Sectors and brands: a dominant triumvirate

Clothing, food and air travel: top of the low-cost tree

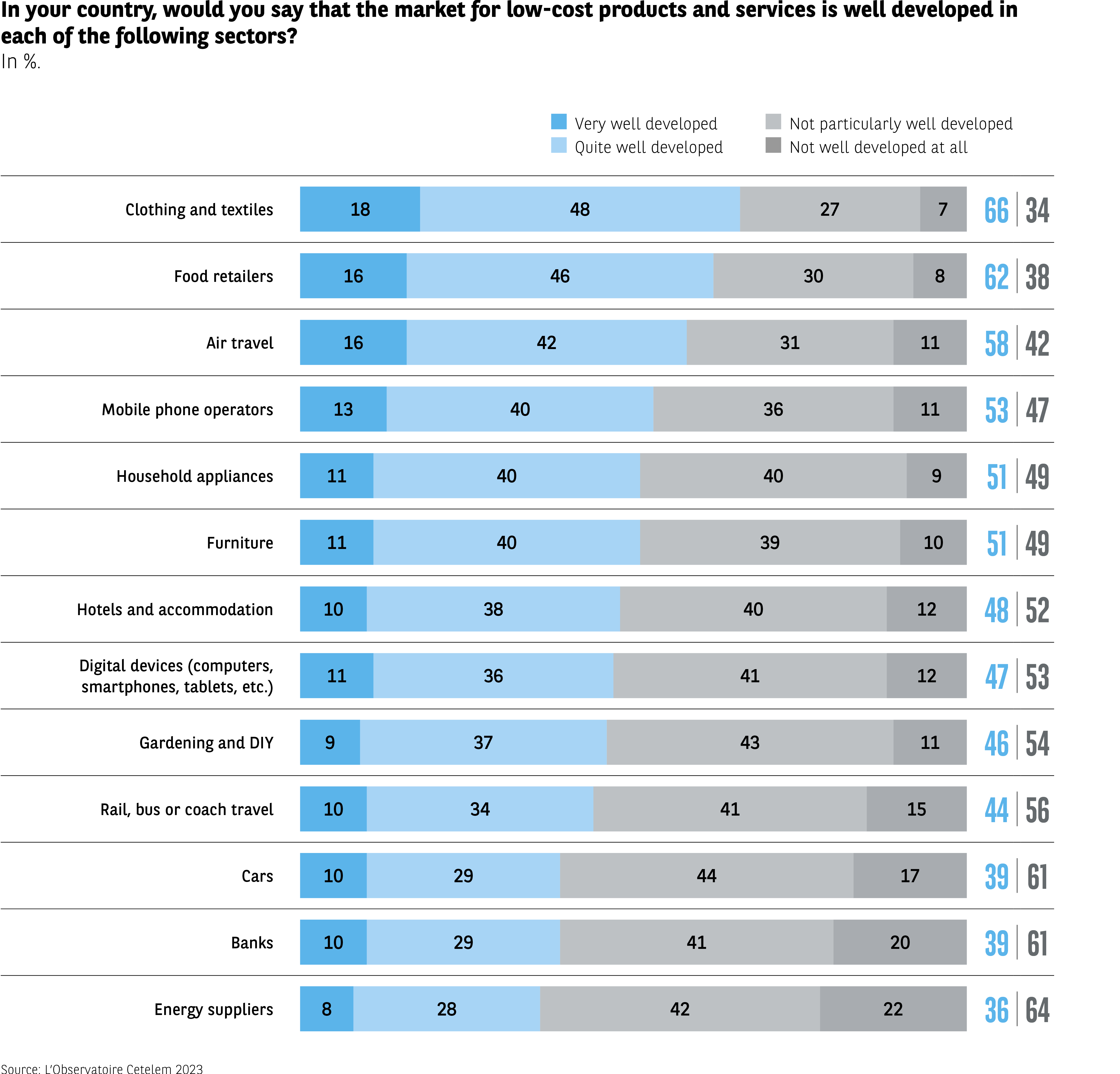

While the low-cost concept has gradually spread to all sectors, three in particular have grown to embody the concept more powerfully. Clothing, food and air travel are the three sectors most synonymous with low-cost products, according to 66%, 62% and 58% of Europeans, respectively. In fourth place is mobile telephony, which reflects how successful operators have been in developing low-cost offerings in what is often a highly competitive field. Conversely, the car industry, a market in which Dacia’s success caused something of a paradigm shift, is rarely associated with the low-cost concept (39%). The same goes for banks, despite the emergence of a substantial online market, as well as energy, a sector that has recently been opened to competition in a number of countries (Fig. 8).

