Electric cars are taking centre stage… but raise new questions

Electric leads the way

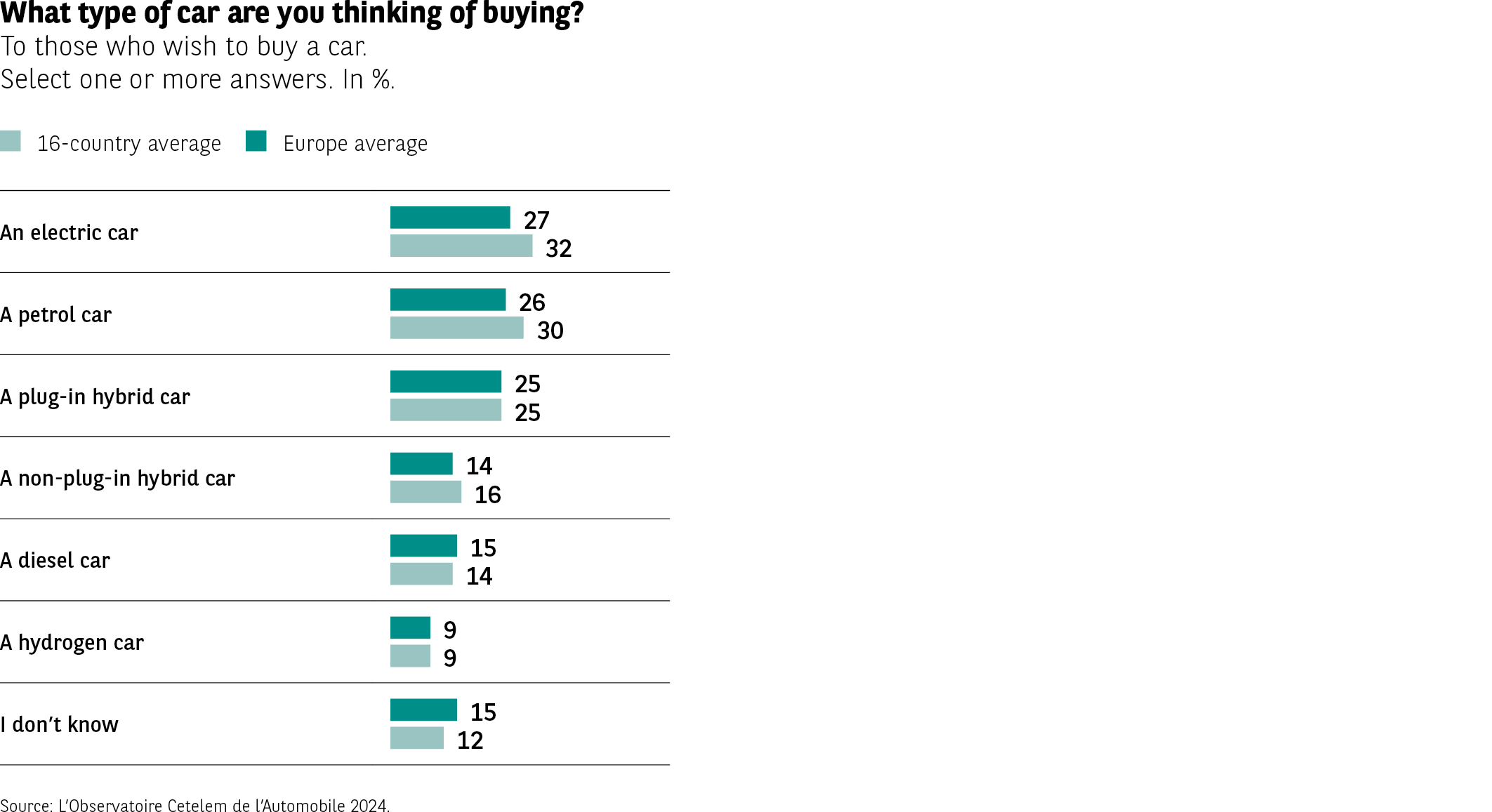

L’Observatoire Cetelem has long paid close attention to electric vehicles, and was among the first to announce their advent. However, this edition should be seen as something of a milestone, since this type of powertrain now tops the list of purchasing intentions for the very first time. This is a significant breakthrough for electric cars, but combustion engine vehicles are putting up a good fight. 1 in 3 people will opt to buy an electric car (Fig. 22). If we add to this figure the number of respondents who state their intention to buy a hybrid car (plug-in or other), it is safe to say that there has been a real shift in the market.

The Chinese and, to a lesser extent, the Norwegians consolidate their lead on matters electric, with purchasing intentions of 65% and 43% respectively. At the other end of the scale, France, Belgium, Austria and Poland are again the countries in which these intentions are the least pronounced, at around 20%.

Fig 22 – Engine types considered for purchase

Download this infographic for your presentations Graph comparing:

Average of 16 countries

Average of Europe

Engine types and results (16 countries / Europe)

Electric car: 27 / 32

Gasoline: 26 / 30

Rechargeable hybrid: 25 / 25

Non-rechargeable hybrid: 14 / 16

Diesel: 15 / 14

Hydrogen: 9 / 9

Don’t know: 15 / 12

Lesson

In Europe, electric remains slightly ahead, followed by gasoline and rechargeable hybrids.

