Loyal, yes, but…

Intentions may be one thing, reality quite another.

Intentions that are not really binding

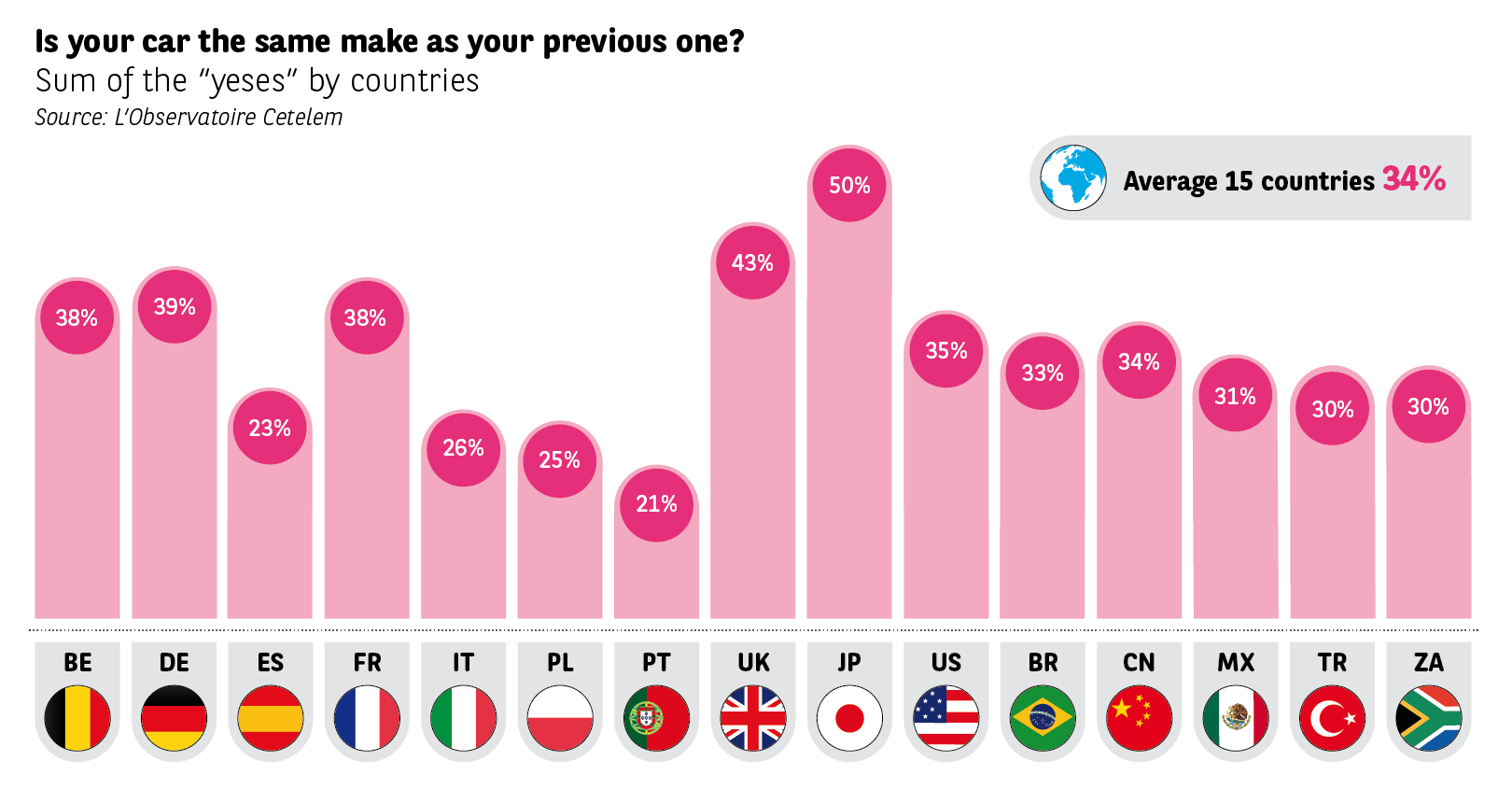

Only 34% of respondents bought the same make of car on their last purchase. Although we are used to seeing that customers are increasingly inconstant when it comes to consumerism, the gap between what people say they do and what they actually do is huge. It amounts to 44 points on average for all of the countries covered. It is in Portugal and China where confirmed loyalties are only at 21% and 34%, that these discrepancies between stated loyalty and actual loyalty are the highest with 69 and 64 points. Then come Poland, Italy and Spain, which also show very low actual loyalty rates. The Japanese are the only ones to show strong coherence between what they say and what they do, with only an 8% discrepancy; the British are just behind them with 26 points.

