TO STAY AFLOAT, HOUSEHOLDS ARE MAKING CERTAIN CHOICES AND DOING WITHOUT, ESPECIALLY WHEN IT COMES TO FOOD

Confronted with the highest inflation in 40 years, Europeans have faced up to the situation and adapted. This is unavoidable when wages fail to rise to the same extent. Thus, in response to the fall in their purchasing power, not only are they foregoing certain items, they are also adopting various strategies to consume more wisely, paving the way for a shift towards more responsible retail.

A TIME FOR GOING WITHOUT

After last year’s economic shock, there are many things people are going without. Simple everyday pleasures are not the least of these.

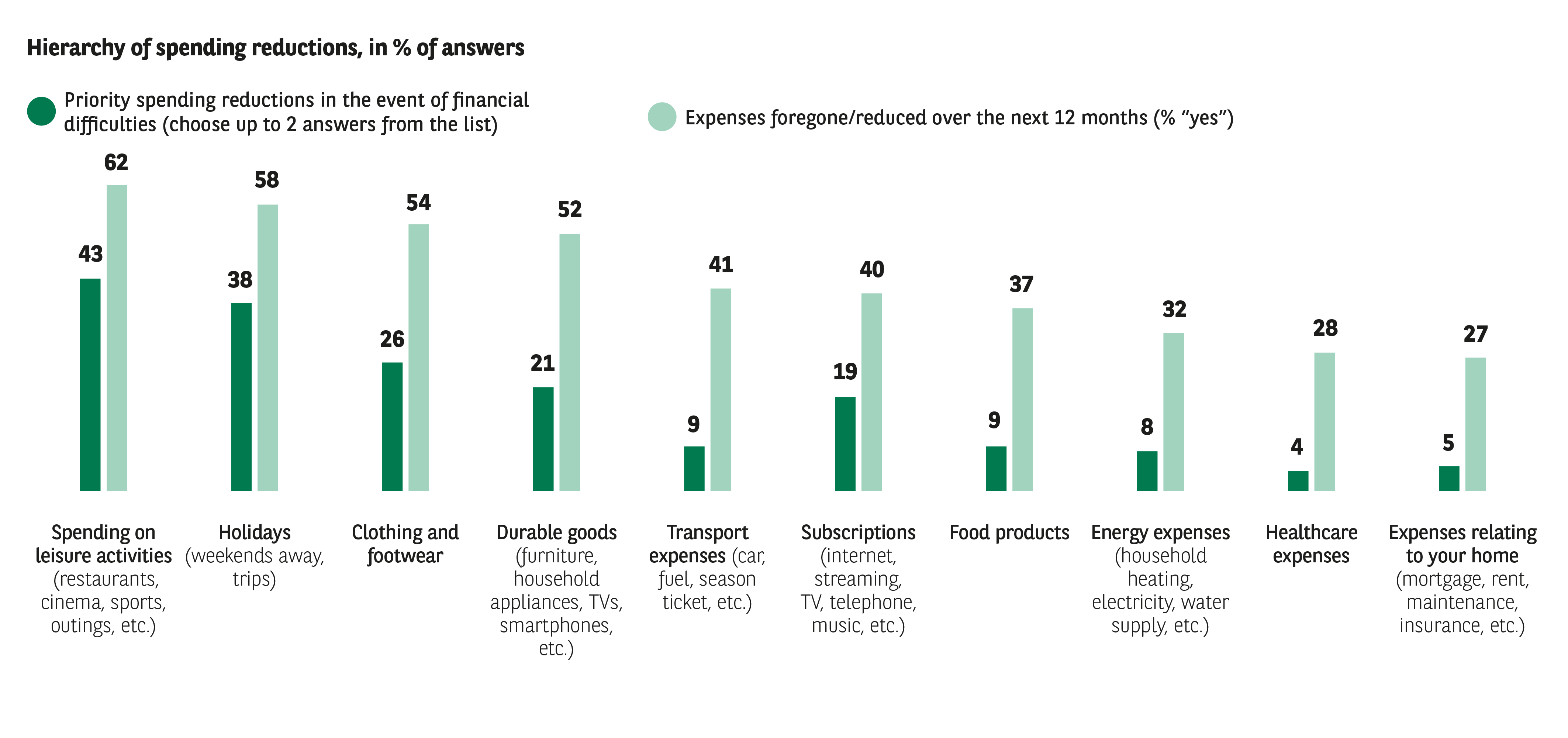

62% of Europeans have decided against spending money on leisure activities (restaurants, cinema, outings, etc.) and 58% on weekends away and travelling. This is hardly surprising, given that in 43% and 38% of cases, respectively, respondents spontaneously cite these two types of expense when it comes to cutting back in the event of financial difficulties (Fig. 14). This is a general trend that can be observed in every country. It is therefore difficult for companies in these sectors to make up for the loss of local business in other European markets.

However, it should be stated that all areas of consumer spending are now subject to these trade-offs. For instance, nearly 4 out of 10 Europeans (37%) have tightened their food budget. Of course, household and personal goods have also been heavily impacted, with figures of 54% for clothing and footwear, and 52% for furniture, household appliances, TVs and smartphones. People are even opting to cut back on unavoidable / necessary purchases. Indeed, 32% of households have reduced their energy spending and 27% have cut expenses relating to the home. And one can hardly blame them, considering the price rises witnessed over the last few years.

