Pulling more than one lever

The right price, of course

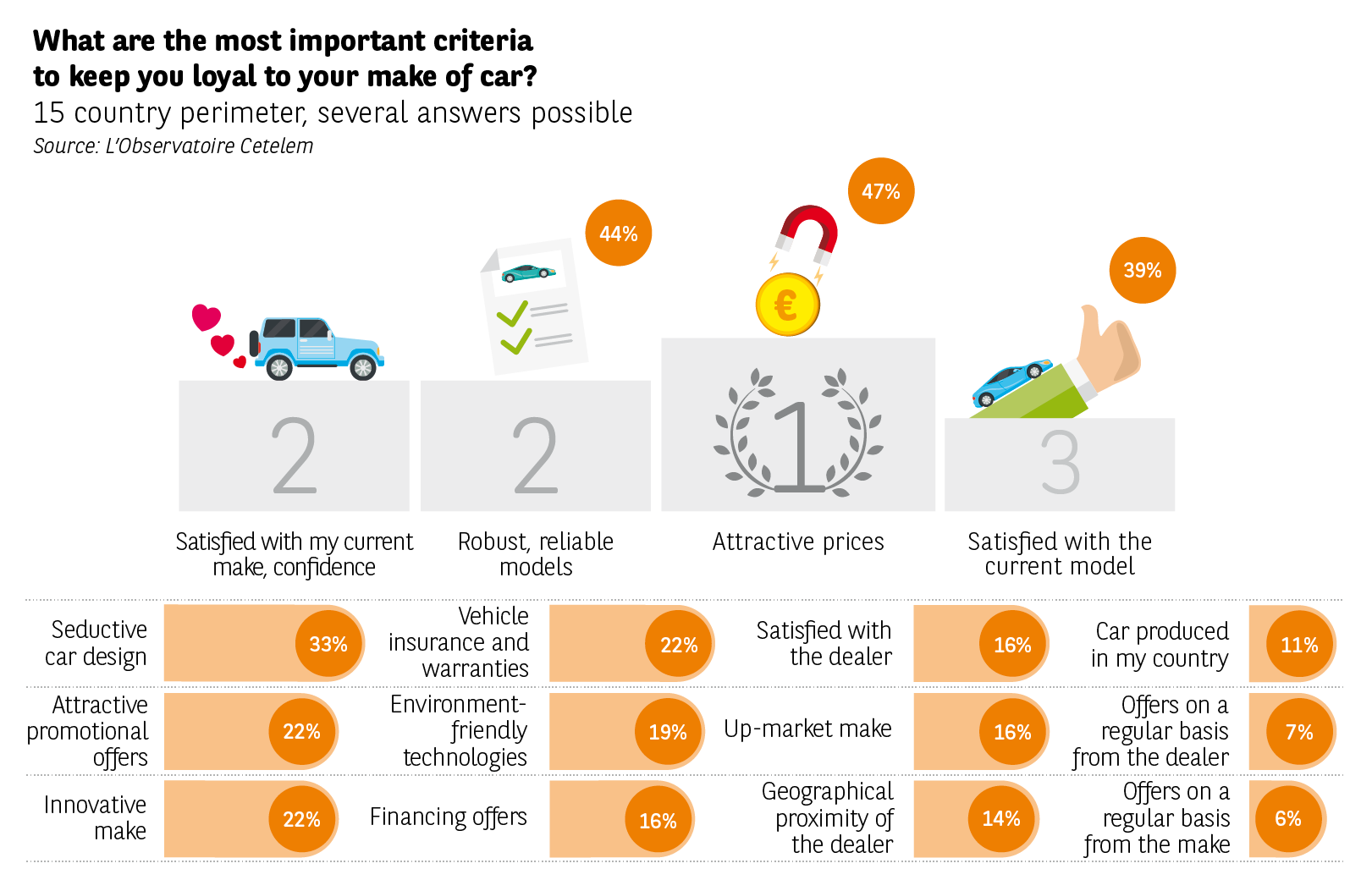

The formula may seem trivial, but loyalty also depends on price. When motorists are asked to rank their loyalty criteria, price comes top of the list with 47% of votes ahead of robustness and brand confidence. This top-ranking criterion is quoted by more than 1 respondent out of 2 in South Africa, the United States, Brazil, Turkey, and also in Germany where households often pay considerable prices for cars.

Because the transportation budget is the second biggest budget item after housing almost everywhere in the world, it’s no wonder that price is a decisive factor when it comes to buying. What’s more, vehicle sophistication, taxation, and running costs (fuel, servicing, insurance, parking, etc.) have for a long while been on a steady upward trend that has outstripped purchasing power.

