2009, The death kneel sounds

Sales collapse

This was an economic and financial crisis first and foremost. The budget required to run a car was finally becoming too much to bear, as oil prices reached a peak. And when the subprime crisis exploded in 2008, many supposed sages announced nothing less than the automobile’s imminent demise.

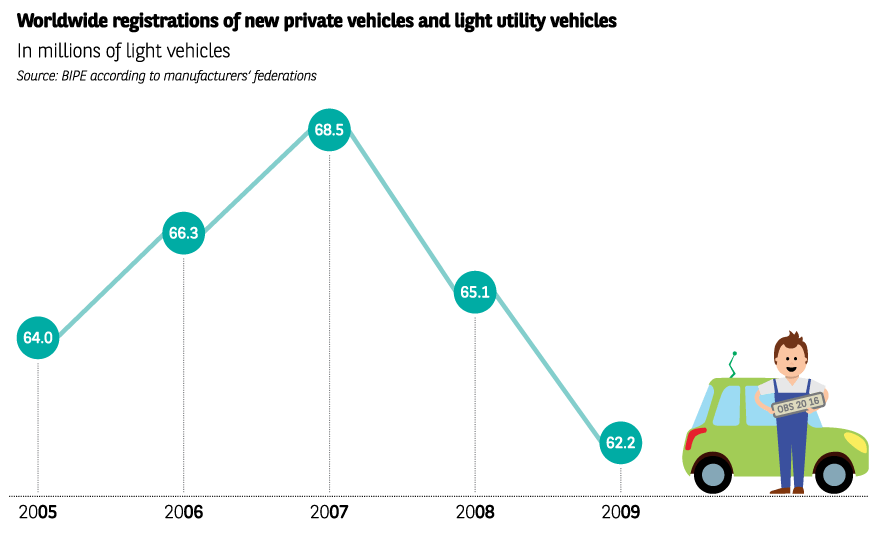

In the United States, sales plummeted to their lowest point in 30 years. Having reached a figure of 16 million light vehicles per year during the previous decade, they collapsed to just 10 million in 2009. It was not long before this climate of gloom hit Europe. The global market fell by 10% in two years.

Bankruptcy here we come

On 30 April 2009, Chrysler was declared bankrupt. One month later, having posted losses of $100 billion in four years, General Motors suffered the same fate. The Detroit company declared debts totalling $172.8 billion, while the value of its assets dropped to $82.3 billion. This was the biggest bankruptcy case in the history of the American industrial sector. Having been the largest company in the world for three-quarters of a century, GM ultimately owed its survival to «nationalisation». The US government injected more than $50 billion into the company, taking a 61% stake in its capital. The Canadian government acquired a 12% stake, the employee pension fund 17% and the firm’s most long-standing creditors 10%. GM provisionally became a state-owned company. A great irony for the land of free enterprise. A third of its 47 industrial sites and concessions were shut down, half of its workforce was made redundant and just four of its thirteen brands remained part of the group.