The Offering

Keeping it simple…

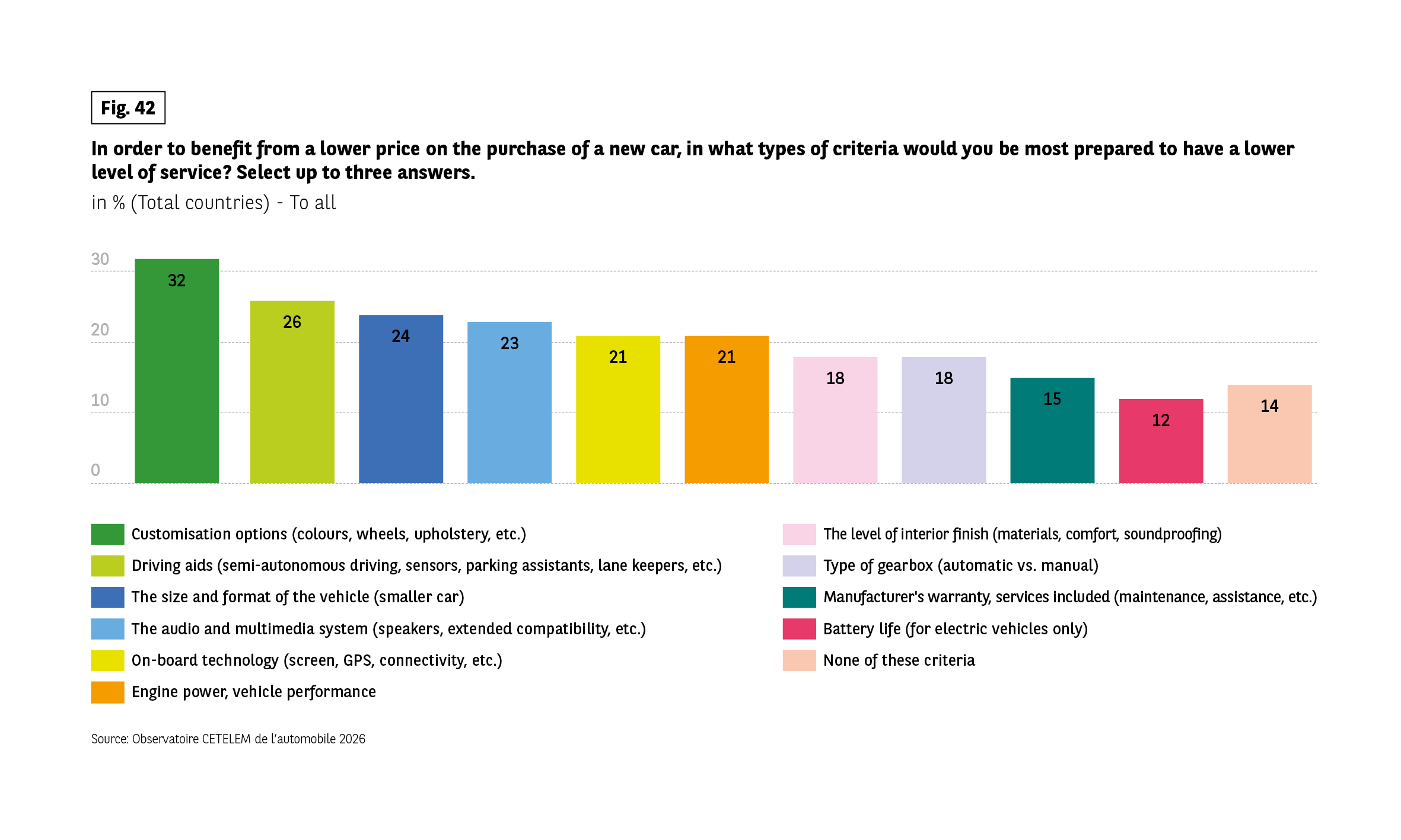

Once again with a view to lowering prices, which is the main lever for recovery, taking a fresh look at the supply side of the market would seem to be the right way to revive the market, according to motorists. (Fig. 42).

