Public policy

Popular incentives, accessible everywhere and for everyone

In terms of public policy, the financial issue remains at the heart of our concerns in order to activate a second lever for recovery. In this area, as in others, public policy has a leading role to play. In the previous section, we pointed out the lack of clarity associated with public policies.

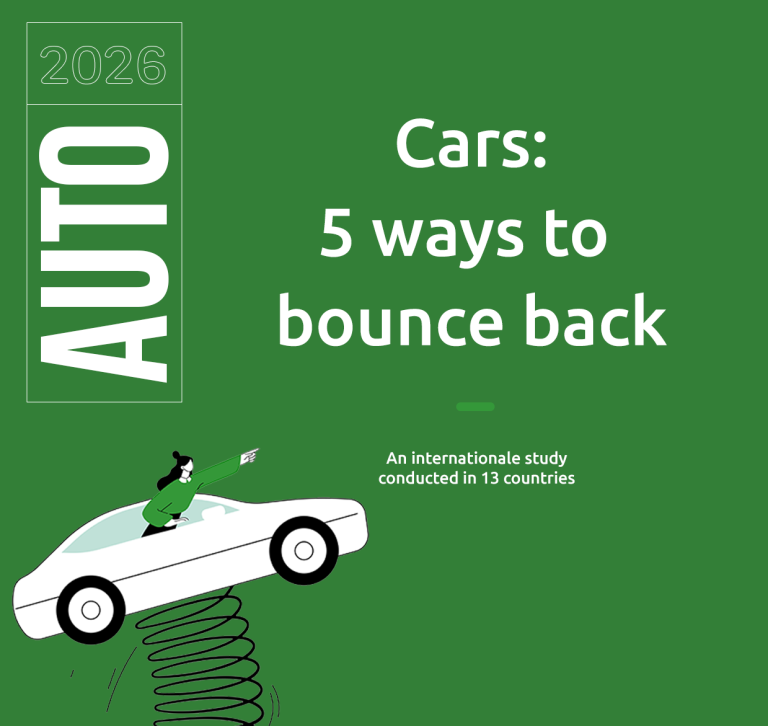

However, when it comes to certain issues, which are still linked to the economic dimension, motorists sometimes have very clear ideas. This is the case for purchase incentives, which have been very well received. (Fig. 31). Nearly 8 out of 10 people are in favour. Once again, the Japanese are the most reserved (61%), in contrast to the Turks and Chinese, who are strongly in favour. Mediterranean countries score above the survey average.

Fig 31 – Support for purchase incentives for new cars

Download this infographic for your presentations Context: Agreement with the statement that public authorities should offer purchase incentives to encourage new car buying. Percentages reflect total agreement.

Data by country (in %):

Germany 67, Belgium 73, China 88, Spain 84, United States 72, France 78, Italy 85, Japan 61, Netherlands 67, Poland 76, Portugal 80, United Kingdom 77, Turkey 93, Europe 76, Total 77.

Key pattern: Support exceeds 70% in nearly all countries. Turkey (93%) and China (88%) show the strongest agreement. Japan shows the lowest (61%).

Source: Observatoire CETELEM de l’automobile 2026.

Context: Agreement with the statement that public authorities should offer purchase incentives to encourage new car buying. Percentages reflect total agreement.

Data by country (in %):

Germany 67, Belgium 73, China 88, Spain 84, United States 72, France 78, Italy 85, Japan 61, Netherlands 67, Poland 76, Portugal 80, United Kingdom 77, Turkey 93, Europe 76, Total 77.

Key pattern: Support exceeds 70% in nearly all countries. Turkey (93%) and China (88%) show the strongest agreement. Japan shows the lowest (61%).

Source: Observatoire CETELEM de l’automobile 2026.