Graph comparing:

Average of 16 countries

Average of Europe

Engine types and results (16 countries / Europe)

Electric car: 27 / 32

Gasoline: 26 / 30

Rechargeable hybrid: 25 / 25

Non-rechargeable hybrid: 14 / 16

Diesel: 15 / 14

Hydrogen: 9 / 9

Don’t know: 15 / 12

Lesson

In Europe, electric remains slightly ahead, followed by gasoline and rechargeable hybrids.

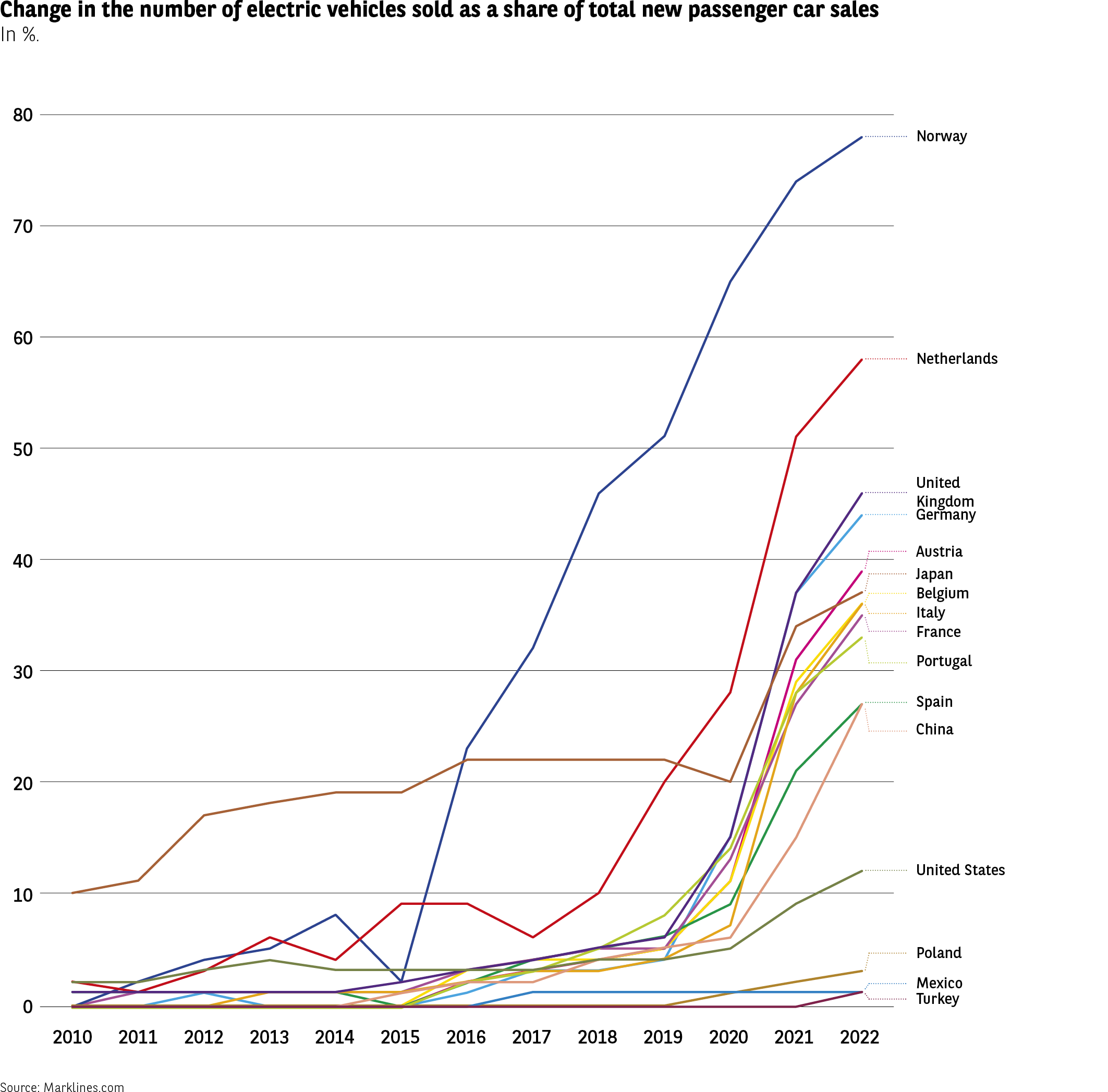

Fig 23 – Share of electric vehicle sales

Download this infographic for your presentations The graph traces the evolution of the share of electric vehicles in private car sales between 2010 and 2022, for several countries. It is a chronological curve.

Key visual elements

Horizontal axis: years 2010 → 2022.

Vertical axis: percentage of market share.

Several national colored curves: Norway, Netherlands, Germany, France, China, United States, etc.

Main trends observed

Norway: very strong and continuous progression, reaching levels above 75% in 2022.

Netherlands: marked growth with a peak before 2020, then stabilization.

China: progressive rise, especially from 2016.

Western Europe (France, Germany, Belgium, United Kingdom): regular but slower progression.

United States: low to moderate increase.

Emerging countries (Turkey, Mexico): lower shares and limited progression.

Lesson

The growth of electric vehicles is very heterogeneous by country, with clear leaders (Norway, Netherlands) and accelerated global progression from 2016.

The graph traces the evolution of the share of electric vehicles in private car sales between 2010 and 2022, for several countries. It is a chronological curve.