BUDGETS HAVE BEEN REVISED AND RESTRUCTURED

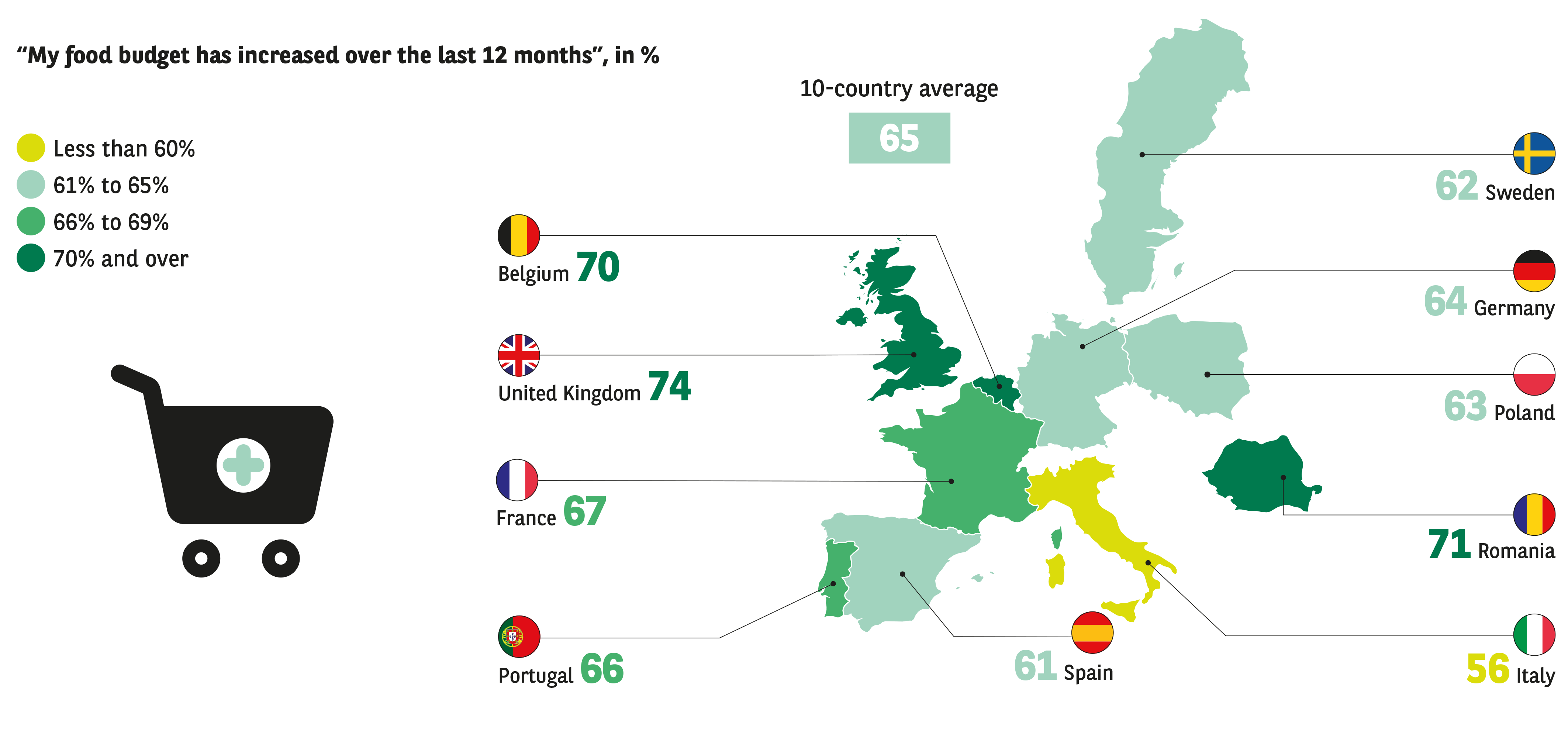

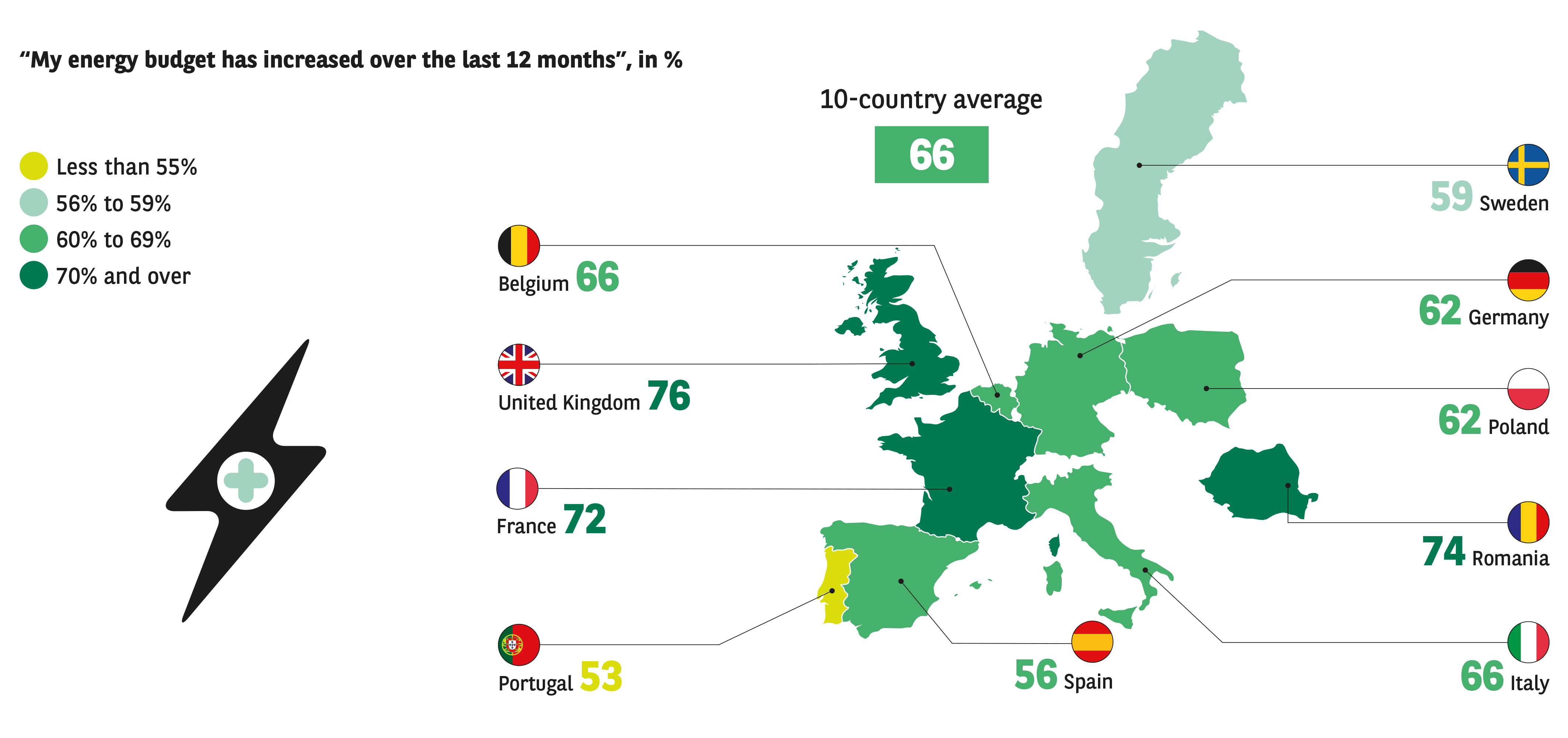

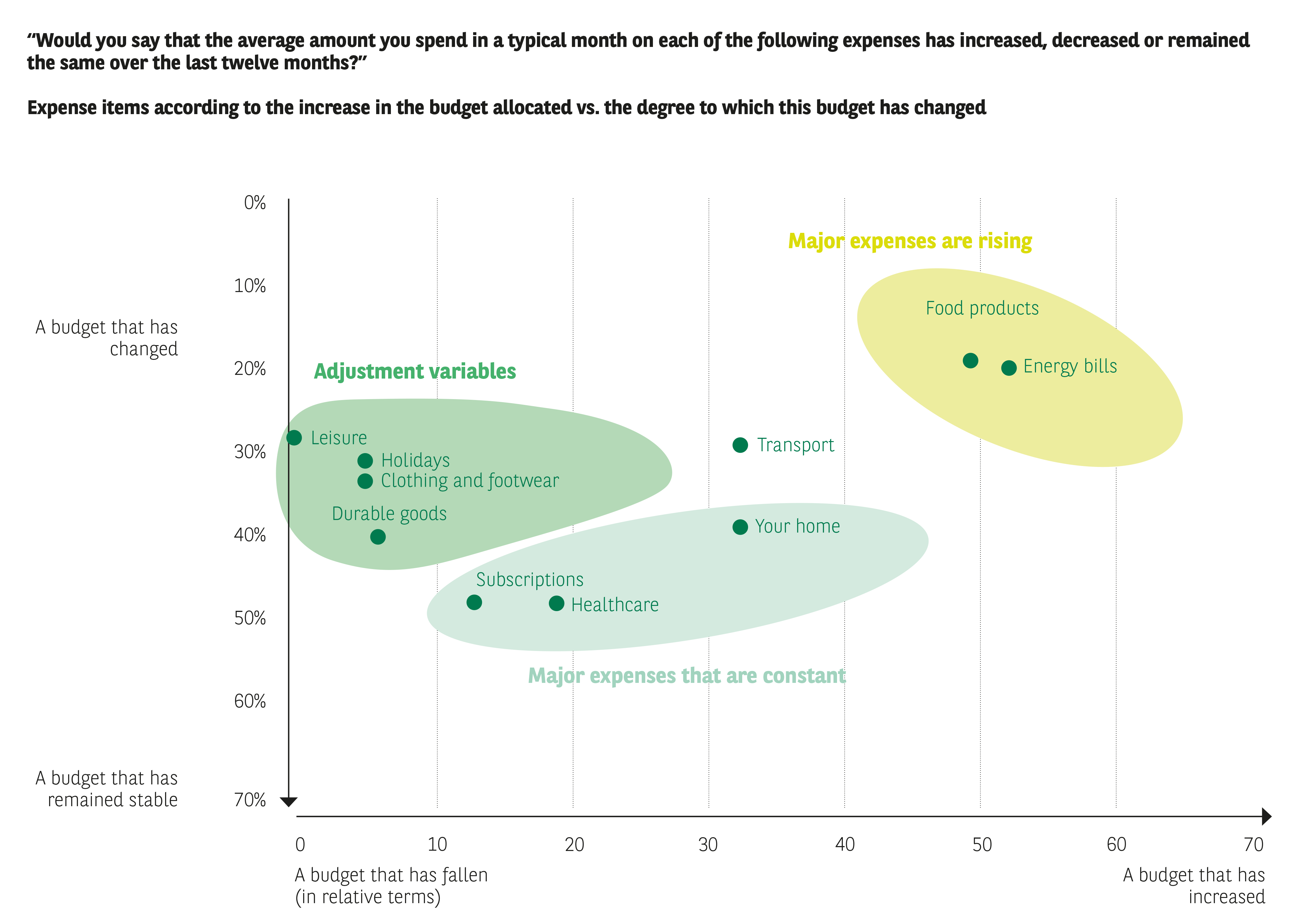

In practice, these decisions to go without can be explained by changes in the structure of monthly household budgets, and in particular by the burden of significant unavoidable expenses. More than half of Europeans say that their energy spending (66%), food bills (65%) and transport costs (52%) have increased over the last twelve months. Household food budgets, for instance, have risen the most in the UK (74%) and Romania (71%) (Fig. 15a). Energy bills have also increased greatly in the United Kingdom (76%) and Romania (74%), but also in France (72 %) (Fig. 15b). Some unavoidable expenses have remained stable. Healthcare, housing and subscriptions are essential, but they have not yet been hit by significant price increases.

Fig 14 / Barometer

Download this infographic for your presentations

Fig 15a / Barometer

Download this infographic for your presentations

Fig 15b / Barometer

Download this infographic for your presentations

It follows that consumers are allocating a falling proportion of their budget to other expenses. Unsurprisingly, consumers are taking action by adjusting their spending on personal and household goods, as well as leisure activities (Fig. 15c).These strategies have been adopted by both low and high earners, although obviously not to the same degree, with higher earners finding themselves less financially constrained.

