UNCERTAINTY HAS LED TO PRECAUTIONARY SAVING AND SUBDUED CONSUMPTION

As we have just seen, inflation is a major concern for Europeans. However, unlike last year, when their reaction was astonishment, they are now organising themselves and adapting. The lasting repercussions of the current inflationary climate and the decline in purchasing power are a reality with which they have learned to come to terms. Thus, Europeans are pulling the levers available to them, namely precautionary saving and controlled spending.

SAVINGS BOOSTED BY UNCERTAINTY

During the pandemic, savings rates reached record levels in Europe, driven by travel restrictions, the postponement of spending plans and uncertainty about the future. Saving subsequently fell, which allowed consumption to recover in 2022.

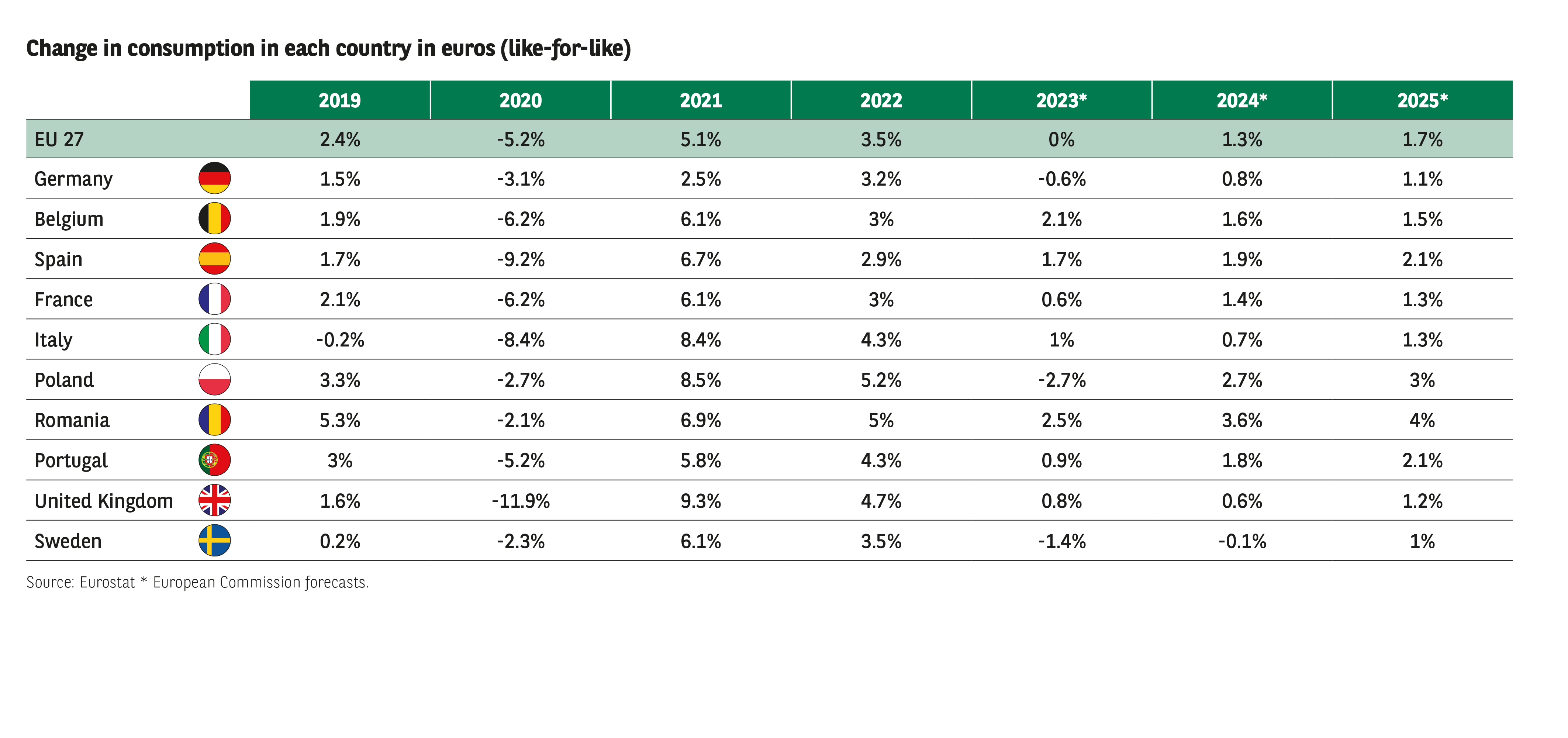

But what is the situation today? The economic data and the results of this 2024 Observatoire Cetelem Barometer are perfectly aligned. Uncertainties, particularly those of an economic nature, have prompted Europeans to build up precautionary savings, despite the strain on their purchasing power. Thus, the average savings rate among Europeans is still slightly higher than before the pandemic, and should remain so for years to come (Fig. 9).