Key visual elements

Horizontal axis: years 2010 → 2022.

Vertical axis: percentage of market share.

Several national colored curves: Norway, Netherlands, Germany, France, China, United States, etc.

Main trends observed

Norway: very strong and continuous progression, reaching levels above 75% in 2022.

Netherlands: marked growth with a peak before 2020, then stabilization.

China: progressive rise, especially from 2016.

Western Europe (France, Germany, Belgium, United Kingdom): regular but slower progression.

United States: low to moderate increase.

Emerging countries (Turkey, Mexico): lower shares and limited progression.

Lesson

The growth of electric vehicles is very heterogeneous by country, with clear leaders (Norway, Netherlands) and accelerated global progression from 2016.

The problem is (still) the price

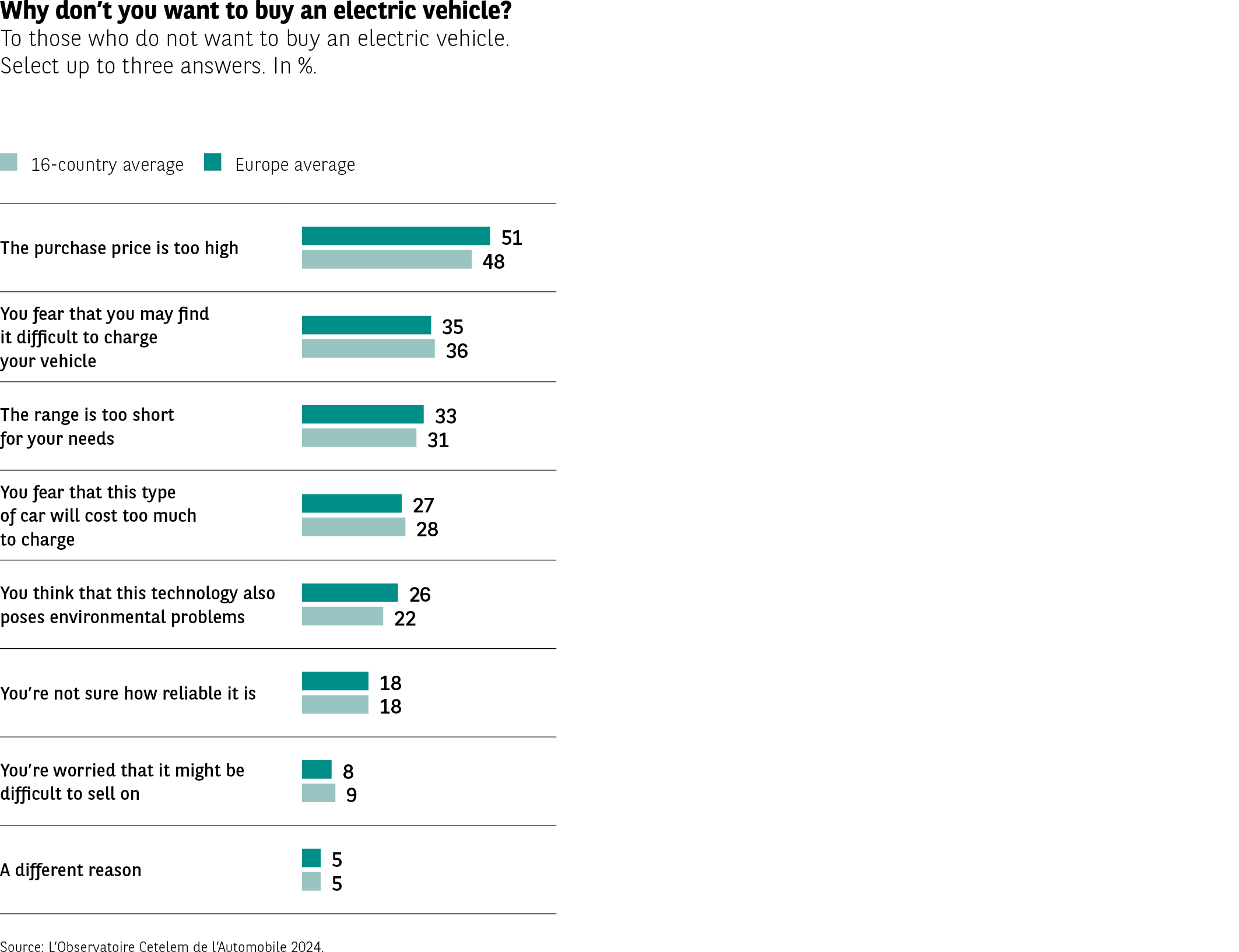

However, the world of electric cars is not exactly a utopia towards which motorists are blissfully careering. Because if there is one thing that hasn’t changed, it’s all the negative factors that prompt potential buyers to put on the brakes.

As always, the main obstacle is financial. Almost half of those surveyed believe that the price of electric vehicles is too high, with the Dutch and French the most likely to stress this point. This is a view held by only 13% of respondents in China, which is home to many long-standing converts.

There is also reticence due to potential charging difficulties and range limitations. Both of these issues are a worry for around 3 in 10 people. Surprisingly, these issues are of greatest concern in China, in contrast to Mexico where they are seen as less of a problem. It should be noted that vehicle range is also a major concern in France.

