China versus the rest of the world

Electricity is making its mark, thanks to China

With the switch to an electric world now in full swing, motorists will no longer be able to rely on their usual points of reference and the trust they have traditionally placed in historic brands. The energy transition is impacting the automotive industry like no other innovation before it. What they now have in front of them is a contrasting and shifting automotive market. But this is only the beginning.

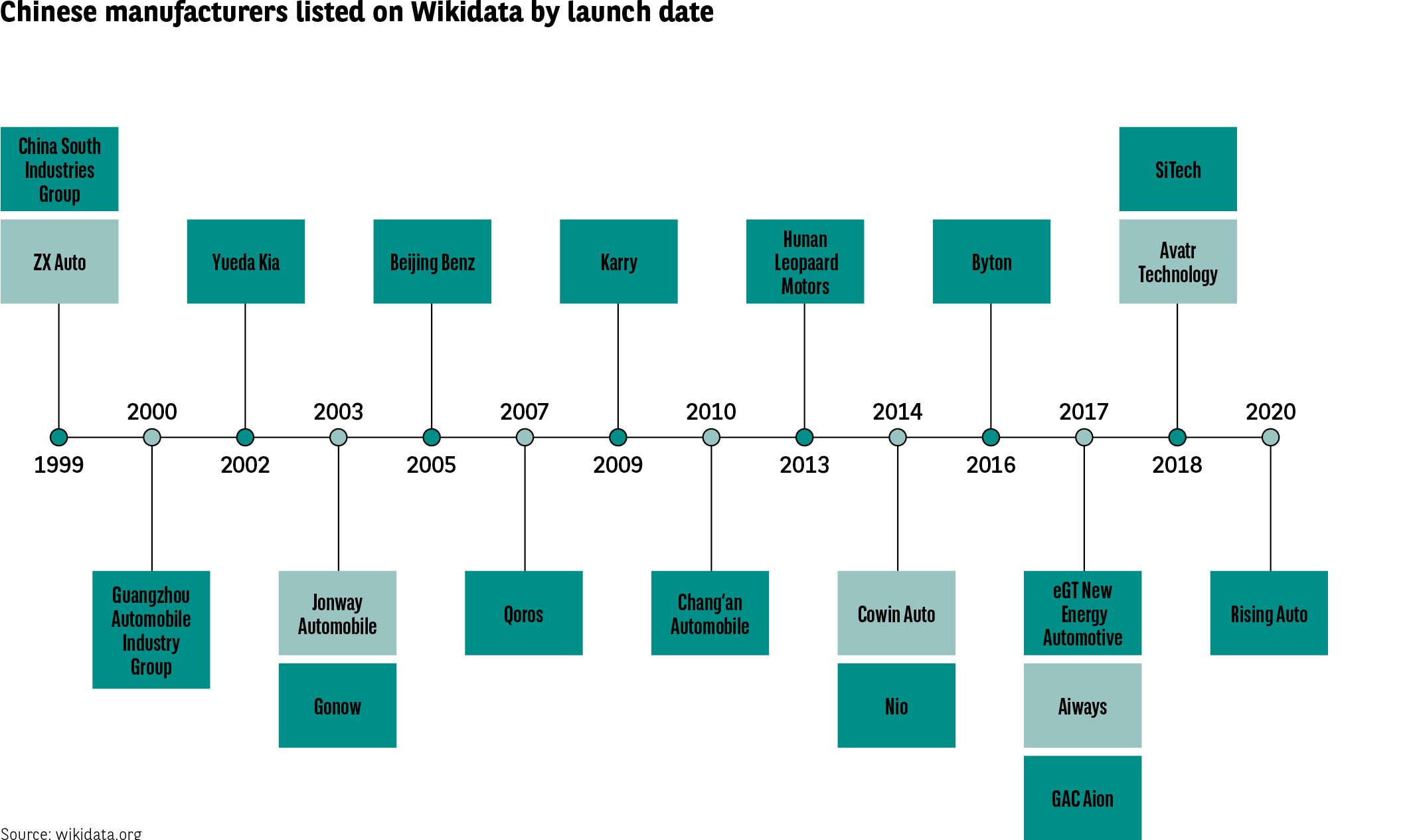

The exponential growth of the Chinese market and its brands is striking proof of this transformation. In just over two decades, more than 20 new brands have seen the light of day (Fig. 35). Most of these brands are developing electric vehicles. And that’s without counting the brands that were already present on the market which, as in the case of MG and even more so BYD, a premium all-electric brand, intend to shake things up and appeal to motorists with low-cost electric vehicles (until now an oxymoron) sold at prices comparable to those of combustion engine vehicles.