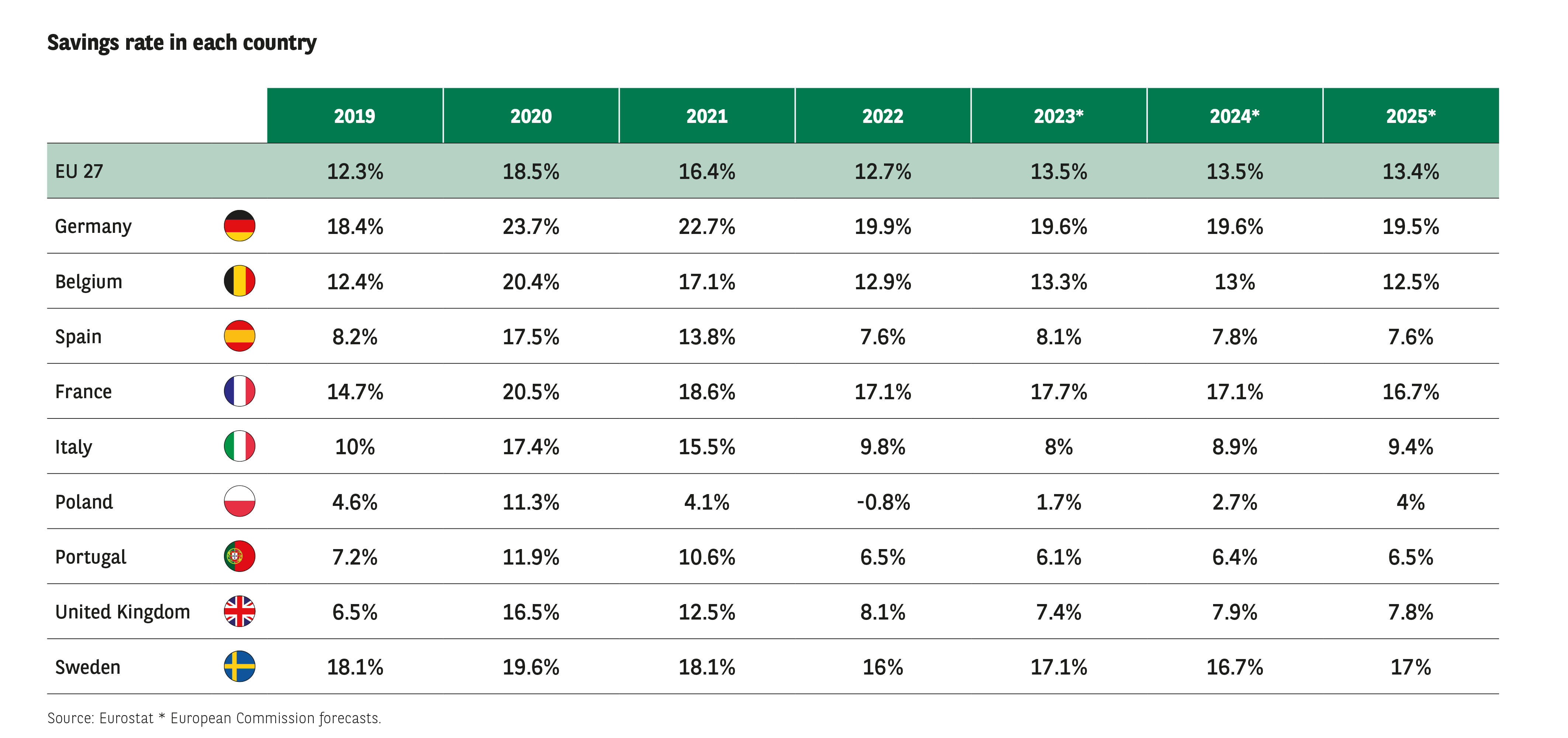

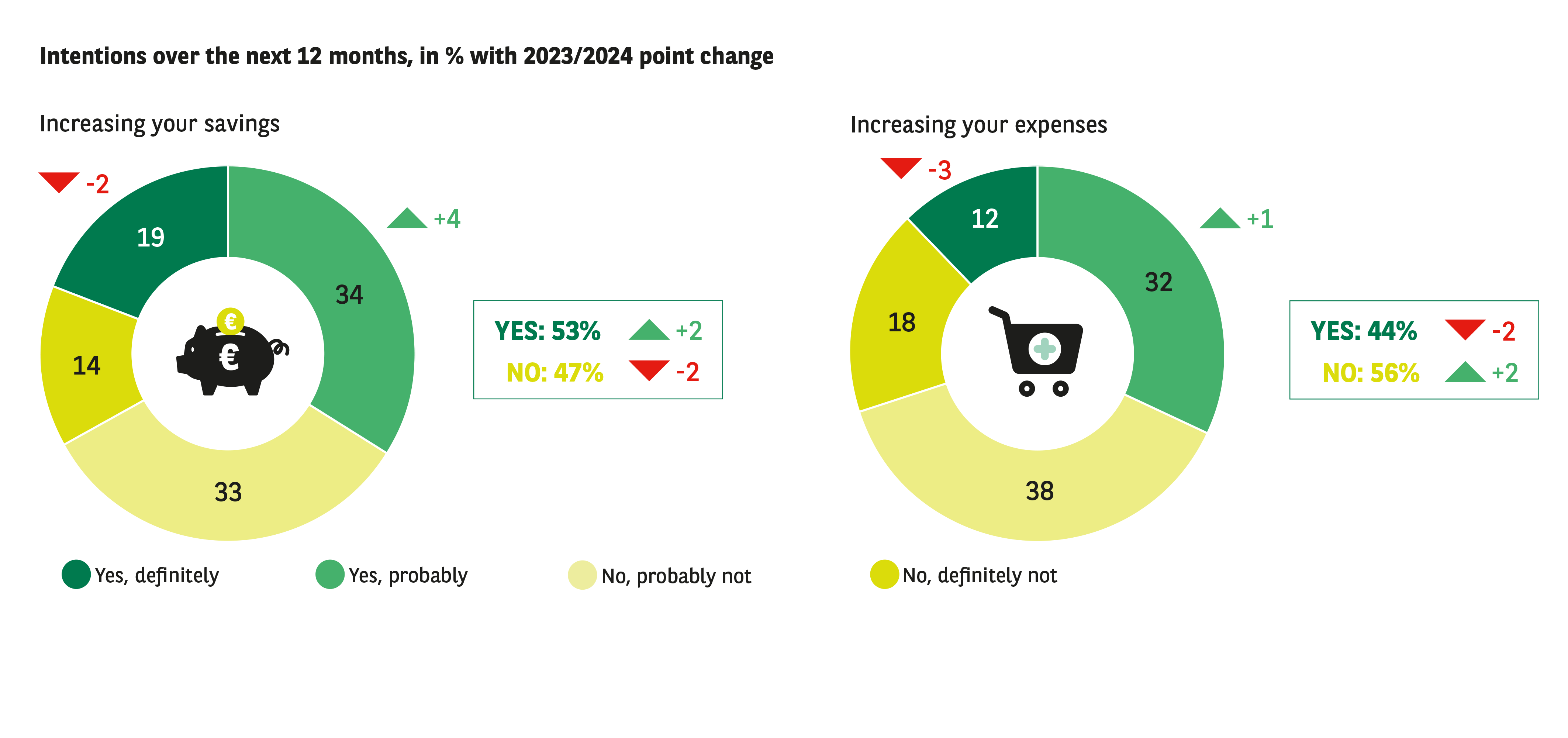

The data gathered by this latest Observatoire Cetelem Barometer confirms this tendency to set some money aside. More than half (53%) of Europeans expect to save more over the next 12 months, an increase of 2 points on last year (Fig. 10a). This upward trend can be seen in all the countries surveyed, with the exception of Germany and Sweden (-2 and -3 points), which, as we have already noted, have seen most of their indicators fall (Fig. 10b). Nevertheless, with 57% of respondents planning to save more in the coming year, these two countries continue, as ever, to lead the way in Europe when it comes to savings, along with Portugal.