However, one result will be a source of great reassurance for manufacturers. Barely 10% of motorists fear that they will struggle to resell an electric vehicle. This suggests that there is a real opportunity for electric cars to become a permanent fixture on the automotive landscape (Fig. 24).

Fig 24 – Reasons for not buying an electric vehicle

Download this infographic for your presentations Horizontal graph presenting the most often cited reasons by people who do not want to buy an electric vehicle. Multiple responses possible.

Commonly displayed reasons

Too high price.

Difficulty accessing charging.

Insufficient autonomy.

Perceived high cost of electricity.

Doubts about the ecological impact of manufacturing.

Perceived uncertain reliability.

Difficult resale.

Other minor reasons.

Visual structure

Each reason appears as a horizontal bar.

Two levels displayed: European average and average of 16 countries.

Lesson

Price and charging constraints are the main brakes, followed by autonomy and energy cost.

Horizontal graph presenting the most often cited reasons by people who do not want to buy an electric vehicle. Multiple responses possible.

Commonly displayed reasons

Too high price.

Difficulty accessing charging.

Insufficient autonomy.

Perceived high cost of electricity.

Doubts about the ecological impact of manufacturing.

Perceived uncertain reliability.

Difficult resale.

Other minor reasons.

Visual structure

Each reason appears as a horizontal bar.

Two levels displayed: European average and average of 16 countries.

Lesson

Price and charging constraints are the main brakes, followed by autonomy and energy cost.

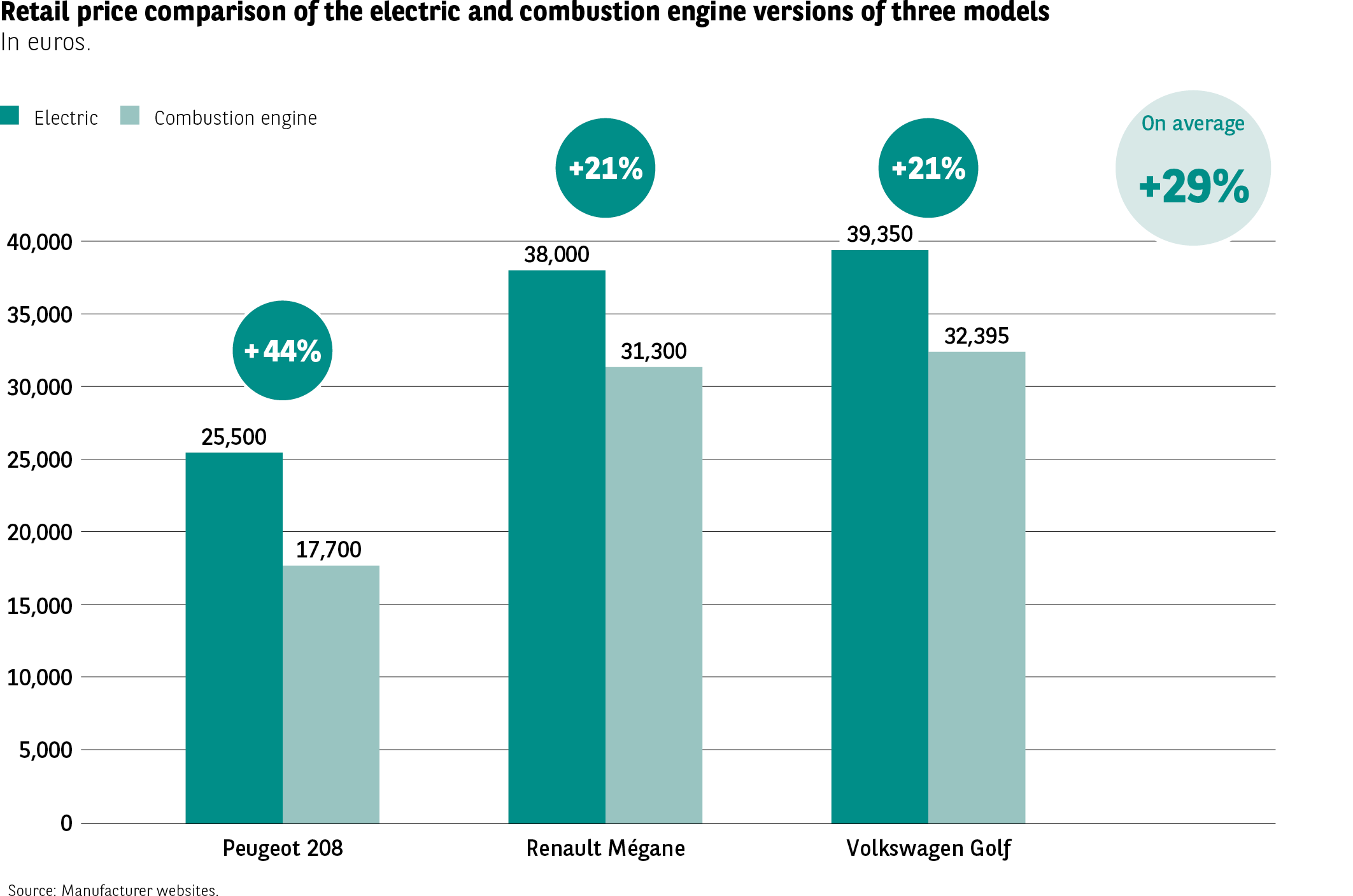

Fig 25 – Electric-thermal price gap

Download this infographic for your presentations Vertical graph comparing the purchase prices of three cars in electric and thermal versions.