Firstly, a third of respondents encourage the production and therefore the sale of vehicles with fewer customisation options. Supporters of this frugality are concentrated in three southern European countries: Portugal, France and Italy (40%, 38% and 36%). In the north of Europe, Germany and Poland are more resistant.

There should be simplicity in terms of choice, but also when it comes to technology. The idea of reducing driving aids to cut costs comes second in this ranking (26%). Somewhat surprisingly, the technophile Chinese and Americans are the most likely to want this.

Finally, the production of smaller, lighter vehicles takes third place. This is good news for supporters of more environmentally-friendly vehicles. Behind the Netherlands, Germany, the country of large saloon cars and SUVs, occupies a surprising second place, with a significant number of motorists prepared to downsize.

Fig 42 – Service aspects people would downgrade for price

Download this infographic for your presentations Context: Respondents selected up to three criteria where they would accept a lower level of service to benefit from a lower purchase price.

Results (in %):

Customisation options 32

Driving aids 26

Size and format of the vehicle 24

Audio and multimedia system 23

On-board technology 21

Engine power and performance 21

Interior finish level 18

Gearbox type 18

Manufacturer’s warranty and services 15

Battery life for electric vehicles 12

None of these criteria 14

Key pattern: Customisation and driving aids are the most frequently accepted trade-offs.

Source: Observatoire CETELEM de l’automobile 2026.

Context: Respondents selected up to three criteria where they would accept a lower level of service to benefit from a lower purchase price.

Results (in %):

Customisation options 32

Driving aids 26

Size and format of the vehicle 24

Audio and multimedia system 23

On-board technology 21

Engine power and performance 21

Interior finish level 18

Gearbox type 18

Manufacturer’s warranty and services 15

Battery life for electric vehicles 12

None of these criteria 14

Key pattern: Customisation and driving aids are the most frequently accepted trade-offs.

Source: Observatoire CETELEM de l’automobile 2026.