With the low cost trend and longer ownership and vehicle lifetimes, resorting to the second-hand market is one of the most tangible signs of the quest for cost performance, especially through transactions among private individuals, which provide the advantage of sidestepping distribution costs. In this respect, the distribution channels can take advantage of untapped progress resources.

Second-hand cars: the first chance to aim for loyalty

The second-hand car trade has long remained the neglected stepchild of the automotive business. Today, the ranks of recent second-hand vehicles swelled by leasing returns have earned their badges of honour. But older cars in the 3 to 5 year bracket are often left to the CtoC (Consumer to Consumer) sector with the majority of transactions occurring on online platforms. While this market does involve certain difficulties (cars need reconditioning, higher breakdown risk, etc…), it’s also the main doorway into the automotive market for youth and low income categories. One day, these customer groups will switch to the new car market with loyalty-enhancing fond memories of their first make and their first vendor.

Long-term leasing, long-term relationship

While lowering prices appears to be a sure-fire lever for loyalty, it’s not the easiest. The temptation of an all-out special offer is strong, but a discount can’t do everything. This is because the customers seek overall savings, optimised total ownership cost over time and the ability to manage this cost dependably. A magic formula appears to exist for this budgetary control for better car running costs. A loyalty-enhancing formula. Otherwise known as leasing, hire-purchase or long-term rental.

The growing appeal this formula exerts on households, especially (and above all) for hire-purchase, seems to back this assumption up. They are switching to the subscription economy just like the business world did before them. The formula is developing in the new car market, and if the advertisements of several makes are to be credited, the second-hand market will soon follow suit. Although they may not be more present, leasing households are set to feature more regularly and more predictably on this market. This is clearly an opportunity for building loyalty. The C-Ways survey conducted in France in 2017 shows that loyalty rates for leasing customers at the end of their contract stands at 37 points above their classic ownership counterparts.

This grassroots movement towards abandoning car ownership appears to be the unavoidable next step. All makes are now using this concept to different extents. Polestar is an extreme case: Volvo’s 100% electric make rolled out its new model exclusively to orders under a two to three year subscription scheme.

In addition to budget visibility, packaged and built-in services plus the attraction of always driving a recent model, the leasing formula caters to motorists’ appetite for change. Almost ¾ of them renew their leasing contract for a new vehicle before its term. Changing cars, not makes.

