… By staying faithful to its cut-price DNA

New low-cost concepts are emerging with a key focus on price

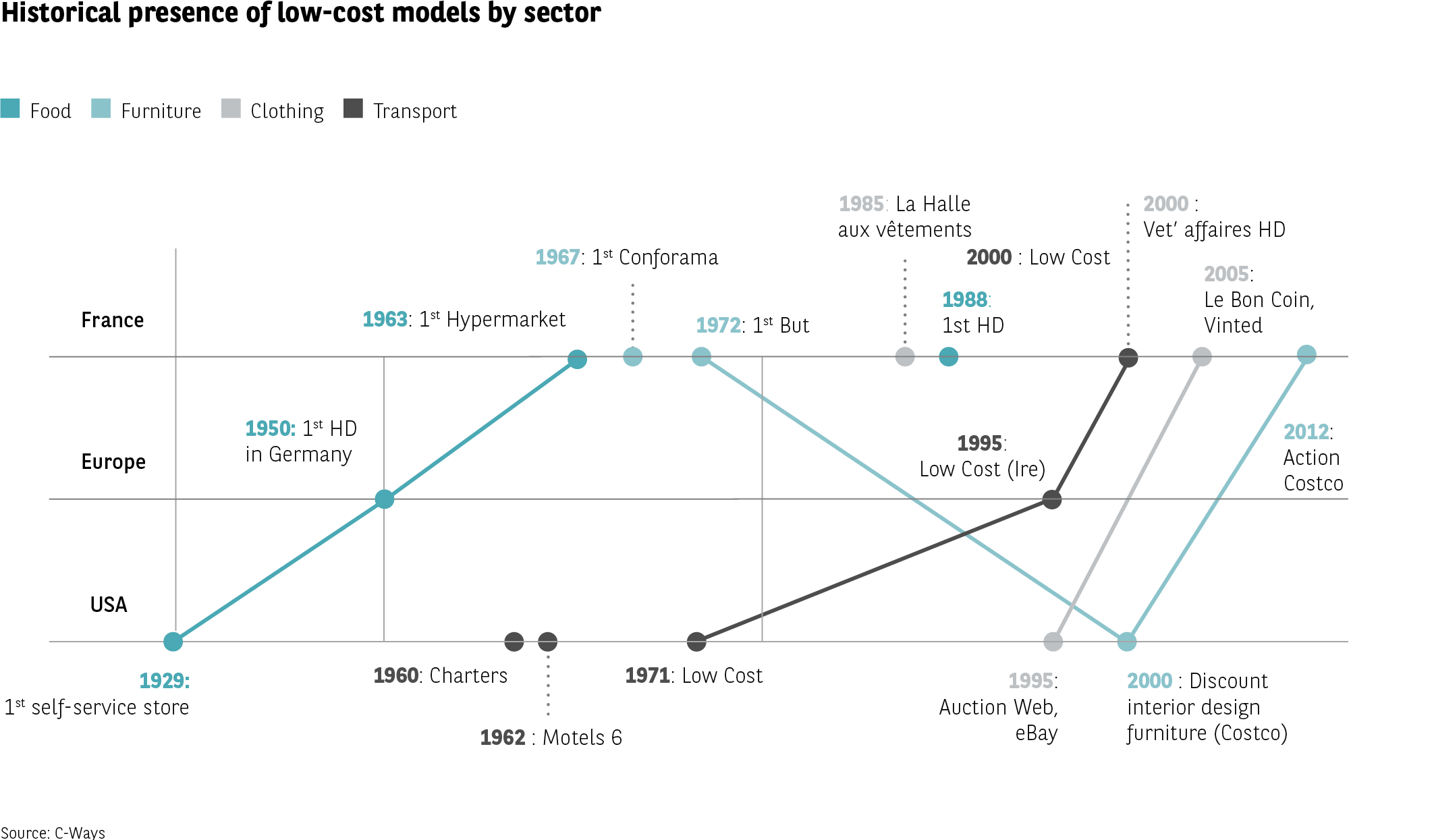

As we have seen, the low-cost model is an innovative consumer concept geared towards significantly lowering prices in order to gain market share. Historically, this has been a fundamental aspect of the model, regardless of the terms one might associate with the concept. In all the countries and all the sectors in which it has been implemented, price cutting has always been central, almost to the point of obsession. This is as true today as it was in the United States in 1929, when the first self-service store was opened during another major economic crisis. It was also the goal of brothers Theo and Albert Albrecht in 1950 when they opened the first hard-discount store, Aldi (a contraction of Albrecht and Diskont), just as Germany was beginning to recover from the Second World War. Cut-price fares are also the credo of charter airlines, which first emerged in the 1960s and reached their apotheosis in 1985 with the launch of Ryanair, the brand that truly heralded the dawn of low-cost air travel. And as time has gone by, companies entering new sectors have continued to aim for the lowest prices, making this the keystone of their business (Fig. 34).