Fig 8 – Level of development of low-cost according to sectors

Download this infographic for your presentations The infographic presents, in percentage, the level of development of the low-cost market in 13 sectors. The responses are divided into “Very developed”, “Rather developed”, “Rather not developed”, and “Not at all developed”.

Data by sector:

1. Clothing, textiles

Very developed: 18%

Rather developed: 48%

Rather not: 27%

Not at all: 7%

Total developed: 66% – Total not developed: 34%

2. Food retailers

16% / 46% / 30% / 8%

Total developed: 62% – Not developed: 38%

3. Air transport

16% / 42% / 31% / 11%

Total developed: 58% – Not developed: 42%

4. Mobile phone operators

13% / 40% / 36% / 11%

Total developed: 53% – Not developed: 47%

5. Appliances

11% / 40% / 40% / 9%

Total developed: 51% – Not developed: 49%

6. Furniture

11% / 40% / 39% / 10%

Total developed: 51% – Not developed: 49%

7. Hotels, accommodation

10% / 38% / 40% / 12%

Total developed: 48% – Not developed: 52%

8. Digital tools (computers, smartphones, tablets)

11% / 36% / 41% / 12%

Total developed: 47% – Not developed: 53%

9. Gardening and DIY

9% / 37% / 43% / 11%

Total developed: 46% – Not developed: 54%

10. Rail, bus, or car transport

10% / 34% / 41% / 15%

Total developed: 44% – Not developed: 56%

11. Automobile

10% / 29% / 44% / 17%

Total developed: 39% – Not developed: 61%

12. Banks

10% / 29% / 41% / 20%

Total developed: 39% – Not developed: 61%

13. Energy providers

8% / 28% / 42% / 22%

Total developed: 36% – Not developed: 64%

The perceived development is highest in textiles, food, and air transport, and lowest in energy, banking, and automobiles.

Source: Cetelem Observatory 2023

The infographic presents, in percentage, the level of development of the low-cost market in 13 sectors. The responses are divided into “Very developed”, “Rather developed”, “Rather not developed”, and “Not at all developed”.

Data by sector:

1. Clothing, textiles

Very developed: 18%

Rather developed: 48%

Rather not: 27%

Not at all: 7%

Total developed: 66% – Total not developed: 34%

2. Food retailers

16% / 46% / 30% / 8%

Total developed: 62% – Not developed: 38%

3. Air transport

16% / 42% / 31% / 11%

Total developed: 58% – Not developed: 42%

4. Mobile phone operators

13% / 40% / 36% / 11%

Total developed: 53% – Not developed: 47%

5. Appliances

11% / 40% / 40% / 9%

Total developed: 51% – Not developed: 49%

6. Furniture

11% / 40% / 39% / 10%

Total developed: 51% – Not developed: 49%

7. Hotels, accommodation

10% / 38% / 40% / 12%

Total developed: 48% – Not developed: 52%

8. Digital tools (computers, smartphones, tablets)

11% / 36% / 41% / 12%

Total developed: 47% – Not developed: 53%

9. Gardening and DIY

9% / 37% / 43% / 11%

Total developed: 46% – Not developed: 54%

10. Rail, bus, or car transport

10% / 34% / 41% / 15%

Total developed: 44% – Not developed: 56%

11. Automobile

10% / 29% / 44% / 17%

Total developed: 39% – Not developed: 61%

12. Banks

10% / 29% / 41% / 20%

Total developed: 39% – Not developed: 61%

13. Energy providers

8% / 28% / 42% / 22%

Total developed: 36% – Not developed: 64%

The perceived development is highest in textiles, food, and air transport, and lowest in energy, banking, and automobiles.

