Opportunities for brands and retailers

Faced with the inexorable rise of peer-to-peer buy/sell platforms and a commercial landscape in which they no longer seem to lead the way in the eyes of consumers, what room for manoeuvre do retailers and brands have when it comes to the circular economy? Will they inevitably become extinct like commercial dinosaurs, crushed by the asteroid sent down by online platforms, or will they be able to adapt and survive in a world of commercial Darwinism? This survey shows that they do not lack the attributes required to adjust to this new paradigm.

A strong attachment to ownership

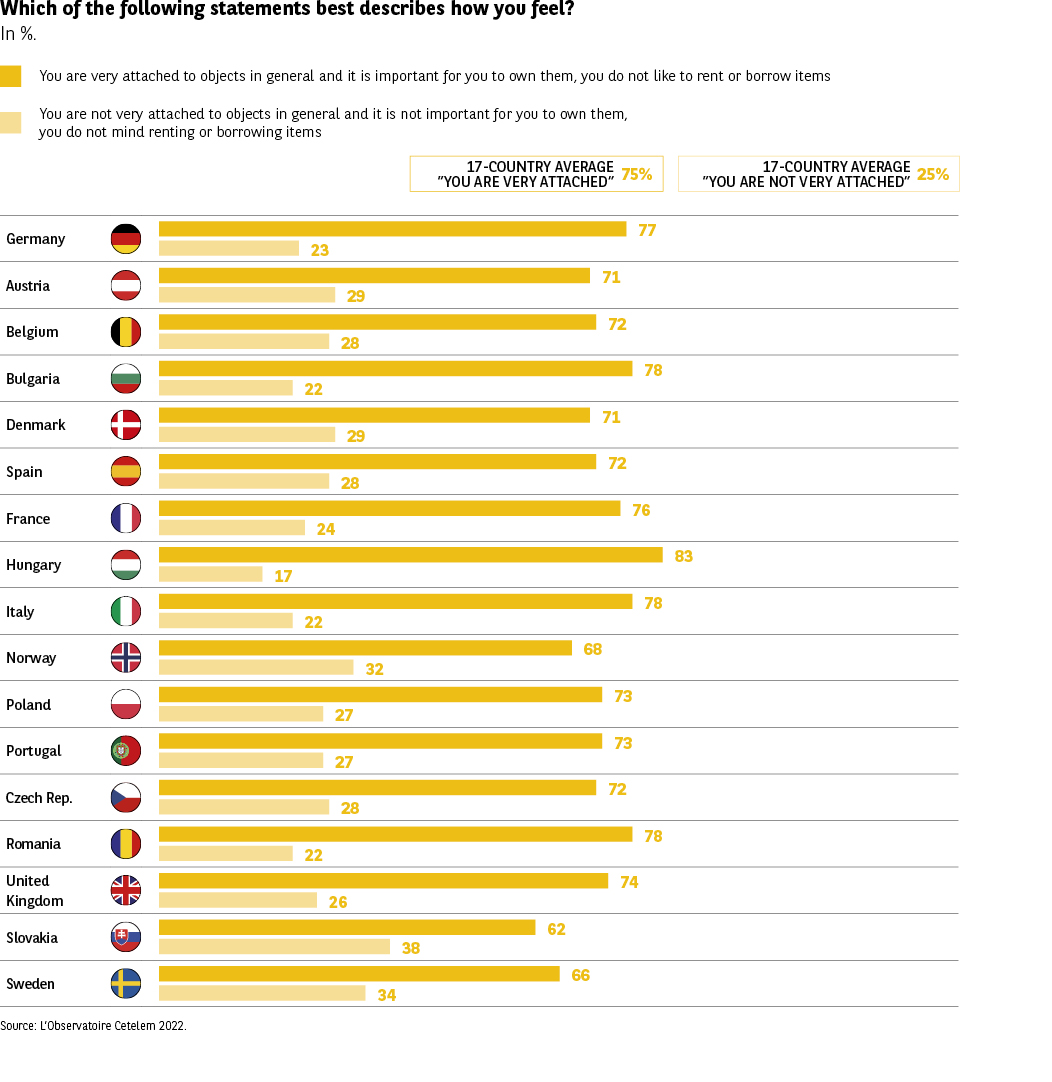

Analysing these attributes prompts us to revisit the very foundations of retail. Although the circular economy places an emphasis on second-hand goods and recycling, ownership still has a bright future ahead of it. 3 in 4 Europeans declare that they are very attached to the idea of owning possessions (Fig. 21). Once again, generational differences can be observed, with older respondents placing greater value on ownership than their younger counterparts. The Swedes, the Norwegians and especially the Slovaks are the least enthusiastic about ownership, while the Hungarians, Bulgarians, Italians and Romanians sit at the opposite end of the scale.