Fig 34 – Historical evolution of low-cost models

Download this infographic for your presentations The infographic presents, in the form of a chronological timeline, the main stages of the emergence of low-cost models in four sectors: food, furniture, clothing, and transportation.

The events are divided into three zones: France, Europe, and the United States.

The legend indicates: Food Furniture Clothing Transportation

Data transcribed in chronological order:

United States

1929 – First self-service store

1960 – Charters (transportation)

1962 – Motels 6 (low-cost accommodation associated with transportation)

1971 – Low-cost (air transportation)

2000 – Discount furniture decoration (Costco)

Europe

1950 – First hard discount in Germany (food)

1995 – Low-cost (Ireland, air transportation)

1995 – Auction Web / eBay (clothing via online resale)

France

1963 – First hypermarket (food)

1967 – First Conforama (furniture)

1972 – First But (furniture)

1985 – La Halle aux vêtements (clothing)

1988 – First hard discount

2000 – Vet’ affaires HD (clothing)

2005 – Le Bon Coin, Vinted (clothing/resale)

The implementation of low-cost models appears to be progressive and sectoral: first in food and transportation, then in furniture and clothing, with a growing role of online platforms from the 2000s.

Source: C-Ways.

The infographic presents, in the form of a chronological timeline, the main stages of the emergence of low-cost models in four sectors: food, furniture, clothing, and transportation.

The events are divided into three zones: France, Europe, and the United States.

The legend indicates: Food Furniture Clothing Transportation

Data transcribed in chronological order:

United States

1929 – First self-service store

1960 – Charters (transportation)

1962 – Motels 6 (low-cost accommodation associated with transportation)

1971 – Low-cost (air transportation)

2000 – Discount furniture decoration (Costco)

Europe

1950 – First hard discount in Germany (food)

1995 – Low-cost (Ireland, air transportation)

1995 – Auction Web / eBay (clothing via online resale)

France

1963 – First hypermarket (food)

1967 – First Conforama (furniture)

1972 – First But (furniture)

1985 – La Halle aux vêtements (clothing)

1988 – First hard discount

2000 – Vet’ affaires HD (clothing)

2005 – Le Bon Coin, Vinted (clothing/resale)

The implementation of low-cost models appears to be progressive and sectoral: first in food and transportation, then in furniture and clothing, with a growing role of online platforms from the 2000s.

Source: C-Ways.