Source: Cetelem Observatory 2023

Lidl, Ryanair and Aldi: a renowned trio

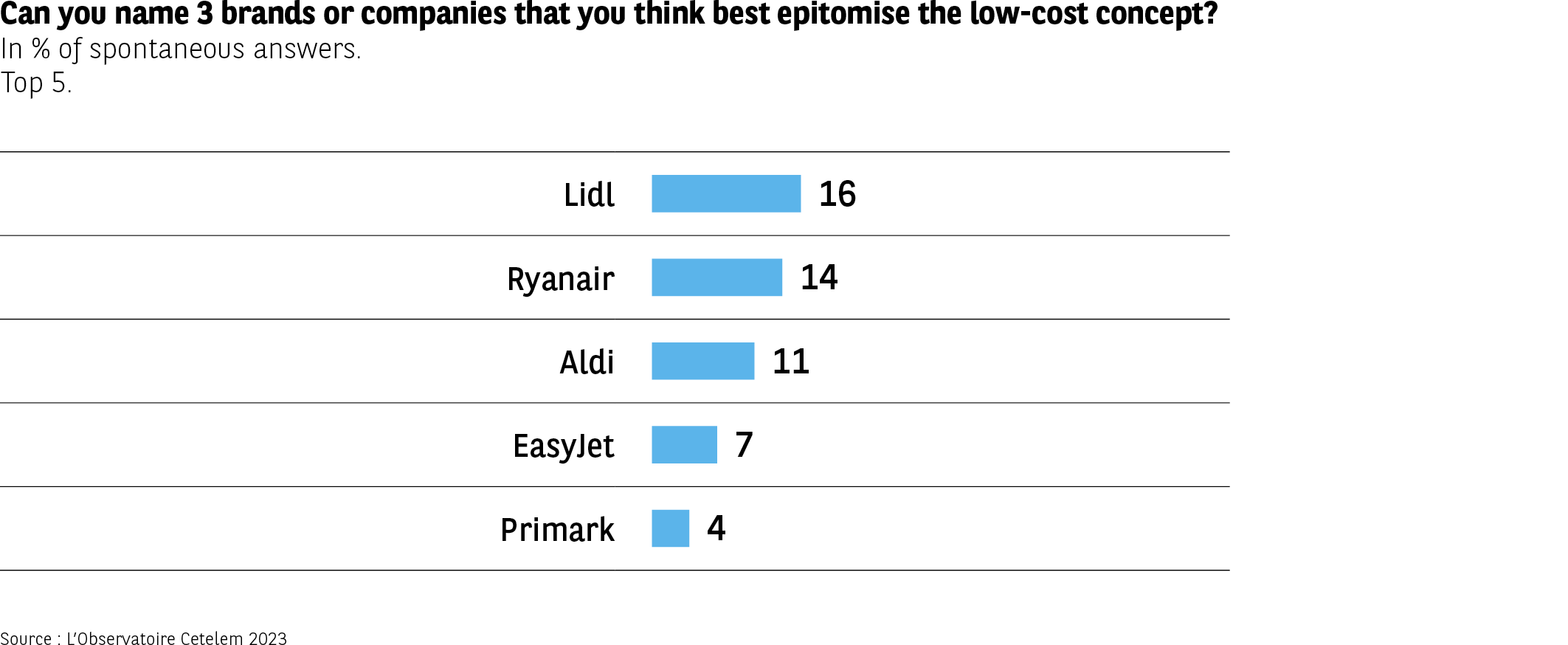

Thus, three sectors stand out, but so do three brands.

Lidl tops the list, having been cited spontaneously by 16% of Europeans, followed by Ryanair, the brand that revolutionized the airline industry, and Aldi, the first established retailer to take the low-cost route (Fig. 9).

Fig 9 – Brands most associated with low-cost

Download this infographic for your presentations The infographic presents the five most frequently cited brands when respondents are asked to name up to three companies that symbolize low-cost. The results are expressed as a percentage of spontaneous responses.

Data:

Lidl: 16%

Ryanair: 14%

Aldi: 11%

EasyJet: 7%

Primark: 4%

Food retailers (Lidl, Aldi) and air transport (Ryanair, EasyJet) are among the brands most associated with low-cost.

Source: Cetelem Observatory 2023

The infographic presents the five most frequently cited brands when respondents are asked to name up to three companies that symbolize low-cost. The results are expressed as a percentage of spontaneous responses.

Data:

Lidl: 16%

Ryanair: 14%

Aldi: 11%

EasyJet: 7%

Primark: 4%

Food retailers (Lidl, Aldi) and air transport (Ryanair, EasyJet) are among the brands most associated with low-cost.