Converging opinions

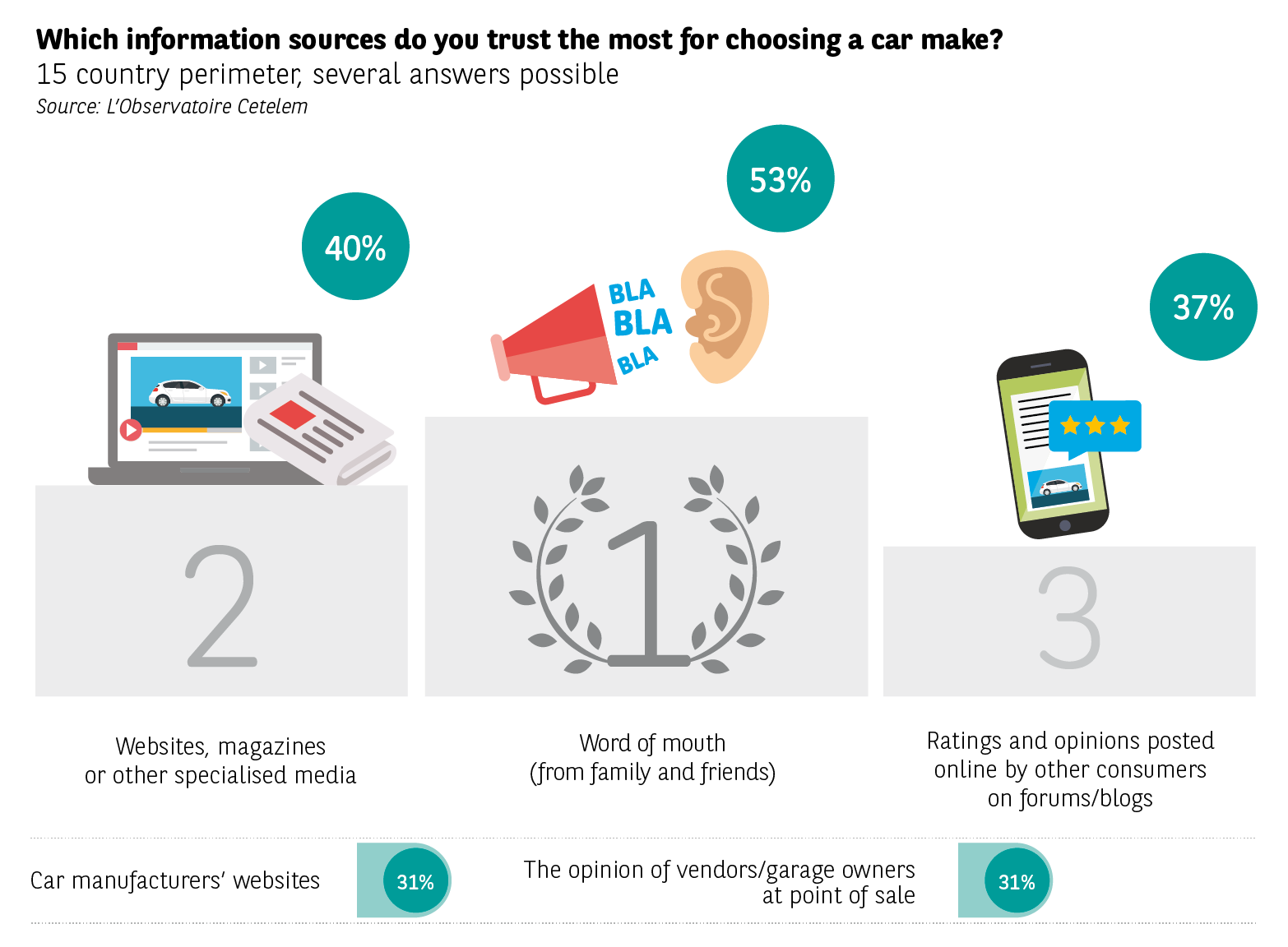

When the aim is to inform, motorists often sidestep the make issue because of information from a “neutral” third party. 53% of motorists first ask their relatives and acquaintances for their opinion about a make. This opinion is then tweaked and confirmed with people who really know and test cars.

40% then consult the Internet, magazines or specialised media. The forums are worth a visit for 37% of the people surveyed, with vendor opinions and official manufacturer websites coming next (31%). As L’Observatoire Cetelem 2017 said, “gone is the time when consumers listened to just one opinion. What is now emerging is a cross-channel approach whereby they gain confidence by gathering a range of different viewpoints.”

From mass media to one-to-one

Results show that experience and the real world come first. Brands and dealers have to play inside the consumer ballpark, explore its roots, inform it, win it over as far as possible and then bank on the ricochet effect. It is crucial for them to replicate into the digital arena, across the forums and social networks to introduce their ranges, offers, and initiatives.

The most accomplished form of this social vitalisation probably lies in a make’s communities of customers or fans and the lifestyle it stands for. My Audi, Me Connect – Mercedes, My Renault, My Peugeot are all online communities set up by the makes and allow customers to stay in contact with them… and vice versa. Potentially quasi-permanent digital contact is a fundamental issue in the emerging era of the connected car.

While it does involve investments, both economic and human, this contact is necessary to continually provide informational and experiential content and to vitalise the community. The viral effects and benefits of this communication are extremely positive for loyalty. To capitalise on the greatest outreach and effects, even indirect ones, the omni-channel approach has become the standard.

The human factor

With their ECUs recording vehicle data (location, mileage, consumable levels, imminent breakdowns, etc.) sent back to the make, the distributors, or repair specialists, tomorrow’s connected cars will empower potentially permanent contact. This contact could become contextual and tailored for servicing, car value trends, promotional offers, etc. A sign of the capital importance of data, the relevant access and usage rights are today being fought over in regulatory battles.

Nonetheless, makes and car distribution professionals should not despair of the roles they will play in the physical world. Indeed, Google tells us that in 2017, 75% of Chinese, American, and German buyers are ready to purchase their next car on the Internet. But if they don’t, this is mainly because of the impossibility of establishing direct human contact with the vendor to negotiate a price, option or related service.

