Design

A strong sense of aesthetics

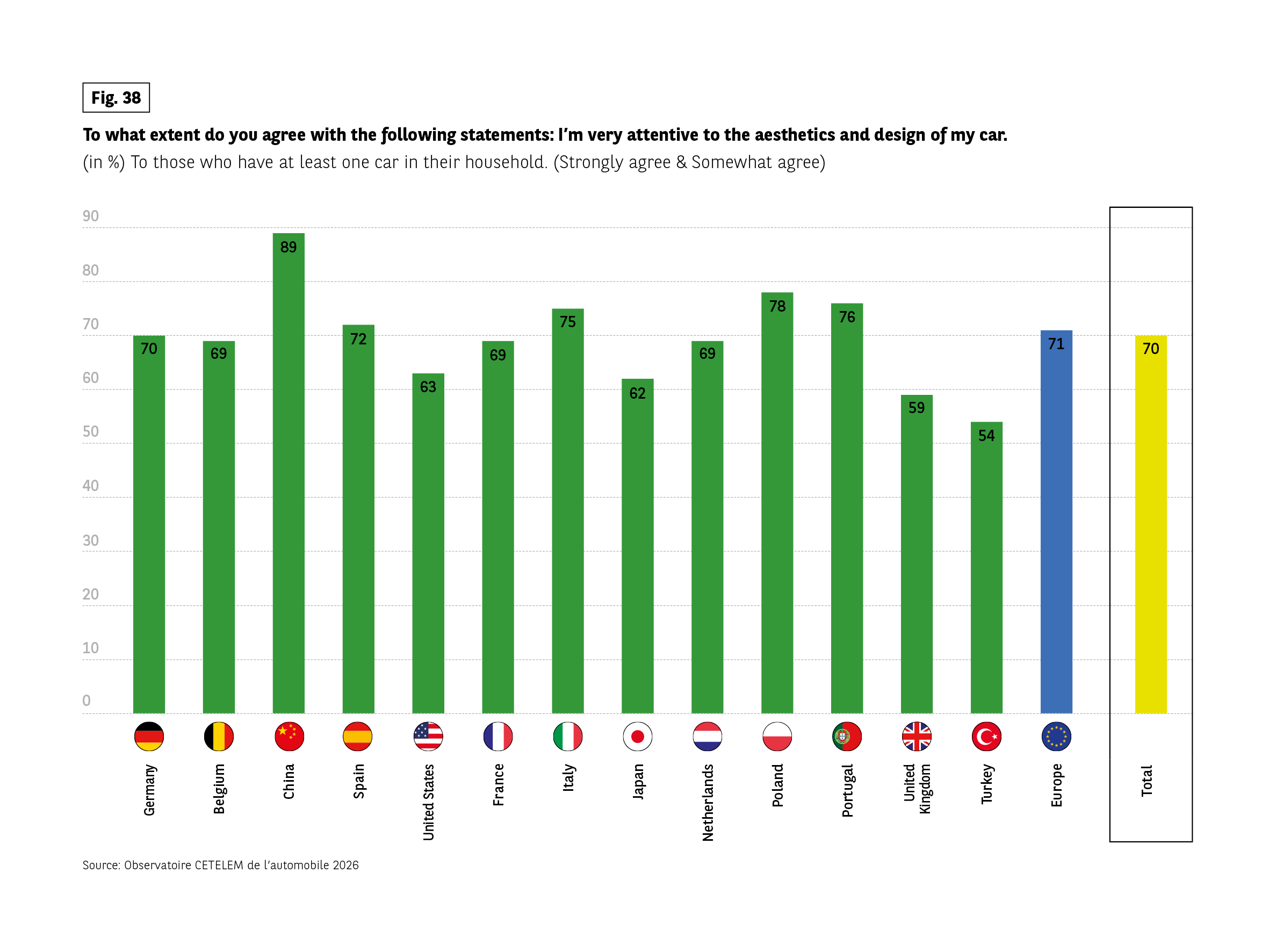

We have already highlighted the excellent image cars have among those who drive them. This opinion should be taken at face value if we are to believe the positive assessment motorists make of their design. This factor is the third lever in the recovery of the automotive industry. 7 out of 10 people say they are very interested in the design of their car. (Fig. 38).

