Saving intentions are up

THE DESIRE TO SAVE IS BEING REKINDLED

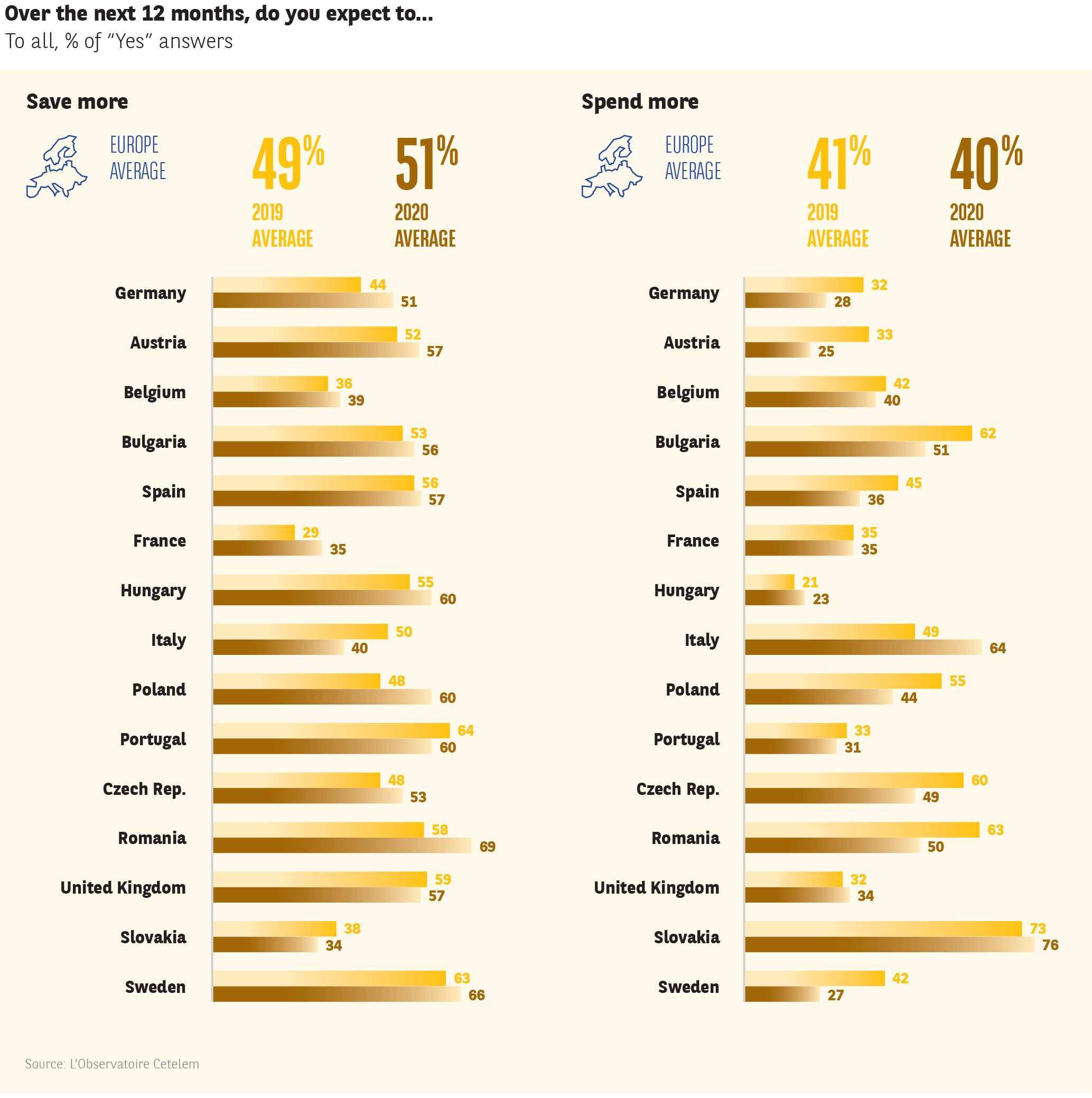

This increase in purchasing power could prompt Europeans to save more in 2020. Thus, saving intentions have risen, while spending intentions are down (Fig. 3). Admittedly the figures have changed only slightly: +2 points in the case of the former, -1 point in the case of the latter. More significantly, saving intentions are up in 11 of the 15 countries covered by L’Observatoire Cetelem de la Consommation , with dramatic increases on display in Poland and Romania, but also in Germany and France (+12, +11, +7 and +6). Swimming against the tide, Italy posts a 10-point fall in saving intentions.

