A sector rendered economically vulnerable

The global market has been hugely affected by Covid

In 2019, the automotive world had allowed itself to be a little more upbeat. It was a relatively successful year and the next few months looked promising. But on 17 November 2019, everything changed. In Wuhan, China, the SARS‑Cov-2 coronavirus was discovered.

A few weeks later, the upbeat mood was gone.

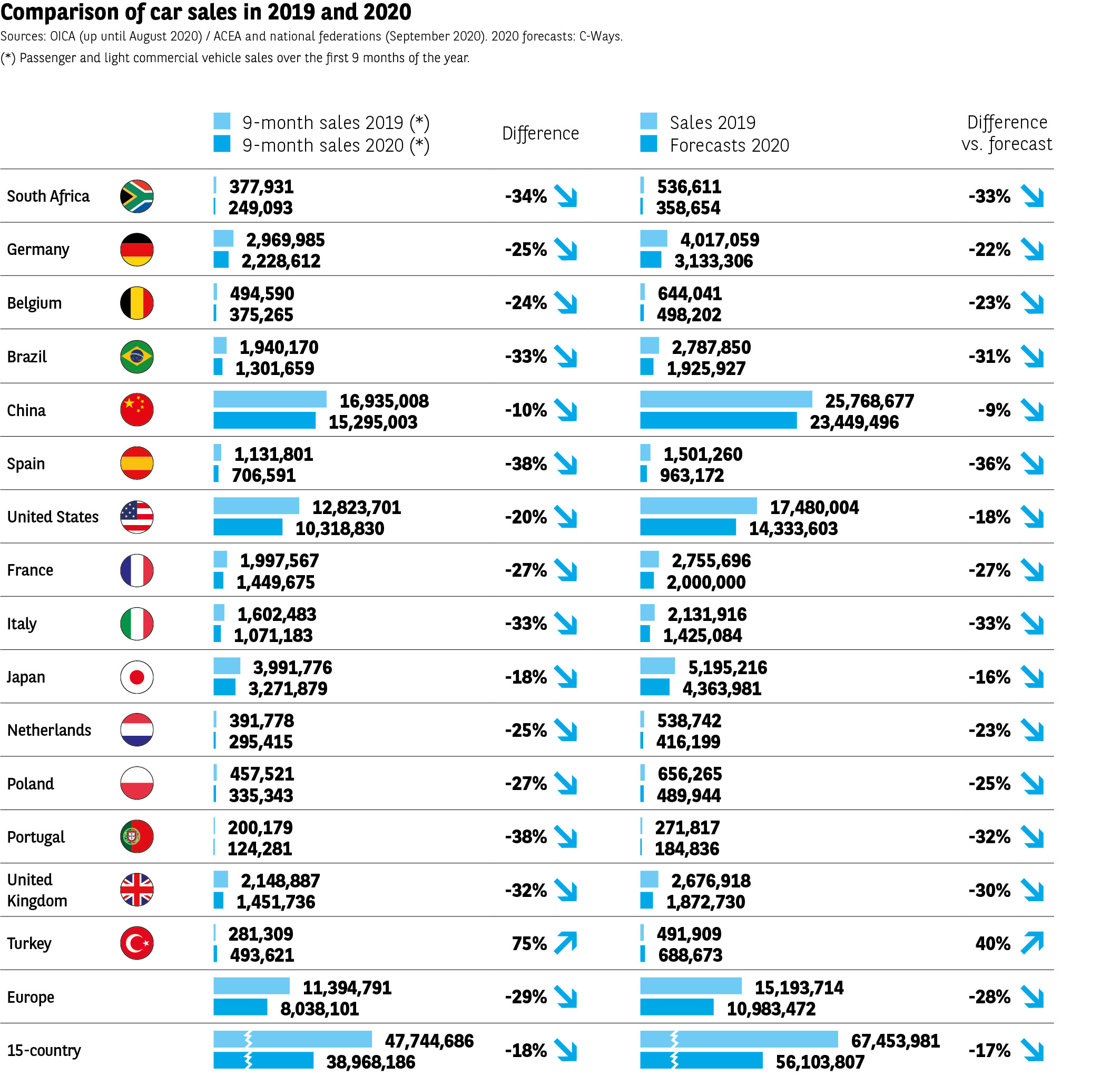

While the economic impact of the pandemic has been all enveloping, profoundly affecting all economic sectors with very few exceptions, the automotive industry was one of the first to be severely impacted. As early as February, sales in China were wiped out almost entirely. The spread of the virus soon triggered a similar collapse across the world.

