The time to buy… or not

Purchasing intentions vary in their timeframes

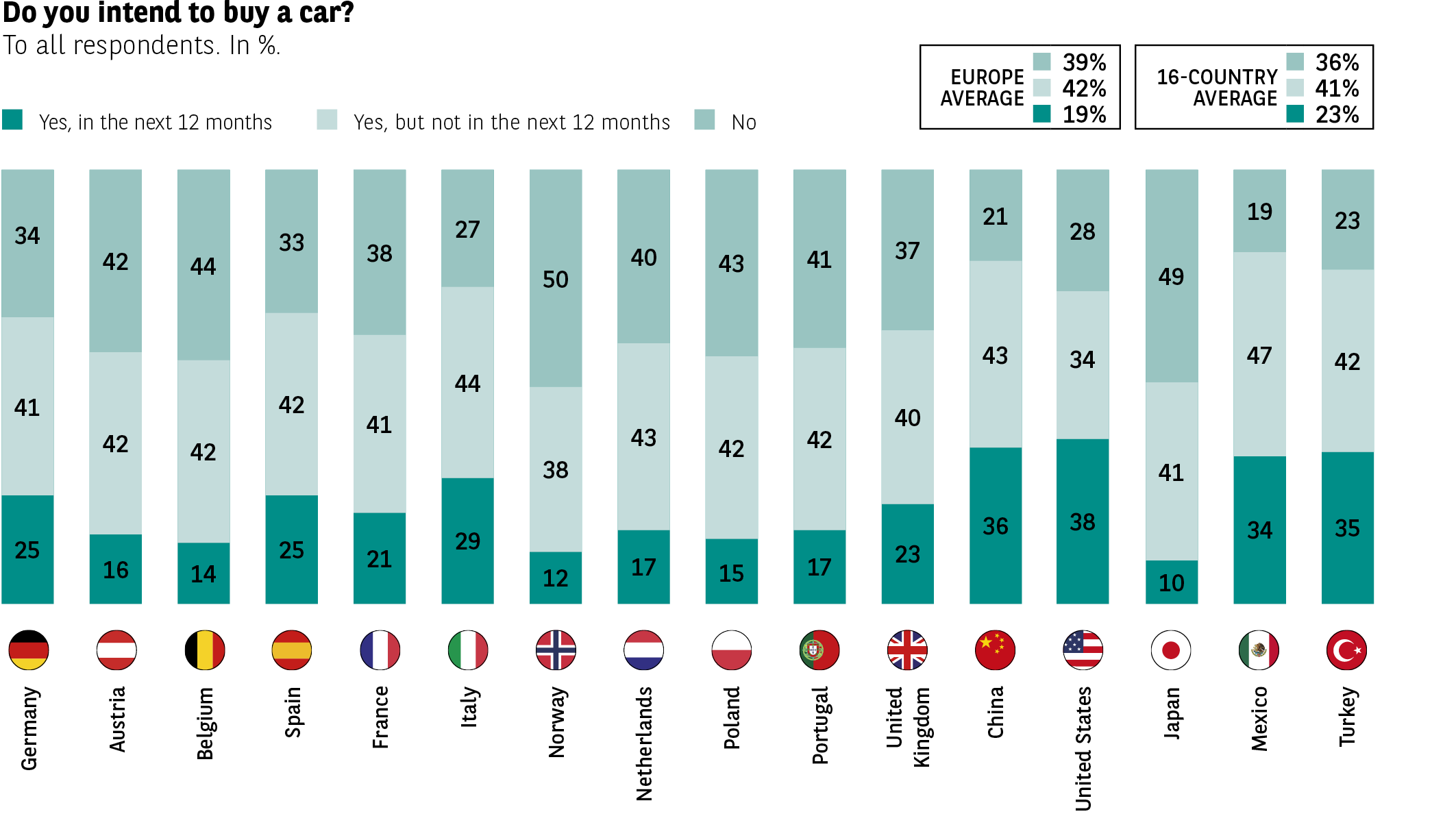

Having an idea of the brands one might buy does not necessarily mean that this will translate into an actual purchase. The pervading uncertainty is reflected in motorists’ purchasing intentions, if the overall results are anything to go by. Only 1 in 4 respondents plan to succumb to temptation in the next 12 months, a decidedly tepid score that nevertheless represents a substantial number of new cars. In roughly equal proportions, around 4 in 10 respondents do not intend to buy a new vehicle at all, or not for at least a year. (Fig. 40).

