People’s (highfalutin) idea of their own loyalty

The automotive sector doesn’t escape this tacit rule. Nonetheless, behind this loyalty mostly expressed in the first person, lie generational, geographical and economic nuances that are rich in teachings.

There was a time when motorists and their families were faithful to one make and only one. People “were” Ford, Volkswagen or Citroën, staunchly and forever, sometimes for generations.

Resolutely rooted in the past

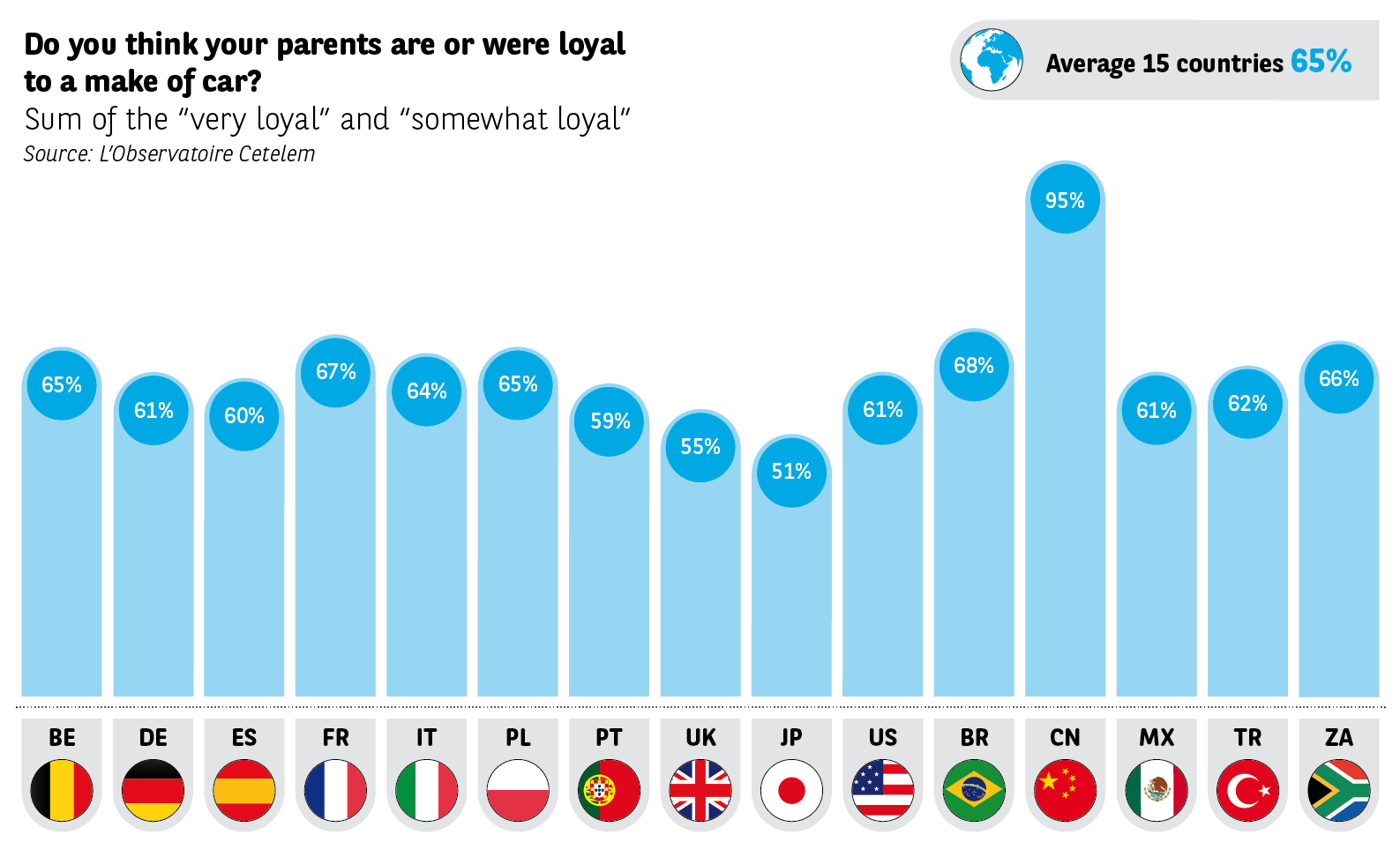

In those days, constancy was the rule, inconstancy the exception. Respondents to L’Observatoire Cetelem de l’Automobile 2018 seem to remember this. Two thirds of them said that their parents were loyal to a make of car. 95% of Chinese state this, too. But did they have a choice of car makes until now? On the other hand, only 55% and 51% of British and Japanese people remember their parents’ loyalty.