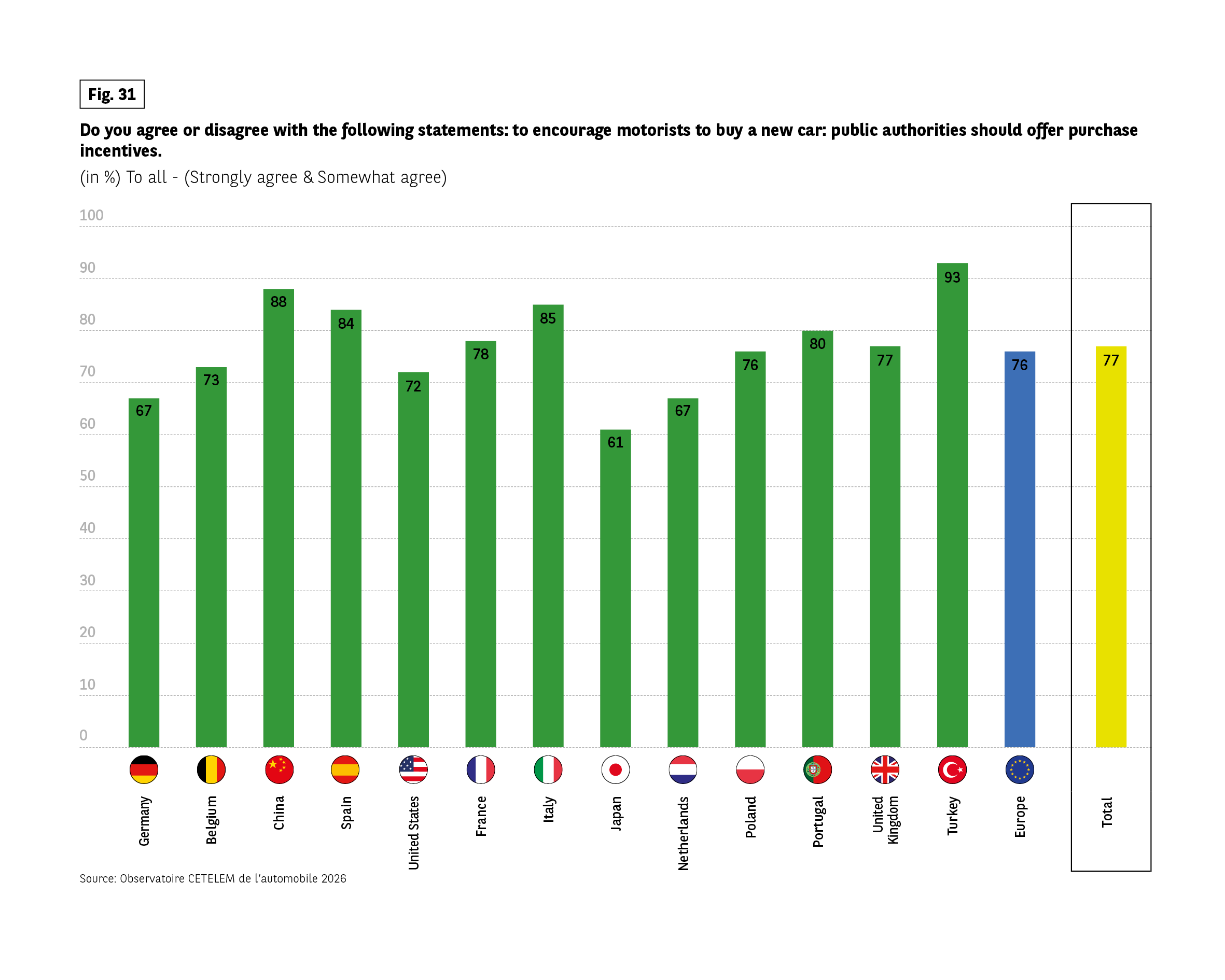

Public support for electric vehicles in Europe: examples of measures announced or in force in 2025

Fig 32 – EV purchase incentives by country in 2025

Download this infographic for your presentations Context: Overview of national EV purchase grants and accompanying measures planned for 2025.

Germany: Subsidy of €3,000–4,000 for new EVs under €45,000, targeted at low- and middle-income households.

Belgium (Flanders): €4,000 for new EVs ≤€40,000 and €2,500 for used EVs.

Spain: MOVES III plan with subsidies up to €4,500–7,000, or €9,000 with scrapping.

France: Green bonus refocused with €1 billion budget and stricter production footprint criteria.

Italy: Up to €10,000 for individuals and €20,000 for small businesses with scrappage.

Poland: “My Electrician 2.0” with PLN 1.6 billion budget.

Portugal: Up to €4,000 for electric cars, scrappage required.

United Kingdom: Discount up to £3,750 on EVs under £37,000.

Other measures include charging infrastructure investment, fleet electrification, and tax incentives.

Sources: C-Ways, ministerial sources, specialist press.

Context: Overview of national EV purchase grants and accompanying measures planned for 2025.

Germany: Subsidy of €3,000–4,000 for new EVs under €45,000, targeted at low- and middle-income households.

Belgium (Flanders): €4,000 for new EVs ≤€40,000 and €2,500 for used EVs.

Spain: MOVES III plan with subsidies up to €4,500–7,000, or €9,000 with scrapping.

France: Green bonus refocused with €1 billion budget and stricter production footprint criteria.

Italy: Up to €10,000 for individuals and €20,000 for small businesses with scrappage.

Poland: “My Electrician 2.0” with PLN 1.6 billion budget.

Portugal: Up to €4,000 for electric cars, scrappage required.

United Kingdom: Discount up to £3,750 on EVs under £37,000.

Other measures include charging infrastructure investment, fleet electrification, and tax incentives.

Sources: C-Ways, ministerial sources, specialist press.