Two countries went on to emerge from this slump. China saw its market bounce back in April and gradually stabilise. Turkey also witnessed a spectacular increase in sales, due primarily to the Turkish lira’s dramatic devaluation in 2019, which had led to a spectacular contraction of the market. If we look at the countries covered by this Observatoire, Japan comes out “on top”, while Spain and the United Kingdom have seen the biggest declines.

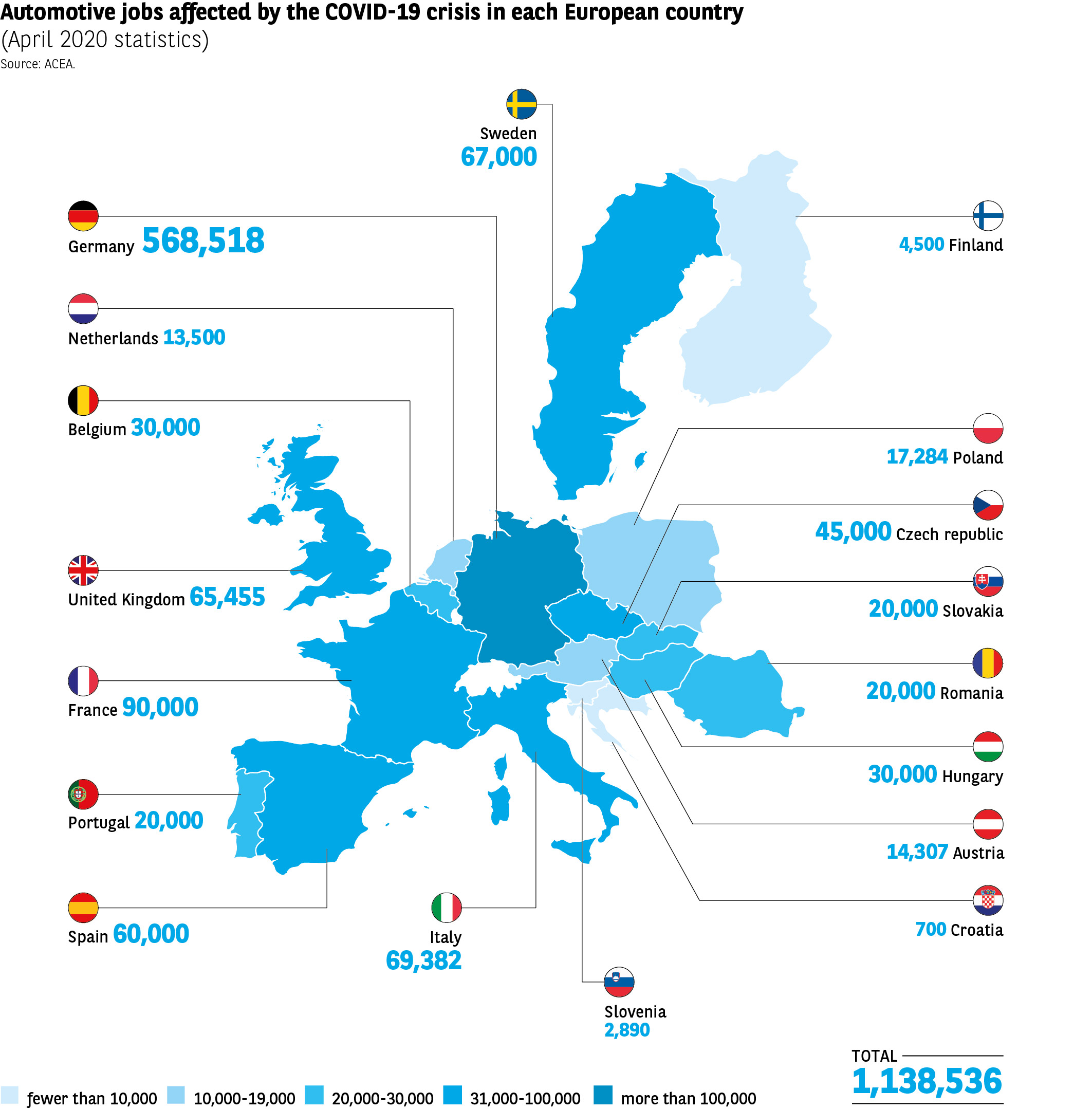

The pandemic is affecting not only sales, but also production. Assembly line stoppages, varying proportions of personnel off sick with the virus… the consequences for the industrial base have been severe, with sharp falls in output in some countries, Germany and Spain in particular. This has had a direct impact on employment.

China: the ship is damaged but still afloat

As the first country affected by COVID-19, China was also the first to see its automotive market suffer the consequences. Sales fell 20% in January and plummeted by 81% in February. They then stabilised and started to bounce back in April. China was also the first country to bring the pandemic under control, with monthly sales growth subsequently fluctuating between -3% and +9% compared with 2019 (source: CAAM).

Fig. 1 / Context:

Download this infographic for your presentations

The crisis threatens a huge number of jobs

In April 2020, at least 1.1 million people worked in the automotive sector in Europe. This figure is non-exhaustive and only includes individuals directly employed by car, truck, van and bus manufacturers. The impact on the wider automotive supply chain has been even more acute.

Fig. 2 / Context:

Download this infographic for your presentations

Purchasing intentions have suffered

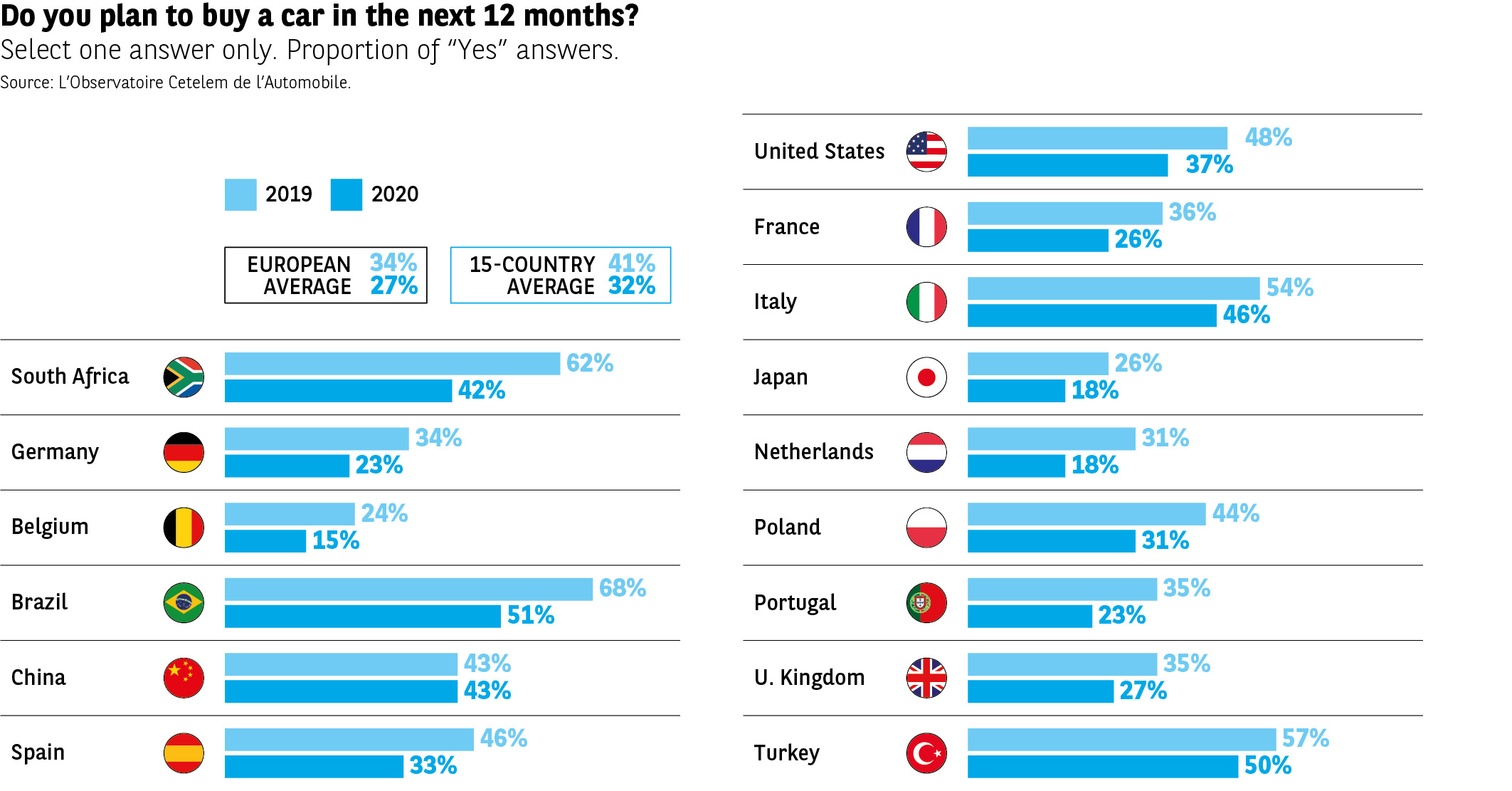

Production output and sales both fell in 2020, while purchasing intentions for the next 12 months do not inspire great optimism. It should be stressed from the outset that the survey was carried out in September, before the second wave of the pandemic, which has affected all participating countries. But even at this juncture it pointed to purchasing intentions that had contracted significantly compared with 2019. Whereas 41% of those surveyed a year ago were planning to buy a