Satisfying consumer demands

A welcome breath of fresh air

72% of motorists declare that they are sensitive to new market launches. The scores are particularly striking in the emerging countries (88%), Brazil in particular (91%). Europe and the United States are not far behind (69% and 60% of motorists, respectively, say they are sometimes tempted by the new models launched), a sign that product offerings have a decisive influence in mature markets. Once again, Japan is the exception, with just one in three motorists liable to splash out on a new model.

The ever increasing beauty of cars

The automotive industry’s ability to reassess itself and understand the expectations of consumers is also demonstrated by the aesthetic changes that have taken place. To meet the emotional needs of motorists, many manufacturers are going for clever and audacious designs, which are more likely to appeal to the hearts of consumers. The trend for novel or «neostalgic» styling (examples include the Mini, Fiat 500 and Range Rover Evoque) has already proved the worth of this strategy.

These same manufacturers have also jumped aboard the concept of «à la carte» cars. As a counterpoint to strict safety and environmental regulations, customisation has emerged as a new way of attracting consumers. Initially the preserve of a handful of luxury brands and segments, more and more customisation options are being offered by mainstream manufacturers. The aim is to propose, not impose. Far behind us are the days when, to quote Henry Ford in 1908, «People can have the Model T in any colour, as long as it’s black».

In China, the automotive cultural revolution is underway. Vehicle customisation is particularly popular in the country and the image of homogeneous saloon cars with tinted windows is on the wane.

More daring still, some car makers such as PSA are banking on a new form of customisation: olfactory design. The intention is to improve air quality inside the car and enhance the sensory experience of passengers by offering a system capable of emitting certain fragrances according to the atmosphere chosen by the user. These new features have captured the imagination of motorists. Between 80 and 96% of those surveyed acknowledge the advances made in car design. The Japanese are alone in displaying a real degree of nostalgia, with one in five motorists believing that current models are less attractive than those of 20 years ago.

A green trump card

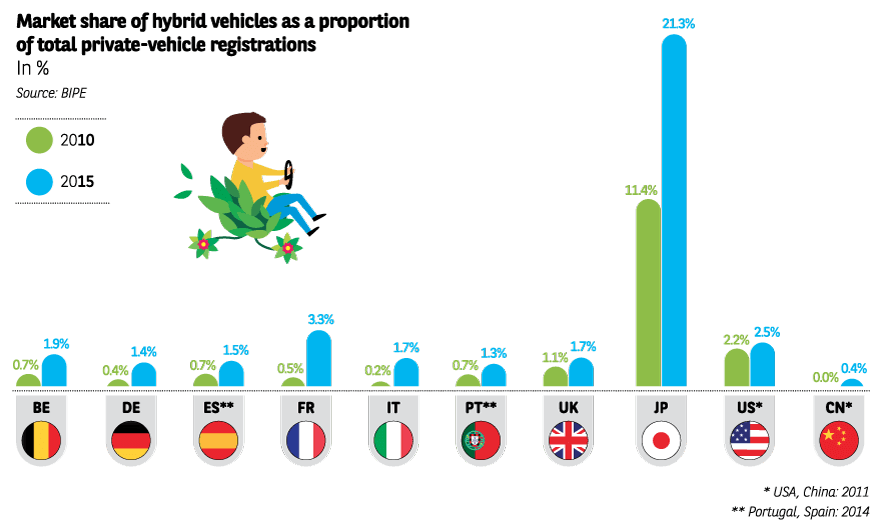

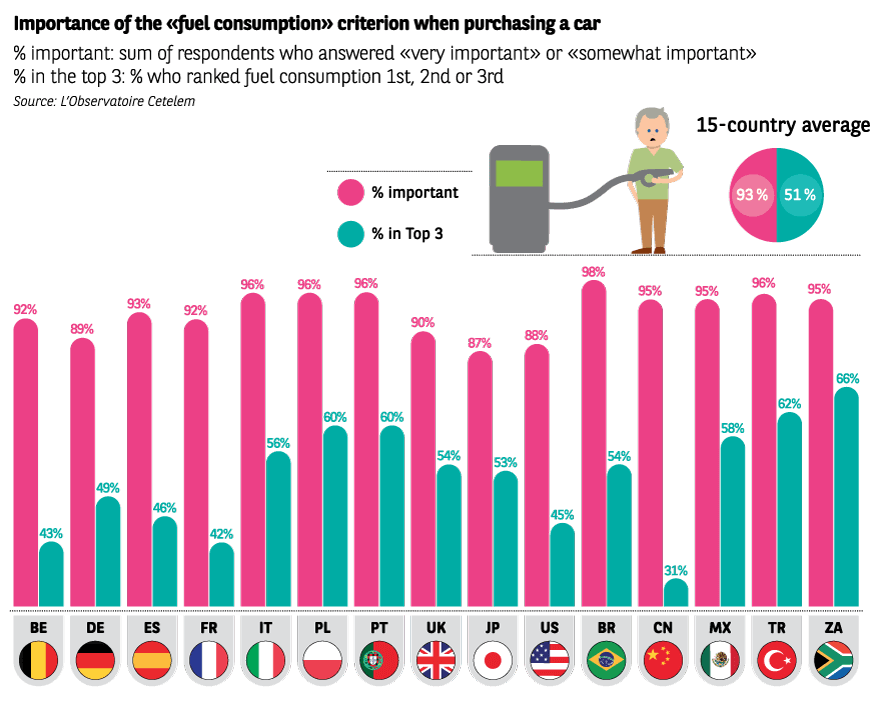

Manufacturers have also shown that they are prepared to listen to motorists’ demands for more eco-friendly vehicles. Indeed, 93% of motorists state that they are mindful of their vehicle’s fuel consumption. More than half include this factor in their top 3 purchasing criteria. Thus, while the success of Toyota, which leads the way when it comes to the market penetration of hybrid engines, remains an exception in the global automotive landscape, technologies combining fossil and electrical energy have made significant progress in terms of sales.

All the evidence points to the trend continuing, given the expectations clearly expressed by consumers. With an average of 7.3 out of 10, hybrid technology scores the highest among the engine types mentioned. With many believing that their range and recharging infrastructure are still too limited, fully electric vehicles (6.6/10) have failed to move above traditional energy forms (petrol and diesel also score 6.6/10), in which manufacturers continue to invest in the aim of improving efficiency.

The french get plugged in

With a market share of close to 1%, France is top of the class when it comes to fully electric vehicles. China follows with 0.7%, but the segment is growing at a particularly rapid rate in the country (sales quadrupled in 2015).