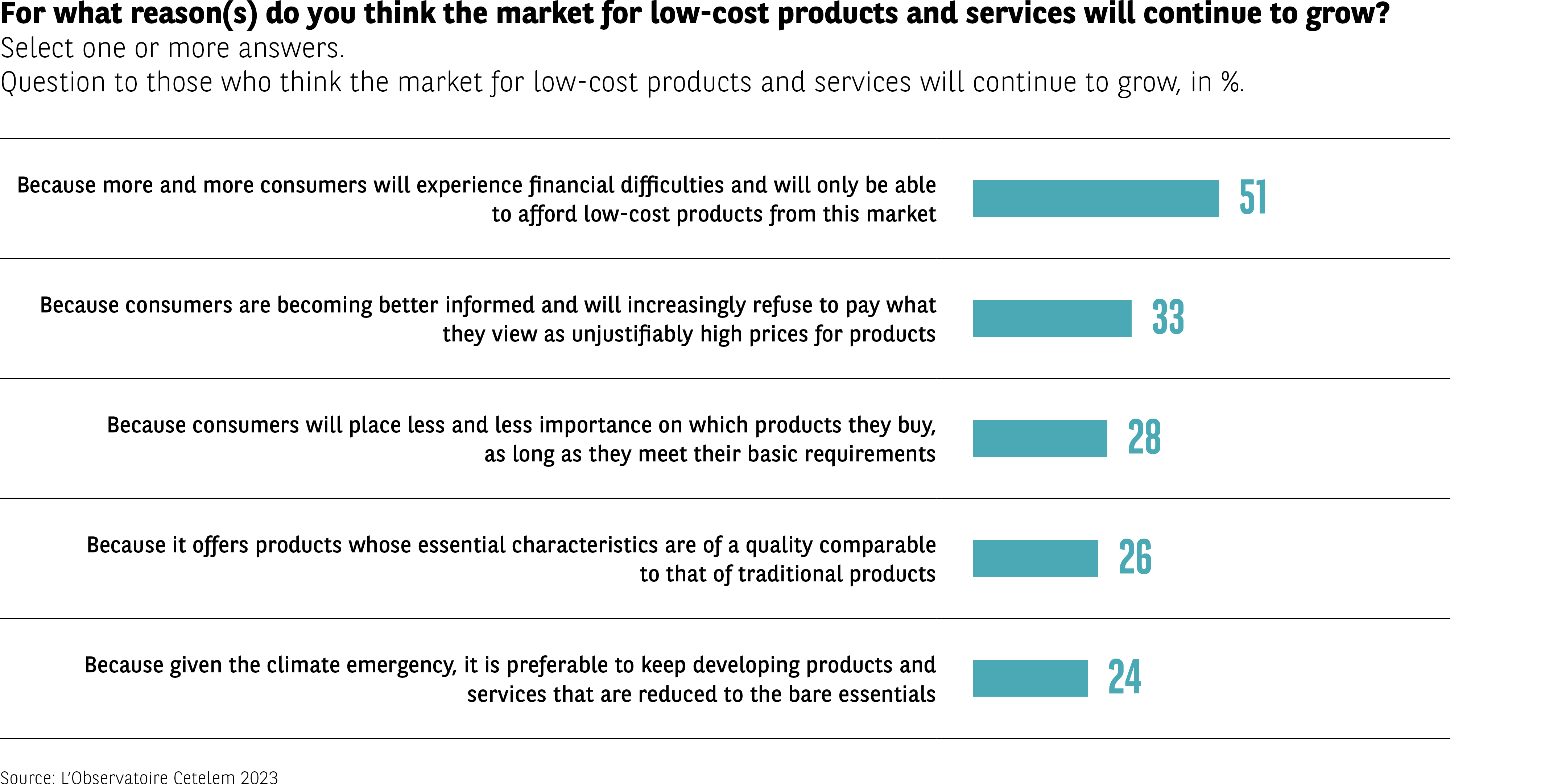

Financial constraints: the model’s main driving force

The creation of low-cost businesses at a time of economic crisis does not appear to be a phenomenon that belongs solely to the past. According to Europeans, economic hardship will continue to fuel the concept’s growth. Of those who expect the market to expand further, 1 in 2 believe this will be due to the rising proportion of consumers who are destined to face financial difficulties. This argument is most likely to be expressed in Hungary, Austria and France, all of which have advanced economies (63%, 60% and 54%, respectively). Looking at the other reasons why respondents expect the low-cost market to grow, consumers being better informed so that they pay a fairer price, the ability of the products purchased to meet basic requirements and the fact that the products offer a similar level of quality to branded products are much less likely to be put forward (33%, 28% and 24%). It is worth noting that the strong relationship between low-cost consumption and economic woes relegates environmental concerns to last place in this ranking. It’s hard to think green when prices make you see red (Fig. 35).

Fig 35 – Anticipated reasons for the growth of the low-cost market

Download this infographic for your presentations Infographic indicating, in %, the reasons mentioned by consumers who believe that the market for low-cost products and services will continue to grow. Multiple responses possible.

Reasons cited (in %):

Increasing financial difficulties of many consumers: 51%

Refusal to pay high prices for products deemed unjustified: 33%

Less importance given to products as long as they meet basic needs: 28%

Low-cost products having essential characteristics with comparable quality: 26%

Environmental need to develop products reduced to the essential: 24%

Main lesson The dominant reason refers to financial concerns, followed by arguments related to quality-price ratio and a change in consumption expectations.

Source: Cetelem Observatory 2023.

Infographic indicating, in %, the reasons mentioned by consumers who believe that the market for low-cost products and services will continue to grow. Multiple responses possible.

Reasons cited (in %):

Increasing financial difficulties of many consumers: 51%

Refusal to pay high prices for products deemed unjustified: 33%

Less importance given to products as long as they meet basic needs: 28%

Low-cost products having essential characteristics with comparable quality: 26%

Environmental need to develop products reduced to the essential: 24%

Main lesson The dominant reason refers to financial concerns, followed by arguments related to quality-price ratio and a change in consumption expectations.