Source: Cetelem Observatory 2023

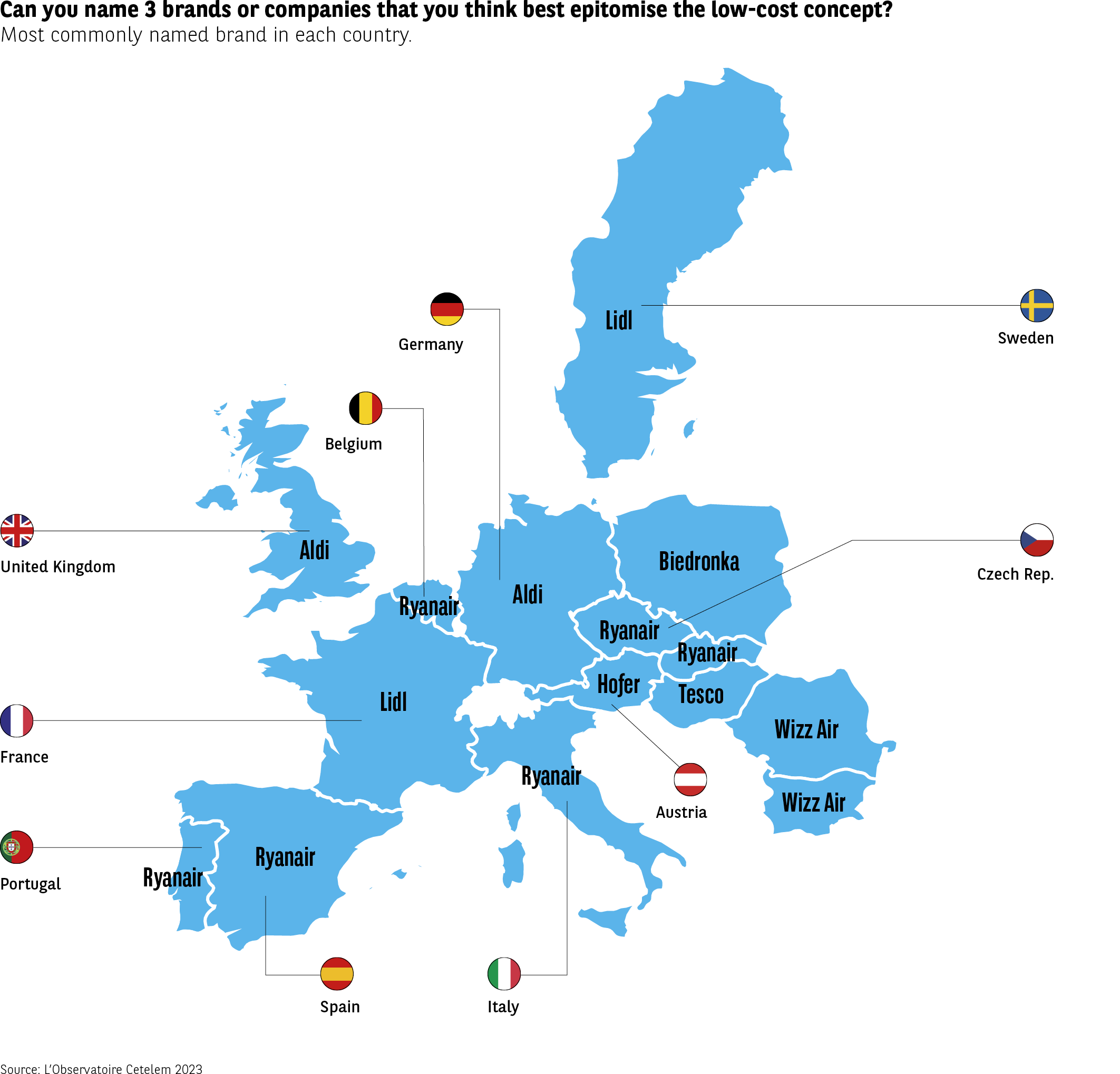

But although these three brands have a truly international reach, a geographical analysis highlights certain particularities specific to each country. Poland’s Biendronka, for example, is a decidedly local low-cost phenomenon (Fig. 10).

Fig 10 – Brand most associated with low-cost by country

Download this infographic for your presentations The infographic represents a map of Europe indicating, for each country studied, the brand most frequently cited as a symbol of low-cost. Each country is associated with a single brand. The labels are placed around or inside the borders depending on the available space.

Data by country:

Germany: Lidl

Austria: Hofer

Belgium: Aldi

Bulgaria: Wizz Air

Spain: Ryanair

France: Lidl

Hungary: Wizz Air

Italy: Ryanair

Poland: Biedronka

Portugal: Ryanair

Czech Republic: Tesco

Romania: Wizz Air

Slovakia: Ryanair

Sweden: Lidl

United Kingdom: Aldi

According to the countries, food retailers (Lidl, Aldi, Biedronka) or low-cost airlines (Ryanair, Wizz Air) are the most frequently cited.

