Buying differently

Multiple purchasing criteria for a reduced budget

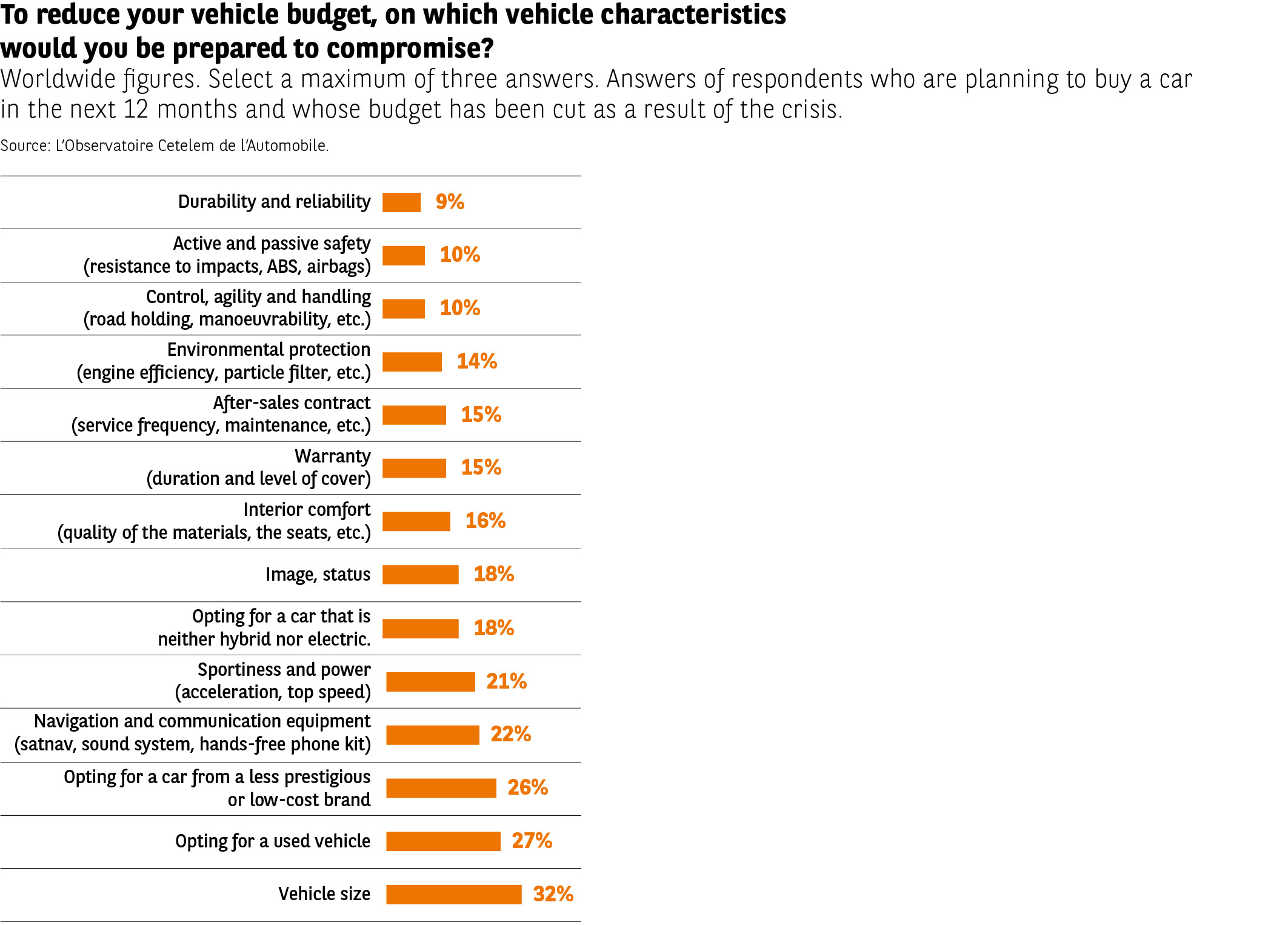

During this health crisis, financial aspects have remained a central part of the purchasing process. To cut their vehicle budget, consumers make choices based on numerous criteria, none of which are particularly predominant. At the top of the list are vehicle size, the option of buying a used car and choosing a less prestigious or low-cost brand, all of which post very similar scores (32%, 27% and 26%, respectively) (Fig. 39).

