INFLATION IS OMNIPRESENT IN THE MINDS OF EUROPEANS, CONSTRAINING THEIR PURCHASING POWER

The previous Observatoire Cetelem Barometer suggested that the shock of inflation was on everyone’s mind and that Europeans were unanimously feeling its impact on their purchasing power. At the time, we lauded their economic acumen. But what about this year? Despite inflation slowing, it remains at the heart of their concerns and continues to affect their purchasing power.

INFLATION REMAINS AT THE HEART OF PEOPLE’S CONCERNS

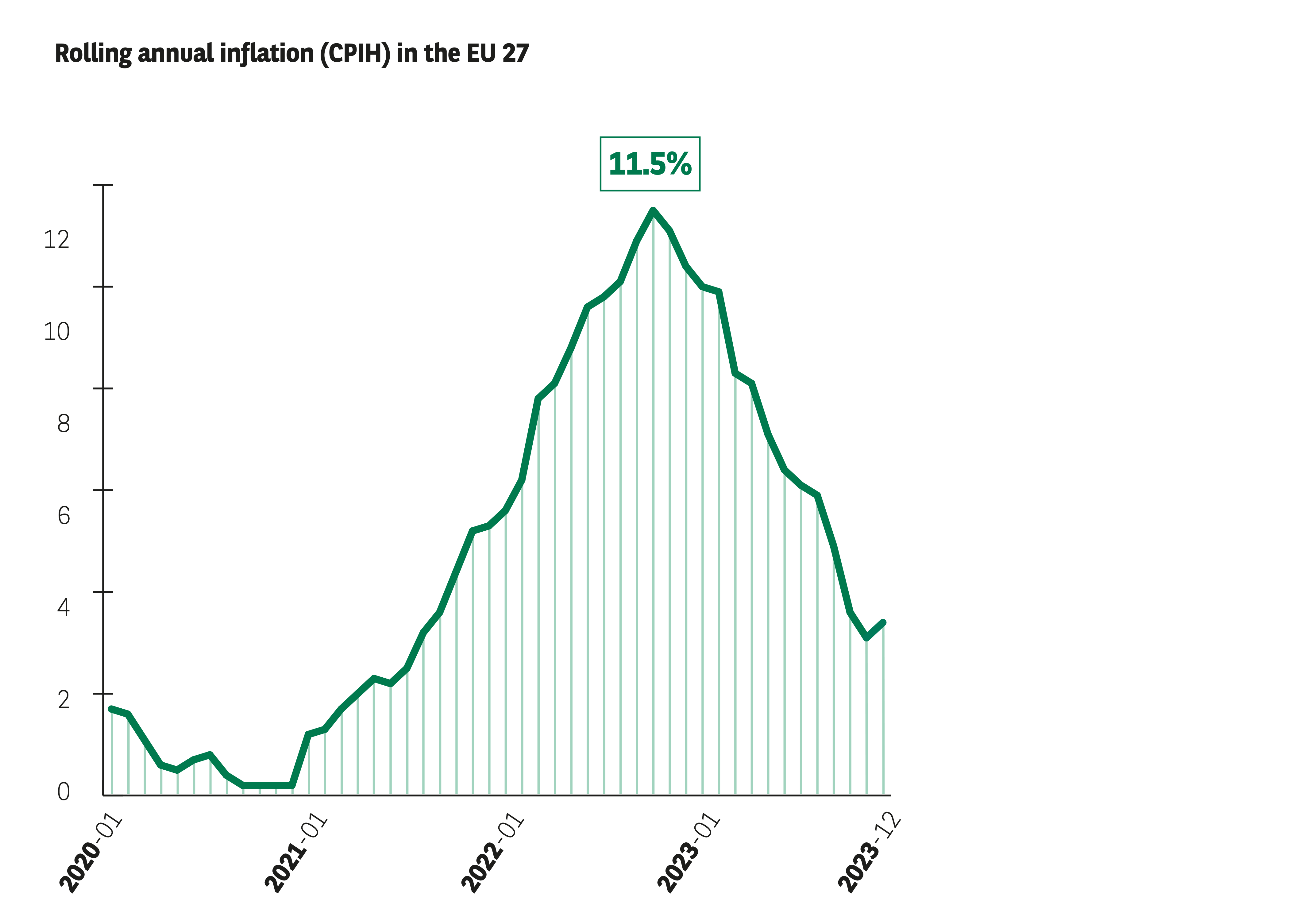

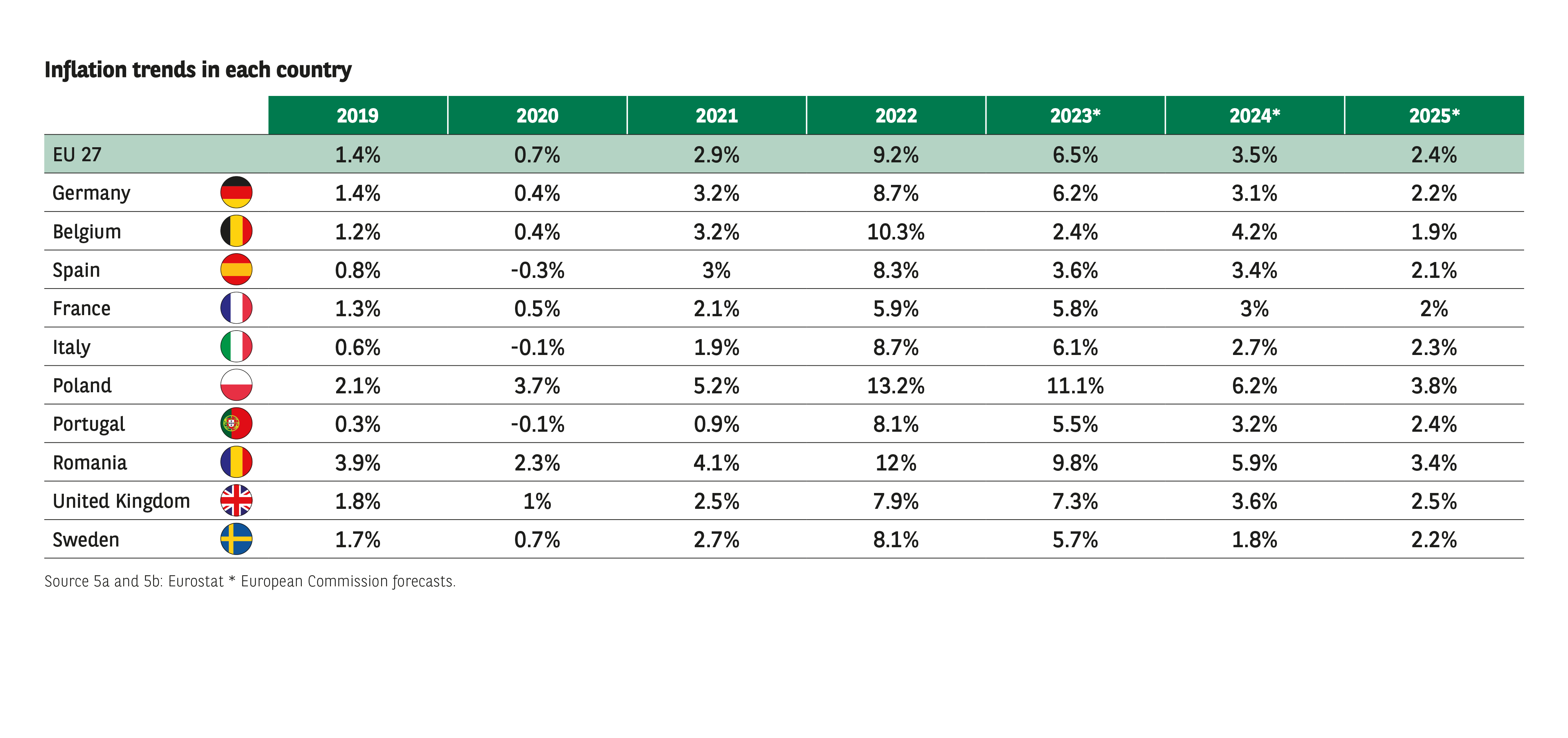