Fig 9 / Barometer

Download this infographic for your presentations

Fig 10a / Barometer

Download this infographic for your presentations

Fig 10b / Barometer

Download this infographic for your presentations

THE DESIRE TO SPEND IS PRESENT BUT FRUSTRATED

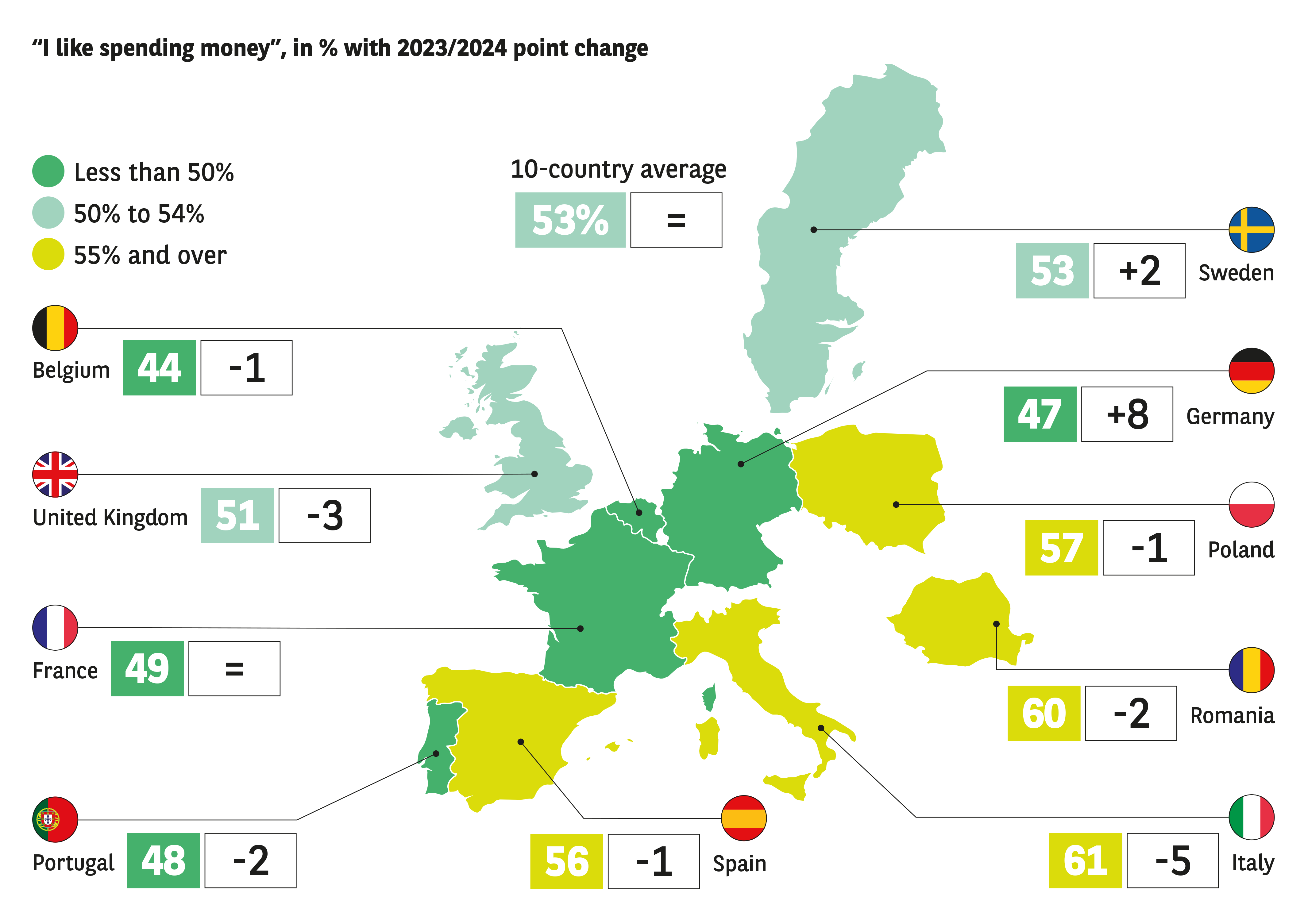

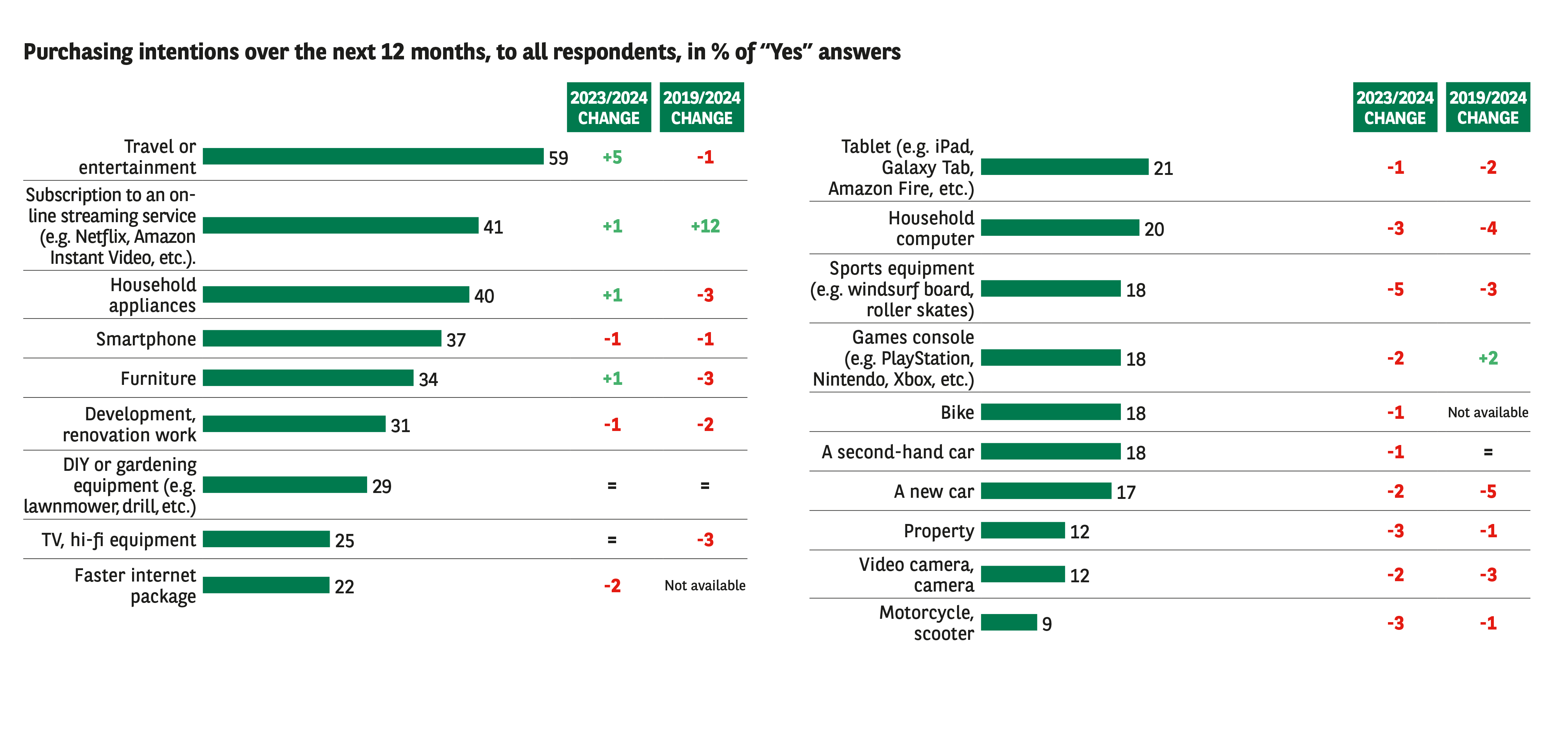

Purchasing intentions have held up well, with 53% stating that they are keen to spend this year (Fig. 11). This figure has not changed since 2023, suggesting that household consumption in Europe will be resilient in 2024 despite high interest rates and relatively poor economic conditions. However, this desire to consume generates a great deal of frustration: 44% of Europeans say they are keen to do so, but can’t always afford to, i.e., 8 out of every 10 people who want to spend! Once again, the Germans and Swedes stand apart. Indeed, while fewer of them can’t afford to spend (7 out of 10 on average), this proportion has risen sharply since last year (+8 and +2 points respectively). Although there are considerable disparities between the countries, both in absolute terms and in terms of year-on-year change, the big winners when it comes to this urge to consume are travel and leisure (59%), far ahead of video streaming subscriptions (41%) and household appliances (40%) (Fig. 12). Over the longer term, streaming services have gained the most ground, with purchasing intentions rising from 29% in 2019 to 41% in 2024.

Fig 11 / Barometer

Download this infographic for your presentations

In contrast, new cars, furniture, household appliances, computers and renovation projects have all experienced significant falls.

