Car still have a bright future

But one thing is certain: we have not finished talking about them. Or so motorists tell us. Indeed, while some do not necessarily see themselves owning a car, they cannot imagine a world without them. Will cars be able to survive in their current form? How important will new forms of “automobility” become around the world, within the different age groups, in cities and in rural areas?

To assess and monitor the roles and uses of cars, as well as access to vehicles, L’Observatoire Cetelem has put forward three exclusive indicators that track traditional and modern uses of cars.

A SMOOTH ROAD TO THE FUTURE

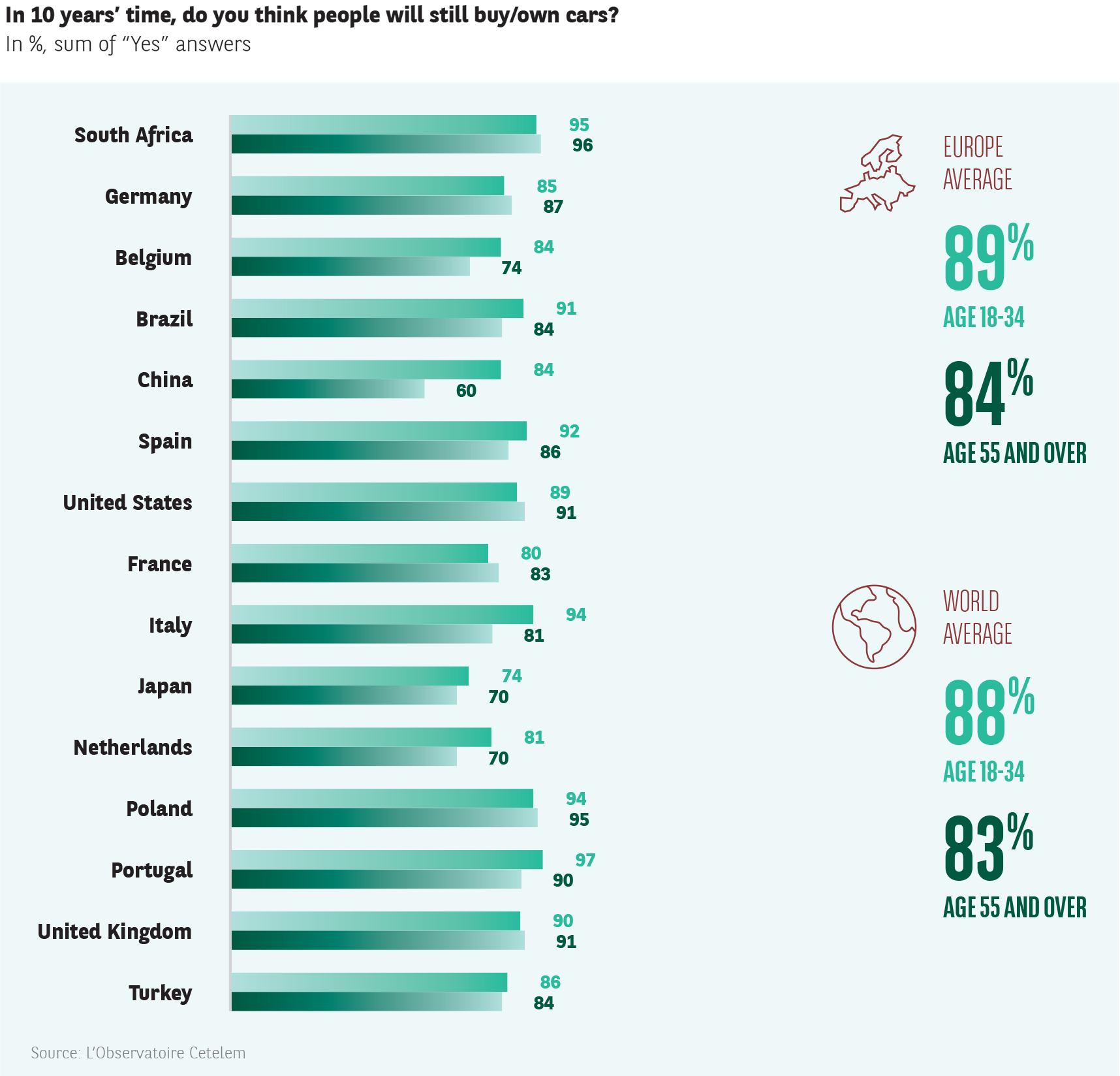

Good news for manufacturers and retailers is the fact that 86% of those surveyed believe that people will still be buying and owning their own cars in 10 years’ time. A quintet of countries state this loud and clear: Poland, South Africa, the United States, Brazil and the United Kingdom. A trio of countries seem less convinced: Japan, China and the Netherlands.

In other good news, millennials are the most likely to be of this opinion, with China displaying the widest generation gap (84% of millennials vs. 60% of seniors).

The gap between urbanites and those who live in rural areas is significantly less marked (Fig. 42).

FIG. 42 :

WHAT IF IT WERE FREE?

Monetizing one’s navigation habits and data, but also agreeing to hear or see advertisements while in your car are possibilities that are more and more technically feasible, thanks to connected vehicles. These options are now being considered as ways of partially or completely offsetting vehicle costs. Could the “zero-dollar car” ever become a reality?