This is particularly true in China, where an ostentatious side has persisted more than in other countries in recent years, even if the days of parading down the avenues of major Chinese cities in testosterone-fuelled racing cars seem (quite rightly) to be over. However, this is also the case in Italy, Poland and Portugal. For once, the Turks are at the very bottom of the rankings, their low opinion of 54% reflecting a more pragmatic than aesthetic approach to the car.

Conversely, younger generations and those on higher incomes claim to be the most receptive to an attractive design.

Fig 38 – Attention to car design and aesthetics

Download this infographic for your presentations Context: Agreement with the statement “I am very attentive to the aesthetics and design of my car”.

Data by country (in %) :

Germany 70, Belgium 69, China 89, Spain 72, United States 63, France 69, Italy 75, Japan 62, Netherlands 69, Poland 78, Portugal 76, United Kingdom 59, Turkey 54, Europe 71, Total 70.

Key pattern: Design sensitivity is highest in China and Poland, and lowest in Turkey and the United Kingdom.

Source: Observatoire CETELEM de l’automobile 2026.

Context: Agreement with the statement “I am very attentive to the aesthetics and design of my car”.

Data by country (in %) :

Germany 70, Belgium 69, China 89, Spain 72, United States 63, France 69, Italy 75, Japan 62, Netherlands 69, Poland 78, Portugal 76, United Kingdom 59, Turkey 54, Europe 71, Total 70.

Key pattern: Design sensitivity is highest in China and Poland, and lowest in Turkey and the United Kingdom.

Source: Observatoire CETELEM de l’automobile 2026.