Source: Cetelem Observatory 2023

The infographic represents a map of Europe indicating, for each country studied, the brand most frequently cited as a symbol of low-cost. Each country is associated with a single brand. The labels are placed around or inside the borders depending on the available space.

Data by country:

Germany: Lidl

Austria: Hofer

Belgium: Aldi

Bulgaria: Wizz Air

Spain: Ryanair

France: Lidl

Hungary: Wizz Air

Italy: Ryanair

Poland: Biedronka

Portugal: Ryanair

Czech Republic: Tesco

Romania: Wizz Air

Slovakia: Ryanair

Sweden: Lidl

United Kingdom: Aldi

According to the countries, food retailers (Lidl, Aldi, Biedronka) or low-cost airlines (Ryanair, Wizz Air) are the most frequently cited.

Source: Cetelem Observatory 2023

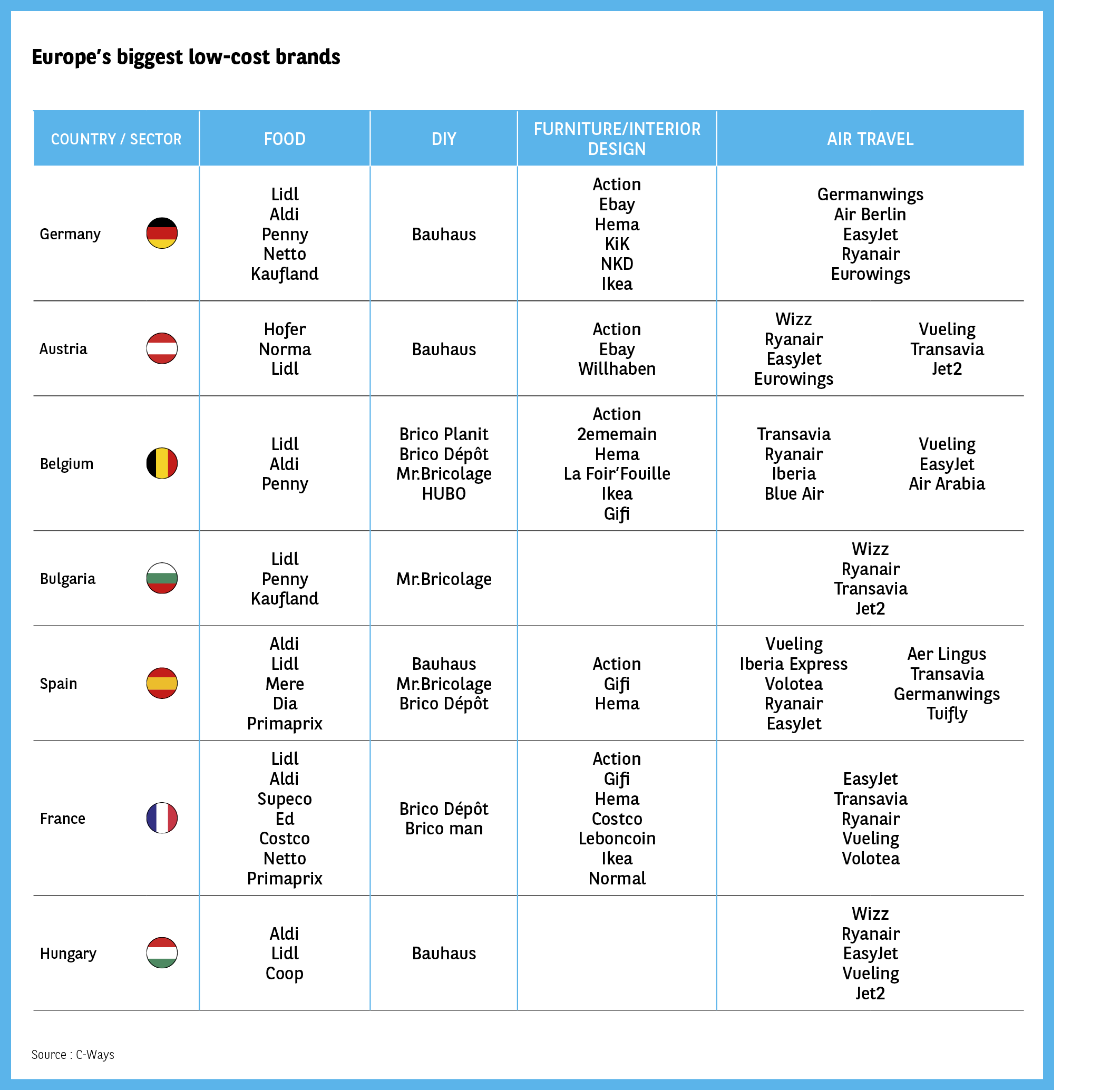

Fig 11 – Main low-cost brands in Europe by sector

Download this infographic for your presentations The infographic presents a table similar to the previous one, covering eight additional countries. The sectors remain: food, DIY, furniture/decoration, air transport.

Table data:

Germany

Food: Lidl, Aldi, Penny, Netto, Kaufland

DIY: Bauhaus

Furniture/decoration: Action, Ebay, Hema, KiK, NKD, Ikea

Air transport: Germanwings, Air Berlin, EasyJet, Ryanair, Eurowings

Austria

Food: Hofer, Norma, Lidl

DIY: Bauhaus

Furniture/decoration: Action, Ebay, Willhaben

Air transport: Wizz, Ryanair, EasyJet, Eurowings, Vueling, Transavia, Jet2

Belgium

Food: Lidl, Aldi, Penny

DIY: Brico Planit, Brico Dépôt, Mr Bricolage, HUBO

Furniture/decoration: Action, 2ememain, Hema, La Foir’Fouille, Ikea, Gifi

Air transport: Transavia, Ryanair, Iberia, Blue Air, Vueling, EasyJet, Air Arabia

Bulgaria

Food: Lidl, Penny, Kaufland

DIY: Mr Bricolage

Air transport: Wizz, Ryanair, Transavia, Jet2

Spain

Food: Aldi, Lidl, Mere, Dia, Primaprix

DIY: Bauhaus, Mr Bricolage, Brico Dépôt

Furniture/decoration: Action, Gifi, Hema

Air transport: Vueling, Iberia Express, Volotea, Ryanair, EasyJet, Aer Lingus, Transavia, Germanwings, TUIFly