FIG. 3 :

SPENDING INTENTIONS FALL SLIGHTLY

When it comes to the intention to spend more, more or less the same 11 countries appear more prudent. Slovakia aside, all the Eastern European countries are pulling the handbrake on spending, as are Spain and, more strikingly, Sweden (-15 points). Once again, Italy stands out from the rest of Europe by displaying a very strong desire to spend (+15 points).

This is likely due to the budgetary measures put in place by the Italian government.

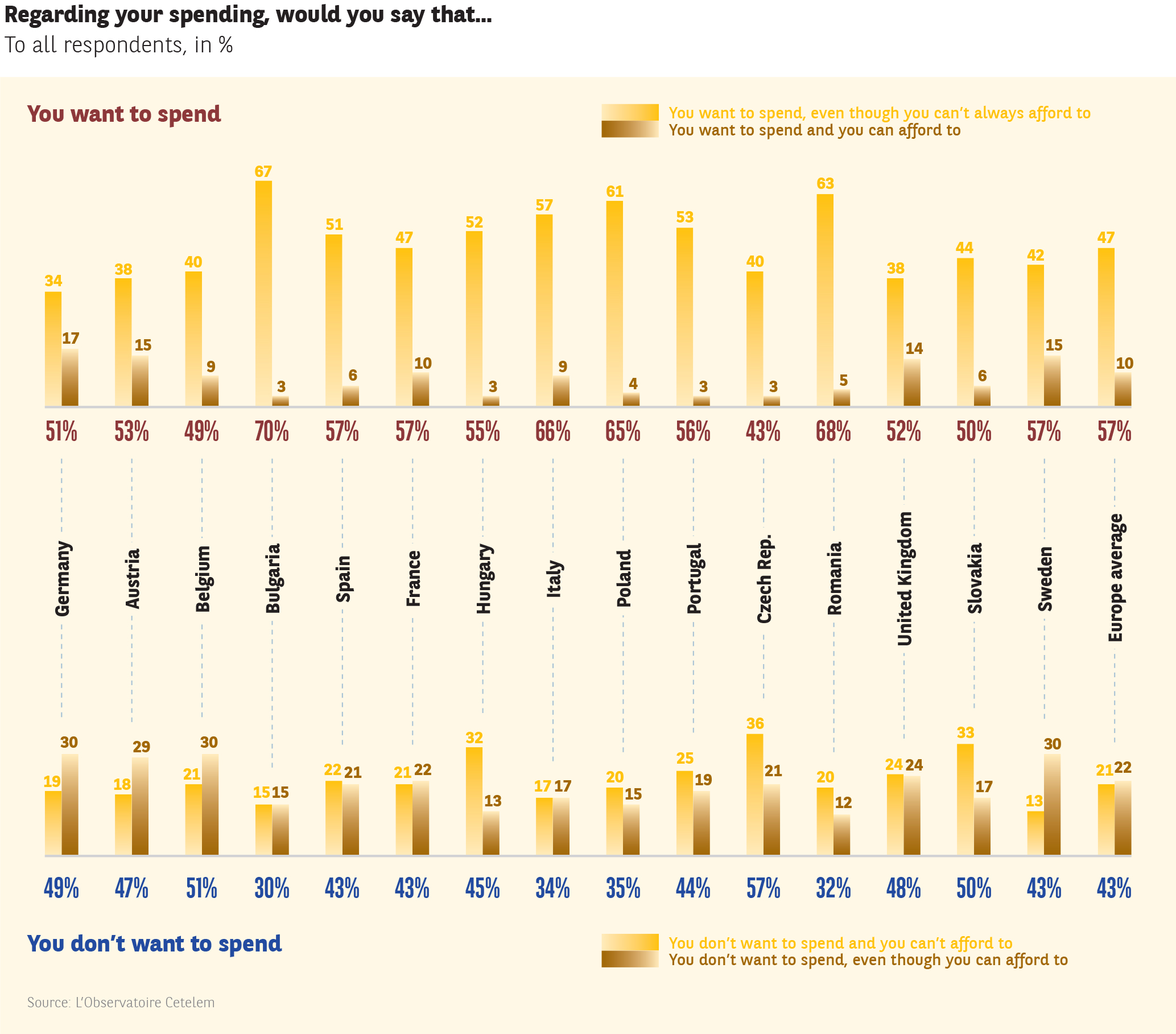

WANT TO CONSUME MORE? 57% OF EUROPEANS SAY YES.

