Loyal customer profiles

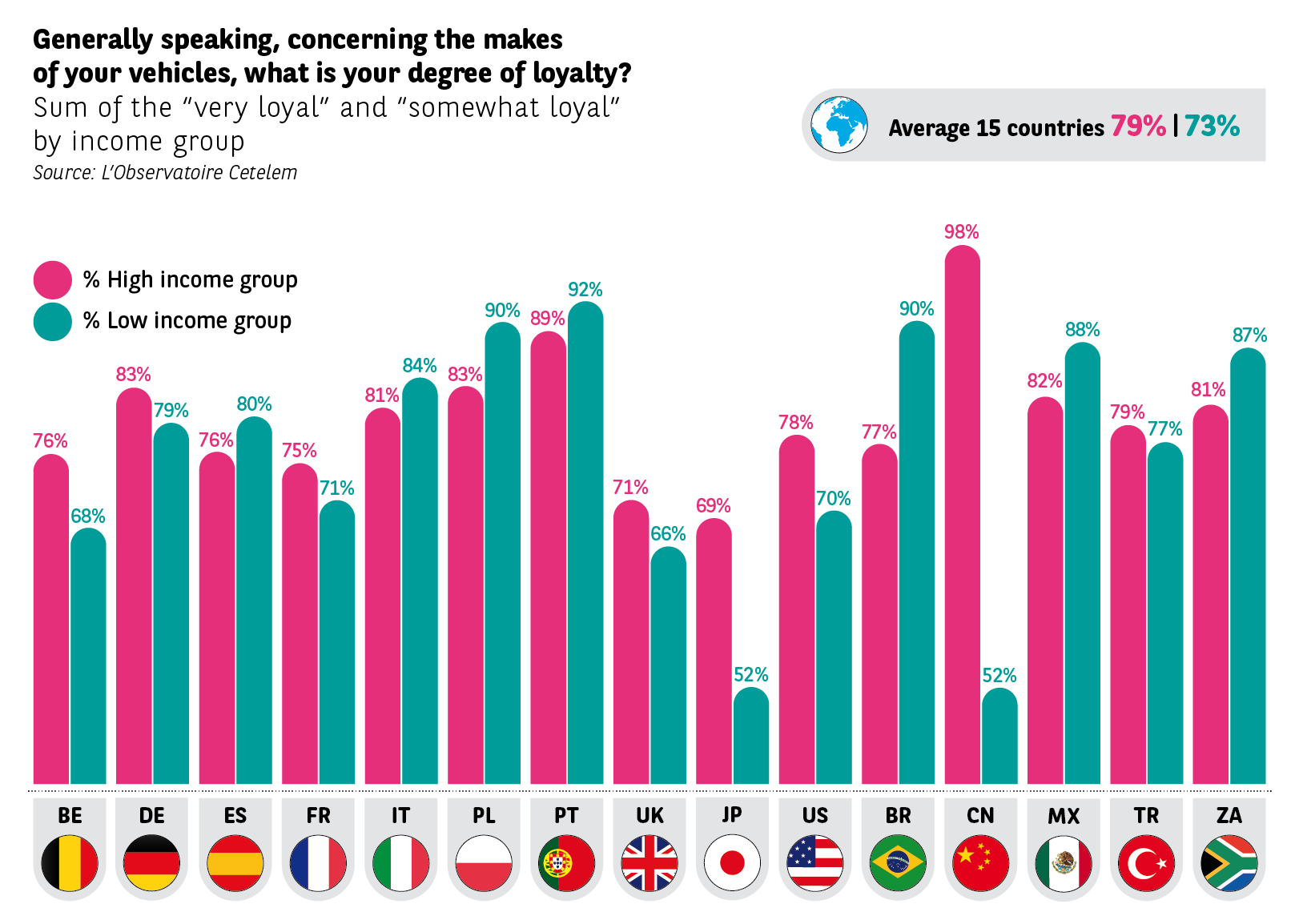

The income factor

Geographically speaking, we find them in low-income countries, or in countries that have been through deep financial crises: Mexico, Brazil, South Africa, Italy, Spain, and Portugal. In these countries, people with the lowest incomes say that they are more loyal to makes of car. This is astonishing since these customers tend to frequent the second-hand market, which creates significantly less loyalty.

If you take into account all the countries in the survey, it’s the higher income bracket that shows a higher level of stability.