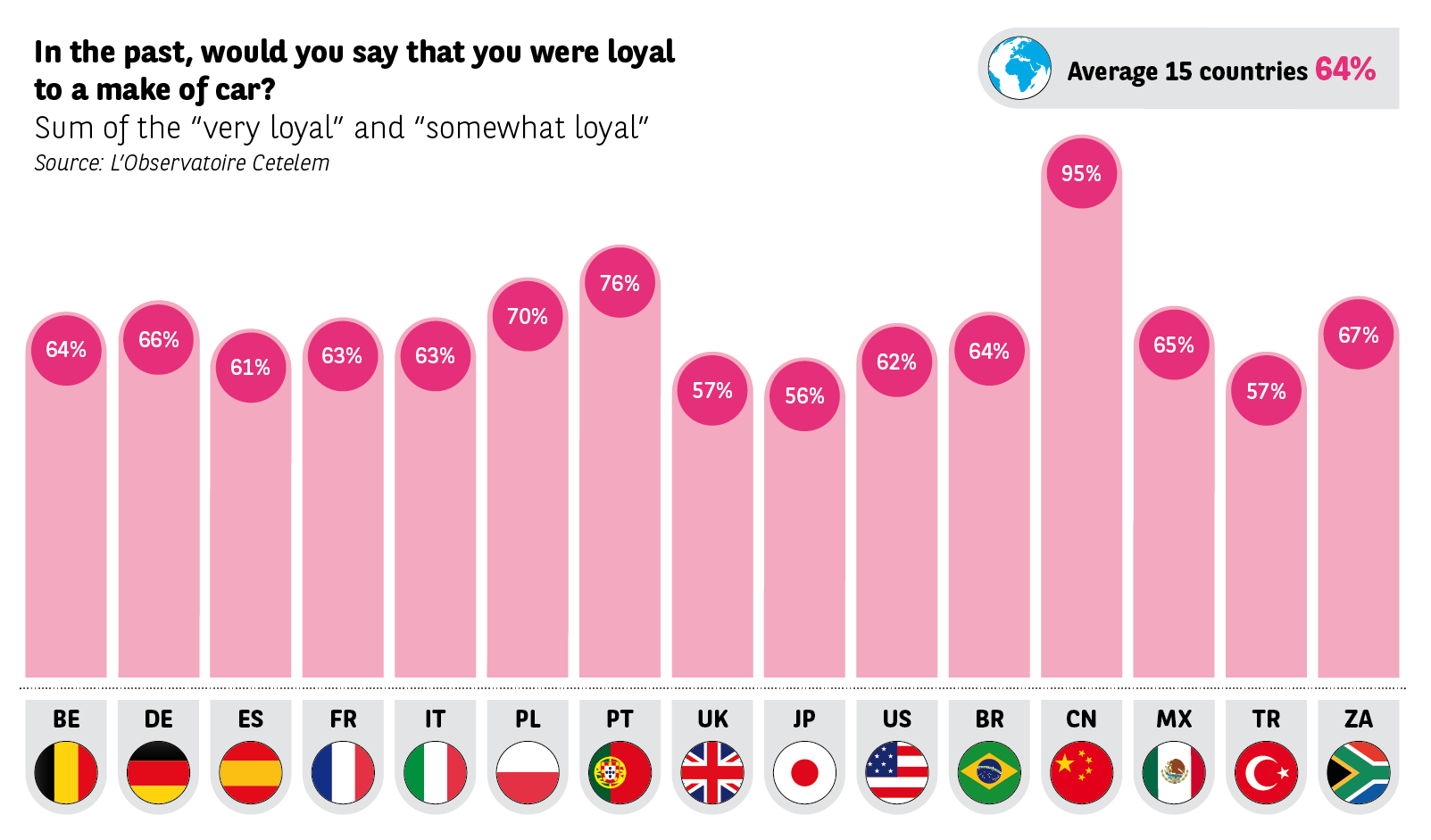

Results remain significantly similar for people when considering their own past loyalty. 64% of respondents stated they were also loyal. Respondents from nine countries even think that they were even more loyal than their parents, especially the Portuguese (+ 17 points).