Models presented

Peugeot 208

Renault Mégane

Volkswagen Golf

Visual elements

Side-by-side columns: electric version (higher price) vs thermal version.

Percentage difference displayed on each pair of bars.

Visible trends

Electric is always more expensive, with gaps ranging from approximately +20% to +45% depending on the models.

Lesson

The price difference constitutes a major barrier to adoption, with the gap often exceeding one-third of the price.

Vertical graph comparing the purchase prices of three cars in electric and thermal versions.

Models presented

Peugeot 208

Renault Mégane

Volkswagen Golf

Visual elements

Side-by-side columns: electric version (higher price) vs thermal version.

Percentage difference displayed on each pair of bars.

Visible trends

Electric is always more expensive, with gaps ranging from approximately +20% to +45% depending on the models.

Lesson

The price difference constitutes a major barrier to adoption, with the gap often exceeding one-third of the price.

Batteries: a tricky choice

- Motorists are not the only ones who are in a fog. Uncertainty also reigns among manufacturers when it comes to choosing which batteries will equip their cars.

- Currently, the two options are LPF (lithium- iron-phosphate) batteries and NMC (nickel- manganese-cobalt) batteries. The former are relatively cheap and allow the cost of vehicles to be reduced, but they are difficult to recycle. The latter are more expensive, but better integrated into the circular economy. They will also be able to use sodium and solid-state batteries within the next few years.

- What to choose? That is the question…

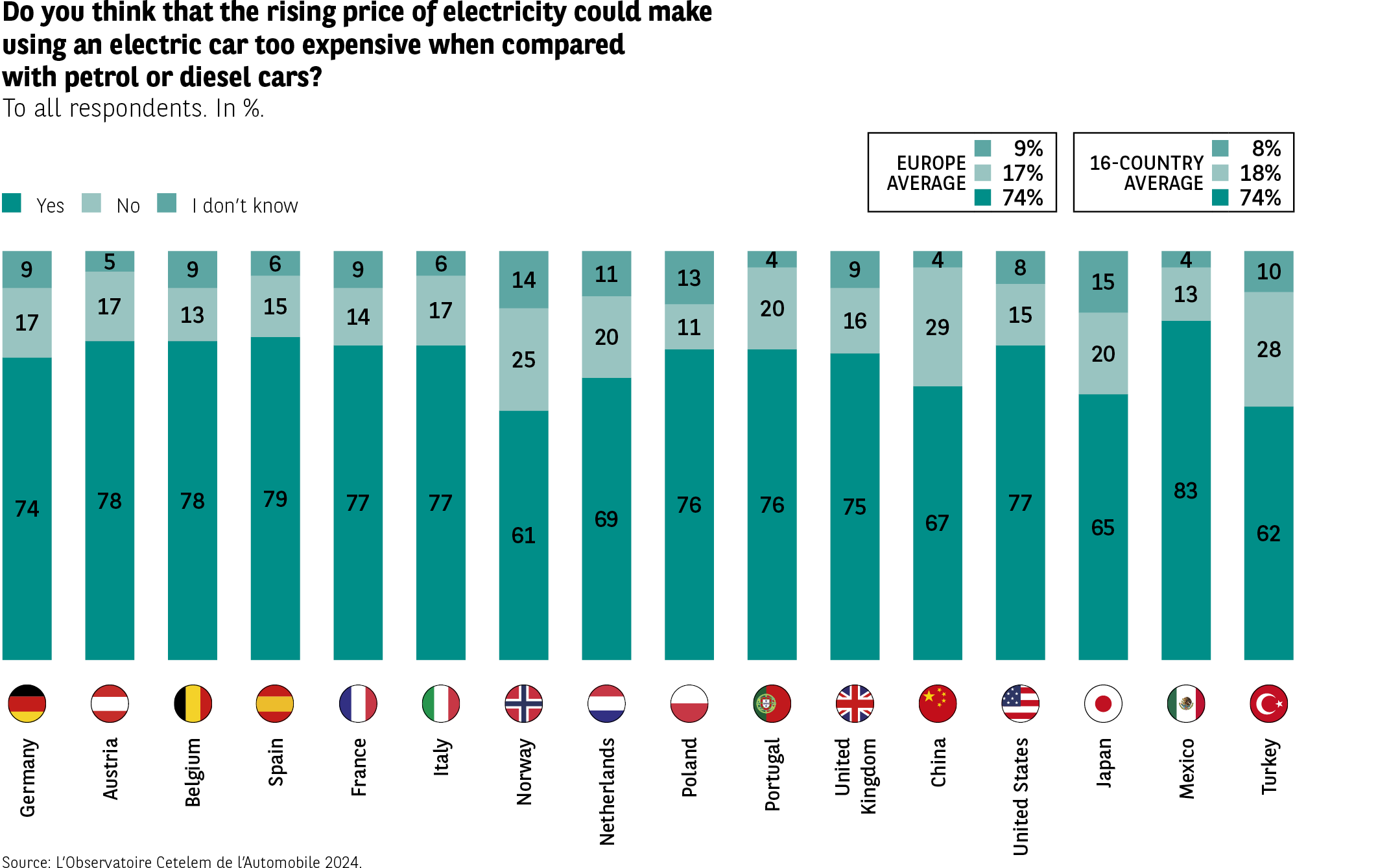

The cost of use could potentially be high

The cost issue is not just confined to the initial purchase of an electric vehicle, but also extends to its day-to-day use. Having witnessed the recent rises in electricity prices and with the potential for more in the future, motorists are in a quandary. Three quarters of motorists believe they will be more expensive to run than a vehicle with a conventional engine.