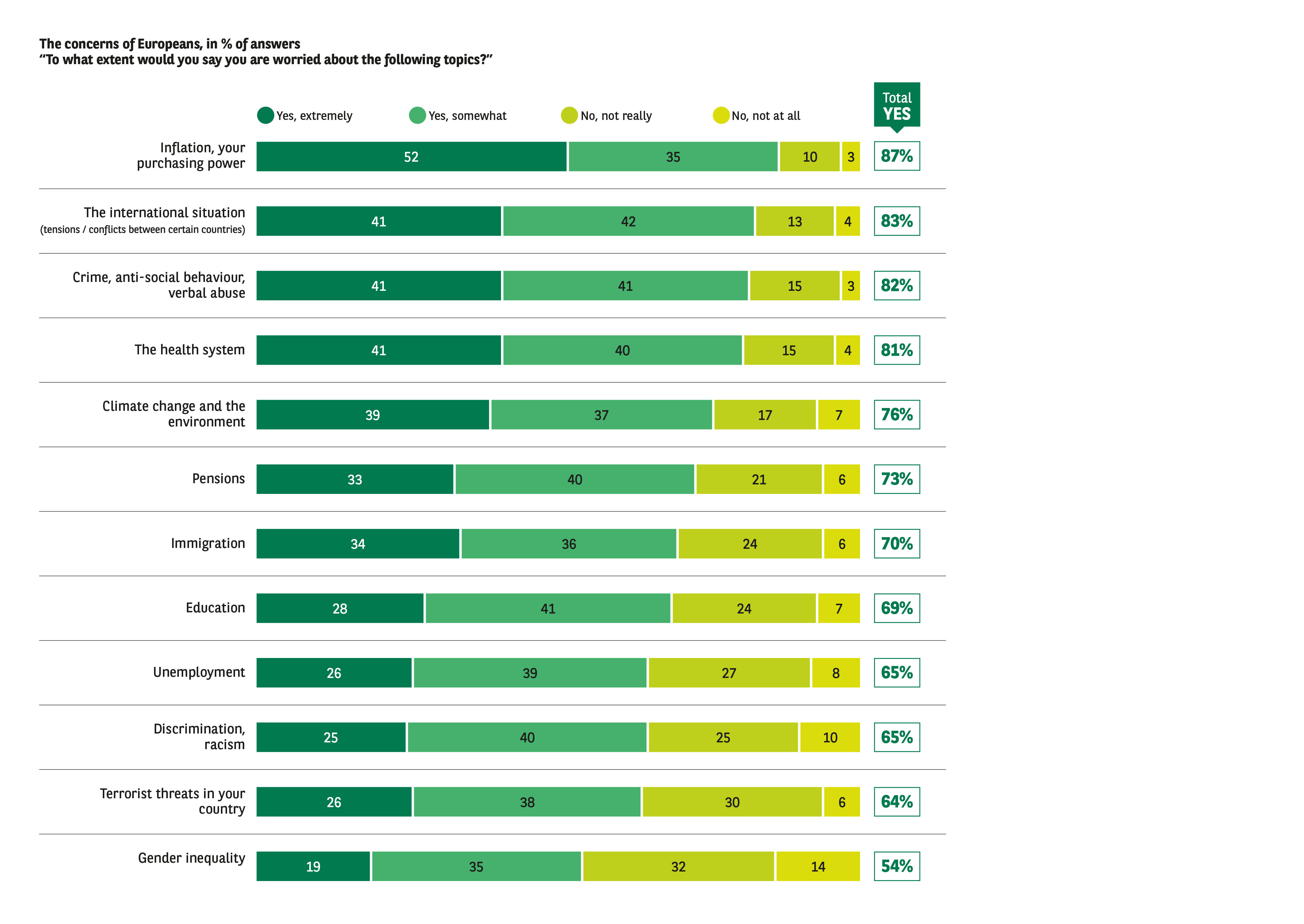

Over the course of 2023, inflation in Europe slowed to a 2-year low of +3.1% in November 2023 (Fig. 5a), after reaching a “historical” peak of +11.5% in October 2022. What’s more, the European Commission’s forecasts indicate that the annual inflation rate will remain under control in 2024 (+3.5%) and 2025 (+2.4%) (Fig. 5b). Is this enough to reassure Europeans in the long term? Not entirely! Consumers remain concerned. An overwhelming majority (87%) say they are worried about inflation and their purchasing power. With 52% answering “yes, very much so”, more than half of Europeans say they are extremely worried. In every country surveyed, they place “inflation/purchasing power” at the top of their list of concerns, ahead of international geopolitical instability (83%), security (82%), concerns regarding the health system (81%) and climate change (76%).

Fig. 5a / Barometer

Download this infographic for your presentations

Fig. 5b / Barometer

Download this infographic for your presentations

Not entirely! Consumers remain concerned. An overwhelming majority (87%) say they are worried about inflation and their purchasing power. With 52% answering “yes, very much so”, more than half of Europeans say they are extremely worried (Fig. 6). In every country surveyed, they place “inflation/purchasing power” at the top of their list of concerns, ahead of international geopolitical instability (83%), security (82%),concerns regarding the health system (81%) and climate change (76%).

Fig. 6 / Barometer

Download this infographic for your presentations

This ranking is worth bearing in mind, especially with the European elections taking place in June 2024. Purchasing power will undoubtedly be the central theme of the upcoming political campaigns in all EU countries.