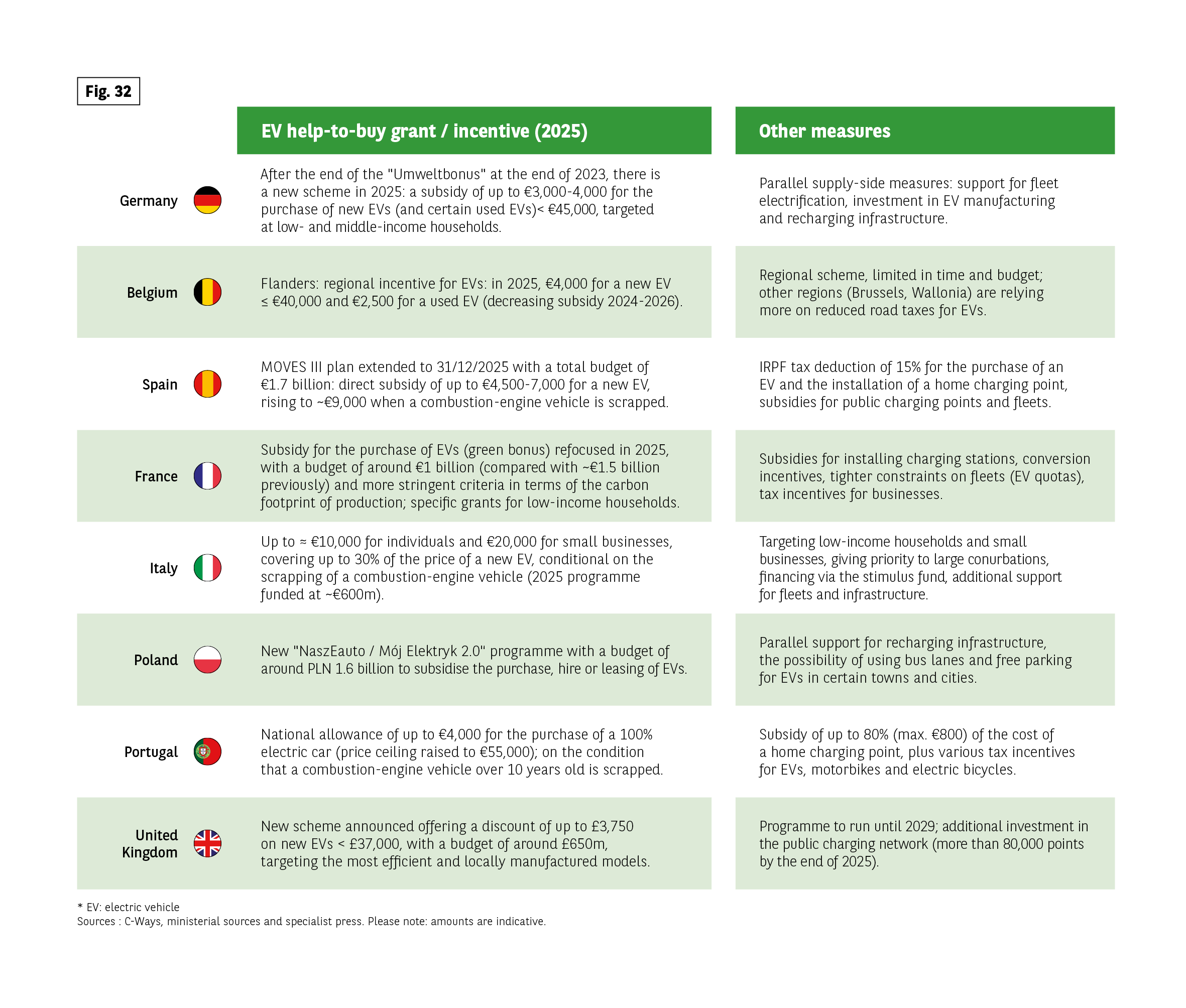

Controlling prices

Still on the financial front, the idea of public authorities controlling prices received almost the same number of votes. (Fig. 33). 3 out of 4 people support this measure. The differences between countries are still marked, with more or less the same countries occupying the same positions in the rankings, with the Chinese-Turkish pair ever in the lead, followed by the Italians, with Japan more wary than ever.

The French penchant for a certain form of economic Colbertism is confirmed by a solid 81%.

The 30-49 age group, people living in big cities and families with children believe that controlling prices will make it easier to buy a car.

Fig 33 – Support for public control of car prices

Download this infographic for your presentations Context: Survey question asking whether respondents agree that public authorities should control car prices to encourage new car purchases. Results shown as percentage of total agreement (strongly agree and somewhat agree).

Data by country (in %):

Germany 74, Belgium 75, China 88, Spain 76, United States 58, France 81, Italy 83, Japan 51, Netherlands 64, Poland 68, Portugal 79, United Kingdom 74, Turkey 92, Europe 75, Total 74.

Key pattern: Support exceeds 70% in most countries. The highest level is in Turkey (92%), while the lowest is in Japan (51%) and the United States (58%).

Source: Observatoire CETELEM de l’automobile 2026.

Context: Survey question asking whether respondents agree that public authorities should control car prices to encourage new car purchases. Results shown as percentage of total agreement (strongly agree and somewhat agree).

Data by country (in %):

Germany 74, Belgium 75, China 88, Spain 76, United States 58, France 81, Italy 83, Japan 51, Netherlands 64, Poland 68, Portugal 79, United Kingdom 74, Turkey 92, Europe 75, Total 74.

Key pattern: Support exceeds 70% in most countries. The highest level is in Turkey (92%), while the lowest is in Japan (51%) and the United States (58%).

Source: Observatoire CETELEM de l’automobile 2026.