In European countries, particularly Spain, this fear is very real (Fig. 26).

Fig 26 – Perceived cost of electric vehicle use

Download this infographic for your presentations Graph with stacked vertical bars: Yes / No / Don’t know.

Question asked

“Do you think that an increase in electricity prices could make the use of an electric car too expensive compared to gasoline or diesel?”

Visual elements

European average

Average of 16 countries

Detailed results by country

General trend

A clear majority responds “yes” in almost all countries, with a particularly high level in continental Europe.

Lesson

The increase in electricity prices is perceived as a major threat to the economic attractiveness of electric vehicles.

Graph with stacked vertical bars: Yes / No / Don’t know.

Question asked

“Do you think that an increase in electricity prices could make the use of an electric car too expensive compared to gasoline or diesel?”

Visual elements

European average

Average of 16 countries

Detailed results by country

General trend

A clear majority responds “yes” in almost all countries, with a particularly high level in continental Europe.

Lesson

The increase in electricity prices is perceived as a major threat to the economic attractiveness of electric vehicles.

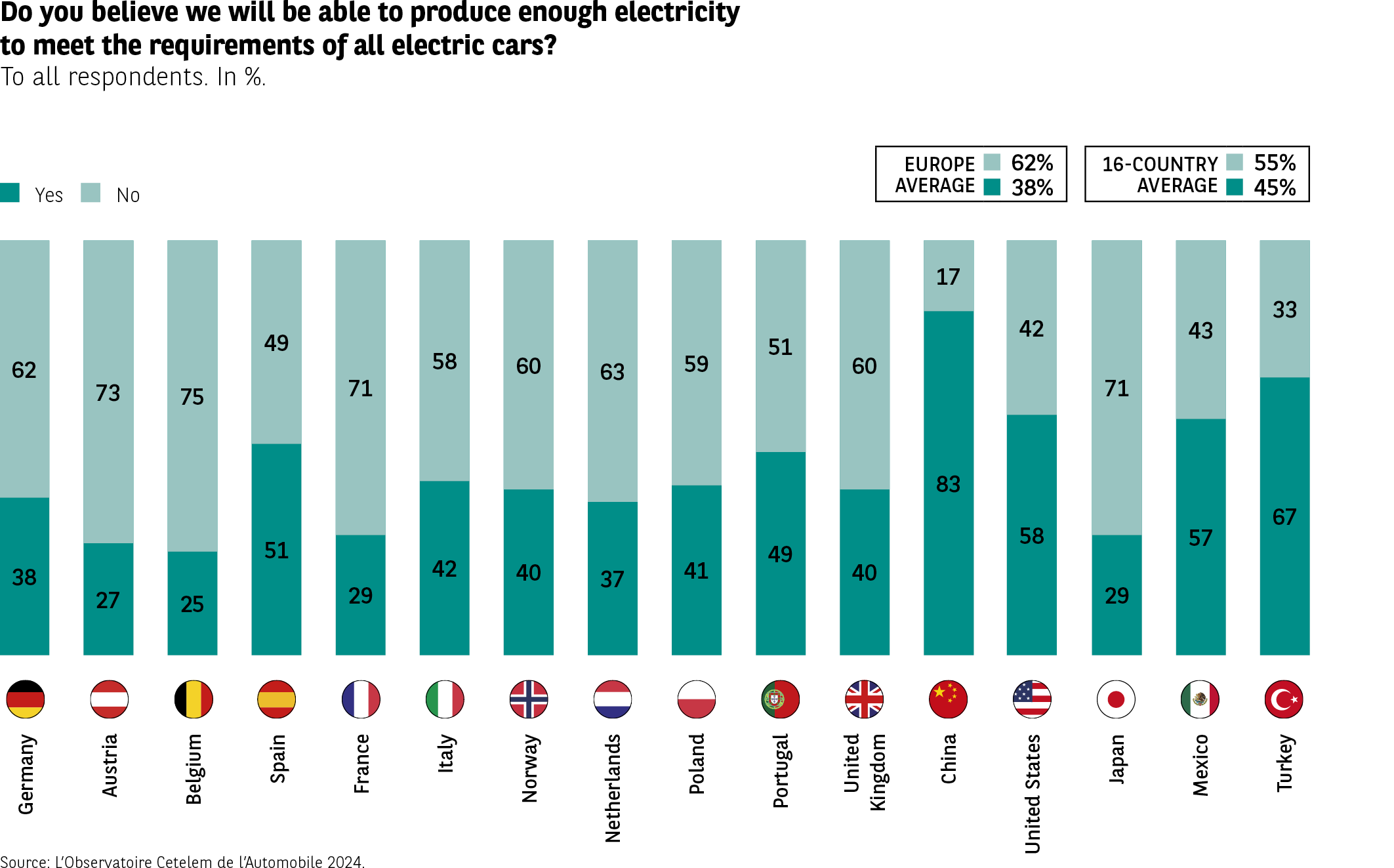

A future lacking in energy

Not only could electricity become more expensive, there are also question marks over its supply. Indeed, more even than the planned pre-eminence of electric vehicles, motorists question their very use, as they suspect that power generation will be inadequate in the future. Three-quarters of respondents take this view, no doubt influenced by the recent energy crises. This seems to exceed the boundaries of mere scepticism.