Their potential and likely success is so concerning for historic brands and governments alike that on 13 September the European Union launched an investigation to determine whether Chinese brands benefit from public subsidies that distort competition and enable them to offer vehicles at irresistible prices.

Fig 35 – Perception of existing public aids

Download this infographic for your presentations Horizontal graph showing the opinion of people who know that public aids exist.

Comparison between:

Average of 16 countries

Average of Europe

Indicators (16 countries / Europe)

Essential: 76 / 79

Complicated, confusing: 75 / 72

Too reserved for specific cases: 74 / 73

Not well known: 72 / 73

Amount adapted to needs: 46 / 55

Too numerous: 45 / 49

A very largely negative perception of complexity and readability.

The adaptation of the amount remains the most criticized point.

The essential character is nonetheless very recognized.

Source: Cetelem Observatory 2024.

Horizontal graph showing the opinion of people who know that public aids exist.

Comparison between:

Average of 16 countries

Average of Europe

Indicators (16 countries / Europe)

Essential: 76 / 79

Complicated, confusing: 75 / 72

Too reserved for specific cases: 74 / 73

Not well known: 72 / 73

Amount adapted to needs: 46 / 55

Too numerous: 45 / 49

A very largely negative perception of complexity and readability.

The adaptation of the amount remains the most criticized point.

The essential character is nonetheless very recognized.

Source: Cetelem Observatory 2024.

Fig 36 – Intention to buy a car

Download this infographic for your presentations Categories

Yes, within the next 12 months

Yes, but not within the next 12 months

No

Averages

Europe: 19% / 42% / 39%

16 countries: 23% / 41% / 36%

Results by country (yes 12 months / yes later / no)

Germany: 25 / 41 / 34

Austria: 16 / 42 / 42

Belgium: 14 / 42 / 44

Spain: 25 / 41 / 33

France: 21 / 41 / 38

Italy: 29 / 44 / 27

Norway: 12 / 38 / 50

Netherlands: 17 / 43 / 40

Poland: 15 / 42 / 43

Portugal: 17 / 42 / 41

United Kingdom: 23 / 40 / 37

China: 36 / 43 / 21

United States: 38 / 34 / 28

Japan: 10 / 41 / 49

Mexico: 34 / 47 / 19

Turkey: 35 / 42 / 23

The intention to buy is very strong in China, Mexico, the United States, and Turkey.

Europe appears to be much more cautious.

Japan is the most reluctant.

Source: Cetelem Observatory 2024.

Categories

Yes, within the next 12 months

Yes, but not within the next 12 months

No

Averages

Europe: 19% / 42% / 39%

16 countries: 23% / 41% / 36%

Results by country (yes 12 months / yes later / no)

Germany: 25 / 41 / 34

Austria: 16 / 42 / 42

Belgium: 14 / 42 / 44

Spain: 25 / 41 / 33

France: 21 / 41 / 38

Italy: 29 / 44 / 27

Norway: 12 / 38 / 50

Netherlands: 17 / 43 / 40

Poland: 15 / 42 / 43

Portugal: 17 / 42 / 41

United Kingdom: 23 / 40 / 37

China: 36 / 43 / 21

United States: 38 / 34 / 28

Japan: 10 / 41 / 49

Mexico: 34 / 47 / 19

Turkey: 35 / 42 / 23

The intention to buy is very strong in China, Mexico, the United States, and Turkey.

Europe appears to be much more cautious.

Japan is the most reluctant.