Source: Cetelem Observatory 2023.

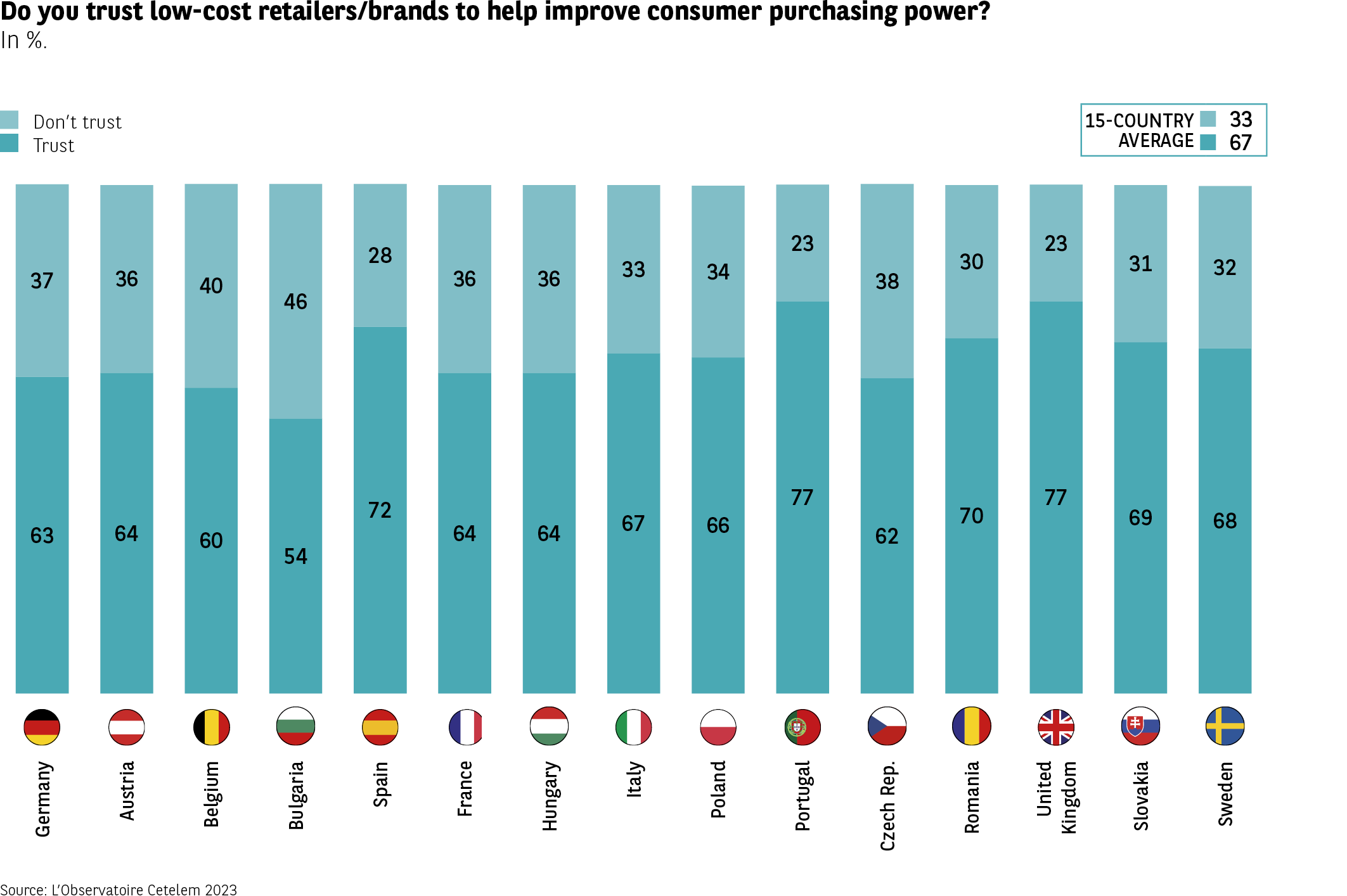

An effective way of preserving purchasing power.

From their perspective as sensible, thoughtful consumers, Europeans also believe that retailers and brands that are focused on cutting prices are best placed to preserve their purchasing power. Almost 7 out of 10 Europeans share this opinion. Along with the British, the inhabitants of both Iberian countries are the most likely to hold this view (77%, 77% and 72%), while the Bulgarians are more sceptical (54%) (Fig. 36).