France

Food: Lidl, Aldi, Supeco, Ed, Costco, Netto, Primaprix

DIY: Brico Dépôt, Brico Man

Furniture/decoration: Action, Gifi, Hema, Costco, Leboncoin, Ikea, Normal

Air transport: EasyJet, Transavia, Ryanair, Vueling, Volotea

Hungary

Food: Aldi, Lidl, Coop

DIY: Bauhaus

Air transport: Wizz, Ryanair, EasyJet, Vueling, Jet2

Lidl, Aldi, Ikea, Bauhaus, and low-cost airlines dominate the list of most representative brands in each country.

Source: C-Ways

The infographic presents a table similar to the previous one, covering eight additional countries. The sectors remain: food, DIY, furniture/decoration, air transport.

Table data:

Germany

Food: Lidl, Aldi, Penny, Netto, Kaufland

DIY: Bauhaus

Furniture/decoration: Action, Ebay, Hema, KiK, NKD, Ikea

Air transport: Germanwings, Air Berlin, EasyJet, Ryanair, Eurowings

Austria

Food: Hofer, Norma, Lidl

DIY: Bauhaus

Furniture/decoration: Action, Ebay, Willhaben

Air transport: Wizz, Ryanair, EasyJet, Eurowings, Vueling, Transavia, Jet2

Belgium

Food: Lidl, Aldi, Penny

DIY: Brico Planit, Brico Dépôt, Mr Bricolage, HUBO

Furniture/decoration: Action, 2ememain, Hema, La Foir’Fouille, Ikea, Gifi

Air transport: Transavia, Ryanair, Iberia, Blue Air, Vueling, EasyJet, Air Arabia

Bulgaria

Food: Lidl, Penny, Kaufland

DIY: Mr Bricolage

Air transport: Wizz, Ryanair, Transavia, Jet2

Spain

Food: Aldi, Lidl, Mere, Dia, Primaprix

DIY: Bauhaus, Mr Bricolage, Brico Dépôt

Furniture/decoration: Action, Gifi, Hema

Air transport: Vueling, Iberia Express, Volotea, Ryanair, EasyJet, Aer Lingus, Transavia, Germanwings, TUIFly

France

Food: Lidl, Aldi, Supeco, Ed, Costco, Netto, Primaprix

DIY: Brico Dépôt, Brico Man

Furniture/decoration: Action, Gifi, Hema, Costco, Leboncoin, Ikea, Normal

Air transport: EasyJet, Transavia, Ryanair, Vueling, Volotea

Hungary

Food: Aldi, Lidl, Coop

DIY: Bauhaus

Air transport: Wizz, Ryanair, EasyJet, Vueling, Jet2

Lidl, Aldi, Ikea, Bauhaus, and low-cost airlines dominate the list of most representative brands in each country.