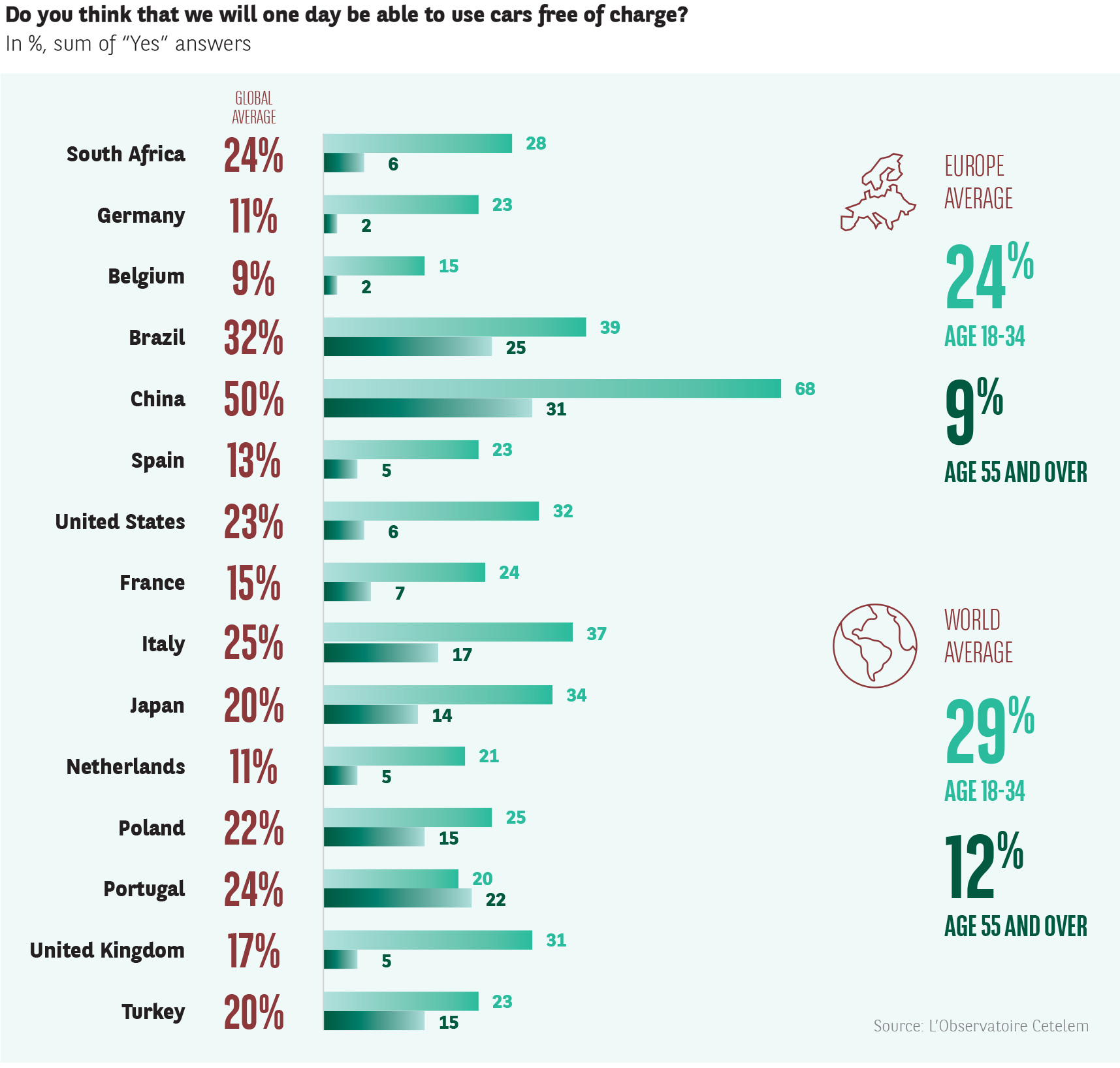

That is what many motorists want, imagining that

they will one day be able to use a vehicle free of charge.

1 in 5 respondents believe this, growing to 1 in 2 in China.

Europeans are the least convinced of the possibility,

especially in Belgium, Germany and the Netherlands

(Fig. 43).

Less digitally savvy and less familiar with freemium services, seniors are the least likely to believe this could happen (12% on average). The high likelihood that they have owned a car for many years, at a cost that they deem too high for the idea to be realistic, probably explains this low score.

Once again, the Germans and Belgians are under no illusion about this.

We should also not forget that this study has shown millennials to be very sensitive to the issue of motoring budgets. It makes perfect sense that they should be more likely than their elders to imagine that motoring will one day be free.

Chinese millennials again stand apart, with two-thirds of them believing that this could become a reality.

The Brazilians, who are also big fans of digital, are not too far behind.

FIG. 43 :

China, home of the car of the future

China, the world’s leading market after 15 years of continuous growth, has seen car sales drop significantly for more than a year now. Could this be a sign of a decline? Not necessarily.

At least if we take into account the nature of this market and how the sector is being modernised. The way in which the country is organised economically and politically has also enabled the implementation of commercial measures and principles that are causing this same market to shift. Faced with the problem of air quality, electric car use is being encouraged there more than anywhere else, both through the subsidies granted for such vehicles and restrictive measures to limit sales of petrol and diesel vehicles. Another crucial parameter is the fact that, if we exclude GAFA, China and its BATX (Baidu, Alibaba, Tencent and Xiaomi) can be described as the world’s leading technological power, particularly in terms of artificial intelligence and the advanced commercial use of telephony. Today, the Chinese can choose, test drive, order and pay for a vehicle with their smartphone and could soon see the widespread appearance of autonomous vehicles, of which China is also a pioneer. Such advances have been made possible by China’s appetite for technology and its state-led ecosystem approach.