vehicle in the next 12 months, only 32% (27% of Europeans) now intend to do so (Fig. 3). The emerging economies, as well as China, Italy and the United States, offset this negative trend somewhat with their greater keenness to make a purchase. Nonetheless, with the exception of China, which, as we have highlighted, was the first to experience something of a recovery, purchasing intentions are down significantly across the board.

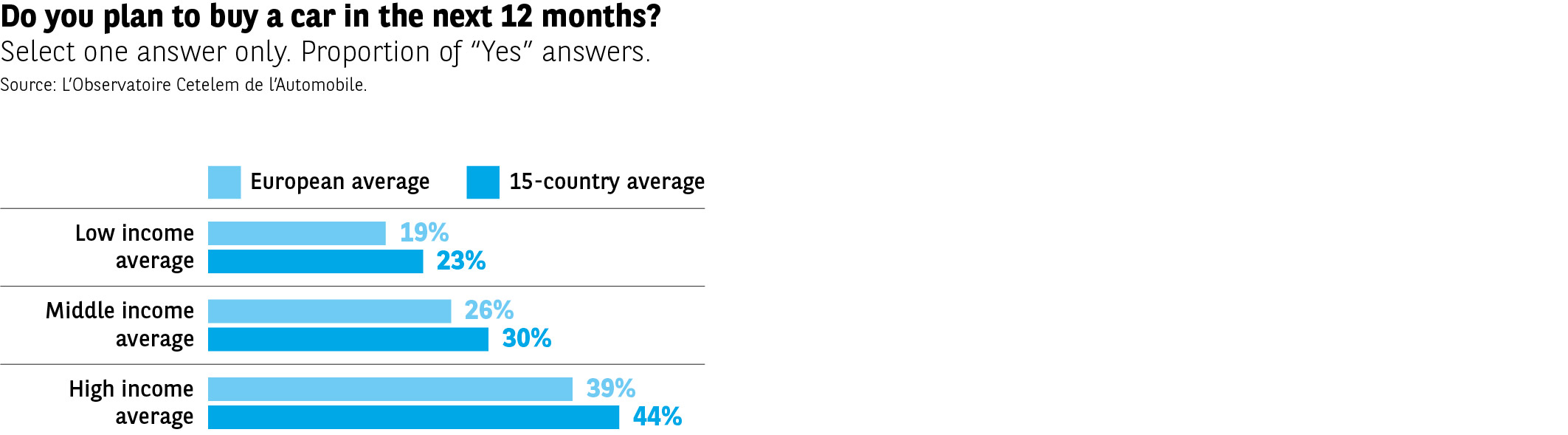

A breakdown based on income points to the fact that wealthier households are more likely than average to want to buy a new vehicle (Fig. 4).