Design appeals, yes, but…

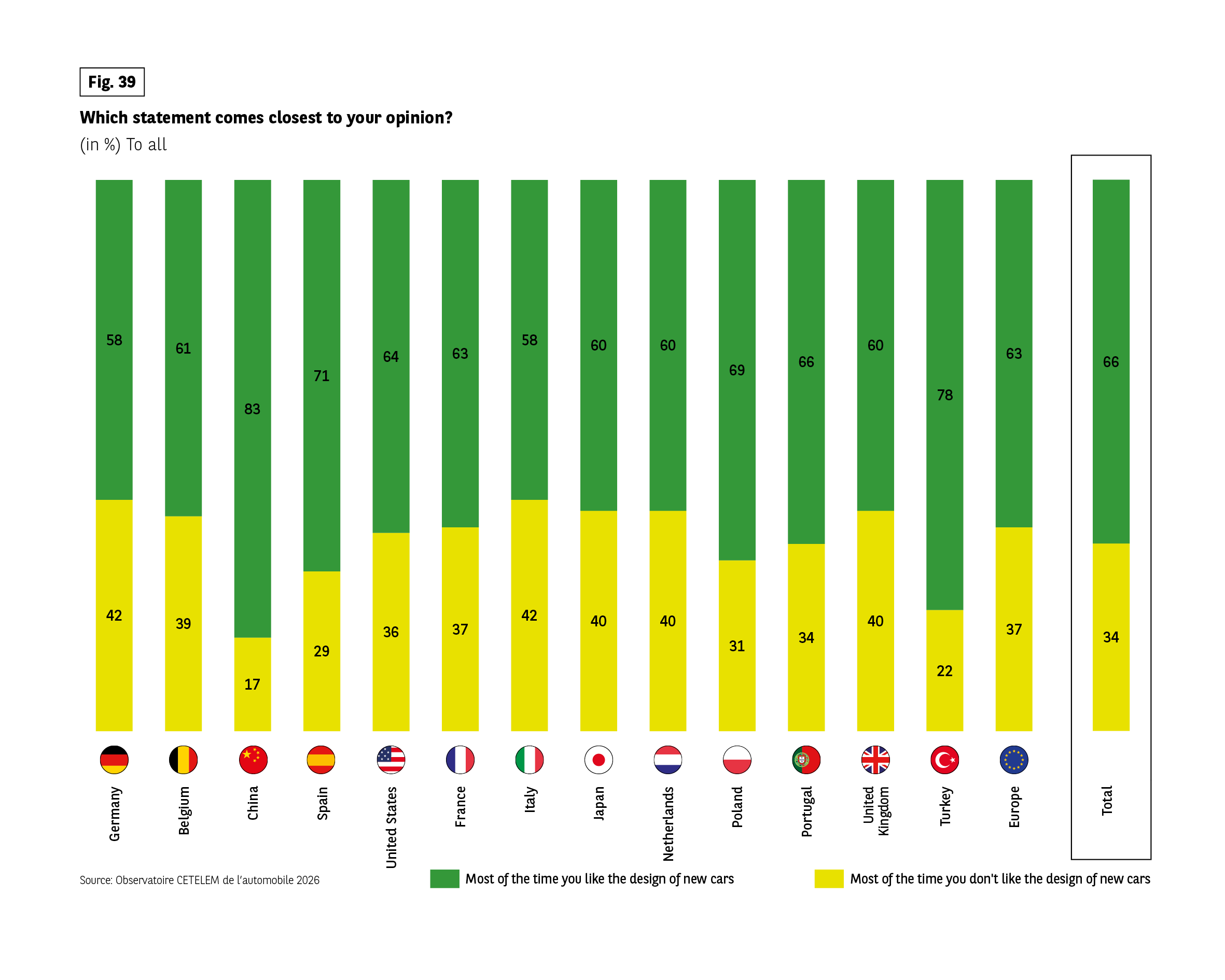

Manufacturers seem to have come up with a response to this interest in aesthetics that satisfies motorists. (Fig. 39).

Two-thirds of them are attracted by the design of today’s new cars and believe that they offer a variety of designs. In China and Turkey, the enthusiasm is unmistakable.

You have to look to Western Europe to find people who are less convinced. With the exception of Spain and Poland, around 4 out of 10 European motorists are not won over by current vehicles and criticise their lack of stylistic diversity.

There is therefore considerable scope for development to meet expectations by activating the lever linked to style.

Fig 39 – Opinion on design of new cars

Download this infographic for your presentations Context: Respondents selected which statement best reflects their opinion: liking or not liking the design of new cars.

Green represents “Most of the time you like the design of new cars”, yellow represents “Most of the time you don’t”.

Data by country (like / do not like, in %):

Germany 58 / 42

Belgium 61 / 39

China 83 / 17

Spain 71 / 29

United States 64 / 36

France 63 / 37

Italy 58 / 42

Japan 60 / 40

Netherlands 60 / 40

Poland 69 / 31

Portugal 66 / 34

United Kingdom 60 / 40

Turkey 78 / 22

Europe 63 / 37

Total 66 / 34

Key pattern: In all countries, a majority report liking the design of new cars. China and Turkey show the highest positive perception.

Source: Observatoire CETELEM de l’automobile 2026.

Context: Respondents selected which statement best reflects their opinion: liking or not liking the design of new cars.

Green represents “Most of the time you like the design of new cars”, yellow represents “Most of the time you don’t”.

Data by country (like / do not like, in %):

Germany 58 / 42

Belgium 61 / 39

China 83 / 17

Spain 71 / 29

United States 64 / 36

France 63 / 37

Italy 58 / 42

Japan 60 / 40

Netherlands 60 / 40

Poland 69 / 31

Portugal 66 / 34

United Kingdom 60 / 40

Turkey 78 / 22

Europe 63 / 37

Total 66 / 34

Key pattern: In all countries, a majority report liking the design of new cars. China and Turkey show the highest positive perception.

Source: Observatoire CETELEM de l’automobile 2026.