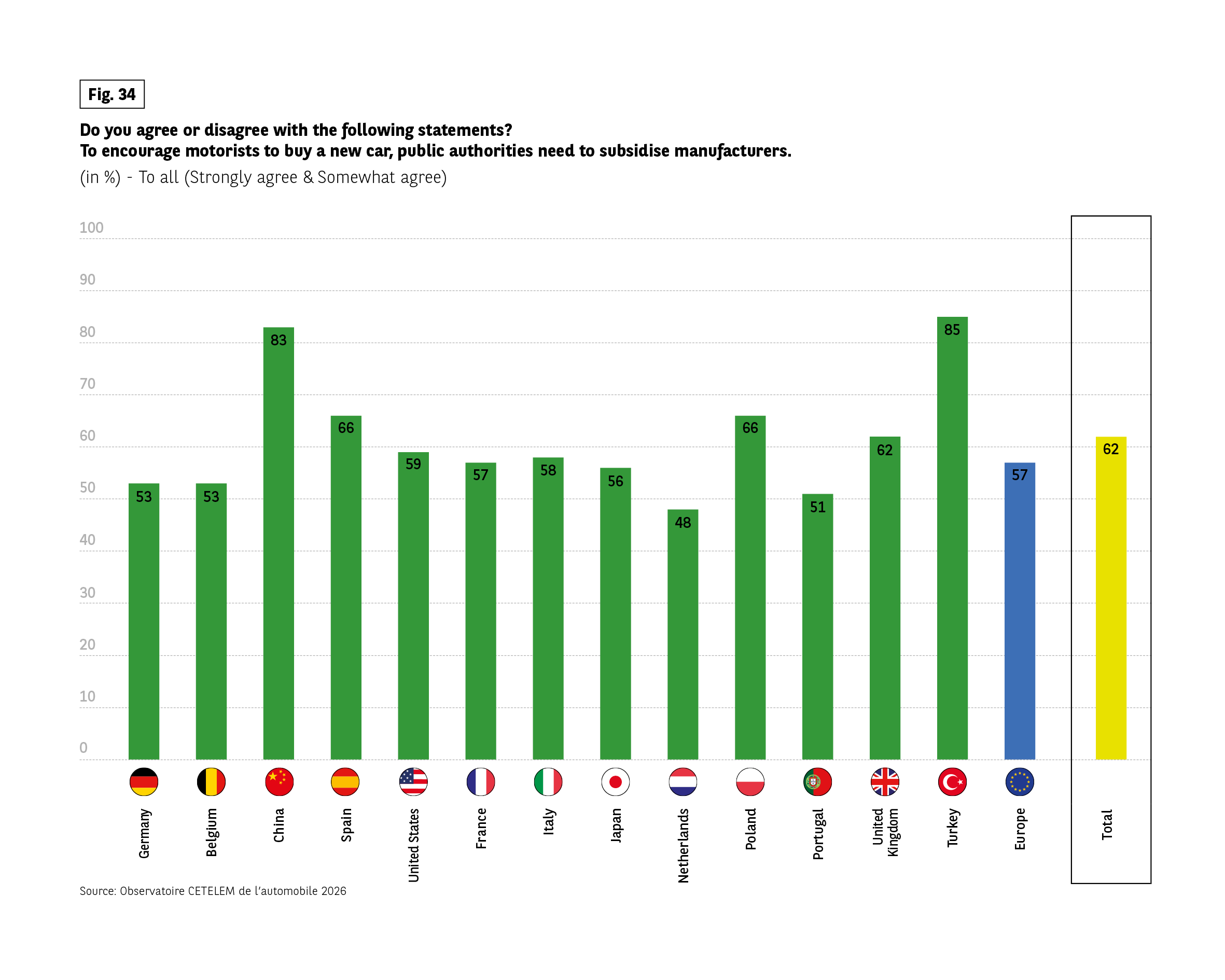

Supporting manufacturers

Supporting manufacturers

To a lesser extent, motorists also agree on the financial support that public authorities should give to manufacturers in order to boost the market (62%). This idea is seen as an obvious decision in Turkey and China, where it is already being put into practice, more or less directly. (Fig. 34).

Many European countries, such as the Netherlands and Portugal, are more reserved, with scores of around 50%, even lower than in the United States.

Fig 34 – Support for subsidising car manufacturers

Download this infographic for your presentations Context: Agreement with the idea that public authorities should subsidise manufacturers to encourage new car buying.

Data by country (in %):

Germany 53, Belgium 53, China 83, Spain 66, United States 59, France 57, Italy 58, Japan 56, Netherlands 48, Poland 66, Portugal 51, United Kingdom 62, Turkey 85, Europe 57, Total 62.

Key pattern: Support varies widely. Turkey (85%) and China (83%) show strongest approval, while the Netherlands shows the lowest (48%).

Source: Observatoire CETELEM de l’automobile 2026.

Context: Agreement with the idea that public authorities should subsidise manufacturers to encourage new car buying.

Data by country (in %):

Germany 53, Belgium 53, China 83, Spain 66, United States 59, France 57, Italy 58, Japan 56, Netherlands 48, Poland 66, Portugal 51, United Kingdom 62, Turkey 85, Europe 57, Total 62.

Key pattern: Support varies widely. Turkey (85%) and China (83%) show strongest approval, while the Netherlands shows the lowest (48%).

Source: Observatoire CETELEM de l’automobile 2026.