The majority of Europeans say they are keen to consume (57%), but admit that they cannot always afford to (21%) (Fig. 4). Once again, it is mainly in the Eastern European countries that this financial frustration is most strongly felt. Conversely, Austria, Germany and Sweden exhibit a high capacity to consume. Meanwhile, France falls squarely within the European average.

FIG. 4 :

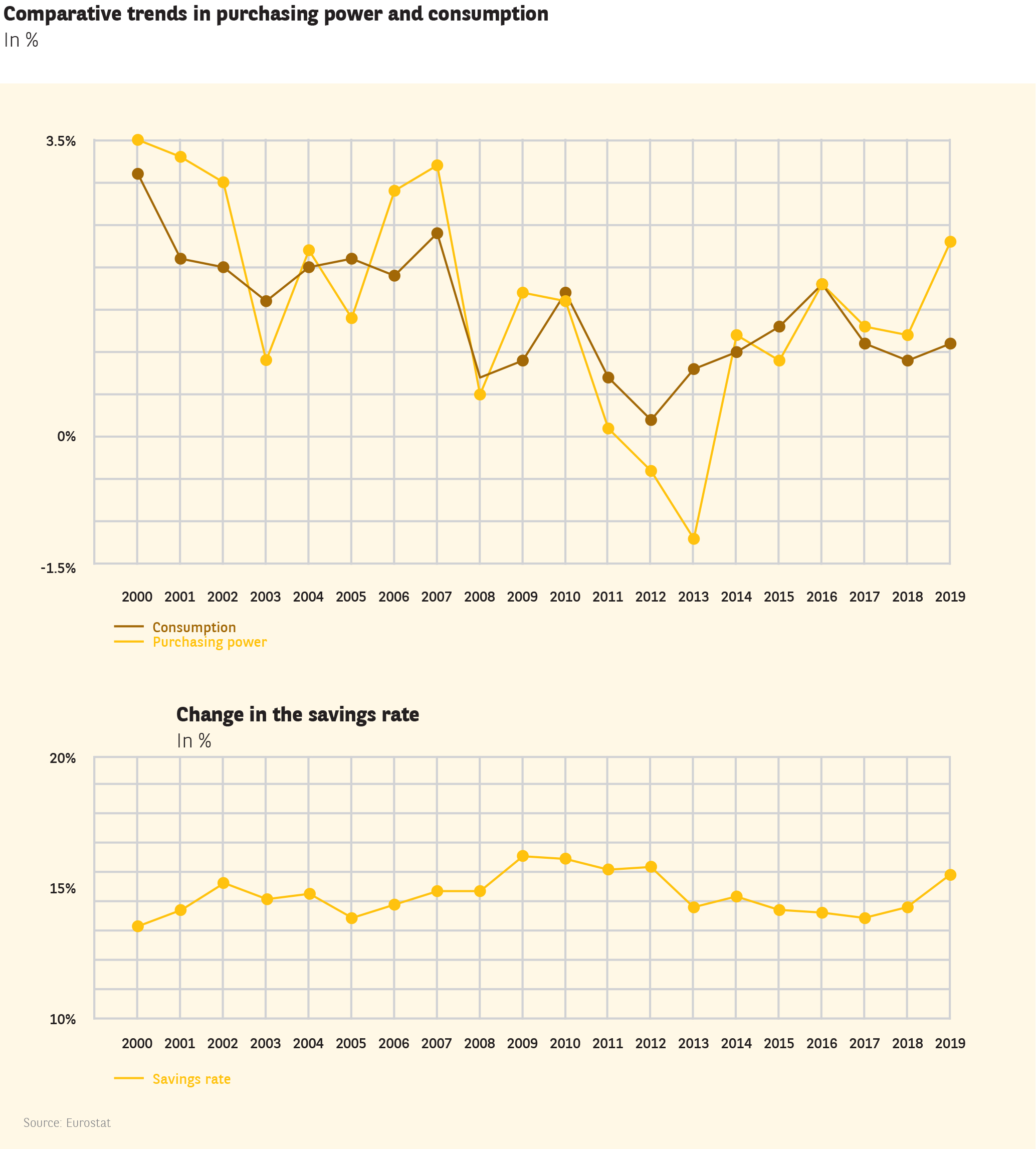

Consumption is holding up well

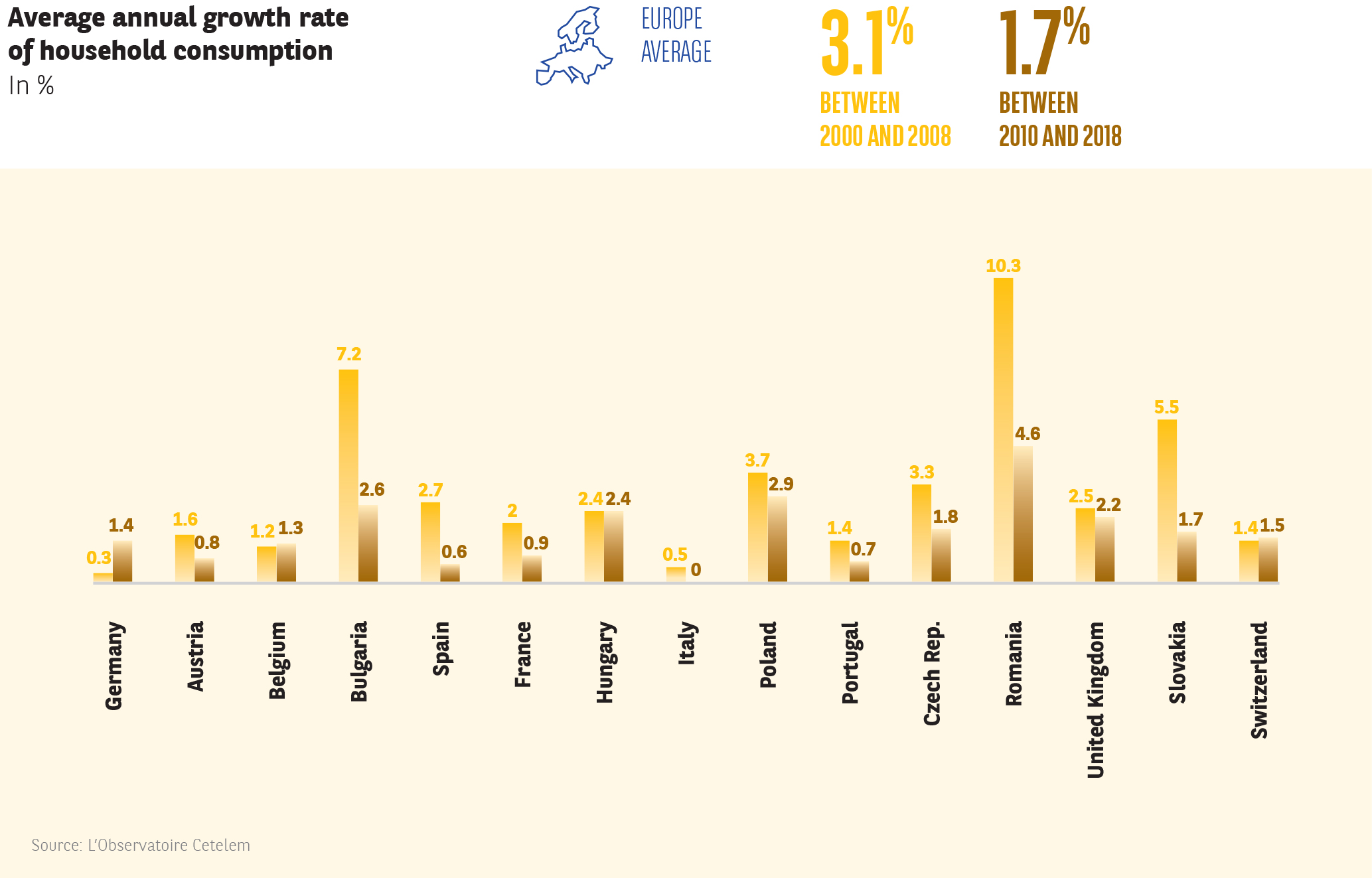

The last 20 years have been marked by continuous growth in household consumption, particularly in Eastern European countries, but there was a sudden slowdown after the 2008 financial crisis (Fig. 5).