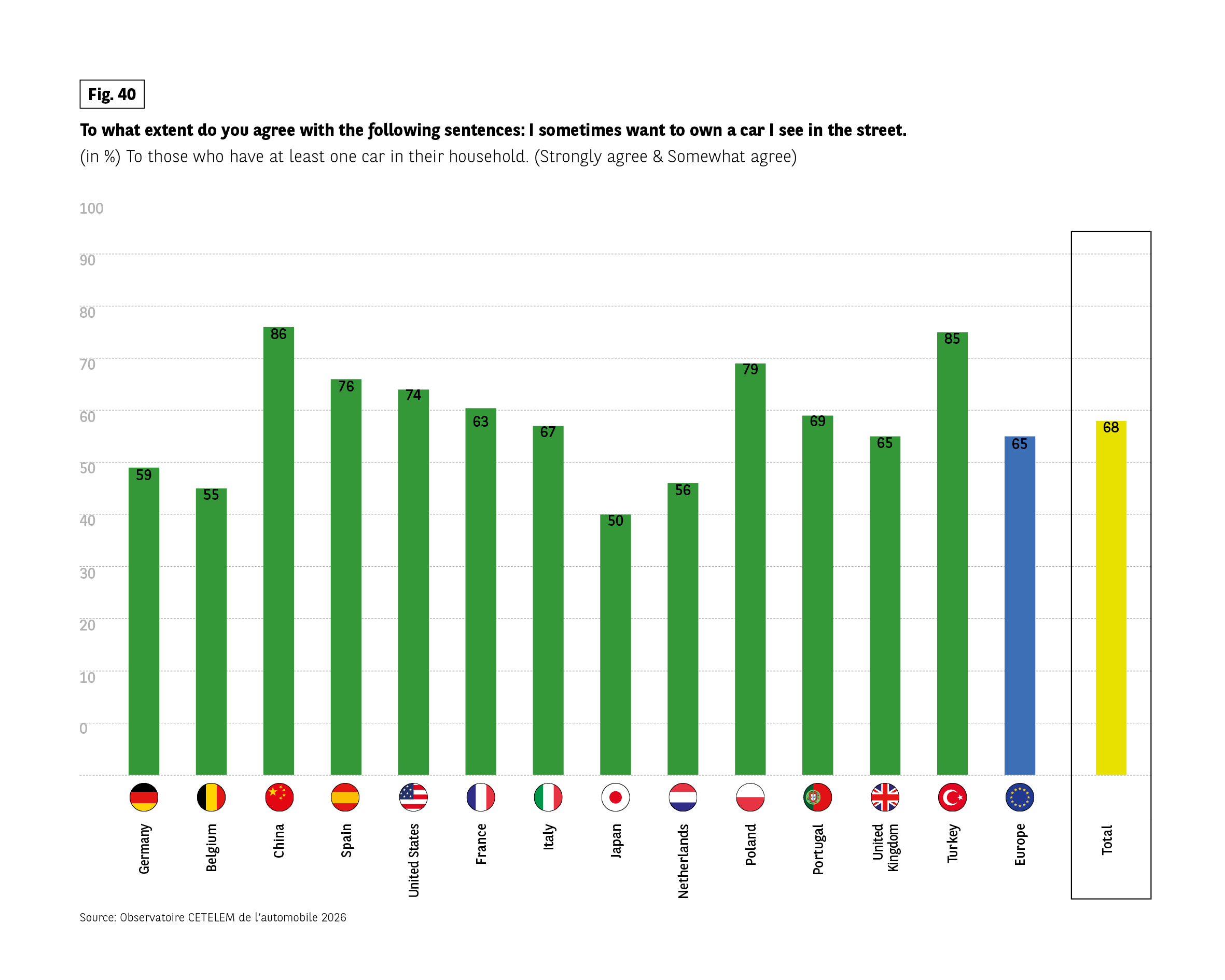

Looks matter

There’s another factor that reinforces this ever-greater attention to design, the first tangible argument that a vehicle conveys to its potential owner.

A further sign of its importance is that almost 7 out of 10 people say they are attracted by the look of a car they see in the street. In China, Turkey, Poland and Spain, this attraction is particularly strong.

