A shift towards used cars

Sales are holding up despite the crisis

Rekindling our relationship with cars also seems dependent on the power of attraction that used vehicles hold now and in the future. On average worldwide, a quarter of upcoming purchases will involve used vehicles. The Portuguese, Poles, South Africans, Dutch and French are the most likely to opt for a second-hand car, with scores of over 30%. Meanwhile, around 90% of Chinese, Spanish and Japanese respondents are not prepared to do so.

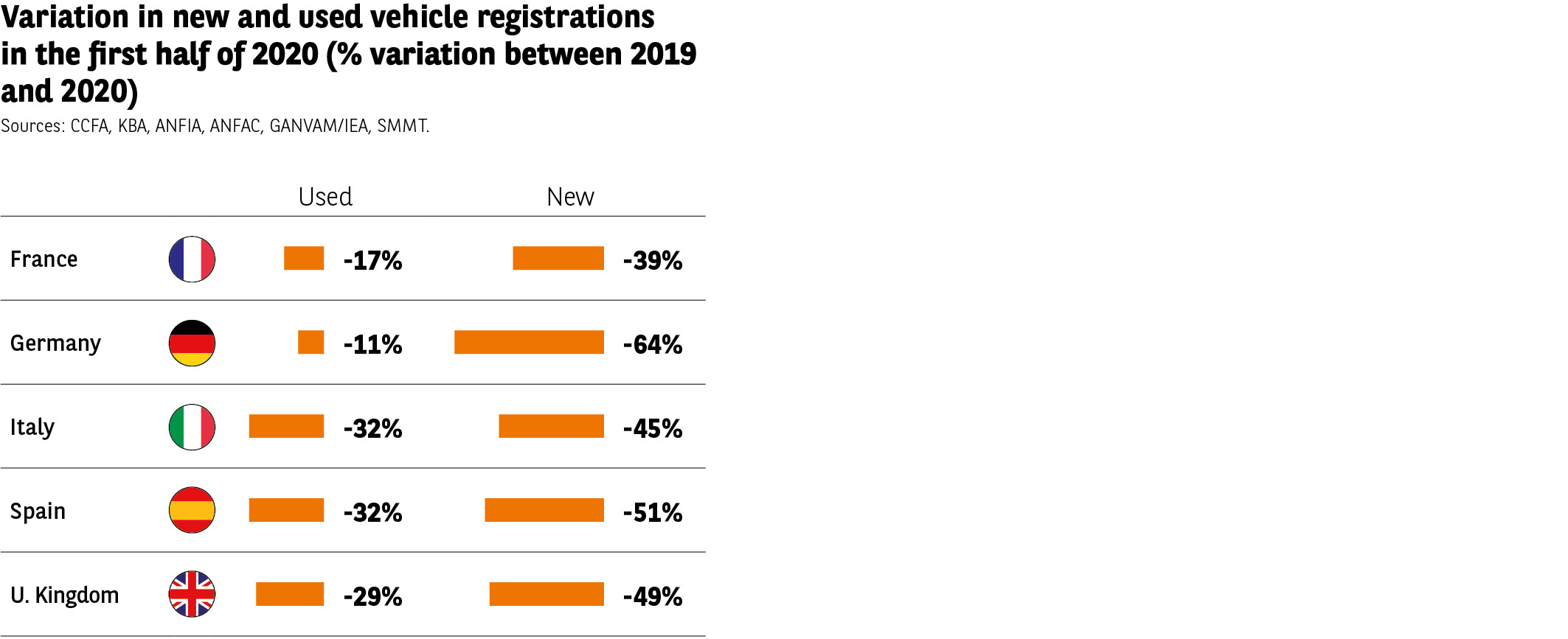

Even more interestingly, in many countries during the first few months of the crisis, the used market demonstrated its resilience relative to new-car sales. In their own way, used vehicles are something of a safe haven, sheltered from the crisis and its consequences. In these uncertain times, the end of which is not yet in sight, this shift in the perception of used vehicles is bound to attract many new buyers.

The second-hand market bounces back

Opting for a used vehicle has always been a natural tendency in tough economic times. 2020 is no exception. In pretty much every country, used-car sales have held up better than those of new vehicles.

Older vehicles (more than 10 years old), whose quality and durability have grown steadily in recent years, are the only way for the lowest income households to access a car. The gradual rise in the average age of cars on the road in the United States and Western Europe reminds us that the used market now covers all categories of vehicle.

