Back to basics: everyone gets what they need

Whether winning new customers or creating loyalty, the offer must first meet the needs and expectations of the demand. The make must of course inspire trust, especially in the quality of their models, but they must also make sure that prospects and customers buying a new car find what they are looking for in the choice offered.

The right model at the right price

In this sense, the range breadth and diversity, in terms of pricing, outline or powertrain, play a decisive role in loyalty among customers whose needs and desires change regularly. At each phase of life (moving home, having children, changing jobs, etc.), car needs change. And even if their first reflex is to go back to their own make, the make in question has to be able to offer the right model at a suitable price. We have seen how top German makes invested and competed in increasingly compact segments (BMW Series 1 and Mini, Audi A3-A1 and new A Class) to win, and keep new clienteles.

Multiplying makes

To increase their chances of being in phase with the fluctuating needs of demand, without having to multiply the number of models they put out, manufacturers have chosen to widen their range of makes through acquisition (Volkswagen has bought 8 makes in the automotive sector alone), or by creating new makes to satisfy needs for premium advantages (DS for PSA Peugeot-Citroen), or more functional ones (Dacia for Renault-Nissan).

One platform, several vehicles

However, with needs, desires also change, and accumulating makes is not enough to continue pleasing the customer. Ranges including completely new models or “restyled” old models have to be presented on a regular basis. To conjugate long-term repeat buying and economic performance, industries have found a solution: platforms – single production lines that produce several models with different types of bodywork without having to multiply investments in the industrial tool and assembly lines.

New models, new trend

For instance, how could you imagine keeping your loyalty rate high without proposing the famous SUVs or Crossovers, which have become the darling of motorists in the last few years?