Source: Cetelem Observatory 2024.

Electricity: a crucial development

- The first Tesla Model S was launched in 2012. A crazy gamble by Elon Musk, par for the course in his case, which has turned into a stunning success story. A little over a decade later, in the first half of 2023, the Tesla Model Y , electric SUV became the best-selling passenger car in Europe across all categories, ahead of its philosophical and technological antithesis, the Dacia Sandero. This success owes a great deal to a drastic reduction in its price.

- Electric mobility seems to exert such appeal country that it is even generating interest in nations where car manufacturing is non-existent. Thus, as part of its Vision 2030 plan, Saudi Arabia plans to launch electric car production, notably with the creation of the Ceer brand, in conjunction with Foxconn and a joint venture with the Chinese start-up Human Horizons, whose HiPhi brand will soon be landing in Europe. Public Investment Fund, the Saudi sovereign wealth fund, has also invested in Tesla and Lucid, in which it holds a 61% stake. Lucid is now planning to build a factory in the country (Fig. 36).

A still fragile image

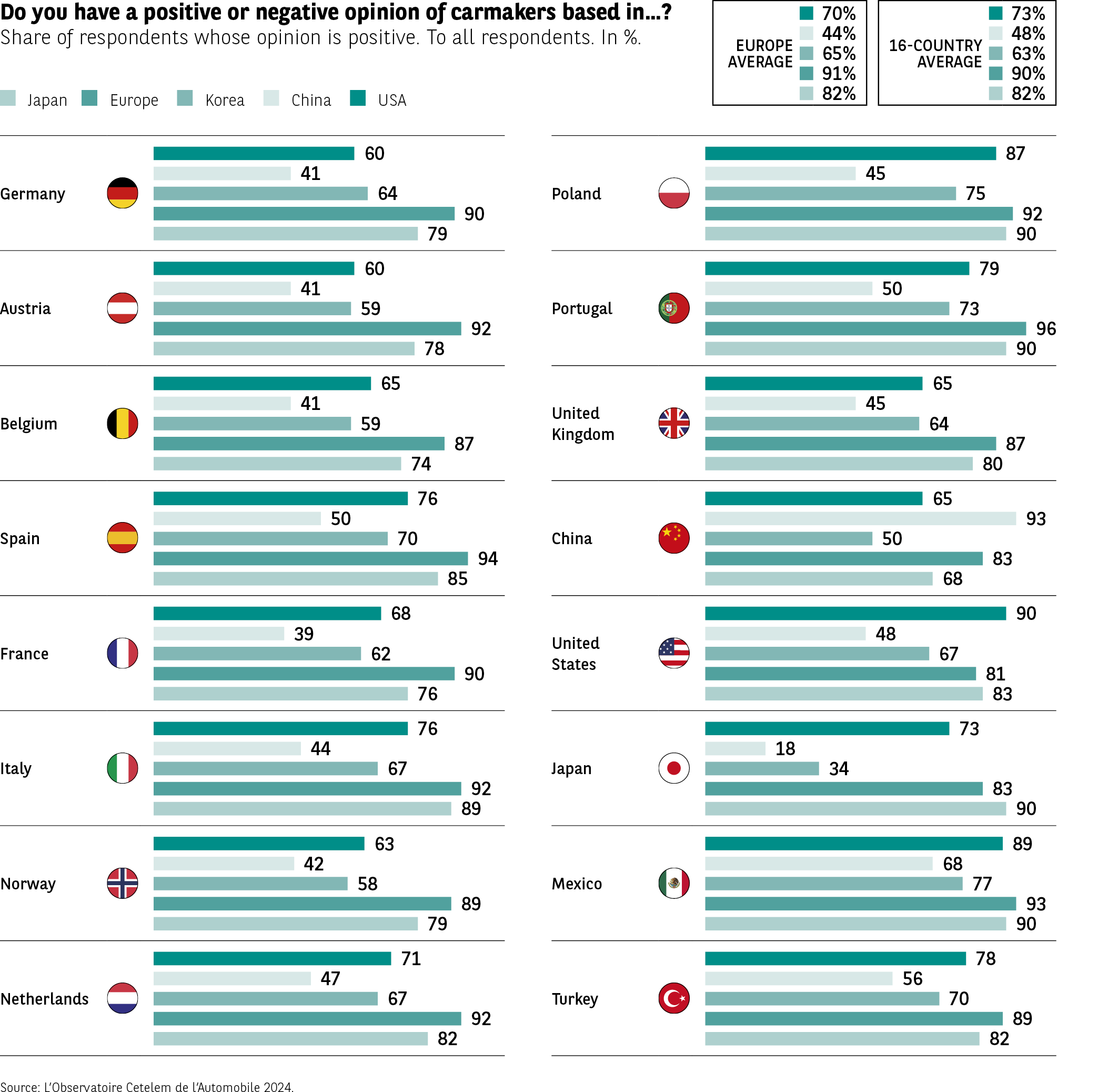

Of all the factors that can influence a brand’s success, image is one of the most crucial. And when we ask motorists, it is clear that this is not one of the strengths they associate with Chinese brands.

Meanwhile, European carmakers benefit from an impressive reputation, not least due to their longstanding presence in all markets. Indeed, their image is positive in the minds of 9 out of 10 respondents. On this point, the differences between the countries are naturally less pronounced, even if the Americans, Chinese and Japanese are somewhat more measured in their praise, given that their industries are in competition with these European players.

Not to be too outdone by this overwhelming score, Japanese brands come out very well, securing a positive opinion in 82% of cases. Naturally, it is in Japan that motorists are the most enthusiastic about the country’s brands, but they are just as popular in Mexico, Poland and Portugal. In China, geopolitical logic dictates that positive opinions barely reach 70%.

American brands come third in the ranking with a score of 73%. American nationalism shines through here, with 9 out of 10 people expressing a positive opinion, a figure that is just as high in neighbouring Mexico, where motorists are big fans of US-made pick-ups and saloon cars. This enthusiasm is much more subdued in two other neighbouring countries, Germany and Austria, which award a modest score of 60%.