Fig 40 – Desire to own cars seen on the street

Download this infographic for your presentations Context: Agreement with the statement “I sometimes want to own a car I see in the street”, among households owning at least one car.

Data by country (in %):

Germany 59, Belgium 55, China 86, Spain 76, United States 74, France 63, Italy 67, Japan 50, Netherlands 56, Poland 79, Portugal 69, United Kingdom 65, Turkey 85, Europe 65, Total 68.

Key pattern: Desire is most frequent in China and Turkey and lowest in Japan.

Source: Observatoire CETELEM de l’automobile 2026.

Context: Agreement with the statement “I sometimes want to own a car I see in the street”, among households owning at least one car.

Data by country (in %):

Germany 59, Belgium 55, China 86, Spain 76, United States 74, France 63, Italy 67, Japan 50, Netherlands 56, Poland 79, Portugal 69, United Kingdom 65, Turkey 85, Europe 65, Total 68.

Key pattern: Desire is most frequent in China and Turkey and lowest in Japan.

Source: Observatoire CETELEM de l’automobile 2026.

An interest in lasting style and novelty

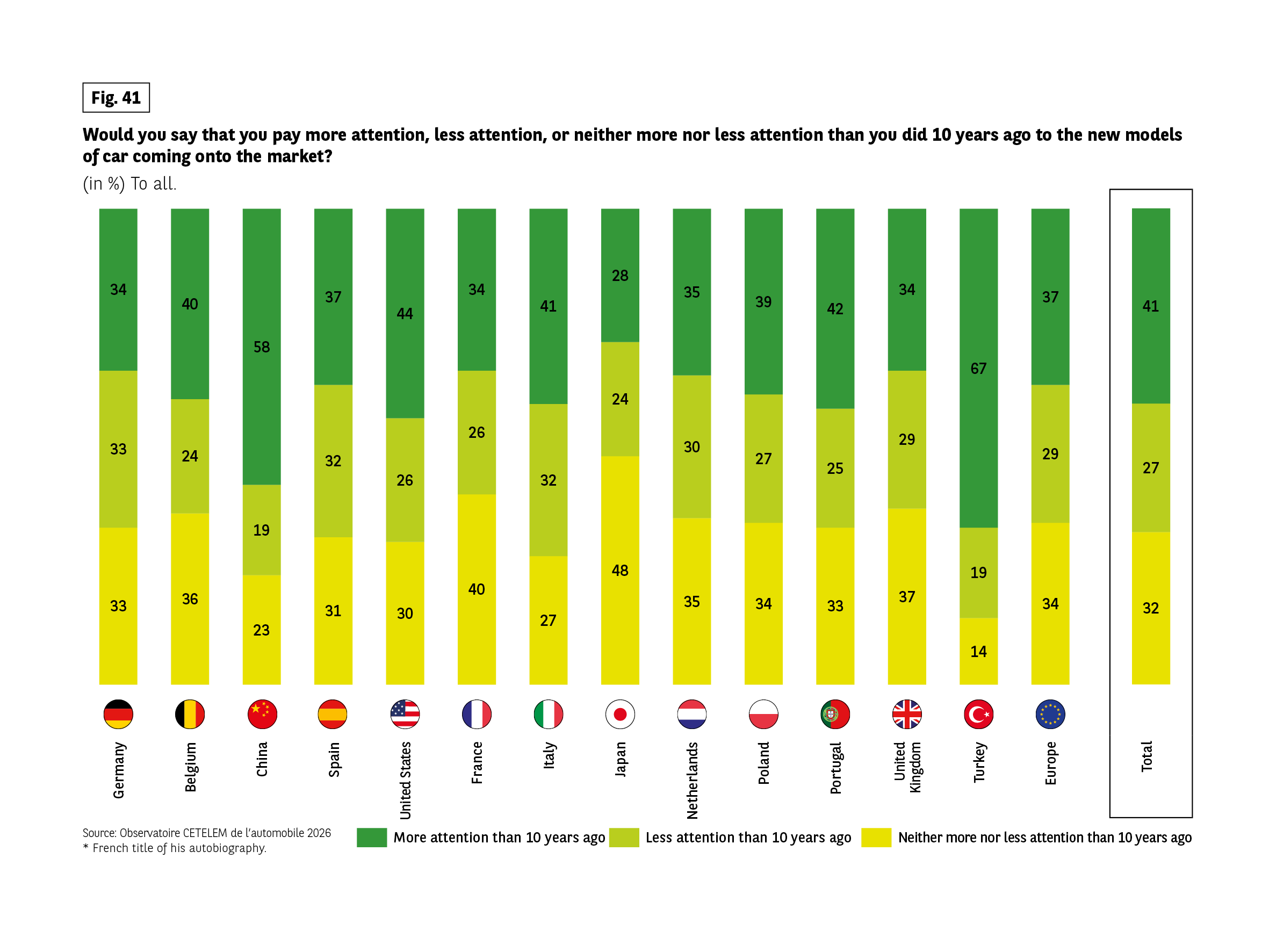

Generally speaking, beyond a single envious glance in the street, there is still a keen interest in new models. Just under 3 in 10 motorists say they are less interested in new models than they were 10 years ago. (Fig. 41).

In this respect, we find the same geographical divides. Turkey and China are still leading the way in being attracted to new models. Less attention is paid to new models in European countries such as Germany, Italy and Spain.

France stands out for its relatively stable attention over this period (40%). The above-average interest in new models is still very much the preserve of young people, high-income earners and people living in large cities. According to Raymond Loewy, one of the world’s greatest designers, who created not only soup cans and cigarette packets, but also cars, ‘Ugliness does not sell’.* The opinions expressed by respondents in this study certainly prove him right, showing that the automotive sector’s ability to bounce back depends on more attention being paid to design.