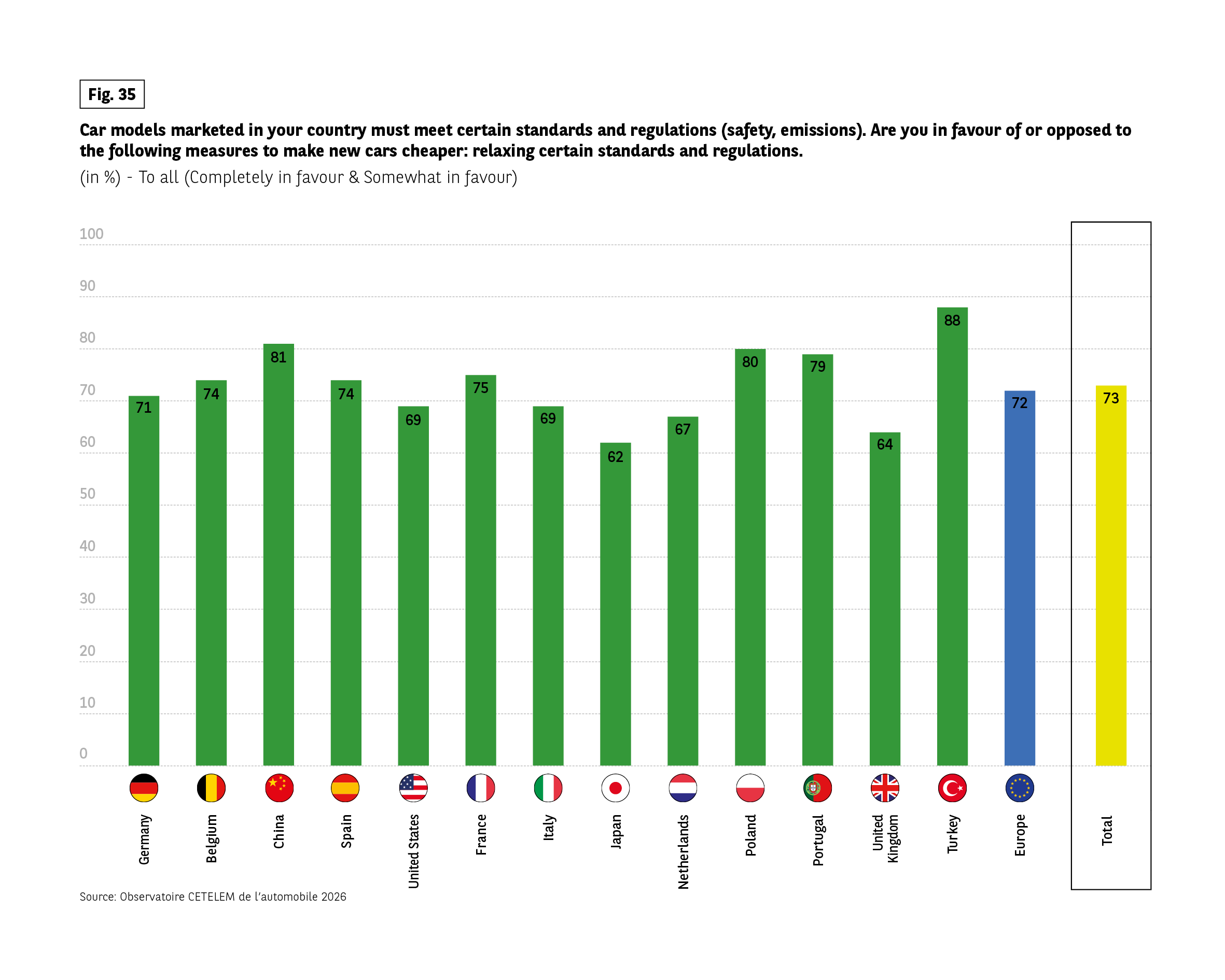

Revisiting regulatory standards

However, the effectiveness of the ‘public policy’ lever cannot be based on the economic dimension alone. Faced with a regulatory environment that they consider vague and changeable, and therefore restrictive, just over 7 out of 10 motorists would like public authorities to relax standards and regulations.

Fig 35 – Support for relaxing car standards for price reduction

Download this infographic for your presentations Context: Respondents were asked whether they support relaxing safety and emissions standards to make new cars cheaper.

Data by country (in % in favour):

Germany 71, Belgium 74, China 81, Spain 74, United States 69, France 75, Italy 69, Japan 62, Netherlands 67, Poland 80, Portugal 79, United Kingdom 64, Turkey 88, Europe 72, Total 73.

Key pattern: In all countries, a majority support regulatory relaxation, with strongest support in Turkey and China.

Source: Observatoire CETELEM de l’automobile 2026.

Context: Respondents were asked whether they support relaxing safety and emissions standards to make new cars cheaper.

Data by country (in % in favour):

Germany 71, Belgium 74, China 81, Spain 74, United States 69, France 75, Italy 69, Japan 62, Netherlands 67, Poland 80, Portugal 79, United Kingdom 64, Turkey 88, Europe 72, Total 73.

Key pattern: In all countries, a majority support regulatory relaxation, with strongest support in Turkey and China.

Source: Observatoire CETELEM de l’automobile 2026.

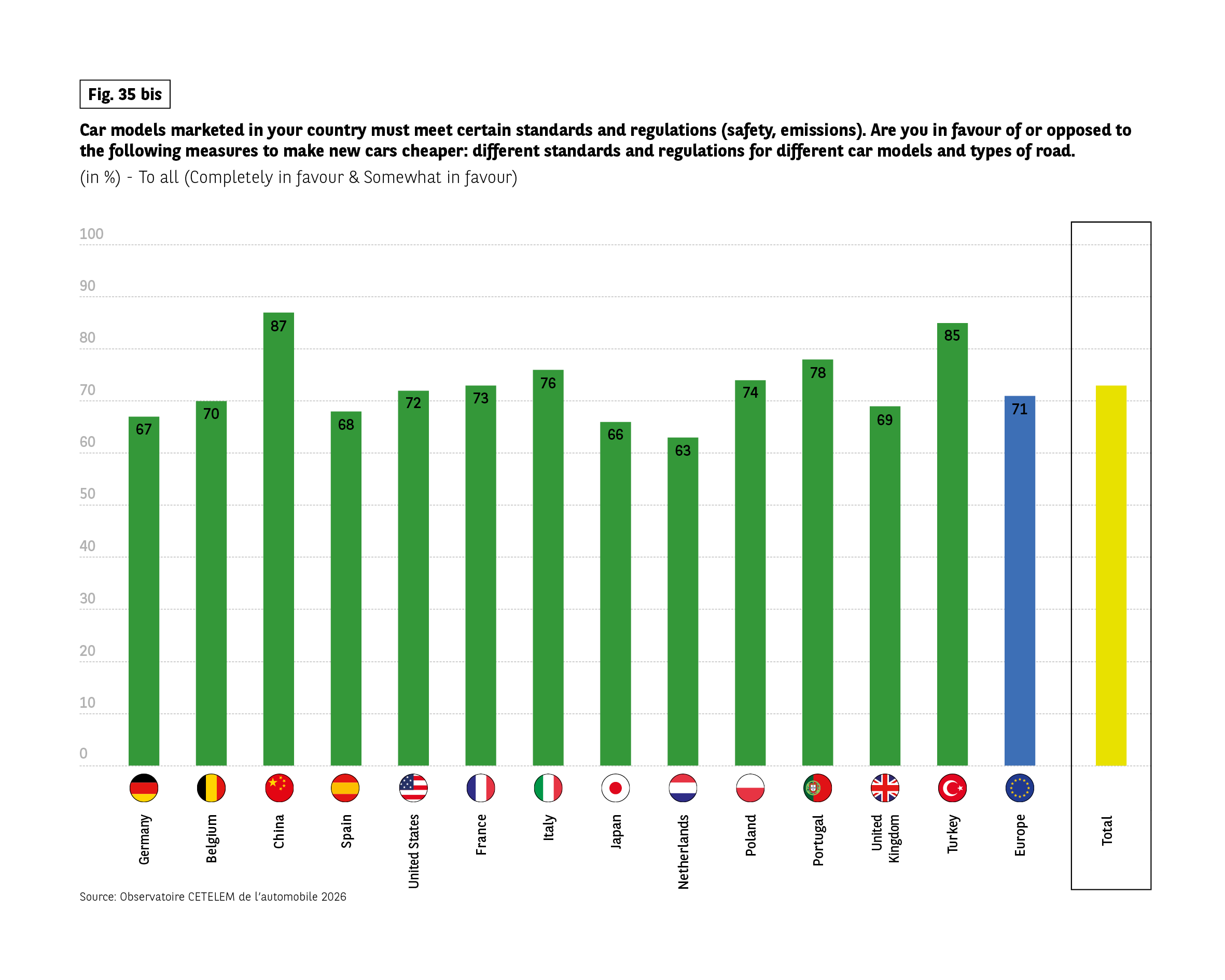

Fig 35bis – Support for differentiated standards to cut car prices

Download this infographic for your presentations Context: Respondents indicated whether they are in favour of relaxing or varying safety and emissions standards for different car models and types of road to make new cars cheaper. Values show combined “completely in favour” and “somewhat in favour”.