Fig. 21 Attachment to personal belongings

Download this infographic for your presentations The chart shows two indicators: people highly attached to possessions (avg.

75%) and those not very attached (25%). Country values vary moderately, from Hungary’s 83% to

Slovakia’s 62%.

The chart shows two indicators: people highly attached to possessions (avg.

75%) and those not very attached (25%). Country values vary moderately, from Hungary’s 83% to

Slovakia’s 62%.

Buying new remains popular

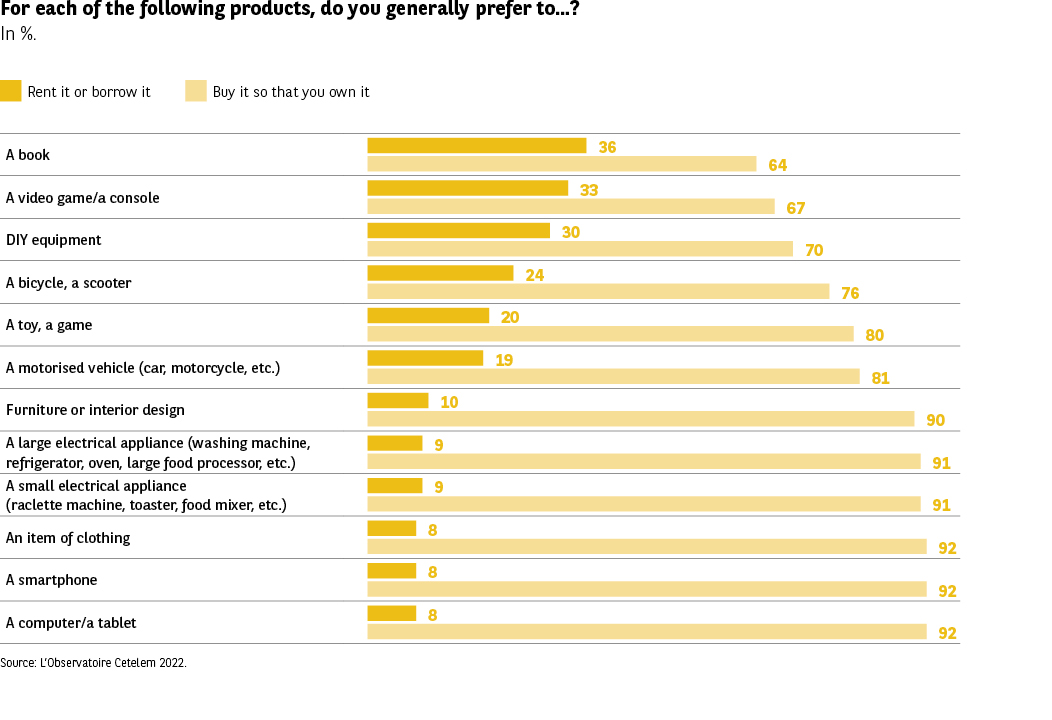

Another mainstay of retail, buying new, is alive and well. Regardless of the product category, Europeans would rather purchase than rent the items in question (Fig. 22). Nonetheless, 36% of respondents prefer to rent or borrow a book and 33% a video game or console. The existence of libraries offering books and other media largely explains this result. 30% also like to rent DIY equipment, which is an understandable choice, depending on the type of tool, given that people tend not to renovate their home every day. And one only has to take a walk in a city to see why 24% like to rent bicycles and scooters. In contrast, while the refurbishing of mobile phones is a rapidly developing segment, 92% of Europeans still prefer to buy them new.