Chinese and Japanese households are much more loyal the higher their income (China: 98% vs. 52%; Japan 69% vs. 52%). This behaviour, in these two leading automobile manufacturing countries, can be explained by a clear preponderance for the new car market, notoriously more loyalty-oriented.

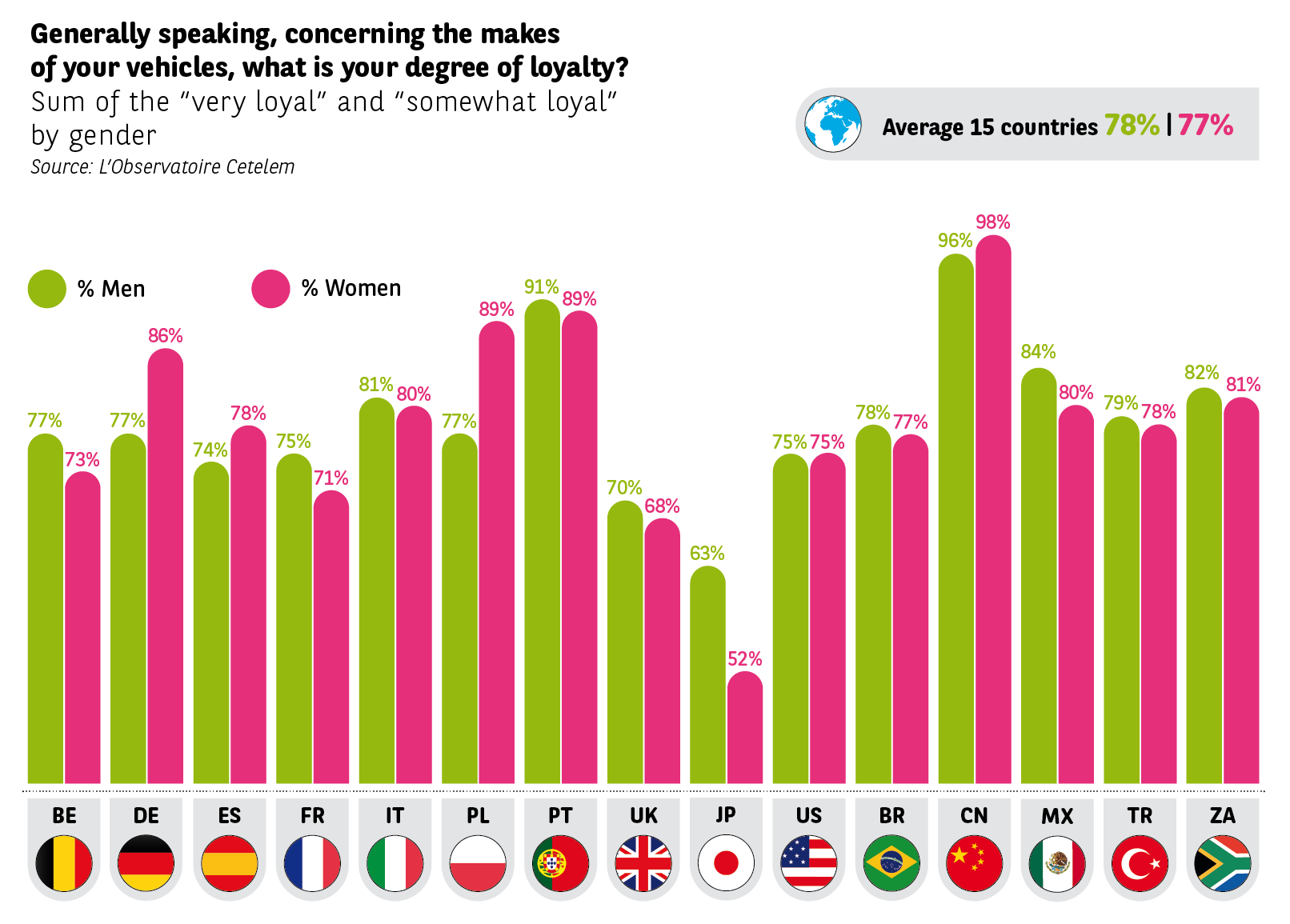

Equality of the sexes

Regarding loyalty, men and women have the same perspective by nearly 78%. Polish women (89%) and German women (86%) show up as significantly more loyal than their male counterparts (77% in both cases). A Japanese man on the other hand will consider himself more loyal than his female counterpart (63% vs. 52%).