Data by country (in %):

Germany 67, Belgium 70, China 87, Spain 68, United States 72, France 73, Italy 76, Japan 66, Netherlands 63, Poland 74, Portugal 78, United Kingdom 69, Turkey 85, Europe 71, Total 71.

Key pattern: Support exceeds 65% in nearly all countries. China and Turkey show the highest support, while the Netherlands shows the lowest.

Source: Observatoire CETELEM de l’automobile 2026.

Context: Respondents indicated whether they are in favour of relaxing or varying safety and emissions standards for different car models and types of road to make new cars cheaper. Values show combined “completely in favour” and “somewhat in favour”.

Data by country (in %):

Germany 67, Belgium 70, China 87, Spain 68, United States 72, France 73, Italy 76, Japan 66, Netherlands 63, Poland 74, Portugal 78, United Kingdom 69, Turkey 85, Europe 71, Total 71.

Key pattern: Support exceeds 65% in nearly all countries. China and Turkey show the highest support, while the Netherlands shows the lowest.

Source: Observatoire CETELEM de l’automobile 2026.

This lever is therefore synonymous with greater freedom. Respondents are also in favour of adjusting these stan- dards according to the type of vehicle and road used.

Nearly three-quarters of people support both these measures. Flexibility is less in demand in Japan and the UK, while adaptation measures are less favoured in Japan and the Netherlands.

France is in the middle of the pack on both counts. Young people and people living in large cities are the most likely to support these measures.