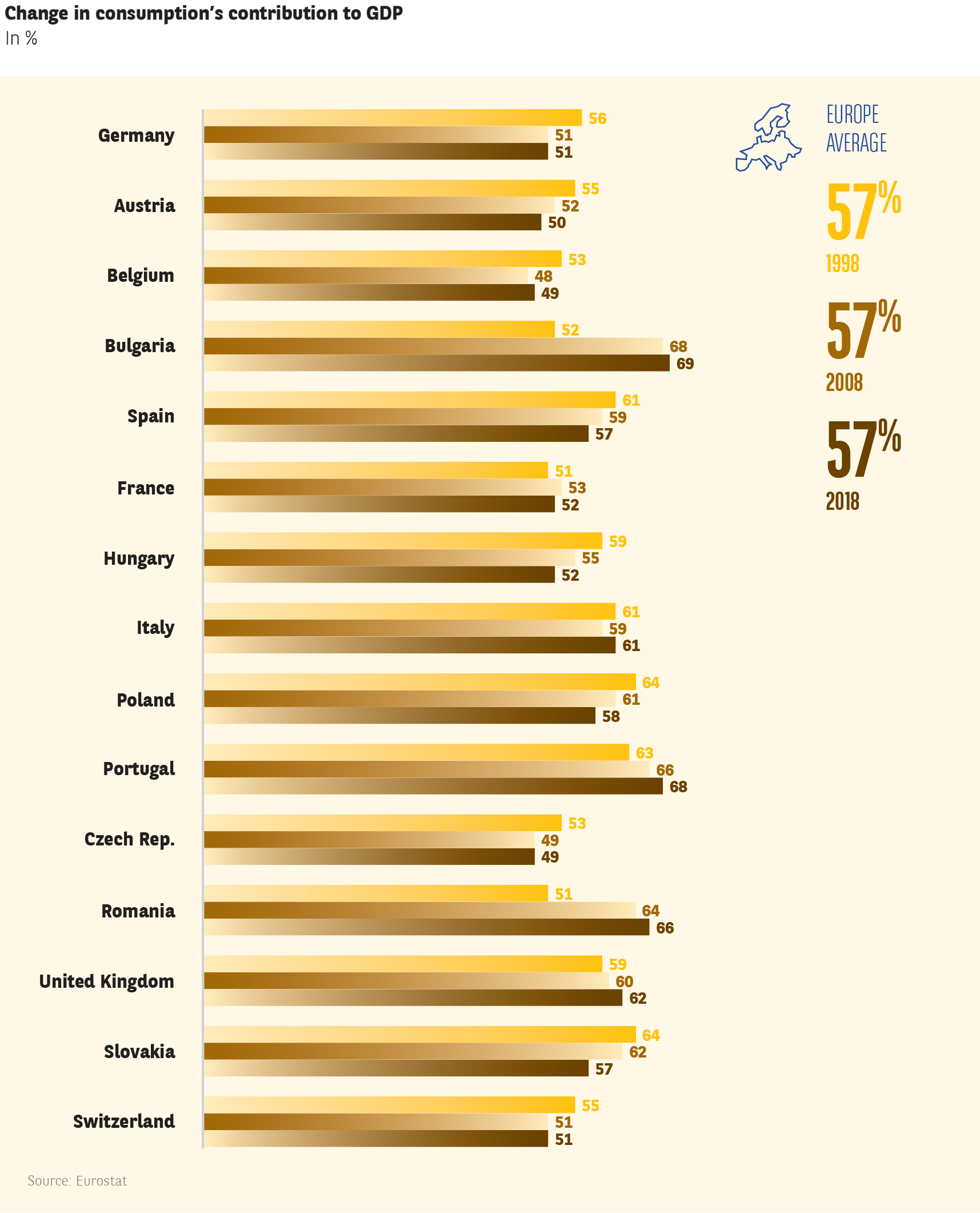

In all countries, and for some time now, consumption has accounted for the bulk of national GDPs and its growth has been the main driver of economic prosperity (Fig. 6).

The fact that it is running out of steam, or even declining in some cases, therefore raises questions about the very structure of economies. Less consumption means less growth, less tax revenue and a higher debt burden. That’s unless new sources of growth can be found through innovation.

Or through “green growth”, as promoted by Ursula von der Leyen, President of the European Commission, who presented an ambitious growth plan in this area in December 2019.

