Inflation and purchasing power: europeans are taking a hit

We concluded the previous Cetelem Barometer with the following sentences. “It goes without saying that the impression that prices are rising is shared in many countries. The fact that these results co-exist with an impression among Europeans that their purchasing power has remained stable indicates that, when it comes to weighing up what has happened in the past and what might occur in the future, the economic sense and rationality of consumers is often more sophisticated than they are given credit for. One would wager that, barring a sudden inversion of price trends next year, which seems unlikely, by then many more Europeans will feel that their purchasing power has deteriorated.”

The inevitability of inflation

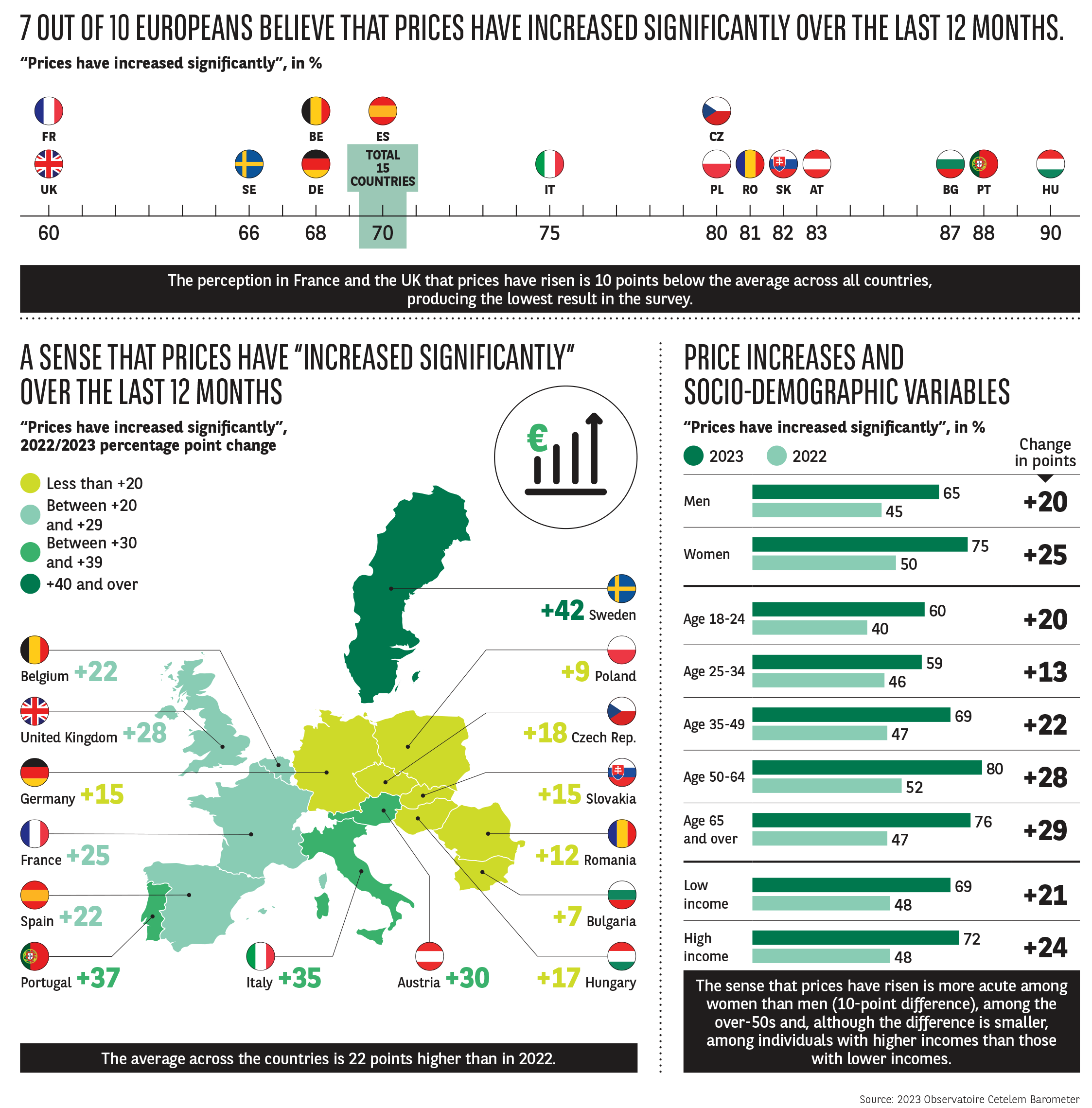

This year’s Barometer serves to confirm what was foreseen a year ago. When it comes to inflation, Europeans had more or less predicted what would transpire, so it is unfair to pass them off as scaremongers, given how close their perceptions were to the reality. According to 9 out of 10 Europeans, price rises are now a fact of life. More strikingly, 7 out of 10 believe that prices have risen significantly. When the figures are so high, it is pointless to search for national differences that do not exist. All the countries surveyed are aligned on the topic of rising inflation. However, Northern and Western European countries are more likely to report a clear increase in prices than last year.

The score is up 42 percentage points in Sweden, 37 points in Italy and 35 points in Portugal, while the average increase stands at 22 points. With a leap of 25 points, France posts a near-average result.

Conversely, the Romanians and Poles post the smallest rises (7 and 9 points, respectively).