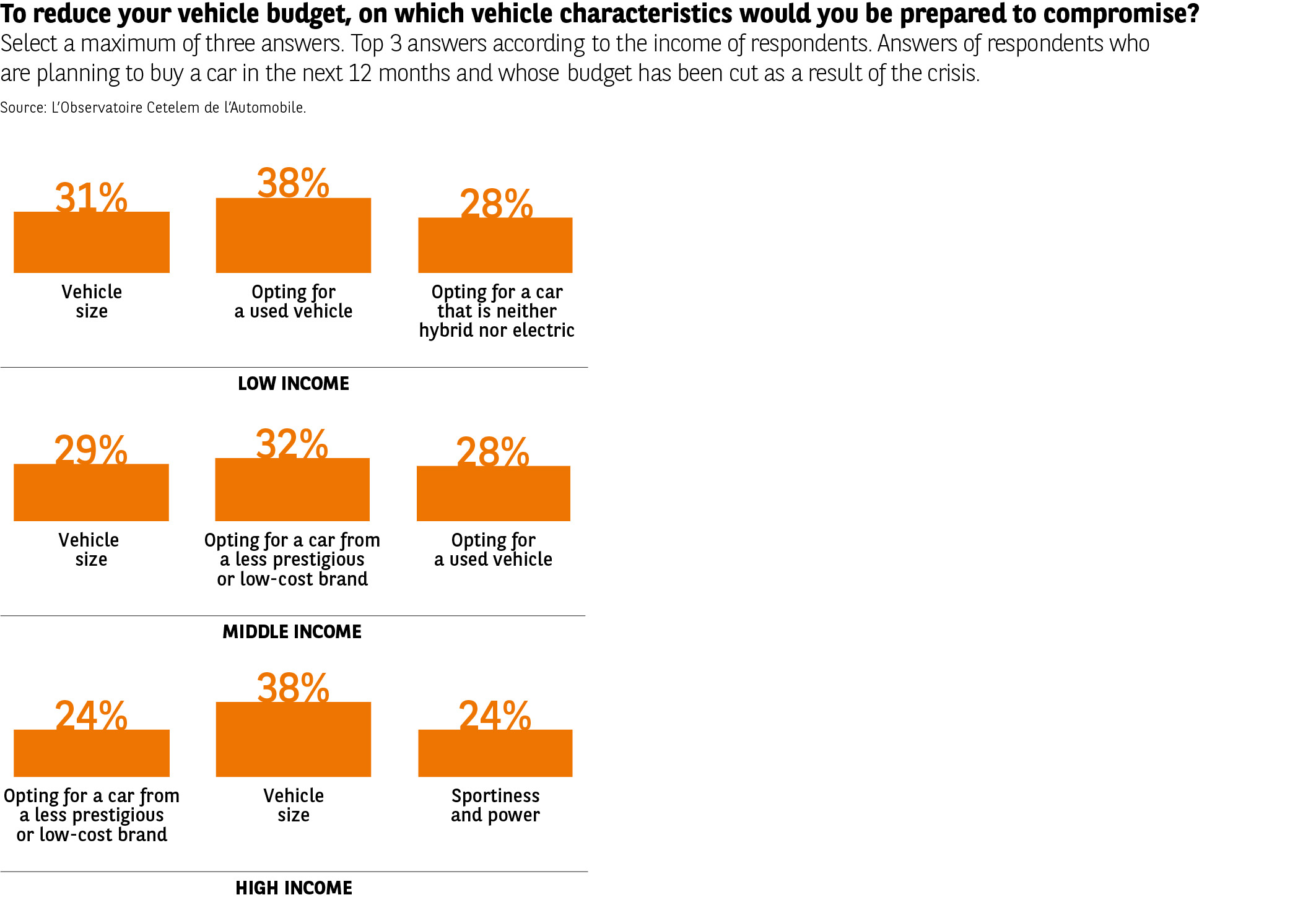

These criteria fall in a different order according to income, but the idea of buying a smaller car to reduce the budget takes the top spot overall (Fig. 40).

At the bottom of the list, safety, durability and road handling are the three factors on which people are the least willing to compromise (9%, 10% and 10%, respectively). It is worth noting that giving up on the idea of buying a greener car is only seen as an option by 14% of respondents. This is a topic that is no longer a matter for debate and which opens the way for a new type of relationship, as we will see further on.

Ownership is not the priority

Enjoying a service can trump actual ownership. Being able to use a car without having to think about wear and tear holds a certain appeal. After MaaS (Mobility as a Service), here comes CaaS (Car as a Service), where cars become merely a transport solution devoid of any notion of exclusive ownership and property concerns. And that is without mentioning the many benefits: faster and cheaper access, cost based on usage time or mileage with no investment required, no depreciation to contend with, and more rational sharing of car fleets resulting in a smaller environmental footprint. Having long been the preserve of companies, leasing offers with option to purchase and long-term hire solutions are increasingly winning over households.

Easier and more secure access to motoring for consumers, the advantage of scheduled contract renewal that is almost independent of any economic difficulties that manufacturers and dealers may face… in many ways, leasing looks like something of a panacea for motorists.