HOW TO EARN MONEY WITH YOUR CAR TOMORROW

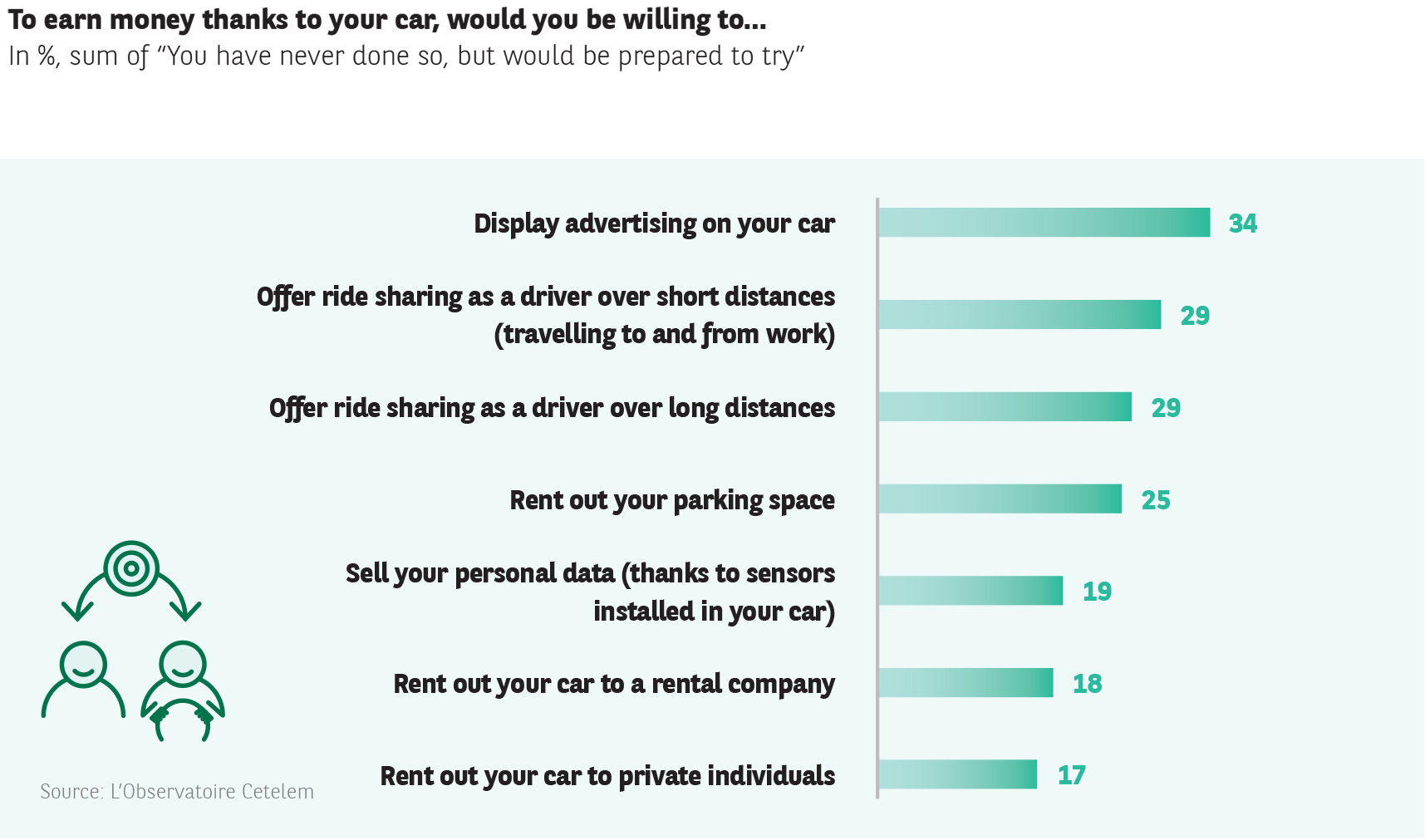

Because potential free access to cars will not become a reality in the immediate future, motorists are prepared to consider solutions that would enable them to earn money with their car.

The first of these is advertising, which 1 in 3 motorists would accept more or less across the panel of countries, with the exception of Japan, which is more timid in embracing the practice (13%).

Ride sharing, over short or long distances, also has many potential fans (29% and 26%), followed closely by the idea of renting out one’s parking space (25%). As we have seen many times when it comes to economic issues, South Africa, China, Turkey and Brazil seem the keenest on this solution.

Renting one’s car to a company or a private individual and selling personal data relating to car use are seen as less attractive. Nonetheless, 1 in 5 motorists say that they are prepared to grasp this new opportunity to earn money with their car (Fig. 44).

FIG. 44 :