… and doing less

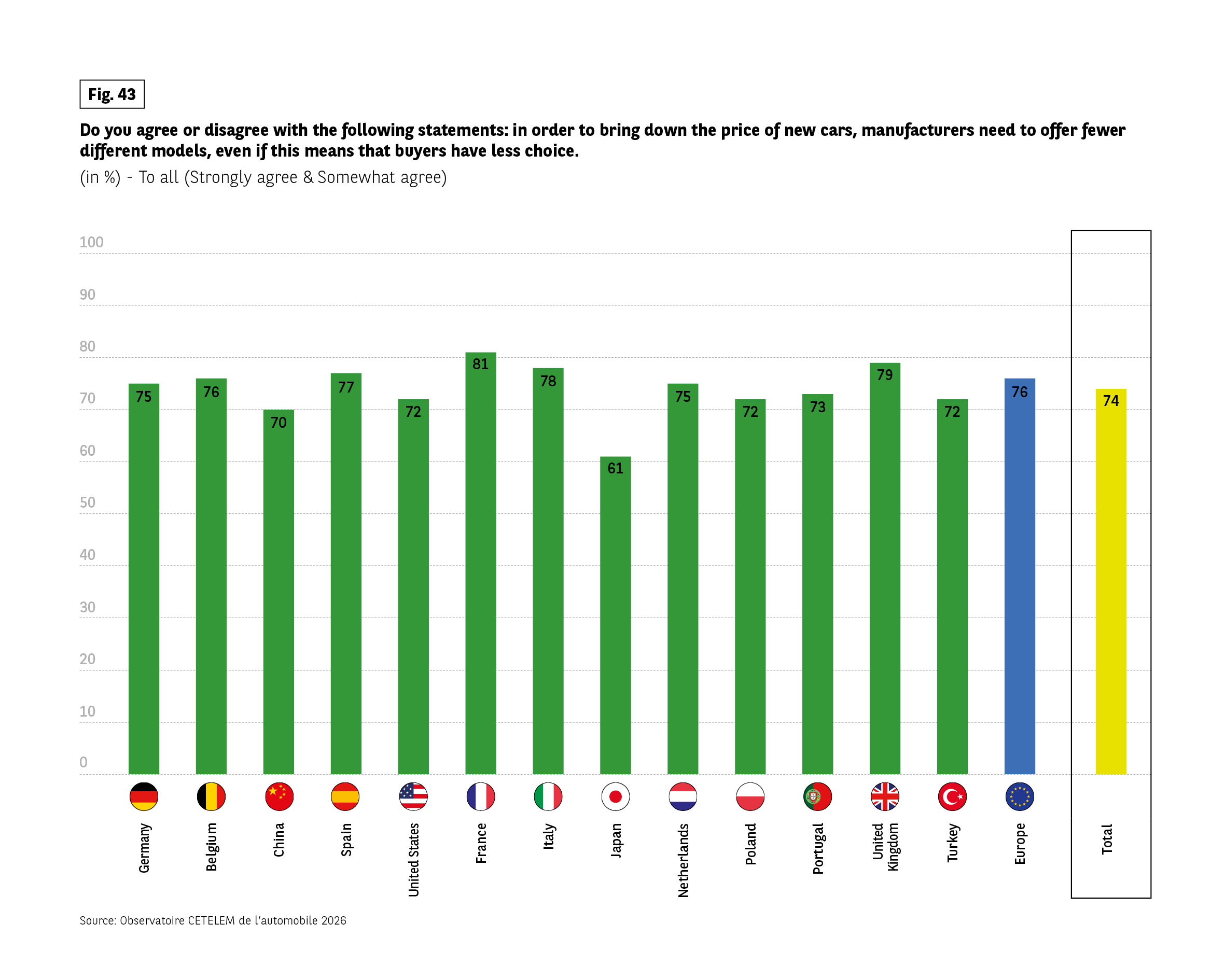

‘Less is more’, said the modernists. Today’s motorists approve. (Fig. 43).

Three-quarters are in favour of fewer models being built. In most countries, opinions on this subject are relatively similar, except in Japan where there is less interest in reducing the offering. The French lead the way on this point, ahead of the British.

Fig 43 – Support for reducing model variety to cut prices

Download this infographic for your presentations Context: Agreement with the statement that manufacturers should offer fewer models to lower prices, even if this reduces consumer choice.

Data by country (in %):

Germany 75, Belgium 76, China 70, Spain 77, United States 72, France 81, Italy 78, Japan 61, Netherlands 75, Poland 72, Portugal 73, United Kingdom 79, Turkey 72, Europe 76, Total 74.

Key pattern: A majority in all countries agree with this approach. Japan records the lowest level of support.

Source: Observatoire CETELEM de l’automobile 2026.

Context: Agreement with the statement that manufacturers should offer fewer models to lower prices, even if this reduces consumer choice.

Data by country (in %):

Germany 75, Belgium 76, China 70, Spain 77, United States 72, France 81, Italy 78, Japan 61, Netherlands 75, Poland 72, Portugal 73, United Kingdom 79, Turkey 72, Europe 76, Total 74.

Key pattern: A majority in all countries agree with this approach. Japan records the lowest level of support.

Source: Observatoire CETELEM de l’automobile 2026.