Fig 36 – Level of trust in low-cost retailers

Download this infographic for your presentations Infographic showing, for 15 countries, the proportion of consumers who declare that they trust or do not trust low-cost retailers and brands to act in favor of purchasing power.

Legend:

No trust

Trust

Average of 15 countries:

No trust: 33%

Trust: 67%

Data by country (No trust / Trust):

Germany: 37 / 63

Austria: 36 / 64

Belgium: 40 / 60

Bulgaria: 46 / 54

Spain: 28 / 72

France: 36 / 64

Hungary: 36 / 64

Italy: 33 / 67

Poland: 34 / 66

Portugal: 23 / 77

Czech Republic: 38 / 62

Romania: 30 / 70

United Kingdom: 23 / 77

Slovakia: 31 / 69

Sweden: 32 / 68

Trust in low-cost retailers is dominant in all countries, with particularly high levels in Portugal, the United Kingdom, and Spain.

Source: Cetelem Observatory 2023.

Infographic showing, for 15 countries, the proportion of consumers who declare that they trust or do not trust low-cost retailers and brands to act in favor of purchasing power.

Legend:

No trust

Trust

Average of 15 countries:

No trust: 33%

Trust: 67%

Data by country (No trust / Trust):

Germany: 37 / 63

Austria: 36 / 64

Belgium: 40 / 60

Bulgaria: 46 / 54

Spain: 28 / 72

France: 36 / 64

Hungary: 36 / 64

Italy: 33 / 67

Poland: 34 / 66

Portugal: 23 / 77

Czech Republic: 38 / 62

Romania: 30 / 70

United Kingdom: 23 / 77

Slovakia: 31 / 69

Sweden: 32 / 68

Trust in low-cost retailers is dominant in all countries, with particularly high levels in Portugal, the United Kingdom, and Spain.

Source: Cetelem Observatory 2023.