FIG. 5 :

FIG. 6 :

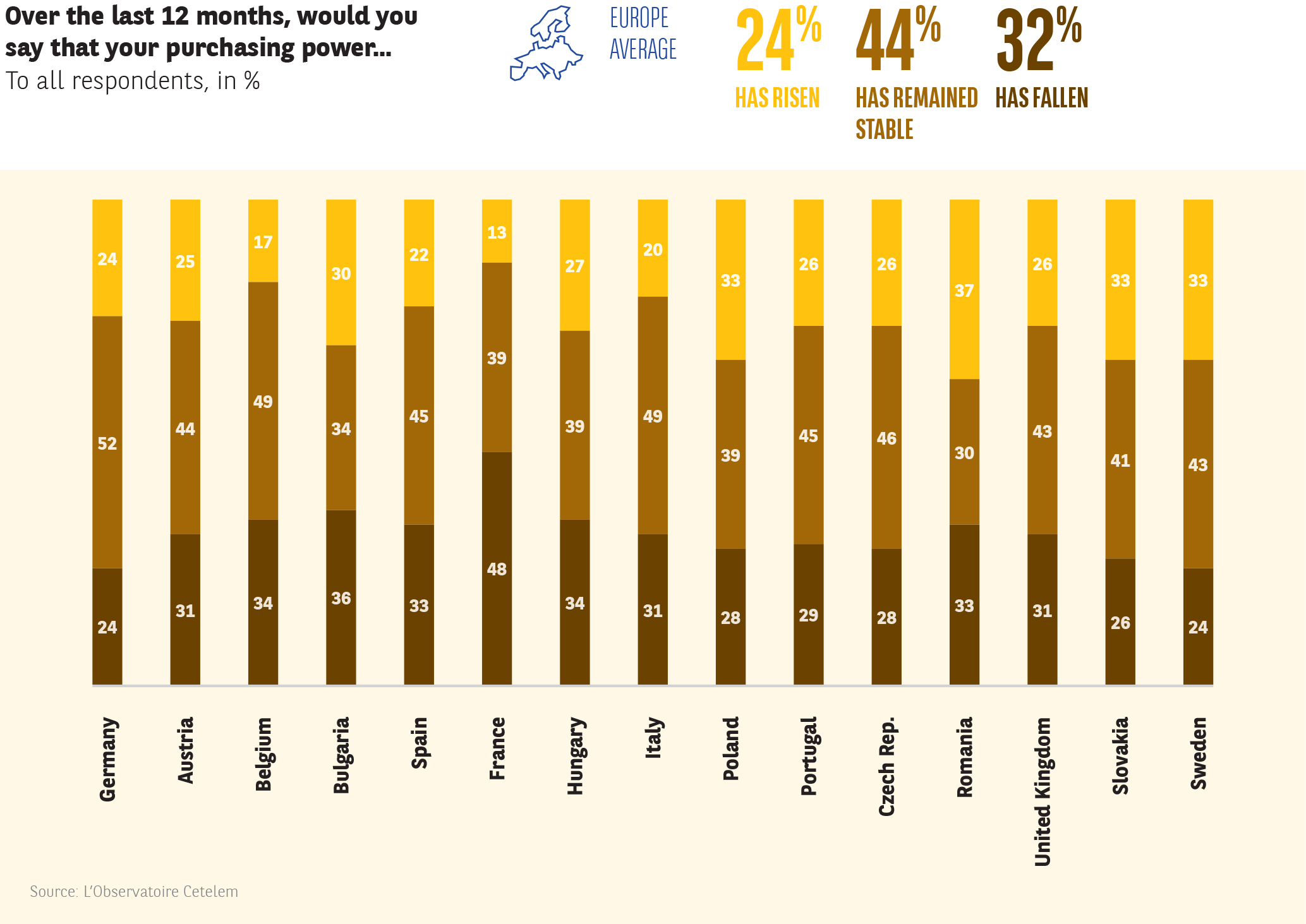

PURCHASING POWER: DEAD CALM

Naturally, this feeling of not being able to afford to consume reflects an overall level of purchasing power that appears stagnant (Fig. 7). Indeed, 44% of Europeans believe nothing has changed in this regard. in 9 out of the 15 countries, the proportion of respondents who state that their purchasing power has increased is up from last year. the most significant upward trends can be observed in Poland, France, Italy and the United Kingdom. It should also be noted that seniors are significantly more likely than average to feel that their purchasing power is declining.

FIG. 7 :

Purchasing and saving power: the French paradox

In France, purchasing power increased faster in 2019 than in any year since 2007. Yet, this was not enough to boost consumption. Conversely, in spite of low interest rates, savings are on the rise. This is evidence that feelings matter as much, if not more, than actual economic data (Fig. 8).