Shadow of a doubt

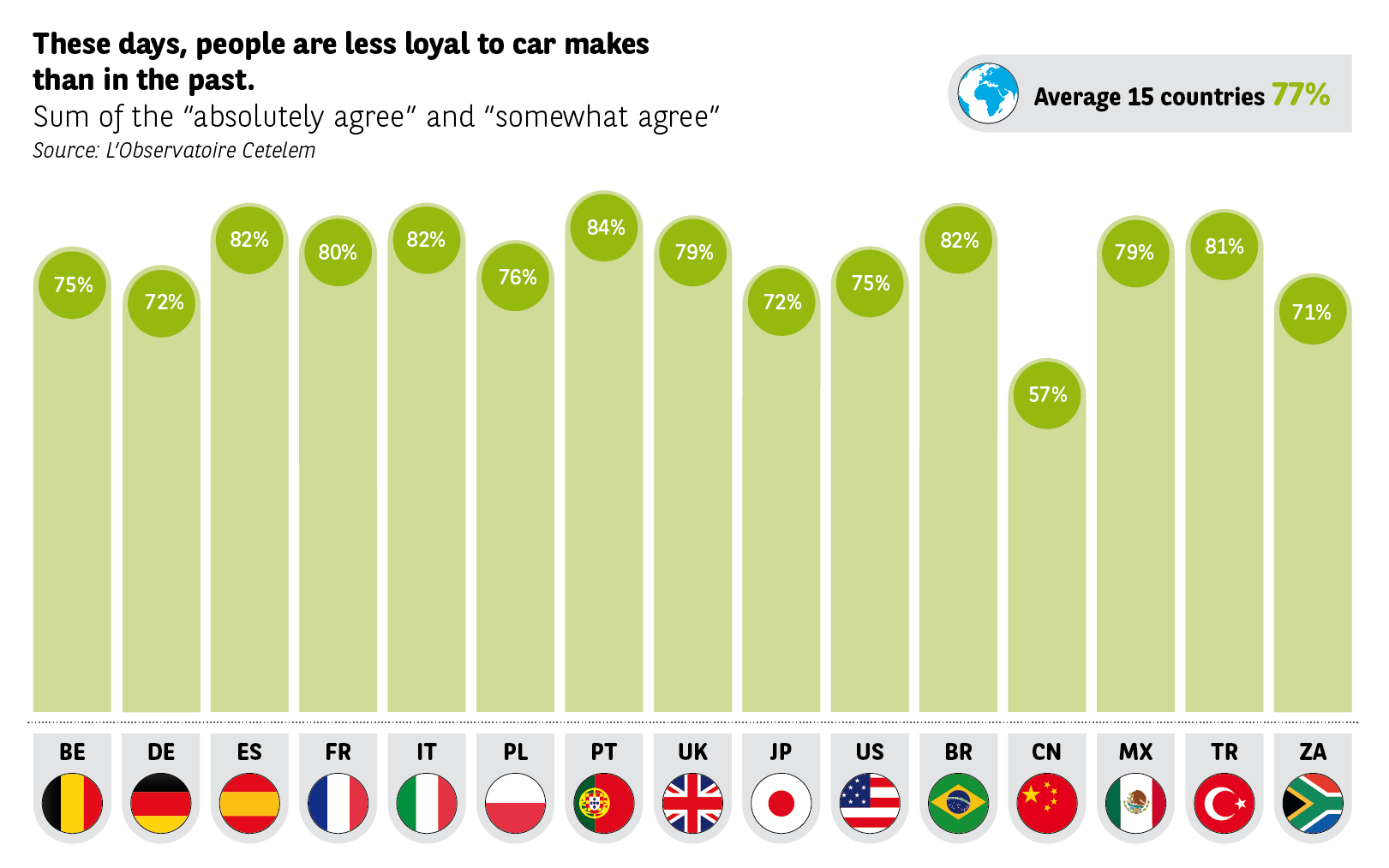

The temptation to change seems to have emerged later. On markets that were previously closed, access to international car makes, facilitated by a tsunami of advertising and increasingly attractive offers, exacerbated the competition. Indeed, motorists seem to be aware of the fact that past loyalty is crumbling. More than 70% think that buyers are less loyal than before. China is the odd one out once again on this score: only 57% of respondents perceive a loss of loyalty over time