Northern and Western countries face up to reality

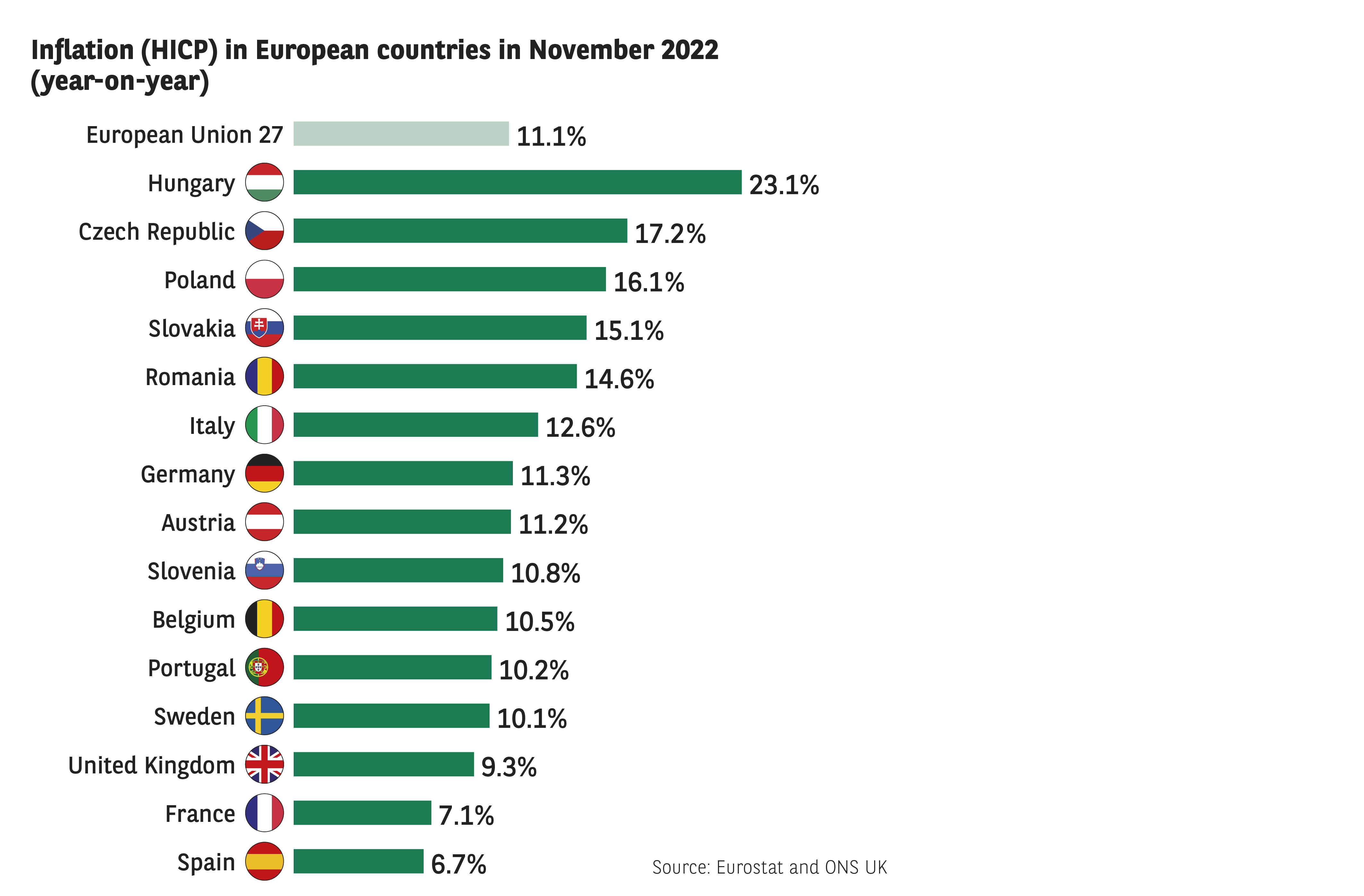

If we compare these different scores to actual inflation rates, the Northern and Western nations seem to have suddenly been plunged into a world where inflation had been lying dormant for years and has now been awakened by an evil Prince Charming. Inflation rates in Eastern Europe were already high, therefore the feeling that they have increased is less dramatic.

And while France boasts the lowest percentage of people who believe that prices have increased significantly, this is probably due to the lowest 2022 rate of inflation of all the countries in this survey.

Socioeconomic factors count

On the question of inflation, it is also useful to mention some of the socioeconomic markers highlighted by the Cetelem Barometer. With regard to gender, more women than men bemoan the significant increase in prices (a difference of 10 points). This is probably because it is still mainly they who shop for day-to-day groceries and pay the household bills, meaning that they see this tangible inflation with their own eyes. In terms of age, over-50s are more concerned about price increases than their juniors (the difference between 50-64 year olds and 18-24 year olds is 20 points). In contrast, differences according to income and place of residence are less pronounced. With regard to the latter, the inhabitants of the least populated areas are more likely to express such views.

A drop in purchasing power that mirrors the rise of inflation

As noted previously, no further evidence of the economic perceptiveness of Europeans is required.