FIG. 8 :

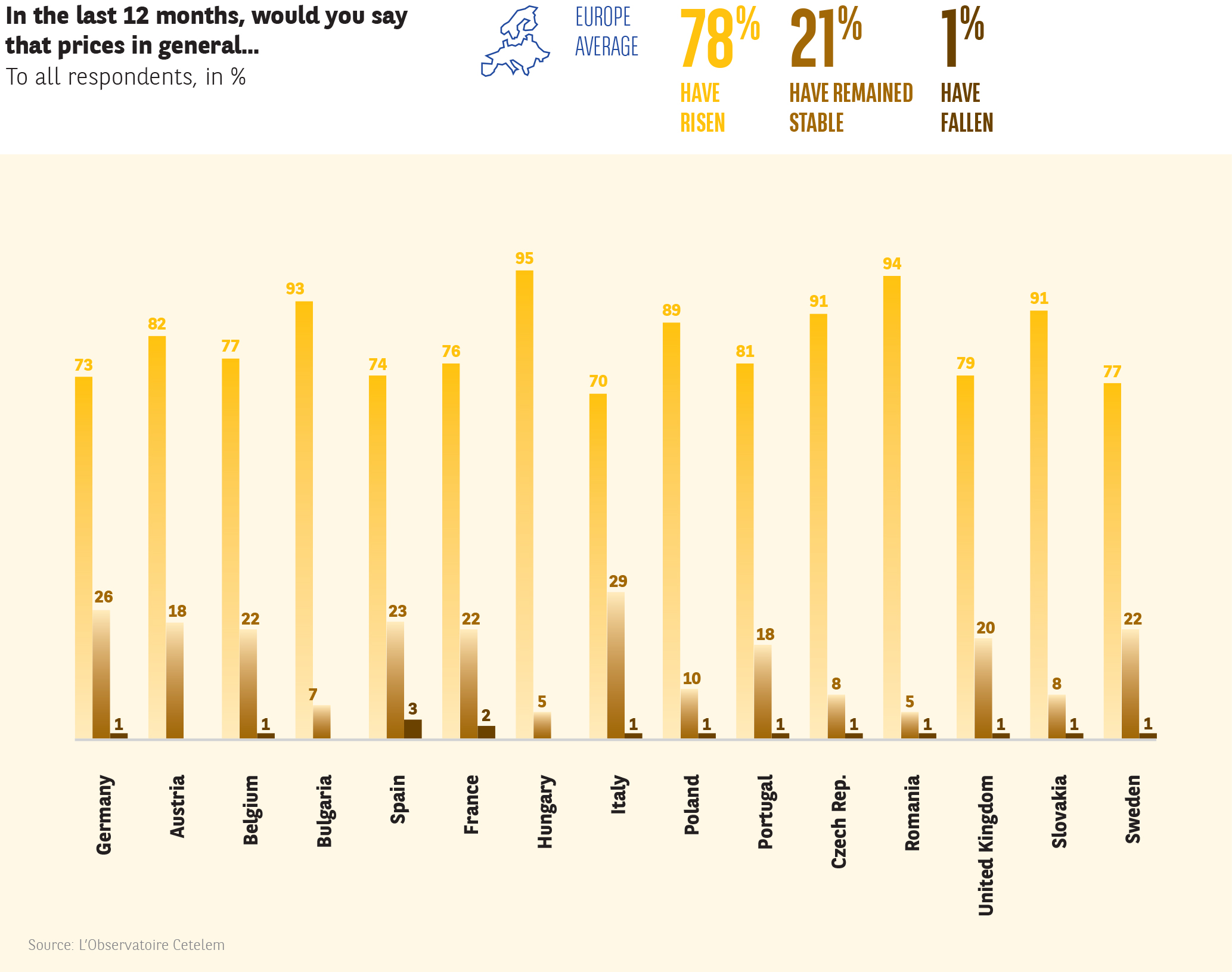

PRICES CONTINUE TO CLIMB

Purchasing power is stable, therefore, but there is a feeling that prices are increasing, reinforcing the sense within households that the somewhat gloomy economic climate continues to affect them (Fig. 9). 78% of Europeans believe prices have risen. Although the average figure is three points lower than in 2019, this feeling can be observed in a slim majority of countries, France and Spain in particular (-7 points). Seniors are more likely to state that prices have increased than young people.