Fig. 22 Purchase vs rental preferences

Download this infographic for your presentations For each category, buying is preferred. Purchase rates range from 64% for books

to over 90% for electronics, appliances, and clothing.

For each category, buying is preferred. Purchase rates range from 64% for books

to over 90% for electronics, appliances, and clothing.

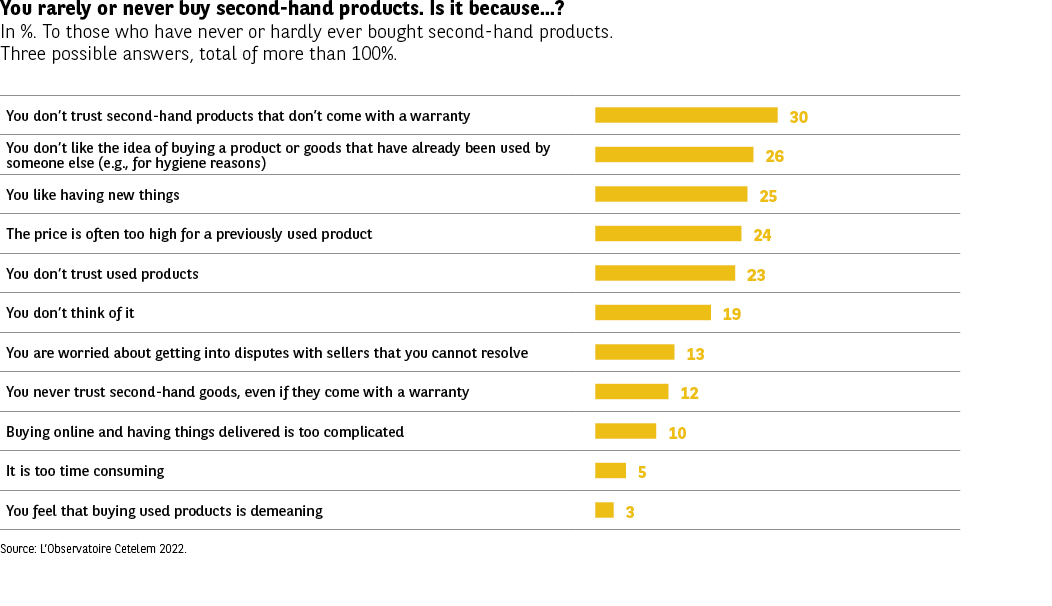

The ability to offer guarantees is a strength to be exploited

The guarantees offered by retailers and brands play an essential role in the trust-based relationships they seek to establish with consumers, a trust that goes some way to ensuring that they remain loyal and therefore make repeat purchases. The views put forward by Europeans on this issue will convince companies to continue down this path. For 30% of respondents, and an even larger proportion of seniors, the lack of a warranty is the primary reason not to buy second-hand products (Fig. 23). These reservations are most likely to be expressed by the Hungarians and the Spanish, while the Romanians and Danes are the least likely to do so. Next on the list comes the thought of buying a product that has already been used by someone else (26%), followed by the desire to buy something brand new (25%). These results appear to confirm that Europeans remain very keen on all that is new, in the widest possible sense.

Fig. 23 Reasons for avoiding second-hand products

Download this infographic for your presentations Key reasons include lack of trust (30%), hygiene concerns (26%), preference for

new (25%), high price (24%), and other lower-frequency factors.

Key reasons include lack of trust (30%), hygiene concerns (26%), preference for

new (25%), high price (24%), and other lower-frequency factors.

