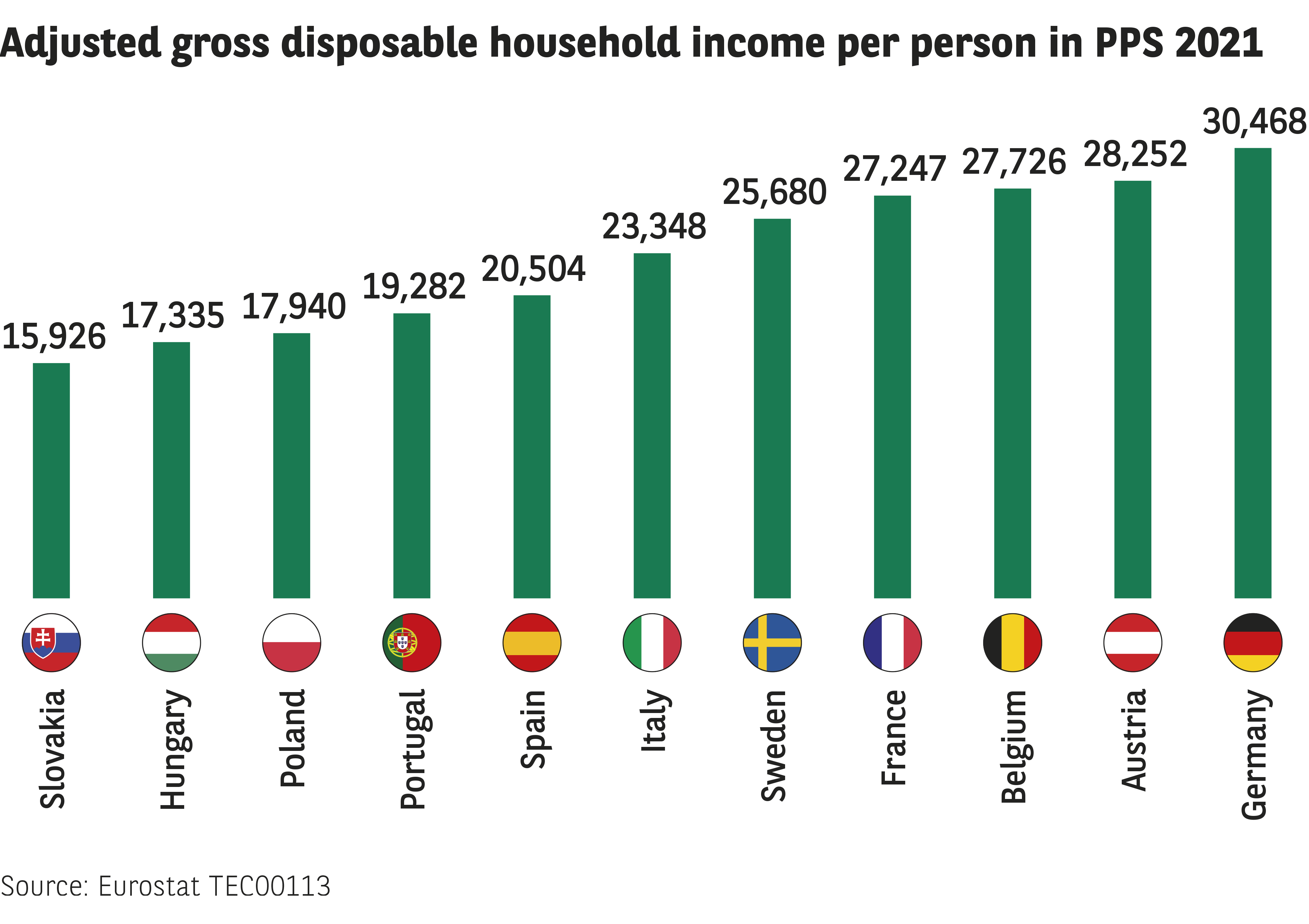

The expectation that personal expenses will rise has shifted somewhat. Only in two countries, Poland and Austria, has it fallen slightly (-3 pts and -1 pt). In 11 countries, increases are the order of the day, in some cases to a striking degree, such as in Portugal (+13 pts), but also Sweden and Slovakia (+9 pts and +8 pts). Once again, as has been the case for the last five years, the latter is the nation at the top of this specific ranking, with a spectacular 91% of respondents expecting their expenses to increase. Slovakia probably stands apart from the other Eastern European nations because of its membership of the eurozone, which shields it from erratic currency fluctuations. Yet Slovakia is the country with the lowest income levels.

Against a backdrop of multiple crises, these results highlight the current pressure on consumption, with spending now directed towards what is necessary and essential for daily life, even though these items are going up in price.

After the post-Covid recovery of 2022 (+3.3% in Europe), real consumption levels will stagnate in 2023 as a result of this pressure.

Adjusted gross disposable household income per person, expressed in PPS, is calculated by dividing the adjusted gross disposable income of households and non-profit institutions serving households (NPIs) by the purchasing power parities (PPPs) of actual individual household consumption and by the total resident population.

The desire to consume is stagnating

The spending intentions expressed by Europeans in this latest Barometer support this assessment. Indeed, they are 1 point down compared to last year, with 1 in 2 Europeans expressing a desire to consume. What is significant is that 1 in 4 state that they have neither the desire nor the means to spend, a figure that has increased by 3 points.

As a sign of the gloom that is gradually spreading among consumers, 10 countries report a fall in spending intentions, with Germany once again proving the most pessimistic of the Western European nations (-6 points). Another sign that people are not in the mood to indulge comes from Slovakia, which usually leads the pack in terms of spending intentions, but now sits at the bottom of the ranking (38%).

While almost every consumer sector is affected by the European downturn, the household equipment segments are the most exposed. Now is no longer the time for enforced cocooning, as it was when the pandemic fuelled people’s urges to redecorate, take up cooking or partake in indoor sports. Household appliances, furniture, TV/Hi-Fi equipment, home improvement/renovation and sports equipment are down almost 5 points.

Infographic N°5

Download this infographic for your presentations