The relative impact of the health crisis

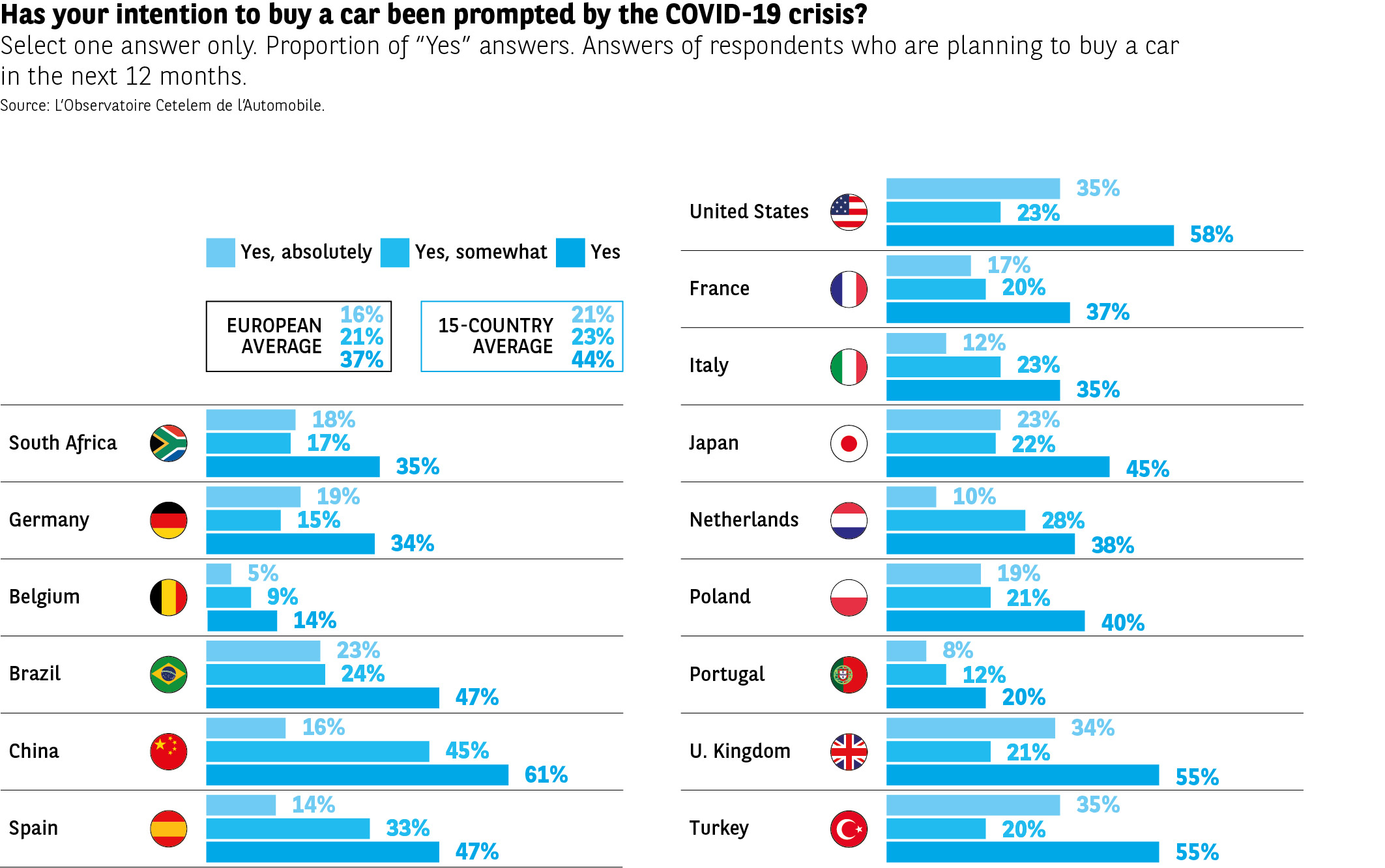

The pandemic has had a real yet moderate impact on these purchasing intentions. This is borne out by the responses of just over a third of those surveyed. However, there are significant disparities between, on the one hand, China, the United States, Turkey and the United Kingdom, where more than 1 in 2 respondents state that they have been influenced by COVID-19, and, on the other, Portugal and Belgium, where the figure is 1 in 5, at the very most (Fig. 5).