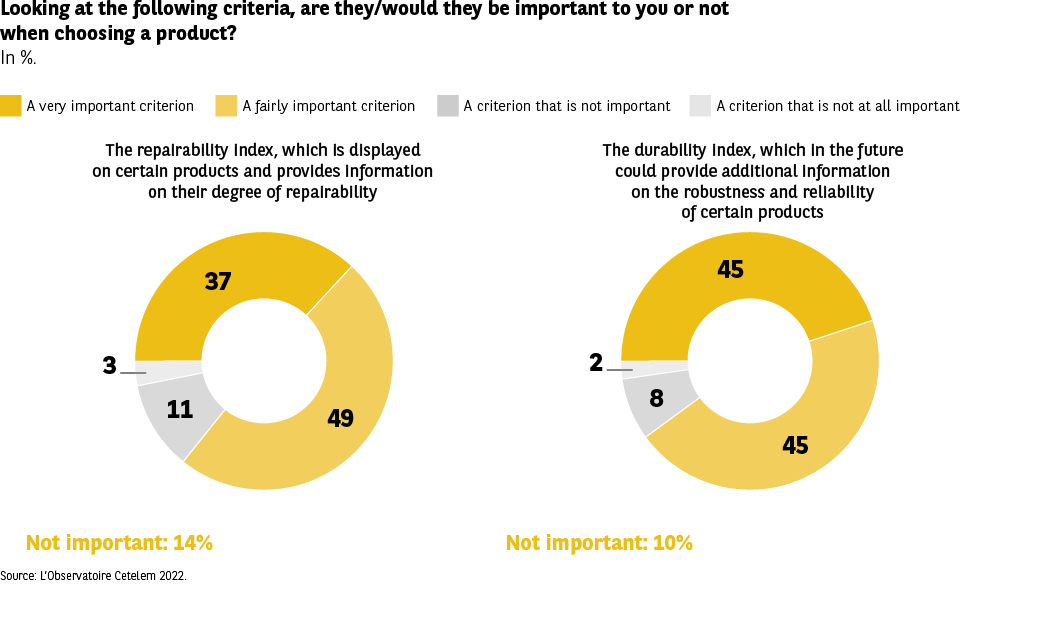

In a way that is not unrelated to the need for guarantees, brands and retailers can also leverage the high expectations of customers in order to secure their loyalty. Indeed, 86% believe that a repairability index is an important or very important factor when choosing a product (Fig. 24). More strikingly still, 90% express this view when asked about a durability index, which would provide information about a product’s robustness and reliability. Regarding the first of these two indices, the Italians and Portuguese are almost unanimously in favour (94%) while the Danes and Swedes are less keen (76% and 77%). As for the second, once more the Italians and Portuguese are the most ardent in their desire for sustainable and responsible trade (95% and 97%), while one must again head to Northern Europe to find lower expectations in this area. This is perhaps because adherence to certain ethical standards is more of a given in the North.

Fig. 24 Importance of repairability and durability criteria

Download this infographic for your presentations Repairability is rated important by 86% of respondents; durability by 90%, with

low rates of “not important”.

Repairability is rated important by 86% of respondents; durability by 90%, with

low rates of “not important”.

The boom in second-hand textiles

In a survey conducted by the Boston Consulting Group on behalf of Vestiaire Collective and published at the end of 2020 in six countries (Germany, Spain, the United States, France, Italy and the United Kingdom), 69% of respondents said they wanted to buy more second-hand clothing products. In 2019, before the Covid crisis, 25% of consumers had bought at least one second-hand product over the course of the year, an increase of 10 million new customers worldwide each year.

The global second-hand textile and clothing market was estimated to be worth between €25 billion and €34 billion in 2020. It is set to grow by 15-20% per year by 2025, by which time it will have doubled in size. At this point it will be worth between €56 billion and €76 billion, with Europe accounting for 40% of the total*.

* Source: BCG study for Vestiaire Collective.