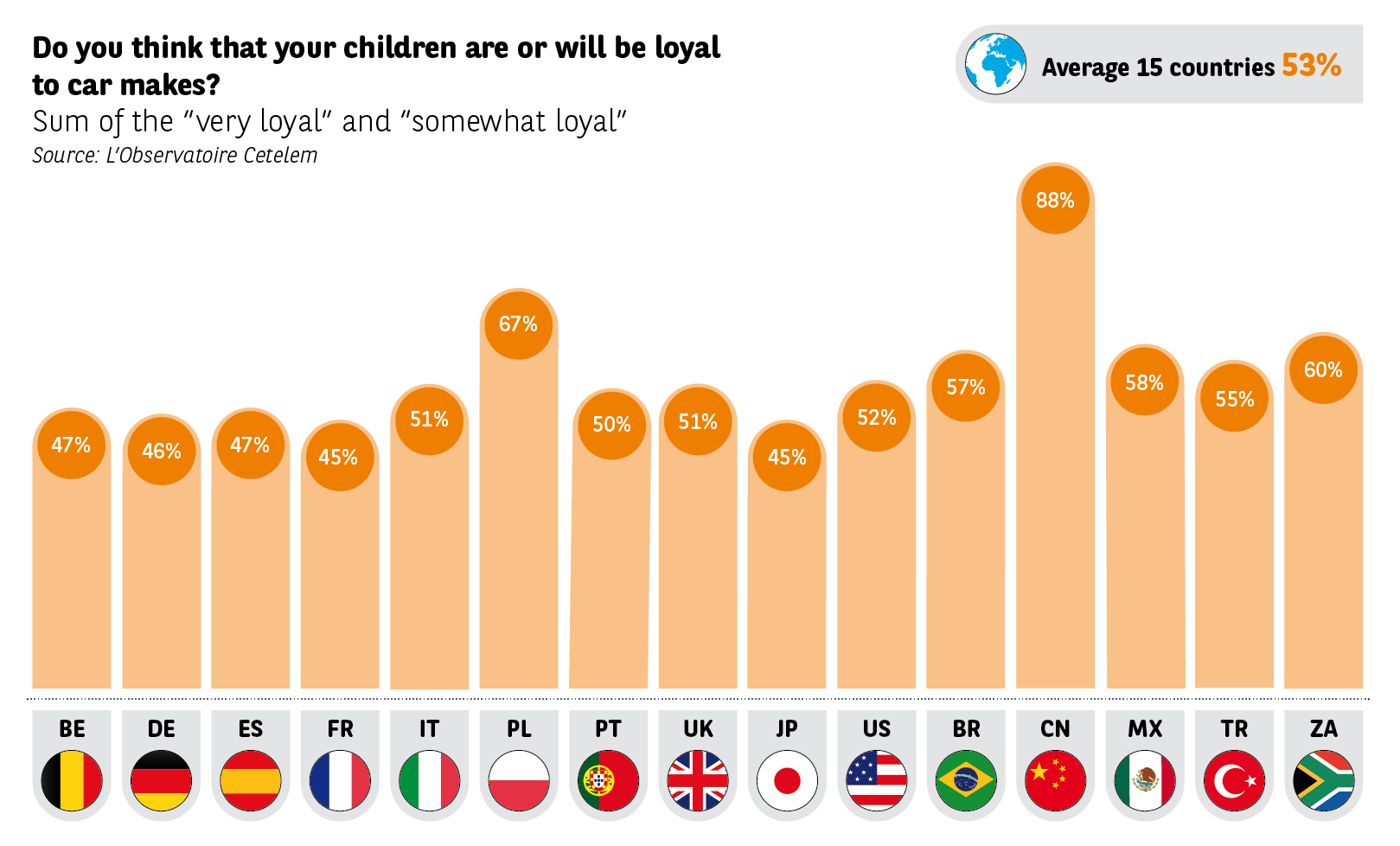

The future also seems less prone to constancy. When they envisage their children’s loyalty to makes of cars, only 53% of motorists see them as being loyal. All the western countries foresee that their descendants will approach or come under the threshold of 50% loyalty to the same make. Only the Chinese once again, and the Polish to a lesser degree, predict more stability among future generations (88% and 67%).