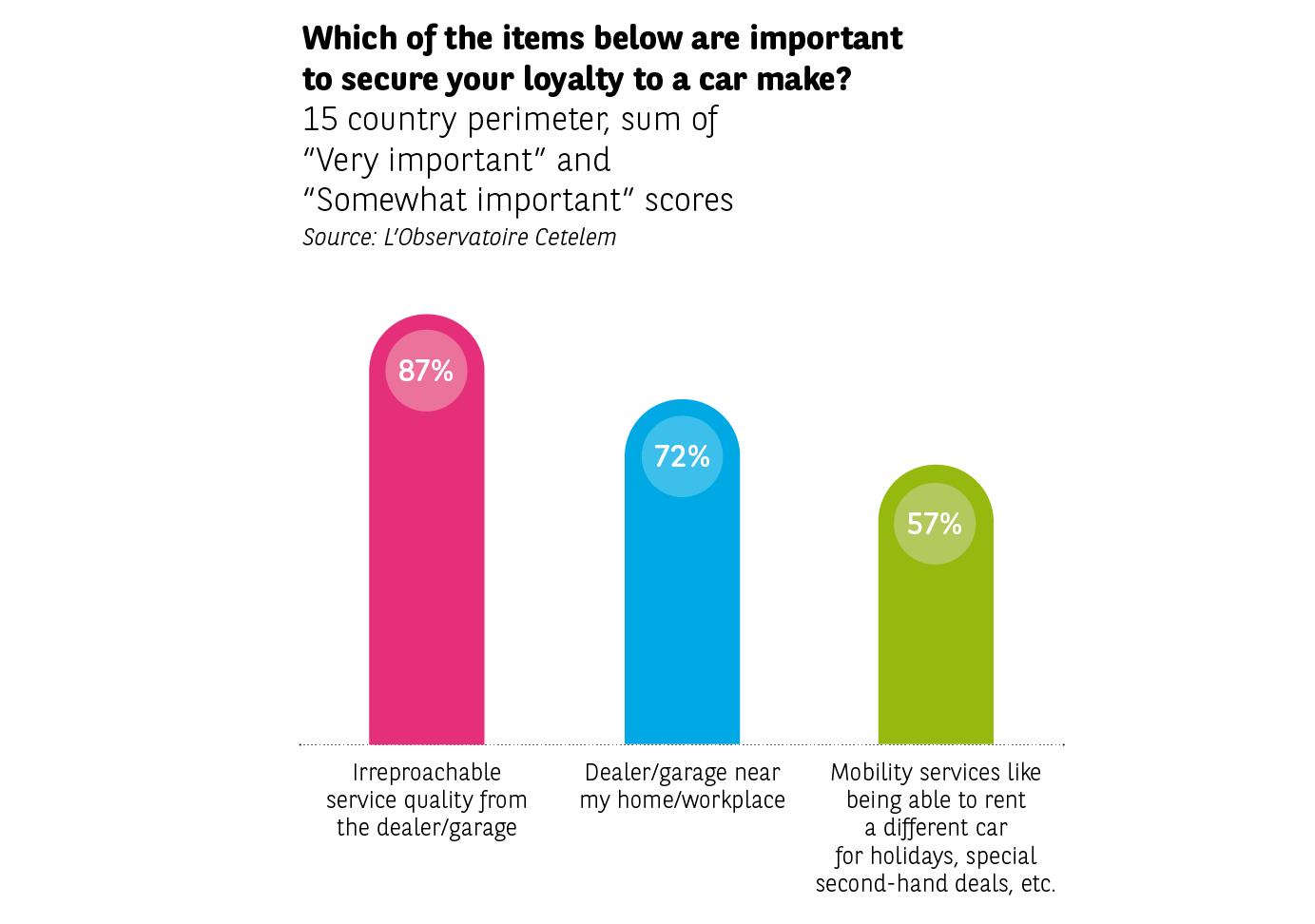

Therefore, although the tenants of the all-digital car trade might not like to admit it, 87% of motorists make a direct link between loyalty and a dealer’s service quality, as well as with geographical proximity (72%). The development of the dealership network, prime locations and controlled catchment zoning remain the essential components.

Long-life action

As “long-life” products with their specific modes of ownership and usage, cars require a number of contact points between a make and its customers, especially through the distributors. From the loan and purchase onwards, through servicing end repairs, there is no shortage of opportunities to transform purchases/servicing into positive, gratifying and engaging experiences for the consumer. These are all levers to understand and contact the customers, reassure and reinsure them, until they are placed in the best possible mindset. These actions, as long as they are delicately and timely implemented, will not be experienced as pushiness or invasive advertising. Of course, investment in terms of manpower, material means and communication is necessary to achieve this result. But the recipe does need to be applied, because the marketing world has long since shown that to gain market share, winning clients over to a make costs six times the price of keeping them loyal.

Proximity and mobility

Customer proximity is all the more decisive as more and more related mobility services are rolled out. While today’s major urban centres provide a plethora of mobility solutions and alternatives (public transport, car and bicycle sharing, chauffeur-driven cars, etc.), rural and peri-urban areas are generally poorly served. Distributors who manage to transform into mobility providers, for instance by converting some of their second-hand or new car inventories into ultra-short duration hire or share fleets, will reap profits from more than just the mobility trade. They will develop their notoriety with future buyers who, having used their services and are confident in them, will return when their needs and means permit them to buy a car. Loyal even before their first purchase!