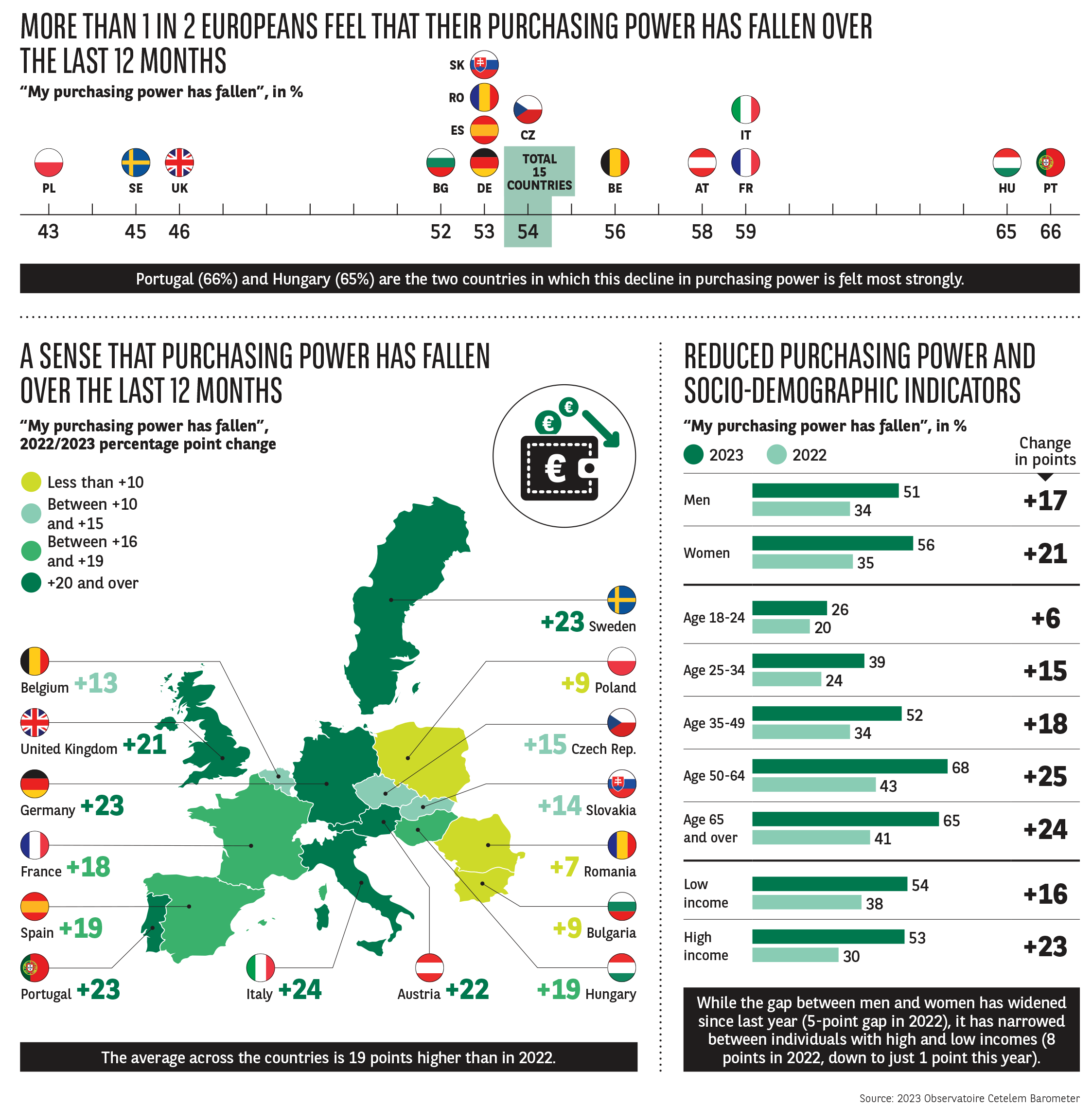

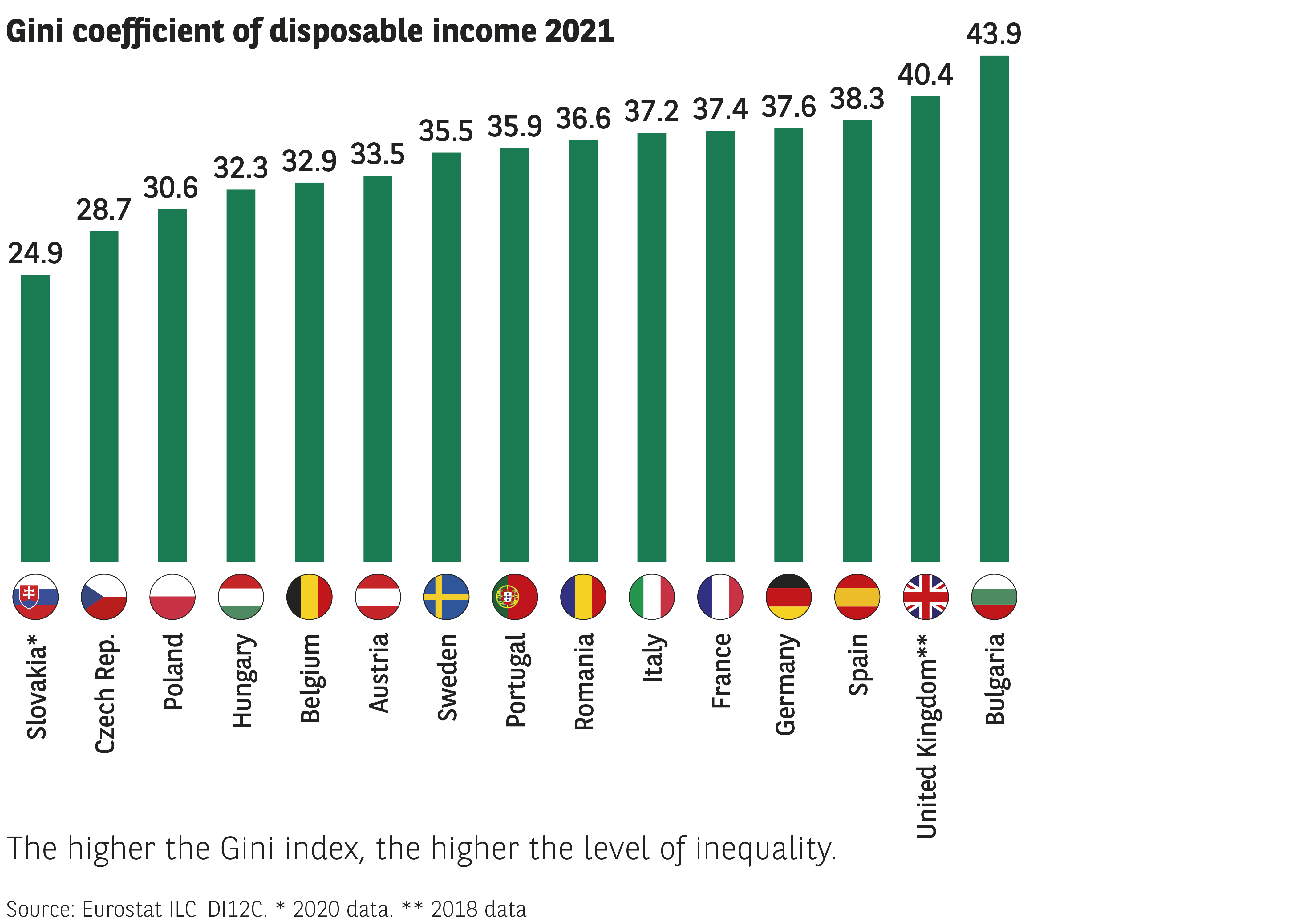

Thus, the sense that purchasing power has fallen significantly has increased by a similar proportion to the rise in inflation, with the two metrics forming almost parallel trend curves. More than 1 in 2 Europeans believe that their purchasing power has fallen, a figure that has increased by an average of 19 points compared to last year. And this mirroring effect is a recurring one, since it is once again the countries of Northern and Western Europe that are the most prone to this decline. Italy, Sweden and Portugal remain at the top of this ranking, joined this time by Germany and the UK. At the other end of the scale, Eastern European countries are again less likely to report a decrease than their Western European counterparts, where inequality tends to be greater. However, it should be noted that, on the whole, the differences observed between the countries in terms of falling purchasing power are much smaller than the differences in inflation rates.