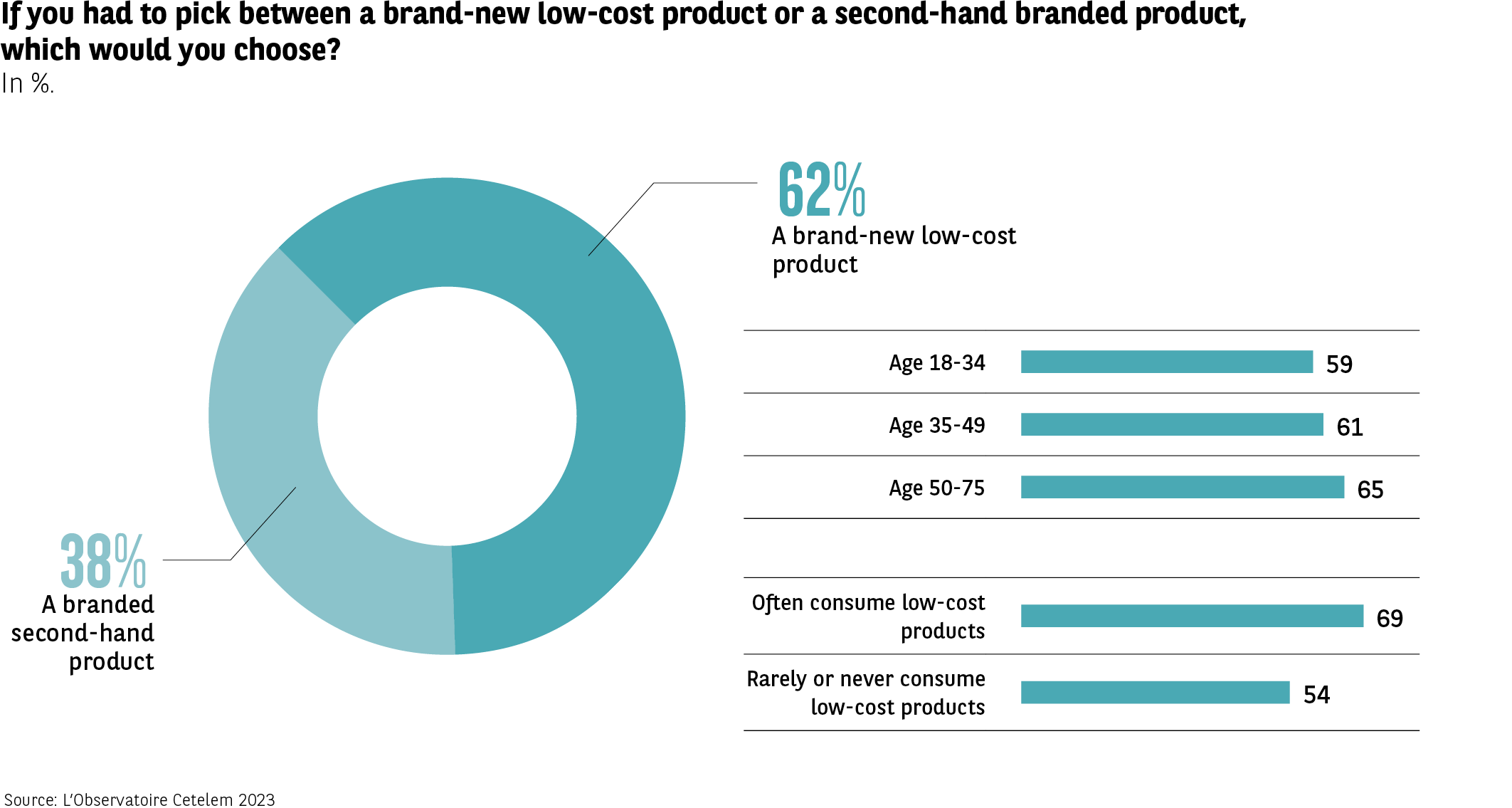

New low-cost products rather than second-hand branded products

While the second-hand market is evidently growing, especially on the Internet and for branded products, and while it allows consumers to buy goods more cheaply in these inflationary times, here again the low-cost model appears to be more popular with Europeans. More than 6 out of 10 respondents would prefer to buy a brand-new low-cost product than a second-hand branded product. Older consumers are more likely to be of this view than the younger generation. But the most enthusiastic in this sense are those who regularly consume low-cost products. Indeed, 69% would rather opt for new low-cost goods, compared with only 54% of those who rarely or never make low-cost purchases (Fig. 37). From a geographical perspective, this is most likely to be the case in Spain, Portugal and Italy. France has the highest proportion of respondents who declare their preference for branded products, even when they are pre-owned.

Fig 37 – Low-cost and second-hand purchase preferences

Download this infographic for your presentations The infographic presents the purchase preferences between new low-cost products and second-hand branded products, expressed as a percentage. The data is segmented by age group and by relationship to low-cost consumption.

Key visual elements:

A ring chart divides the responses between two options.

On the right, horizontal bars indicate the results for different profiles.

Data indicated:

62% prefer a new low-cost product. 38% prefer a second-hand branded product.

Breakdown by age group: 18-34 years: 59% for new low-cost.

35-49 years: 61%.

50-75 years: 65%.

Breakdown by relationship to low-cost:

Frequent low-cost consumer: 69% choose new low-cost.

Rare or non-low-cost consumer: 54%.

The majority preference is for buying a new low-cost product, with a more pronounced trend among older people or those accustomed to low-cost shopping.

Source: Cetelem Observatory 2023.

The infographic presents the purchase preferences between new low-cost products and second-hand branded products, expressed as a percentage. The data is segmented by age group and by relationship to low-cost consumption.

Key visual elements:

A ring chart divides the responses between two options.

On the right, horizontal bars indicate the results for different profiles.

Data indicated:

62% prefer a new low-cost product. 38% prefer a second-hand branded product.

Breakdown by age group: 18-34 years: 59% for new low-cost.

35-49 years: 61%.

50-75 years: 65%.

Breakdown by relationship to low-cost:

Frequent low-cost consumer: 69% choose new low-cost.

Rare or non-low-cost consumer: 54%.

The majority preference is for buying a new low-cost product, with a more pronounced trend among older people or those accustomed to low-cost shopping.

Source: Cetelem Observatory 2023.