Fig 40 – New automotive OEMs since 2010

Download this infographic for your presentations Cumulative curve graph comparing new “OEM” manufacturers referenced on Wikidata.

Countries represented and approximate evolution (number of new OEMs)

China: growth from 0 in 2011 to 11 in 2020, then stabilization

France: progress from 0 to 8 in 2021

United States: slow rise to ~6 in 2019

Netherlands: from 0 to 5 in 2020

United Kingdom: from 0 to 4 in 2017

Germany: from 0 to 2 in 2023

Mexico / Austria / Turkey: each reaching ~1 or 2 over the period

China dominates the creation of new brands.

Western Europe (France, Netherlands, United Kingdom) makes strong progress between 2014 and 2020.

Source: Wikidata.com.

Cumulative curve graph comparing new “OEM” manufacturers referenced on Wikidata.

Countries represented and approximate evolution (number of new OEMs)

China: growth from 0 in 2011 to 11 in 2020, then stabilization

France: progress from 0 to 8 in 2021

United States: slow rise to ~6 in 2019

Netherlands: from 0 to 5 in 2020

United Kingdom: from 0 to 4 in 2017

Germany: from 0 to 2 in 2023

Mexico / Austria / Turkey: each reaching ~1 or 2 over the period

China dominates the creation of new brands.

Western Europe (France, Netherlands, United Kingdom) makes strong progress between 2014 and 2020.

Source: Wikidata.com.

Based on the previous results, one might have expected inflationary pressures to have generated a degree of timidity in the countries that were most vocal about the issue. The reality is more complex While the highest proportions of motorists who intend to replace their vehicle can be found in the world’s largest markets, China and the United States (around 4 out of 10 respondents), a comparable number can be found in Turkey and Mexico. The leading European countries, including France, fall within the overall average. Norway and Japan trail behind, with motorists remaining hesitant, not to say reluctant.