* French title of his autobiography, Never Leave Well Enough Alone.

Fig 41 – Change in attention to new car models

Download this infographic for your presentations Context: Respondents compared their level of attention to new car models today versus ten years ago. Three options: more attention, less attention, or neither more nor less.

Legend:

Green = More attention than 10 years ago

Light green = Less attention than 10 years ago

Yellow = Neither more nor less attention

Total (all countries):

More attention 41%, Less attention 27%, Neither more nor less 32%.

Selected country data (more / less / same, in %):

Germany 34 / 33 / 33

Belgium 40 / 24 / 36

China 58 / 19 / 23

Spain 37 / 32 / 31

United States 44 / 26 / 30

France 34 / 26 / 40

Italy 41 / 32 / 27

Japan 28 / 24 / 48

Netherlands 35 / 30 / 35

Poland 39 / 27 / 34

Portugal 42 / 25 / 33

United Kingdom 34 / 29 / 37

Turkey 67 / 19 / 14

Europe 37 / 29 / 34

Key pattern: In most countries, the population is divided between greater attention and stability. Turkey shows the strongest increase in attention.

Source: Observatoire CETELEM de l’automobile 2026.

Context: Respondents compared their level of attention to new car models today versus ten years ago. Three options: more attention, less attention, or neither more nor less.

Legend:

Green = More attention than 10 years ago

Light green = Less attention than 10 years ago

Yellow = Neither more nor less attention

Total (all countries):

More attention 41%, Less attention 27%, Neither more nor less 32%.

Selected country data (more / less / same, in %):

Germany 34 / 33 / 33

Belgium 40 / 24 / 36

China 58 / 19 / 23

Spain 37 / 32 / 31

United States 44 / 26 / 30

France 34 / 26 / 40

Italy 41 / 32 / 27

Japan 28 / 24 / 48

Netherlands 35 / 30 / 35

Poland 39 / 27 / 34

Portugal 42 / 25 / 33

United Kingdom 34 / 29 / 37

Turkey 67 / 19 / 14

Europe 37 / 29 / 34

Key pattern: In most countries, the population is divided between greater attention and stability. Turkey shows the strongest increase in attention.

Source: Observatoire CETELEM de l’automobile 2026.