One must cross the Pacific to find the country that sits in fourth place, with Korea achieving a score of 63%. Local rivalries are clearly apparent here, with only 34% of Japanese and 50% of Chinese respondents viewing Korean brands positively. Conversely, they are popular among almost 8 out of 10 people in Mexico, Poland and Portugal.

Bottom of the pile is the world’s top carmaking nation, China, whose achievements in the electric sector are impressive, not to say preoccupying. With just under 1 in 2 people expressing a favourable opinion of them, one might think that the country’s brands still have a lot of work to do in terms of image and recognition. One could also argue that this score is quite honourable for what are relatively new brands that are yet to build up a strong presence in many markets, and which have not benefited from word-of-mouth communication developed over a period of many years.

This result provides a solid basis for growth, particularly in view of the efforts they have made to improve the quality of their vehicles and meet the expectations of Western customers. It is no surprise to see that the Chinese are totally on board and that the Japanese are very much at the other end of the scale, with scores of 93% and 18% respectively. In between these two extremes, most European countries score below the overall average, highlighting a certain mistrust of Chinese brands.

It should be noted that young people and higher earners have a more positive view of carmakers than average, regardless of the brand’s country of origin(Fig. 37).

Fig 37 – Chronology of Chinese manufacturers

Download this infographic for your presentations Horizontal timeline from 1999 to 2020.

Each manufacturer is represented by a vertical block positioned at its year of creation.

Manufacturers and dates

1999: China South Industries Group, ZX Auto

2000: Guangzhou Automobile Industry Group

2002: Yueda Kia, Jonway Automobile, Gonow

2003: Beijing Benz

2005: —

2007: Karry

2009: Qoros

2010: Chang’an Automobile

2013: Hunan Leopard Motors

2014: Cowin Auto, Nio

2016: Byton

2017: eGT New Energy Automotive, Aiways, GAC Aion

2018: Avatr Technology

2020: SiTech, Rising Auto

Strong acceleration from 2010.