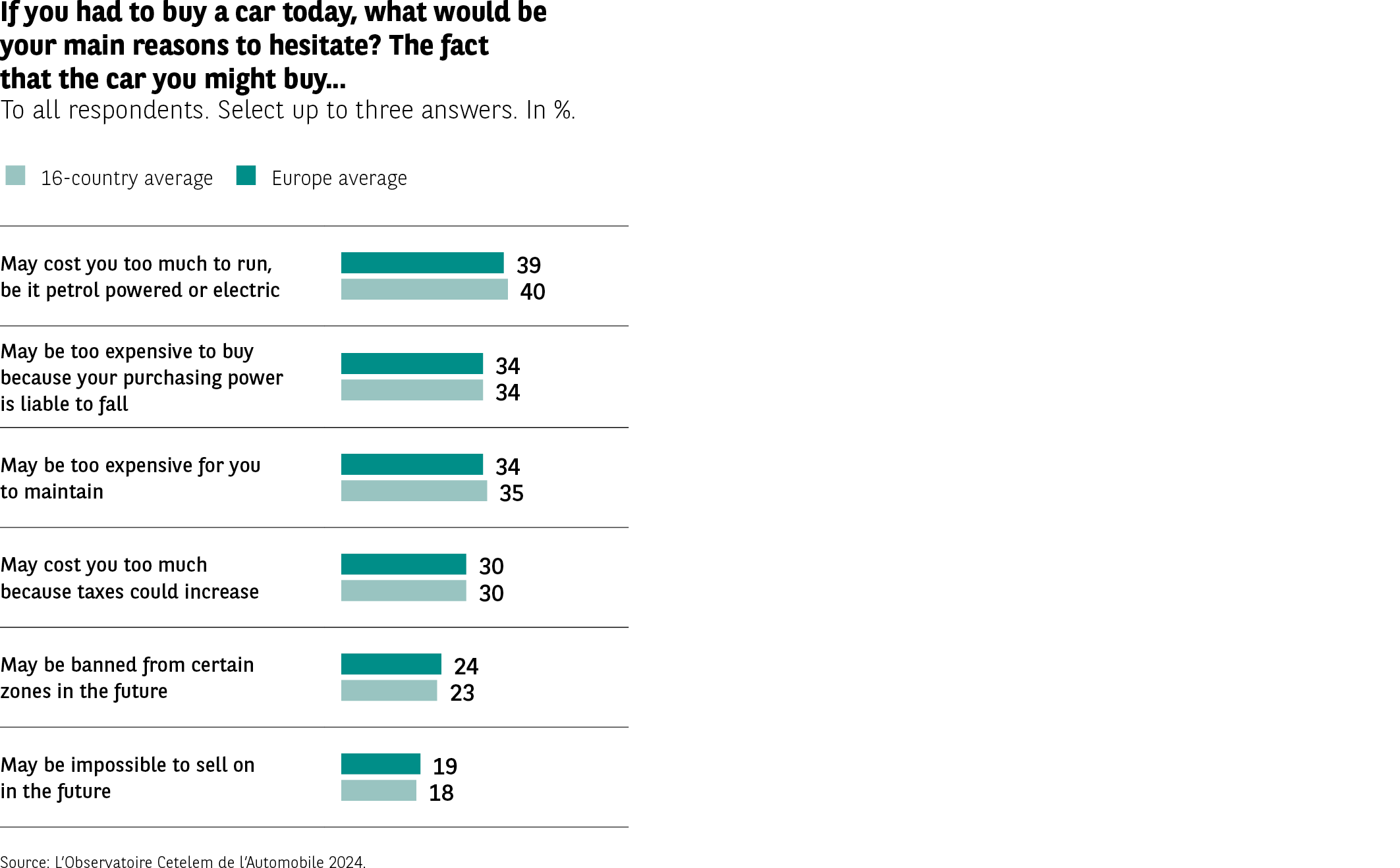

Energy is costly and money is scarce

There are several reasons why consumers might be wary of making a purchase today, with the main ones relating to the current economic climate. 4 out of 10 people are hesitant because of the cost of energy, while almost a third are worried that their purchasing power will fall, a sign that inflation is taking its toll. With regard to both of these items, the French express the most concern, in direct contrast to the Americans.

Maintenance costs also weigh heavily on motorists’ willingness to buy a new vehicle, particularly in Japan and Mexico. Because they are not yet in full effect or particularly widespread, only a quarter of those questioned are concerned about traffic restrictions (Fig. 41).

Fig 41 – Reasons for not buying a car

Download this infographic for your presentations Horizontal graph presenting the main reasons cited by people who do not want to buy a car. Two possible responses.

Visual elements

Two series of bars: average of 16 countries (dark green) and European average (light green).

The reasons displayed:

“You don’t need one”: ~48% (16 countries), ~46% (Europe).

“You can’t afford it”: ~35% (16 countries), ~38% (Europe).

“Too much uncertainty about regulations / energy prices / choice of engine”: 18% (16 countries and Europe).

“You don’t know which brand to buy”: 2% (16 countries and Europe).

“For another reason”: 17% (16 countries), 16% (Europe).

The lack of need and financial means are the two dominant explanations.

Horizontal graph presenting the main reasons cited by people who do not want to buy a car. Two possible responses.

Visual elements

Two series of bars: average of 16 countries (dark green) and European average (light green).

The reasons displayed:

“You don’t need one”: ~48% (16 countries), ~46% (Europe).

“You can’t afford it”: ~35% (16 countries), ~38% (Europe).

“Too much uncertainty about regulations / energy prices / choice of engine”: 18% (16 countries and Europe).

“You don’t know which brand to buy”: 2% (16 countries and Europe).

“For another reason”: 17% (16 countries), 16% (Europe).

The lack of need and financial means are the two dominant explanations.