But if we look at the detail, opinions are again extremely variable. The Chinese, and to a lesser extent the Turks, are in very little doubt about the availability of electricity to power their cars. In Europe meanwhile, the concern is palpable, particularly in Austria and Belgium, with the Spanish and their Portuguese neighbours occupying the middle ground. The energy crisis triggered by the war in Ukraine has clearly left its mark (Fig. 27).

Fig 27 – Future electricity production capacity

Download this infographic for your presentations Graph indicating confidence or not in future electricity production capacity.

Categories

Yes

No

Visual elements

European average

Average of 16 countries

Results by country

General trend

In Europe: pessimistic majority (“no” > “yes”).

In China, Turkey, and Mexico: optimistic majority.

Lesson

World opinion is divided, but Europe stands out for its marked skepticism.

Graph indicating confidence or not in future electricity production capacity.

Categories

Yes

No

Visual elements

European average

Average of 16 countries

Results by country

General trend

In Europe: pessimistic majority (“no” > “yes”).

In China, Turkey, and Mexico: optimistic majority.

Lesson

World opinion is divided, but Europe stands out for its marked skepticism.

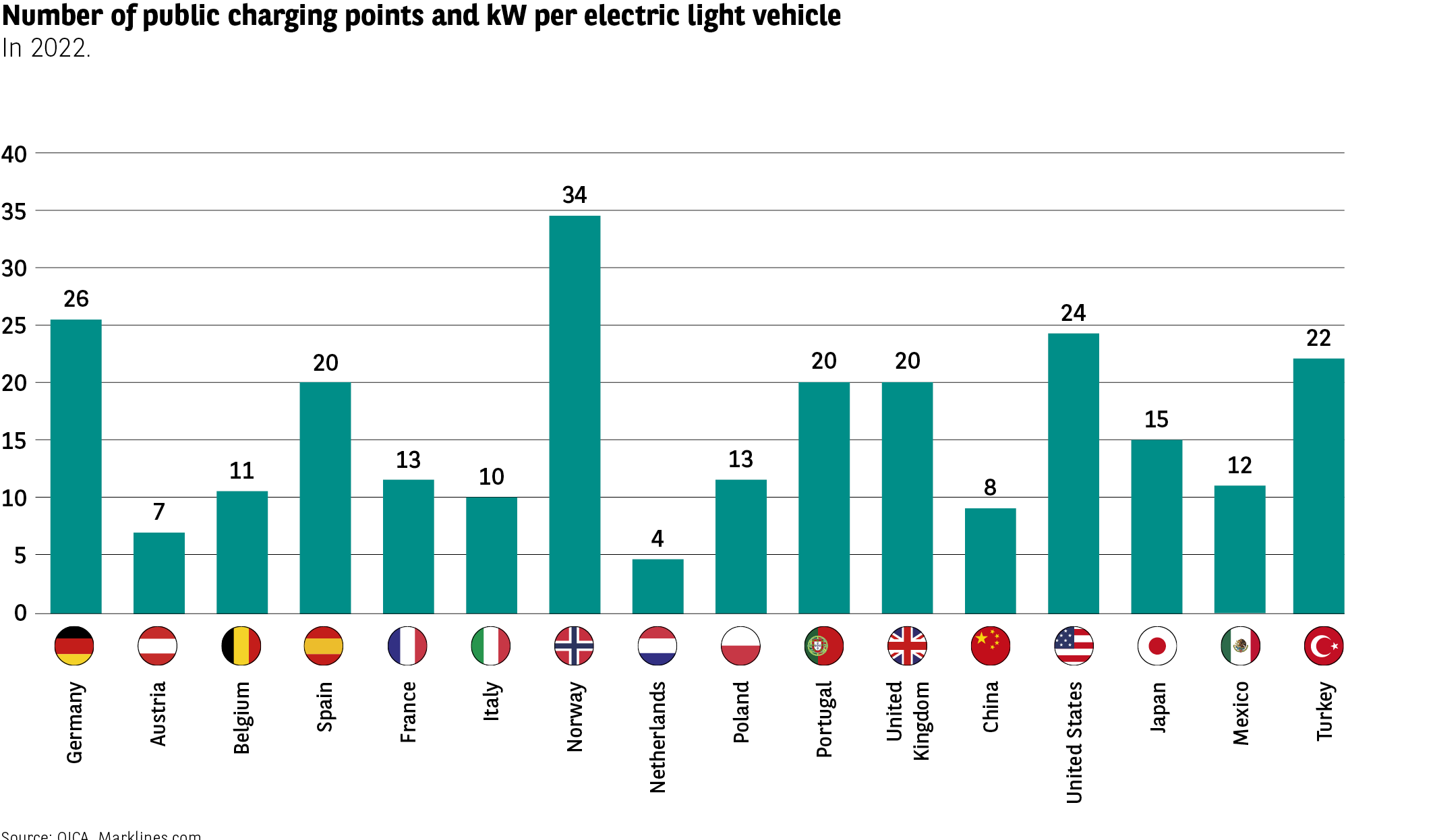

Fig 28 – Public charging points per electric vehicle

Download this infographic for your presentations Vertical graph presenting the number of kilowatts available in public charging points per electric vehicle in circulation.