FIG. 9 :

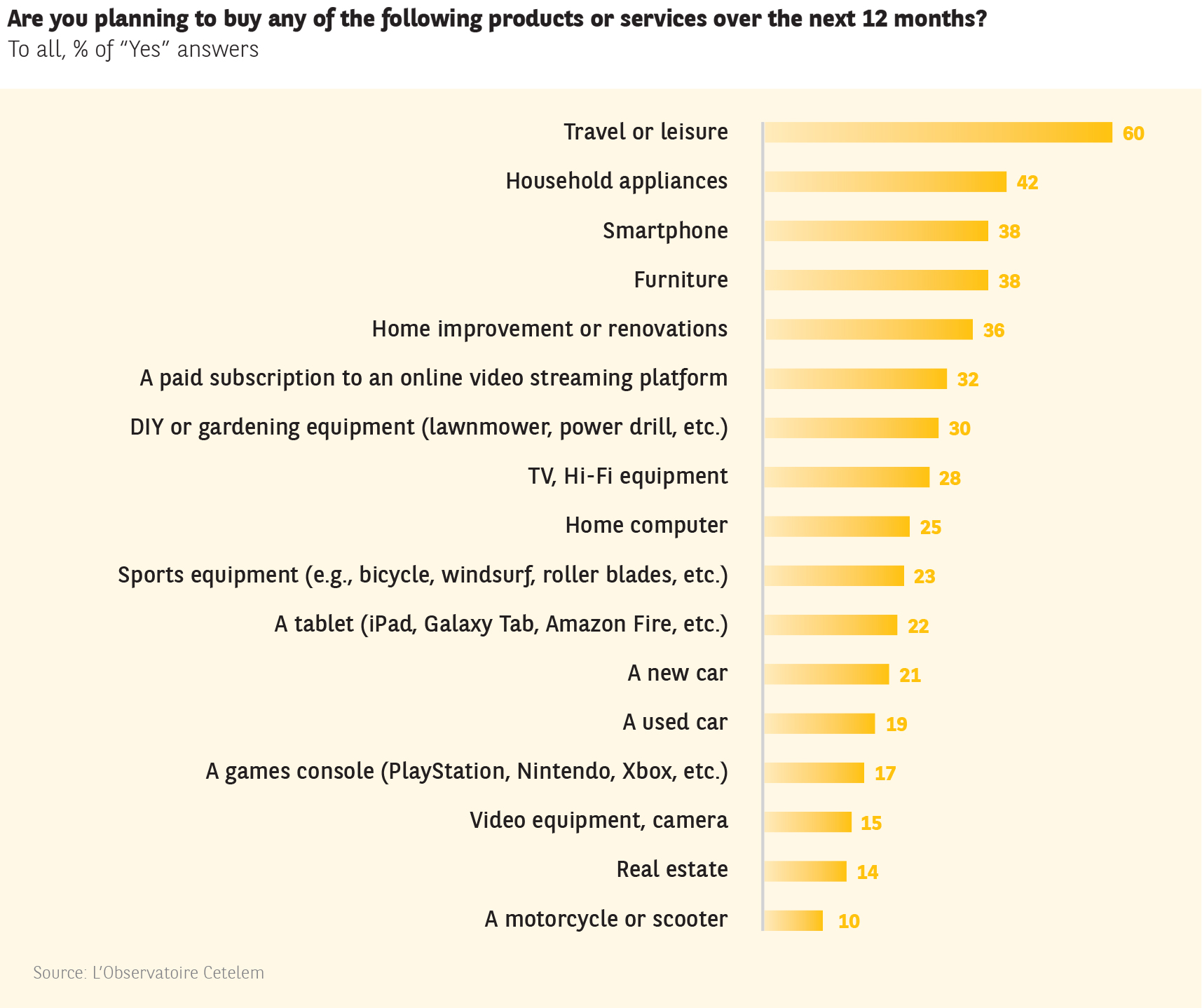

THE MOST POPULAR SPENDING CATEGORIES REMAIN UNCHANGED

However, this economic pressure has not affected the ranking of purchasing intentions by sector over the next 12 months (Fig. 10). Most scores are either stable or up slightly, with the exception of household electrical appliances, which are ranked in second place.

Travel and leisure are still the number one among Europeans. And like last year, subscriptions to streaming or VOD services are the fastest growing category (+4 points).

FIG. 10 :