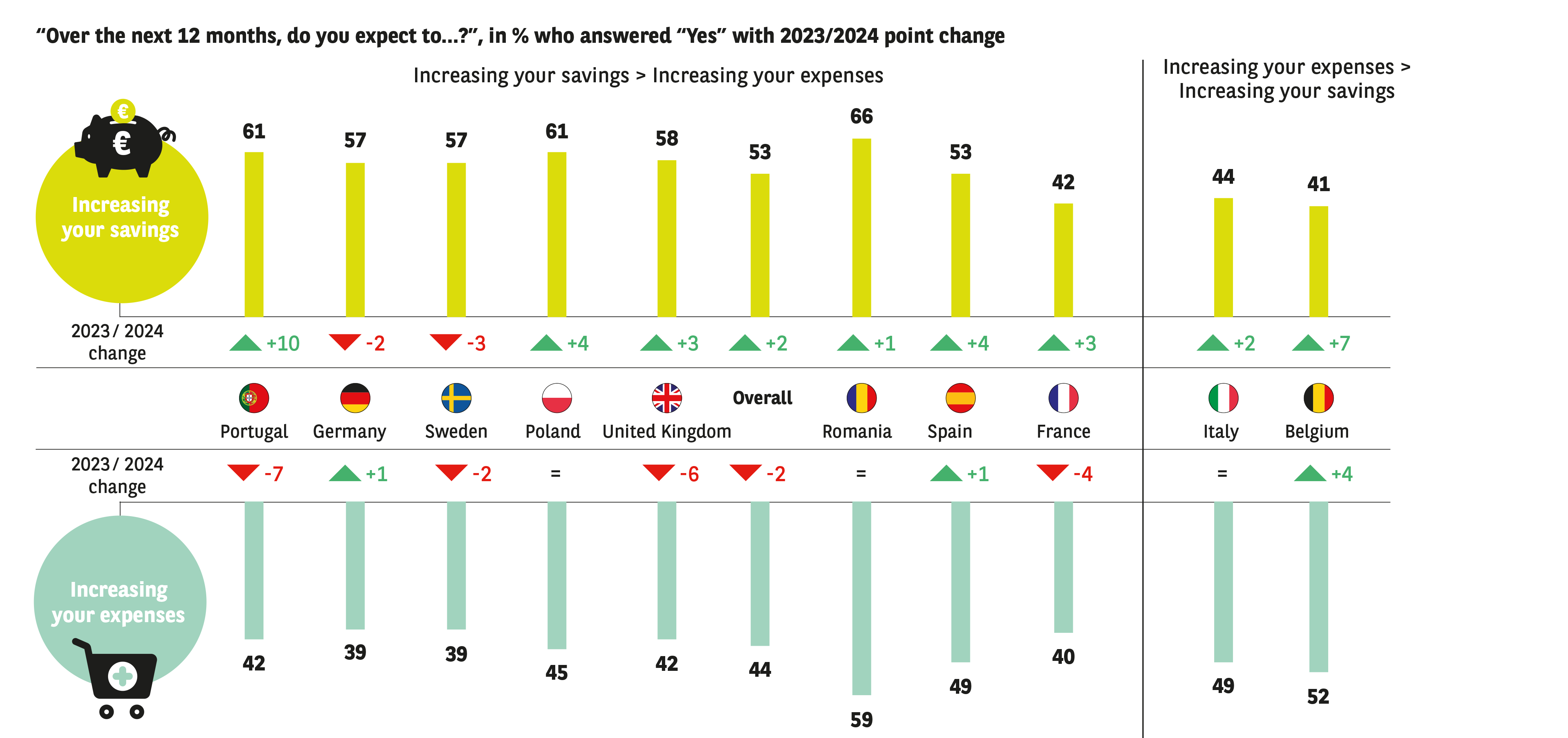

This current tendency to rein in one’s spending is in line with the Eurostat data on household consumption, which points to a stabilisation in 2023. However, the European Commission’s projections for the near future are a little more optimistic than our respondents, suggesting that consumption will recover gradually in 2024 and 2025 (Fig. 13), particularly in Sweden, the UK, Italy and Germany. This outlook echoes the findings of the Observatoire Cetelem Barometer, which support the idea that the worst may be over.

Fig 12 / Barometer

Download this infographic for your presentations

Fig 13 / Barometer

Download this infographic for your presentations