A very strong personal conviction

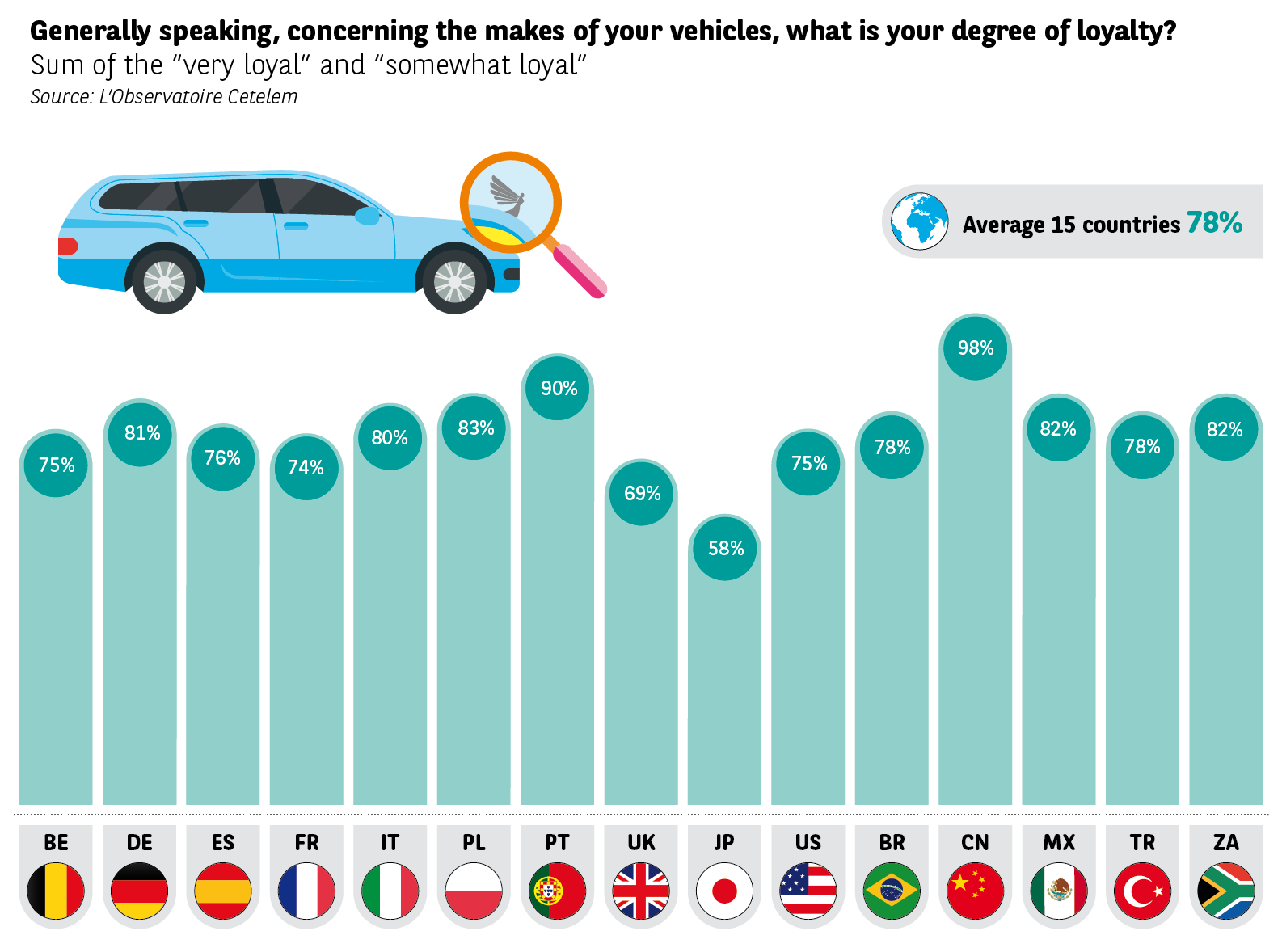

On the other hand, when we ask motorists if they themselves are loyal to car makes, 78% state, loud and clear, that they are. The Chinese and Portuguese come top at 98% and 90% loyalty. 5 other countries are attached to their make by more than 80%. The British and Japanese almost seem unstable with “a mere” 69% and 58% of declared loyalty.