The economic perceptiveness of Europeans

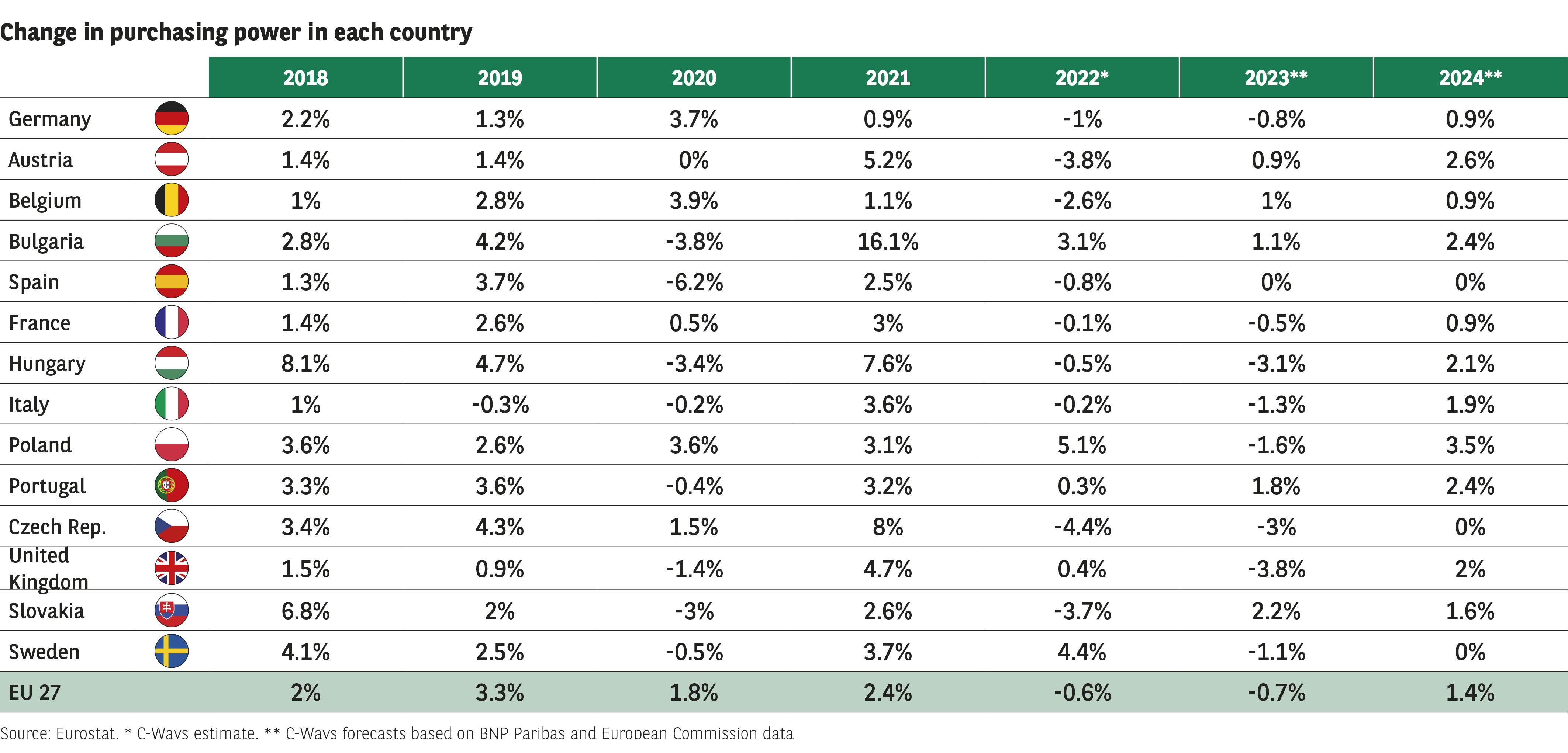

The actual data on purchasing power trends serves to demonstrate the perceptiveness of Europeans. Although growth remains positive in all the countries covered by the survey, economies are contracting overall (with the exception of Romania and Portugal), both as a result of the inflation shock and as a reaction to the bounce back that occurred in 2021 when the effects of the public health crisis died down.