Multiplication of electric vehicle manufacturers after 2015.

Source: Wikidata.org.

Horizontal timeline from 1999 to 2020.

Each manufacturer is represented by a vertical block positioned at its year of creation.

Manufacturers and dates

1999: China South Industries Group, ZX Auto

2000: Guangzhou Automobile Industry Group

2002: Yueda Kia, Jonway Automobile, Gonow

2003: Beijing Benz

2005: —

2007: Karry

2009: Qoros

2010: Chang’an Automobile

2013: Hunan Leopard Motors

2014: Cowin Auto, Nio

2016: Byton

2017: eGT New Energy Automotive, Aiways, GAC Aion

2018: Avatr Technology

2020: SiTech, Rising Auto

Strong acceleration from 2010.

Multiplication of electric vehicle manufacturers after 2015.

Source: Wikidata.org.

A favorable quality-price ratio might eliminate any hesitation

Aside from its geographical origin, on what does a brand’s reputation hinge? When it comes to European brands, the factors of quality, aesthetics, safety and performance win the day. It goes without saying that Europeans are the keenest on these qualities. The Japanese express less enthusiasm about each of these factors, barring the aesthetic appeal of the vehicles, which they do acknowledge.

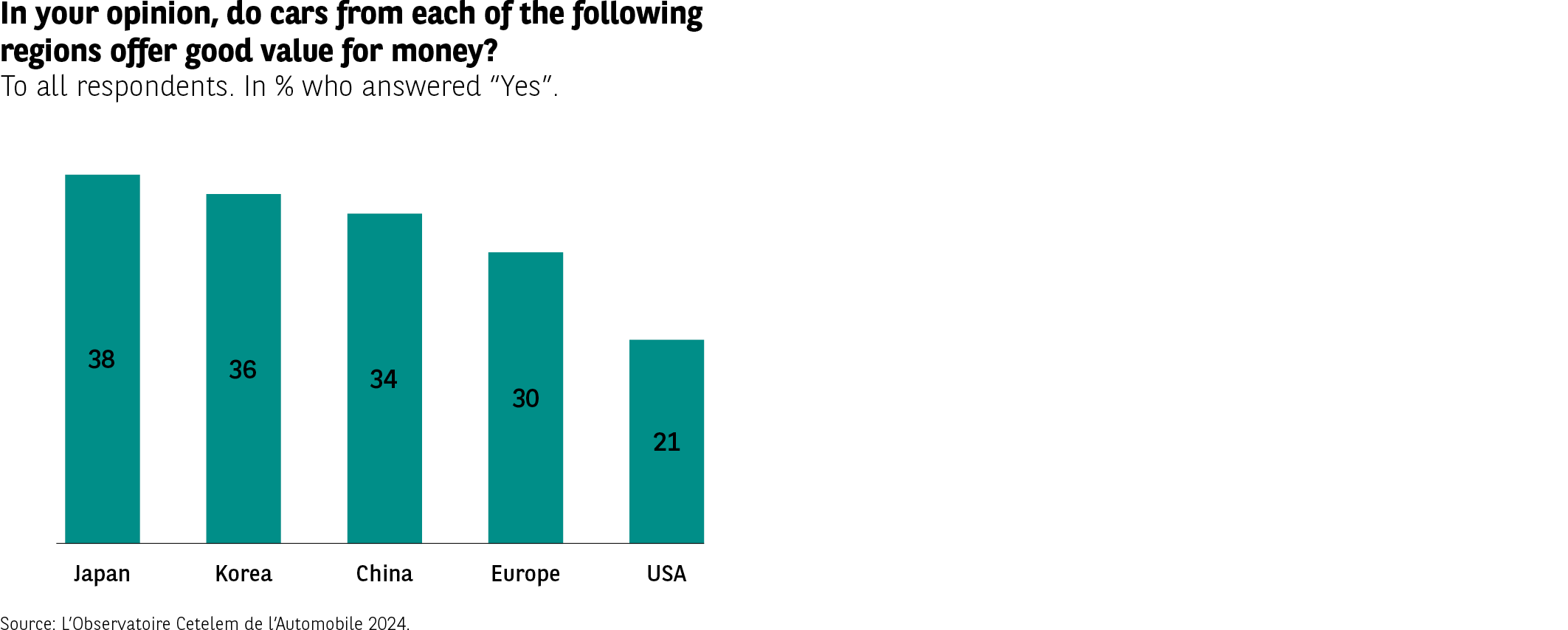

Brands from Japan are naturally the most likely to appeal to the nation’s consumers. Indeed, their reliability, safety, performance and value for money are widely recognized (Fig. 38).