The importance of low prices

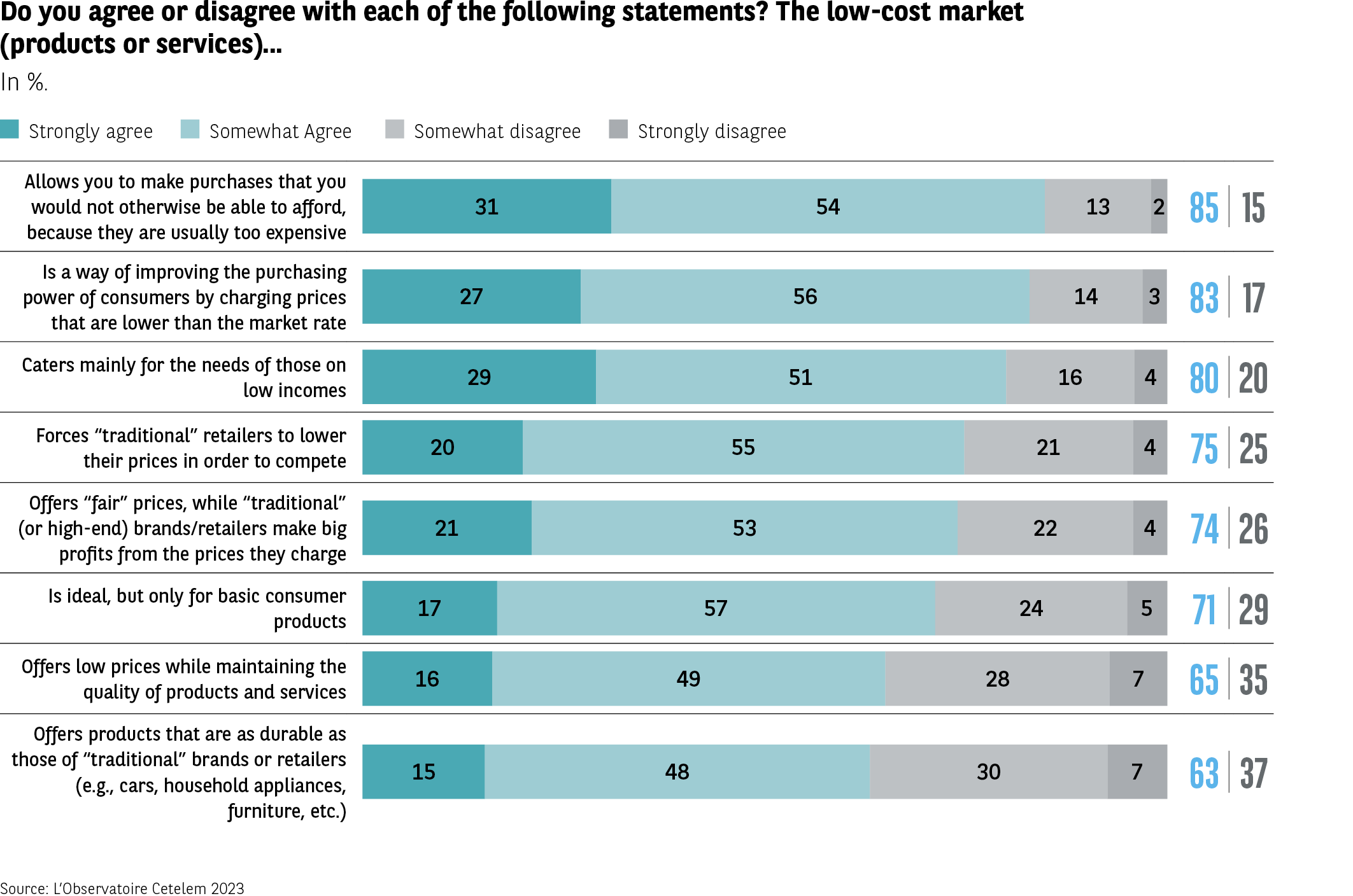

Thus, low prices and purchasing power are inseparable in the minds of Europeans. 83% of Europeans believe that the low-cost model is a decent solution in this regard But they also see it as enabling the most disadvantaged households to keep consuming. 85% believe that the low-cost market allows purchases to be made that would be too costly otherwise. 80% believe that it caters well for the needs of the lowest-income groups. Moreover, the low-cost market is seen as providing a strong incentive for traditional brands and retailers to lower their prices (75%) (Fig. 38). This may well be the (low) price they must pay to maintain their position and the market share that goes with it.

Fig 38 – Perception of low-cost offers

Download this infographic for your presentations The infographic evaluates the degree of agreement with eight statements about low-cost offers, divided into four response categories. The values are expressed as a percentage.

Key visual elements: For each statement, a horizontal bar represents: “completely agree”, “rather agree”, “rather disagree”, “completely disagree”. On the right, a total “agree” (sum of the first two categories) and a total “disagree”.