Moreover, the growing proportion of new vehicles that are acquired by companies, which are keeping their cars for ever shorter periods of time, is providing the used-car market with more and more low-mileage and well-maintained vehicles. The number of leasing contracts that are coming to an end is also on the rise. Indeed, three or four years after having been acquired new, these cars are finding a second home via the second-hand market. This is a boon both for households and dealers. And although used-car prices and profit margins are lower, dealerships do not have to share the proceeds with a manufacturer. Once considered of secondary importance, the used car market is slowly becoming a crucial one for retailers and motorists alike.

A clear economic value

At a time when households are under increased financial strain, used vehicles make a significant difference, given that the budgets available for new cars are lower than was previously the case. Thus, the key advantages put forward are a significantly lower purchase price (48%), and the fact that new cars depreciate faster (34%). These financial arguments inevitably enhance the power of attraction of the used market.

The appeal of cars under a year old

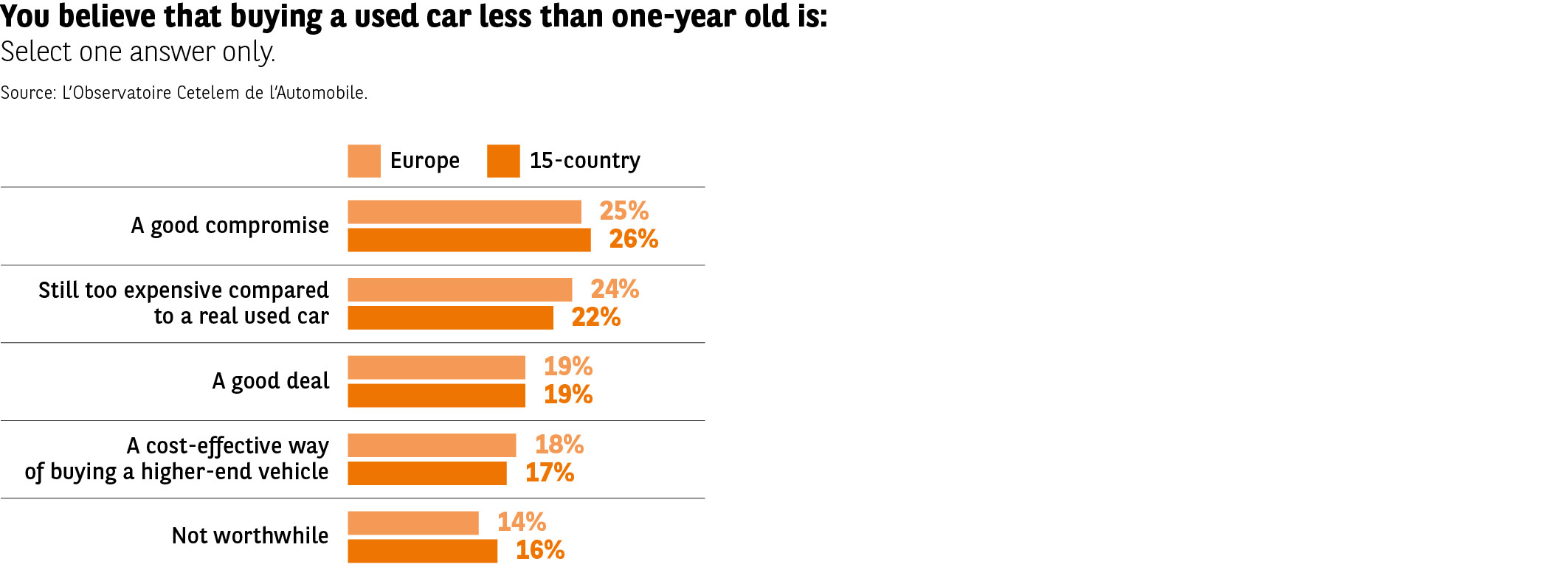

An interesting variation on the used-car theme, cars under a year old make a few winning arguments that many are drawn in by. The number of people who consider them to be a good compromise between new and used vehicles is similar to the proportion who consider them too expensive compared to “real” second-hand cars (26% and 22%, respectively) (Fig. 38). Overall, 1 in 5 people believe them to be an attractive proposition.