Fig 38 – Perceived quality/price ratio by origin

Download this infographic for your presentations Categories evaluated (% “yes”)

Japanese: 38

Korean: 36

Chinese: 34

European: 30

American: 21

Japanese vehicles are perceived as the most balanced.

Europe appears to be less competitive than Asia.

American brands bring up the rear.

Source: Cetelem Observatory 2024.

Categories evaluated (% “yes”)

Japanese: 38

Korean: 36

Chinese: 34

European: 30

American: 21

Japanese vehicles are perceived as the most balanced.

Europe appears to be less competitive than Asia.

American brands bring up the rear.

Source: Cetelem Observatory 2024.

On that final crucial point – remember the enduring importance of price when buying a car – the Korean and Chinese brands hold their own against the Japanese. As for Chinese brands, this is by far the most frequently cited criterion and the main attraction they hold for motorists, even if they still have a long way to go before people are convinced of their performance, aesthetics and safety. None of these criteria obtain a score of more than 20%.

When it comes to value for money, American brands score the lowest, with the European brands not far ahead, outstripped by all the Asian brands.

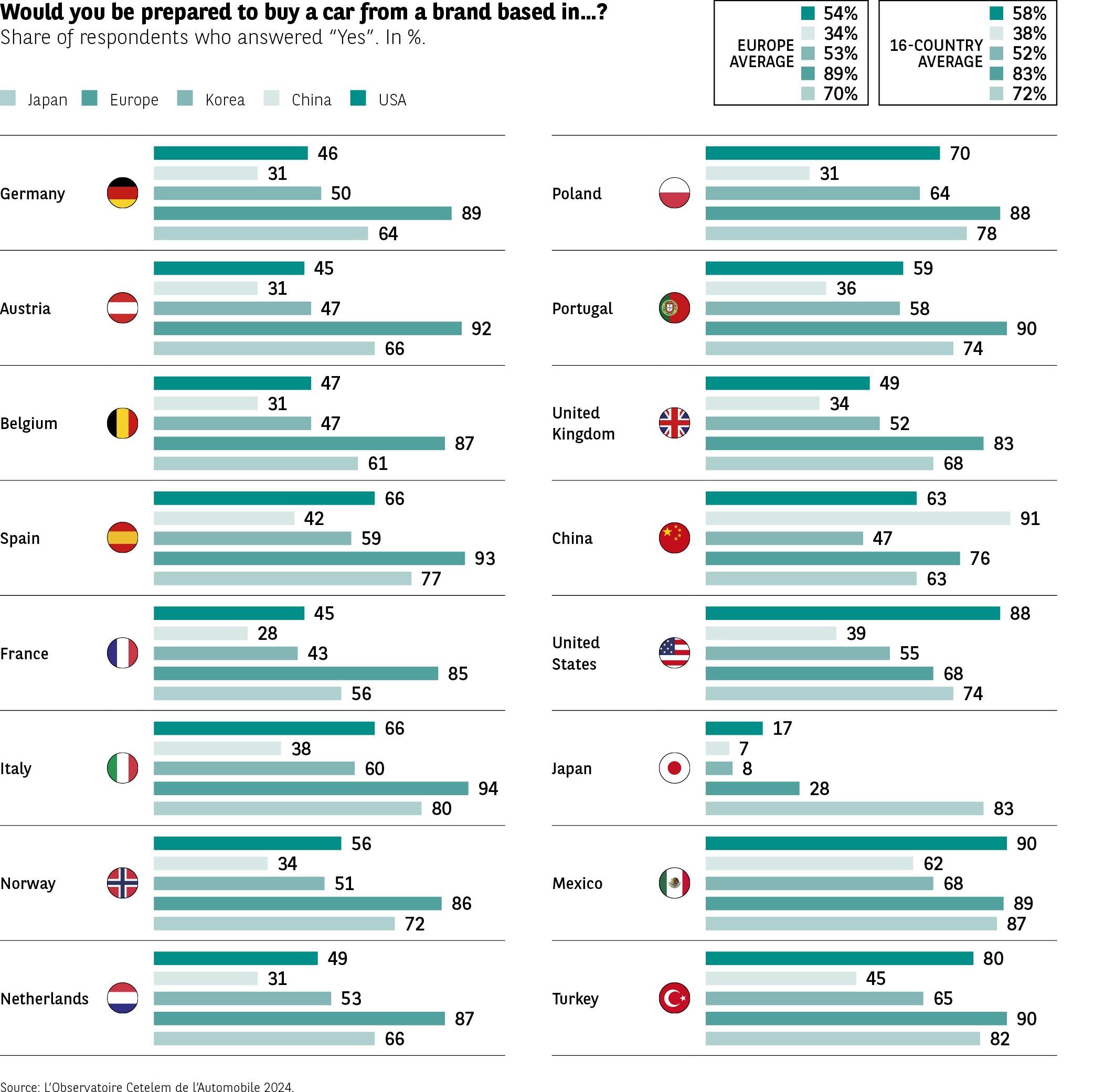

Purchasing desires remain to be converted

Now that we have established the respective reputations and qualities of the world’s brands, the main question is whether motorists are prepared to buy a vehicle. The responses gathered do not upset the established order, with the same brands securing people’s preferences in descending order. Just over 8 out of 10 respondents express a preference for buying European brands, while the Japanese remain firmly opposed to the idea (and generally to anything that isn’t “Made in Japan”).