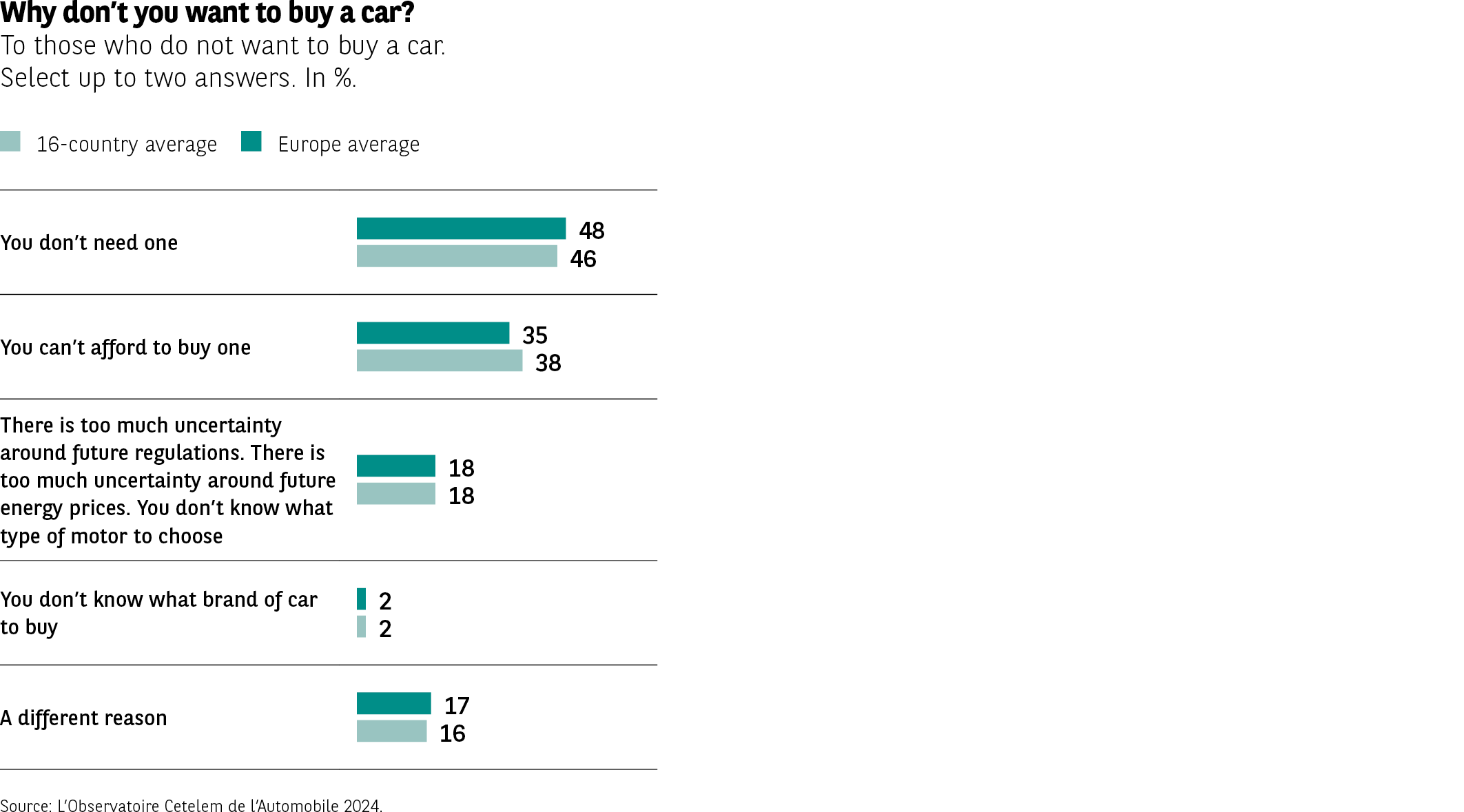

Not everyone feels that owning a car is a necessity

Almost half of those who do not want to buy a new car, be it today or in the future, put one main reason forward: they simply do not need one. This is particularly true in the UK and Austria. In Turkey, only 22% state that they can do without a car.

However, this is also the country in which the lack of financial resources to buy a car is most acute. 7 out of 10 Turks who do not intend to buy a vehicle mention this factor, whereas the overall average for this item is less than 40%. Once again, the Mexicans agree with them on this point. Conversely, the Chinese, and even more so the Belgians, Germans and Austrians, are less concerned about potential financial struggles.

Uncertainty over regulations, engine types and energy costs is cited by 1 in 5 people (Fig. 42).