An emphasis on local production

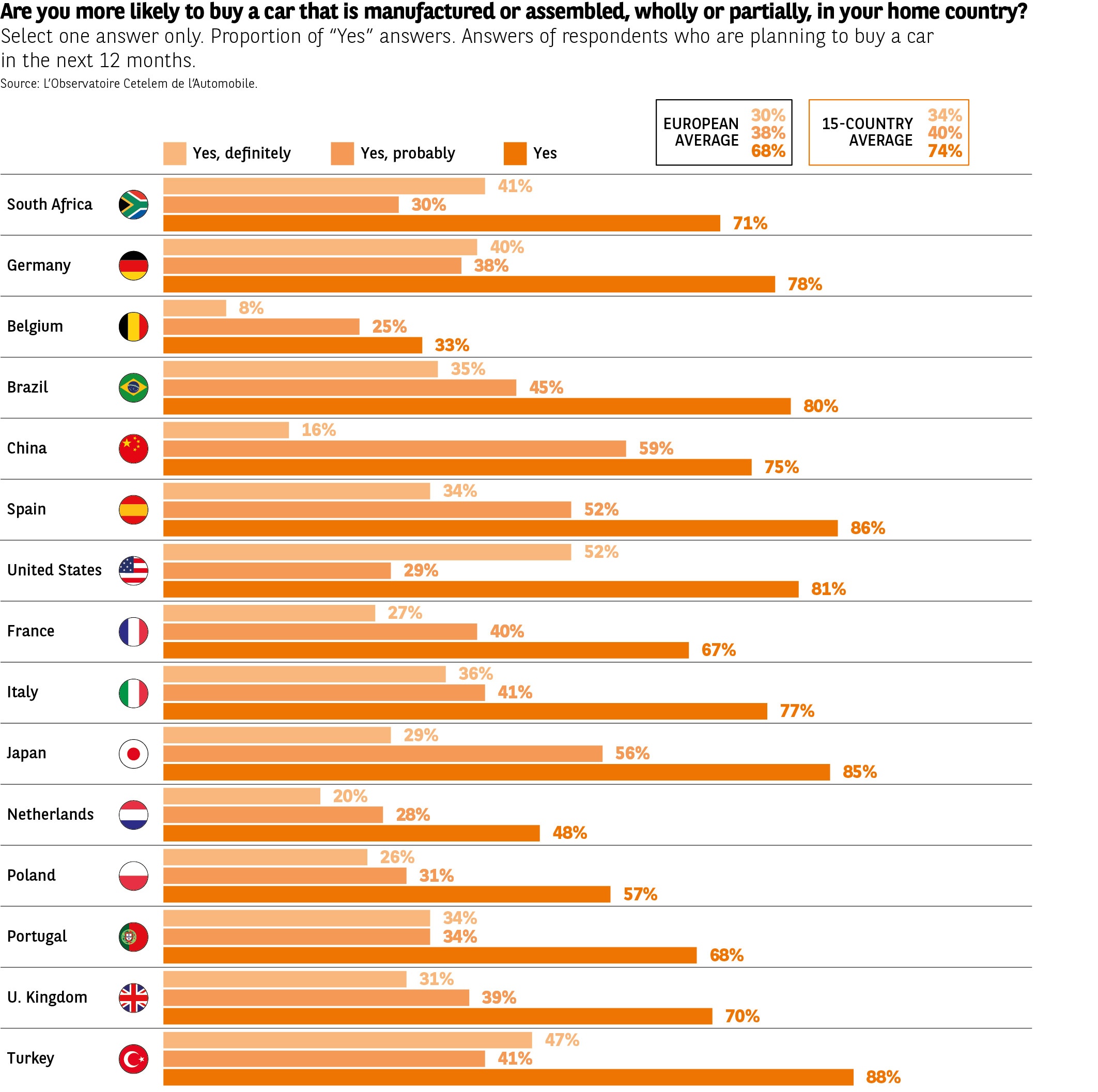

Reinvigorating people’s fondness for cars also means re-establishing their relationship with their home country. The last Observatoire Cetelem on European consumption highlighted the importance of localism. The automotive industry is no exception. 3 in 4 people state that they would prefer to buy a car manufactured or assembled in their country (Fig. 41). Outside Belgium and the Netherlands, where there are no car assembly plants, the scores are close to or higher than 50%. The Turks display the greatest degree of patriotism, something that is likely to have had some bearing on the creation of the TOGG brand.

TOGG: Turkey marks its territory

Have you heard of TOGG (Türkiye’nin Otomobili Girisim Grubu)? Possibly not, but the Turks definitely have. Under the impetus of the government and the leadership of President Erdogan, five local companies have formed a consortium to manufacture the first Turkish-built electric cars in Bursa. The government has committed to purchasing 30,000 units of the new vehicles, which were designed by Pininfarina. The brand is looking to conquer the Turkish market as of 2022 with two models, a saloon car and an SUV, before launching them internationally.

A preference for less polluting vehicles

The purchasing criteria cited by motorists show that they are not inclined to sacrifice environmental protection. When it comes to acquiring a new vehicle, they take their thinking one step further, stating that they would like the least polluting vehicles to be treated more favourably. This special treatment would mainly involve VAT cuts (81%), preferential road use (67%) and support from local authorities and governments, who should prioritise the purchase of such vehicles (78%).