Then come the Japanese, American and Korean brands, in that order. The Chinese brands again bring up the rear, with only 4 out of 10 people being prepared to buy one of their vehicles. There are two ways of looking at this result. This score could either be considered low, or it could be viewed as encouraging, considering the lack of penetration these brands sometimes suffer from outside their country of origin. Once they have achieved greater success outside their borders, this score is likely to change rapidly. And the sales volumes generated will be great enough to trigger a knock-on effect that will be harder to counter (Fig. 39).

Fig 39 – Future of existing public aids

Download this infographic for your presentations Categories:

Will disappear

Will continue

Averages:

Europe: 58% continue / 42% disappear

16 countries: 64% continue / 36% disappear

Results by country (disappear / continue)

Germany: 49 / 51

Austria: 50 / 50

Belgium: 44 / 56

Spain: 29 / 71

France: 43 / 57

Italy: 25 / 75

Norway: 58 / 42

Netherlands: 24 / 76

Poland: 50 / 50

Portugal: 32 / 68

United Kingdom: 19 / 81

China: 16 / 84

United States: 46 / 54

Japan: 18 / 82

Mexico: 18 / 82

Turkey: 19 / 81

Very strong confidence in the continuity of aids in Asia and Southern Europe.

Great concern in Norway and Germany.

Source: Cetelem Observatory 2024.

Categories:

Will disappear

Will continue

Averages:

Europe: 58% continue / 42% disappear

16 countries: 64% continue / 36% disappear

Results by country (disappear / continue)

Germany: 49 / 51

Austria: 50 / 50

Belgium: 44 / 56

Spain: 29 / 71

France: 43 / 57

Italy: 25 / 75

Norway: 58 / 42

Netherlands: 24 / 76

Poland: 50 / 50

Portugal: 32 / 68

United Kingdom: 19 / 81

China: 16 / 84

United States: 46 / 54

Japan: 18 / 82

Mexico: 18 / 82

Turkey: 19 / 81

Very strong confidence in the continuity of aids in Asia and Southern Europe.

Great concern in Norway and Germany.

Source: Cetelem Observatory 2024.