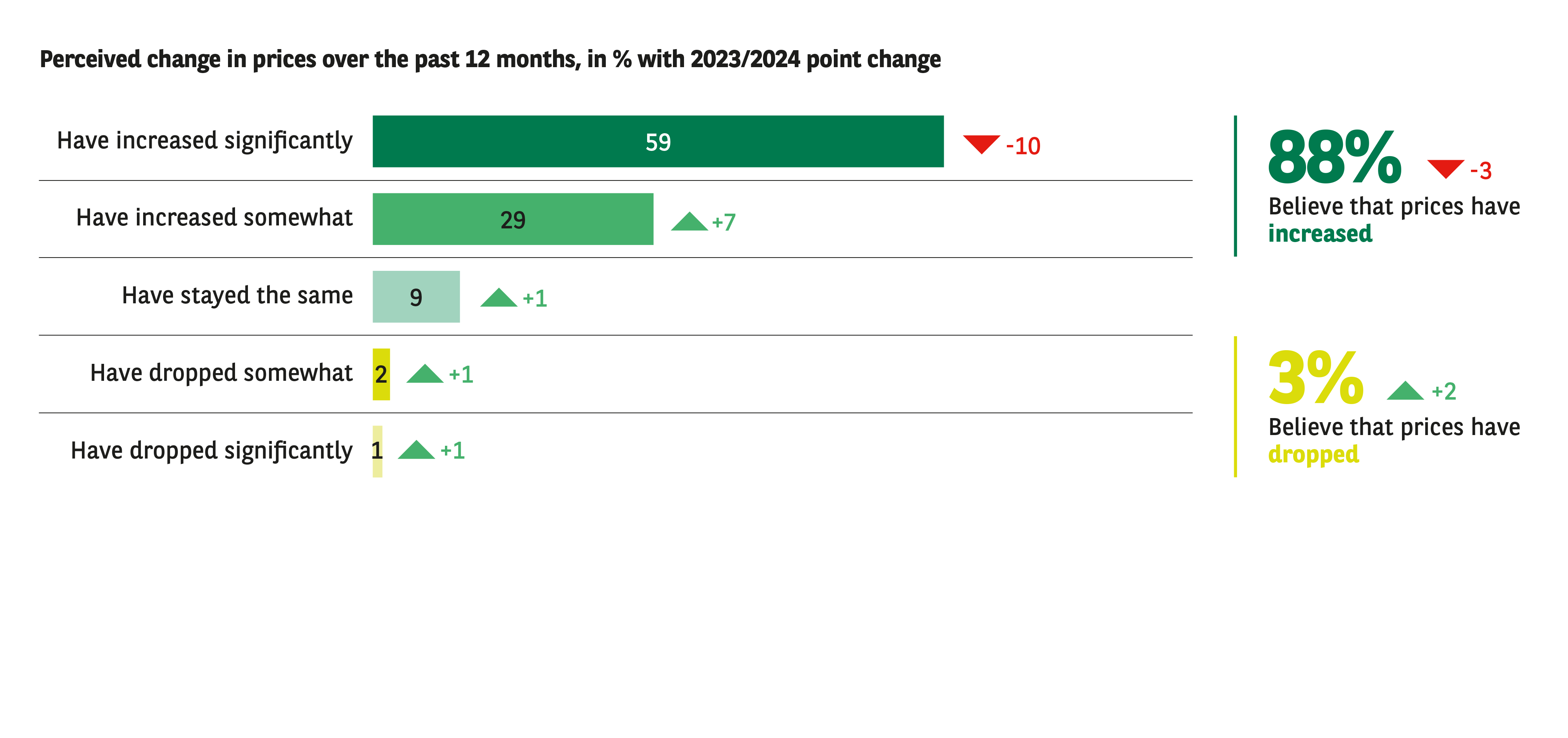

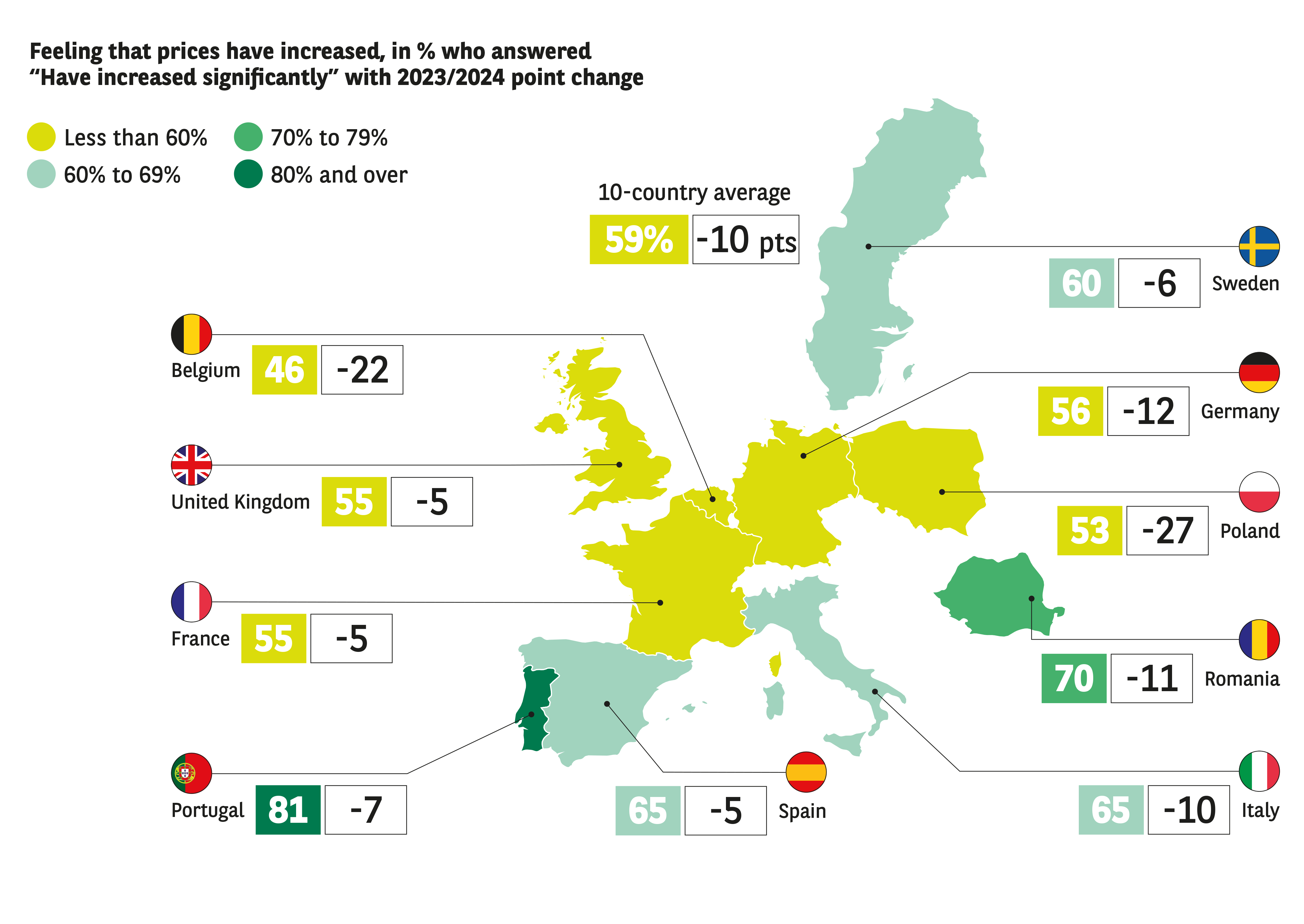

Inflation continues to have a sizeable impact on the daily lives of Europeans. Indeed, they are almost unanimous (88%) in believing that prices have risen over the past year. This figure seems especially high if we recall that 91% of respondents to the 2023 Observatoire Cetelem Barometer also answered “yes” to this question. Furthermore, 59% of Europeans believe that prices have risen “significantly” (Fig. 7a). On this point, local situations vary somewhat. While 81% of Portuguese and 70% of Romanians believe that prices have “risen significantly”, the proportion is only 55% in France and 56% in Germany (Fig. 7b).

All in all, over the last 2 years, i.e., between November 2021 and November 2023, the cost of living has shot up 14.5% in Europe, an increase not fully offset by wage increases. Of course, this makes a noticeable difference to the daily lives of Europeans. In line with the annual inflation rate, this perceived pressure appears to be decreasing overall: the proportion who answered “increased significantly” is down 10 points, while “increased somewhat” is up 7 points. This is particularly true in Poland and Belgium, where the share of respondents who answered “increased significantly” fell by 27 points and 22 points respectively.