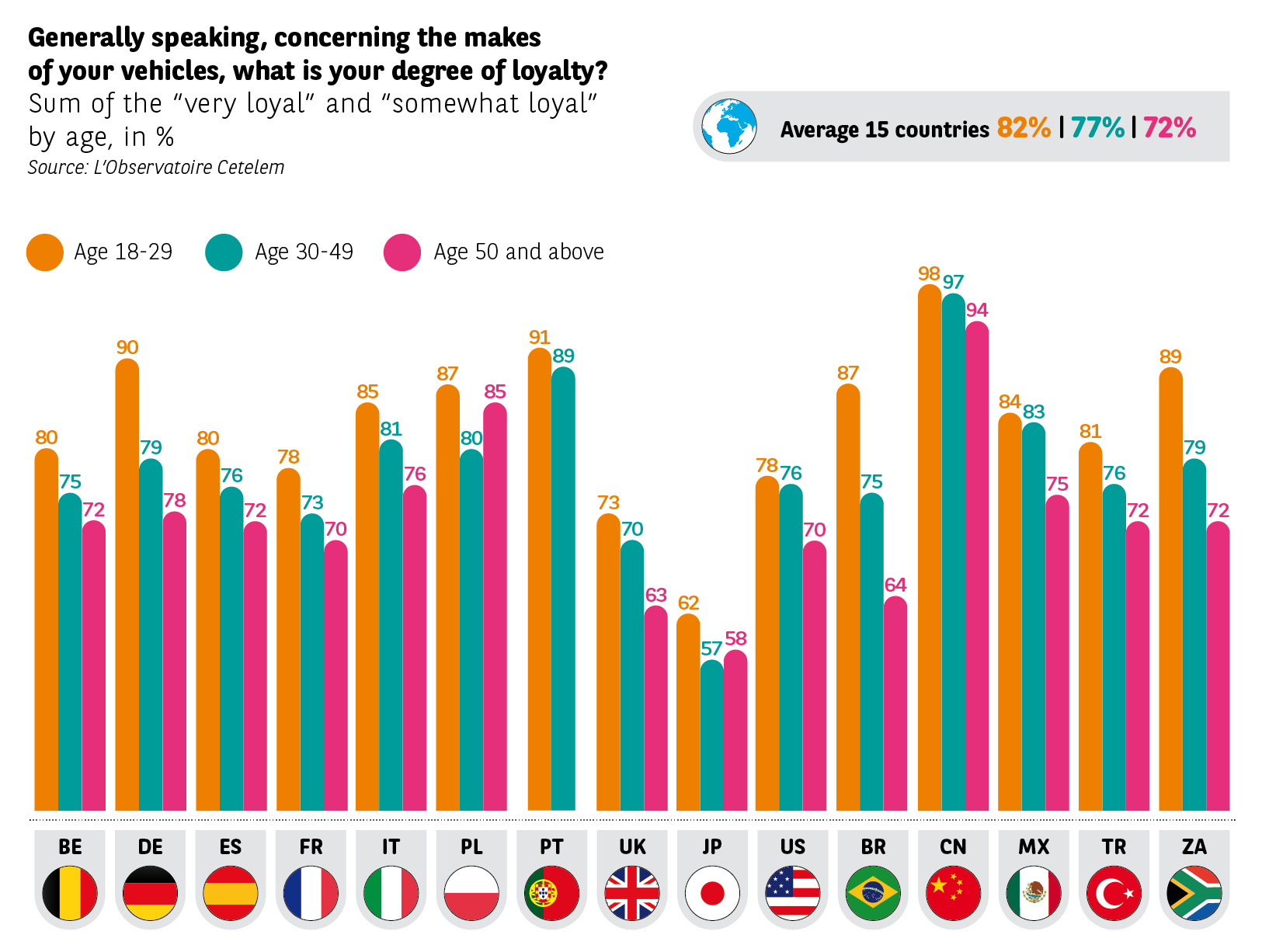

A steady youth

Loyalty does not wait for maturity in years. The younger people are, the more they see themselves as loyal. A surprising result when you consider that first-time buyers are more inclined to try out the second-hand market, which is much less implicated by loyalty. And inconsistent with the previous observation which holds that future generation will be inveterately fickle.