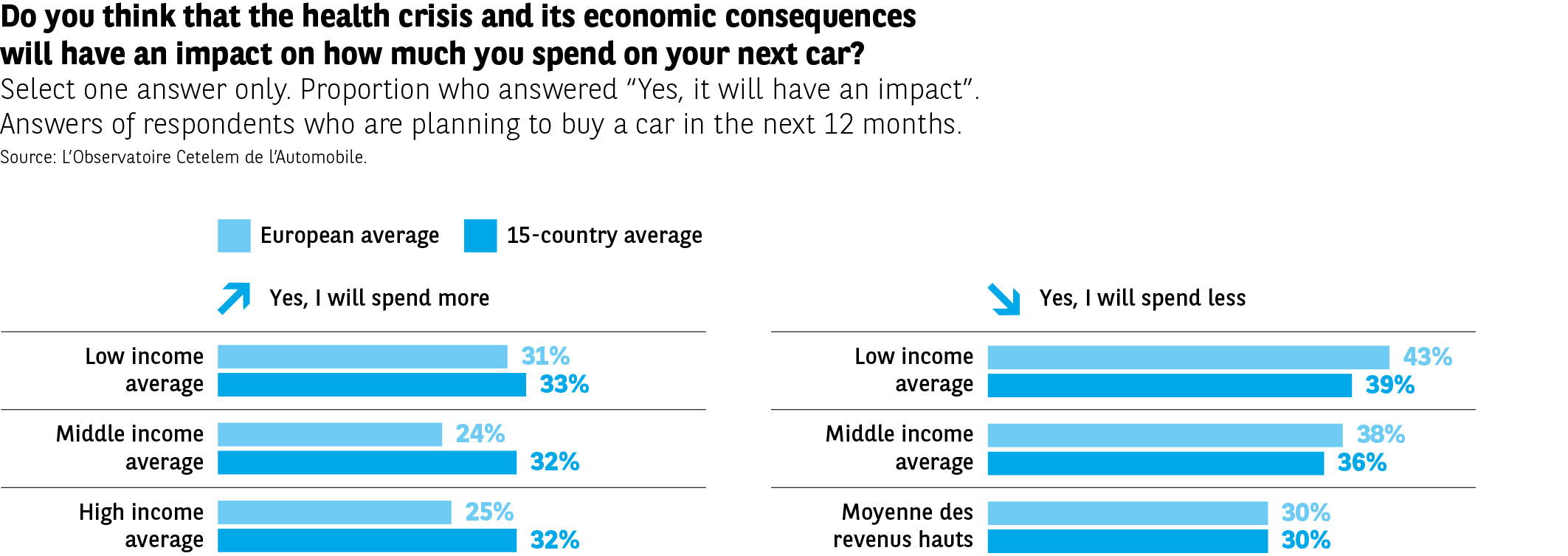

Spending budgets have been downsized

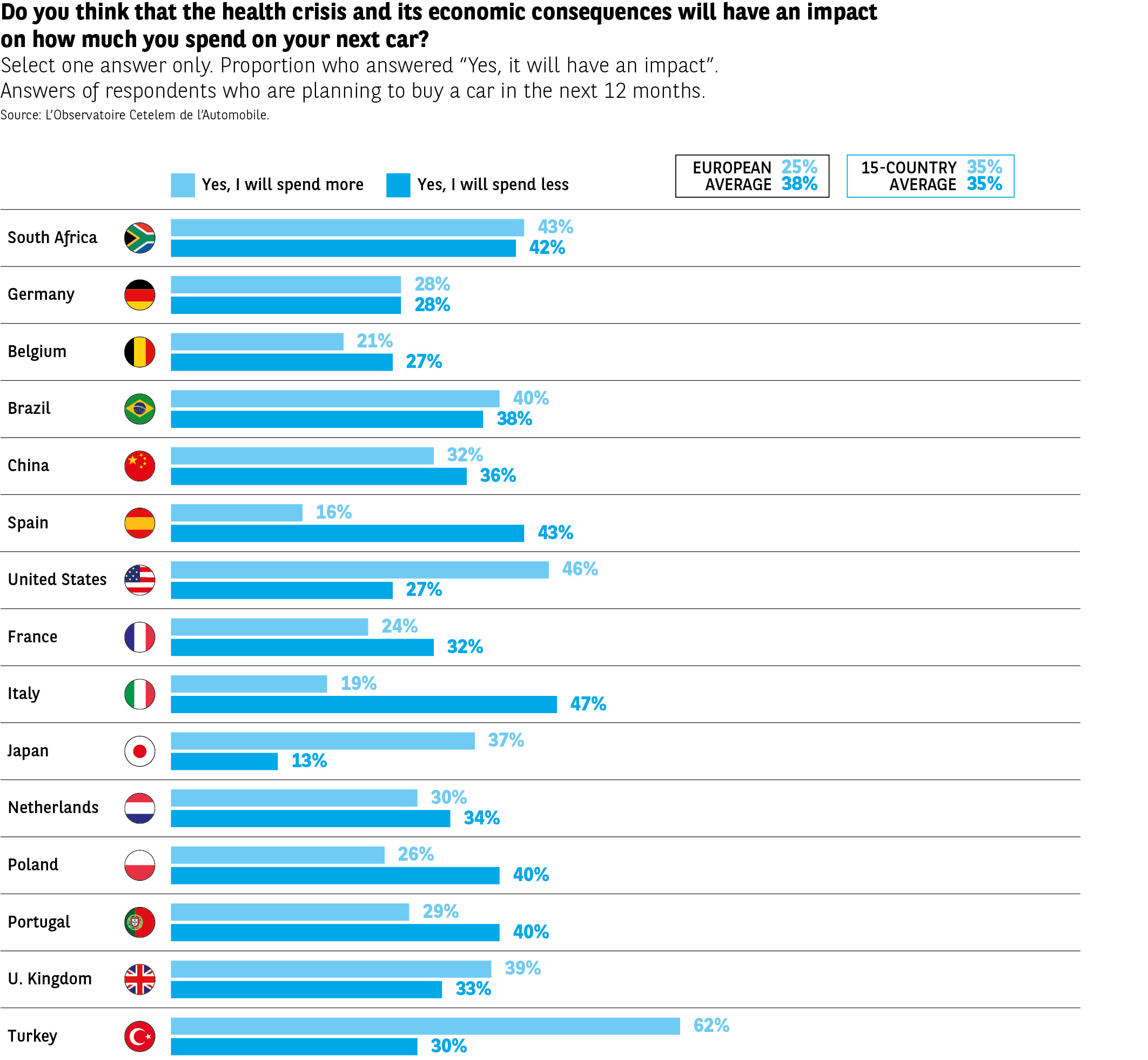

Similarly, the impact of the virus on the budget consumers plan to set aside for a future vehicle purchase highlights two contrasting groups of countries, but overall there are as many motorists who want to spend more as there are who want to spend less (35% in both cases) (Fig. 6). Those most willing to part with their money are the emerging nations, but also the United States, the UK and Japan. Meanwhile, a significant proportion of Turks intend to increase their budget (62%), in line with the mass spending that took place in 2019. Conversely, vehicle acquisition budgets have fallen most significantly in the Latin countries, with nearly 1 in 2 Italians planning to cut the amount they spend.

In almost every country, those on the lowest incomes state their intention to spend less (Fig. 7). It is worth noting that in three countries, virtually equal numbers of respondents intend to increase and reduce their budget: Germany, South Africa and Brazil.