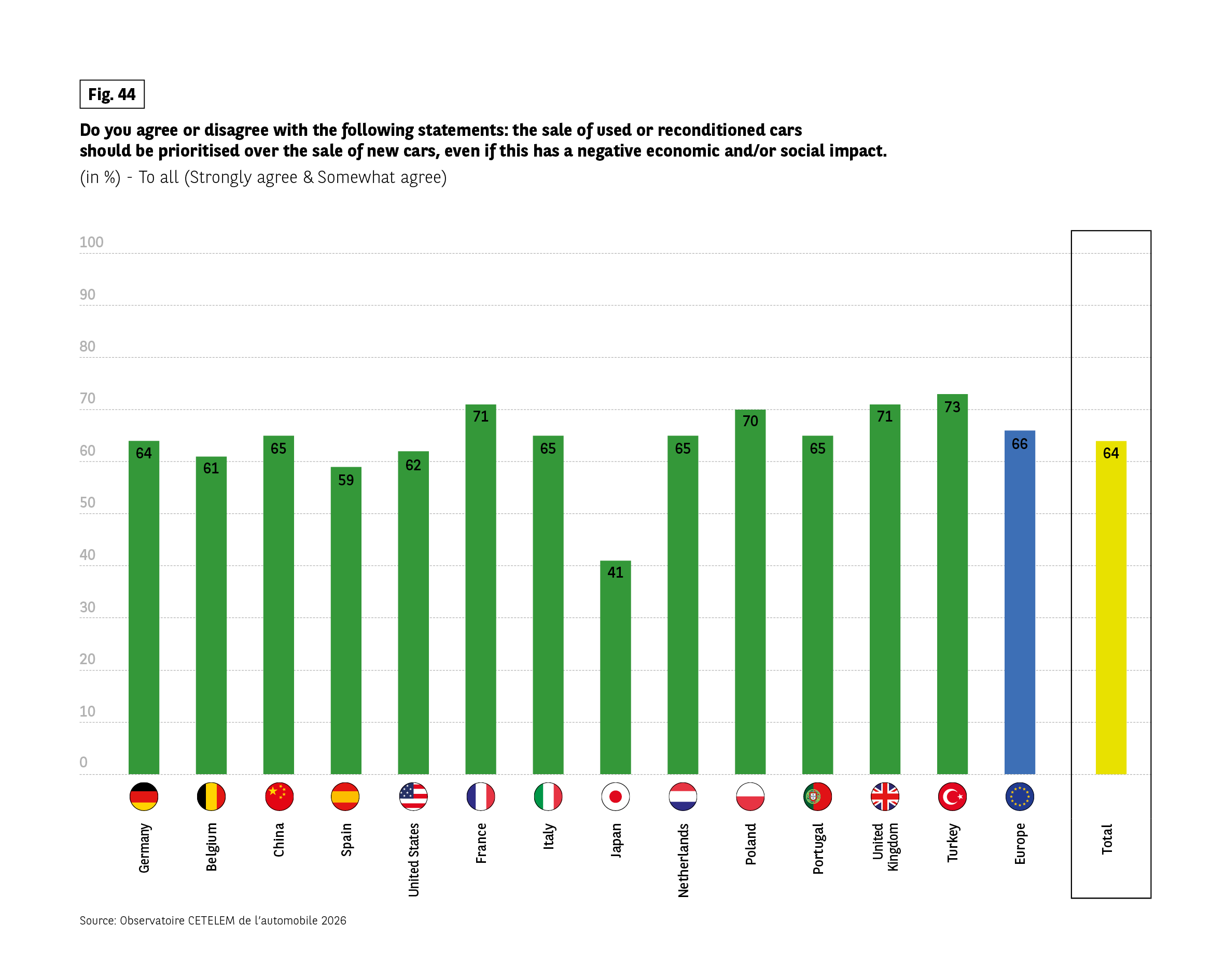

Promoting used and reconditioned cars

Lastly, two-thirds of respondents felt that the range of cars on offer could benefit from a shift towards used and reconditioned vehicles. (Fig. 44).

Here again, Japan is not in favour, the only country where only a small minority supports the idea. Naturally, young people are in favour of reconditioning, an idea that’s in keeping with the times.

Fig 44 – Support for prioritising used car sales

Download this infographic for your presentations Context: Agreement with the statement that the sale of used or reconditioned cars should be prioritised over the sale of new cars, even if this has a negative economic or social impact.

Data by country (in %):

Germany 64, Belgium 61, China 65, Spain 59, United States 62, France 71, Italy 65, Japan 41, Netherlands 65, Poland 70, Portugal 65, United Kingdom 71, Turkey 73, Europe 66, Total 64.

Key pattern: A majority support prioritising used cars in most countries, with notably lower support in Japan.

Source: Observatoire CETELEM de l’automobile 2026.

Context: Agreement with the statement that the sale of used or reconditioned cars should be prioritised over the sale of new cars, even if this has a negative economic or social impact.

Data by country (in %):

Germany 64, Belgium 61, China 65, Spain 59, United States 62, France 71, Italy 65, Japan 41, Netherlands 65, Poland 70, Portugal 65, United Kingdom 71, Turkey 73, Europe 66, Total 64.

Key pattern: A majority support prioritising used cars in most countries, with notably lower support in Japan.

Source: Observatoire CETELEM de l’automobile 2026.