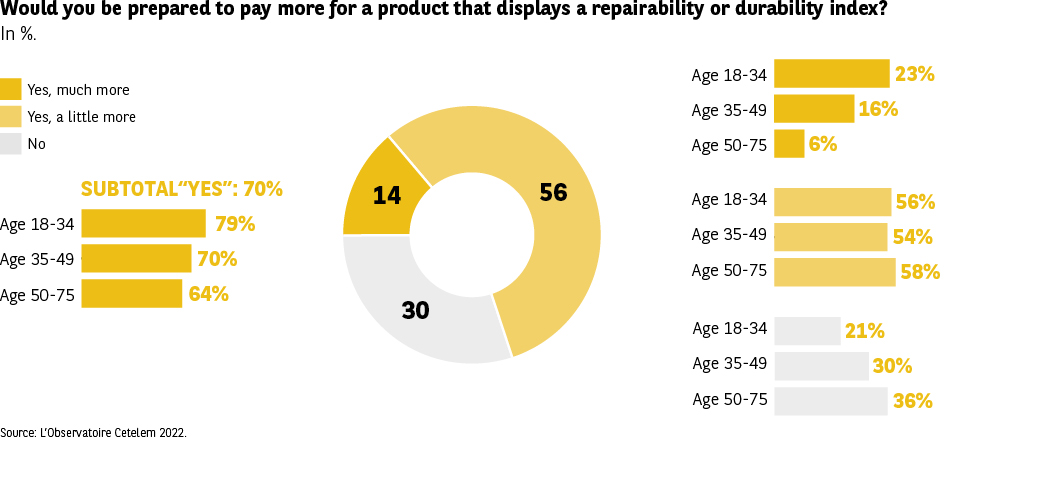

Consumers are prepared to pay more

This desire for reassurance when it comes to repairability and durability is not without consequence for the price of products. Quite the contrary in fact. Europeans are aware that this commitment by brands and retailers to be more responsible may come at a cost, but they are willing to accept it. 7 out of 10 Europeans say they are prepared to pay more for products that are labelled in this way (Fig. 25). The Romanians, Bulgarians and Hungarians are clearly in favour (84%, 83% and 80%), while the French and Belgians are slightly more reluctant to loosen their purse strings (61% and 63%). From a generational perspective, 8 out of 10 under-35s say they are willing to pay a higher price for products they will be able to rely on for longer.

Fig. 25 Willingness to pay more for repairable products

Download this infographic for your presentations Overall, 70% are willing to pay extra. Younger adults show the strongest

willingness (79%).

Overall, 70% are willing to pay extra. Younger adults show the strongest

willingness (79%).

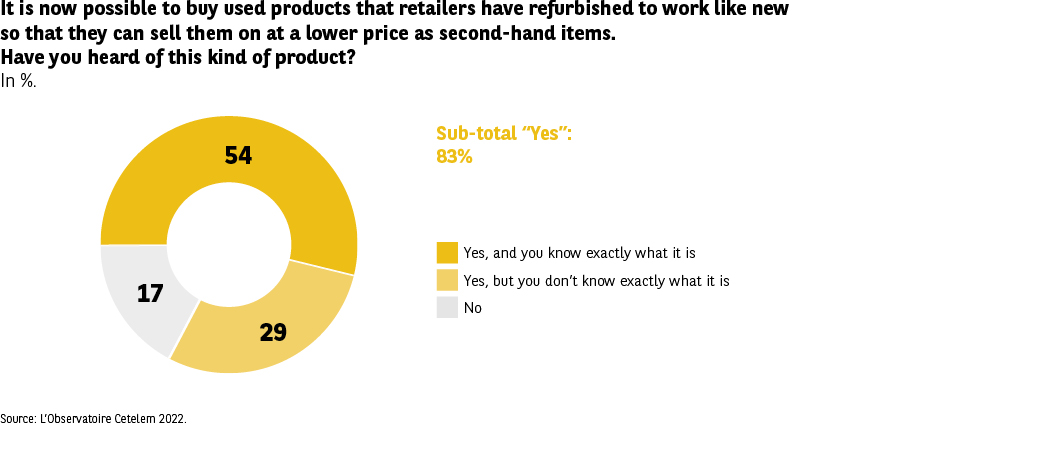

Refurbishing: well known and well understood

The importance consumers place on durability and repairability mirrors the success of refurbished products, phones in particular. Far from being a fad, as we saw previously with the circular economy, this has become a well established part of the consumer landscape (Fig. 26). Just over 8 out of 10 Europeans have heard of it, and 1 in 2 understand exactly what it is. And this awareness knows no borders. The Latin countries, led by Italy (9 out of 10), display the greatest awareness of the practice. The Czechs are the least likely to have heard of it, although the figure is still 7 out of 10. It is therefore in the best interests of brands and retailers to make the most of this awareness by embracing refurbishing and exploiting its many benefits.

Fig. 26 Awareness of refurbished “as new” products

Download this infographic for your presentations 83% are aware of the concept, with 54% knowing exactly what it refers to.