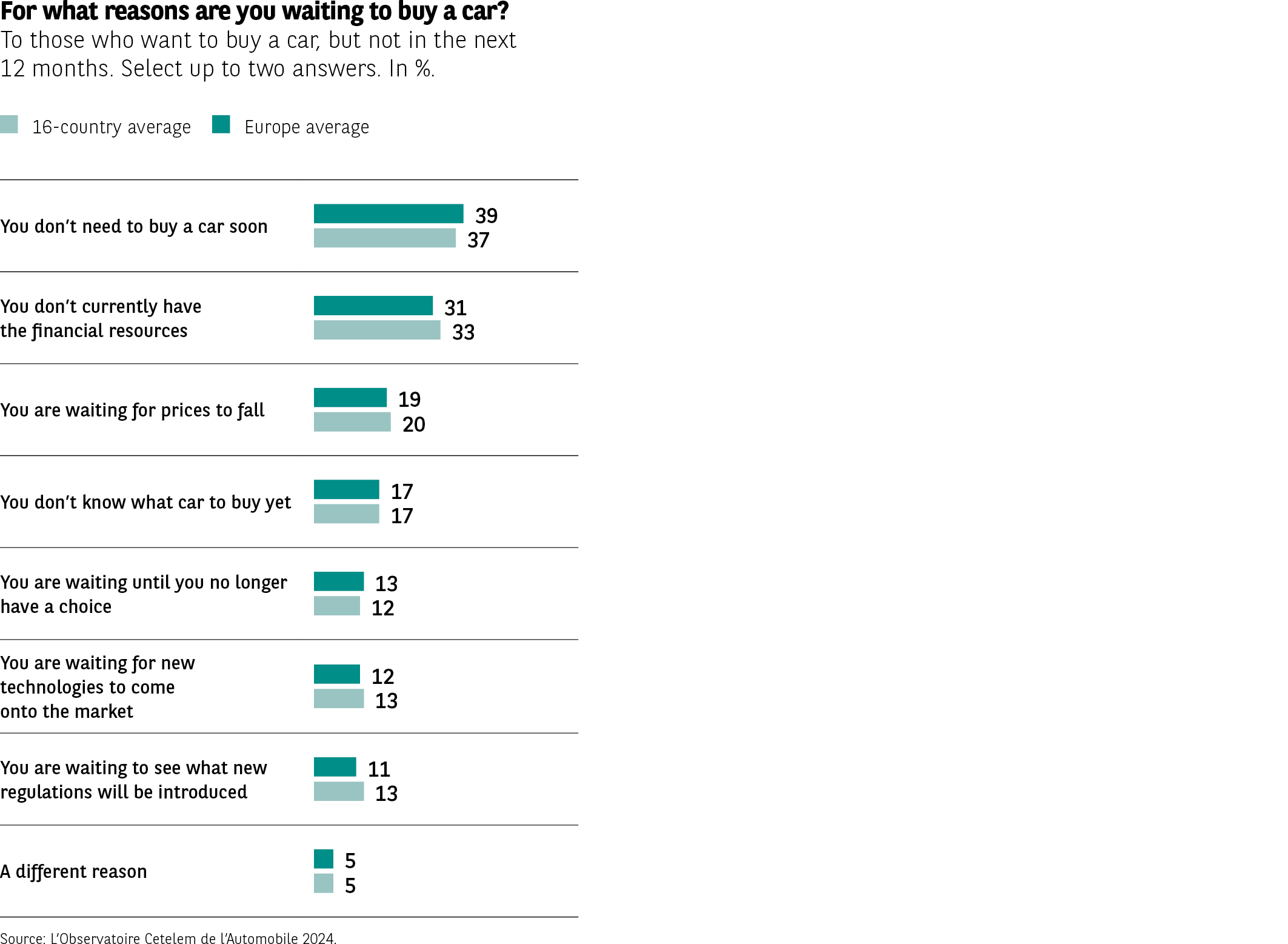

Fig 42 – Reasons for waiting to buy a car

Download this infographic for your presentations Horizontal graph intended for people who want to buy a car but not within the next 12 months. Two possible responses.

Visual elements:

Reasons classified, with scores (16 countries / Europe):

No urgent need: 39% / 37%.

Lack of financial resources: 31% / 33%.

Waiting for a price drop: 19% / 20%.

Don’t know which vehicle to buy yet: 17% / 17%.

Waiting to be forced to: 13% / 12%.

Waiting for new technologies: 12% / 13%.

Waiting to know future regulations: 11% / 13%.

Other reason: 5% / 5%.

The wait is mainly motivated by the lack of urgency and financial difficulties.

Horizontal graph intended for people who want to buy a car but not within the next 12 months. Two possible responses.

Visual elements:

Reasons classified, with scores (16 countries / Europe):

No urgent need: 39% / 37%.

Lack of financial resources: 31% / 33%.

Waiting for a price drop: 19% / 20%.

Don’t know which vehicle to buy yet: 17% / 17%.

Waiting to be forced to: 13% / 12%.

Waiting for new technologies: 12% / 13%.

Waiting to know future regulations: 11% / 13%.

Other reason: 5% / 5%.