Fig 15c / Barometer

Download this infographic for your presentations

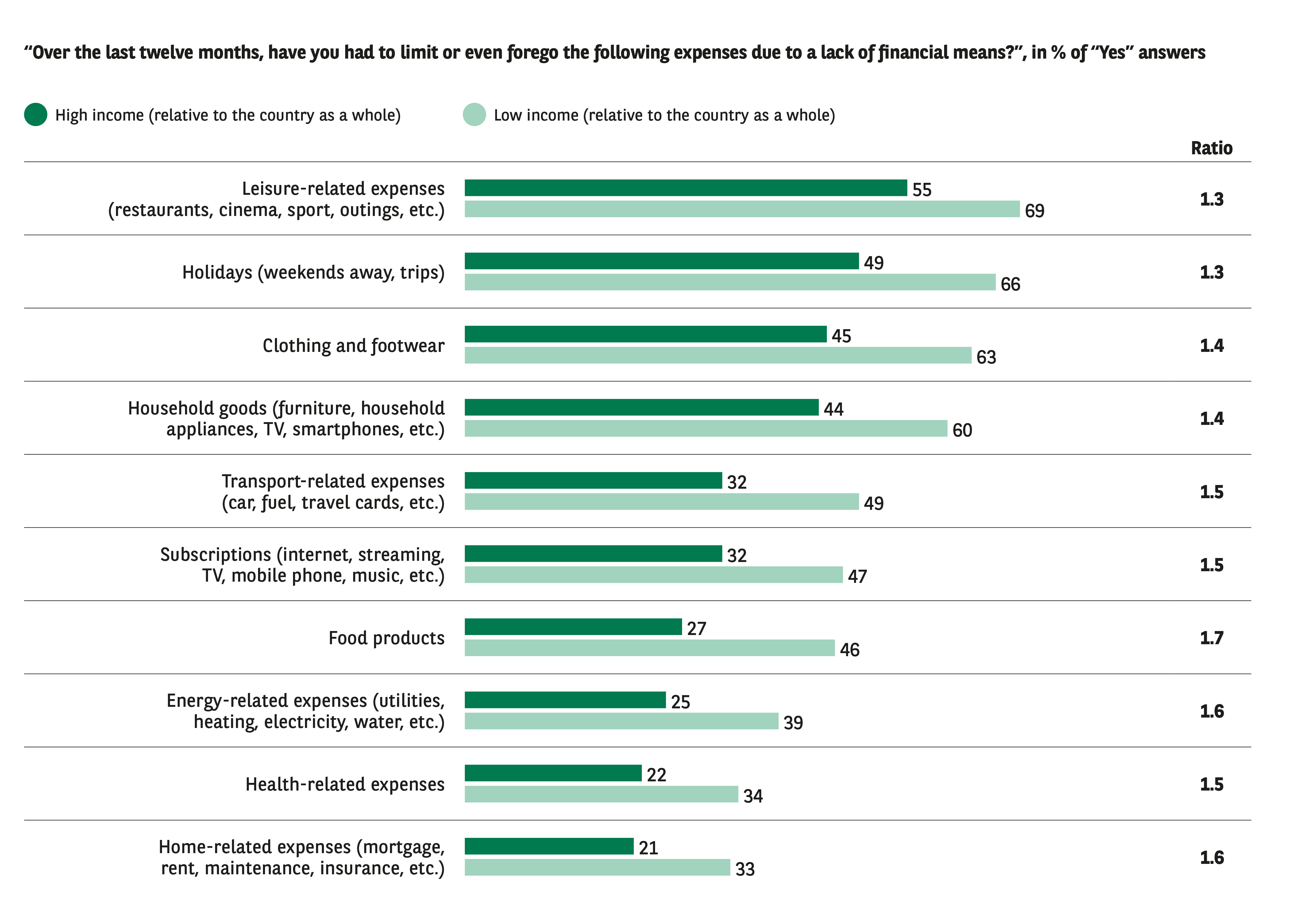

LOW EARNERS AND HIGH EARNERS ARE FOREGOING THE SAME ITEMS

The scale of the crisis currently affecting Europe is such that all households, regardless of their income, have adopted strategies to preserve their purchasing power. While 69% of low earners have foregone leisure activities this year, the proportion among high earners is 55%. (Fig. 16) A similar picture emerges when it comes to energy, with figures of 39% and 25% respectively. All consumers are therefore tightening their belts. Of course, as we have just seen, the pressure is greater for households with smaller budgets, but the gap between them and wealthier households remains the same in all expense categories. The only exception to this rule is food. While 46% low earners have reduced or foregone some purchases, this is much less likely among high earners, for whom the figure is “only” 27%. This equates to a ratio of 1.7, compared with 1.3 in the case of leisure and holidays. Proof that, now more than ever, the priority is to keep spending under control, especially “incidental” expenses.