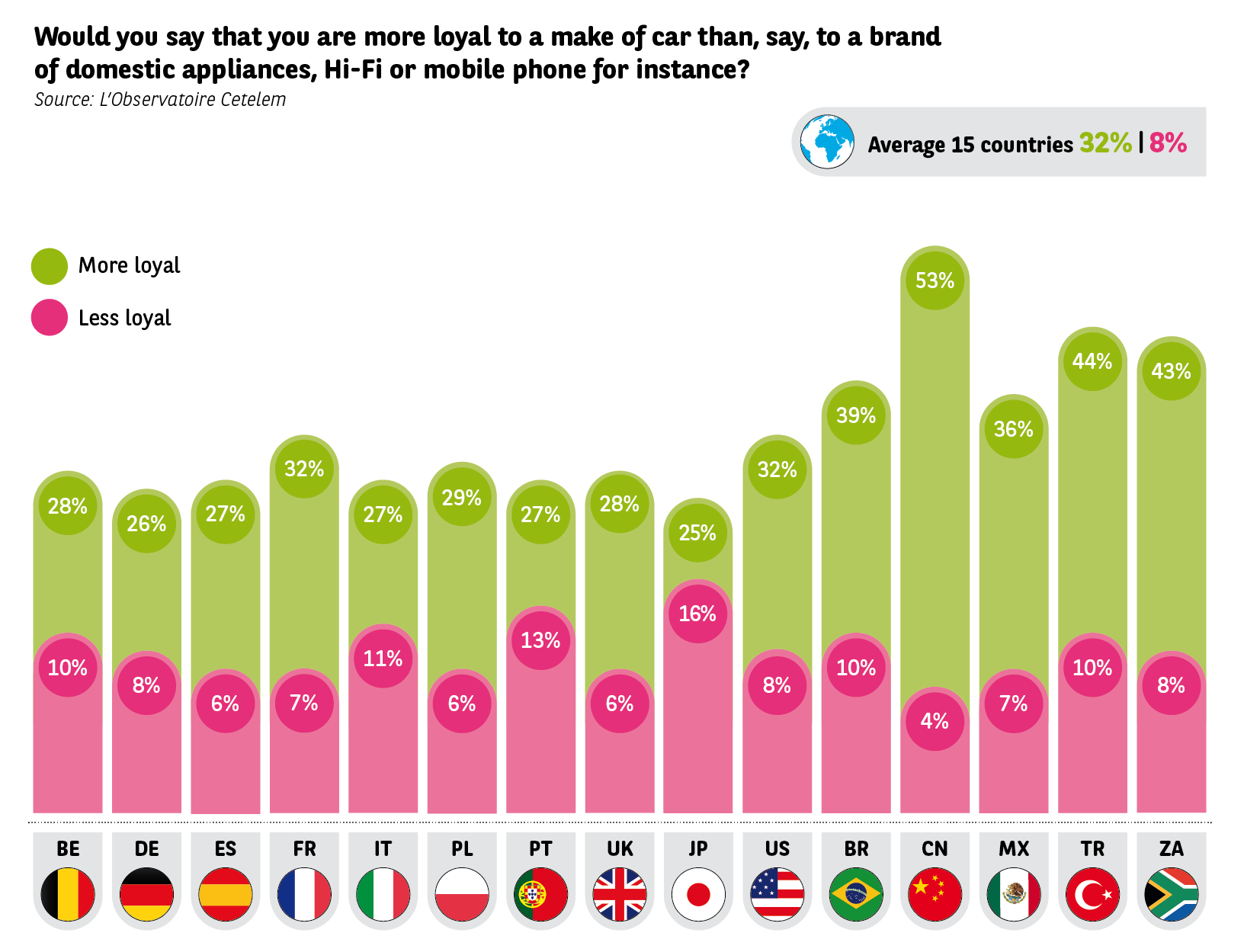

What’s more, this incredible degree of declared loyalty is something people are proud of. Only 8% of the people questioned turn out to be less loyal to cars than in other consumer areas. In 32% of cases, car loyalty is higher than for other products. More than 40% of Turks and South-Africans think this is true, and this even goes for 1 out of 2 Chinese people. These figures suggest that the car is still a product unlike others. Although some people still buy on impulse, we can safely say that choosing a make of car does not just happen on the spur of the moment. It is, more often than not, the result of a long decision-making process, especially on the issue of price. So why is this important?

Declarations of (almost) eternal love

In point of fact, as the question process delves deeper, people’s certainties do not buckle. Intentions to purchase the same make of car are still 77% for all countries considered. In many cases, loyalty strengthens over time. British, Spanish, American, Brazilians, Mexicans, and Japanese state that they will be more loyal when they come to change their vehicle. In Belgium, Italy, Poland, Turkey, and South Africa, these intentions are more conservative and are closer to the general statements. It’s only the Portuguese, Chinese, Germans, and French who foresee a decline in loyalty on their next visit to a dealership.