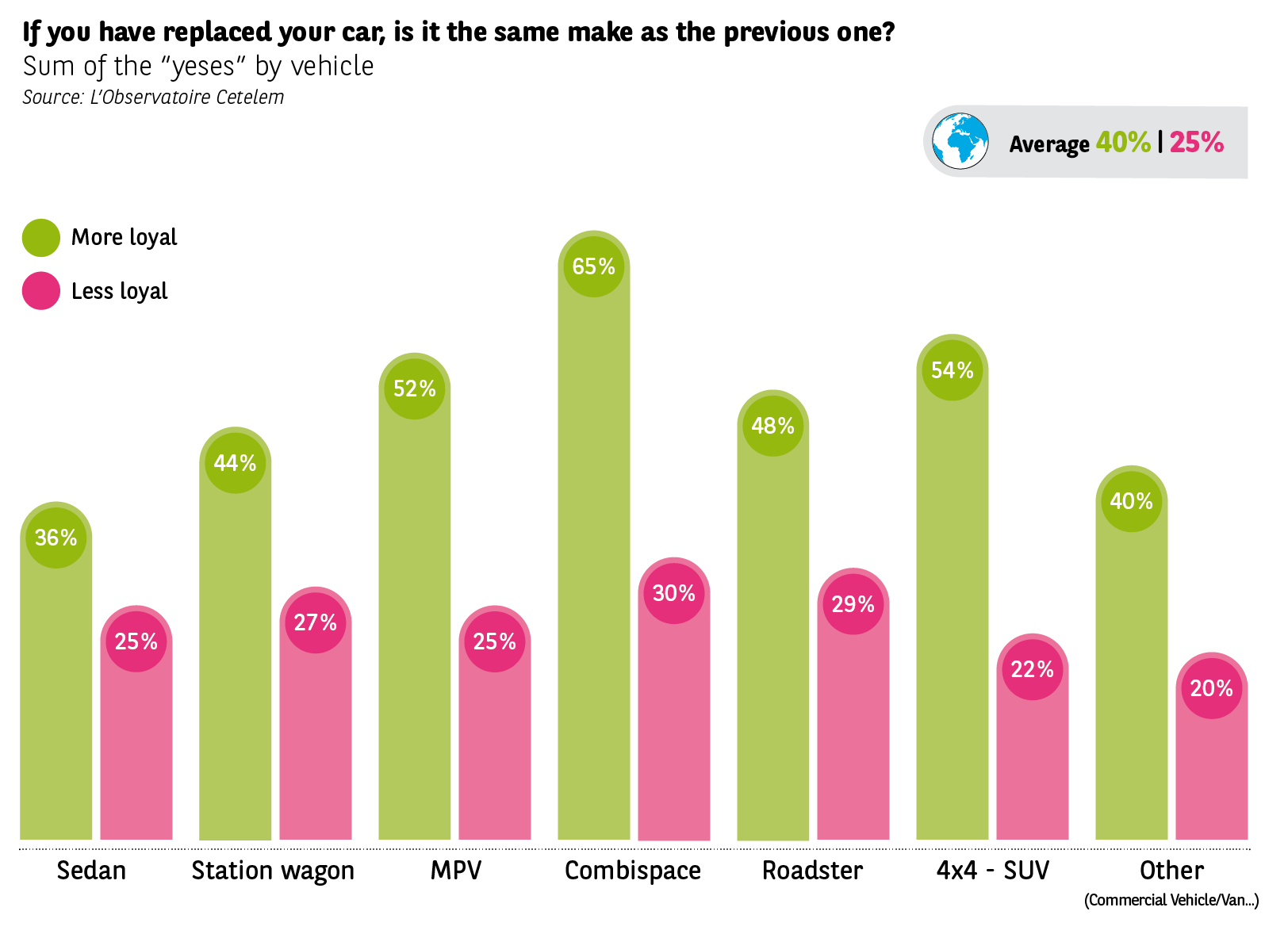

Changing a vehicle’s outline is a high risk area for makes. Only 25% of repeat customers who change their car and car outline at the same time will stay loyal to their make compared to 40% who choose not to change outline.

Knowing what to count on

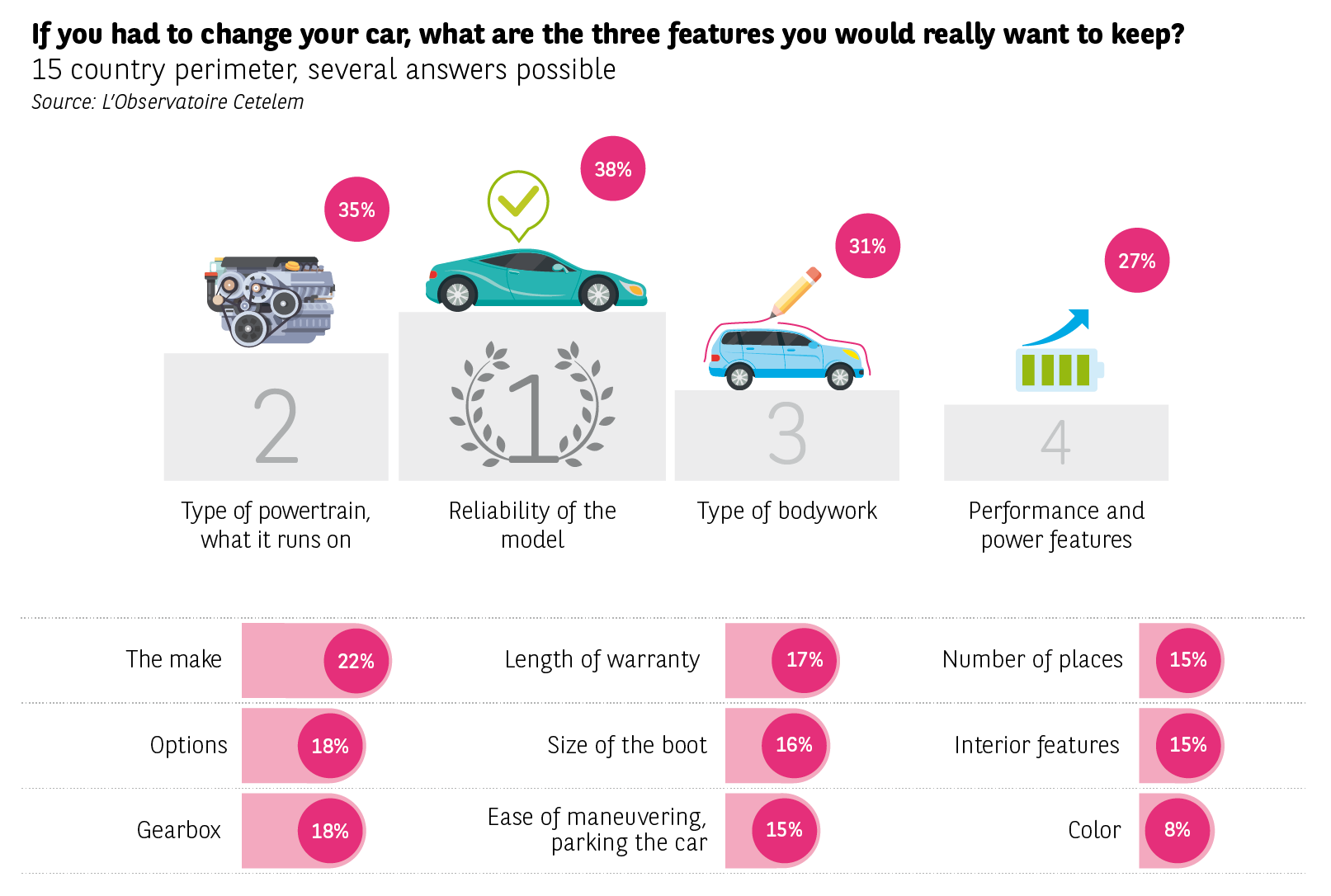

Change is happening in a kind of continuity. When it is time to change cars, customers base their choices on certain values in this world of frenzied choice. Reliability (38%), type of powertrain (35%) and outline (31%) are the triptych of these values sought by the motorists interviewed. It’s worth pointing out that the Italians, Portuguese, Turks, Mexicans, and French are the most attached to the powertrain.