Source: C-Ways

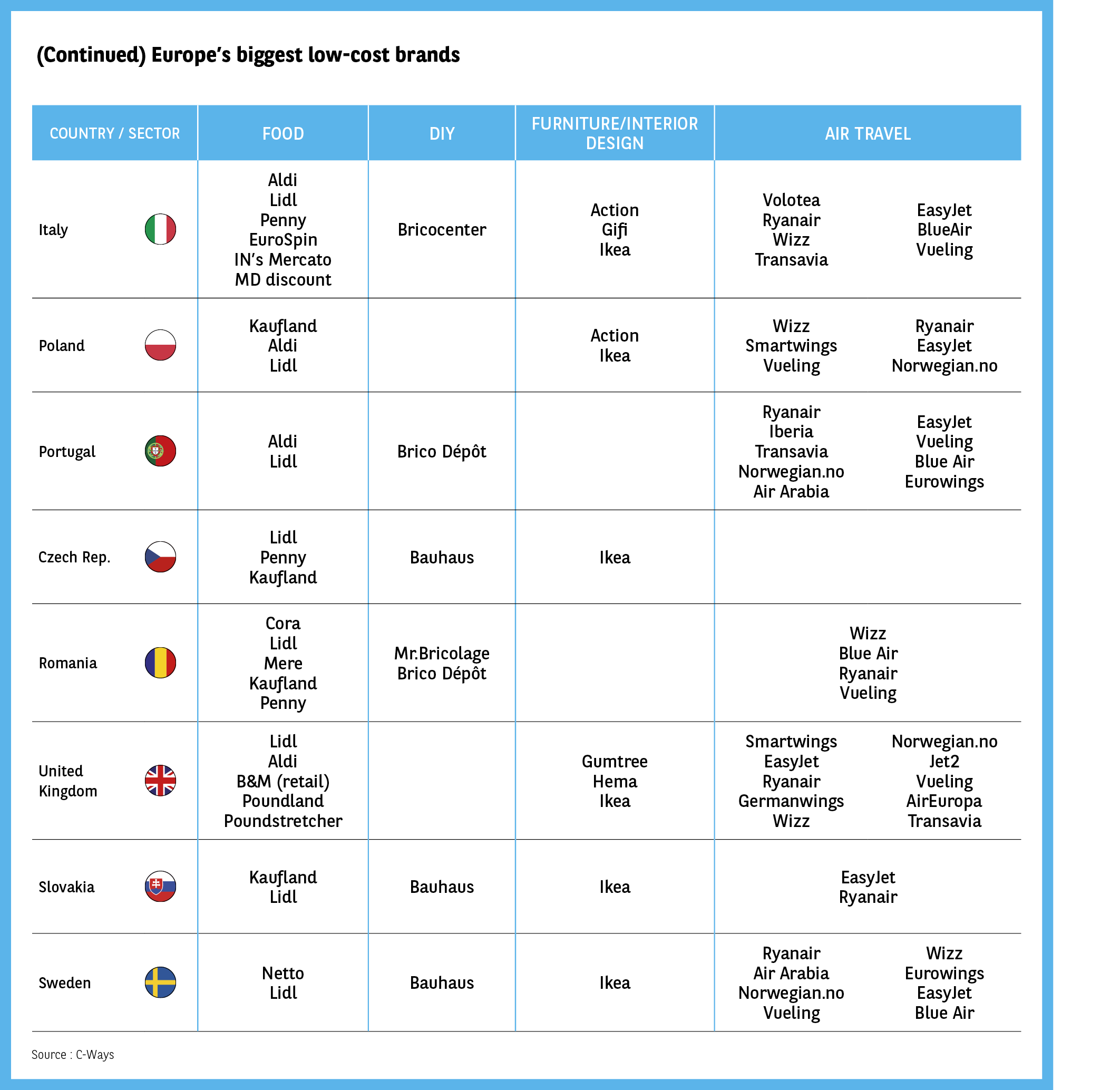

Fig 11 (part 2) – Main low-cost brands in Europe by sector

Download this infographic for your presentations The infographic presents a table listing the main low-cost brands for eight European countries. The sectors covered are: food, DIY, furniture/decoration, and air transport.