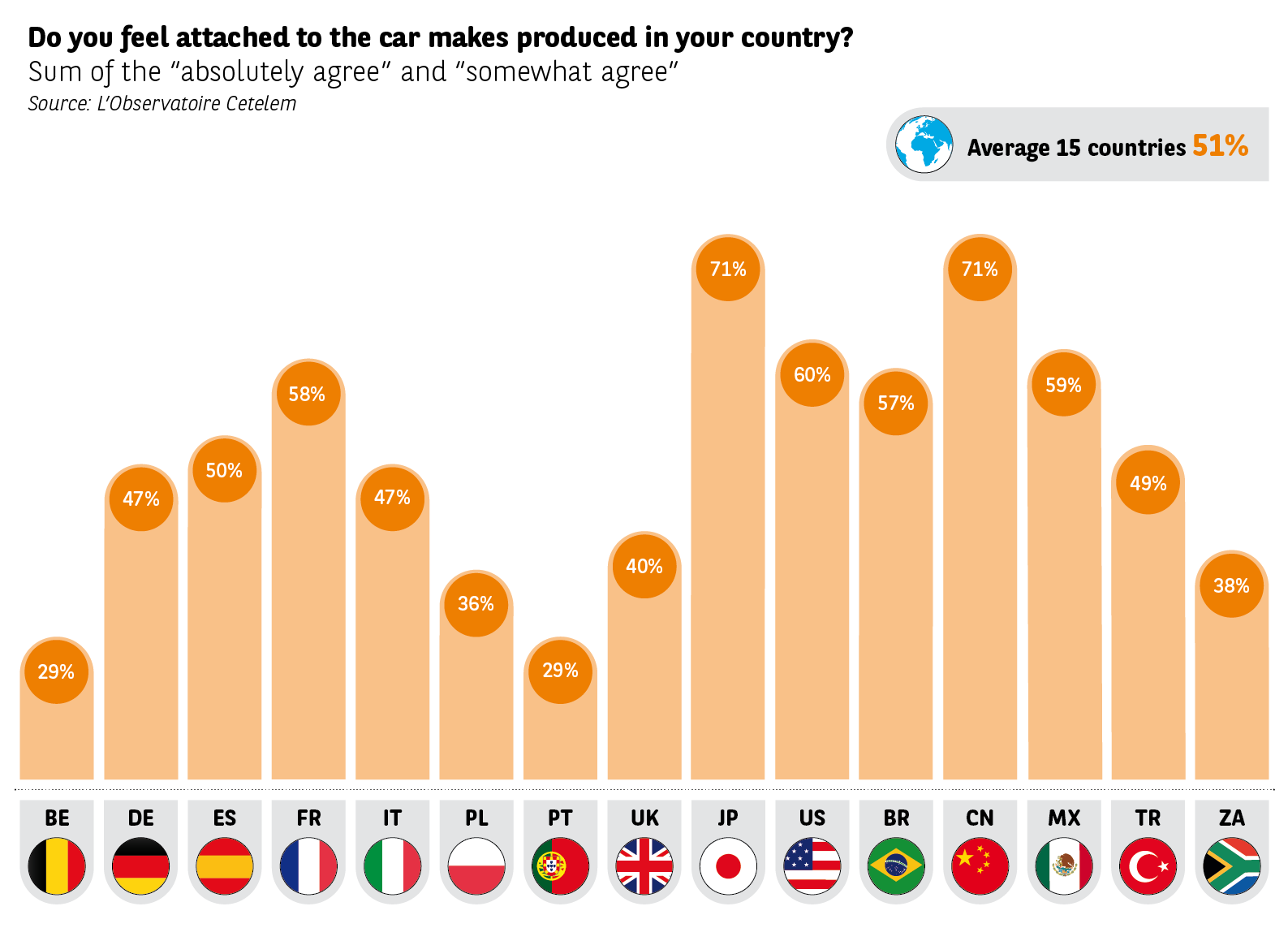

A rather neutral national marker

Localism is a long outdated concept, the entire planet now being the playing field for international car manufacturers. Despite the excesses of globalisation, 1 out of 2 motorists state that they are not particularly attached either to car makes from their own country, nor to the principle of local manufacture. In Belgium and in Portugal, where there are no local makes and few assembly lines, only and logically 29% feel concerned about this issue. Respondents in Japan, China, USA and France, automotive strongholds where temptations and protectionist messages are abundant, are the most concerned about the future of their factories (respectively 71%, 71%, 60% and 58%). Surprisingly, other historically high seats of the automotive industry, like Germany, Italy, United Kingdom and Spain, seem less concerned about their makes and local factories. Brexit or no Brexit, the British are a mere 40% concerned about local production.