The wait is mainly motivated by the lack of urgency and financial difficulties.

Now is the time to wait

Those who are playing a waiting game give similar reasons for not making a purchase in the near future. Once again, the fact that they have no particular need for a car is the main reason put forward by nearly 4 out of 10 people, a view shared by a majority of respondents in Japan (58%). A current lack of financial resources to buy a car is cited by almost a third of motorists. True to form, the Turks and Mexicans also highlight these financial difficulties, followed closely by the Portuguese, but also the Norwegians, two populations that mention this factor in almost identical proportions. Despite leading the world in the adoption of electric vehicles, along with the Chinese, the Norwegians also seem fearful of the high cost of these cars compared with other types of powertrain (Fig. 43).

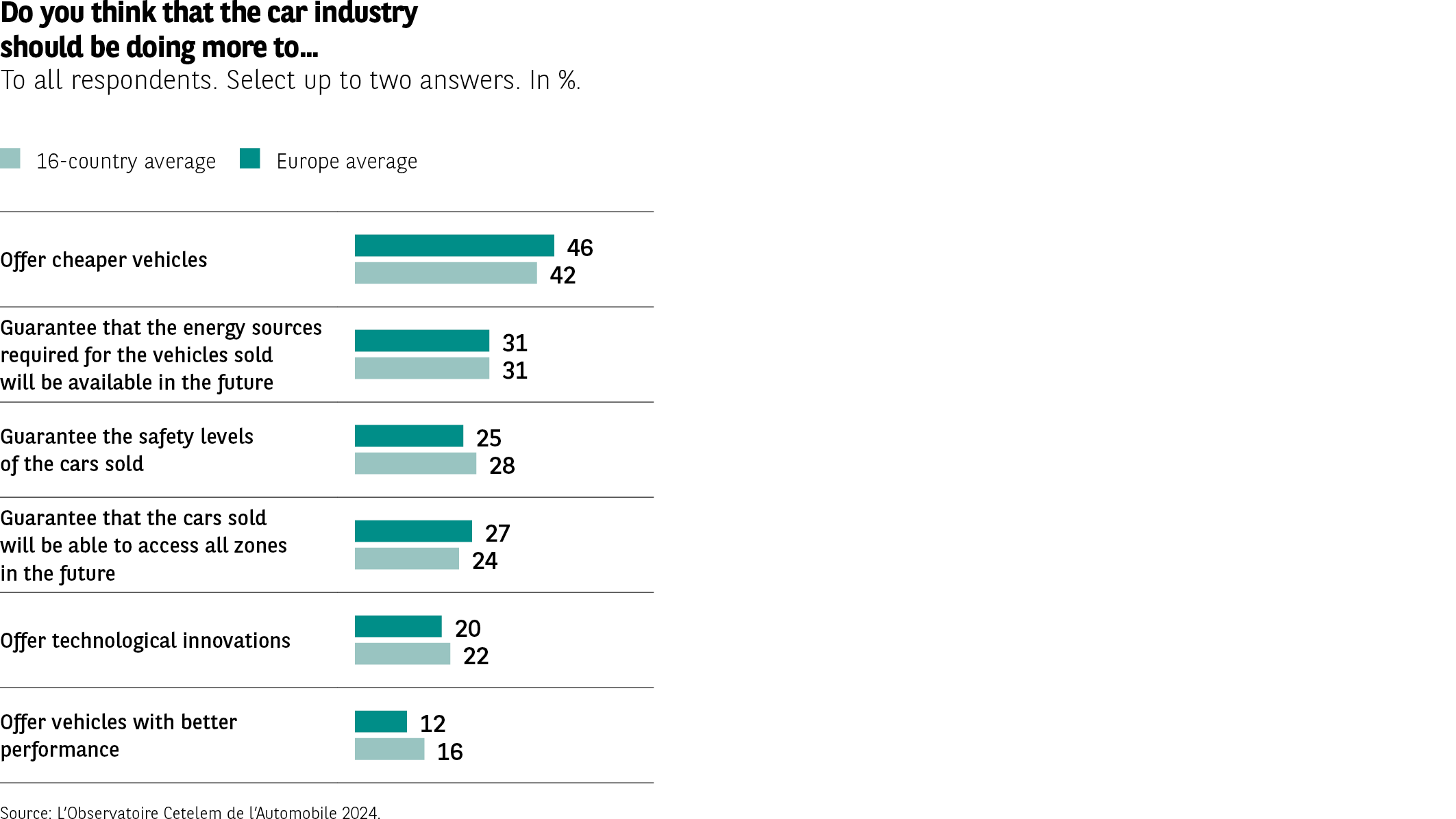

Fig 43 – Priorities expected from the automotive industry

Download this infographic for your presentations Horizontal graph presenting the two main objectives that the automotive industry should pursue according to respondents.

