Segmented offerins with wide appeal

SUVs gain further ground

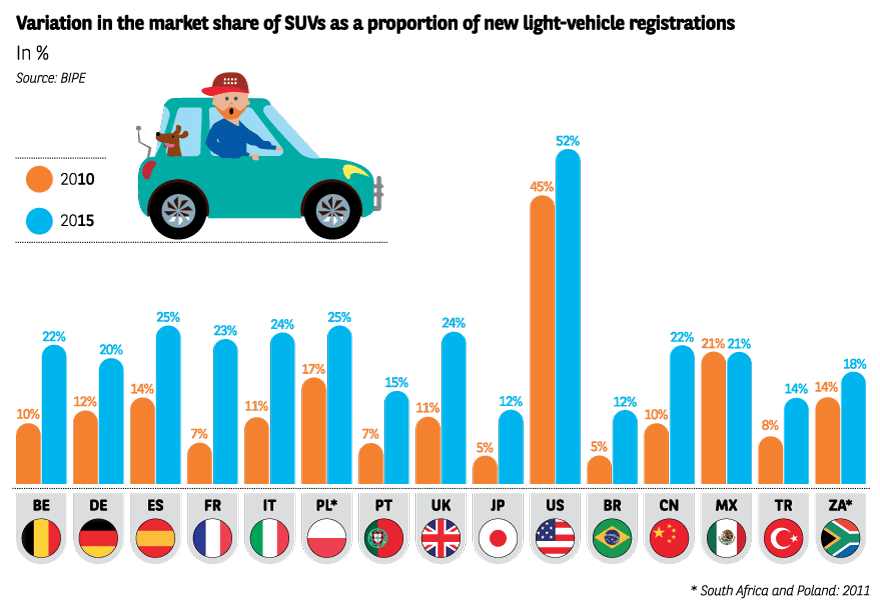

The SUV segment has been the quickest to get back to speed. Already accounting for more than 50% of light-vehicle registrations in the United States (pick-ups included), the market share of SUVs in Europe leapt from 8% in 2010 to 20% in 2015. Their popularity is particularly striking in Italy (22%), Spain (21%) and the United Kingdom (20%). Even in Japan, where sales growth remains tentative, these models have become favourites among motorists, particularly the younger generations. The same can be said of the emerging countries, with SUVs now accounting for almost a quarter of sales in China.

SUVs are well suited to urban driving and generally meet the toughest environmental requirements. As well as their practicality and fun design, there is something altogether reassuring about these vehicles. In certain countries, including China, great importance is placed on the social status they convey. This makes sense when one considers that 70% of motorists in the emerging countries, and as many as 82% in China, believe that the image projected by their car in terms of living standards and social status is crucial, compared with a 15-country average of «only» 52%.

Every brand has seized the opportunity to harness and even anticipate this consumer trend. The Nissan Qashqai, which initiated the phenomenon in Europe, the Renault Kadjar, the Volkswagen Tiguan 7-seater, the Peugeot 3008, the Audi Q2 and the Mercedes GLC coupé are just a few of the many models available. One of China’s great success stories is Haval, a sub-brand of Chinese car maker Greatwall that is entirely devoted to SUVs. Several new players, including Seat, Skoda and Subaru, not to mention Jaguar and Maserati, will soon be taking their first steps in the segment.

Premium brands find new buyers

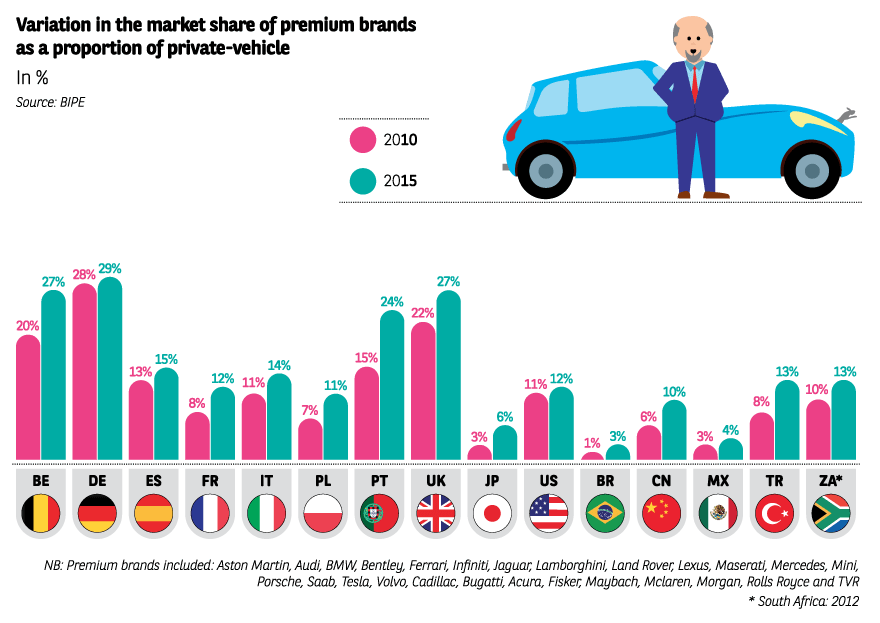

Another illustration of the renewed health of the car market is the growing interest of motorists in premium brands. Between 2010 and 2015, their sales increased significantly.