Data by statement:

1. Allows for purchases that would otherwise be inaccessible:

Completely agree: 31%

Rather agree: 54%

Rather disagree: 13%

Completely disagree: 2%

Total agree: 85%

Total disagree: 15%

2. Improves purchasing power with prices lower than the market: 27% / 56% / 14% / 3%

Total agree: 83%

Total disagree: 17%

3. Is mainly aimed at people with low incomes: 29% / 51% / 16% / 4%

Total agree: 80%

Total disagree: 20%

4. Forces traditional players to lower their prices: 20% / 55% / 21% / 4%

Total agree: 75%

Total disagree: 25%

5. Offers fair prices compared to high-end products with high margins: 21% / 53% / 22% / 4%

Total agree: 74%

Total disagree: 26%

6. Is ideal but only for basic products: 17% / 57% / 24% / 5%

Total agree: 71%

Total disagree: 29%

7. Offers low prices while maintaining quality: 16% / 49% / 28% / 7%

Total agree: 65%

Total disagree: 35%

8. Is just as durable as traditional products (cars, appliances, furniture…): 15% / 48% / 30% / 7%

Total agree: 63%

Total disagree: 37%

For all the proposed statements, the majority agreement level exceeds 60%, indicating a generally favorable perception of low-cost, although reservations appear regarding durability and quality.

Source: Cetelem Observatory 2023.

The infographic evaluates the degree of agreement with eight statements about low-cost offers, divided into four response categories. The values are expressed as a percentage.

Key visual elements: For each statement, a horizontal bar represents: “completely agree”, “rather agree”, “rather disagree”, “completely disagree”. On the right, a total “agree” (sum of the first two categories) and a total “disagree”.

Data by statement:

1. Allows for purchases that would otherwise be inaccessible:

Completely agree: 31%

Rather agree: 54%

Rather disagree: 13%

Completely disagree: 2%

Total agree: 85%

Total disagree: 15%

2. Improves purchasing power with prices lower than the market: 27% / 56% / 14% / 3%

Total agree: 83%

Total disagree: 17%

3. Is mainly aimed at people with low incomes: 29% / 51% / 16% / 4%

Total agree: 80%

Total disagree: 20%

4. Forces traditional players to lower their prices: 20% / 55% / 21% / 4%

Total agree: 75%

Total disagree: 25%

5. Offers fair prices compared to high-end products with high margins: 21% / 53% / 22% / 4%

Total agree: 74%

Total disagree: 26%

6. Is ideal but only for basic products: 17% / 57% / 24% / 5%

Total agree: 71%

Total disagree: 29%

7. Offers low prices while maintaining quality: 16% / 49% / 28% / 7%

Total agree: 65%

Total disagree: 35%

8. Is just as durable as traditional products (cars, appliances, furniture…): 15% / 48% / 30% / 7%

Total agree: 63%

Total disagree: 37%

For all the proposed statements, the majority agreement level exceeds 60%, indicating a generally favorable perception of low-cost, although reservations appear regarding durability and quality.

Source: Cetelem Observatory 2023.

The essential

The infographic groups several data from the Cetelem Observatory 2023 regarding low-cost consumption, trust in brands, and perception of its future development.

Transcribed data:

More than 4 out of 10 Europeans plan to increase their low-cost consumption in the near future.

41% of Europeans have bought more low-cost food products in the past year.

For 1 consumer out of 2, the low-cost market will continue to develop due to financial difficulties.

2 out of 3 Europeans trust low-cost brands and retailers to act in favor of purchasing power.

6 out of 10 prefer to buy a new low-cost product rather than a second-hand branded product.

83% believe that low-cost, with its low prices, is a good solution for improving purchasing power.

Main lesson: The data shows a dynamic of increasing low-cost consumption, supported by the trust given to brands and the perception of a positive role in purchasing power.

Source: Cetelem Observatory 2023.

The infographic groups several data from the Cetelem Observatory 2023 regarding low-cost consumption, trust in brands, and perception of its future development.

Transcribed data:

More than 4 out of 10 Europeans plan to increase their low-cost consumption in the near future.

41% of Europeans have bought more low-cost food products in the past year.

For 1 consumer out of 2, the low-cost market will continue to develop due to financial difficulties.

2 out of 3 Europeans trust low-cost brands and retailers to act in favor of purchasing power.

6 out of 10 prefer to buy a new low-cost product rather than a second-hand branded product.

83% believe that low-cost, with its low prices, is a good solution for improving purchasing power.

Main lesson: The data shows a dynamic of increasing low-cost consumption, supported by the trust given to brands and the perception of a positive role in purchasing power.

Source: Cetelem Observatory 2023.