Objective factors that explain the discrepancies observed

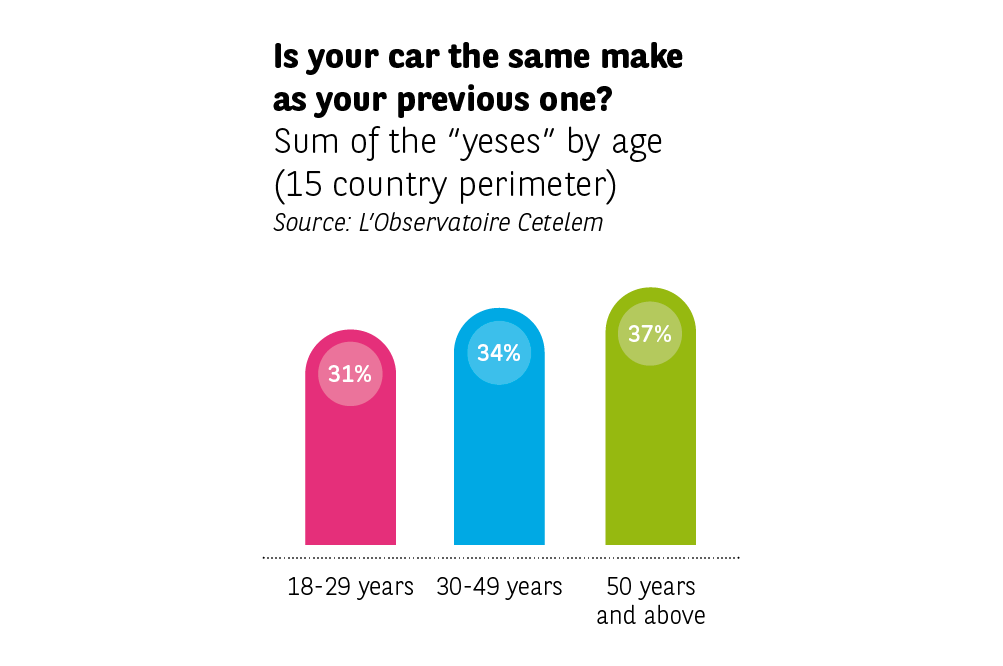

However, there are several downsides. L’Observatoire Cetelem de l’Automobile survey caps the age of its sample at 65. But, in actual fact, car loyalty very clearly increases with age.

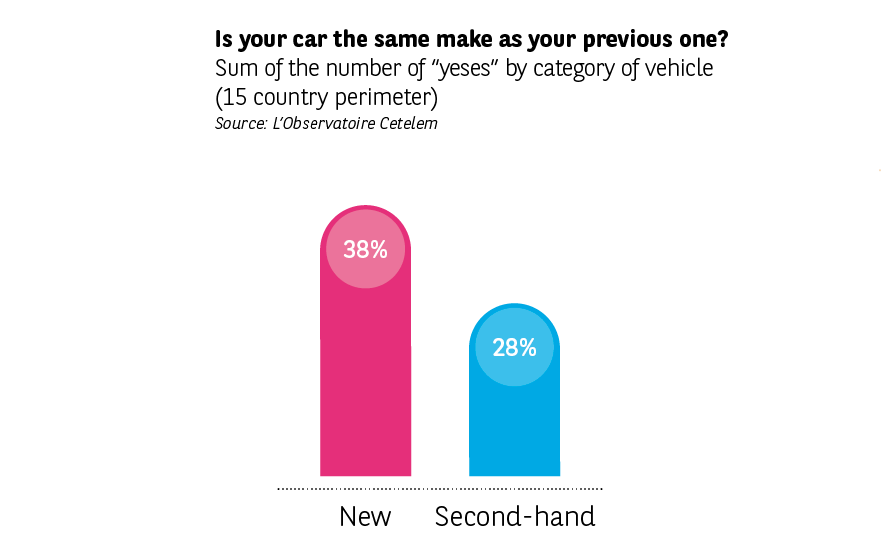

If we were to include repeat buyers aged 65 and above, a far from negligible number, the loyalty rate would go up significantly. Moreover, the survey measures the loyalty of new and second-hand car buyers. We know that the former are much more loyal than the latter. Within a 15-country perimeter, there is a 10 point difference between the two categories.

Statistics for objective loyalty as shown by the Observatoire Cetelem de l’Automobile are therefore slightly more severe than the reality. And yet, according to manufacturers’ survey sources, 2016 loyalty rates for purchasers of new cars, of all ages, amount to 55% in the United Kingdom, 34% in Italy and 25% in Spain, and less than 50% in Europe. Actual loyalty is unquestionably low and very far from the idea householders have of it.

Manufacturing countries in the lead

If we focus only on the confirmed loyalty rates among repeat purchasers of new cars, Japan, United Kingdom, United States, Germany and France are in the lead (respectively 54%, 51%, 47%, 39% and 38%)1, in other words, the strongholds of car manufacturing where production is high.

We could be surprised to note that Spain and Italy are not in this group. Spain hasn’t really got its own make to speak of, Seat being under the German wing for a while now. As for Italy, we are now talking about an Italian-American make when we refer to the Fiat Chrysler Group. Not to mention the fact that the concentration of sales on a single model, the Fiat 500, even if you take into account the different models of bodywork, does not provide enough diversity and breadth of range to raise the national loyalty rate.

Loyalty rates in China can also be surprising, not only because the Chinese see themselves as loyal by 98%, but also because it is the world leading car manufacturer. Nonetheless, although it is huge, the Chinese automotive market is only 10 years old. Just a short while ago it was limited to state-owned brands, but the market has literally exploded in favour of foreign makes. Chinese brands have evolved and progressed at an exponential speed. Cheaper than their foreign competitors, they are seducing clienteles through increasing cost effectiveness. The trend over the past two to three years is clearly showing an increase in their market shares, which inevitably causes a decline in loyal rate. From 2015 to date, the market share of Chinese brands gained more than 5 points, placing it henceforth at over 43%. It was at a mere 27% in 2013.

1 Manufacturers’ surveys rather indicate 2016 loyalty rates, all ages considered, at above 50% for France and Germany.