83% are aware of the concept, with 54% knowing exactly what it refers to.

The refurbished markets have the wind in their sales

Smartphones

The global market was estimated to be worth €20 billion in 2020. It is expected to grow 8.5% per year between now and 2027, to reach €35 billion.

Source: Research and Market.

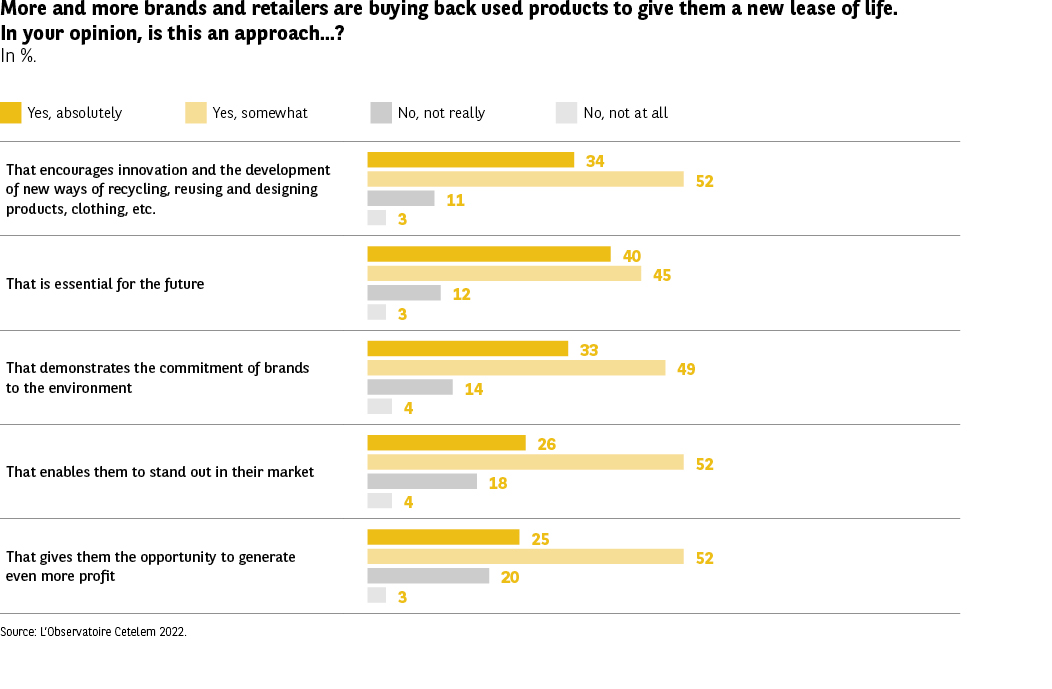

Enhancing one’s image and thinking about the future

It appears that consumers have a very positive opinion of brands and retailers moving into the second-hand market by retrieving products they have sold previously to give them a new lease of life. At the top of the list, 86% believe that companies treat it as an opportunity to demonstrate their sense of innovation. Every country surveyed is in agreement on this point, with the Italians and Portuguese once again expressing this view the loudest.

Innovation and the future clearly go hand in hand. 85% of Europeans believe it is an excellent way for brands and retailers to prepare for tomorrow (Fig. 27). This is another topic on which there is a certain unanimity, with the same pair emerging as the most fervent exponents of the idea.

Third in the ranking, with 82%, is the suggestion that the practice demonstrates a commitment to the environment. The ability to stand out in the market and the opportunity to make a profit receive a near-equal proportion of the vote (78% and 77%). On both of these items, the differences between the countries are much more pronounced. Regarding the former, while 87% of Portuguese and 86% of Hungarians see the practice as a source of differentiation, just 64% of Germans are in agreement. And when it comes to the suggestion that this is about generating additional profits, 86% of Bulgarians and 85% of Spaniards are of this opinion, compared to 62% of Germans and 63% of Austrians.

Fig. 27 Perception of brands’ take-back initiatives

Download this infographic for your presentations Most respondents view these initiatives positively, especially regarding

sustainability and innovation.

Most respondents view these initiatives positively, especially regarding

sustainability and innovation.