Visual elements:

Comparison: average of 16 countries / average of Europe.

Themes and results:

Offer cheaper vehicles: 46% / 42%.

Ensure future energy availability: 31% / 31%.

Ensure vehicle safety: 25% / 28%.

Ensure the right to future circulation: 27% / 24%.

Offer technological innovations: 20% / 22%.

Offer more performing vehicles: 12% / 16%.

The absolute priority is to reduce prices, then to ensure energy and safety.

Horizontal graph presenting the two main objectives that the automotive industry should pursue according to respondents.

Visual elements:

Comparison: average of 16 countries / average of Europe.

Themes and results:

Offer cheaper vehicles: 46% / 42%.

Ensure future energy availability: 31% / 31%.

Ensure vehicle safety: 25% / 28%.

Ensure the right to future circulation: 27% / 24%.

Offer technological innovations: 20% / 22%.

Offer more performing vehicles: 12% / 16%.

The absolute priority is to reduce prices, then to ensure energy and safety.

Price over progress

Progress is all very well, but we should not ignore a reality that is more prosaic. And no particular insight is needed to highlight once again what is most important in the minds of motorists: price. As underlined at the start of this report, this is people’s number one preoccupation year after year, particularly in Poland and France, where this issue scores over 50%. The fact that electric vehicles cost more than internal combustion vehicles does little to reassure motorists or offer them a clearer picture, much like the price increases applied by carmakers in recent years. The price war predicted will likely plunge them further into uncertainty and exacerbate their hesitation.

Aware of the uncertainty surrounding future energy supplies, they are also looking for guarantees that the energy source their vehicle uses will remain available. This is a view expressed most strongly in Mexico and Germany, but with relatively little vigour in Japan.

Motorists are also keen to receive guarantees in terms of vehicle safety and road access. While manufacturers are not entirely responsible for the latter of the two, this indicates that motorists would like the model ranges on offer to invariably comply with the regulations. This is a topic that is particularly close to the hearts of Germans and Austrians (Fig. 44).

Fig 44 – Sources of hesitation before buying a car

Download this infographic for your presentations Horizontal graph listing the concerns that slow down car buying. Three possible responses.

Visual elements:

Reasons classified, with scores (16 countries / Europe):

Cost too high for fuel/electricity: 39% / 40%.

Cost too high due to decreased purchasing power: 34% / 34%.

Cost too high for maintenance: 34% / 35%.

Cost too high due to future taxes: 30% / 30%.

Risk of future ban in certain areas: 24% / 23%.

Risk of poor resale: 19% / 18%.

The dominant concern is cost, in various forms (energy, maintenance, purchasing power, taxes).

Horizontal graph listing the concerns that slow down car buying. Three possible responses.

Visual elements:

Reasons classified, with scores (16 countries / Europe):

Cost too high for fuel/electricity: 39% / 40%.

Cost too high due to decreased purchasing power: 34% / 34%.

Cost too high for maintenance: 34% / 35%.

Cost too high due to future taxes: 30% / 30%.

Risk of future ban in certain areas: 24% / 23%.

Risk of poor resale: 19% / 18%.

The dominant concern is cost, in various forms (energy, maintenance, purchasing power, taxes).

The car market is still on tenterhooks

- Since its inception, the car industry has enjoyed a sense of long-term confidence and certainty, which has translated into reasonably predictable sales volumes. The last few years have seen the waters muddied somewhat, with trends becoming more erratic across all regions. After sales peaked in 2017, the Covid-19 crisis revealed an economic and market situation that was less buoyant than it had previously appeared. Europe is still not quite sure where it stands, despite the possibility of a slight upturn in 2023. Over the last two years, China has experienced an identical pattern, illustrated by a marked downturn in sales.

- In response to this faltering market, most brands have opted to focus on profit margins and premium segments, to the detriment of sales volumes, achieving record profits in the process. But this will have been merely an interlude, since the price war has now resumed.

The essential