Visual elements

Countries represented: 16

Values in kW per electric vehicle

Usual examples: Norway very high, Netherlands very low.

Lesson

The Nordic countries, particularly Norway, have a much higher public charging capacity per vehicle than the rest of the world.

Vertical graph presenting the number of kilowatts available in public charging points per electric vehicle in circulation.

Visual elements

Countries represented: 16

Values in kW per electric vehicle

Usual examples: Norway very high, Netherlands very low.

Lesson

The Nordic countries, particularly Norway, have a much higher public charging capacity per vehicle than the rest of the world.

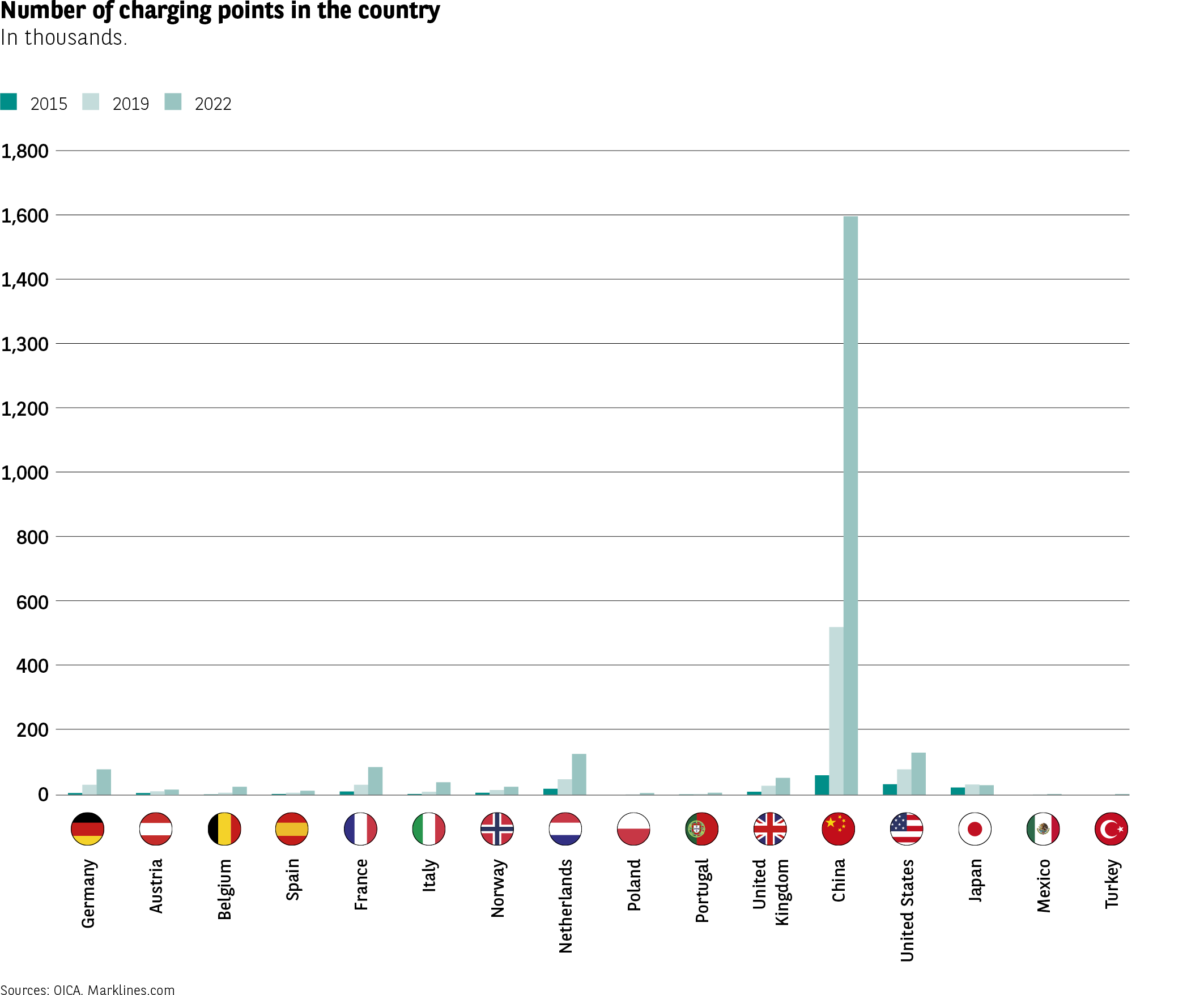

Fig 29 – Total number of charging points

Download this infographic for your presentations Vertical graph comparing the total number of charging points installed in 16 countries.

Visual elements

Vertical bars classified by country

Unit: number of public charging points

Strong contrast between countries (China and Netherlands very high, Poland low, etc.)

The deployment is very disparate, with very high volumes in only a few countries.

Vertical graph comparing the total number of charging points installed in 16 countries.

Visual elements

Vertical bars classified by country

Unit: number of public charging points

Strong contrast between countries (China and Netherlands very high, Poland low, etc.)

The deployment is very disparate, with very high volumes in only a few countries.