PURCHASING POWER REMAINS UNDER PRESSURE DESPITE A SLIGHT IMPROVEMENT

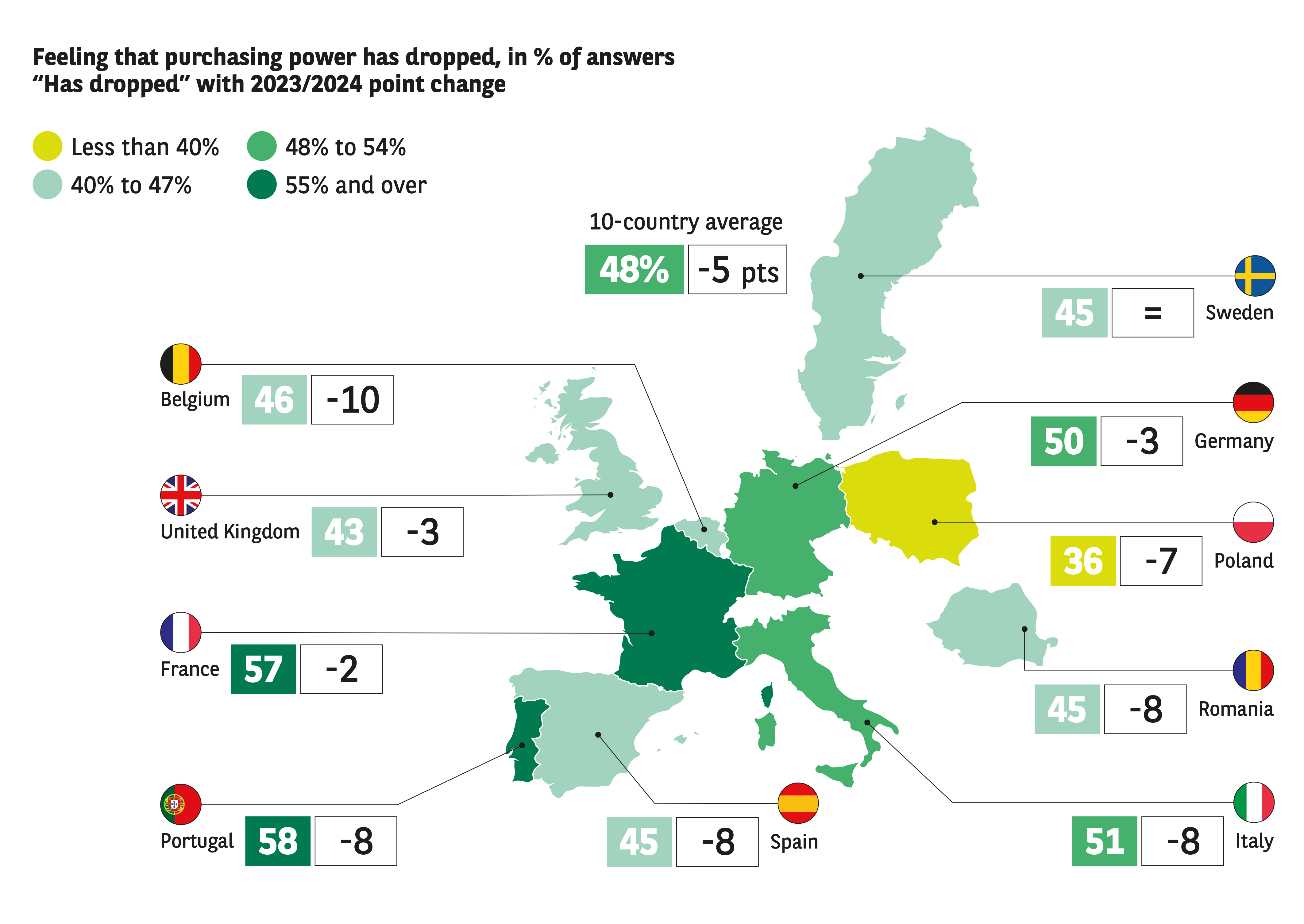

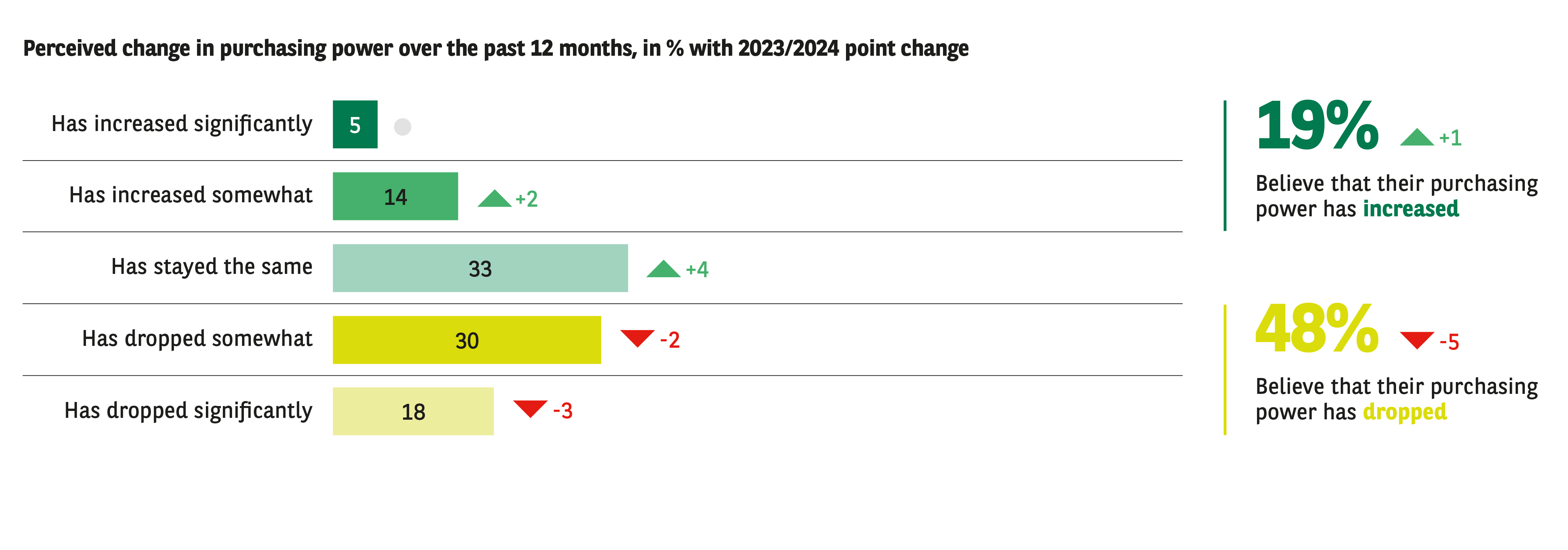

As a result of their perception that prices are rising, almost half (48%) of Europeans feel that their purchasing power has fallen over the past year, while a third feel that it has not improved (Fig. 8a). The sense that purchasing power has declined is at its greatest in Portugal. 58% of the country’s inhabitants bemoan this trend, which is in line with the perception that the cost of living has risen significantly. France comes a close second with 57%. It is worth noting that in the 2023 Observatoire Cetelem Barometer, these two countries were already home to the highest proportions of individuals who answered “my purchasing power has fallen over the last 12 months”.

Nonetheless, the pressure on purchasing power seems to be easing in comparison with last year, as reflected by a 5-point drop in the sense that it has fallen. Indeed, last year 53% of Europeans felt that their purchasing power had declined over the previous 12 months. This relative pressure reduction can be witnessed in all ten countries surveyed, not least in Belgium (-10 points on “% dropped”) (Fig. 8b).

If we extend the period of analysis, the findings are even more striking. In 2019, only 23% of Germans felt that their purchasing power had fallen. The figure was 23% in Sweden and 27% in the UK. This trio helped to bring the European average down to 34%. France, for its part, stood out from the rest with a figure of 59% (at a time when the “yellow vests” crisis was raging)! Five years on, the Observatoire Cetelem Barometer reports scores of 50% for Germany, 45% for Sweden and 43% for the UK, i.e., increases of 27, 19 and 16 points respectively. Here again, it is clear that the scores of the different European countries are converging.

Fig. 7a / Barometer

Download this infographic for your presentations

Fig. 7b / Barometer

Download this infographic for your presentations

Fig. 8a / Barometer

Download this infographic for your presentations

Fig. 8b / Barometer

Download this infographic for your presentations