Table data:

Italy

Food: Aldi, Lidl, Penny, EuroSpin, IN’s Mercato, MD Discount

DIY: Bricocenter

Furniture/decoration: Action, Gifi, Ikea

Air transport: Volotea, Ryanair, Wizz, Transavia, EasyJet, BlueAir, Vueling

Poland

Food: Kaufland, Aldi, Lidl

Furniture/decoration: Action, Ikea

Air transport: Wizz, Smartwings, Vueling, Ryanair, EasyJet, Norwegian.no

Portugal

Food: Aldi, Lidl

DIY: Brico Dépôt

Air transport: Ryanair, Iberia, Transavia, Norwegian.no, Air Arabia, EasyJet, Vueling, Blue Air, Eurowings

Czech Republic

Food: Lidl, Penny, Kaufland

DIY: Bauhaus

Furniture/decoration: Ikea

Romania

Food: Cora, Lidl, Mere, Kaufland, Penny

DIY: Mr Bricolage, Brico Dépôt

Air transport: Wizz, Blue Air, Ryanair, Vueling

United Kingdom

Food: Lidl, Aldi, B&M (distribution), Poundland, Poundstretcher

Furniture/decoration: Gumtree, Hema, Ikea

Air transport: Smartwings, EasyJet, Ryanair, Germanwings, Wizz, Norwegian.no, Jet2, Vueling, AirEuropa, Transavia

Slovakia

Food: Kaufland, Lidl

DIY: Bauhaus

Furniture/decoration: Ikea

Air transport: EasyJet, Ryanair

Sweden

Food: Netto, Lidl

DIY: Bauhaus

Furniture/decoration: Ikea

Air transport: Ryanair, Air Arabia, Norwegian.no, Vueling, Wizz, Eurowings, EasyJet, Blue Air

The most frequent low-cost brands vary by country, with a recurring presence of Lidl, Aldi, Bauhaus, Ikea, and airlines like Ryanair or EasyJet.

Source: C-Ways

The infographic presents a table listing the main low-cost brands for eight European countries. The sectors covered are: food, DIY, furniture/decoration, and air transport.

Table data:

Italy

Food: Aldi, Lidl, Penny, EuroSpin, IN’s Mercato, MD Discount

DIY: Bricocenter

Furniture/decoration: Action, Gifi, Ikea

Air transport: Volotea, Ryanair, Wizz, Transavia, EasyJet, BlueAir, Vueling

Poland

Food: Kaufland, Aldi, Lidl

Furniture/decoration: Action, Ikea

Air transport: Wizz, Smartwings, Vueling, Ryanair, EasyJet, Norwegian.no

Portugal

Food: Aldi, Lidl

DIY: Brico Dépôt

Air transport: Ryanair, Iberia, Transavia, Norwegian.no, Air Arabia, EasyJet, Vueling, Blue Air, Eurowings

Czech Republic

Food: Lidl, Penny, Kaufland

DIY: Bauhaus

Furniture/decoration: Ikea

Romania

Food: Cora, Lidl, Mere, Kaufland, Penny

DIY: Mr Bricolage, Brico Dépôt

Air transport: Wizz, Blue Air, Ryanair, Vueling

United Kingdom

Food: Lidl, Aldi, B&M (distribution), Poundland, Poundstretcher

Furniture/decoration: Gumtree, Hema, Ikea

Air transport: Smartwings, EasyJet, Ryanair, Germanwings, Wizz, Norwegian.no, Jet2, Vueling, AirEuropa, Transavia

Slovakia

Food: Kaufland, Lidl

DIY: Bauhaus

Furniture/decoration: Ikea

Air transport: EasyJet, Ryanair

Sweden

Food: Netto, Lidl

DIY: Bauhaus

Furniture/decoration: Ikea

Air transport: Ryanair, Air Arabia, Norwegian.no, Vueling, Wizz, Eurowings, EasyJet, Blue Air

The most frequent low-cost brands vary by country, with a recurring presence of Lidl, Aldi, Bauhaus, Ikea, and airlines like Ryanair or EasyJet.

Source: C-Ways