New methods of acquisition and usage are no more decisive

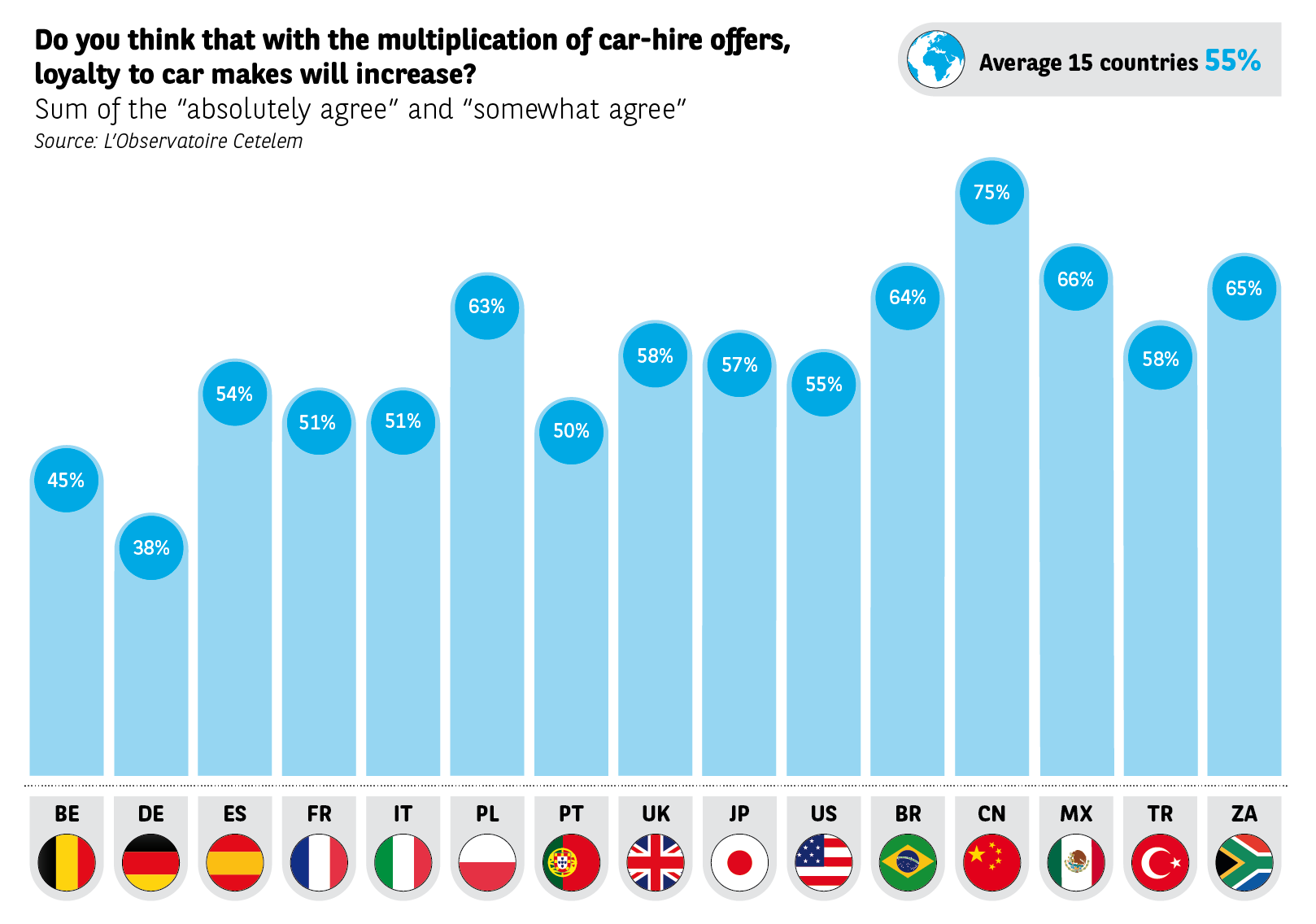

If you believe what respondents say, full entry of the automobile into the service era should not profoundly affect loyalty. Although leasing and long or medium-term car hire offers with or without a purchase obligation, something Anglo-Saxons have been doing for a long time now, is encountering increasing success, people don’t think it will necessarily have a radical impact on motorists’ loyalty. Indeed, 55% think these offers will increase loyalty, and the Chinese and Polish are still the most affirmative on this score (75% et 63 %).