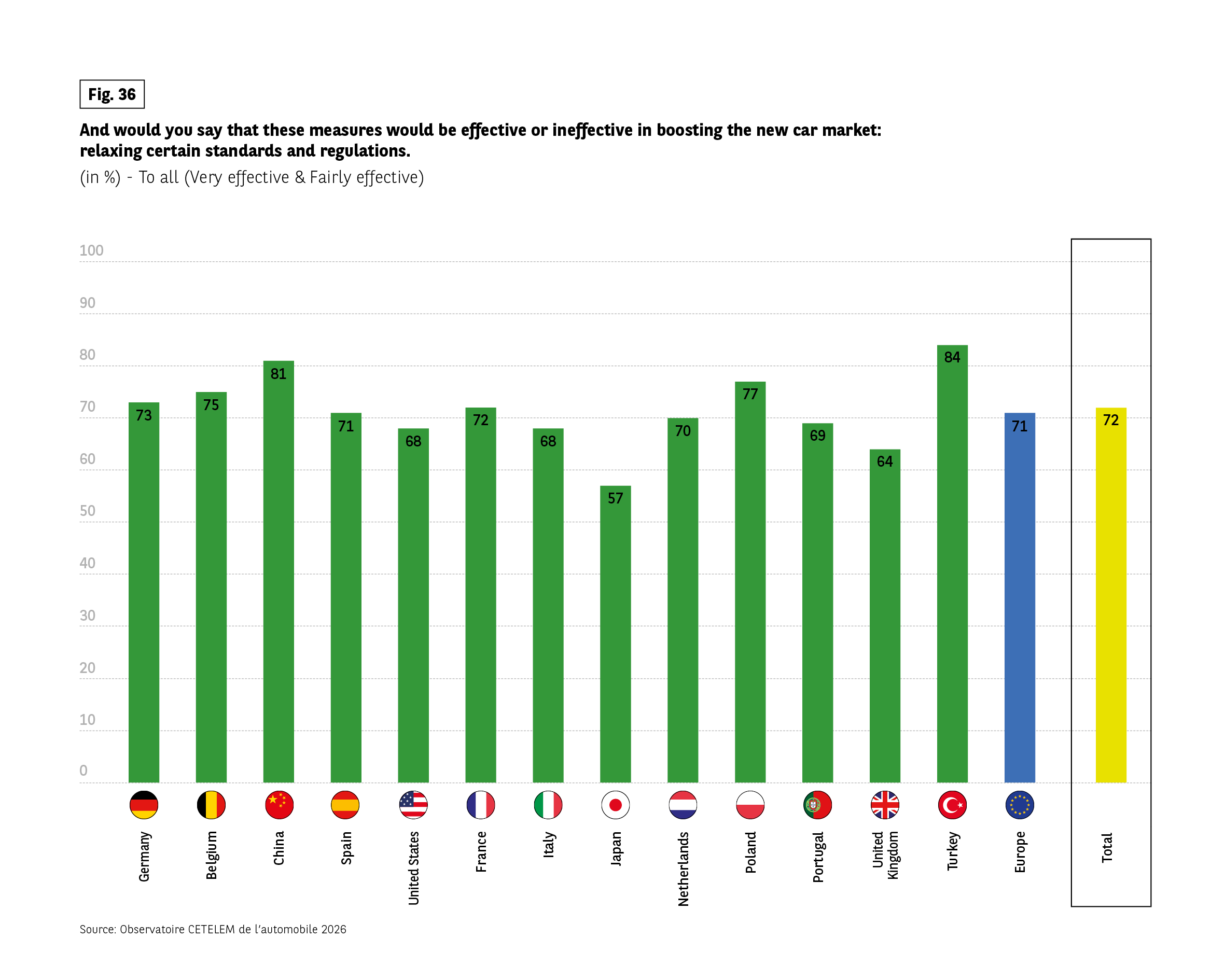

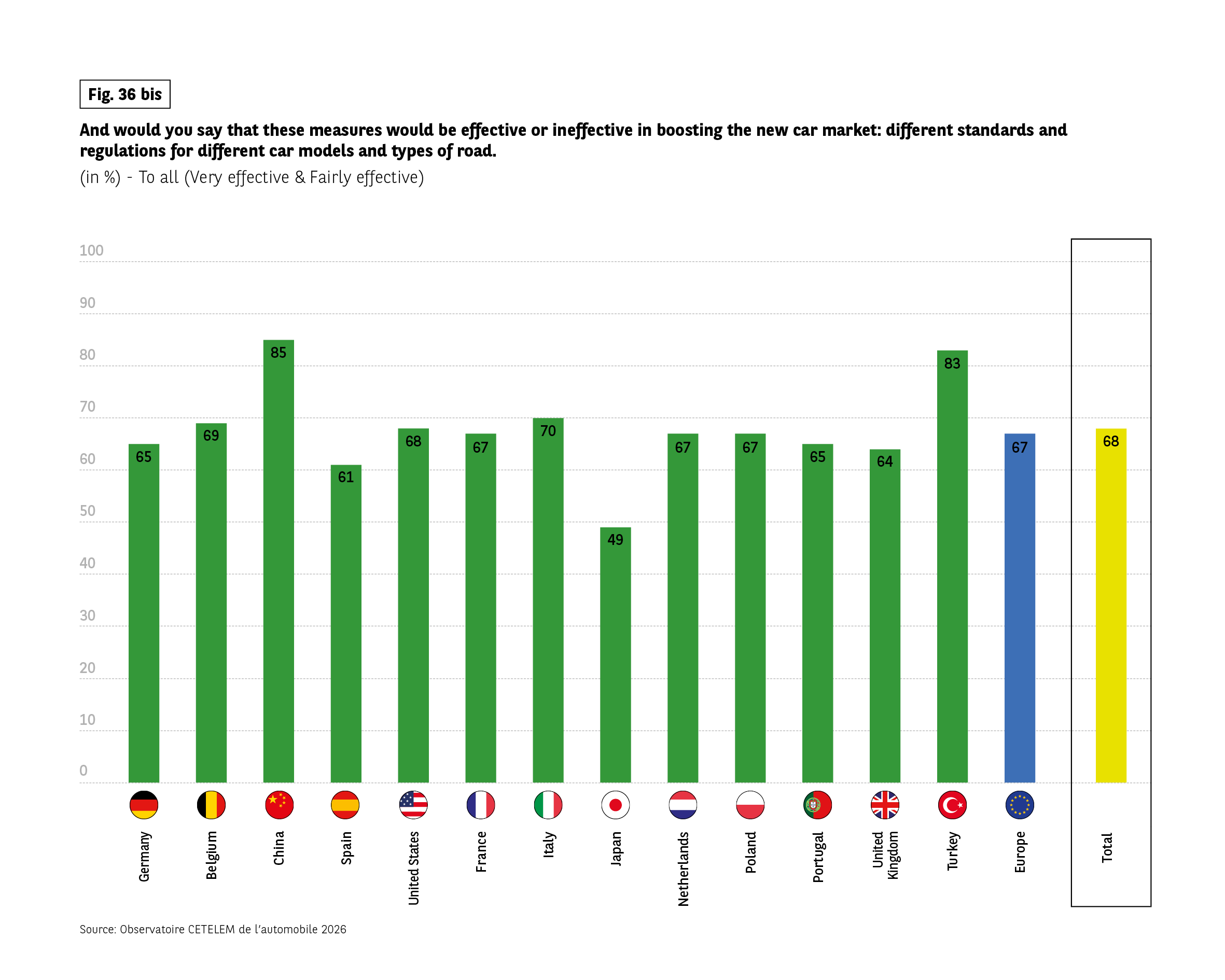

Almost as many motorists believe that this step backwards would be effective in reviving the market. However, opinions are a little more clear-cut from one country to the next, with the same oppositions between the sceptical Japanese and the enthusiastic Chinese and Turks. Once again, the under-50s and people living in big cities show an interest, as do couples with children.

Fig 36 – Perceived effectiveness of relaxing car regulations

Download this infographic for your presentations Context: Respondents assessed whether relaxing certain standards and regulations would be effective in boosting the new car market. Values represent combined “very effective” and “fairly effective”.

Data by country (in %):

Germany 73, Belgium 75, China 81, Spain 71, United States 68, France 72, Italy 68, Japan 57, Netherlands 70, Poland 77, Portugal 69, United Kingdom 64, Turkey 84, Europe 71, Total 72.

Key pattern: A majority in every country considers deregulation effective. Support is highest in Turkey (84%) and China (81), and lowest in Japan (57%).

Source: Observatoire CETELEM de l’automobile 2026.

Context: Respondents assessed whether relaxing certain standards and regulations would be effective in boosting the new car market. Values represent combined “very effective” and “fairly effective”.

Data by country (in %):

Germany 73, Belgium 75, China 81, Spain 71, United States 68, France 72, Italy 68, Japan 57, Netherlands 70, Poland 77, Portugal 69, United Kingdom 64, Turkey 84, Europe 71, Total 72.

Key pattern: A majority in every country considers deregulation effective. Support is highest in Turkey (84%) and China (81), and lowest in Japan (57%).

Source: Observatoire CETELEM de l’automobile 2026.

Fig 36bis – Perceived effectiveness of differentiated car standards

Download this infographic for your presentations Context: Respondents evaluated whether adopting different standards and regulations for different car models and types of road would be effective in boosting the new car market. Percentages represent combined “very effective” and “fairly effective”.