EUROPEANS ARE EATING SMART

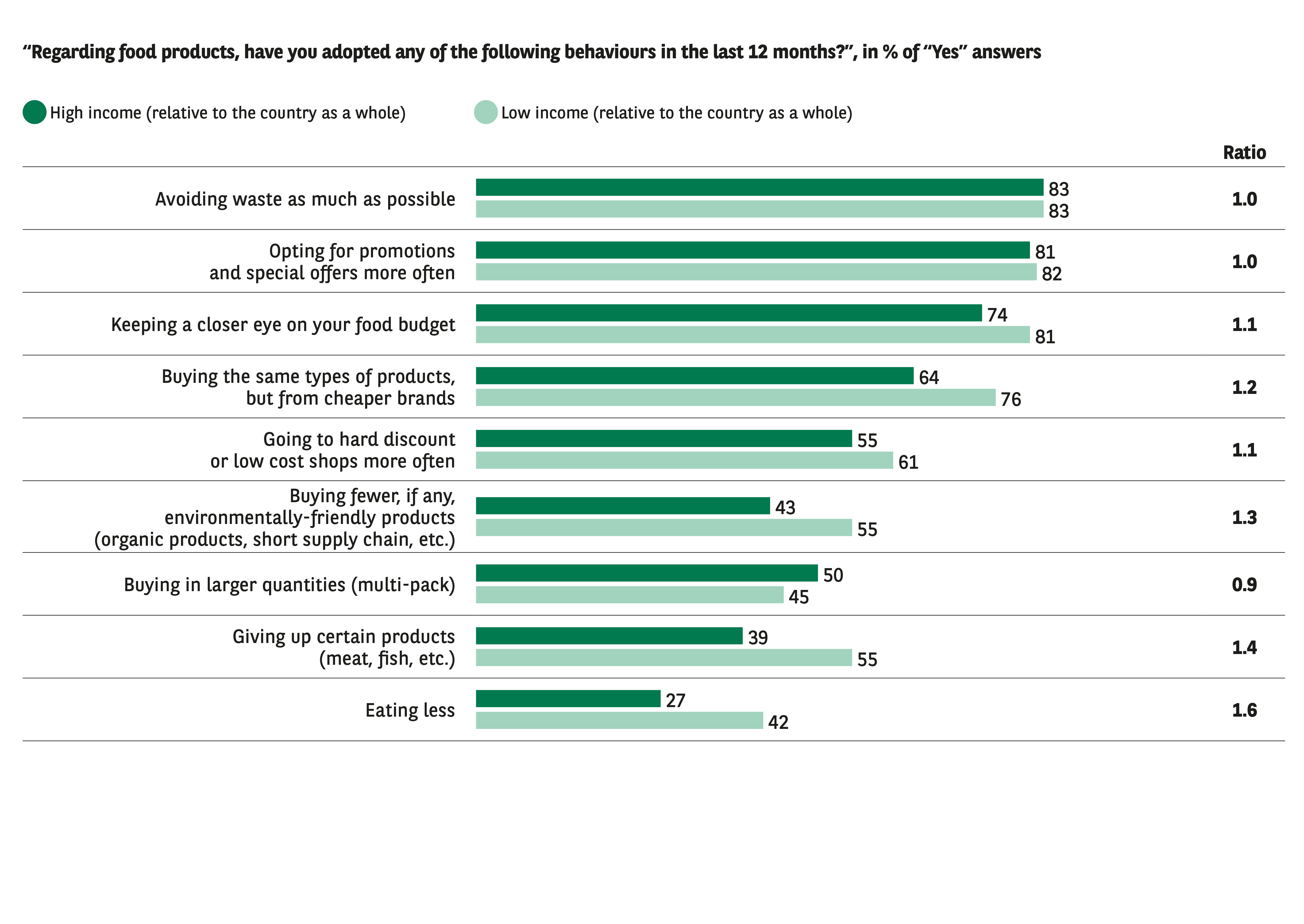

If we examine the dietary habits of Europeans more closely, we can see that lower earners are the most likely to go without certain items, and unsurprisingly so. 55% of them have stopped buying meat or fish so as to control their food spending. And, more worryingly, 42% of these less wealthy households have had to eat less (Fig. 17).

Fig 16 / Baromètre

Download this infographic for your presentations

In addition to these more radical measures, Europeans as a whole have embraced various ways of dealing with soaring food prices and are eating smarter. The same behaviours can be observed in both income categories. An analysis of the results of the 2024 Observatoire Cetelem Barometer reveals two strategies.

The first is based on common sense. Understandably, 81% of those surveyed say they are more likely to take advantage of promotional offers and low prices this year. This trend is having a very tangible impact on the market share of food retailers. Also to be included in this category of measures are reducing waste to a minimum (83%), keeping to a strict budget (77%) and, of course, switching to low-cost and hard-discount brands (58%).

The second involves reducing not only the quality, but also the quantity of food consumed. What is the main type of behaviour stemming from this strategy? Buying the same products, but from cheaper brands. Forgoing organic products, which 49% of Europeans have opted to do, is another choice people make, as are going without meat or fish (47%) and eating less in general (35%). 4 out of 10 French people say they are “eating less” than in the past. 29% of Spaniards, 30% of Germans and 35% of Britons also answer “yes” to this question. What this demonstrates is that, unfortunately, this is happening across Europe.

Fig 17 / Baromètre

Download this infographic for your presentations