Having said this, in France, loyalty in the context of car hire offers with a purchase option was measured at 90%, generating an increase in the rate of car make loyalty by 30 points!

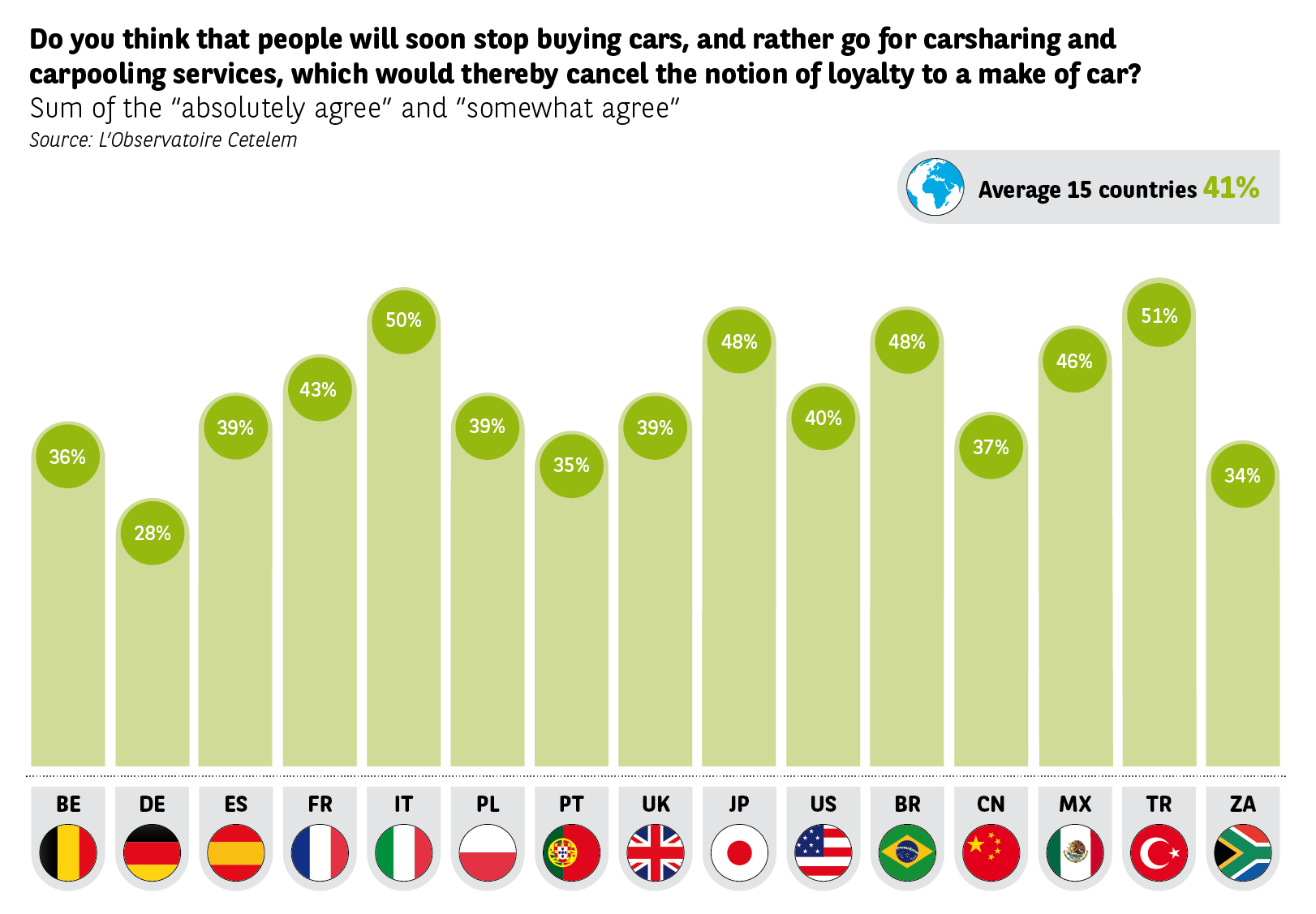

More globally, motorists no longer believe that the generalization of services, like one-off car hire, carsharing or carpooling, will cause disloyalty. Only 4 out of 10 consider that it will incite people to be less loyal. Only Turkey shows a slight majority in this sense (51%). It is in Germany that people consider that nothing will change (28%), France classing itself in the average (43%).