In China, their market share almost doubled, rising from 6% in 2010 to 10% in 2015. Hitherto focused on traditional large saloon cars, premium brands are now investing in more compact segments, which are particularly prized by young women from the wealthier classes. The appearance on the market of a new generation of second-time buyers (the first cohort to replace their vehicles since the market took off 10 years ago), also explains why premium brands are doing such good business. Indeed, replacing one’s vehicle often means making a move up-market. What’s more, the purchasing restrictions imposed in large cities naturally favour potential buyers with the highest incomes, who are obviously more likely to opt for premium brands.

In Europe, the market for new high-end cars continues to be fuelled by businesses, first and foremost. Finance solutions such as leasing allow manufacturers to offer competitive instalment plans that enable the cost of buying a car to spread over a period of time, while guaranteeing fuss-free motoring (servicing and maintenance is included in the fees paid). Another advantage of buying these premium vehicles is that they boast a relatively high residual value. With households now able to access these financing solutions, all the elements appear to be in place for Europeans to realise their dreams more easily. 53% have already stated their interest in high-end vehicles.

In the United States, a market populated by a number of brands without a presence in Europe (Cadillac, Lincoln, Acura, etc.), the premium market is still dominated by German luxury car specialists BMW and Mercedes. High-end manufacturers enjoy a 14% share of overall sales, a figure that has remained stable over the last five years. Japan is the exception to the rule when it comes to global market trends, but high-end brands still increased their share of sales in the country between 2010 and 2015. In South Africa, which is home to BMW and Mercedes plants, premium brands are also going strong (13% of sales in 2015).

A bright future

At the heart of what one might call a «techno-craze» triggered by the economic, societal, environmental and scientific context, the car serves as a catalyst for innovation. The sector is attracting new industrial and technological players. Its appeal is also rising among a clientele whose needs were apparently not met by traditional vehicles. Focusing on autonomous vehicles and new automotive technologies, L’Observatoire Cetelem de l’Automobile 2016 revealed that one in three motorists would use their car more frequently if it was connected.

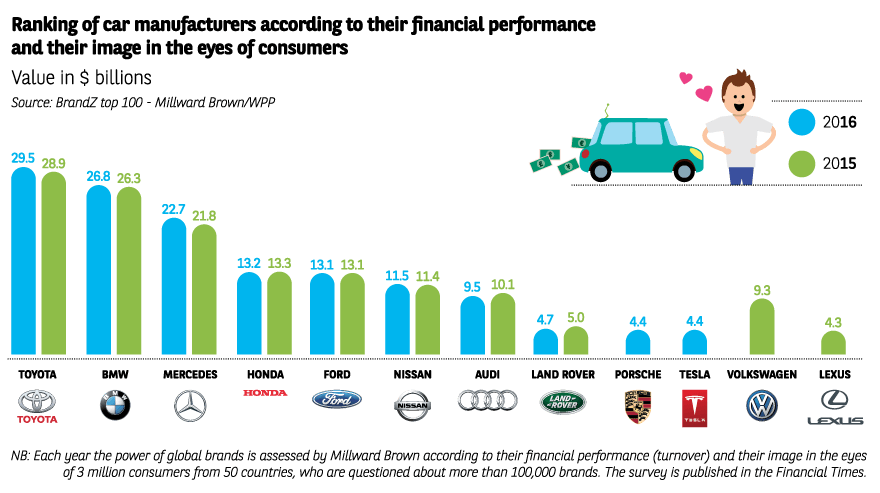

One new entrant in particular has received a great deal of attention. Tesla, the first US car maker to be floated on the stock exchange since the 1950s, is a product of Silicon Valley and has made a speciality of high-end electric vehicles. Its ambition is to attain the same stock market value as Apple by 2025. The rapid increase in the firm’s worldwide popularity between 2012 and 2015 is undeniable. What’s more, it is said to have And in 2016, the brand featured among the top 10 most valuable car brands of the Millward Brown BrandZ ranking, a sure-fire sign that «the future is now».

Consumer Testimonies

« Connected cars, like the Tesla I tried recently, really appeal to me. This is more than just a vehicle. The fact that it is connected allows you to do anything you can do on a normal computer. This is great for techno-geeks, because you really feel at home! »