Data by country (in %):

Germany 65, Belgium 69, China 85, Spain 61, United States 68, France 67, Italy 70, Japan 49, Netherlands 67, Poland 67, Portugal 65, United Kingdom 64, Turkey 83, Europe 67, Total 68.

Key pattern: Perceived effectiveness is above 60% in most countries. Support is highest in China and Turkey, and lowest in Japan.

Source: Observatoire CETELEM de l’automobile 2026.

Context: Respondents evaluated whether adopting different standards and regulations for different car models and types of road would be effective in boosting the new car market. Percentages represent combined “very effective” and “fairly effective”.

Data by country (in %):

Germany 65, Belgium 69, China 85, Spain 61, United States 68, France 67, Italy 70, Japan 49, Netherlands 67, Poland 67, Portugal 65, United Kingdom 64, Turkey 83, Europe 67, Total 68.

Key pattern: Perceived effectiveness is above 60% in most countries. Support is highest in China and Turkey, and lowest in Japan.

Source: Observatoire CETELEM de l’automobile 2026.

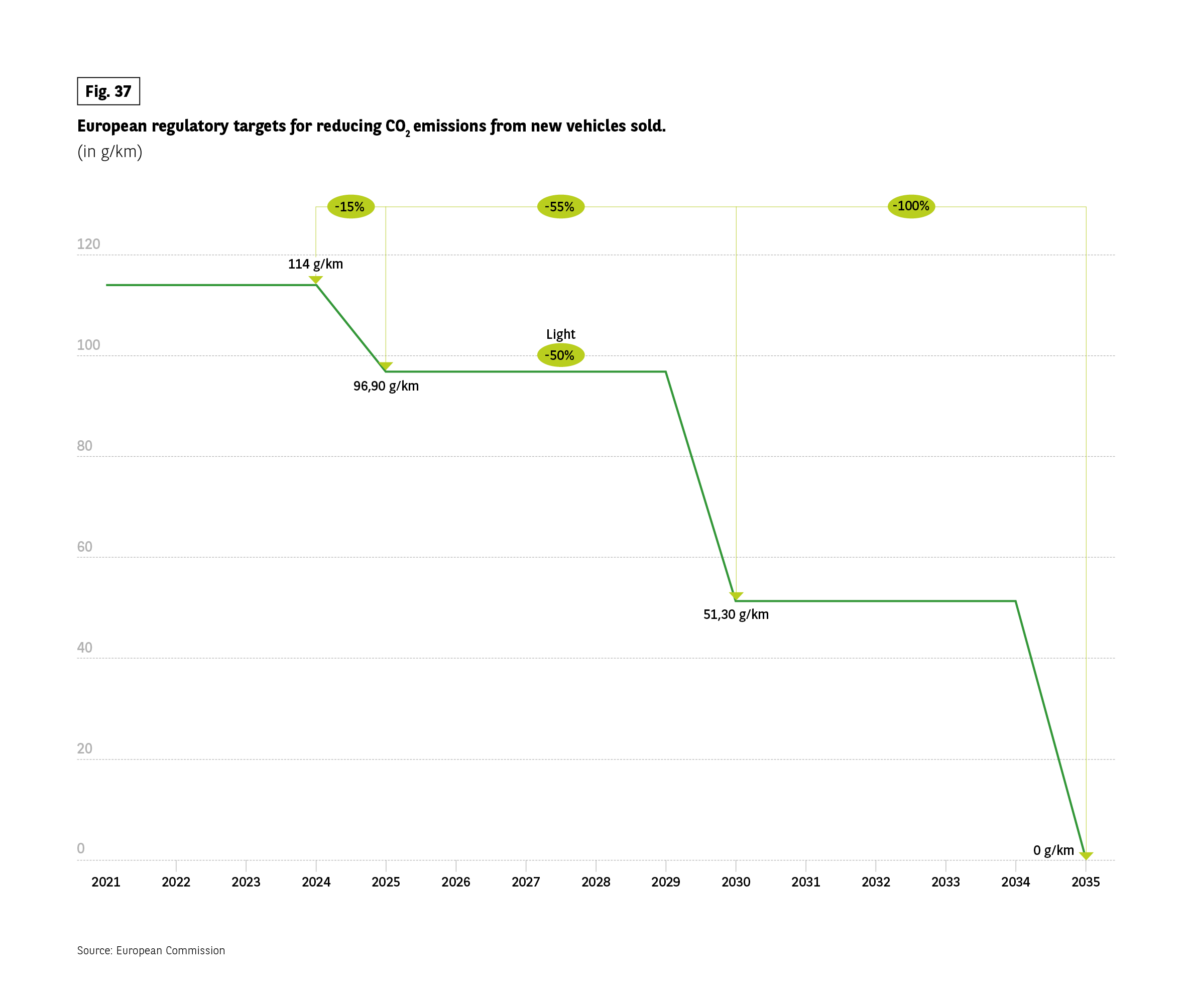

Fig 37 – European CO₂ emission targets for new cars

Download this infographic for your presentations Context: European regulatory targets for reducing CO₂ emissions from new vehicles sold, expressed in grams per kilometre (g/km).

Timeline:

2024: 114 g/km

2025: 96.90 g/km (–15%)

2030: 51.30 g/km (–55%, light vehicles –50%)

2035: 0 g/km (–100%)

Key pattern: Targets show a stepwise reduction with a complete phase-out of CO₂ emissions for new vehicles by 2035.

Source: European Commission.

Context: European regulatory targets for reducing CO₂ emissions from new vehicles sold, expressed in grams per kilometre (g/km).

Timeline:

2024: 114 g/km

2025: 96.90 g/km (–15%)

2030: 51.30 g/km (–55%, light vehicles –50%)

2035: 0 g/km (–100%)

Key pattern: Targets show a stepwise reduction with a complete phase-out of CO₂ emissions for new vehicles by 2035.

Source: European Commission.