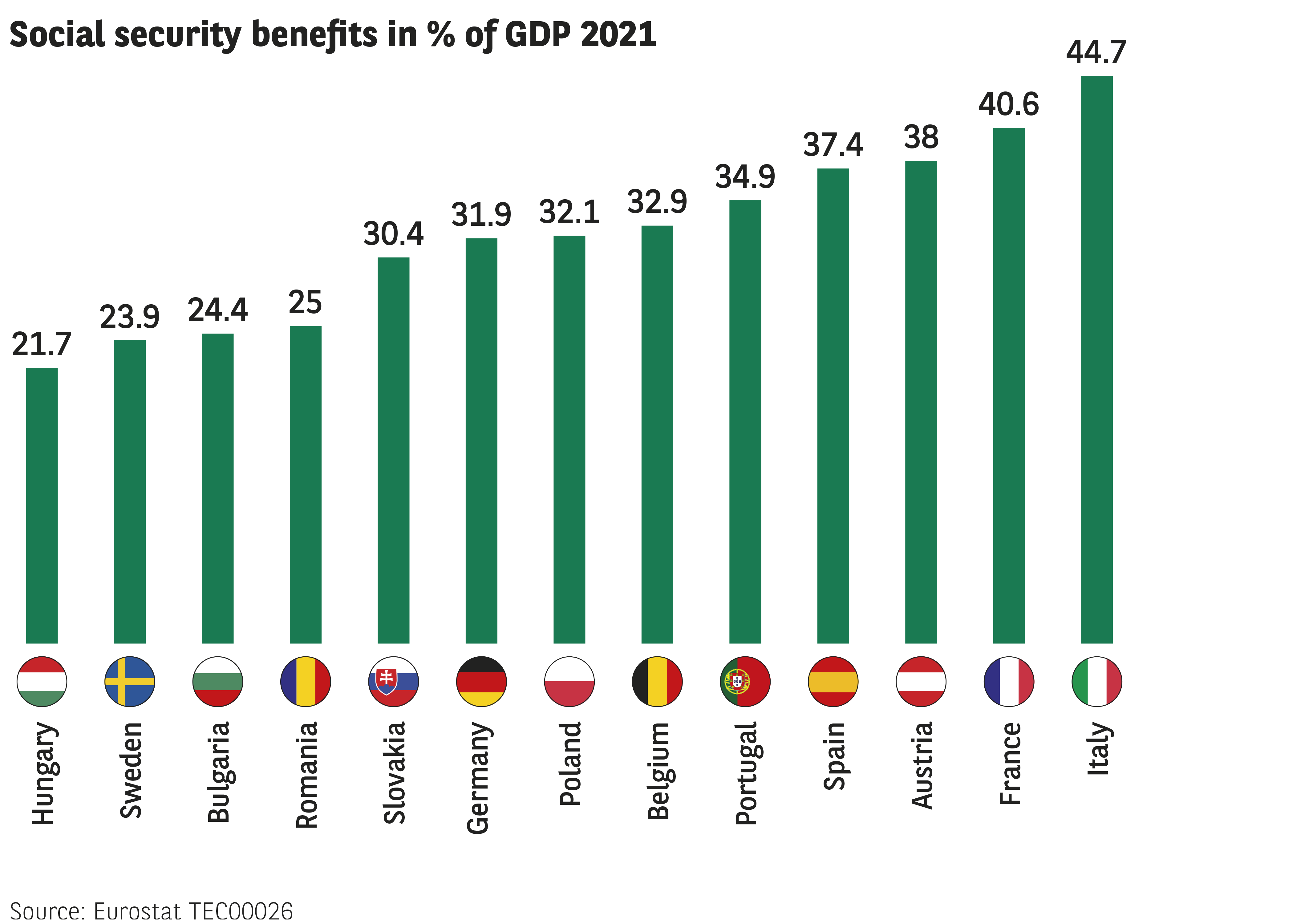

The year ahead looks as though it will be even bleaker, with recession rearing its head once again and almost certainly set to impact major countries such as Germany and the UK. It is therefore very probable that the next Cetelem Barometer will reflect this reality. To arrest this spiral, support plans and other protective measures have been introduced in many countries, not least to enable households to withstand the energy crisis (aid plans worth €200 billion in Germany, €66 billion in Italy, €150 billion in the United Kingdom, and a €44 billion tariff shield in France in 2023, in the wake of a €24 billion package in 2022). This does not include the substantial social benefits provided in some countries, including Italy and France, which help to maintain purchasing power.

The same socioeconomic differences

Socio-demographic factors also confirm the mirroring effect observed earlier. Once again, women and the over-50s are the most likely to feel that their purchasing power has fallen, with the gender gap widening further in this respect since last year. Residents of mid-sized cities are also more likely to be of this view. The “income” variable still has no real bearing on the results. Having previously stood at 8 points, the gap between high and low incomes is now just a single point.

Infographic N°3

Download this infographic for your presentations

Infographic N°4

Download this infographic for your presentations